Published

- 05:00 am

PayU’s consumer lending business LazyPay and PaySense, India’s fastest growing digital credit platform, have today announced the plans to merge their business operations to build a full-stack digital lending platform in India. PayU will acquire a controlling stake in PaySense and all its assets at a valuation of $185 million. Additionally, PayU will inject a total of up to $200M in the new enterprise in the form of equity capital; $65M of the total amount will be immediately invested, while the balance corpus will be infused in the next 24 months to grow the loan book.

This planned merger is aligned with PayU’s long term vision of orchestrating a fintech ecosystem in India by partnering with the right companies and offering multiple financial services. The combination will bring together two highly complementary companies, each with an excellent reputation in the alternative lending space. PayU’s understanding of consumer backgrounds and insights into their purchase behaviour and affluence levels from its payment gateway business, and LazyPay’s deep experience in driving customer acquisition and engagement combined with PaySense’s strong analytics, tech & risk management capabilities will enable the combined entity to serve more of the new-to-credit Indian population.

While India’s banked population has more than doubled since 2011 to over 80%, credit bureau coverage is still limited. BCG research shows that India’s digital lending market represents a $1 trillion opportunity over the next five years[1].

PayU’s unified digital credit platform will enable third parties such as banks, NBFCs and alternate lenders to co-lend and grow assets and will also enable borrowers to access credit when and where they need it in a digital and seamless way. The joint team will combine its complementary assets, capabilities and talented teams with the goal of making access to credit quick, seamless and widely available for the underserved in India and drive higher customer satisfaction.

Siddhartha Jajodia, Global Head of Credit, PayU commented, “Technology has the power to completely transform people’s access to financial services and the credit market in India is ripe for further digital disruption. This merger is the next step in our journey as we accelerate our vision for credit in India. We’re delighted to welcome Prashanth and his experienced team as we integrate this fast-growing business and build a full-stack digital lending platform aligned with PayU’s overall plan of orchestrating a broader fintech ecosystem in the region.

Prashanth Ranganathan, Founder and CEO, PaySense added, “Providing more Indian consumers with access to credit is crucial to helping individuals grow and succeed. PayU is a natural partner for us as we both strive to make finance more simple, accessible and transparent. We’re excited to start bringing our personal loan product to more consumers throughout India and truly democratise credit.”

Sayali Karanjkar, Co-founder, PaySense said, “We continue to witness the massively untapped market potential for short-term collateral-free loans among the digitally savvy aspirational youth. Our endeavor is to facilitate easy digital credit options for this new-to-credit segment and support their ambitions. Both PayU and PaySense believe in leveraging the enormous potential of technology to unlock credit and financial services for vastly underserved consumers in India and this merger reflects our allied vision of delivering financial freedom to all."

As a part of the deal, Prashanth Ranganathan, currently PaySense CEO will lead PayU’s credit business in India as the CEO of the new enterprise. Prashanth will continue to retain a stake in the merged enterprise, while all the other investors and shareholders will exit. PaySense’s strong management team of seasoned technology and fintech experts will also become part of the PayU’s credit team, adding value to the combined business.

Related News

- 06:00 am

Planixs, the leading provider of real time, intraday cash, collateral and liquidity management solutions, today announced that an award-winning UK bank has selected Realiti Essentials to ensure BCBS248 compliance and manage its intraday liquidity.

Realiti Essentials is Planixs’ latest market offering comprising a SaaS only, all-inclusive, low-cost solution for SME banks and financial institutions to ensure regulatory compliance and help firms manage their intraday liquidity. Realiti Essentials includes the Planixs’ Intraday Liquidity Management Module, Regulatory Reporting Suite and Intraday Stress Modelling Solution to cover all the liquidity and regulatory compliance needs (BCBS248) for smaller banking firms.

The award-winning bank commented, “We are delighted to have selected Planixs’ Realiti Essentials as our solution to BCBS248 regulatory reporting and intraday liquidity. After an extensive review of the market only Realiti Essentials met our functional and cost needs and we look forward to a rapid implementation with their latest market offering”.

Neville Roberts, Planixs’ CEO said, “This UK-based bank needed a low-cost solution to meet its regulatory compliance needs (BCBS248) and manage its intraday liquidity on a daily basis. We are thrilled that they have chosen Realiti Essentials as their solution of choice to address their needs. Our latest Realiti offering is set to allow all SME banks and financial institutions across the world to meet these challenges”.

Planixs’ Realiti continues to be the pioneering intraday cash, collateral and liquidity management solution with live implementations at global scale. Its SaaS or on premise delivery models and high performance and scalable architecture mean that Realiti can be deployed with minimal intrusion to a bank’s infrastructure, rapidly delivering business value.

Related News

- 04:00 am

A new partnership between IoTech Lab and Keesing Technologies ensures seamless alignment between risk-based approach rating analysis, transaction monitoring and reliable identity verification. By integrating Keesing’s ID verification technology, IoTech Lab provides an extensive Know-Your-Customer checking platform.

Keesing Technologies, the Amsterdam-based leading global identity verification provider, has teamed up with IoTech Lab, a Singapore-based software development powerhouse, to provide industry-leading identity verification to IoTech Lab’s KYC (Know-Your-Customer) platform known as Solis.

Solis is a cost effective, holistic and all-in-one KYC solution that performs extensive KYC checks, including ID document verification combined with facial recognition, risk-based approach rating analysis, and transaction monitoring. The partnership with Keesing enables IoTech Lab’s clientele to streamline their customer identification and onboarding processes, meet AML (anti-money laundering) compliance legislation, and detect fraud through the Solis platform.

The partnership builds on the commitment of both companies to provide customers with fraud prevention and KYC solutions of the highest standard. It allows IoTech Lab to offer a best of breed solution and makes trusted identity verification solutions more accessible.

By integrating Keesing’s flagship solution AuthentiScan into its global KYC platform Solis, IoTech Lab delivers an effective and reliable e-KYC solution. Through AuthentiScan, technology customers can identify and verify their customers in near real time, based on biometric checks and extensive ID document verification. It enables IoTech Lab’s customers to provide their users a safe and convenient onboarding process and protection against money laundering and other types of fraud. “We are excited to work with Keesing Technologies. Through this partnership, we combine Keesing’s century long experience in fraud prevention with our state-of-the-art technology. This enables us to deliver best in class e-KYC solutions for our customers.”, says Joris De Meulenaere, CEO of IoTech Lab.

Keesing strives to provide organisations all over the world with easy access to its trusted identity verification solutions to help prevent and combat fraud. Through strategic partnerships, Keesing is better able to serve local organisations and accelerate the introduction of trusted identity verification technology in the region. “We are eager to work with IoTech Lab. The software development powerhouse has a great understanding of the challenges organisations in the region struggle with. Their resources and professional experience within the region offer us an excellent way to set foot here with our identity verification solutions and to start new projects”, comments Daniel Suess, Commercial Director at Keesing Technologies.

Keesing works with various organisations in the financial services industry around the world to streamline and secure customer onboarding processes. Partnering with loTech Lab is part of Keesing’s strategy to expand its presence as a leading identity verification provider in the APAC region.

Related News

- 08:00 am

LiquidityBook, a leading Software-as-a-Service (SaaS)-based provider of buy- and sell-side trading solutions, today announced two new London-based hires for its EMEA Client Service Team: James Pearson and Abdullah Al Nasiri. Pearson will serve as a Technical Implementation Analyst, while Al Nasiri will serve as a Client Services Analyst.

Both Pearson and Al Nasiri will play crucial roles in ensuring that clients are able to effectively use LiquidityBook platforms. Pearson will play a key role in onboarding projects, working closely with both internal developers and external clients, while Al Nasiri will work in the client support group. The hires arrive at the firm at a time when an increasing number of fund managers are abandoning their legacy technology providers in favor of more agile, web-based systems like LiqudityBook’s.

Pearson spent the last 13 years at Schneider Trading Associates, where he most recently served as Head of IT. In this role, he controlled all aspects of IT for the company, setting strategy and direction for the department and managing supplier relationships. He previously served as a Senior Developer, and started at the firm as a Risk Assistant. He began his career at RBS and holds a degree in computer studies and software development from South Essex College.

Al Nasiri joins LiquidityBook from Fidessa, where he served as a Technical Support Analyst. He will play a significant role in assisting in FIX development and deployment to the firm’s client base, supporting critical trade processes and ensuring clients are able to unlock the full power of LiquidityBook platforms. He is a graduate of Queen Mary University of London, holding a degree in computer science.

Commenting on the hires, Sean Sullivan, Chief Revenue Officer at LiquidityBook, said: “We are constantly looking for potential employees with core financial industry skill sets and the desire to apply those skills within the framework of a more modern technology platform. More and more, we find that such talented individuals are coming from legacy business models. The appeal for them is the opportunity to work with new and more cutting-edge platforms that will benefit their careers for years to come. James and Abdullah both come to us with strong resumes of unique skills, and we look forward to them having a great impact on our ability to scale and deliver our products to match the growth of our business in EMEA.”

Related News

- 03:00 am

CREALOGIX has been announced as a member of the new 2020 cohort of the Fintech Power 50, an exclusive annual programme working with 40 of the most innovative Fintech companies and 10 of the most trusted industry thought leaders that are judged as having the biggest impact in the broad fintech ecosystem worldwide.

CREALOGIX was nominated, and subsequently accepted into the prestigious group of 50, as a globally leading software provider specialising in digital self-service and user experience modernisation in private banking and wealth management. The Fintech Power 50 was launched in 2019 as a list of the most influential and up-and-coming businesses in banking and payments, and the 2020 cohort of financial technology brands was announced recently at the FinTech Connect exhibition in London, the UK’s largest fintech event. The organisation behind the Fintech Power 50 has built a global community of both established financial brands, and innovative tech startups, striving to help each other shape the future of financial technology.

Jason Williams, Founder of the Fintech Power 50, comments: “We are delighted to welcome CREALOGIX into the the Fintech Power 50. Our membership is made up of a careful selection of the world’s leading technology innovators and challenger brands in banking and payments, and we welcome the inclusion of a specialist in digital customer experience for private banking and wealth management.”

The Fintech Power 50 last year included some of the biggest hitters in the global financial services industry, including Brett King, world-renowned futurist and speaker, and Chris Skinner, all with high profiles globally as influencers researching and commenting on the future of financial services and technology. Businesses honoured on the list for 2020, alongside CREALOGIX, include Tide, Form3 and Galileo.

System of engagement

Headquartered in Zurich, Switzerland, and powering solutions in over 550 banks and wealth management firms worldwide, CREALOGIX provides a digital banking engagement platform with functionality covering retail, private, and business banking scopes. The modular software-as-a-service developed by CREALOGIX provide financial brands with a fast time to market when updating or rolling out new digital investor products and services.

“We’re truly proud that CREALOGIX has been included in the new Fintech Power 50, and we are looking forward to exchanging ideas with the renowned digital leaders in this unique group. The impressive range of brands represented really highlights the breadth, diversity and creativity of the global fintech scene,” commented David Joyce, CEO at CREALOGIX UK.

About The Fintech Power 50

A membership group based on annual nominations from the industry, the Fintech Power 50 functions like an accelerator programme with a hub-like community, facilitating new connections with industry influencers and investors, and providing a platform for strategic leaders to share their experience and innovations.

Related News

Product Profile

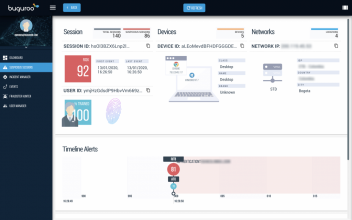

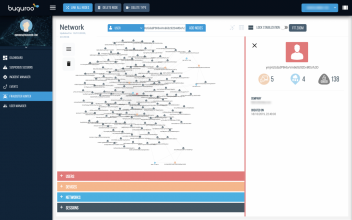

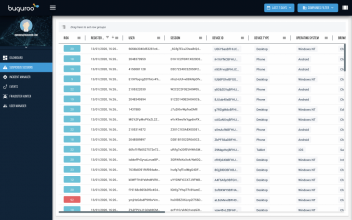

Screenshots

Product/Service Description

Buguroo is a step ahead of fraudsters. By protecting the user from login to logout with zero impact on their experience, we ensure that our proprietary behavioral biometrics technology delivers the most comprehensive online fraud prevention solution for the financial industry.

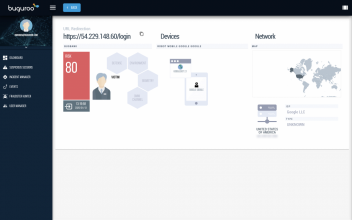

Identity theft and Account Takeover (ATO) is becoming a significant issue for the protection of the digital identity of online users. It doesn’t matter what the threat is. bugFraud ensures that the user is who they say they are and that they are not being manipulated during the whole session and in real-time, analyzing anomalies that allow the detection of fraud before it happens. Continuous authentication detects and enables prevention of attacks such as Man-in-the-middle or Man-in-the-browser.

The result of this analysis translates into a technological risk verdict on the user session provided in real-time, which makes it possible to take the correct action regarding suspicious or anomalous user behaviors.

In addition to protecting the end-user, bugFraud improves user experience thanks by reducing the number of authentication challenges. With our technology, there is no need to oblige users to install anything. The solution does not store any confidential or private user data, facilitating compliance with the GDPR and PSD2.

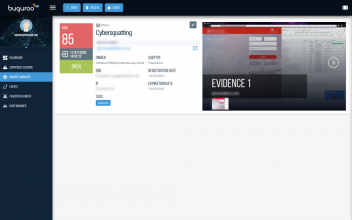

With bugFraud console, we simplify the process of identifying fraudsters by adding contextual information to the sessions. bugFraud allows pinpointing of cybercriminals and identification of modus operandi thanks to the multiple data sources combined with the deep learning process.

Customer Overview

Features

TBuguroo proposes a new solution to provide end-users' full protection and to allow the bank of each client to know and understand the origin of the attack. This system is highly attractive to the market, thanks to the following features:

•Automate your response to attacks against your customers with malware by using our unique Greylisting approach

•Prevent the effects of account take over with our per profile behavioral biometrics

•Target fraudsters with our engine that allows pinpointing the criminals by acquiring the information about the context and behavioral biometrics

Benefits

Below we present the most outstanding benefits that the bugFraud solution offers:

•An integral, holistic layer of defence that complements other BANK security systems, focusing on the protection of its customers using digital banking as these are usually the most vulnerable in the use of online banking services.

•Advanced Artificial Intelligence and Deep Learning techniques for biometric profiling of behavior are used for real-time detection of attacks that seek to supplant the identity of the user (ATO). It is also a protection layer against theft of online or offline credentials, attacks that take remote control of sessions such as RAT, or attacks by automatic bots.

•Immediate protection of 100% of digital banking users once the BANK implements it in its online web banking channels and is updated in the mobile banking application.

•Active protection during the entire online banking session: from the moment authentication through the actions such as executing queries and operations in digital banking, until they finally close and exit the online banking session. It works throughout the session and not only at certain specific static moments.

•Execution of automatic countermeasures for the BANK clients to protect them in real-time against the cyberattacks.

•Transparent and without impacting the user experience in the use of online banking through "agentless" or "frictionless protection" that does not require any action or software installation on the user's device, but works transparently and automatic within the digital banking session itself.

•Protection of both web channel and in the mobile app analyzing and relating dozens of device parameters, user behavior biometrics and advanced malware detection techniques.

•Detection of fraud attacks at an early stage such as phishing campaigns as well as more sophisticated attacks directed against bank clients. Attacks based on web injections, MITB, even in unknown malware (Zero Day), or any use of digital banking that does not belong to the real user.

•Real-time insight and intelligence about the victims of the fraud. Based on that information BANK knows from the beginning and without delay, which of its users are attacked as well as how, when and where they became victims of an attack.

•Easy installation, commissioning and subsequent maintenance by the BANK as it is a component that works embedded in the web portal or within the digital banking app that, thanks to its design and architecture, allows for hot updating and execution without affecting the performance of the users.

•Acquisition of non-sensitive information related to customers or bank operations and information, complying regulations and regulations with data protection personal (e.g. GDPR);

•Support service that works in the cloud with 24x7 support in English and Spanish under the significant benefits related to the availability and security of the solution.

•An optional graphical console for monitoring and visualization of alarms with anomalies and technological risk of users in online sessions detected in real-time, as support in analysis activities of said alarms.

•Optional integration with other systems or applications existing in the BANK such as SIEM, transaction monitors, risk analysis engines and others). Thanks to integration options bugFraud provide risk information, alarms and events, which can be processed with other tools and sources of information from the BANK. It allows the creation of advanced actions of greater scope, trigger research flows, analyze risks and present alarms in a single user interface that could already exist deployed.

Both Buguroo’s solution and their competitors detect online fraud and anticipate potential cases that can end up in fraud (early detection, before it happens). However, as much as they detect attacks, fraudsters will keep trying.

Buguroo proposes a new solution to provide end users’ full protection and to allow the bank of each client to know the origin of the attack. This system is highly attractive to the market thanks to the following features:

•Their inability to guarantee sufficient confidence of the two fundamental principles of fraud prevention: to ensure the legitimate identity of end-users and to ensure they are not deceived during the online session.

•Non-full session protection. They are often only valid for specific moments of the online service and not capable of protecting users during the entire duration of the online session "continuous authentication".

•A smaller scope of detection capabilities and less adaption to changes in cyber-attacks techniques, since they use predictive models not based on AI.

•Disregarding User Experience (UX). Several solutions do not care about the end-user experience: friction is created to them because software must be installed in the end-user devices or because users must overcome more security challenges to confirm their identity. Such an approach reduces the business simplicity of the processes.

Presented arguments render the majority of existing solutions inefficient and incomplete to solve the variety and complexity of current and future attacks in online fraud.

Platform & Workflow

With bugFraud console, we simplify the process of identifying fraudsters by adding contextual information to the sessions. bugFraud allows pinpointing of cybercriminals and identification of modus operandi thanks to the multiple data sources combined with the deep learning process

Connectivity, Hosting and Intergration

Support Services

Branches

Alternatives

Media Coverage (Quick Links)

Related News

Blogs

Publications

Ted Hansson

SVP of Mobile BL at Fingerprints

Digitalization leaves nothing untouched, especially security. see more

- 05:00 am

Today, Nets, a leader in the payments industry, announces its acquisition of Finnish software developer Poplatek, together with its spin-off company Poplapay that provides payment terminal services in Finland. The acquisitions will further strengthen Nets’ group-wide payment application capabilities and offerings within payment terminal services.

CEO of Merchant Services at Nets, Robert Hoffmann, says: “Our ambition is to become a pan-European payments champion. Poplatek is an agile and high performing tech company, and Poplapay has solid capabilities within payment terminal services. Together, they will help us increase our flexibility to better accommodate different customer needs across Europe and provide best-in-class payment acceptance solutions, also going forward.”

CEO of Poplatek, Mikko Virtanen, says: “Becoming part of a leading pan-European industry player like Nets is very exciting for us. We look forward to taking part in the European journey that Nets has embarked on and bringing our skilled teams together to develop solutions for the benefit of merchants across Europe.”

CEO of Poplapay, Petri Ahti, says: “We are thrilled about the opportunity to take our service capabilities to the international playground. Becoming part of the Nets family paves the way for us to increase our market reach and gives us resources to further improve our services for existing customers as well as accelerating development of new services designed to fulfil the demands of European customers.”

Poplatek and Poplapay employ approximately 40 people in total and have a combined annual revenue of around €5 million. The acquisitions were completed on 8 January 2020.

Related News

- 06:00 am

Koine, the provider of segregated, institutional custody and settlement services for digital assets, has retained US Capital Global Securities as its lead financial advisor on a $50 million equity raise.

Koine will utilise the $50 million equity financing to diversify its service offerings and acquire additional regulatory permissions to support its strategic international growth.

Headquartered in San Francisco, US Capital Global is a full-service private financial group with an established track record in debt and equity finance, investment management, and financial advisory. All strategic advisory, private placements, securities, and other related services are offered by the group’s FINRA-licensed broker dealer affiliate, US Capital Global Securities LLC.

Hugh Hughes, Chairman and CEO at Koine, said: “Market reaction to Koine’s ultra-secure scalable institutional class solution for custody and settlement, has been immensely favourable. As we enter 2020, we are focused on driving and supporting international participation in the digital assets marketplace with our application for regulatory licenses in other trusted jurisdictions, in line with our aim to become the most highly-regulated solution for custody and settlement of digital assets globally.

“US Capital Global’s proven experience and valuable insight into capital formation, especially in the FinTech arena, will be tremendously beneficial to us at this crucial time in Koine’s development.”

Charles Towle, CEO at US Capital Global Securities, said: “It’s an honour to serve Koine as its placement agent and lead financial advisor for this upcoming investment opportunity as we engage selected dealers to expand the distribution of this offering. Koine is driven by an expansive, forward-thinking vision of the digital assets market that we at US Capital Global find very exciting.”

Related News

- 02:00 am

NORD/LB Luxembourg S.A. Covered Bond Bank (CBB), a wholly-owned subsidiary of German Landesbank NORD/LB, has successfully completed the migration of three group international branches – New York, Singapore and Shanghai – to the Avaloq Banking Suite. This project builds on an established ten-year relationship between Avaloq and NORD/LB CBB which selected Avaloq as a strategic partner in 2010 to support its wholesale and financial markets businesses. The project utilised key Avaloq functionality, allowing for American and mainland Chinese client entities to be consolidated in one centralised IT operations for the first time.

The latest implementation utilises Avaloq’s multi-entity, single-instance (MESI) capabilities to centralise the bank’s IT operations in Luxembourg and thus to reduce the complexity, while at the same time it offers a wider range of functionalities to NORD/LB. The solution leverages the fully integrated corporate and wholesale banking functionalities of the Avaloq Banking Suite, already used by NORD/LB CBB to run the institution’s New York, Shanghai and Singapore operations on one platform. Long-term implementation partner Orbium conducted the full scope of Avaloq migration, delivering a fully localized platform through onsite consultancy support.

NORD/LB Luxembourg Covered Bond Bank generates competitive refinancing for NORD/LB group's core lending business through the issuance of high-quality covered bonds. It was formed in 2015 through the merger of NORD/LB Luxembourg and its subsidiary NORD/LB Covered Finance Bank. At 30 June 2019, the institution held total assets of EUR 16.5 billion.

Paco Hauser, Global Head of Markets Avaloq, said: “Our latest project with NORD/LB showcases the advanced technical capabilities of Avaloq and the compelling benefits that consolidating complex, cross-border systems onto one platform can bring - in this case, our centralized platform operated in Luxembourg. This project, the outcome of the close cooperation between Avaloq, Orbium and the project team at NORD/LB, strengthens Luxembourg as a central operating centre but also extends Avaloq’s footprint into new target jurisdictions.”