Published

- 04:00 am

Yesterday, news broke that Nayib Bukele, President of El Salvador, announced that he was soon introducing legislation which would make the country the first sovereign state in the world to adopt Bitcoin as legal tender. He made the announcement via video to the Bitcoin 2021 conference held in Miami, noting that implementation would be in partnership with a digital wallet company tasked with upgrading the country’s financial infrastructure to make the transition possible.

“While other countries are jockeying for position, trying to ensure that they are ready to launch a CBDC, El Salvador is moving the other direction, eager to adopt cryptocurrency in a different fashion,” said Richard Gardner, CEO of Modulus, a US-based developer of ultra-high-performance trading and surveillance technology that powers global equities, derivatives, and digital asset exchanges.

“What’s interesting about this move is that it could foreshadow a new approach taken by smaller countries with fewer resources to spend on infrastructure upgrades. The global powers are all certain to compete to make sure their own digital currency is king. CBDCs will help unbanked populations and will, very likely, also make banking far less expensive. Major powers will want to harness and consolidate the power of digital currencies for themselves. But, smaller countries like El Salvador may have just opened the door to a digital financial revolution utilizing technology which already exists,” noted Gardner.

Thus far, CBDCs have found willing audiences across the globe. The Bahamas launched its own digital currency, while China is rolling out beta testing of its e-yuan to trial segments of the population in key cities. The EU, Britain, and the United States have all started to evaluate how virtual currencies would enhance their own financial systems.

“CBDCs are the new frontier in digital assets. But El Salvador is moving with vigor to be the first nation to embrace Bitcoin in this fashion, putting it on par with the US Dollar. While the country has a relatively small economy, it is a symbolic step which indicates its president is interested in a blockchain future. The technology behind Bitcoin and CBDCs is truly revolutionary. There will be many ways to harness its power, and the industry should watch how the Central American nation rolls out its financial infrastructure to allow for adoption, assuming that the legislation passes into law,” said Gardner.

Modulus is known throughout the financial technology segment as a leader in the development of ultra-high frequency trading systems and blockchain technologies. Over the past twenty years, the company has built technology for the world’s most notable exchanges, with a client list which includes NASA, NASDAQ, Goldman Sachs, Merrill Lynch, JP Morgan Chase, Bank of America, Barclays, Siemens, Shell, Yahoo!, Microsoft, Cornell University, and the University of Chicago.

“One of the most important things to note is that, regardless of what form it takes, digital currencies are the future. So, governments, exchanges, and multinational corporations are going to want to begin to plan for it now. If you don’t want to get blindsided, the smart move is to begin to make sure that your technological infrastructure is ready to adapt to the change, particularly as more and more financial systems begin to trend towards a digital future,” Gardner said.

Related News

- 06:00 am

Bahrain-based Islamic FinTech provider, IFIN, has launched the first of its kind, real economy, automated Islamic financing platform. The secure, innovative technology connects retailers and Islamic finance providers, enabling them to offer consumers instant access to Islamic financing for purchases, at the point of sale.

IFIN’s cloud-based platform reduces the traditional Islamic financing process from several days to just a few minutes and is set to revolutionise the in-store shopping experience. IFIN’s platform eliminates the need for customers to visit their bank branch in order to secure a finance, allowing them to do so as soon as they have made their purchasing decision in the store.

IFIN platform provides retailers with the opportunity to boost their sales and increase customer loyalty by enhancing the payment options for their customers. The platform serves a wide range of goods and service providers, including car dealerships, furniture showrooms, electronics stores, travel agents, healthcare providers, private schools and academic institutions.

Similarly, IFIN’s cutting-edge, secure and fully automated platform enables Islamic financial institutions to substantially expand their distribution network to hundreds or even thousands of retailers and extend their operations beyond the traditional branch model and usual banking working hours and days, thus allowing them to continue booking new financing even on weekends and banking holidays, with utmost simplicity and without any major investment.

Research undertaken in the Sultanate of Oman and the Kingdom of Saudi Arabia, by independent research company, Nielsen on behalf of IFIN, reveals a substantial market opportunity for both financial institutions and retailers. According to the research findings, almost 90% of consumers in both countries are either ‘interested’ or ‘very interested’ in the IFIN offering.

IFIN is a joint venture between two Islamic finance pioneers - Path Solutions (www.path-solutions.com), the world’s leading provider of Islamic finance technology, and IFAAS (Islamic Finance Advisory & Assurance Services), a leading international advisory firm dedicated to Islamic finance.

The founder and CEO of IFIN, Dr. Shaher Abbas said “We are very proud to bring the first of its kind FinTech solution to the Islamic financial services industry. The end-to-end digitalisation of the financing process allows Islamic financial institutions to significantly reduce their costs, enhance their profitability and expand their outreach to be where their customers are, without laying another brick. On the other hand, with the whole financing process taking only 10 minutes to be completed, retailers can boost their sales, expand their product offering and provide their customers with the unique shopping and financing experience that IFIN brings. IFIN plans to expand in 20 countries over the next 5 years to capture a market potentially worth over $600 billion”.

Mohammed Kateeb, Chairman and CEO of Path Solutions added, “We are delighted that, by using our cumulative knowledge in Islamic finance technology and through our collaboration with IFAAS, we have developed an industry-leading solution that will deliver real impact to Islamic financial institutions, retailers and customers. We have known and understood the industry challenges very thoroughly and developed a practical solution not only to meet those challenges but also to help take the industry to the next level”.

Farrukh Raza, IFAAS Group CEO, also commented on the launch saying, “Our experience and insight of the industry has enabled us to develop a much-needed FinTech with Path Solutions to lay down the foundation of a digital Islamic finance industry that serves the real economy and supports the development of communities”.

Related News

- 02:00 am

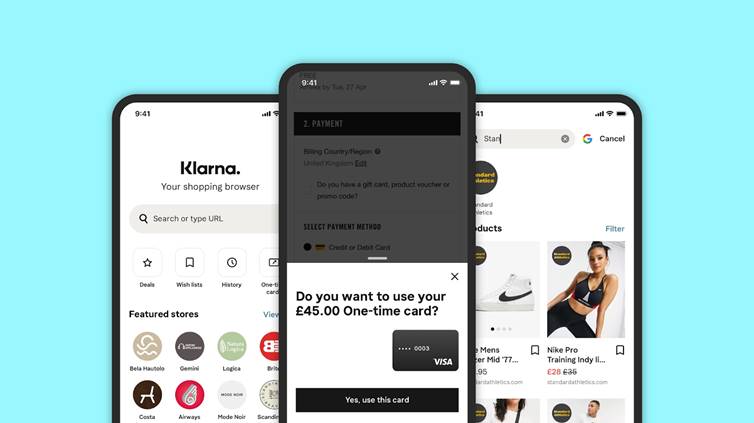

- Klarna users can now shop using pay in 3 at any online retailer, regardless of whether they’re partnered with Klarna or not, directly from the app

- The new feature eliminates the need to use credit cards when shopping online, making high-interest APRs a thing of the past

- Additional features include personalised wish lists, price drop notifications, thousands of deals updated daily, monthly budgets and personal spending limits

Klarna, the leading global banking, payments and shopping service, has today launched its Shopping app, empowering users to Pay in 3 in any online shop directly through the Klarna app, without ever paying more than the price of the product. Klarna’s in-app shopping experience now covers the whole retail journey, from inspiration and discovery right through to purchase and return management.

This new Shopping feature allows UK Klarna users to shop at any online retailer, regardless of whether they’re partnered with Klarna or not, and split the payment into three interest-free instalments - eliminating the need to use a credit card. It will also integrate monthly budgets and personal spending limit functionalities for users to set and remain in control of their spending.

Additional features include personalised wish lists and curated content based on consumers’ interests and their favourite stores, price drop notifications, thousands of deals updated daily, and lists of retailers for users to decide where to buy their favourite product, at the best price.

With an estimated 72% of e-commerce to take place on a mobile device by the end of the year, the Klarna app will give shoppers everything they need right at their fingertips and never have to juggle multiple apps ever again.

The launch of Klarna’s new shopping feature comes during Klarna’s prominent #WhyPayInterest advertising campaign. The campaign highlights the difference between buy now pay later products and credit cards, challenging the outdated credit model that saw Brits pay £5.7 billion in credit card interest and fees in 2020 alone.

Sebastian Siemiatkowski, CEO of Klarna said: “At Klarna, we believe that no-one should ever have to pay credit card fees or high interest rates and now, thanks to our new in-app shopping feature, they don’t have to. Shoppers now can interact with their favourite retailers without having to leave the Klarna app, to create a smooth, safe and frictionless shopping experience. Our one stop shop app is the future of shopping, it creates a truly personalised and bespoke service for every user and liberates consumers from ever paying more than the price of the product.”

The feature is already live in other markets including the US, Australia and Sweden where the app is used by 6.5 million people on average each month and the pay later interest free feature has been used over 12.8 million times to make a purchase through the app. The app is available to download for iOS and Android mobile devices today.

Related News

- 07:00 am

Temenos, the banking software company, has been listed as the only ‘Global Power Seller’ in Forrester’s prestigious Global Banking Platform Deals Survey 2021, with a 20% increase in new named deals compared to previous year. Temenos was the only top 5 vendor to grow its number of deals in 2020. Temenos landed more new global banking deals than any other surveyed provider in 2020, as stated in the Forrester report. Temenos was also named a ‘Top Global Player’ in the survey, based on combined deals, which represent a vendor’s ability to enhance its market position and keep creating value for its existing customers. Temenos also became the first vendor to be recognized by Forrester as a ‘Top Global Cross-Seller’ in Forrester’s newest category focused on extended business. According to Forrester, “extended business deals represent a vendor’s ability to keep creating value for its existing customers.”

Forrester reconfirmed Temenos’ status as a ‘Top Global Player’ for the 9th consecutive year. This ranking recognizes platforms with over 150 combined deals (new names and extended deals with existing customers) in more than five regions. With 209 deals signed with new and existing customers, Temenos maintained its position. Temenos also retains its position as a ‘Global Power Seller’, the highest status in the vendor pyramid for new deals, with 93 new business deals in 2020, 3X more deals than the next surveyed vendor. This marks the 15th consecutive year that Temenos has received this recognition.

Max Chuard, Chief Executive Officer, Temenos, said: “We are delighted to be recognized in Forrester’s Global Banking Platform Deals Survey across all seven surveyed regions and categories, and to be the only technology company to be in the top segment of all three tables. We operate in a huge USD 63 billion addressable market, which is largely underpenetrated, with only 27% today spent with third-parties, which creates big opportunities. As the deal figures show, Temenos is one of the only technology providers continuing to grow. We have over 3,000 customers, including over 70 challengers, and we are servicing them by constantly investing in innovation and in our technology roadmap across products and geographies to help them transform their IT landscapes. And by bringing to market The Temenos Banking Cloud, we now empower banks to digitally transform and massively scale faster than ever. We are putting banks in control of their business models and innovation cycles, giving them the agility and speed to deliver real value to their customers and build profitable businesses.”

The report, Use The Pandemic's Market Impact To Improve The ROI Of Digital Transformation:

Results From Forrester's Global Banking Platform Deals Survey 2021, authored by Jost Hoppermann, Vice President and Principal Analyst, Forrester, states: “Banks have long recognized that their application landscapes can’t deliver the seamless and convenient experiences their customers require, leading to many institutions accepting the transformation imperative[...]. The pandemic has improved the banking industry’s application landscapes and digital readiness. However, it is still far from perfect: Despite the increased transformation pace, plenty of functional areas still need digital transformation. Well-suited off-the-shelf banking software is an effective option to drive this transformation.”

Temenos was most recently recognized as a leader in ‘The Forrester Wave : Digital Banking Processing Platforms, Q3 2020’ (Retail Banking and Corporate Banking) and previously in ‘The Forrester Wave™: Digital Banking Engagement Platforms, Q3 2019’.

The Global Banking Platform Deals Survey 2021 is an independent survey conducted annually by Forrester. It assesses both the volume and geographical spread of banking platform sales to new and existing customers for 2020 deals. The research is used by decision-makers at financial institutions around the world looking to effectively evaluate the plethora of banking software solutions available.

Related News

- 04:00 am

Innovative payments ecosystem provider set to cut cost and timescale of cross border payments and FX

www.bankingcircle.com PayAlly, the fully integrated payments ecosystem for SMEs is using Banking Circle solutions to improve its multi-currency B2B cross border payments services. In particular, the new partnership gives PayAlly access to a wider choice of payment rails through the Banking Circle super-correspondent banking network, thereby improving the speed and cost of international payments for its e-commerce customers.

With the aim of halving the cost of acquiring and payments for e-commerce SMEs, PayAlly delivers accounts, payments, prepaid cards, Foreign Exchange (FX) and factoring, alongside value-added solutions including supply chain Customer Management System, accounting and E-invoicing. Crucially with its focus on delivering a personal service for every customer, PayAlly aims to empower its customers through its services as Rafal Andzejevsky, PayAlly Co-Founder & CEO explained:

“At PayAlly we strive to help smaller businesses and individuals by providing them with quicker and more reliable payments. Working with Banking Circle, which offers us additional routes for international payments, we are able to improve our ability to execute B2B cross border payments in various currencies more quickly, efficiently and smoothly than we were previously able to do. As a result our clients can send and receive funds much faster and with less hassle and that is good news for their cashflow and profitability.”

London-based PayAlly serves over 1,000 corporate clients around the world and is now using Banking Circle to manage the cross border payments and FX requirements of these clients. Banking Circle enables local B2B payments and collections across borders and eliminates the need for a physical presence or a relationship with a correspondent bank in that region.

PayAlly can issue accounts to business customers, in multiple jurisdictions, giving them access to a reliable and fully flexible cross border payment system previously only accessible through larger banking institutions.

“With its mission to provide customer-centric solutions that break down barriers to international payments and increase SME financial inclusion, PayAlly’s ethos is very closely aligned to ours”, added Anders la Cour, co-founder and Chief Executive Officer at Banking Circle. “Working together, we can help PayAlly’s e-commerce clients expand internationally without the high cost and slow transfer fees that could otherwise hold them back.”

Related News

- 05:00 am

A new report from Juniper Research has found sales of iPhones will bring in over $200 billion in 2022; nearly 40% of the total smartphone hardware market, despite representing less than 20% of devices sold that year.

The new research, Smartphone Market: Device Innovation, Regional Analysis & Market Share Forecasts 2021-2026 Market Research, notes that although smartphone purchase cycles are lengthening, Apple has managed to consistently convince users to purchase higher-priced models through curation of a strong hardware and software ecosystem, which other vendors have only limited opportunities to do in the current market. As a result, Apple’s average selling price will rise in the coming years, while Android devices will decline, unless they can leverage new technologies like 5G or bring new design features, such as foldable phones, into the market.

For more insights, download the free whitepaper, Smartphone Market Innovation: A Two-horse Race? Whitepaper

Differentiation Needs More than Features, as Newer Vendors Gain Ground

Juniper Research believes Android vendors will struggle to compete on a features basis in future. The research shows how vendors that focus on a particular segment and investing in premium features, such as high-end audio and advances in camera technology, will not appeal widely enough to compete at scale in the smartphone market.

‘Feature diversification alone is not enough for lasting success in the crowded smartphone market,’ remarked research co-author Nick Hunt. ‘Apple and Samsung have succeeded in fostering brand loyalty, which smaller vendors have struggled with, despite many introducing new capabilities. These players need to pair strong features with strong branding to have sustained success.’

The research also notes that the decline in Huawei’s fortunes, thanks to the US trade ban, will not restore older brands to prominence, but allow other Chinese brands to expand. We expect BBK, the manufacturer of Oppo, Vivo, Realme, iQOO and OnePlus smartphones, will have over 200 million smartphones shipped in 2022; making it the third largest player that year. In the meantime, Huawei’s market share will decline to just over 9% in 2022, from 11% in 2019.

Whitepaper Download: https://www.juniperresearch.com/whitepapers/smartphone-market-innovation-two-horse-race

Smartphone Market market research: https://www.juniperresearch.com/researchstore/devices-technology/smartphone-market-research-report

Related News

- 04:00 am

Tonik, the Philippines' first digital-only neobank continues to make waves in the local fintech and banking industry as it secures a digital bank license from the Bangko Sentral ng Pilipinas (BSP) – the first for any private and purely digital bank in the country.

The development comes after the neobank’s highly successful public launch in March 2021, which saw it secure over 1 billion pesos (US$20M) in retail deposits in under 1 month - a historic record for any new bank launching in the Philippines. Most recently, Tonik has also bagged its Pre-Series B funding, solidifying its position as one of the highest funded fintechs in Southeast Asia.

“Securing a digital banking license is one of this year’s anticipated milestones for us,” shares Greg Krasnov, Tonik CEO and Founder. “This will help us further strengthen our foothold in the neobanking space through accelerating the roll out of our additional lending and payment products.”

In December 2019, Tonik received its initial rural bank license from the BSP, allowing the neobank to provide retail banking services focused on retail deposits, card payments and consumer loans. A year later, the BSP issued Circular No. 1105 on The Guidelines on the Establishment of Digital Banks, clearing the way for Tonik to scale up and apply for a formal digital bank license.

“We are truly privileged to be working with a regulator such as the BSP who shares the same vision of bolstering financial inclusion in the country,” shares Long Pineda, Country President at Tonik. “An official digital bank license will enable us to offer more products and services to narrow the gap between the banked population and the huge underserved segment in the Philippines.”

Tonik is on a mission to revolutionize the way money works with a new all-digital way of banking operating on a highly secure platform. The neobank offers accessible, flexible, and inclusive financial services, including industry-leading deposit interest rates of up to 6% per annum, and unique saving features such as its Solo Stash and Group Stash products, as well as Term Deposits.

Tonik is supervised by the Bangko Sentral ng Pilipinas (BSP) and deposits are insured by the Philippine Deposit Insurance Corporation (PDIC). Its unique cloud-based solution is powered by global financial technology leaders such as Mastercard, Amazon Web Services, and Finastra.

Learn more about this story and other news from Tonik via http://tonikbank.com.

Related News

- 03:00 am

Local and regional leaders from the UK and abroad will be meeting to discuss plans to achieve net zero at a key event attended by COP26 President Alok Sharma and Business Secretary Kwasi Kwarteng

Today (5 June), World Environment Day, registration has opened for the International Net Zero Leadership conference taking place next month in the West Midlands.

The international event will bring together leaders from across the UK and worldwide, from government, industry and research, to discuss the climate challenge and how best to achieve net zero.

Mayor of the West Midlands, Andy Street

Hosted by Mayor of the West Midlands, Andy Street, those speaking at this key milestone event in the run up to the global COP26 summit in Glasgow later in the year will include: COP26 President, Alok Sharma; Business Secretary, Kwasi Kwarteng; Greater Manchester Mayor, Andy Burnham. Also present will be regional leaders from the across the globe including Mayor of Los Angeles and Chair of the C40 group of global cities, Eric Garcetti, and Mayor of Paris, Anne Hidalgo.

The event will take place on 13 July in Birmingham but will be broadcast online for anyone to attend virtually. Registration for the conference has now opened coinciding with World Environment Day and anyone wishing to attend can sign up by visiting International Net Zero Local Leadership Conference (https://uk.virtualeventhosts.com/UK100-Netzero/register)

COP26 President Alok Sharma, who will be addressing the conference following the leaders’ summit, said:

“Tackling climate change and safeguarding our planet for future generations requires everyone to work together. That is why moments like this matter so much.

“Bringing climate leaders together to discuss the plans that need to be put in place at every level is crucial if we are to keep the target of limiting warming to 1.5C alive.”

UK Business & Energy Secretary Kwasi Kwarteng said: “Creating good quality, green jobs across the UK while levelling up the country and reinvigorating our industrial heartlands, including the Midlands, is our highest priority.

“I look forward to speaking at this milestone event next month and discussing with global leaders at all levels on how we can collectively achieve our world-leading targets to tackle climate change and build back better”.

The event is being co-hosted by the West Midlands Combined Authority (WMCA) and UK100, the UK’s national network of net zero leaders.

Andy Street, the Mayor of the West Midlands, said: “The West Midlands and the wider UK is facing a climate emergency, and the UK100 conference will give people the opportunity to hear from leaders as to how this challenge will be overcome.

“As the birthplace of the industrial revolution our region has a moral responsibility to lead the fightback against climate change, and so I am pleased that we are getting on and delivering on our pledge to become a carbon-neutral region by 2041. From retrofitting hundreds of thousands of homes to become a global leader in state-of-the-art battery production, we have ambitious plans to make this happen.

“But we cannot achieve our goals and overcome the climate challenge without significant collaborative and partnership working, and this conference will help us build on that.”

Cllr Ian Courts WMCA portfolio lead for energy and environment and Leader of Solihull Council said: “I’m really proud of the plan we’ve developed for the West Midlands which puts us on firmly on the track to achieve our net zero aspiration by 2041.

“Like the Mayor, I’m keen to focus on the exciting opportunities that a well-planned transition to net zero can unlock, both in terms of creating new jobs and growth as well as a cleaner more pleasant environment to live in. Most importantly we need to ensure these opportunities are equally shared out by delivering a transition that is fair to everyone.

“This is a milestone event for local leaders in the UK, and from across the world, as we head nearer to COP26.

“The West Midlands Combined Authority has set out how it proposes the region reaches net zero by 2041; now we are looking forward to working with UK local leaders and national government to work together to reach net zero across the country.”

Related News

- 05:00 am

Today, Tinkoff signed a Cooperation Memorandum with the Non-Profit Association for the Development of the RTS Financial Market (NP RTS Association), a primary shareholder of SPB Exchange, agreeing to purchase a stake of up to 7.5% in SPB Exchange from the NP RTS Association. The agreement was signed on the sidelines of the 2021 St. Petersburg International Economic Forum.

The parties agreed to unite their efforts to extend the list of financial instruments traded on SPB Exchange. Tinkoff and the NP RTS Association intend to boost further development of the Russian securities market, both primary securities and derivatives, including options on international securities.

Tinkoff Investments is one of the largest traders on SPB Exchange, topping the ratings in trading volumes, the number of registered and active customers, as well as customers’ assets. In 2020, Tinkoff Investments increased the number of its customers fivefold, with customers’ profits reaching RUB 30 billion. Today Tinkoff Investments continues to develop its informational and educational services available both in the mobile app and on the corporate website tinkoff.ru. Since the launch of its Investment Guide, more than 1.2 million users have completed all of its tasks. The Pulse social network maintained by Tinkoff Investments has 1.2 million registered users.

Stanislav Bliznyuk, Chairman of the Management Board, Tinkoff Bank:

“SPB Exchange is our key partner in international securities trading; Tinkoff Investments’ customers complete hundreds of thousands of transactions every day. Having signed the Cooperation Memorandum, we can both strengthen our partnership and jointly develop and present investors with a wider range of financial instruments, including complex investment products. This will help us to proactively shape a favourable environment for the further development of brokerage services in Russia.”

Roman Goryunov, President of NP RTS Association, Board Member of the SPB Exchange:

“SPB Exchange is continuing to grow and develop as an independent market platform that establishes a corporate structure for its financial intermediaries as both partners and shareholders. To achieve this goal, NP RTS Association continually decreases its stake at SPB Exchange, while inviting key traders to become partners. For this reason, the signing of this Cooperation Memorandum with our long-standing partner Tinkoff is a consistent step in SPB Exchange’s development path. We noticed a long time ago a strong similarity in our companies’ DNA. For many years now, the Tinkoff team has been shaping banking trends and has been considered an eternal generator of ideas in any sphere attracting its attention. Tinkoff Investments trading platform further confirms this reputation: the service has been in high demand from its launch and has sparked a revolution in the Russian investment market. Tinkoff has become our leading partner, while topping the rating of financial intermediaries present on SPB Exchange. I’m certain that we will continue to proactively contribute to the development of our companies to benefit the Russian financial market.”

Related News

By Matt Jackson

Head of Partner Development, EMEA at PPRO

A staggering 3.8 billion people use social media, around half the internet user see more