Published

- 08:00 am

Nutanix, Inc. (NASDAQ: NTNX), a leader in private cloud, hybrid, and multicloud computing, today announced the appointment of Andrew Gill as Channel Director for Western Europe & Sub-Saharan Africa (WEURSSA).

Responsible for leading all channel and OEM activities in WEURSSA, Andrew will oversee Nutanix's go-to-market relationships with resellers, distributors, regional system integrators and technology partners in the region. Additionally, Andrew will play a key role in driving channel focused initiatives such as Nutanix Cloud Bundles, a strategic and unified offering to access Nutanix enterprise cloud software and solutions, while providing partners with greater value and autonomy through the sales channel. This unified management bundle enables Nutanix to expand access to its solutions, with an offering that meets the needs and budgets of any company as an essential addition to their Enterprise portfolio.

Commenting on his appointment, Andrew said: “The powerful combination of Nutanix’s unsurpassed multi-cloud approach and its clear commitment to driving true business value for customers and partners alike make it a highly desirable organisation to join.” He continued: “It was clear to me that as well as Nutanix’s market leading technology and outstanding high value Partner program, the company genuinely cares about the success of its customers and partners hence its enviable NPS score of over 90 over the last 7 years - that's a company I want to be part of.”

Andrew joins Nutanix from his position as Director of Partner Ecosystems at IBM, where he was responsible for the sales and go-to-market strategy for the partner ecosystem for the UK and Ireland. During his tenure at IBM, Andrew excelled at selling and enabling high value IT solutions for corporate and commercial marketplaces through partner ecosystems. He also gained invaluable experience within the IT industry with a high-profile start-up business and accelerated his career through multiple roles across the IBM business portfolio.

Dom Poloniecki, VP Sales, WEURSSA at Nutanix, said: “Andrew has a proven track record in consistently overachieving on business objectives by leveraging his expertise in running highly successful, profitable sales teams and partner ecosystems.” He continued: “He is a welcome addition to the team and both his experience and passion as well as his extensive executive relationships in the partner community will help us to enable our industry-leading partner ecosystem to gain maximum benefit from the innovative product portfolio that we offer."

Related News

- 03:00 am

Finastra announced that it has joined the Federal Reserve’s FedNow Pilot Program to support development, testing and adoption of the FedNowSM Service. Finastra joins other progressive banks, credit unions and payments technology organizations in the FedNow Community to help shape the future of payments and develop use cases that leverage FedNow functionality.

“Finastra has deep expertise and knowledge of instant payment schemes globally, having enabled financial institutions to process payments and implement associated overlay services for instant payment schemes in 12 countries across four continents,” said Ohad Chenkin, Vice President, Product Management, Payments Product and Platform at Finastra. “We look forward to bringing our knowledge and experience to the FedNow Pilot program and to help advance instant payments in the United States.”

The FedNow Pilot program is designed to support development, testing and adoption of the FedNow Service, and to encourage development of services and use cases that leverage FedNow functionality. As a part of the FedNow Pilot Program, Finastra will help shape and provide input into the service and adoption roadmap, industry preparation, and overall instant payments strategy. Pilot firms will also have the opportunity to work with the FedNow Service prior to general availability.

Finastra’s payment solutions provide financial institutions with the tools to meet all of the challenges of new technologies and innovations in the payments space, including immediate/real-time payment schemes, open APIs, artificial intelligence, and cloud computing. With a broad suite of integrated solutions for financial institutions ranging from the world’s largest banks to community banks and credit unions, Finastra provides the technology platform to take payments systems forward on a road to modernization.

Related News

- 08:00 am

Phil Shelley, ex-Goldman banker and founder of Arlington Capital Markets Ltd has been appointed Chairman of the Board of ALT/AVE (www.altave.co.uk), a new, London-based Regtech startup that uses Distributed Ledger Technology to help combat the underreported paper waste problem faced by financial institutions by offering a secure and sustainable digital solution for distributing highly regulated documents to their customers.

Phil has more than 23 years of experience working in the investment banking industry and is currently Chairman of WH Ireland, a financial services and wealth management company, which, following his appointment in October 2019, has moved from losing £10m in 2018/2019 to now being profitable. Phil has also been Vice Chairman at Barclays Investment Bank and Head of UK Corporate Broking and ECM at Goldman Sachs International.

ALT/AVE uses Distributed Ledger Technology to provide financial institutions with a durable medium to send regulated documents to their customers. ALT/AVE enables banks and other financial institutions to meet the strict regulatory requirements set out by the Financial Conduct Authority (https://www.handbook.fca.org.uk/handbook/BCOBS/4.pdf) on how these documents must be distributed without relying on paper. The financial services sector is currently estimated to distribute 5.2bn pieces of paper at a cost of £1.7bn a year, equivalent to 2.4 million trees.

“We are extremely excited to have Phil join the ALT/AVE team as chairman of the board,” says Chris Ansara, founder & CEO of ALT/AVE. “His impressive background and breadth of industry experience will play a crucial role in enabling the company to reach its next level of success. As we take on the challenge of digitising what has long been a manual and outdated process of financial institutions sending paper documents to banking customers, Phil’s role as chairman opens up new avenues of opportunity and marks a significant moment in the history of our organisation.”

“I am delighted to be joining ALT/AVE at this exciting time,” says Phil Shelley. “The team has created a product which clearly meets a pressing need for the financial services sector. It combines regulatory compliance with high levels of security and improved customer experience whilst reducing paper usage. There is much to do but the work our team has already done means we can look forward to an exciting future.”

Related News

- 05:00 am

Leading mortgage technology provider, Twenty7Tec, has announced that following the completion of a successful pilot with Virgin Money, all users of the CloudTwenty7 platform will now be able to access the APPLY integration.

During the pilot phase, Mortgage Advice Bureau (MAB) and Connells successfully submitted over 1,000 applications to Virgin Money via APPLY.

The APPLY integration with Virgin will enable users of the CloudTwenty7 platform to:

- Apply for a Decision in Principle (DIP) from Virgin Money, as well as submitting a Full Mortgage Application (FMA), avoiding duplication of data and speeding up submission.

- Receive decisions and case tracking updates from Virgin via APPLY.

- View case notes to confirm the required documents that are needed and fees to be paid to Virgin before conversion to full mortgage application.

Nathan Reilly, Head of Lender Relationship at Twenty7Tec commented “The initial roll out of our APPLY integration with Virgin to both MAB and Connells has been our most successful pilot to date, and we are delighted to now be able to extend this integration to all users of our CloudTwenty7 platform. This integration represents a significant milestone in our ambitions to deliver the very best solutions to help our advisers’ source, apply and ultimately obtain a mortgage for their clients”.

Simon Wallace, Head of Mortgage Integration and Transformation at Virgin Money said: “The wider roll out of the APPLY platform to registered brokers in partnership with Twenty7Tec is very exciting. The pilot successfully demonstrated the speed and ease in which brokers can submit business to us through the platform, giving them more time to spend on helping their next client with their application. This is a great example of Virgin Money’s commitment to drive change and innovation in the mortgage market and push the boundaries of technology to help our intermediary partners and customers.”

Twenty7Tec will be issuing a white paper shortly which analyses the success of the pilot in more detail.

Related News

- 05:00 am

Banks are looking for greater flexibility and functionality to enhance the customer experience at their ATMs and advanced software is helping them get there

In recent years, banks across the world have been increasingly investing in advanced ATM software as they migrate transactions away from teller positions as part of their wider self-service strategy. The brand-new ATM Software 2021 study by strategic research and consulting firm RBR explores the current approach to ATM software taken by leading banks from across the globe, and reveals insights on their future plans.

Banks looking to offer touch-free, personalised interaction

The ongoing COVID-19 pandemic has made offering customers a touch-free way of interacting with an ATM even more important. Many banks are actively exploring software which allows methods for identifying a customer other than the ubiquitous card and PIN. NFC/contactless withdrawals are becoming more common, while there is growing interest in biometric authentication across the world, with deployers from China to Colombia either rolling it out, or evaluating whether to do so.

RBR’s research shows enhancing the customer experience at ATMs though personalisation is also a major focus for banks. Many provide a “quick cash” option, which dispenses a default amount predefined by the customer, while having access to a payee list drawn from other channels is increasingly available. Banks are also keen to use marketing solutions at their terminals which offer tailored products to individual customers, and some are upgrading their ATM software specifically to implement this.

Monitoring is becoming more advanced, as banks seek detailed analytics

The research presents banks’ perspectives on how they monitor and manage their ATM fleets, and the critical value of keeping ATMs available to customers remains a core theme. As standard, banks are keeping track of terminals’ uptime and status, but many are also using more sophisticated tools to monitor cash usage, consumables levels and review an inventory of their hardware and software.

Banks also want access to more detailed information on transactions including predictive analytics so that potential problems at ATMs can be resolved before they occur, and crucially, keep availability high.

Deployers see advantages in separating software and hardware procurement

RBR’s research reveals that banks are continuing to move away from using vendor-native software as part of a bundled procurement process when they purchase hardware. Some see this strategy as a way of cutting costs and allowing them to use solutions that support more advanced functionality at their ATMs, often in conjunction with omnichannel integration. Others believe it enables greater flexibility in terms of their hardware strategy as deployers can more easily swap between suppliers, which may be particularly attractive to those with large ATM fleets spread across vast geographies.

Open banking initiatives at ATMs in early stages

In recent years, the concept of “open banking”, where customers can share their banking information with accredited third parties, has become a familiar talking point in the industry. It remains early days in terms of the sharing of ATM-specific information in most countries, but many banks expressed commitment to the idea, and see value in the potential ability to offer customers new services off the back of this approach.

ATM software is clearly evolving, as banks recognise the value of the technology as part of their overall omnichannel strategy. Alan Burt, who led the research, commented: “Banks are seeking solutions that can run on any hardware, allow access via a range of contactless methods, provide a unique, personalised customer experience, and keep terminals available round the clock. Suppliers, therefore, have vast scope to offer banks their expertise and guidance to ensure ATMs meet customers’ needs in a new post-COVID-19 world”.

Related News

- 05:00 am

upSWOT, a fintech platform helping financial institutions dramatically improve their ability to service Small-Medium Business clients (SMBs), announces a $4.3M seed round with commitments from multiple VC firms, corporate partners, and 50+ prominent angels and industry operators. Utilizing an API-driven, modern approach, similar to Plaid, upSWOT connects, collects, and normalizes data from over 120 business software tools SMBs regularly use, such as Quickbooks, Xero, Salesforce, Amazon, eBay, Shopify, Freshbooks, Sage, and more. SMBs can easily and accurately track business operations through KPI dashboards, real-time insights, and automatic alerts. At the same time, their bank partners obtain actionable data to meaningfully engage and help fuel growth.

upSWOT's 45-person team currently services a diversified clientele from US and European banks like Raiffeisen Bank Aval, Société Générale RosBank, to Fintechs like Tribal Credit, and non-banking FIs like MasterCard. Common Ocean Ventures led this Seed round with participation from CFV Ventures, ICBA, First Southern National Bank, SpeedUp Venture Group, and previous investors. Common Ocean General Partner, Igor Ulis, joined upSWOT's Board of Directors.

With this funding round, upSWOT plans to expand its US footprint, continue hiring onshore staff to support a growing list of deployments with Tier 1 and Tier 2 financial institutions, and further enhance the product to widen the competitive advantage gap.

While personal financial management tools, like Mint, designed to aggregate data from multiple sources to get timely assistance and advice have been available to individuals for over a decade, SMBs have primarily had to fend for themselves. upSWOT aims to change this dynamic by partnering with financial institutions and bringing simple-to-use data aggregation, visualization, and analytics to millions of businesses. Using a mix of metrics-driven dashboards and timely recommendations, SMBs get modern-day tools for cash flow management, debt funding decisions, financial planning, and accurate cash reporting to ensure supply chains stay healthy, customers are happy, and workers get paid.

Small businesses create two-thirds of net new jobs and account for 44% of US economic activity, but this client segment is also the riskiest for lenders due to business owners' frequent lack of scaling experience, lack of data transparency, low data consistency, and thin credit files.

"Managing a portfolio of SMB clients is a challenge for every bank, lender, and servicer,” explains Dmitry Norenko, upSWOT CEO. “Amidst a global pandemic, the financial industry must find new and innovative ways to support this vital customer segment. Our white-label cloud solution helps leading national and community banks gain granular insights into their SMB customers launched within 6 weeks, and with minimal strain on internal IT or overlap with legacy systems.”

"The pandemic accelerated a shift to digital platforms as the primary interface with customers. Banks need to offer sophisticated tools to keep pace with demand," adds Ulis. "When it comes to quick deployment of innovative financial products, first-mover advantage has worked in upSWOT's favor. In under two years, they've integrated 120 mission-critical SaaS products and launched pilots with 30 financial institutions across Europe and North America and have already shown customer success. Their momentum is a clear indicator of market need, product fit, and the agility of upSWOT's team."

In addition to VC participation, upSWOT has brought on a consortium of angel investors, including Knut Frangsmyr, COO of Klarna; Kaustav Das, Chief Risk and Analytics Officer of Quadpay; David Rabkin, former EVP & GM at American Express; Hannes Liebe, COO of Finastra; Aiaz Kazi, Former Chief Platform Officer at Banco Santander; Levi King, Chairman, NAV; Kerry Agiasotis, EVP, Sage, and more than 50 other financial industry leaders, visionaries, and operators.

"Given the number of SMBs globally and the historic friction in collaborating with banks, upSWOT is addressing a critical problem at the right time and in a vast market," said Panagiotis Spiliopoulos CFO, Temenos and upSWOT angel.

“upSWOT's technology creates a unique win-win situation for financial institutions and their SMB customers,” said Alex Keltner, CEO of First Southern National Bank and upSWOT client. “Banks and FinTechs alike can now offer timely credit products and efficiently scale their portfolio servicing operations. At the same time, SMBs, who form the backbone of our economy, have much-needed access to working capital and financial tools to ensure their success.”

Related News

- 07:00 am

MACROBOND Financial, a leading provider of economic and financial data and analytics, announced today that it has appointed John Leffler as Vice President for the Americas andChris Seaman as Regional Managing Director in the UK.

Leffler will be responsible for expanding Macrobond's business in Canada, the US and South America, while Seaman will oversee all existing and new business in the UK, France, Germany, Austria, Switzerland, Italy and MENA.

The new hires follow the recent opening of Macrobond’s Stockholm office, its seventh global location, and the appointment of Howard Rees as Chief Commercial Officer based in London, who joined Macrobond earlier this year.

Macrobond is the world’s most comprehensive source of economic intelligence for more than 4,000 finance professionals globally. Its flexible SaaS platform provides instant access to macroeconomic, aggregate financial and sector time-series data from more than 2,500 global sources, along with integrated analytics that enable users to quickly analyse, visualise and share the data - helping them gain strategic insights and collaborate better across their businesses.

“Macrobond has seen significant growth outside our domestic market in the last few years, and we expect this trend to continue as we expand to new markets. Our desktop solutions continue to sell strongly and we are now preparing to launch new complementary products in the near future. John and Chris have strong track records selling enterprise solutions for some of the biggest names in our industry and I’m delighted to have them on board for this next stage of our growth journey,” said Tomas Liljeborg, Chief Executive Officer, Macrobond.

Leffler joins Macrobond from Donnelley Financial Solutions, a leading global risk and compliance solutions company where he served as Vice President and Global Head of Venue Sales. Prior to that, he spent 17 years at FactSet Research Systems in multiple senior roles, including Sales Manager for SCG sales when he managed teams that oversaw the development, maintenance and growth of current accounts across the United States.

John Leffler, Vice President Americas, Macrobond, commented: “It’s not often that you get the chance to join a company with such strong data quality and analytics. I hope to replicate Macrobond’s domestic market success across the Americas and continue helping firms work more efficiently with strong data and analytic workflows.”

Seaman was previously Global Head of Sales at trading and logistics firm Benteler Trading International. Prior to that he was Managing Director, EMEA at software company Gtreasury, and Global Head of Corporate Treasury Management Solutions at Bloomberg, where he spent 10 years in a variety of sales roles focused on FX, derivative and corporate treasury products. Seaman studied at the Association of Corporate Treasurers and holds a MSc in Money Banking and Finance from Lancaster University in England and a BA in Economics from Liverpool University.

Chris Seaman, Regional Managing Director, Macrobond, said: “This is a unique opportunity to join a company with a vision for changing the way that firms work with macroeconomic data. Its recent success is admirable and I’m excited to take this next step in growing Macrobond’s footprint even further.”

Related News

- 03:00 am

A new study from Juniper Research has found revenue from tokenisation provisioning and management in mobile payments will exceed $53 billion in 2025, from $18 billion in 2020. The report found tokenisation, where account details are replaced with data useless to fraudsters, is taking hold in both in-store and remote commerce. This strong growth, of over 180%, will be fuelled by increased use of OEM Pays in both in-store and remote commerce, as well as increasing adoption of tokenisation by digital wallet providers and their tighter integration into app checkout processes.

The research recommends that digital wallet providers move to implement tokenisation immediately, if not already, and prioritise acceptance to increase security in checkout processes.

Related News

- 09:00 am

A socially-minded technology company set to transform the travel experiences of those with reduced mobility has secured £2.3m in a funding round led by Blackfinch and Praetura Ventures.

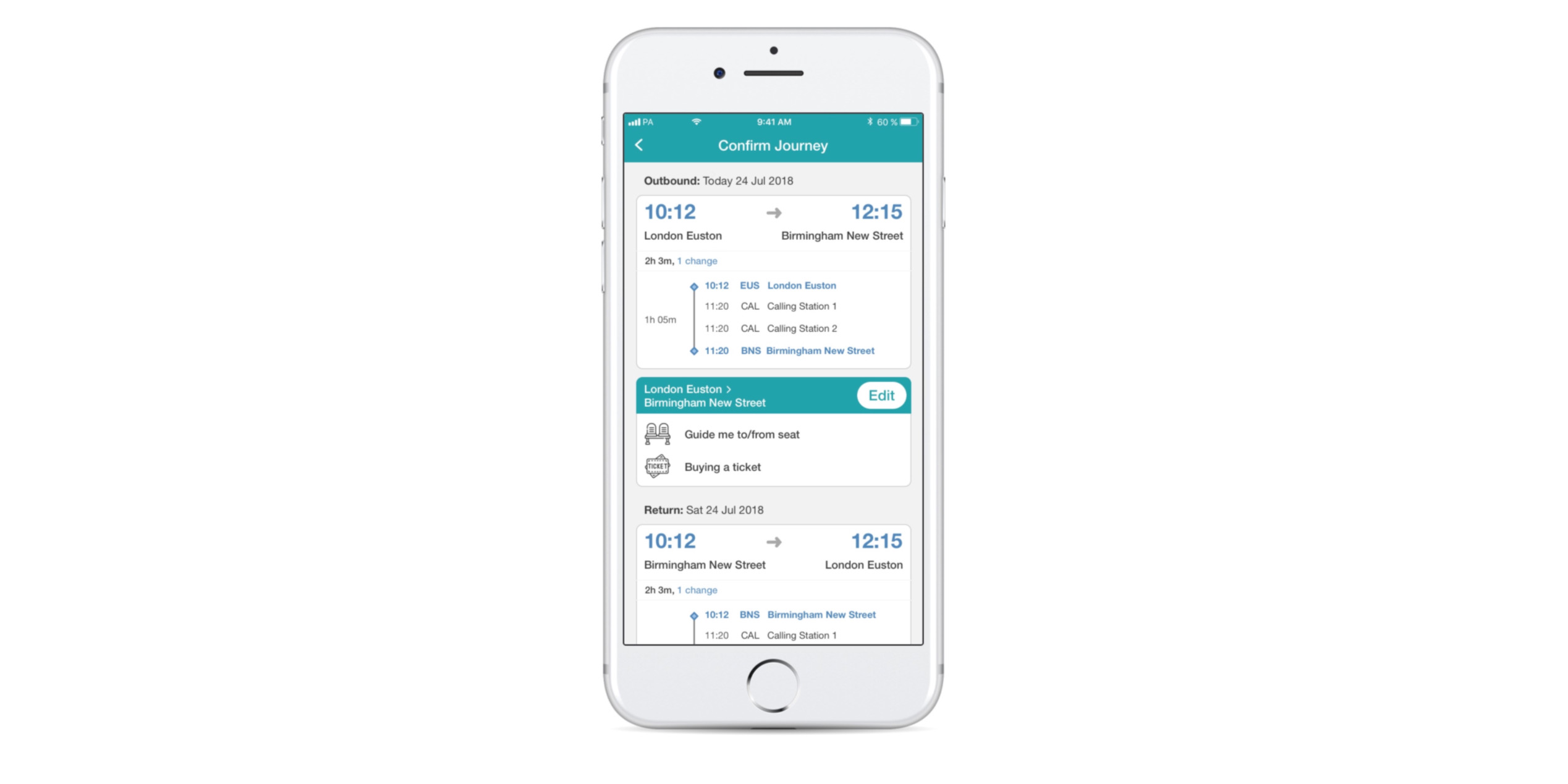

Transreport, which has offices in London and Glasgow, has designed an app that helps rail passengers with disabilities and mobility restrictions by better enabling rail operators and station staff to respond to booked assistance requests.

The innovative Passenger Assistance tool - which is already being trialled by major rail operators including West Midlands Railway, Northwestern Railway and Govia Thameslink Railway - allows passengers to alert staff to their needs as part of their everyday journeys, making rail travel more accessible and socially inclusive for all.

The progressive technology also means staff can respond effectively to changes in the event of cancellations, delays, platform alterations or missed trains, and is set to transform the travel experiences of those with reduced mobility.

This investment round was led by Reuben Wilcock of Blackfinch and Pete Carway and Louise Chapman of Praetura Ventures. Andy Sumner, portfolio managing director of Praetura Ventures, will join the Transreport board as a non-executive director.

Blackfinch will have invested a total of £1.3m by tax-year-end, and Praetura Ventures has invested £1m as part of the deal, which includes personal investment from Dominic McGregor, co-founder of Social Chain and one of Praetura Ventures’ venture partners. This investment will now allow Transreport to drive expansion, as well as invest in marketing for key products. With the support of the teams at Blackfinch and Praetura Ventures, Transreport also plans to further solidify its multi-modal proposition.

Jay Shen, founder of Transreport, said: “Both Blackfinch and Praetura Ventures instantly recognised what Transreport is trying to achieve: make transport more accessible. Their respective strategic visions for a more equal, equitable and inclusive society aligns completely with our own. Going forward, there is a strong belief that companies which put people and the planet first, will undoubtedly be more profitable. We maintain an ethos of using technology for doing good, and the entire team is greatly looking forward to working with them to help grow Transreport further to maximise its positive impact on as many people as possible.”

Reuben Wilcock, head of ventures at Blackfinch, said: “Transreport’s unique proposition provides a practical solution to an everyday challenge experienced by the rail operators and their customers. The Passenger Assistance tool makes train travel more accessible to those with disabilities and mobility challenges, and that concept perfectly aligns with the Blackfinch Group’s commitment to investing in companies that are making a positive impact on society. The interest that the app has already had from across the industry is indicative of the strong growth and return potential that it offers for investors.”

Pete Carway, investment director at Praetura Ventures, added: “Businesses that drive positive social change have never been so important and Transreport is one of the most exciting businesses in the market. Jay has established a highly experienced, credible and ambitious team and together they have created a model that has huge potential. Not only does the business exist for the sole purpose of making travel more accessible to all people, it also improves the quality and inclusivity of the service rail operators can provide.

“Through a deep understanding of the issues facing people with mobility issues, the team has been able to develop a truly revolutionary product that genuinely puts the customer at the heart of the journey and improves accessibility for all. We’re looking forward to working in partnership with Blackfinch to provide the investment and strategic support that will support Transreport as it embarks on the next stage of its growth journey.”

The funds have been secured from Blackfinch’s EIS Ventures Portfolios, which invests in innovative start-up and early-stage technology companies across the UK in a variety of industry sectors, and its Spring Venture Capital Trust (VCT), which invests primarily in companies at the start of their growth journey. It follows a comprehensive rebrand for the Blackfinch Group which last year confirmed its commitment to helping to create a more sustainable world through its own focus on environment, social and governance factors.

Praetura Ventures, the venture capital fund that targets early-stage businesses in high-growth sectors, has invested from its EIS Growth Fund and this deal follows investments in Leeds-based RapidSpike and tech-for-good platform Culture Shift. Its Venture Partner programme is an investment scheme aimed at experienced, connected and successful individuals who have a desire to add value and potentially provide mentorship, advice and investment to the next generation of entrepreneurs.

Shakespeare Martineau and Hill Dickinson provided legal advice to Blackfinch and Praetura Ventures. Transreport was advised by Ignition Law.

Related News

- 05:00 am

Mswipe, India’s leading financial services platforms for SMEs, today launched ATM Express, a micro ATM which allows merchants to offer their point-of-sale (POS) terminals to customers for cash withdrawal, check bank balance among other features. The ATM Express will help merchants bring additional footfalls and add revenue stream through commission.

Mswipe will utilise ATM Express to increase access to banking facilities through its SME network, especially in Tier 2, 3 and 4 cities with limited ATM facilities and bank branches.

According to RBI, till June 2020, there were an estimated 84 crore debit card holders and about 2.10 lakh onsite and offsite ATMs in India. On an average, there is one ATM for 4,000+ debit card holders, and even fewer in Tier 3 and 4 cities.

Mswipe’s ATM Express is a cost-effective way for banks to serve their customers, as it eliminates the cost of setting up ATM kiosksand overheads such as rent, maintenance, CMS and security. Customers can withdraw a maximum of Rs.10,000 twice a day from the ATM Express at no additional cost.

Mswipe Founder and CEO Manish Patel said: “Mswipe has been in the forefront of helping SMEs grow their businessesthrough our innovative and user-friendly digital payments solutions. Our ATM Express service is a natural extension of Value Added Services (VAS) possibilities via Mswipe’s smart POS terminals. It will enable both merchants and retailers bring conveniences to customers, serve as an additional source of revenue for the SMEs, increase footfalls in their stores, and prevent long queues at regular bank ATMs.”

Merchants will earn commission on providing ATM Express facilities and their customers will be only be charged for availing ATM services as per the charges of the issuer bank.

Mswipe Business Head - Micro ATM and VAS Vivek Patil said: “Availing ATM services continues to be challenge in Tier 2-4 cities due to limited number of ATMs or non-functional facilities. By layering micro ATM services on POS terminals which are available even in the smallest of shops, we are empowering merchants to simplify the life of their customers and at the same time generate revenue for themselves. ”

Mswipe is the only player with a full range of digital paymentssolutions for SMEs in India, including UPI QR, NFC-based Tap and Pay, POS and Payment Link. The company is the largest POS acquirer with 6.75 lakh POS and 1.1 million QR merchants, and the fastest-growing issuer of its prepaid Moneyback Card.