Published

Willand Brienen

Product owner at Onguard

Data and the insights that are derived from it offer organisations many benefits. see more

- 07:00 am

Curve Credit, the credit subsidiary of Curve, the banking platform that consolidates multiple cards and accounts into one smart card and app, has now opened its waitlist for customers who want early access to its world first Curve Credit product when it hits the market later this year.

Curve has also announced that the top 200 customers on the waitlist will get early access to Curve Credit before the product is fully available to customers, subject to eligibility checks.

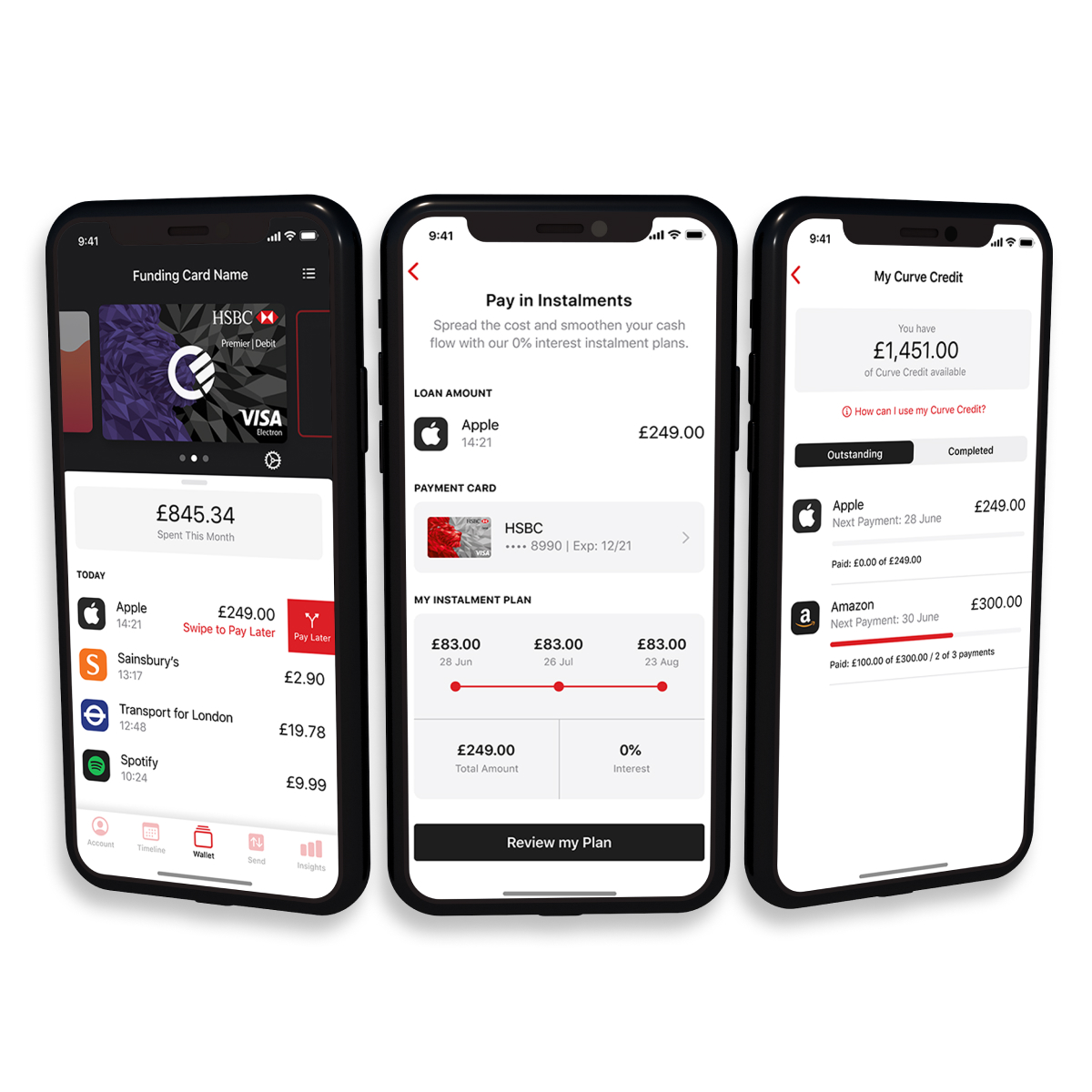

Curve Credit will transform consumer credit by enabling customers to pay off their credit card debt and to split transactions into instalments, made on any connected cards, at any merchant, at any time, all effortlessly managed within Curve’s app.

The functionality for Curve Credit is built directly from Curve’s patent-pending Go Back in Time technology, which advances the buy-now-pay-later model pioneered by companies such as Klarna and Afterpay by enabling customers to split into instalments after the purchase, as well as at the point of sale.

To be one of the first people in the world to access Curve Credit when it launches, sign up to the waitlist here now: www.curve.com/credit.

The initial beta is currently being rolled out and tested by Curve employees before being extended to a select community of trusted Curve testers ahead of a full consumer launch later this year.

Paul Harrald, Head of Curve Credit, previously a founding member of the consumer credit company NewDay, and Executive Director of RBS said:

“Curve Credit will offer our customers a unique combination of capabilities that will generate a truly satisfying experience. We're able to do this because we will be a genuine "fintech" lender, using the synergies, the economies of scope, that exist between payments, lending, and a beautiful UX design. Customers can shop with any merchant, using any underlying funding card they choose, and we will allow them either immediately or at their leisure to "go back in time" and split the purchase into instalments. So, we're always available, any-merchant, any card, point-of-sale finance. And, you can change your mind later. This is a truly unique offering that will change the way people manage their cash flow.”

This is a tangible example of the power and capabilities of the Over-The-Top Banking Platform, a category Curve has been building for the past four years. By consolidating its customers’ banking relationships into one smart card and app, Curve provides a birds-eye-view of all of their finances as well as access to responsible instalment credit, without consideration for merchant or bank.

The success of buy-now-pay-later companies is well documented, with Worldpay’s ‘Global Payments Report: The pathways of people and payments’ revealing that pre lockdown, schemes like Klarna, Afterpay and Affirm are growing at a rate of 39 percent annually in the U.K. and will double their market share by 2023. Additionally, the FCA has announced its commitment to reduce the levels of Persistent Debt by ensuring that Credit Card issuers offer an instalment repayment plan if debt persists.

Related News

- 03:00 am

Eventus Systems, Inc., a multi-award winning global trade surveillance and risk management software platform provider, today announced the appointment in London of Jeff Gale as Sales Director, EMEA, representing the newest addition to the team charged with growing and supporting the firm’s presence in the Europe, Middle East and Africa region. Gale has more than three decades of experience in finance and technology across multiple asset classes, in business development, strategic finance and other key roles. Most recently, he served as Co-Founder at Seismic Foundry, a capital markets fintech fund and consultancy focused on promising early-stage firms.

Reporting to Scott Schroeder, Global Head of Sales, Gale will build and maintain new relationships with firms throughout the region with the goal of further accelerating adoption of the Validus platform that has won multiple awards in the past month alone.

Following the February completion of a $10.5 million Series A funding round, Eventus established a presence in Europe and began a series of hires across the U.S., Europe and Asia with a plan to double its staff by year end. That goal was already achieved by June, and there are now expectations of adding another 10 professionals this year.

Schroeder said: “Since the earliest days of his impressive career, Jeff has established strong and lasting relationships throughout the financial markets ecosystem, including with banks, as well as brokerage, clearing and proprietary trading firms that can leverage Validus to its full potential. He’s demonstrated a deep understanding of, and enthusiasm for, our technology and our high-touch client service approach. We’re thrilled to bring his talents and experience in this critical period of accelerated growth.”

Gale said: “After evaluating hundreds of fintech firms in my role at Seismic, I view Eventus as one of the most exciting I’ve seen in the last several years. I’ve been incredibly impressed with the expertise and passion of the team and the firm’s fantastic, market-leading solution for financial institutions in need of cutting-edge technology to meet the demands of an ever-changing regulatory landscape. I firmly believe a quality product like Validus that utilizes machine learning of huge amounts of data – particularly as it pertains to the compliance, regulatory and trade surveillance space – is one of the most powerful and useful applications of technology in the markets today.”

Gale co-founded Seismic Foundry in London in 2017 and simultaneously served for nearly two years as Business Development Manager for Clear Compress, an interest rate swap portfolio compression service, where he forged relationships with a wide range of institutions, including many Tier-1 banks. From 2015 to 2016, Gale was a business development consultant to CurveGlobal, an interest rate derivatives exchange delivered via the London Stock Exchange, where he helped design and implement the platform underlying the new marketplace.

Previously, Gale spent 18 years at ICAP PLC (now TP ICAP), the largest global interdealer broker. He joined ICAP in 1997 as a Senior Broker on the interest rate swap desk. In 2007, he became Executive Director on the Board of joint venture ICAP/JLT Ltd. and in 2009 Senior Broker in ICAP’s emerging markets interest rate options. In 2012 he was promoted to Global Head of Sales and Bank Relations at ICAP’s MyTreasury, a leading trading platform for corporate treasurers. In 2014, Gale was tasked as Commercial Lead for the creation of an ICAP joint venture company charged with developing a new platform that delivered electronic trading access to liquidity across a diverse range of asset classes and currencies.

Earlier in his career, Gale was a senior broker for two other financial institutions where he set up new interest rate trading desks.

Related News

- 05:00 am

Sensibill has partnered with Chase to provide the bank with its digital receipt management solution, making it easier and quicker than ever before for Chase customers to make returns, submit warranties and expenses, track spending and manage their financial health.

“Chase has created a digital banking experience that makes it easier for consumers and businesses to manage their finances,” said Corey Gross, co-founder and CEO at Sensibill. “Through our partnership with Chase, millions of customers will have access to a best-in-class product that solves the hassle of expense and receipt management.”

Receipts have historically been a major source of friction and headache for consumers and businesses alike. Sensibill’s digitized approach to receipt management will allow Chase’s customers to conveniently monitor spending and manage their purchases from within the Chase Mobile app. Through a progressive rollout, Sensibill’s solution will be available within the Chase Mobile app to all of its 38 million active mobile users later this year.

Related News

- 07:00 am

Ingenico Group (Euronext: FR0000125346 - ING), the global leader in seamless payments, has integrated with OroCommerce offering personalized checkout experiences to B2B retailers for speedier and more convenient online shopping. OroCommerce is the B2B digital commerce platform from Oro Inc. providing a wide range of open source commerce applications to thousands of online businesses. With convenience being critical to unlocking customer loyalty, the integration between OroCommerce and Ingenico brings benefits to ecommerce that boost conversions and grow sales. Through the integration, businesses can firmly place themselves at the forefront of their industries by offering custom-tailored payment experiences without sacrificing security.

Business buyers want convenient ordering and payment experiences just as shoppers do. According to the Global B2B Payment Trends report, a negative customer experience will impact B2B sales in much the same way it would for a consumer:

- Over 57% of B2B buyers did not complete their purchase because their checkout process took too long.

- 48% of buyers have not completed their purchase due to their preferred payment method not being available.

- More than 98% of B2B buyers agree it is important to have the same purchasing experiences across all channels and 41% of buyers are frustrated by inefficient websites, portals, and checkout forms.

Ingenico ePayments’ global payment platform extension for OroCommerce enables its sellers to improve their payments experience by accepting online payments from customers in the OroCommerce storefront and manage all transactions in the OroCommerce back office. The integration allows Ingenico ePayments’ merchants to fast-track online shopping with personalized checkout experiences and the payment methods of their choice. Ingenico ePayments’ integration allows sellers to set up custom payment rules and payment methods. B2B customers can choose from Ingenico’s payment methods – SEPA Direct Debit, ACH, Mastercard, Visa or American Express amongst others – and its “Tokenization” option allows buyers to save payment credentials as tokens for future use.

“We are always looking for new ways to grow and improve our ecosystem,” said Motti Danino, Chief Operations Officer, Oro Inc. “Our integration with Ingenico ePayments gives us a means of going to market and improving the B2B online shopping experience. In B2B eCommerce, buyer experience is vital and a seamless payment process is an important component Ingenico’s platform has been critical in enabling us to offer personalization and choice to our customers and that is core to our business.”

“Being able to offer a quality customer experience is as strong a competitive differentiator as you can find in ecommerce these days,” said Andrew Monroe, General Manager, North America, Ingenico ePayments. “By creating personalized checkout experiences, custom payment rules, and more, we’re able to offer a flexible integration that can provide more value to an ecommerce company like Oro. Through this integration, Oro’s customers will be able to thrive in the B2B digital commerce space and not worry about playing catch-up with their B2C counterparts.”

Related News

John Cragg

CEO at MYHSM

This really is the decade of the Fintech start-up. see more

- 04:00 am

ACI Worldwide (NASDAQ: ACIW), a leading global provider of real-time electronic payment and banking solutions, today announced that India’s Federal Bank is leveraging its UP Payments Risk Management solution to identify fraudulent card activity, mitigate losses and enhance customer relationships. Through ACI’s solution, the bank can enhance fraud detection capabilities with insights into real-time status of card transactions based on pre-defined parameters, empowering the bank to provide better customer experience and security.

Federal Bank, one of India’s largest private sector commercial banks, has more than 2,800 touchpoints (over 1,200 branches and over 1,600 ATMs) spread across the country, serving a customer base of more than 10 million. The bank is a technology pioneer among India’s private sector banks and was one of the first to computerize all its branches. To address the evolving threat of fraud and offer additional security for digital transactions, Federal Bank sought to deploy a solution with real-time monitoring for deterring, detecting and blocking fraud. ACI customized its fraud and risk management solution for Federal Bank at two action levels: cards and merchants.

“Our objective was to equip Federal Bank with real-time reactivity and adaptation to emerging fraud trends, enabling faster decision-making,” said Kaushik Roy, vice president and country leader – South Asia, ACI Worldwide. “We’re delighted to partner with the bank in its ongoing digital transformation journey, delivering a solution that incorporates fraud and payments data through proprietary as well as third-party modelling."

According to RBI data, from October to December 2019, debit card fraud alone reached 11,058 cases involving Rs 94.5 crore, or USD $12.4 million. Federal Bank required a counter-fraud solution for both its cardholders and merchants, with mission-critical features that are easy to deploy, responsive and reduce the financial impacts of fraud.

After deploying UP Payments Risk Management for real-time monitoring of card transactions, the bank saw a considerable drop in fraudulent transactions, including vishing fraud. In addition to alerting customers of risks, the solution also includes automated alerts that have helped the bank recognize and decline potential fraudulent transactions on more than 2,700 cards over a recent six-month period.

“Digital technologies are transforming the way people access banking services and at Federal Bank, our aim is to provide a frictionless experience at every touchpoint. While security challenges for banks are changing fundamentally, we want to make sure that we are always ahead of fraudsters,” said Shalini Warrier, executive director, Federal Bank. “Given ACI’s expertise and proven ability to scale, we approached them to discuss our fraud and risk management requirements. Since the solution enables us to protect our customers against several types of fraud, not only does this significantly improve their satisfaction and mitigate risk, but it also helps us stay ahead of the digital curve.”

Related News

- 03:00 am

CLS, a market infrastructure group delivering settlement, processing and data solutions, and IHS Markit, a world leader in critical information, analytics and solutions, today announced that Goldman Sachs has joined its cross-currency swaps settlement service. There are now eight settlement members live on the service, including some of the largest global banks.

The service is an extension of CLS’s unique payment-versus-payment (PvP) settlement service and uses the MarkitSERV trade confirmation platform to allow CLSSettlement members to send their cross-currency swaps into CLSSettlement for settlement. The cross-currency swap flows are multilaterally netted against all other FX transactions in CLSSettlement, resulting in a significant reduction in daily funding requirements for clients and considerable liquidity optimization benefits across the industry.

Richard Chambers, global head of Short Macro Trading at Goldman Sachs comments: “Becoming a participant of the cross-currency swap service provided by CLS and IHS Markit helps us to further mitigate settlement risk, and we expect to see further operational and funding efficiency benefits as more counterparties join the service.”

Keith Tippell, Head of Product, CLS: “We are delighted to welcome Goldman Sachs as the latest participant in our cross-currency swaps settlement service. Demand has never been higher from market participants for risk mitigation, liquidity optimization and post-trade efficiency. Further, this demonstrates the benefits we can deliver to our clients by leveraging our unique position as a financial market infrastructure in the FX marketplace and collaborating with established service providers that share the same client base, such as IHS Markit.

Chris Jackson, Managing Director, IHS Markit said: “Our collaboration with CLS is a powerful example of service providers working together to make the swaps market more efficient. As the community of global financial institutions connected by the MarkitSERV network continues to grow, the addition of Goldman Sachs to the cross-currency swaps settlement service demonstrates the industry’s ongoing support for such initiatives.”

Related News

- 01:00 am

Since the global economy and political environment are currently undergoing deep changes, IMF forecasts that Chinese economy growth in 2020 will keep falling back, and will be still at the bottom of the operating stage. In this year, three goals will be "finished", so keeping stably growth is very important, and it is expected that countercyclical policies will maintain "deterministic growth" in the uncertainty of economic environment. With the strong supporting strength still kept by supervision to dealing of NPL of commercial banks, in 2020 the special-mentioned loan will change in focus way, which results in that NPL of commercial banks will rapidly grow up to the top. The supply side of NPL expands to the fields such as non-bank financial institutions NPL of non-bank financial organizations, the bailout of crisis companies, the dealing of breaking debts, etc. which will bring more opportunities and challenges to the special asset industry.

The 6th China NPL Investment and Restructuring Forum, an annual grand industry event sponsored by Total Finance, will be held from April 23 to 24, 2020 in Shanghai, and the cutting-edge legal academy and industry assets with regard to three main subjects including "bailout of crisis companies, release regional risks, investment for special opportunity will impact on the 2-day forum. The summit takes deeply analyzing “Big NPL” operation, enhancing the value of assets and enterprises, clearing out inefficient and ineffective assets, etc. as current important topics, and sincerely invites government supervision leaders, home and abroad well-known institutions, and industry leaders to gather in Shanghai, in order to jointly research and discuss the bailout of crisis companies and removal of financial risks, and jointly promote the orderly and healthy development of Chinese special opportunity investment industry.

Related News

- 03:00 am

Today, Mastercard and Octet Europe announce the launch of a new trade solution across the European Economic Area (EEA). The Mastercard Trade Solution powered by Octet Europe helps small and medium-sized enterprises (SMEs) grow their business by managing any business transaction in a safe, real time and more efficient way. Powered by Octet, the Mastercard Trade Solution facilitates domestic and cross border trade by enabling a trusted value chain, secure payments, management of cash flows and simplifying back office functions thereby supporting economies globally by powering the vital SME sector.

SMEs are an indispensable part of our economy, accounting for two thirds of jobs in most countries and driving greater economic inclusiveness.[1] Expanding international or “cross border” trade is a key driver of many SMEs' performance and competitiveness. Despite their critical role in the economy, however, small businesses are underrepresented in international trade: only a quarter of European SMEs export.[2] To help these small businesses integrate into the global economy and fulfill their potential, Mastercard and Octet Europe have teamed up to provide a tailored solution.

The Mastercard Trade Solution is directly accessible and encompasses Octet Europe’s state-of-the-art, cloud based B2B trade platform, which thoroughly reviews each company in its network. Specifically, all members transacting on the Octet platform are extensively verified via industry-leading Anti-Money Laundering (AML), Know Your Customer (KYC), Counter Terrorism Financing (CTF) and Economic Trade Sanctions (ETS) processes to reduce the risk for all parties in the network. This provides peace of mind for SMEs who want to find new business partners abroad and access foreign markets.

One additional challenge for small businesses’ is access to finance. To overcome this, the new trade solution enables SMEs to use their Mastercard cards as powerful tools to manage their cashflows and pay any suppliers to grow their business, while enjoying their valuable card benefits and reward points. Mastercard Trade Solution and Octet Europe are able to leverage Mastercard for payment services. The platform provides greater flexibility on the preferred payment method for businesses. In practical terms, this means that buyers have the choice to pay by card even if the supplier doesn’t process card payments; meanwhile sellers can accept payments to their bank accounts regardless of how the buyer chooses to pay. This flexibility empowers companies to transact in their preferred way, be it by card or another payment method, thus enabling them to manage their finances more effectively and conveniently.

The tool also helps small business owners manage and simplifying multiple tasks by enabling them to track, validate and authorise every step of a business transaction and settle B2B purchases using cards (debit or credit) with full visibility of all supporting trade documentation.

Milan Gauder, Executive Vice President of Product and Innovation at Mastercard Europe noted: “Small business owners can incur a lot of expenses by running detailed background checks on their supply chain, especially if it involves cross-border suppliers. This in turn can limit their willingness and ability to grow their business internationally. The Mastercard Trade Solution powered by Octet will help the vital SME sector thrive in the global economy by unlocking their potential with flexibility, confidence and peace of mind. At Mastercard, we are committed to remaining the partner of choice for businesses of all sizes and to powering economies.”

Margrith Lutschg-Emmenegger, CEO and Co-Founder Octet Europe noted: “We are excited and delighted to be partnering with Mastercard and see tremendous potential in making our unique product offering available to SMEs across Europe via their powerful partner network. It is an exceptional opportunity to create more usage of corporate cards for procurement and trade, which will greatly support SME’s and their role in sustaining global supply chains.”