Published

- 04:00 am

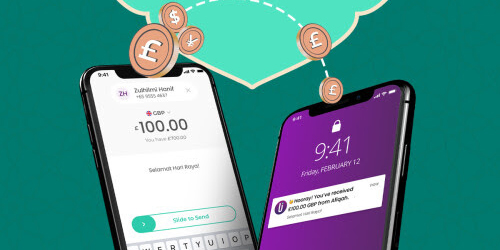

YouTrip, Singapore's leading multi-currency mobile wallet, forecasts at least a tenfold monthly increase in e-gifting transfer count this Hari Raya Aidilfitri. The insight stems from similar patterns observed during Chinese New Year earlier this year where the mobile wallet cited an increase in transfer count by 15 times during the festive season.

With e-transfers expected to remain a trend given visiting restrictions in this pandemic, YouTrip is anticipating a similar surge to emerge this month, especially amongst its Muslim community.

Get Rewarded When You YouTrip Send An e-Duit Raya

In line with recent measures to curb the spread of COVID-19 community cases, the mobile wallet is rolling out cashback rewards to encourage users to send their Duit Raya digitally as a safer alternative to festive gifting instead. This feature also allows users to send money instantly in any of the 10[1] wallet currencies, which includes SGD, USD, GBP and AUD.

"Family visitings are a big part of Hari Raya celebrations, but unfortunately the pandemic will be thinning our opportunities to do so. The overwhelming response for our peer-to-peer transfer feature during the festive periods earlier this year is testament that our users are already seeking innovative ways to keep the tradition of gifting alive despite physical restrictions. We're excited that YouTrip is here to enable that, and most importantly, keep family connected", Caecilia Chu, Co-Founder and CEO of YouTrip shares.

From 12 to 16 May 2021, YouTrip users will be able to receive up to S$500 in guaranteed cashback when they send an e-Duit Raya using YouTrip Send, the mobile wallet's peer-to-peer transfer feature.

Senders will be eligible for cashback upon completing these steps:

- Tap on the "Send" button on the app home screen

- Send an e-Duit Raya within the campaign period in any of the 10 supported currencies

- Eligible awardees will receive a randomised cashback ranging from S$0.30 to S$500. The one-time cashback reward will be credited to their YouTrip account by 21 May 2021

To sweeten the deal, new account applicants during this festive season can also enjoy a reward of S$10 when they complete their sign up using the promo code 'RAYA10'. Singaporean citizens or permanent residents can enjoy an accelerated application of 3 minutes or less by applying through their SingPass account.

For more information about the campaign, please visit this website.

Related News

- 08:00 am

API integrations lie at the heart of every modern business, connecting hundreds - even thousands - of cloud and on-premises software applications and data sources. How those integrations are built and managed can make the difference between a company’s success and failure, between growth and stagnation.

Increasingly, businesses are realising that maintaining the complex network of integration connections using just internal resources simply isn’t feasible. Integration platform-as-a-service (iPaaS) enables these businesses to seamlessly automate the creation and management of their integrations.

Jitterbit's best-in-class iPaaS technology provides nearly endless possibilities for organisations looking to unlock the power of digital transformation and create 360-degree experiences for customers and employees.

But one common hurdle businesses face is finding the right expertise to build solutions efficiently and cost-effectively while also incorporating best practices.

Now integration platform provider Jitterbit is revolutionising the integration management space by launching anIntegration Solutions Marketplace. The marketplace enables Jitterbit’s technology partners to build and publish pre-packaged integration solutions and make them available to customers on-demand.

End-user customers benefit because all integration solutions on the Marketplace are Jitterbit certified - removing all the reliability and security risks to end users of deploying open-source API integrations. The breadth of available integrations solutions means even the most niche of integration requirements can be met, with more custom integration solutions being added to the Marketplace constantly.

For solution partners looking to join the Jitterbit Marketplace, Jitterbit’s partner development “factories” can help partners build and certify new solutions in four to sixteen weeks, depending on the complexity of the solution. These solutions can then be made available to customers via the Marketplace, opening up a new revenue stream for solution providers.

Barry Flaherty, Head of Alliances (EMEA) at Jitterbit said;

"Traditionally, end users with custom API integration requirements will approach a service provider or vendor and ask them to code a one-off solution. Alternatively, they might be able to find an open source solution, but have no guarantee that this is either reliable or secure. Our new Jitterbit Marketplace changes that completely. We have created a new ecosystem, where vendors and service providers can build on our platform repeatable integrations and make them available to multiple end users. At the same time, end users can be sure that what they deploy is Jitterbit-certified, removing all the risk that comes with working with open source alternatives or unknown partners.”

“The Marketplace is going to create a new network effect within the integration space - bringing together end users and service providers in a dynamic way, unlocking new opportunities for growth on all sides and accelerating the rate of digital transformation within companies", continued Flaherty.

Ian Robertson, Sales and Marketing Director at BrightBridge said;

“BrightBridge is delighted to be one of the first Jitterbit Certified Partners in EMEA to embrace the new Jitterbit Marketplace. This will not only give us an opportunity to work closely with other Jitterbit partners, but also build our own library of connectors around Oracle NetSuite, Microsoft Dynamics 365, Salesforce and many other ERP and line of business applications."

“We want to help all of our customers deliver on their automation operating models, and being part of the Jitterbit Marketplace will be advantageous to our customers, first and foremost, as well as enhancing our relationship with the team at Jitterbit”, continued Robertson.

https://www.jitterbit.com/marketplace/

Related News

- 01:00 am

Temenos (SIX: TEMN), the banking software company, today announced that 10,000 business leaders and technologists will come together on 26 - 27 May at TCF Online 2021, the flagship event in banking. The two-day interactive, online-only event will feature keynotes from PayPal, Barclays and Varo, plus over 50 live and on-demand sessions and 50 industry speakers inspired by a shared mission to make banking better, together. Register for this free to attend event.

Powered by new technologies such as Cloud, AI and SaaS, banks of all sizes can deliver customer experiences that are better, faster and smarter. They can also achieve hyper-efficient cost models to deliver more value to their customers and leverage open ecosystems to enhance and extend their offering. At TCF Online 2021, Temenos will unveil game-changing innovations enabling banks to simplify their operations, innovate and collaborate at speed and digitally transform faster than ever before.

At TCF Online 2021, attendees from over 150 countries will also hear from some of the most influential industry experts in the financial sector, including:

- Ryan Prichard, VP, CTO of Global Credit, PayPal, on the latest innovations in payments, including how PayPal is disrupting the market with its new buy now, pay later product enabled by Temenos technology.

- Ashok Vaswani, CEO of Consumer Banking and Payments, Barclays, on the importance of banks being purpose-led and playing a greater role in the economy and society in a post-pandemic world.

- Colin Walsh, Founder and CEO, Varo, a year on after making history as the first fintech in the U.S. to obtain a national banking license, on making banking more accessible and inclusive for all.

- Jim Marous, co-publisher of The Financial Brand and top 100 influencer, on how banks can humanize their customer experience in a digital world and joining him on the virtual stage, Chris Parker, Co-CEO of Partners Federal Credit Union.

- Eric Purdum, General Manager, DXC on its collaboration with Temenos and accelerating the digital transformation for large tier-1 banks.

- David Hornery, Co-CEO and Co-Founder, Judo, on the future for challenger banks and Judo’s unique approach to the SME market in Australia.

- Barri Maggott, CEO, Curo Fund Services, on the digital transformation journey in funds administration.

- And Max Chuard, CEO of Temenos, on the once-in-a-generation opportunity digital presents for banking, unveiling Temenos’ latest innovations in cloud and AI that will propel the industry forward.

Max Chuard, CEO, Temenos, said: “The urgency for change in banking has never been greater. Consumers and business customers demand and expect fast, frictionless, personalized experiences. Covid-19 has accelerated the trend towards digital banking and new technologies such as Cloud, AI and SaaS make the business case for transformation compelling. Yet while challengers are innovating and launching rapidly on modern technology stacks, legacy systems are still holding banks back. Temenos technology gives all banks the freedom, agility and speed to innovate and adapt to changing customer behavior, business and regulatory change. At TCF Online 2021, our community of thousands will hear about the latest innovations and how together we will make banking better.”

TCF Online brings the key announcements, customer insights and latest software demonstrations from Temenos. To register for this free-to-attend event, visit www.temenos.com/events/tcf-online-2021.

Related News

- 09:00 am

Allica Bank has appointed three Business Development Managers to further drive its broker distribution channel.

The appointments coincide with a decision to further increase its commercial mortgage maximum loan size from £3 million to £5 million following feedback and requests from brokers. Allica’s maximum asset finance loan has also been increased from £250,000 to £500,000. The bank says it has a joint mission with brokers to help more SMEs gain access to the finance they need to grow, and this is part of an ongoing journey to expand its broker operations in the UK.

Having been in the banking and finance sector for 14 years, Arshad Miah joins Allica to manage its asset finance broker relationships in the Midlands and East Anglia regions. With recent experience of a successful asset finance launch, he says he was attracted to Allica Bank because it has created a niche in the market: “As a technology-driven, but also relationship-focused SME bank, Allica is re-defining the future of banking for businesses and for brokers,” he explains.

“Asset Finance is an invaluable offering to SMEs,” he continues, “enabling them to acquire business critical assets whilst spreading the cost over a fixed term – it helps them to grow, expand and stay ahead of their competition. The Government’s recent super deduction tax break announcement makes this form of finance further appealing to SMEs – allowing them to protect profits when investing in their business’ assets.”

Ben Green has worked with SMEs for the last seven years, both in banking roles and as a broker. He will be focused on supporting commercial mortgage brokers and their clients in the West Midlands. He says his experience as a broker will help him to deliver what brokers want and need: “Speed, honesty and communication are key. I look forward to building strong relationships with Allica’s existing broker network as well as bringing new relationships into play.”

Ben says he was impressed to see that Allica won in the Commercial Mortgage Lender of the Year and Business Relationship Manager categories at last year’s NACFB awards: “That achievement so early in its life, as well as huge advocacy from the brokers I spoke to about Allica’s common-sense approach to underwriting and continual support to SMEs throughout the pandemic, make this role a very exciting opportunity,” he adds.

Allica’s new Central Business Development Manager, Sam Roberts, will be focused on building an active and engaged panel of brokers in the asset finance market. He says his five years’ financial services experience specialising in haulage, logistics and construction will help to build Allica’s asset finance offering:

“I joined Allica because I was excited by the challenge of building its asset finance division. Also, I really believe in the brand and its drive to support SMEs, and have been impressed by how well it performed during the pandemic.”

Nick Baker, Managing Director - Intermediaries at Allica Bank, says the investment in two new BDMs is part of a strategy to ensure it provides the very highest levels of service to its broker partners:

“Arshad, Ben and Sam have the experience and understanding to know what solutions and approaches make brokers’ lives easier,” he says. “I’m delighted to welcome them to our fast-growing team.”

Commenting on the increase in its maximum commercial mortgage and asset finance loans, Nick adds: “Our recent quarterly broker survey showed this is what our broker panel wanted. I am pleased that, thanks to the fantastic support of our broker panel in helping us to grow our loan book, we were able to deliver and will hopefully be able to support even more of their clients.”

Related News

- 02:00 am

To address challenges in mass adoption of cryptocurrencies owing to hurdles in fiat to crypto conversion, bank related delays and high fiat deposit/withdrawal fee, Bitex has launched Bitex Coin (BTX) – a utility token to trade on the exchange, make payments and exchange crypto at a lower fees. Currently, high fiat deposit/withdrawal fee, custody of fiat funds and 2-5 days to process fiat withdrawals are other major deterrents to trading on cryptocurrency exchanges.

Of the total limited supply of 1billion token to be issued by Global Cryptocurrency Exchange, 20 percent will be available for public sale through an Initial Exchange Offering (IEO).

The token will be available at a face value of INR 10 during a pre-sale till June 1. BTX will list on Bitex exchange on June 4 and a second round of the public sale will begin on July 4.

A decentralized digital asset based on Ethereum, BTX is designed as the native currency of Bitex Cryptocurrency Exchange. The token has been developed for trading other cryptocurrencies on exchanges, crypto credit cards payments, payments processing, traveling bookings, entertainment, investment, loans & transfers in future.

Bitex Founder & CEO Monark Modi said, “A significant interest in cryptocurrencies has been observed since last year across India and around the world. Yet despite the mainstreaming of the digital asset, it continues to be concentrated among few investors and mass adoption is still at the periphery owing to several systematic challenges ranging withdrawal/ deposit time, banking related delays among many others. BTX is our endeavour towards removing the current imbalance in the cryptocurrency ecosystem by giving regular retail investors a chance to be part of the cryptocurrency ecosystem without facing these hurdles. We are unlocking the future of crypto payments with our utility token.”

As part of the industry global ritual Bitex shared a whitepaper on the BTX’s role in the ecosystem explaining potential users about the purpose of the cryptocurrency. The whitepaper states it as a ‘reward to early adopters and supporters of Bitex’. (Read: https://bitex.com/whitepaper-btx.pdf).

Some of the benefits of the utility token include zero trade fee on BTX trading pairs, 50 percent trading fee discount for other cryptocurrencies and to pay fee or interest on amount borrowed for margin trading.

BTX benefits will also extend to bounty programs, trading competition rewards, staking rewards, exchange listing and investment rewards, promotion campaigns, token burning and investor returns.

Related News

Vince Graziani

CEO at IDEX Biometrics ASA

The use of prepaid cards is on the rise, and at first glance the trend seems completely understandable. see more

- 08:00 am

Capital.com, the high-growth trading and investing platform empowering everyone to trade responsibly, today announced its growth results for the first quarter ended March 31, 2021. During this period, the company grew the number of clients on its platform to more than 2 million.

In Q1 2021, the number of people who opened an account on Capital.com for the first time increased by more than 233% compared to Q4 2020. Over the same period, total trading volume across the platform grew by 78% to reach USD82bn.

The platform’s growth in Q1 was in part driven by the global market rally and rising retail participation in financial markets owing to national lockdown measures. These external factors coupled with Capital.com’s strengths as a regulated and transparently priced platform enabled the platform to engage with more clients.

“The extraordinary growth on the platform is testament to Capital.com's ability to build a strong business that is responsive to wider changes. This is just the beginning for us. Looking ahead, we will continue to deliver solutions and services and make improvements to our platform to empower more people to trade with confidence and ease,” said Jonathan Squires, Chief Executive Officer, Capital.com.

Over the same period, clients also increased their trading activity on the platform. The total number of trades executed by clients increased by 240% in Q1 compared to the previous quarter with notable retail interest in cryptocurrencies. Of the top five most traded assets on the platform in Q1, the first three included cryptocurrency pairs Dogecoin/USD, Ripple/USD and Ethereum/USD. Derivatives trading on Gamestop and AMC were the other two top traded assets during the period. By contrast in Q4 2020, Ripple/USD was the top traded asset followed by crude oil, gold, Tesla and Bitcoin/USD.

“Not all clients are allowed to trade cryptocurrency derivatives but in those markets where it is permissible, there has clearly been a growing interest in the fledgling asset class. However, the volumes traded in crypto derivatives by individual investors are still relatively small,” noted Squires.

Capital.com enables clients to trade more than 3,000 of the world’s most popular indices, commodities, cryptocurrencies, shares and currency pairs through its web and mobile platforms. The platform adheres to a transparent pricing structure with no hidden fees, and clients have access to free education and trading tools, including its all-in-one app to learn finance, Investmate.

Related News

- 04:00 am

The number of people choosing to share their data through open banking has tripled since the start of the Covid-19 pandemic, according to the latest statistics from Experian.

In February, Experian’s Open Data Platform saw more than 188 million data sharing requests (up from 47 million in February 2020) – 30% of the 669 million made in the UK overall1. Lenders are also seeing the benefits with recent Experian research finding that 57% of lenders have adopted open banking technology in the last 12 months, helping people manage their finances in more fluid and intuitive ways online.

An accelerated shift towards digital banking has seen a greater number of people taking advantage of a new wave of convenient apps and services that can help them manage their finances. As a result of the pandemic, many people have turned to digital - as accessing branches, or using cash, became increasingly difficult, particularly during lockdown.

Research showed one in five UK adults started using online banking powered apps during lockdown. Over half of Britons (54%) now say they now use them regularly2.

Lisa Fretwell, Managing Director of Data Services at Experian, said: “We’ve seen an incredible boom in digital financial tools over the course of 2020, especially when it comes to open banking powered services. People are increasingly understanding the ways their financial data can help them manage their finances more productively. They’re increasingly calling on it to support their financial management and planning – more of a priority than ever as we face into a second year of potential economic upheaval.”

The use of these financial digital apps and services offer people new insights that can help them manage their money and access better products that they may not have been able to access before. Many of these services are also personalised or tailored to someone’s individual behaviours or lifestyles, offering a much better user experience.

In the future, other sources of financial data, such as mortgages, investment accounts, pensions and insurance, would help people manage their entire financial footprint in one central place. It would also help them save with automated switching and renewal service personalised to their circumstances, get faster, cheaper finance, or tailored debt advice.

The launch of Experian Boost in November has also been a major factor in the surge of open banking requests.

The new, free service has allowed more people to take control of their credit score by voluntarily adding further information about their everyday financial activity, such as Netflix or Amazon Prime subscription payments, via open banking – an industry first. This has become an important tool to help improve people’s chances of access to affordable credit, especially those seeking to soften the financial blow caused by the Covid-19 pandemic.

Fretwell, continues: “Open banking has the potential to do so much good – transforming the way people manage their money, helping them plan for the future with confidence. The next step is about moving as an industry to help build understanding about the benefits of these tools, so that everyone can feel confident in how and when they want to share their data, and the value they get in return.”

David Beardmore, Ecosystem Development Developer, Open Banking Implementation Entity said: "The are more than three million active users of Open banking and a growing number of fintech providers helping consumers and SMEs tackle and manage their day-to-day personal and business finance needs. Open banking is a safe and secure way to share your financial data and it's great to see from this research that more people benefiting from the technology in the current climate."

Experian’s Open Data Platform is currently being used by over 200 organisations and the technology has allowed credit card and auto finance providers, rental property agencies, mortgage lenders and gaming companies to better assess whether services are affordable for their customers.

Related News

- 04:00 am

Next-generation financial services platform Nium and global invoicing and payments platform Rimuut announced a strategic partnership that will allow Rimuut to leverage Nium’s vast payout network and speedy cross-border collection service.

With approximately 20 million freelancers in the EU, making up 8% of the workforce in the region and nearly 60 million freelancers in the US, which make up about 35% of the workforce[1], the partnership with Nium will enable Rimuut to gain competitive advantage in the booming freelance ecosystem and gig economy.

With a simple yet secure financial operations approach, Rimuut sets the facilitation of the invoicing and payment processes between businesses and independent professionals at its core. Businesses have become more agile thanks to the swift nature of Rimuut's invoicing and payment system. The collaboration with Nium will make this process even more convenient, secure, and fast.

Nium’s global payments technology stack will not only make the collection and disbursement of funds in local currencies quicker and more cost-efficient for Rimuut, but it will also introduce Rimuut to new markets, including access to countries such as Taiwan or the Philippines.

With a global network of over 40 partnering banks and a robust regulatory portfolio that includes licences in Singapore, Malaysia, Australia, Hong Kong, India, Indonesia, Japan, the UK, the EU, Canada, and the USA, Nium is also able to provide guidance and support on local policies and regulations in new markets and will enable Rimuut to scale globally.

“We’ve been working on our international expansion for a while now. Currently, Rimuut offers financial solutions to more than 3,500 businesses engaged in financial transactions with over 35,000 freelancers located in different countries. This partnership will widen our reach, strengthen our operation, and provide financial services to empower businesses who need to make cross-border payments through our innovative platform. We believe that our partnership with Nium will provide just the right support we need to offer the best, most convenient service to our users,” says Mert Bulut, Co-Founder and CEO of Rimuut.

Nium’s pay-out capability allows Rimuut to:

- Access to over 65 payment corridors

- Pay freelancers in full in their desired currency (making sure the full amount reaches the payee, with no hidden fees)

- Provide instant, speedy settlements to freelancers

Nium’s pay-in capability allows Rimuut to:

- To collect funds from their global corporate partners into dedicated onshore currency accounts in APAC, the EU, the UK & the US

“We are very excited about this partnership and the tremendous opportunities this presents for both parties. We strongly believe in Rimuut’s unique business model and want to make sure that every transactional process powered by Nium, will contribute to the overall efficiency and agility of the platform and experience for its users. Our journey together has begun, and we have big plans to unlock even more capabilities and embedded platform APIs to Rimuut as we grow this partnership further,” says Danny Carolan May - VP and Head of Business Development in Europe, at Nium.

Related News

- 09:00 am

Highlights:

- Average spend on UK credit cards 9 percent lower than March 2020

- The average amount spent over the card limit continues to increase to another over two-year high - 25 percent higher than March 2020

- The percentage of payments to balance fell a further 4 percent

- Average balances on accounts missing two or more payments higher than a year ago

- Cash usage continues to fall – now 60 percent lower year on year

Global analytics software provider FICO today released its analysis of UK card trends for March 2021, which shows a big change in spending and financial management in the last 12 months. The average spend per card is lower but the average amount spent over a card’s limit is 25 percent higher. The latest data suggests that the downward trend for those facing debt issues continues to be masked by those whose financial status has improved during lockdowns.

“Our March data shows the impact of what is hopefully the last full month of a national lockdown and the ongoing financial support, with fewer accounts exceeding their limit, falling card and cash usage and low missed payment rates,” explained Steve Hadaway, who oversees FICO’s operations in EMEA. “But we may be starting to see a deterioration in affordability, with a lower percentage of payments to balance and slowly increasing volumes of accounts with missed payments. With the lockdowns ending and the opportunities to spend increasing, April will be a pivotal month in starting to reveal the true state of consumer finances.

“The increased spending opportunities will highlight if any extra spend is down to those who’ve built up their savings pot or whether a proportion are consumers wanting to take advantage of the newfound freedom even if their financial future is uncertain. The impact of the sustainability of certain businesses will also start to be reflected next month. It will be crucial for issuers to be on alert for any signs of financial stress in their customer base, and have systems, strategies and treatments ready to respond to what may be quickly changing customer circumstances.”

Spend on UK cards increased with the percentage of payments falling

The average spend on UK credit cards increased by £13 to £560 in March 2021, with sales 9 percent lower than a year ago. “Spend has started to increase for the first time since December,” continued Hadaway. “Potentially this is due to anticipation of the first stage in the reopening of retail and hospitality sectors and some consumers may have booked summer holidays, whether domestically or taking a chance that foreign travel will be permitted.”

However, March data also shows the second consecutive fall in the percentage of payments to balance, by a further 4 percent, making it 1.5 percent lower than a year ago. In the three months to March 2020 this fell 1.2 percent. The same period this year has seen a 11.5 percent drop. Compounding this is a further decrease in average card balances falling £13 or 1 percent and reaching another over two-year low.

There was a shift in consumers paying greater than the amount due on their cards to paying the amount due or less. Since January there has been a 13 percent increase in those paying the amount due compared to a drop of 5 percent in the same period last year that shifted to paying the full amount.

These are further signs that financial circumstances have resulted in some consumers’ inability to pay their outstanding amount due or as much as they were paying previously, combined with a conscious decision to pay less of their debt, knowing they may spend more from April 12th because of the reopening of non-essential retail, hospitality and outdoor attractions.

Missed payment rates remain low but they are increasing

March 2020 saw an increase in the percentage of accounts missing payments and their associated percent of balance to total balance, as the early fallout from the pandemic hit some consumers hard. March 2021 has also seen an increase, although for balances at a lower level than a year ago. This has been fuelled by accounts missing one payment, though levels are 29 percent and 24 percent lower year on year.

Average balances on accounts missing two or more payments remain higher than a year ago. For accounts missing two payments, average balances are £103 or 4 percent higher than March 2020. Average balances on accounts with three missed payments are £414 higher (16 percent) and four missed payments plus are £349 higher (12 percent), reaching another over two-year high.

Card limits remain steady, but the average amount over-limit reached another over two-year high

Average card limits increased £7 in March and are £18 lower than a year ago. Limits on accounts opened less than a year have fallen £173 since December. This can either be due to issuers tightening their qualification criteria or lowering their initial limit range, or because of higher risk applicants. The highest proportion of accounts — 29 percent — remain in the limit range of £5,001 to £10,000, with an average balance of only £1,123, another over two-year low. 10 percent of credit cards have a limit greater than £10,000 and their average balance is just £2,160, another over two-year low.

The percentage of accounts going over their limit has been decreasing since January 2020 and the pandemic has accelerated the trend. It is now 53 percent lower than March 2020 and reached another over two-year low. However, for those who have spent above their limit, the average amount over the limit grew to yet another over two-year high, and is 25 percent higher than a year ago.

“The above-limit lockdown spend has continued to grow, despite a lower proportion of customers exceeding their limit,” added Steve Hadaway. “This is a worrying trend. With no sign of the average spend over the limit decreasing, issuers should target this sub population, as they may be struggling financially. With more accounts shifting to paying the minimum amount due and exceeding a limit incurring fees, this may result in additional consumers finding themselves in the persistent debt process.”

Cash usage downward trend continues

The percentage of consumers using their cards to withdraw cash has been on a downwards trajectory since September 2019, and the pandemic accelerated this. It fell a further 6 percent in March 2021 and is now 60 percent lower year-on-year. However, cash as a percentage of total spend continued to increase in March, albeit marginally. Some consumers may not realise the higher costs associated with using cash on a credit card; issuers could contact these customers to try to pre-empt debt problems.

“March is another month where the continued financial support and higher savings pots have masked the extent of the impact of the pandemic on consumers’ finances,” concluded Steve Hadaway. “However, we can now start to see early signs of what may be coming down the road. The abundance of data available to credit issuers should facilitate a review of the current strategies across the customer lifecycle to ensure they are appropriate for the changing economic conditions and potential increase in the volume of their customers facing financial stresses. Issuers should also ensure they use this data to make consistent decisions on customers across all their interactions.”

These card performance figures are part of the data shared with subscribers of the FICO® Benchmark Reporting Service. The data sample comes from client reports generated by the FICO® TRIAD® Customer Manager solution in use by some 80 percent of UK card issuers. Issuers wishing to subscribe to this service can contact staceywest@fico.com.

For past reports on UK card trends, see the FICO Blog.