Published

- 04:00 am

The Domestic Payments Schemes Jury today releases its 2021 report titled: “To Survive or Thrive? Domestic Payments Innovation in the Pandemic" revealing that while many domestic payment organisations had to make some adjustments to their innovation programmes due to the pandemic, 36% reported that the pandemic had ultimately led to an increase in their innovation activities.

Undertaken in collaboration with World Bank and European Card Payments Association (ECPA) the Domestic Payments Schemes Jury is made up of 48 C-level executives from 40 countries representing a rich tapestry of national payment schemes and operators. The 2021 report, the sixth in a series spanning eight years, explores the impact of the Covid-19 pandemic on domestic payment organisations; from the rapid surge in usage and their responses, to the acceleration in innovation and the evolution of the regulatory landscape.

“In the face of unprecedented digital evolution in the last year the ubiquitous role of the domestic payments organisation has significantly changed. As card schemes, telcos, social media platforms and fintechs vie for market share, domestic payments organisations have to strike a balance between standing on their own two feet commercially while bringing their diverse national payments communities together,” Chairman of the Jury, John Chaplin, commented.

“This year’s Domestic Payments Schemes Jury has concluded that the best strategic response for domestic payments organisations in the wake of the pandemic is a programme of systemic innovation that delivers value-added services beyond their traditional card payments, and at the same time demonstrably supports public policy goals,” continued Chaplin.

Download the full report from www.innovationjury.com

Key findings:

Despite steep declines in transaction volumes at the outset of the pandemic - nearly half (48%) of the Jury reported declines of more than 25% - 89% reported significant or full recovery of transaction volumes, helped in large part by the development and roll out of digital capabilities.

While 52% of respondents had to make some adjustments to their innovation activities due to the pandemic, most reported that their programmes remained largely intact and 36% reported that the pandemic had ultimately led to a further increase in their innovation activities.

Supporting mobile and app-based services remains the biggest innovation priority for domestic payment systems (90%) with real-time account to account payments, enhancements to card services - such as QR codes - and digital identity all equally popular among the Jury (70%).

The study showed that domestic payments organisations were well positioned to facilitate Covid relief programmes in different markets, with the Jury reporting that two thirds of respondents (70%) were provided emergency support to government efforts to either contain the pandemic and/or manage the adverse effects on the economy.

Diversification away from a single form factor and business model remains at the forefront of many domestic card payments organisations minds, with digital identity proving a popular option according to report contributor and industry stalwart David Birch.

As market structures evolve regulators are facing increasingly challenging policy choices as new real-time services are introduced with a need to balance operating efficiency with competition and innovation. A such, the 2021 report also explores the role of regulators as domestic payments organisations increasingly move beyond purely supplying services to banks and expand to include fintechs, telcos and retailers, among others.

The 2021 report also shows that many domestic payments organisations are becoming more international in their strategies, with nearly half (44%) now conducting activity in more than one country compared to 27% in 2015

The Domestic Payment Schemes Jury 2021 Report: To Survive or Thrive, Domestic Payments Innovation in the Pandemic can be read in full here: www.innovationjury.com

Related News

- 02:00 am

The use of fintech apps has increased more than 61% since the pandemic started last year, reveals deVere Group, one of the world’s largest independent financial advisory and fintech organisations.

The jump comes as financial technology apps show further evidence that the way we manage our finances further shifted in light of the coronavirus pandemic.

James Green, deVere Group’s Divisional Manager of Europe, notes: “Pre-coronavirus, we were already in an exciting new era driven by the lightning pace of the digitalisation of our everyday lives.

“But like so many areas of our lives, the pandemic has accelerated this trend.”

He continues: “The jump in usage of fintech apps from existing clients, and a sharp increase in enquiries from potential ones, underscores that people are becoming more tech-savvy than ever.

“Like never before, people are embracing the convenience of immediate, low-cost access to, use and management of their money.”

The deVere CEO and founder, Nigel Green, who has been a long-term advocate of fintech having launched a series of pioneering apps, believes the trend will further increase.

“The financial services sector is currently undergoing, I believe, possibly the most profound transformation in history.

“We’re seeing seismic and far-reaching shifts in client expectations. As the world moves towards an ever-more digitalised and globalised future – which is increasingly influenced by those who’ve grown-up with 'on-the go' tech - this phenomenon can only be expected to gain momentum.

“The way we save, invest, use and manage our money has changed forever. We are witnessing a personal finance revolution.”

The CEO goes on to add: “This revolution is a positive force.

“Fintech allows all clients’ personal financial services to be dealt with online and/or on their mobile devices, wherever they choose to be.

“It will speed-up financial inclusion around the world, especially for those who aren’t able to use financial services because of the biases of traditional financial firms.

“In addition, it allows firms within the financial sector the opportunity to diversify, reduce costs, fulfil regulatory requirements and further enhance the client experience.”

Of the year-on-year jump in fintech apps usage, James Green concludes: “Whether the trend in the usage of fintech is a long-term one will be demonstrated as lockdown restrictions are eased around the world and we look ahead to a post-pandemic future."

“I will be surprised if those new users of fintech will ever go back to traditional methods of accessing, using and managing their money.”

Related News

- 07:00 am

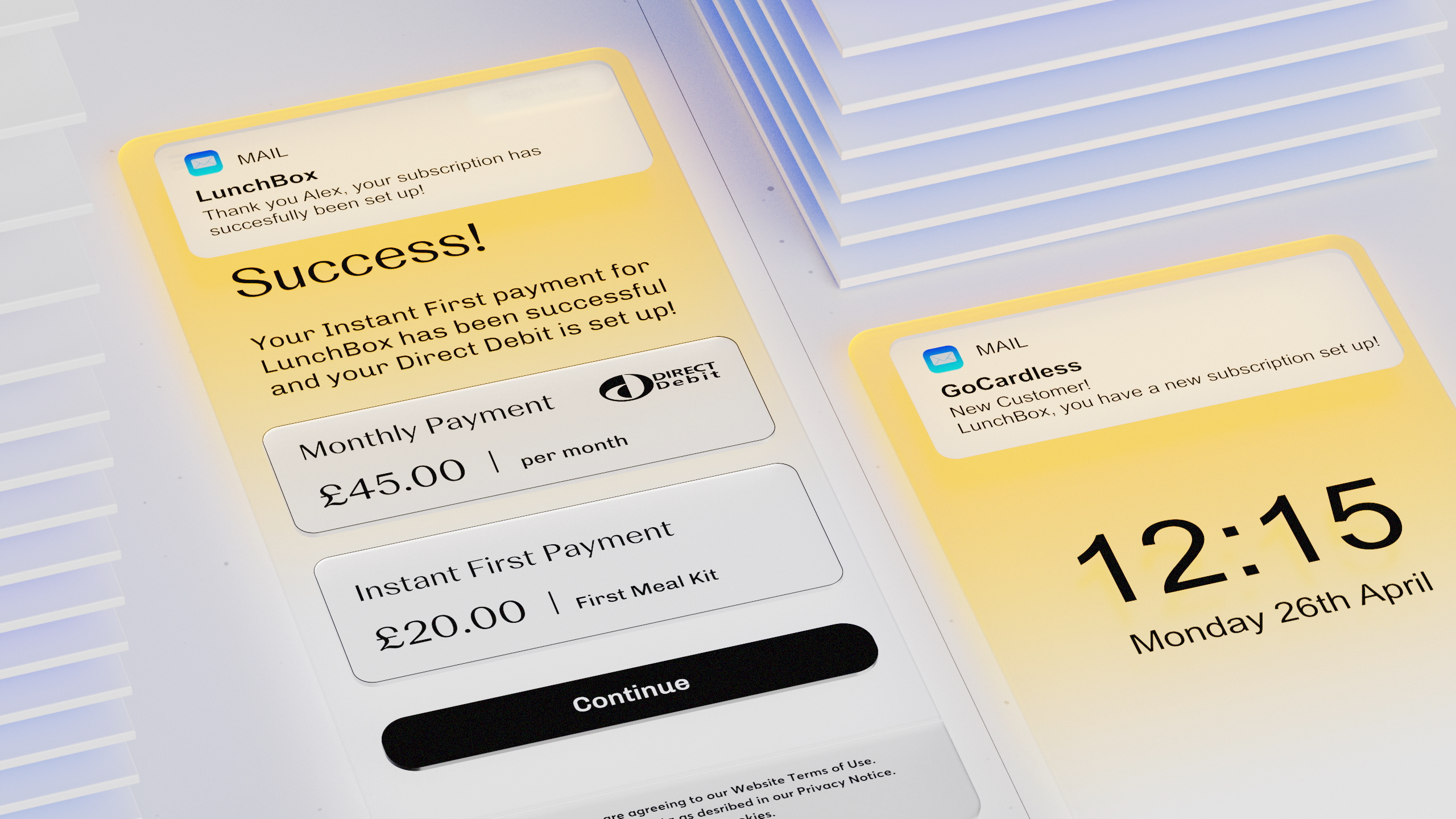

GoCardless, a leading fintech for bank-to-bank payments, has today launched Instant Bank Pay, a new open banking feature directly integrated into its global payment platform. With Instant Bank Pay, merchants can take instant, one-off bank-to-bank payments from new and existing customers while still reaping the benefits of bank debit for their recurring payments.

The announcement marks the first milestone in GoCardless’ journey to accelerate its open banking strategy, for which it received $95m in funding at the end of 2020. By combining open banking technology with its existing global bank debit network, GoCardless can offer its 60,000 merchants a new low-cost, seamless and convenient way to collect instant payments that works for any revenue model.

“We’ve specialised in bank-to-bank payments for over 10 years, with bank debit as the primary payment method. And while it provides many advantages to consumers and businesses, speed of payment authorisation is a drawback,” said Hiroki Takeuchi, co-founder and CEO of GoCardless. “Instant Bank Pay addresses this by giving merchants the best of both worlds: open banking will provide instant confirmation of payment authorisation, enabling them to have immediate visibility of their one-off payments, and bank debit will continue to offer the cash flow, cost and retention benefits they have come to expect.”

With the introduction of Instant Bank Pay, GoCardless will expand its offering into the adjacent e-commerce market, where it can take on both one-off and ‘card-on-file’ payments.

Takeuchi added: “By enabling businesses to take any kind of payment through GoCardless, we can challenge the dominance of cards and move beyond collecting subscriptions, invoices and instalments. The launch of this open banking feature means we can now serve any merchant, regardless of whether they have an ongoing or one-off relationship with their customers.”

While it can be used in many scenarios, Instant Bank Pay addresses an issue that is particularly acute for recurring revenue businesses: according to research from GoCardless, 85 per cent of merchants with this business model have a need for collecting additional one-off payments. Examples include making a first payment when setting up a bank debit (e.g. signing up for a gym membership), purchasing additional goods or services, or topping up an account outside of a customer’s regular payment schedule.

Bank debit is not suitable for one-off payments because it doesn’t provide instant visibility of payment authorisation. This has forced many merchants to turn to card payments, often with high fees attached, or time-consuming manual bank transfers. Instant Bank Pay is a fast and easy way for customers to make a one-off account-to-account payment. Instant confirmation provides better visibility of payments, eliminates costly credit card fees, and reduces late payments thanks to a seamless payer journey.

Broadband provider Cuckoo used Instant Bank Pay as part of an early access programme to collect first and ad hoc payments for new and existing customers. During the pilot, two-thirds (66 per cent) of customers who experienced a failed payment were able to benefit from using Instant Bank Pay. Of those, 86 per cent were able to make a payment within 48 hours, minimising disruption to their service. Furthermore, before Instant Bank Pay the process of chasing and collecting a failed payment could take 21 days; using this feature Cuckoo has the capability to reduce this to just seven days.

Alexander Fitzgerald, Founder and CEO at Cuckoo, said: “We're taking on a broken broadband industry with simple pricing, fair contracts and exceptional service. The payment process plays a vital role in our mission and working with GoCardless means our customers have a seamless payment experience when switching to us and paying their monthly bill.

“We’re excited to continue using Instant Bank Pay for one-off payments. Not only will it prevent our customers from losing access to our services, it’ll also help reduce the time we spend chasing late payments and the risk of costs outstanding.”

Merchants can build the Instant Bank Pay option straight into their checkout flow or simply send a payment request with a link to pay. Similar to a mobile wallet payment, payers are seamlessly connected to their bank, and can authorise a payment directly from their bank account in just a few clicks.

Related News

- 04:00 am

Worldline, the European leader in the payments and transactional services industry and number 4 worldwide, today announced it has partnered with the International Air Transport Association (IATA) to give all their member airlines access to a wider range of payment solutions to better serve their passengers. All of Worldline’s payment capabilities and services will be made available through IATA Financial Gateway (IFG).

As part of the partnership, Worldline has incorporated Ingenico’s TravelHub solution into IFG. This solution provides companies with easy access to more than 150 online payment methods and offers a range of currency options that are relevant to customers around the globe, including in high growth markets such as Russia, India, Brazil and China. It also offers smart transaction routing capabilities both globally and locally, which improve conversion rates and in turn, revenue.

Airlines connected with IFG will be notified of the new payment services made available to them as a result of the partnership and can reach out to Worldline, via IATA, to gain access to payment capabilities in new markets. Once an airline decides to utilize the IATA/Worldline TravelHub infrastructure, testing will be carried out in conjunction with IATA, which will then seamlessly activate the service so it can be used by the business.

These services include global end to end payment processing, state of the art fraud prevention solutions, more than 150 alternative methods of payment, and local access to new markets like Russia, Brazil, India, China and many others. As an active partner of the IFG community, Worldline, together with IFG, will be supporting airlines in optimizing payment processes and building a cost-effective global payment strategy.

Muhammad Albakri, IATA’s Senior Vice President, Financial Distribution and Data Services commented: “IFG provides a consolidated and cost-effective solution for airlines and travel suppliers to optimize their different sales payment processes. We’re excited to work with Worldline to provide more payment options through IFG to airlines.”

Eric Liebman, Head of Travel at Digital Commerce, Merchant Services at Worldline: “As the travel industry is set to recover, gaining access to a wide range of payment methods and currencies is key to servicing customers who are eager to plan new trips and experiences. For airlines, navigating the complex travel and payments ecosystem can be challenging, so we help make it much easier for them. By partnering with IATA, we are providing one simple connection to our payment methods and capabilities across the world – enabling our partner airlines to offer the payment options that their customers prefer.”

To learn more about the solutions available via IFG, visit: https://www.ingenico.com/travelhub.

Related News

- 08:00 am

To enable it to keep up with its projected business growth, National Commercial Bank (NCB) in Vietnam has migrated its in-house processing centre to TranzAxis, an open development payments platform, from Compass Plus.

As part of a major initiative to become one of the leading retail banks in Vietnam, NCB made the decision to modernise its payments infrastructure after realising that the legacy system it was using would be unable to keep up with the bank’s growth plans for much longer. The bank opted to replace it with TranzAxis due to the flexibility the platform provides and its ability to future-proof their business without the limitations that many other payments platforms have.

The main objective of the first phase of the project was to migrate NCB’s local debit cards to the new platform. This phase was completed in December 2020. The local Compass Plus team based in Hanoi, as well as remote support, ensured the project was successfully delivered on time. The second phase of the project, due to go-live early 2021, will see Visa credit cards migrated to the new system.

Compass Plus teamed up with one of their regional partners, Cyberbeat, on the project. “Cyberbeat congratulates NCB and Compass Plus on achieving Phase 1 go-live. We continue to provide comprehensive services for digital payment transformation for clients and partners in the region,” said Rajan S. Narayan, CEO of Cyberbeat.

“We needed a payments platform that could not only keep up with our growth today, but long into the future. Compass Plus’ reputation in Vietnam, coupled with the flexibility that its next generation platform TranzAxis offers, made migrating to it a no-brainer,” said a top leader from NCB. “Compass Plus’ local project team were available to support us with the migration of the project, which fell during the imposed travel restrictions due to COVID-19.”

“NCB has already grown significantly since its inception, and its projected growth rate meant that it needed a more robust, and most importantly future-proof, system for its in-house processing centre,” said Igor Simonov, AVP, Business Development and Sales Manager, Asia Pacific at Compass Plus. “Having TranzAxis as the backbone of NCB’s payments infrastructure will provide them with the ability to adapt their strategy and respond quickly to changing market requirements, truly drive innovation, and hopefully enable their vision of becoming one of Vietnam’s leading retail banks. We look forward to continuing our relationship with NCB long into the future.”

Related News

- 09:00 am

FSS (Financial Software and Systems), a globally leading provider of integrated payment products and India’s largest payments processor, and NPCI International Payments Ltd (NIPL, International arm of National Payment Corporation of India), have signed a strategic partnership to expand UPI (Unified Payment Interface) rails in international markets.

India is among the first countries globally to launch real-time payments rails, processing close to three billion transactions a month on the UPI network. Several governments and regulators globally, and emerging markets, in particular, are keen on modelling NPCI’s success in building an interoperable, real-time payments infrastructure, supporting the long-term growth of the digital payments’ economy.

The FSS and NIPL collaboration brings together complementary capabilities to deliver a compelling end-to-end proposition to activate real-time payments at speed and minimal risk. Under the umbrella of the partnership, NIPL would offer its market-leading real-time payments processing platform and technical acumen to scheme operators whilst FSS would leverage its deep domain understanding and experience in implementing large-scale national payments infrastructure projects, as well as UPI payment services for PSPs, to extend integration and support services.

Commenting on the partnership K. Srinivasan, COO, PayTech, FSS, stated: “Worldwide the drive towards real-time payments is gaining momentum, with many countries embarking on modernization of payments infrastructure to broad-base the benefits of the digital economy. We are excited to partner with NIPL to bring a proven, best-in-class real-time payment offering that will speed innovation and adoption of digital commerce and have a wide-ranging economic impact. The implementation of real-time payments is complex as flavors differ across regions. The collaboration confirms FSS expertise and capabilities in delivering world-class payment infrastructures and services at scale around the world.”

Speaking on the partnership Ritesh Shukla, CEO, NIPL, said: “At NIPL, we are dedicated to take our exemplary robust payments system to global markets and equip willing nations with resources and technological proficiency. FSS is a demonstrated leader in payments and its domain expertise combined with a strong international presence makes them a valuable partner to offer a market-leading, real-time payments system to millions of people across the globe. We look forward to attaining new highs with this partnership."

The shift from a batch payment processing infrastructure to a modern real-time 24X7X365 payments model can be challenging for scheme operators as well as participants. The UPI platform has successfully brought about this shift and transformed the digital payment ecosystem of India. Since its inception in 2016, UPI has witnessed exponential growth in transactions, app users and QR codes deployments. In 2020, UPI processed transactions worth $457 Billion, which is equivalent to 15% of

Indian GDP and this feat is achieved at an impressive CAGR of 285%. FSS - UPI Gateway currently supports many bank PSPs in India to connect to the UPI central payments infrastructure and brings a range of overlay services - QR Payments, Split Payments, Request to Pay, Corporate Payments, AutoPay – as well as reconciliation and authentication to enable banks monetize investments in real-time UPI infrastructure. UPI’s multi-party collaborative model (Bank, PSP, FinTechs etc.) fosters collaboration bringing in incremental efficiencies and levels of adoption.

About FSS

Financial Software and Systems (FSS) is a leader in payments technology and transaction processing. The company offers an integrated portfolio of software products, hosted payment services and software solutions built over three decades of experience. FSS, end-to-end payments products suite, powers retail delivery channels including ATM, POS, Internet and Mobile as well as critical back-end functions including cards management, reconciliation, settlement, merchant management and device monitoring. Headquartered in Chennai, India, FSS services leading global banks, financial institutions, processors, central regulators and governments across North America, UK/Europe, ME/Africa, and APAC and has 2,500 experts on-board. For more information visit www.fsstech.com

About NPCI International

NPCI International Payments Limited (NIPL) was incorporated on April 3, 2020 as a wholly-owned subsidiary of the National Payments Corporation of India (NPCI). As the international arm of NPCI, NIPL is devoted for the deployment of NPCI’s indigenous, successful Real-Time Payment System – Unified Payments Interface (UPI) and Domestic Card Scheme – RuPay, outside of India.

NPCI has successfully developed and proved its product and technological capabilities in the domestic market by transforming payment segment in India. Conversely, there are several countries which want to establish a ‘real-time payment system’ or ‘domestic card scheme’ in their own country. NIPL, with its knowledge and experience, can offer these countries technological assistance through licensing, consulting for building real time payment system to meet the rapidly evolving need of fast-growing global business.

NIPL is focused on transforming payments across the globe with the use of technology and innovation. It will not only enable payment for Indians but also uplift other countries by enhancing their payment capabilities through technological assistance, consulting and infrastructure.

Related News

- 08:00 am

ComplyAdvantage, a global data technology company transforming financial crime detection, today announced a new early-stage anti-money laundering (AML) program aimed at growth-focused startups called ComplyLaunch™. The program provides qualified startups with free access to the company’s award-winning AML and Know Your Customer (KYC) tools and resources needed to uncover and reduce the threat of money-laundering activities so they can onboard new customers with lower risk and greater trust.

In addition, ComplyAdvantage has partnered with the global financial crime compliance consultancy FINTRAIL to provide AML education and ongoing training for program participants. FINTRAIL is a recognised authority on financial crime prevention in financial technology (FinTech) and the application of regulatory technology (RegTech), working with industry leading clients across the globe to transform, build, scale, and assure AFC compliance frameworks that are relevant for digital products.

Why ComplyLaunch, Why Now?

The impetus for the program was to prepare startups to take on one of the biggest challenges their businesses will face, which is money-laundering. If transacting startups want to maximize their competitive advantage with new or expanded services, then they need intelligent AML and risk management data solutions to prevent the unintended consequences from unknowingly onboarding criminal entities.

As a serial entrepreneur, ComplyAdvantage founder and CEO Charles Delingpole has experienced first-hand the many challenges that startup teams face and that the early-stage prevention of money-laundering shouldn’t be one of them. As such, Delingpole believes that providing free access to ComplyAdvantage’s AML tools will allow more fintech startups to reach success faster by reducing the business exposure due to unforeseen financial crimes.

“At ComplyAdvantage, we believe that free early access to AML tools and education on setting up a compliance program is a benefit to our entire fintech ecosystem,” said Charles Delingpole, founder and CEO of ComplyAdvantage. “By democratising access to best in class financial crime prevention tools, we are allowing fintech startups to not only match but exceed the compliance program standards of the largest, most regulated banks. ComplyLaunch is a very important program designed to maintain the integrity of Fintech insurgents by reducing the growing threat of financial crimes.”

The first startups to join ComplyLaunch include trustshare, a company that’s revolutionising escrow payments and Juno a company that delivers comprehensive solutions to integrate multi-channel payment services with ERPs and e-Commerce platforms.

“Because we’re focused on simplifying bank payments between friends, family, customers and businesses it made complete sense for our team to join the ComplyLaunch program,” said Pete Bailey, founder and CPO of Juno. “Partnering with ComplyAdvantage to implement their gold-standard AML detection solution means that we can on-board customers with greater confidence.”

Those early-stage fintech startups with no institutional funding are invited to apply for the program. To apply, applicants must meet the following criteria:

Less than $1M in annual revenue

Pre-seed - Seed stage

A company website or web profile

Less than 10 years old

“We’re excited to join as a launch partner for ComplyLaunch and to provide program members with access to our world-class AML training”, said James Nurse, Managing Director of FINTRAIL EMEA. “There are future fintech unicorns waiting to grow and early money-laundering and risk prevention resources will only help them to reach their success, faster.”

As a sign of growing community interest, the ComplyLaunch program will be promoted with the support of world-class organizations including the leading talent investor Entrepreneur First and Seccl an innovative technology platform providing outsourced custody for financial services firms looking to safeguard their clients' assets.

"There has never been a greater time to start a fintech company and we've seen more and more of the world's most ambitious people wanting to startup in this space,” said Jonny Clifford, of Entrepreneur First. “With the growing complexity of financial service interdependencies, ComplyLaunch is a great idea at the perfect time to help these emerging, disruptive fintech startups to scale more easily and more confidently.”

And finally, Max Rimple a Principal at Index Ventures and a lead investor in ComplyAdvantage also shared his thoughts on the program launch, "with the staggering amount of investment capital going into fintech and related financial services, it's important that startups have early access to intelligent AML and risk management tools so they can grow with integrity and confidence. The ComplyLaunch program is a great starting point for fintech founders to safeguard their businesses from the risks of financial crimes. It's also good for their investors who appreciate that early compliance practices help to set the stage for future success."

ComplyAdvantage offers a true hyperscale financial risk insight and AML data solution that leverages machine learning and natural language processing to help regulated organizations manage their risk obligations and prevent financial crime. The company’s proprietary database is derived from millions of data points that provide dynamic, real-time insights across sanctions, watchlists, politically exposed persons, and negative news. This reduces dependence on manual review processes and legacy databases by up to 80% and improves how companies screen and monitor clients and transactions.

Related News

- 01:00 am

SEON, the fraud fighters, today announces the launch of its new office in Austin, Texas. The move marks the company’s expansion in the North American market, as it adds strategic new hires to better serve its customers and continues its mission to remove the barriers to fraud prevention around the globe.

Progress in the North American market is the next phase of SEON’s growth plan. In its initial phase, the company experienced great success in the European, Latin America (LatAm) and Asia-Pacific (APAC) markets. Now, it is setting up base in the US to further expand in the noisier and more competitive market that is North America.

Prior to the opening of the office, US-based companies accounted for approximately 10% of SEON’s revenue. With 56% of US companies experiencing fraud in the past two years, the region will play an essential part in the company’s growth plans, as it aims to have it account for as much as 50% of its revenue in the next 3-5 years. The move comes following the announcement of the SEON’s latest series A funding round, in which it secured €10 million (USD 12 million). As Hungary’s largest series A funding round, the investment is spurring on SEON’s growth, bolstering its global expansion and helping it provide services to customers in different markets around the world.

With three in ten US companies recognising that their most disruptive fraud highlighted a need for new technologies, SEON aims to incorporate its solution in these different markets to help mend a number of pain points that have been hindering the fraud prevention industry and preventing businesses from accessing the fraud mitigation services they need. These include, long integration times, lengthy contracts, packages that are only suitable for certain sized businesses and an overreliance on artificial intelligence (AI) and machine learning (ML) for decisioning.

By contrast, SEON’s solution has monthly rolling contracts, a free trial period and can be integrated within minutes. Additionally, its solution is suitable for businesses regardless of their size and structure and works on a supervised learning basis, meaning that fraud managers can understand why the solution’s logic and rules have made certain decisions. As such, they have the information and data necessary to make effective and efficient fraud prevention decisions.

Talking about the issues it will be addressing in the North American Market, SEON’s Chief Commercial Officer, Jimmy Fong, said: “In the past, fraud managers have been faced with difficult decisions when it comes to choosing a fraud prevention partner. Not only are they locked into lengthy contracts once signed up, making it difficult to swap providers if needed, but the industry has been bound by outdated legacy systems that have meant that integration times can take weeks.”

Over the past year, SEON has taken note of how these issues have been even more problematic during the COVID-19 pandemic, as Jimmy added: “With many businesses rapidly moving into the online space to survive lockdowns and social distancing, they have needed quick access to fraud prevention solutions, highlighting the demand for rapid integration times. At the same time, online fraud has risen in line with online activity, so businesses must be more prepared for fraud to take place than ever. Therefore, by expanding our operations to North America, we’ll be ensuring that companies have access to the solutions they need to operate in the online space and in turn, better serve our customers. We’ll be ripping up the rule book to give the industry and its customers new options when it comes to fraud prevention.”

To learn more about SEON and the services it provides, visit: https://seon.io/

Related News

- 02:00 am

Plenitude, the Financial Crime, Risk and Compliance specialists offering advisory, transformation services and innovative RegTech products, has appointed former HSBC UK Head of Financial Crime Compliance and Money Laundering Reporting Officer (MLRO), Allan Clare as Senior Advisor. Allan will help deliver Plenitude’s ambitious growth plans and business strategy to meet the challenges posed by the evolving financial crime landscape.

Financial crime is multi-faceted and its impact is felt in many ways across society and the economy. Organisations are paying a heavy financial cost, collectively spending billions trying to prevent financial crime, yet they have seen the threats of money laundering, fraud, theft and corruption continue to grow. The combination of heightened regulatory scrutiny and consumer expectations of financial institutions means it has never been more important for organisations to meet their customer, legal and regulatory obligations.

Allan Clare’s appointment follows a sustained period of growth for Plenitude, having recently announced a number of senior new hires and expanding its technology offering. The firm works across the spectrum of financial institutions globally, providing deep subject matter expertise, advisory and transformation services on some of the largest and most complex financial crime initiatives in the industry. Beyond helping clients mitigate risk, Plenitude improves the productivity of compliance divisions through the use of innovative technology to automate, streamline compliance workflows and provide enhanced insight into the vast array of related laws, regulations, guidance and risk indicators.

Allan Clare has decades of financial crime risk and compliance (FCC) experience, leading and managing financial crime functions and mitigation programmes at systemically important financial institutions. Prior to joining Plenitude, Allan has held Managing Director roles at HSBC, Barclays and Nationwide Building Society and has extensive expertise of the insurance market as Director of Risk, Financial Crime & Security at RBS Insurance Group with responsibility for all financial crime risks across all insurance brands and businesses.

Commenting on the announcement, Allan Clare said: “Effective financial crime risk management and compliance is critical to making our society and economy safer. Plenitude has developed a well-deserved reputation for serving its clients with first rate advisory, transformation and technology solutions. I am looking forward to helping the firm continue to grow, bringing my insights and experiences to bear so that Plenitude continues to provide robust and sustainable programmes to meet clients’ requirements not just for today but tomorrow.”

Alan Paterson, Plenitude Managing Director, added: "We are delighted to appoint Allan as a Senior Advisor given his extensive FCC industry experience and expertise. This builds on our recent appointments of Barbara Patow and Shahmeem Purdasy and further demonstrates the calibre of our Senior Leadership Team at Plenitude. Allan will play a key role in terms of guiding the business and providing strategic advice which will be invaluable as we grow and develop our offering to meet the increasing industry demand for our advisory, transformation services and RegTech subscription products.”

Related News

- 02:00 am

Mastercard today announced a US$10 million (approximately 75 crore rupees) commitment to directly address critical Covid-related needs in India. Over the past few weeks, the country has seen a spike in both Covid diagnoses and deaths, with the healthcare system being stretched to its limits as more than 350,000 new cases are identified each day.

The philanthropic efforts, delivered through the Mastercard Impact Fund, will focus on three priority areas – access to hospital resources, access to additional oxygen supplies and continued support of the company’s employees across the country.

The largest contribution will be designated to support the expansion of 2,000 beds through the installation of portable hospitals that can address the immediate healthcare needs. Working with the government and local partners on the ground, these hospitals can be constructed quickly and could help an estimated 2.5 million Indians gain access to healthcare, adding to the nation’s healthcare infrastructure.

“The situation in India is gut-wrenching; it’s clear that no one has been left untouched and that no one can be a bystander,” said Ajay Banga, executive chairman of Mastercard. “We have long been advocates for the people of India, as employers and as enablers of the economy. Now it’s time for us to put our shoulders to the wheel and do whatever we can to help all of India get through this intensified crisis.”

In addition to the on-the-ground medical support, Mastercard is also allocating funding for additional shipments of 1,000 oxygen generators, as part of a broader corporate effort. And the company is donating to local charities and NGOs to allow for direct support of those affected by the virus, including the frontline medical workers across the country.

“The U.S. and India have a shared history of helping each other during times of crisis,” said Richard Verma, general counsel at Mastercard and former U.S. ambassador to India. “We’re hearing from our own teams the challenges that they and their families are facing. It’s critical that we stand by our friends and help those who have been impacted. Our commitment today and into the future is strong and enduring.”

Prof. K. Vijay Raghavan, Principal Scientific Adviser to Government of India added, "The steep rise of Covid-19 cases poses an enormous challenge to clinical care facilities/ Revamping existing hospital infrastructure by increasing the number of beds to accommodate more patients requiring critical care and procuring more equipment to enhance oxygenation for patients, is of utmost priority. We are grateful to the industry for their support to aid various State Governments’ critical care systems to boost their response to Covid-19. Mastercard and office of the Principal Scientific adviser to Government of India have joined hands to provide 2000 beds and purchase oxygen concentrators for hospitals in states that have been affected the most. There have been many such partnerships, many more such needed in the coming days. We hope to speedily facilitate them where there is most need.”

Extended Support for Employees, Partners

Mastercard has already committed to cover all vaccine-related costs for its India-based employees and immediate families, as doses are available. To help extend these efforts – and provide another outlet for its employees across the globe to help each other – Mastercard will also match employee donations to its Employee Assistance Fund, up to $15,000 per individual. This comes on top of a $500,000 corporate contribution to the fund.

The company will continue to explore other opportunities to activate partnerships in India and across the global community – from the U.S.-India Strategic Partnership Forum and U.S.-India Business Council to the Business Roundtable and the American India Foundation – to support these efforts.