Published

- 06:00 am

Drawbridge, a premier provider of cybersecurity software and solutions to the alternative investment industry, today announced the appointment of Darrell Tucker as Managing Director, Client Services. Tucker will join the Drawbridge Executive Team and be responsible for managing global client engagement, identifying methods to enhance the overall client experience for Drawbridge platform users and driving customer success.

Tucker brings over 20 years of client engagement, technical services, growth development and operational experience in the financial services industry to Drawbridge. Most recently he served as Managing Director of Sales & Business Development at Siepe, a cloud and data analytics provider. Prior to Siepe, Tucker spent ten years at Abacus Group, where he began as Director, Technical Services before being elevated to Managing Director, Business Development. Earlier in his career, he was the Head of US Project Management for Options-IT and Technical Director for BNP Paribas’s Prime Brokerage Division in the Eastern Region.

“Darrell’s deep industry knowledge, leadership experience and client service expertise are a perfect fit for Drawbridge, and we’re thrilled to welcome him to the team,” said Jason, Elmer, CEO, Drawbridge. “Now more than ever, alternative investment firms need a trusted and reliable cybersecurity partner to help them navigate the evolving threat landscape and manage their most complex cybersecurity programs. Darrell’s commitment to client success will be crucial for us as we continuously deliver the best customer experience to our burgeoning client base.”

“Drawbridge is in the midst of remarkable global client growth, which is a testament to the strength of its software, services and commitment to delivering exceptional client experiences,” said Darrell Tucker, Managing Director, Client Services, Drawbridge. “I’m thrilled to join Drawbridge at such an exciting time in the company’s history to expand our culture of service excellence, enhance client delivery and ensure our clients maximize their use of the Drawbridge platform.”

Related News

- 06:00 am

IGEL, provider of the next-gen edge OS for cloud workspaces, is expanding its collaboration with ControlUp with the integration of their ControlUp Remote DX and ControlUp Edge DX for IGEL OS-powered endpoint environments. These new capabilities provide greater visibility into endpoint performance while optimizing the digital employee experience for the end user.

“Our expanded relationship with ControlUp provides our mutual customers with more key metrics for expanded visibility and control over the performance of their endpoints, while at the same time helping to identify ways to better optimize the employee digital experience,” said Matthias Haas, CTO, IGEL. “With ControlUp, organizations can make more educated decisions about how to improve the performance of their Citrix, VMware, and other virtual desktop and cloud workspace solutions. As a result, they can drive greater productivity and flexibility for end-users.”

Leading the Charge in Digital Employee Experience Management

IGEL and ControlUp first began collaborating in 2019 when the two companies forged an alliance to deliver best-in-class, real-time monitoring combined with an endpoint OS designed for secure, flexible access to cloud-delivered digital workspaces. With the launch of ControlUp Remote DX and ControlUp Edge DX, IGEL and ControlUp are continuing, together, to optimize the end-user’s digital experience.

- ControlUp Remote DX: Visibility into the digital employee experience, by monitoring local network performance, including Wi-Fi strength and speed, as well as user device ISP connectivity measurement, regardless of employee location.

- ControlUp Edge DX: ControlUp brings its proven real-time monitoring and optimization capabilities from the world of virtual applications and desktops into the realm of physical endpoints (e. machines running Windows, macOS, or Linux).

“To remain productive, today’s increasingly distributed workforce relies on being able to connect remotely to their business-critical resources and applications,” said Alexander Rublowsky, Executive Vice President of Marketing at ControlUp. “Enterprises simply can’t risk a diminished user experience due to poor connectivity. With the acquisition of Avacee in December 2020, ControlUp is now able to offer a powerful solution that provides high availability, reliability, and performance while supporting the new “work-from-anywhere” business model. We are thrilled to be teaming with IGEL to expand our relationship and enhance the digital experience for our mutual customers.”

Latest ControlUp Release Providers Simpler Access to IGEL Performance Metrics

In February 2021, ControlUp released ControlUp v8.2, the latest version of its real-time performance monitoring dashboard. IGEL OS will support the new functionality with the release of 11.06.100 in August.

“Embedding ControlUp into IGEL OS enables organizations to quickly leverage new features and capabilities that are available in a way that further simplifies the monitoring and optimization of IGEL-powered endpoints, so that users can remain more productive and happier,” continued Haas.

ControlUp IGEL-Verified Solutions Featured in IGEL Ready Program

ControlUp is a member of the IGEL Ready Program, which opens up IGEL’s core enterprise software, so any technology partner can integrate with and validate their products. For more information, visit: https://www.igel.com/ready. To view ControlUp’s partner profile in the IGEL Ready Showcase, visit https://www.igel.com/ready/showcase-partners/controlup/.

Related News

- 03:00 am

Finastra today announced the launch of Fusion Originate, a single platform encompassing consumer and business deposits, loans and mortgages. The harmonized user experience for digital online channels and back office benefits from the expertise of the Finastra UX team and design thinking to deliver a consistent and simplified user experience with a broad range of functionality.

“Financial firms have historically had to use different systems for originating loans, deposits and mortgages, creating different internal processes as well as inconsistent user experiences for account holders,” said Steve Hoke, Vice President & General Manager, Mortgage & Lending Solutions, Finastra. “Fusion Originate changes all that. This is a unique offering in the market, providing a single solution for the full spectrum of origination types, so financial institutions can set up their entire digital channel with a common look and feel.”

With Fusion Originate, community banks and credit unions will benefit from an enhanced ability to transform the customer portal into an online sales channel and convert prospects into customers with a self-service application process. The solution integrates seamlessly with a range of loan origination and core banking systems, available from Finastra and third-party providers, delivering a real-time onboarding and decisioning origination experience. It includes robust functionality to combat fraud and ensure compliance, while a cohesive, modern UX complements financial institutions’ branding.

Fusion Originate represents the consolidation of several of Finastra’s best-of-breed lending and account opening solutions, including Fusion uOpen (business and consumer deposits, consumer lending), Fusion Consumerbot (consumer lending), and Fusion MortgagebotPOS (mortgage origination), combined with new functionality for business lending (available in Summer 2021). While each of these solutions will continue to be available independently, clients will have the option to upgrade to the complete Fusion Originate suite.

Related News

- 01:00 am

Trayport Limited (Trayport), a wholly owned subsidiary of TMX Group, today announced that it has entered into an agreement to acquire Tradesignal, a leading provider of rule-based energy trading and analysis solutions.

“The acquisition of Tradesignal is another milestone in our growth strategy, as we continue to focus on meeting the increasing market demand for data and analytics, to support quantitative and automated approaches to trading,” said Peter Conroy, President, Trayport. “Tradesignal complements Joule, and combined with Trayport’s Data Analytics and autoTRADER solutions, will further enhance decision making and the trading experience. A large number of major European energy market participants are already existing Tradesignal clients, and we look forward to working with the Tradesignal team to offer mutual and new clients the opportunity to harness a full suite of interconnected data & automated trading tools.”

Tradesignal provides traders, portfolio managers and analysts the capabilities to develop, test and optimise multiple trading strategies, including short-term intraday modelling to yearly portfolio basket based approaches. Users have the ability to create their own strategies or use one of the hundreds of predefined out of the box strategies to maximise opportunities and manage risks.

“We are excited to announce this agreement with Trayport, allowing us to further integrate our leading-edge and award winning solutions across Trayport’s product offering,” said Jürgen Mittelstaedt, Managing Director, Tradesignal. “We share a long history of successfully working together, first as a Certified Solutions Provider and more recently as the provider of software that underpins Trayport’s existing Joule charting capabilities. This announcement will serve to further strengthen the benefits users receive.”

The transaction is expected to close in the second quarter of 2021, subject to customary closing conditions and is not subject to regulatory approval.

Related News

- 08:00 am

Digital adoption has seen a revolutionary change in the past decade, which has been significantly accelerated as a result of the global pandemic. In this context, the open banking revolution offers countless opportunities for providers of services like accounting, budgeting, investment advice to businesses.

The accounting software market was valued at USD 12.01 billion in 2020 and is expected to reach USD 19.59 billion by 2026. Considering the current digitally-oriented environment, open banking brings a significant impetus to the accounting software market that is growing exponentially. Open banking can benefit any type of accounting service provider – be it an accounting firm that handles the activities for hundreds of SMEs or an accounting software used by the financial director of a big corporation with offices spread across the globe. Open banking-powered tools can be used to optimise accounting processes at all levels by automatising complex and repetitive tasks.

Salt Edge has been empowering accounting companies to use open banking features for the past two years. And today we’re going to explore how tech-forward accounting companies and software can reap the benefits of open banking-enabled digitalisation.

1. Upgrade your accounting soft with automatic import of bank data

Many accounting processes are still head over heels dumped in spreadsheet piles. Currently, many accountants still have to extract bank statements in excel/PDF formats from many different banks and then include the data manually or semi-manually in the accounting software, which is highly time-consuming and prone to human error. That’s why live bank feeds become the most important digital link for accounting, ushering the new era in this market. Leveraging open banking, accounting companies get instant access to clients’ data from any bank in any country in an easy and compliant way. All the data is ready-to-use because it has been normalised into a unified format, eliminating the need to convert the data from different banks to a common standard. Automatic upload of data considerably reduces the risk of human error, saves time and money, and improves productivity.

The automation of data import directly from the bank can also help with onboarding dozens of new companies in the accounting soft. Every accounting company knows first-hand that this process could be challenging. Automatic import of live bank feeds data, including KYC details, account numbers, and personal data simplifies the onboarding flow, creating a seamless user experience and less manual work for accountants.

On top of that, accounting companies can get years of transaction history via one seamless integration in just several clicks to finally break free from the spreadsheets avalanche. Automation of bookkeeping ensures greater transparency, enhanced real-time reporting, and improved liquidity.

2. Add a digital boost to invoicing, billing, and reconciliation

Getting all the transactions directly to the software considerably simplifies tax calculations by adding and classifying the data automatically regardless of the bank or account type. Manual invoice fulfillment can be easily automated via open banking to stop matching payments with open invoices endlessly.

Another time-consuming and error-ridden accounting process is the manual bank account reconciliation, which can be automatised with open banking. Thus businesses can minimise the time, cost, and amount of potential errors.

To top it off, the bank data can be further processed by smart algorithms to create up-to-date and actionable insights that enable accounting apps to incorporate budgeting, forecasting, financial reporting, and cash-flow analysis features. During times when economic uncertainty reigns, ERP budgeting, and forecasting bring clarity to business decisions. Knowing how much money a business can spend is vital, and can help to stay afloat.

3. Enable to make payments directly from the accounting soft

As our world is rushing towards a cashless society, open banking offers the possibility to pay salaries, taxes, and any invoice directly from the accounting software. Businesses get the option to pay seamlessly directly from the accounting app with a bank account, eliminating the back-and-forth of traditional payment processing. Handling payments inside the accounting app provides a prime opportunity to increase customer loyalty by helping them save time. Instant payments via open banking reveal the possibility to move from sluggish outdated and expensive processes to recoup payments faster.

Payment initiation functionality can boost efficiency by automating payments with recurring billing and installment plans or batch payments, and bundle processing to handle several transactions all at once. With open banking, businesses can enjoy receiving or sending payments with minimal fees, up to 5 to 10 times lower in a matter of several seconds.

Ready to start using open banking?

To summarize, the formula for success in modern financial services and technology requires placing the customer at the center of every decision, collaborating to innovate. Embracing open banking makes next-gen solutions accessible for every business, but they should be sure that the rush to leverage this innovative technology does not leave gaps in future strategies. There is plenty of technical, compliance, and security matters that could become challenging for a company to cover without assistance. Choose the partner wisely.

Salt Edge offers a helping hand by taking care of all those aspects and more for you. We provide real-world solutions to challenges. Are you in?

Related News

- 06:00 am

Following the announcement by UK-based Arqit who have entered into a definitive agreement that would result in Arqit becoming a publicly listed company on Nasdaq, James Bruegger, Chief Investment Officer at Seraphim Capital said:

“Arqit’s business combination transaction represents a huge moment for the UK spaceech ecosystem. With an impressive transaction, Arqit will be the first UK SpaceTech company to enter into a business combination transaction with a U.S. publicly listed SPAC, in less than 5 years since its inception. Arqit is an excellent showcase for the UK’s ability to produce world-leading companies in cutting edge areas such as quantum cybersecurity technology and Spacetech."

“Our research indicates that the SpaceTech industry has become one of the most sought-after markets for SPAC mergers. By the first quarter of 2021, 11 space-related companies have already announced their intention to undertake transactions with SPACs. The industry finds itself at a watershed moment, and the transformative potential of SpaceTech is now accepted within the investment community, with SPAC transactions as the main means of accelerating their ability to access the capital required to realise their visions."

“The announcement of Arqit’s business combination transaction demonstrates that, notwithstanding the recent slowdown in the SPAC market, outstanding SpaceTech companies remain of high interest to public market investors. We believe that Space represents a $1 trillion investment opportunity with long-term growth potential and, as such, will continue to be attractive to private and public market investors alike."

“Having first backed Arqit in its seed round in 2018, Seraphim Capital has invested in every round since and are proud to have supported Arqit’s journey to become one of the most exciting cybersecurity companies in the world.”

Related News

- 05:00 am

Community IX a Non Profit 501(c)6 Internet Exchange (IX), announces that the Board has appointed Randy Epstein as the organization’s first Executive Director. In this newly formed position, Randy will have full oversight and responsibility for the company’s IX’s in Atlanta, GA (CIX-ATL) and Miami, Florida (FL-IX), with operational, technical and administrative responsibilities of the volunteer-led organization.

“As a Co-Founder of Community IX, Randy Epstein has been a committed volunteer since our inception,” comments Dave Temkin, Chair and Co-Founder of Community IX. “As our operations continue to grow, and more networks adopt peering as a go-to interconnection solution, proven to improve internet performance and lower costs, it’s important that we formalize our structure with a full-time leader who can help take us to the next level.”

As the Executive Director of Community IX, Randy Epstein, will be responsible for the day to day business operations while taking on a more leadership and active role among the board. In this role, Randy is responsible to abide by the company’s bylaws, host annual elections among its members, liaise with vendors, oversee all financial obligations of the organization, all the while ensuring optimal infrastructure performance across its highly distributed IX’s in Atlanta and Miami.

“It is an honor to be appointed the first Executive Director of Community IX and I look forward to continuing to help grow our reach and connect more networks,” comments Randy Epstein, Executive Director of Community IX. “Over the past six plus years, I’ve had the pleasure to onboard our many volunteers, work side-by-side with our Board and Technical Committee to ensure smooth operations while growing and expanding our reach. I am excited to continue our mission and commitment to high standards, raising the bar on what community-led IX’s can do for the markets they serve.”

Co-Founded by Dave Temkin in 2015, with colocation, equipment, and hardware donated by Netflix, Zayo, and Host.net (now 365 Data Centers), Community IX is funded by its member organizations and supported by volunteer network engineers across the industry. Today, Community IX is one of the most distributed non-profit IXs of its kind and the largest in the Southeast US. Formed out of the need to increase access to and enable an open exchange of internet traffic, Community IX is accessible from the most number of data center and colocation operators in each market it serves. Today, Community IX is available from over 20 data centers, interconnecting over 160 networks and has a throughput of over 7.5 Tbps. Since forming its operations, Community IX has implemented and maintained the highest standards for interconnection, providing 10G-100G and soon 400G connectivity solutions, while achieving 100% uptime.

For more information about Community IX, visit: www.communityix.org or follow @communityIXon Twitter.

Related News

- 02:00 am

Specialist data reconciliation and reporting platform, Kani Payments, has partnered with the world’s largest Quality of Life services company, Sodexo Engage.

Kani’s automated reconciliation platform will integrate with Sodexo Engage’s IT, Finance and Operations divisions for the improved management of e-payments, pre-paid cards, gift cards, vouchers, and risk identification data.

The partnership will allow Sodexo Engage to speed up reconciliation of data flows, align reconciliation efforts across the company, and give it more control over its payment data.

Kani will replace Sodexo Engage’s legacy data management systems which ran manually, becoming a drain on time, money, and resources, and lacking the scale required to handle the sheer volume of data processed by the engagement giant.

In doing so, Kani will simplify Sodexo Engage’s complex transaction data and provide a single space for data management. In addition, the platform will provide real-time, actionable data insights that allow for Sodexo’s critical business decisions to be implemented faster and with greater efficiency.

Nicole Dunn, Head of Business Process Management of Sodexo Engage UK, commented: “Our partnership with Kani Payments marks an important step forward for Sodexo Engage, one that will help us to better understand the needs of our customers. We process thousands of transactions every day, so the real-time data analytics that Kani provides will ensure that we remain responsive and agile to meet any challenges head on."

“We’re committed to embracing innovative ways of working, with digital solutions such as Kani’s playing a critical part in the future of the business. We’re proud of our forward-thinking approach that allows us to consistently stay ahead of the competition.”

Aaron Holmes, Chief Executive Officer of Kani Payments, added: “It’s brilliant to partner with Sodexo Engage to support its payments data reconciliation, reporting, and business intelligence. A better understanding of thousands, or hundreds of thousands, of datasets allows for meaningful process improvements, while simultaneously freeing up employees’ time."

“As they say, data is the new oil. It is invaluable to modern companies, but complex or encrypted files minimise its worth. By cleaning up data and making it extremely user-friendly, a business can get much more from the information in front of them, not to mention accurate and auditable transactional data, crucial to any payments company.”

Related News

- 07:00 am

Frankfurt-based Degussa Bank and European payment services provider Nets have joined forces to create a modern, innovative consumer credit card offering in Germany.

“Since the pandemic, the shift from cash to digital payment solutions has accelerated dramatically,” said Silke-Christina Kummer, Head of Card Business Advisory & Services at Degussa Bank. “Consumers in Germany are increasingly looking for integrated digital services and our new solution with Nets is designed to meet demand for frictionless, digital banking experiences.”

The services Nets will provide to Degussa include a comprehensive card management solution –Apple Pay and Google Pay integrations, virtual cards and more – all backed by Nets’ state-of-the-art processing services. The agreement also includes German-language contact centre services, providing 24/7 voice support to handle complex enquiries as more customers go digital.

“We have an ambitious growth strategy and our goal is to be the digital leader in Germany,” says Jessica Hofmann, Head of Card Operations at Degussa Bank. “In order to execute on the strategy, we required an experienced technology expert with the latest know-how and capabilities. We see Nets as a great innovation partner with high engagement and modern, flexible solutions. Nets has a strong track record in the Nordics, which are highly digitised societies, and we truly feel that they are the best partner to help us create the best possible card product in Germany.”

Torsten Hagen Jørgensen, CEO of Issuer and eSecurity Services at Nets, said: “We are excited to join Degussa Bank on its ambitious journey to wider adoption of digital card services in Germany. This is a perfect example of our commitment to provide innovative, best-in-class modular issuing services that enable faster time-to-market and scale. This will enable Degussa to deliver modern, digital payment experiences to customers across Germany.”

The partnership is an important step in Nets’ growth strategy as it expands its issuing product offering to across central Europe.

“At Nets we have decades of experience of digital payment and processing solutions, formed within the most digitalised part of Europe,” added Jørgensen. “It is our ambition to be a European payments champion and with Degussa Bank as our first issuing customer in Germany, we look forward to driving the digital agenda together.”

The implementation is now pending, and Degussa customers will expectedly benefit from the new features in first quarter 2022.

Related News

- 07:00 am

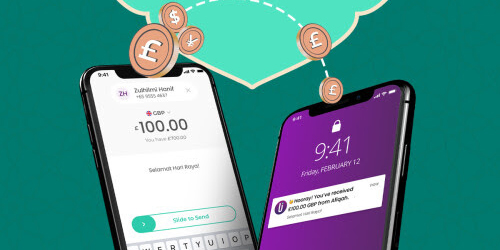

YouTrip, Singapore's leading multi-currency mobile wallet, forecasts at least a tenfold monthly increase in e-gifting transfer count this Hari Raya Aidilfitri. The insight stems from similar patterns observed during Chinese New Year earlier this year where the mobile wallet cited an increase in transfer count by 15 times during the festive season.

With e-transfers expected to remain a trend given visiting restrictions in this pandemic, YouTrip is anticipating a similar surge to emerge this month, especially amongst its Muslim community.

Get Rewarded When You YouTrip Send An e-Duit Raya

In line with recent measures to curb the spread of COVID-19 community cases, the mobile wallet is rolling out cashback rewards to encourage users to send their Duit Raya digitally as a safer alternative to festive gifting instead. This feature also allows users to send money instantly in any of the 10[1] wallet currencies, which includes SGD, USD, GBP and AUD.

"Family visitings are a big part of Hari Raya celebrations, but unfortunately the pandemic will be thinning our opportunities to do so. The overwhelming response for our peer-to-peer transfer feature during the festive periods earlier this year is testament that our users are already seeking innovative ways to keep the tradition of gifting alive despite physical restrictions. We're excited that YouTrip is here to enable that, and most importantly, keep family connected", Caecilia Chu, Co-Founder and CEO of YouTrip shares.

From 12 to 16 May 2021, YouTrip users will be able to receive up to S$500 in guaranteed cashback when they send an e-Duit Raya using YouTrip Send, the mobile wallet's peer-to-peer transfer feature.

Senders will be eligible for cashback upon completing these steps:

- Tap on the "Send" button on the app home screen

- Send an e-Duit Raya within the campaign period in any of the 10 supported currencies

- Eligible awardees will receive a randomised cashback ranging from S$0.30 to S$500. The one-time cashback reward will be credited to their YouTrip account by 21 May 2021

To sweeten the deal, new account applicants during this festive season can also enjoy a reward of S$10 when they complete their sign up using the promo code 'RAYA10'. Singaporean citizens or permanent residents can enjoy an accelerated application of 3 minutes or less by applying through their SingPass account.

For more information about the campaign, please visit this website.