Published

- 07:00 am

Today Nordic API Gateway further scales its fintech reach in Norway by empowering one of the fastest growing fintech companies Horde. With the open banking collaboration, Horde is making it possible to manage loans and receive better loan opportunities by consolidating credit card debt. Alongside that Horde has launched a social lending platform in which friends and family can lend each other money in a structured way based on open banking payments.

Horde is a fintech company that seeks to disrupt the consumer credit market in the Norwegian banking sector. With its consumer-focused approach, it has grown to become a major challenger for the traditional players.

With the partnership Horde uses access to account aggregation to show a complete overview of consumer loans helping more than a 150.000 users consolidate depth into cheap loans. Next to that Horde is utilizing payment initiation from Nordic API Gateway to further expand its offerings by launching the feature ‘Vennelån’ (‘Friend-loan’) which is expected to be a game changer for private loans in the Nordics.

The partnership adds to Nordic API Gateway’s quickly expanding list of open banking empowered fintechs that also counts the likes of Nordic fintech companies such as Lunar, Pleo, Billy, Swiipe and Dinero. With the Nordic API Gateway collaboration in place, Horde will be given access to a unified API platform granting them access to account aggregation services and payment initiation services in Norway.

Commenting on the partnership, Alf Gunnar Andersen, CEO & Founder of Horde, says: “Having browsed and tested the open banking landscape for quite some time, we’ve chosen Nordic API Gateway due to the proven quality of the platform. They’re delivering the most stable open banking connection which is crucial for our users. With this new feature, we’re using open banking to structure and facilitate loans between friends and family by using account aggregation and payment initiation which basically will make it easier than ever to do social lending. We believe it will be a stepping stone to open a new chapter for Horde to empower Norwegian consumers even further with new loan opportunities”

Rune Mai, CEO & Founder of Nordic API Gateway, also commented on the collaboration saying: “We’re happy to see Horde choose Nordic API Gateway based on the quality and service of our platform. Building the kind of quality platform that allows clients to successfully build and launch services in a fragile open banking world requires true craftsmanship. We focus on the tiniest details - from quickly fixing issues with bank APIs and ensuring the compliance of our clients to effective onboarding with our straightforward communication principles - and we do it with a local mentality of each market we operate in ... no matter what market that might be.”

The new social lending platform is already being rolled out in Norway this week and is expected to be further expanded in the Nordics in the future.

Related News

- 02:00 am

Hudson Fintech, the London-based Capital Markets technology firm, today announced the launch of Trade Hospital. A key component of the Hudson Edge technology platform, Trade Hospital acts as an advanced workflow management service which filters, aggregates and reconciles trade messages before sending optimised submissions to back office systems for confirmation and settlement.

“Hudson Trade Hospital resolves a major headache for our clients, optimising processing workflows and immediately saving on processing costs,” said Michael Walliss, CEO of Hudson Fintech. “This shows the power of the Hudson Edge platform, where we are able to apply our flexible ECS technology to solutions such as the Trade Hospital by quickly creating workflows which deliver real benefits.”

He added, “Hudson is live with Trade Hospital and Repo Trading modules. We are already in development with several new products as our clients see what can be achieved by using innovative ECS architecture.”

Hudson developed Trade Hospital in response to clients requesting a post-trade flow optimiser to manage their trade submission processes. Trade Hospital introduces a new holding stage where the majority of trades can be processed immediately to settlement systems, whilst those which can be aggregated or are not required, follow a different workflow. One example is a block trade workflow where trades are held until the original block trade is fully allocated to the relevant sub accounts. Once done, these trades are submitted for processing and the original block trade is subsequently cancelled within Hudson’s Trade Hospital, meaning no unnecessary submissions or charges are incurred. The holding process is completely configurable and compliant with the regulations regarding booking times for transactions.

Many financial organisations use back office systems which process trades on a cost per transaction basis, where costs rise with the volume of transactions. In certain circumstances a transaction results in multiple trade messages being created, each incurring a fee. Trade Hospital’s intelligent post-trade processing minimises the number of messages being sent without impacting the trade economics and reducing costs.

Providing financial institutions with a flexible, modular and future-proof design which promises cost savings of over 50%, Hudson is used to support multiple asset types and business lines, such as Repo trade capture, Securities Lending, data management for regulatory reporting, clearing complex structures like TRS, and reducing the risk of ‘shadow computing’. Hudson is the first FinTech to use Entity-Component-System (ECS) in Capital Markets, an advanced software architecture, which resolves the inherent issues associated with traditional ‘hierarchical’ software design. ECS works with a flexible data model where changes can be incorporated at any stage, not just during the initial design process.

Related News

- 01:00 am

Modularbank, the Estonian-founded next-generation core banking platform, and HAWK:AI, the German-founded money-laundering detection and investigation platform, have today announced a new partnership which sees HAWK:AI’s AML software added as an out-of-the-box integration to Modularbank’s core banking suite.

Modularbank’s cloud-agnostic core banking platform, developed using an API-first approach, allows banks, financial services companies, or even businesses outside of financial services (like retail or telemedicine), to seamlessly integrate its modular core banking technology into their existing infrastructure, allowing for a fast and efficient roll out of innovative financial products tailored to their customers’ needs.

By including HAWK:AI’s solution in their ecosystem, Modularbank can now offer customers the benefit of real-time Transaction Monitoring and Sanction screening, optimized using Machine Learning. This addresses multiple compliance and crime detection use cases. Regulated companies in the financial services sector are required to apply risk-based monitoring of customers and transactions to identify suspicious behavior, an often expensive and time-consuming endeavor.

“By utilising HAWK:AI’s software, Modularbank’s customers can improve their detection capabilities and reduce False Positives, based on a combination of traditional rules and Machine Learning. This results in a reduction of manual workload and delivers significant cost savings, in addition to achieving better detection rates,” comments Tobias Schweiger, Co-founder and CEO of HAWK:AI. “We believe that an integrated approach spanning core banking and AML/CFT systems reduces risk, both from a technology and compliance standpoint.”

As Modularbank co-founder and CEO Vilve Vene notes: “This partnership represents a significant step for us in expanding our ecosystem and being able to provide our customers with a complete banking suite. Financial crime compliance can be a major burden for our clients, both monetarily and time-wise, which is why we have sought out the very best in AI-driven AML solutions to address these concerns.”

Related News

- 02:00 am

Joining as its newest scale-up member, Aire will use the partnership to further its consumer first approach to credit – and the fairer access it provides – for the mainstream.

Charlotte Crosswell, CEO at Innovate Finance, comments: "We are delighted to welcome Aire to the Innovate Finance community, where they will join an ever-growing ecosystem of forward-thinking and innovative companies, ranging from seed stage startups and global financial institutions to investors, professional services firms, and global FinTech hubs. We look forward to collaborating to build a strong and fruitful partnership long into the future."

Related News

- 01:00 am

Tinkoff Group Holding, Russia's leading provider of online financial and lifestyle services via its Tinkoff ecosystem, today announces its consolidated financial results for the three months and twelve months ended 31 December 2020.

Tinkoff, dual listed in London and Moscow, said total revenues grew 21% to RUB 195.8bn in FY’20 and net profit rose 22% to a record RUB 44.2bn in FY’20. Tinkoff’s return on equity (ROE) remained above 40% in 2020, as the digital ecosystem continued to deliver profitable growth. Non-credit business lines helped fuel profitability. Non-credit business lines including Tinkoff Investments brokerage platform, Tinkoff Business serving SMEs and Tinkoff Acquiring amounted to a record 37% of revenues and 37% of net profit.

Tinkoff’s total customer base expanded further, reaching 13.3 million in FY’20, compared with 10.2 million in 2019.

Oliver Hughes, CEO of Tinkoff Group, commented:

“Despite its challenges, 2020 proved to be yet another year of record profit for us – we reported net profit of RUB 44.2 billion, beating our full-year guidance. Tinkoff was quick to adjust to changing consumer preferences, which helped both our credit and non-credit business lines go from strength to strength.We retained our strong growth momentum with the total number of customers reaching 13.3 million, up from 10.2 million a year ago. This solidified Tinkoff’s position as Russia’s third largest bank by the number of active customers and its largest digital-only player in the financial sector. This puts us firmly on track to expand our customer base to more than 20 million over the next three years. Our engagement with each customer continues to deepen, with average products per customers growing from 1.3 at the end of 2019 to 1.4 at the end of 2020, despite strong growth of the customer base.

Our non-credit businesses reached new heights, underpinned by the popularity of our financial and lifestyle offering. These business lines, which include our current account Tinkoff Black, Tinkoff Investments brokerage platform, Tinkoff Business and Tinkoff Acquiring, generated RUB 73.0 billion of revenues (up 47% year-on-year and representing 37% of total revenue) and RUB 20.6 billion of profit before tax (up 2.5x YoY and representing 37% of total profit before tax). You can see this in much more detail now thanks to our new financial segmental breakdown. Tinkoff Black revenue grew by 41% year-on-year to RUB 21.2 billion. This business has become by far our largest customer acquisition channel and the locomotive of our growth. We increased the number of total Tinkoff Black customers by 2.9 million in 2020 alone from 4.7 million to 7.5 million, and our growth is further accelerating. These customers are highly digital, highly engaged, and we have confidence that they will be using more and more of our ecosystem as time goes on.Tinkoff Investments has blasted into outer space as the brokerage platform reached another milestone of over 1.25 million total customers by the end of 2020 and generated revenues amounting to RUB 8.1 billion, an over eightfold increase. In December, Tinkoff Investment’s active customer base represented more than 60% of all active customers on the Moscow Exchange – a remarkable result.Tinkoff Business posted revenues and profit before tax of RUB 11.5 billion and RUB 5.6 billion respectively in 2020, a 17% and 71% respective increase from the previous year. We are visibly moving into the medium-sized company segment through solutions such as accounting software, tax reporting, website creators, CRM tools and much more.

Tinkoff Acquiring’s revenues and profit before tax grew to RUB 11.2 billion and RUB 2.3 billion respectively in 2020, a 33% and 79% respective increase from the previous year, as e-commerce adoption accelerated and more and more businesses looked to Tinkoff for their customer service and expertise in C2B payments.

We recently announced the launch of Tinkoff Checkout, a one-stop shop that enables companies to take care of all of their online and offline payment needs. It will combine existing Tinkoff payment technologies and new solutions, including services provided by Tinkoff’s CloudPayments.Our credit business grew despite the challenging environment: we increased the total number of customers with credit products to 6.9 million with net loans rising 14%, even as we retained our conservative approach to lending. Our share of Russia’s short-term retail credit market increased to 8.6% as of 1 January 2021, consolidating our position as the second largest player in this segment. Our ROE remained above 40% in 2020, as we continued to deliver profitable growth.’’

Stanislav Bliznyuk, SVP, Head of Business Development, added:

“Throughout 2020 we continued to innovate, launching new products and improving existing services. For the first time in our history, the number of non-credit product customers exceeded the number of credit product customers.

We launched Tinkoff Pro, a financial subscription that allows customers to use products and privileges of Tinkoff ecosystem and its partners on special terms. We have ambitious targets for this product to enhance retention and increase the LTV of our customers. As of the end of 2020, we already had over 150,000 Tinkoff Pro subscribers.

In 2020, Tinkoff became the largest player in the Central Bank’s Faster Payments System thanks to our continued efforts to build out support and integration in the Tinkoff ecosystem.

Tinkoff Mobile unveiled a new version 2.0 of our trailblazing voice assistant Oleg, which enables customers to create their own mobile concierge with customizable features, including the assistant’s voice and name.

Altogether these and many more innovations enabled us to increase the number of monthly active users (MAU) across our main interfaces from 6.0 mn to 9.3 mn.

I am pleased to note that our efforts were recognised by the international community. Tinkoff was named the world’s Best Consumer Digital Bank and honoured with multiple other category wins at Global Finance’s Digital Bank Awards 2020.Tinkoff was also recognised as Russia’s Best-Performing Bank Overall by The Banker magazine, which scored Tinkoff’s 2020 performance in the areas of growth, profitability, operational efficiency, asset quality, return on risk, liquidity, soundness and leverage.

Our robust performance is made possible by our deep bench of first-rate talent, attracted to Tinkoff’s unique corporate culture and its ability to foster innovation, while driving solid results. Tinkoff was recognised among Russia’s Top 3 Employers for 2020, according to Forbes.’’

Related News

- 03:00 am

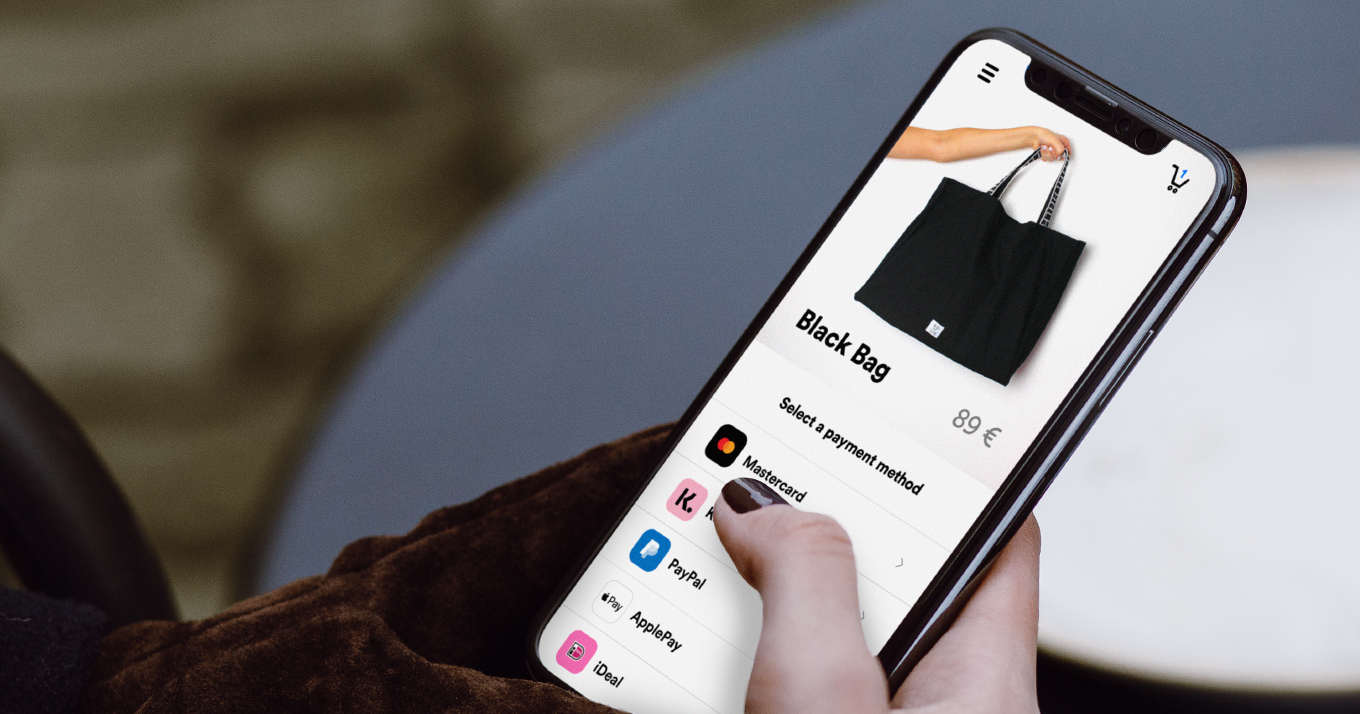

Mollie, one of the fastest-growing payment service providers in Europe, has published research unveiling the state of payments in retail today as well as the challenges and opportunities in the retail market following a turbulent year.

The findings, based on responses from 2,500 European retailers, can be viewed in full in this report, and also highlight the difficulties retailers face in e-commerce environments.

For example, when asked the biggest challenges in online retail, 65% retailers cited converting shoppers to purchase, 43% rated high costs for shipping or payment providers and 41% selected low margins. And for a third of online retailers (34%), cart abandonment is the biggest challenge with 30% reporting that 6-10% of carts were abandoned.

Additional key findings include:

- EU and UK merchants rely on a multitude of channels to sell: As bricks and mortar shops closed their doors, online has become far more important. Specifically, 46% of all revenue now comes from an online webshop. And on average, 37% of sales occur via third-party marketplaces such as Amazon. Finally, as much as 16% of annual revenue now comes through social media platforms like Instagram.

- Two-thirds of retailers had revenues impacted by the pandemic: The pandemic has had both a positive and negative effect on retail sales. 23% of merchants saw sales increase last year. Conversely, 29% either saw no change or had sales decrease somewhat. And 17% saw sales decrease significantly. Of those who reported an increase, revenues went up on average by 29%. The average decrease in revenues was 27%.

- Issues with the payments process can hurt sales and growth: 31% said that an issue with the payment service offered or the range of payment service options provided was the reason for abandoned carts. 41% cited a lack of innovation in payment systems as hindering growth.

- ‘Buy now, pay later’ now offered by more than a fifth of retailers: With many consumers looking for more flexible ways to pay during the pandemic, 22% of retailers now offer ‘buy now, pay later’ or Apple Pay payment methods. And 20% offer Google Pay. This is set to increase with 31% looking to improve payment systems to help grow online revenue within the next 12 months.

“The retail sector has had a difficult year and this is reflected in the findings which expose a multitude of challenges and areas for development,” said Josh Guthrie, UK Country Manager at Mollie. “As the market also comes to terms with the Brexit deal, the ability to adapt and grow under pressure is paramount. To weather the storm, retailers are smartly looking to offer consumers a broader range of payment options to improve the checkout experience and cut cart abandonment. By embracing this digital innovation, merchants can help bolster growth and ensure that 2021 is a better year for sales and revenue than the last.”

Related News

- 03:00 am

Tradeteq, the technology provider for bank asset distribution, has announced the appointment of James Baxter as the company’s Head of Structuring. The news follows Tradeteq’s recently completed Series A funding round and is part of the company’s investment into expanding the team and its products.

Having worked in the capital markets department at Latham & Watkins for the past thirteen years, James brings a powerful combination of capital markets and legal expertise to Tradeteq. During his career in law, he represented investment banks, issuers, sponsors, investors and trustees on a wide variety of capital markets transactions, including trade finance repackaging.

Tradeteq provides banks, credit insurers and asset managers with technology that repackages trade finance into investable assets. Its technology automates and streamlines the asset distribution process and reduces friction costs for clients. James will play a key role in helping trade finance originators to structure and package their loans into standardised, transparent and investable notes that can be sold to investors.

Nils Behling, Co-Founder and CFO at Tradeteq, says: “Banks and institutional investors are increasingly seeing trade finance as a safe, stable and viable addition to their portfolios. Creating the infrastructure to support this new asset class requires in-depth knowledge of international regulatory frameworks and capital markets. James will be a crucial member of our team as we continue to build the hub for trade finance distribution, and achieve our vision to make trade finance accessible to a broad range of investors.”

James Baxter, Head of Structuring at Tradeteq, added: “It’s clear that banks can no longer be the sole providers of trade finance funding, as balancing the requirements of international regulatory frameworks like Basel IV while supporting the world’s businesses is becoming increasingly challenging. This is where Tradeteq can play a transformative role. It has the potential to have a real impact on the global economy and is a solution that has been long overdue. I’m eager to lend my expertise to help make trade finance more efficient for originators, businesses and institutional investors.”

Related News

- 02:00 am

equensWorldline, a subsidiary of Worldline (Euronext: WLN), the European leader in the payments and transactional services industry and #4 player worldwide, and comdirect, a Commerzbank AG brand, have extended their existing service agreement: equensWorldline will process the bank’s new Visa debit card via its API based WL Extended Issuing service. Within that agreement the existing debit cards are switched over to the new product. The contract has been signed for an initial period until 2025.

Through flexible adjustments to equensWorldline’s front and back-office systems, the service provides a cutting-edge customer experience and the highest efficiency. It delivers an optimum solution meeting banks’ need to be able to react more rapidly and more effectively to market demand. The primary goal is to be able to offer cardholders an array of value-added services. The first comdirect customers can already take advantage of these.

With the progressive card switchover for existing and new customers and the introduction of additional services like a travel insurance package or Bargeld Plus (a cash service providing maximum flexibility worldwide), comdirect is building a new convenient and versatile debit card portfolio, laying further foundations for profitable growth.

Multi-stage switchover

In several stages, comdirect is switching over all existing and new customers to the new Visa debit cards processed by equensWorldline. Once they receive their new card, customers can independently and seamlessly choose their own PIN.

From February 2021, all the bank’s existing customers are switched over to the new equensWorldline platform and receive their new card. The objective is that comdirect debit cards will be processed on the equensWorldline platform by April 2021.

Efficient real-time and the digitalized card processing

Unlike most conventional batch-based systems, WL Extended Issuing processes transactions in real-time, which brings decisive advantages in terms of user-friendliness. comdirect’s customers can apply for new cards directly on the website. Once the card has been issued by comdirect, customers get all the details about their new card, including the card number, in real-time. As soon as customers receive their physical card, they can immediately and independently change the PIN to a number of their choice. In general, WL Extended Issuing can process pure virtual / tokenized cards, enabling a native digitalized user experience. In any case, it will be possible to print the physical card a second time.

Michael Steinbach, Managing Director, Financial Services at Worldline, commented: “We are delighted that comdirect is the first bank in Germany to have chosen our new services within WL Extended Issuing to process its new Visa debit card portfolio. Serving already a big number of banks in the Issuing back-office processing with our state-of-the art and future proof WL IBO application across Europe, WL Extended Issuing is offering innovative white-label solutions on the bank to customer interface side, covering highly user-friendly and real-time services for the cardholders.”

Thore Ludwig, Managing Director Banking at comdirect added: "For an outstanding customer experience, the purely digital and thus fast and user-friendly issuing and processing of our card products by equensWordline is an important building block. For example, customers will be able to use the digital version of their Visa debit card for mobile payment right after opening their current account. Additional services can be added flexibly for immediate use. Together with equensWordline, comdirect has succeeded in significantly increasing the user-friendliness of our mobile current account once again."

Related News

- 03:00 am

Temenos (SIX: TEMN), the banking software company, today announced that Crédit du Maroc, a subsidiary of Crédit Agricole, has selected Temenos to digitally transform its core banking and payments infrastructure. The core transformation project with Temenos will prepare Crédit du Maroc for the future, to deliver improved, frictionless and innovative omnichannel experience for its retail and business customers and grow sustainably.

Temenos Transact next generation core banking will provide the flexibility and agility for Crédit du Maroc to offer personalized, customer-centric products, while allowing for lower operational costs and increased return on equity (ROE). With integrated Temenos Payments, it also provides a comprehensive, universal platform for efficient payment execution and distribution.

Crédit du Maroc is one of the largest banks in Morocco with 2,500 staff. It is a universal bank and recognized as a major player in the retail, corporates, and more recently, agricultural and agro-industry sectors. The bank’s affiliation with the Crédit Agricole group gives it a key commercial edge, offering its customers a global approach and the expertise of an international group.

Temenos’ modern API-first technology will enable Crédit du Maroc to make it easier and faster for retail and business banking customers to manage their accounts and cards, make deposits and send payments as well as accelerate time-to-market for new products and services designed to enhance the digital customer experience.

With Temenos Payments, the bank will be able to scale its payment processing capability to meet ever-increasing volumes, range of channel and customer demands for increased transparency and speed of service. Temenos Payments also enables the bank to adapt quickly to new regulations and standards including ISO 20022, payment schemes such as new instant / real-time payments as well as rapidly innovate new payment services such as Request to Pay.

Yann Crispin, Transformation Deputy Managing Director, Crédit du Maroc, commented: “With Temenos we are preparing Crédit du Maroc for the future with ambitious plans to be an innovative financial player, a sustainable partner to our customers and socially responsible. Temenos’ modern technology platform will not only help to drive incredible operational efficiency it also enables the bank to accelerate time to market for new products. In a highly competitive market for financial services, Temenos gives us the edge and ensures we deliver the highest levels of customer satisfaction and attract new customers to drive growth.”

Alexa Guenoun, Chief Operating Officer, Temenos, said: “Temenos is proud to partner with Crédit du Maroc on this exciting transformation project. Temenos has a strong track-record with banks in the region and more than 10 years of investment in the Morocco market. It means that we are able to support Crédit du Maroc with an experienced team that has a deep understanding of the local banking requirements. Crédit du Maroc has clear focus and with Temenos it is set to drive innovation in the market and make banking better for individuals and business in Morocco.”

Related News

- 03:00 am

Canoe Intelligence (“Canoe”), a financial technology company focused on reimagining data management processes for alternative investors, wealth managers, asset servicing firms and capital allocators, today announced it has expanded its EMEA presence with new clients, a new London office and the hire of Toby Bailey as Vice President of Sales, EMEA.

The alternative assets industry in Europe is robust and growing, making it the optimal time for Canoe to expand its presence in the region. Total assets under management for Europe-based alternatives funds reached EUR2.00 trillion for the first time as of the end of 2019, according to Preqin's 2020 Alternative Assets in Europe report[1]. This is up from EUR1.79 trillion at the end of 2018, and EUR1.39 trillion at the end of 2015.

In 2020, Canoe’s global client base grew by more than 150% as clients implemented Canoe’s technology to automate and scale their alternative data processes from document collection to data extraction and delivery into downstream systems.

Mr. Bailey, who has joined Canoe’s growing team in its new London-based office, will be responsible for leading Canoe’s go-to-market strategy, building partnerships and driving revenue growth in the region. Mr. Bailey will spearhead the company’s business strategy to expand Canoe’s reach into new and existing markets.

Mr. Bailey has over 12 years of experience in sales and sales leadership at private markets software and data businesses. He began his career at the Mergermarket Group where he helped launch and grow the company’s M&A platform, MergerID, which was ultimately acquired by Intralinks. Mr. Bailey was the third hire for iLEVEL in Europe, where he contributed to establishing iLEVEL as the dominant portfolio monitoring software for private capital GPs and LPs. He was with the business through its acquisitions by both Ipreo and IHS Markit. Most recently, Mr. Bailey opened the UK office for CEPRES where he successfully established a team and grew its client base of European institutional investors.

“Alternative investments are growing rapidly around the world and we’re looking forward to being at the forefront of this regional expansion. We’re excited to welcome someone of Toby’s caliber to the team,” said Canoe CEO Jason Eiswerth. “As we continue to expand our reach internationally and more firms recognize the importance of streamlining alternative investment processes, Toby’s track record of successfully growing organizations within the UK and beyond will make a significant impact at Canoe.”

Commenting on the new role, Mr. Bailey said: “Canoe’s expansion over the last three years—now on a global scale—is nothing short of inspiring. I look forward to contributing to the team’s ongoing success as we expand into new and existing markets. Jason and the rest of the Canoe team have built a revolutionary firm that solves alternative investors’ and allocators’ biggest challenges, and I’m eager to share the incredible benefits of our solution with many more firms in the region.”

This announcement makes for a prosperous first quarter for Canoe following a successful 2020, as the company increased its client base by over 150%. Canoe continues to grow its client engagements with institutional investors and large family offices.