Published

- 06:00 am

Mark Hendry, Director of Data Protection and Cyber Security at global legal business, DWF, comments on the Fastly outage the online presence of major organisations.

"The online presence of major organisations in the economy have been disrupted by a technical issue experienced by a commonly used service provider, Fastly. Amazon, Reddit. Bloomberg, The Financial Times, The New York Times, CNN, The Guardian, The Independent, The Spectator and UK Government are all reportedly affected, with websites being inaccessible to many users.

"Fastly provide content delivery network ("CDN") services to companies. The intention of CDNs is to route (or distribute) internet traffic and services through 'nodes' in order to balance the load of traffic, prevent bottlenecks and result in high availability and faster content delivery. Requests for content are directed by an algorithm, for instance the algorithm might direct the traffic so that it routes through the most available or highest performing node, or so that the traffic takes the fastest network route to the requestor. This is the reason that some internet users are reporting no issues with accessing content that is unavailable to others – for instance individuals from Berlin are reporting via Twitter that they can access website content that users in London cannot access.

"Fastly have not yet provided comment on the precise nature of the problem. Some of the affected organisations have apparently sought to rectify the issue, perhaps by reverting to non-CDN schemes of distribution, however if this is the case users of those websites can expect for their experience to be slower than normal until the CDN can be restored.

"Whilst the outage can be considered an availability of services issue, it is not clear at this time whether any underlying data or infrastructure belonging to the affected organisations has become vulnerable as a result of the issue."

Related News

- 01:00 am

CDC Group, the UK's development finance institution (DFI) and impact investor, today announces a new US$50 million risk-sharing facility with Absa Bank Limited (Absa). The commitment increases Absa's capacity to offer financing solutions to Micro, Small and Medium Enterprises (MSMEs) and households across Sub-Saharan Africa through Microfinance Institutions & Non-Bank Financial Institutions (MFI & NBFIs).

This MFI and NBFI risk sharing facility is the first of its kind for CDC – supporting lending to these institutions (through credit risk mitigation) and allowing them to better serve households and MSMEs across Africa. The facility will enable Absa to deploy significant sums of capital and provide vital assistance to businesses and households in need of finance, helping them remain resilient and emerge from the crisis. Moreover, the investment forms part of CDC's COVID-19 response and boosts systemic liquidity at a critical time when commercial lending is limited due to the economic challenges brought on by the pandemic.

This investment bolsters Absa's strategy to promote responsible lending practices among MFIs & NBFIs in its portfolio and highlights opportunities within the financial inclusion segment – sending a positive signal to commercial banks to increase their lending to this segment of the economy where considerable funding needs remain unmet.

CDC has a long relationship with Absa, Sub-Saharan Africa's third-largest bank, and this latest investment reinforces the partnership between both institutions. This facility builds on the existing trade finance partnership, helping to enhance access to funds in the markets, facilitate increased trading of goods and services, and deepen financial inclusion among underserved communities and individuals across Africa's markets.

Stephen Priestley, Managing Director, Head of Financial Services, at CDC Group, said: "We are thrilled to once again partner with Absa. This is CDC’s first risk-sharing facility that provides a local currency solution to MSMEs and local households. We are confident that CDC’s counter-cyclical funding will provide much needed support to local financial institutions by diversifying their funding base and enhancing their ability to provide smaller loans to local businesses and hard-to-reach communities. CDC remains committed to ensuring that businesses and people have greater access to the financial support needed to enable them to grow and remain resilient throughout the crisis."

Anand Naidoo, Managing Executive: Client Coverage, Absa Corporate and Investment Banking said: “We are proud to have built this partnership with CDC, which does not only bring value to the relationship but is also aligned to our overall business strategy. This facility is another proof point in the execution of our shared growth strategy which focuses on providing finance and assisting clients to achieve sustainable economic growth in the markets where we operate.

“The framework details the use of proceeds, the process for project evaluation and selection, the ongoing management of proceeds as well as the reporting and transparency. There is a definite trend from global investors to invest in more socially responsible projects and companies because they want to see that their funds are being invested in activities that promote sustainable economic growth.”

Related News

Nora Beqaj

Business Director at The Nest UK

With nearly 9.4 billion euros invested in Financial Technology across Europe in 2020, it’s clear that FinTech, InsureTech and RegTech businesses are transforming the wa see more

- 06:00 am

BSO, the global pioneering infrastructure and connectivity provider, announced today that it has opened a new office in New Jersey with 20 staff members.

After expanding to the US market over five years ago and experiencing steady growth, the new office follows a year during which BSO has established itself as a leader in capital markets connectivity in North America. The business has seen a 40% year on year growth based on demand from high-frequency trading firms, brokers and banks seeking to connect to the main financial exchanges in North America, Europe, Asia, Latin America and the Middle East. BSO’s radio frequency network provides ultra-low latency connectivity to leading exchanges including CBOE, CME, NYSE, ICE, Nasdaq and Toronto’s TMX.

To meet demand, BSO acquired Apsara Networks in 2017 and has since expanded its network to reach over 240 global points of presence (PoPs) and more than 40 cloud on-ramps. In addition, the company has also developed low latency cloud-to-cloud and cloud connectivity solutions to support the cryptocurrency and digital asset trading communities.

“The US and Canada are the key venues in global capital markets,” said Michael Ourabah, CEO of BSO. “As we emerge from the pandemic, we expect further demand for our ultra-low latency and crypto connectivity solutions. And our office in New Jersey will be critical to meeting this demand.”

“With a growing team of sales, product and engineering specialists we needed a bigger space,” said Stephen McConnell, Head of Sales Americas at BSO “The new offices will bring us closer to our clients and we believe face-to-face contact with customers and staff will continue to be essential despite new virtual ways of working. The new office is a landmark moment in BSO’s global expansion.”

Related News

- 08:00 am

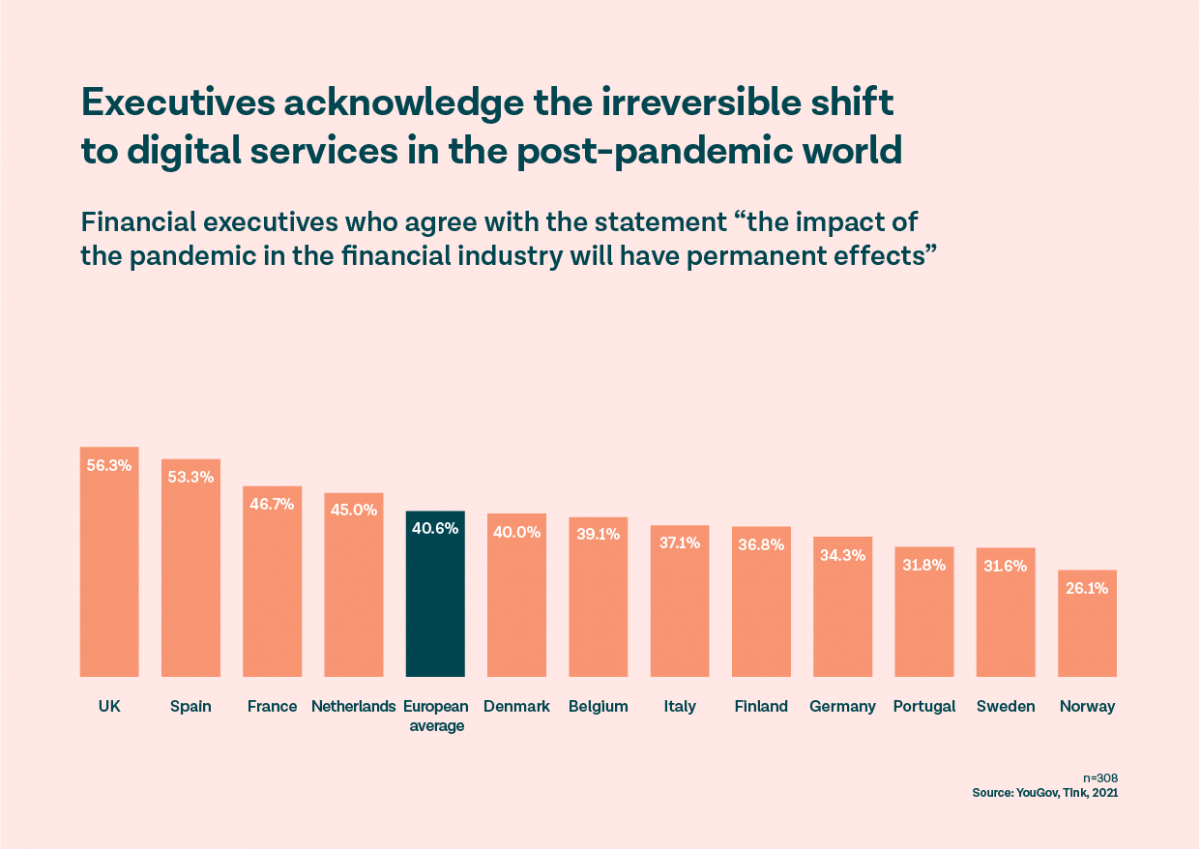

- 68% of European financial executives say the pandemic has increased their focus on open banking (Vs 72% in the UK)

- This shift is propelling banks to concentrate their efforts on the creation of digital services, improving the customer experience and restoring profitability

- The UK continues to lead the charge in digital innovation with greater acknowledgement that the digital shift is permanent (56% Vs the European average of 41%) and a bigger focus on open banking compared to its European counterparts

A new report published today from open banking platform Tink suggests that COVID-19 has irreversibly increased the shift to digital financial services.

As a result of the pandemic, financial institutions have been forced to adapt to more digital ways of serving their customers, while people across all age groups have had to become familiar with using more digital services. This has led to the digitalisation of financial services being fast-tracked – and 41% of European financial executives believe the effects of the COVID-19 pandemic on the financial services industry will be permanent.

Open banking gets a boost

Even in light of the digital transformation efforts that have been set in motion over the past few years, 65% of financial executives across Europe still believe that banks need to increase their speed of innovation. This digitalisations shift has resulted in an increased appetite for financial institutions to leverage technology and find solutions to new challenges as a result of Covid-19. In fact, more than two-thirds (68%) of European financial executives say their interest in open banking has increased during the pandemic.

The report also shows that the pandemic has focused European financial institutions on three key business priorities. Three-quarters (74%) of executives see an increased need to enhance their digital services – to streamline onboarding and manage more customers digitally. While 70% are also focused on the customer experience – to differentiate themselves from competitors and boost customer engagement in an increasingly digital world. For 68% of financial executives, there is an increased focus on restoring profitability, through automating and streamlining business processes.

Lasting long-term impact or short-term blip?

However, despite the big shifts the financial services industry has witnessed during the pandemic, 59% of financial executives still see the transition to digital as a short-term blip and expect things to return to normal. Similarly, only two-thirds (67%) of respondents think that Covid has increased business risk, despite clear signs of looming economic danger on the horizon – with households under increasing financial distress, non-performing loans set to rise and businesses at risk of bankruptcy when governmental support runs out. This suggests that some European financial institutions are at risk of sleepwalking into a future of unforeseen challenges that may have a severe impact on their customers, unless they recognise the significant and lasting impact that Covid has had on the financial industry.

Daniel Kjellén, co-founder and CEO, Tink, said: “The pandemic has forced many executives to remedy the lack of personal interaction with customers by focusing on delivering digital services. But this has also provided a way of creating more value for the customer, while increasing insights to identify or even predict potential risks and new demands. Financial institutions have seen that open banking technology presents opportunities to increase the speed of innovation, introduce new commercial streams and revenue opportunities, while enabling operational efficiencies that will benefit their business long term.

“But there are also many executives who are expecting things to go back to normal, who will need a plan on how to respond and where to focus their digitalisation efforts as the transformation of financial services continues to pick up pace. We have set out to help empower the pioneers of financial services – the banks that are looking at technology not as a cost, but as an opportunity to improve many of the things they do today. How they operate internally, how they deliver their products, and how they will serve their customers in a post-pandemic world.”

The UK: leading the way in the digital shift

Out of all the financial executives surveyed in Europe, those in the UK were the most ardent believers that the digital financial shift will be permanent (56% Vs the European average of 41%). It’s therefore unsurprising, but encouraging, to see that 75% of UK respondents feel that the pandemic has increased the need to enhance digital services. And with 88% saying they believe that the pandemic has increased the focus on customer experience (compared to the European average of 70%), it’s likely that innovation within financial services will be high on their agendas as we move forward.

Rafa Plantier, Head of UK and Ireland at Tink, commented: “The UK leads the way in believing the digital shift in financial services is here to stay. In fact, the UK is ahead of the curve on interest in open banking increasing during the pandemic, allowing them to improve digital services, level-up the customer experience and bring greater profitability to their organisations. This reflects the UK’s position as a leading hub for fintech innovation and as pioneers of the open banking movement.”

Related News

- 01:00 am

Nutanix, a leader in private, hybrid and multicloud computing, today announced the launch of the Nutanix Elevate Service Provider Program, further extending the benefits of the Elevate Partner Program to now include service providers globally. The program empowers service provider partners – including managed and cloud service providers – to build highly-differentiated hybrid and multicloud services delivering increased profitability and faster time-to-market.

As many organisations look for opportunities to simplify their IT operations, IDC forecasts the managed cloud services market to grow to $101.1B by 2024↿. With this opportunity, comes the challenge of service providers meeting increasingly individualised customer demands while staying profitable. The Nutanix Elevate Service Provider Program helps service providers improve margins and agility by addressing the lock-in and minimum commitment requirements encountered in traditional service provider vendor models and programs.

“As the demand for managed and cloud services surges, service providers are uniquely positioned to assist an organisation’s growth, optimisation initiatives, and digital transformation needs,” said Christian Alvarez, SVP Worldwide Channels at Nutanix. “Through the Nutanix Elevate Service Provider Program, we are rewarding our partners’ commitment in delivering high value IT cloud service offerings and helping them maximise profitability and increase their revenue growth potential through premium offerings.”

Nutanix Elevate Service Provider Program Details

This service provider program adds two partnership levels to Nutanix Elevate: Authorised Service Provider and Professional Service Provider. Authorised Service Providers will include partners new to Nutanix or those delivering Nutanix services to small to mid-market organisations. Professional Service Provider will deliver differentiated services for enterprise organisations. Partners who join the program will be able to take advantage of all the benefits outlined in the Elevate Service Provider Program Guide including training, Not For Resale (NFR) and Nutanix XLAB software licenses, and enablement support. Professional Service Provider partners will be able to take advantage of expanded support from Nutanix including marketing materials, potential market development funds, sales tools, goal-based financial incentives and rebates, and personalised insights in Nutanix’s Partner Portal.

Key advantages of Nutanix Solutions and Elevate Service Provider Program include:

- Improved Bottom Line: Simplified pricing options, no minimum commitment levels or mandatory product purchases help deliver increased profitability for service providers. Nutanix service providers also benefit from significantly lower management overhead with Nutanix, compared to competitors, ultimately delivering a highly capable and cost effective HCI solution.

- Increased Top Line and Faster Time-to-Market: The simplicity of Nutanix solutions can also help deliver faster time-to-market thanks to more than 80% faster deployment. Nutanix service providers can also onboard and rapidly scale new services including private, hybrid and multicloud, Desktop as a Service (DaaS), Disaster Recovery as a Service (DRaaS), Database as a Service (DBaaS), and more. Additionally, Nutanix software licenses can be used by service providers at their customer site, in the service provider’s environment, or on Nutanix Clusters running in public cloud environments, including AWS, AWS GovCloud and with support for Microsoft Azure under development, giving their customers a fast path to hybrid cloud.

- Simplicity: A hallmark of Nutanix solutions, and a key driver behind the company’s average NPS score of 90 for the last seven years, is simplicity. Service providers will be able to deliver IT services, at any scale, with simple one-click deployment, upgrades, scaling, self-healing capabilities, troubleshooting and more with Nutanix. This will allow our service provider partners to realise nearly 60% more efficient IT infrastructure management, freeing up significant time to focus on innovation and supporting broader business priorities. Additionally, service providers can take advantage of auto-metering, enabling them to provide granular billing to their customers.

Nutanix is running a Service Provider Starter Pack promotional offer for new partners joining the Elevate Service Provider Program. This promotional offer includes training, certification and the right Nutanix software to help our partners bring their differentiated services to production and start generating revenue. This offer is available immediately.

The Nutanix Elevate Service Provider program is available now to providers worldwide. More information on how to sign up, accompanying benefits, and the program guide are available at https://www.nutanix.com/partners/become-a-partner. Partners can also learn more about the program by signing up for the upcoming webinar on June 30, 2021, here.

Supporting quotes about the launch of the NESPP:

- Cyxtera: “Thanks to the successful partnership we’ve built with Nutanix, Cyxtera’s customers can now deploy Nutanix Cloud Platform on our automated, on-demand infrastructure platform in more than half of our world-class datacentres. The Nutanix Elevate Service Provider Program offers us the ability to continue growing together. We are very excited to provide our customers increased flexibility by eliminating the complexities of procurement, logistics, and capital equipment management as a strategic Nutanix partner for hosted private infrastructure via Cyxtera’s Enterprise Bare Metal offering.” – Russell Cozart, Senior Vice President of Marketing and Product Strategy, Cyxtera

- HKT: “At HKT, we are continuously enhancing our managed service offerings of integrated solutions to support the unique business needs of Hong Kong enterprises. Nutanix is a trusted and reliable partner, which performs admirably in terms of technology and support. With the new Nutanix Elevate Service Provider Program, together we will be able to deliver greater value and innovation for our customers’ digital transformation journey, in a way that can best meet their business demands across hybrid and multicloud.” – Tom Chan, Managing Director of HKT Commercial Group, HKT

- OneNeck: "OneNeck IT Solutions partnered with Nutanix to power our ReliaCloud Edge, a hosted private cloud, because Nutanix technologies provided the scalability to meet our customer’s IT needs with the reliability, security and high performance that their business demands. As we continue to expand our partnership with new services powered by Nutanix, the option to join the Nutanix Elevate Service Provider Program offers us additional benefits that will help us expand our customers' ability to consume our data center services.” – Ted Wiessing, SVP Technology and Chief Security & Privacy Officer, OneNeck

- OVH: “Partnering with Nutanix is a significant step forward to better address hosted private cloud’s growing demand with a high level of technical solutions. Today we are announcing a great partnership between OVHcloud and Nutanix to offer a breadth of infrastructure options, with an eye toward future innovations, for our customers. Leading hosted private cloud solutions offered by OVHcloud continue to gain momentum in the market. Together with Nutanix and the new Nutanix Elevate Service Provider Program, OVHcloud is embarking on the mission to deliver next-generation hosted private cloud service offerings with a strong feature set offering performances and security that address a broad range of use cases for companies of all sizes at the best price.” – Michel Paulin, CEO, OVHcloud

- TierPoint: “TierPoint is all about meeting our customers where they are on their journeys to IT transformation and delivering successful business outcomes to them. We picked Nutanix to build managed private cloud and cloud-to-cloud recovery solutions because of the simplicity, stability, and scalability of the Nutanix platform. Tierpoint joining the Nutanix Elevate Service Provider Program will make it even easier to add and deliver services that power our customer’s success and will continue to allow us to work hand-in-hand to find ways to advance the objectives of our shared clients.” – Brian Anderson, VP of Product Development, TierPoint

- Yotta: “Yotta chose Nutanix to power our managed private cloud services because of its well-architected platform and portfolio. Nutanix delivers performance, security, and control at scale for our customer’s mission critical business applications. We are excited for the Nutanix Elevate Service Provider Program as we continue to expand our partnership to deliver leading data centre services to our customers at the most reasonable costs.” - Sunil Gupta, Managing Partner & CEO, Yotta

- Source: IDC, Worldwide Managed Cloud Services Forecast, 2020–2024: An Extraction View of Technology Outsourcing Services Markets (IDC #US45926720, September 2020)

Related News

- 07:00 am

Pannovate, an established and award-winning digital solution provider for the financial services sector, has been certified by Visa to join the innovative Visa Ready partner programme. The ‘Certified by Visa’ mark is trusted recognition by the global payments ecosystem and enables Pannovate to accelerate its growth by providing digital-first solutions, and access to Visa’s products and go-to-market expertise. Visa Ready certification will enable Pannovate to differentiate its banking as a service solution, Launchpad, establish trust with clients, and expand its business with the Visa Ready seal of approval.

Pannovate is pleased to be included in the Visa Ready programme. Being recognised and participating in this global network is a strategic step forward. Pannovate’s Launchpad range highlights Pannovate’s ability to answer market demand with a turn-key solution for customers looking to go to market quickly and cost effectively. To this day, Launchpad is unique in the way it is built. It is the first app to be designed for the payments industry, by a payments expert, in-house, rather than a classic app builder with little knowledge or experience in the payments industry. Pannovate’s dedication to excellence is evidenced in the slick and attractive user interface in all Launchpad products, that satisfies even the most exacting consumer demands.

“We are delighted to be working with the Visa Ready Program. This endorsement is a key strategic step for us. It also supports our global initiative to provide robust products that are built to enable quick and easy integration with a wide variety of suppliers to create solutions with the best business fit.”

Pavle Ljujic, CEO of Pannovate

Related News

- 05:00 am

This month virtual network service provider Atlas VPN released a new security feature called Data Breach Monitor. The new feature, currently available on iOS and Android platforms, helps its users check if their personal information has been leaked online.

First, users are prompted to scan their email addresses with Data Breach Monitor. The tool then searches through leaked databases to check whether the data there matches the user's information.

If matching information is found, the user is presented with a list of past and current security breaches associated with their online accounts. In addition, the list includes information about when and where the breach occurred and what type of information was leaked.

The leaked data can include anything from credentials such as email address, username, and password to social security numbers or other types of personal information.

The tool also notifies users of new leaks affecting their personal data so they can take immediate action and stop malicious actors from exploiting their online accounts.

"In the first quarter of 2021 alone, more than 5 billion records were leaked in various data breaches. These numbers are alarming, so in addition to a VPN, we wanted to offer our users an even broader set of tools to protect their online security," said the Chief Operating Officer at Atlas VPN.

While all Atlas VPN users can take advantage of the Data Breach monitor to boost their online security, Premium users get full access to the feature. It means they can connect multiple email addresses to the tool to safeguard all their online accounts.

Related News

- 05:00 am

Far from operating in the shadows, criminals disguise their activities as legitimate businesses to hide illicit funds. Failing to understand who you are doing business with, or the status of the client counterparty (KYC) or the Ultimate Beneficial Owner (UBO), increases your organisations’ risk of financial crime or reputational damage.

Join our latest webinar on Tuesday 15th June at 14:00 BST with renowned MoneyLand author and journalist Oliver Bullough, award-winning compliance officer Oonagh van den Berg, and senior AML policy officer at Transparency International Laure Brillaud, to discuss why the UK is still attractive to global crooks and Kleptocrats; what can be achieved and looking at the best approach for identifying and monitoring UBOs.

Key topics

- How big is the problem

- How Beneficial Ownerships are used for Money laundering

- Proactive approach to transparency

- Impact of regulation

- Best practice to verify and monitor UBOs

The Speakers

Oliver Bullough

Author of the MoneyLand and Journalist

Oliver Bullough is a journalist and author from Wales who moved in 1999 to Russia to work as a journalist. He worked first for local newspapers in St Petersburg and Bishkek (Kyrgyzstan), then for Reuters. He stayed in Moscow, mainly reporting on the war in Chechnya, until 2006.

Since leaving Reuters, he has written three books. The first – Let Our Fame be Great – is about the peoples of the North Caucasus, and his travels to find their scattered communities. The second –The Last Man in Russia – is a biography of a dissident Orthodox priest, whose life closely mirrors that of the Russian nation in the 20th century, and sheds light on the demographic tragedy of modern Russia. The third is called Moneyland and tells the story of how the world’s super-rich have broken free of democratic control and formed their own nomadic global community.

Oonagh van den Berg

Managing Director and Founder

Raw Compliance

Oonagh van den Berg is a Northern Irish award-winning compliance professional. She is a recognised Subject Matter Expert in various areas of compliance, is a passionate trainer, and an advocate of increased automation, ethical behaviour and sustainable culture building.

Oonagh began her career as a legal intern at the European Central Bank in Frankfurt. She then joined JP Morgan in London as a product legal documentation specialist, before moving into compliance and working in various roles across a number of international Banks. After a number of years working in banking, Oonagh moved to consultancy working for Protiviti, before stepping out on her own through the launch of her boutique compliance consultancy firm Virtual Risk Solutions VRS Limited, where she is the Founder and Managing Director, providing compliance consultancy services including training and managed services to global clients including traditional banking, FinTech’s, and governmental bodies. She also acts as an advisor on various policy decision committees and public-private partnerships.

Laure Brillaud

Senior Policy Officer – Anti-Money Laundering

Transparency International

Laure joined Transparency International EU in 2016 and leads the work on anti-money laundering. Her priority areas include beneficial ownership transparency, the role of intermediaries in AML, AML supervision, golden visa market regulations, asset recovery, etc. Prior to that, she worked at the Organisation for Economic Cooperation and Development (OECD). In particular, she conducted policy analysis and outreach on corruption in the extractive sector as well as other key development issues such as global inequalities and social cohesion. Laure holds a Masters’ degree in Engineering from Mines ParisTech as well as dual Masters’ degree in International Affairs and Public Administration from Science Po Paris and Columbia University.

Related News

- 07:00 am

Even before the pandemic, the global digital banking market had been growing rapidly, with millions of people choosing an app or web-based bank over a traditional high-street financial institution.

However, the COVID-19 had accelerated the shift to digital banking like never before, as customer expectations changed during the pandemic.

According to data presented by AksjeBloggen.com, the global digital banking market is expected to hit a $2.5trn transaction value in 2021, a massive 70% increase in a year.

The Number of Users Almost Tripled Amid the Pandemic

Digital banks, also known as neobanks or online banks, changed the way people handle and manage money. These app or web-based banks offer a line of mobile banking services that can be used entirely from smartphones, which especially became useful amid the COVID-19 lockdowns.

In 2019, the global digital banking market hit $836.5bn transaction value, revealed the Statista data. After the pandemic struck, the transaction value jumped by 81% YoY to over $1.5trn. However, the following years are set to witness even more impressive growth. Next year, digital banking is forecast to become a $4trn worth industry. By 2025, the transaction value of all digital banks worldwide is expected to double and hit nearly $8.3trn.

The number of people using online banking services has also surged. Statistics show the number of users almost tripled to 141 million since the pandemic struck. In the next four years, this figure is set to jump to 334 million globally.

The US to Generate One-Third of Total Transaction Value in 2021, UK Market to Grow by 70% YoY

In global comparison, the United States is the leader in digital banking services. Home to some of the world's largest neobanks like Chime, SoFi, and Robinhood, the US market has multiplied over the years. In 2021, the transaction value of the US digital banking market is expected to jump by 62% and reach $820bn, or one-third of all transactions this year.

However, the United Kingdom, as the second-largest market globally, is expected to witness even more impressive growth in 2021, with transaction value growing by 70% to $430.7bn. The largest digital bank in Europe and the second-largest globally, UK`s Revolut, has also grown rapidly over the years. In February 2018, the London-based challenger with the highest number of customers of any European online bank announced that they had hit 1.5 million users. This figure grew to 10 million last year.

As the world's third-largest digital banking market, Russia is expected to hit a $313.7bn transaction value this year. Brazil and Germany follow with $178.6bn and $138.1bn, respectively.

The full story can be read here: https://aksjebloggen.com/digital-banking-market-to-hit-2-5t-transaction-value-in-2021-a-massive-70-jump-in-a-year/