Published

- 03:00 am

While in the past few years there has been considerable investment and disruption in merchant acquiring, with the emergence of winners such as Stripe and Adyen, the role of the technology providers behind the cardholder side of the payments equation – otherwise known as issuer processors – has been largely overlooked, despite enabling many of the most innovative and valuable fintechs today.

However, that is beginning to change. The intrinsic value of issuer processors is increasingly being reflected by the post-M&A valuations of some of the biggest companies in the space, from SoFi’s $1.2 billion acquisition of Galileo and its recent SPAC merger taking its market cap to $16.9 billion, to SaltPay’s acquisition of Tutuka and its subsequent $700 million fundraise now valuing the company at over $1 billion. This is only further highlighted by retail investor interest in US-based Marqeta’s IPO, demonstrating that the year of the issuer processor has now arrived.

While the market opportunity is huge in the US, with issuers processing $6.7 trillion worth of transactions in 2020, our experience is that this opportunity stretches across the globe and could be almost five times that amount, given the rapid shift to digital payments adoption and increasingly cashless societies post-Covid.”

Related News

- 07:00 am

Wellington Management is one of the largest global asset managers offering investment solutions spanning across the global equity, fixed income, multi-asset and alternatives.

The latest addition to Fineco's investment platform follows a string of recent fund announcements made this year including AXA IM, Candriam and Ninety One.

Paolo Di Grazia, Deputy General Manager, Fineco: "Following the recent news that more than 70% of Fineco clients hold active current accounts on brokerage, we are determined to continue expanding our investment offerings. We are very pleased to have partnered with Wellington Management and to offer our UK customers access to their selection of quality funds through our competitively priced investment platform."

Matthew Knight, Head of UK distribution, Wellington Management: "At Wellington Management, we strive to combine the resources of a large, global asset manager with the boutique feel of an independent, privately held partnership. We look forward to working with Fineco to offer their UK clients our innovative investment solutions."

About FinecoBank

Launched in 2017 in UK, FinecoBank, the multi-currency bank and one of the most important FinTech banks in Europe, has built an integrated business model proposing customers its One-Stop-Solution: it offers from a single account banking, trading and investment services through innovative transactional platforms developed with proprietary technologies. Fineco represents a new way of banking, a smart way to invest money.

Fineco's mission is to simplify customers' lives when dealing with financial services and has developed a very powerful yet user-friendly platform. Learn more about us on finecobank.co.uk.

About Wellington Management

Tracing its history to 1928, Wellington Management is one of the world's largest independent investment management firms, serving as a trusted adviser to over 2,200 clients in more than 60 countries. The firm manages more than US$1 trillion for pensions, endowments and foundations, insurers, family offices, fund sponsors, global wealth managers, and other clients. As a private partnership whose only business is investment management, the firm is able to align its long-term views and interests with those of its clients. The firm offers comprehensive investment management capabilities that span nearly all segments of the global capital markets, including equity, fixed income, multi-asset, and alternative strategies. With more than 800 investment professionals located in offices around the world, Wellington pairs deep multi-disciplinary research resources with independent investment teams operating in an entrepreneurial boutique" environment. For more information, please visit www.wellingtonfunds.com.

Related News

- 06:00 am

Commenting on sterling and UK equity markets’ muted reaction to UK GDP, Mike Owens, Global Sales Trader at Saxo Markets, said: “Although UK GDP registered strong growth, the numbers are nothing to shout about considering where we’ve come from. As expected, the biggest contributions were consumer services that had previously been hampered by Covid-19 restrictions. Industrial production fell 1.3% Month-on-Month against an expected 1.2% gain although this will hopefully only be temporary. Sterling and UK equity markets have had a muted reaction to the figures and it’ll be a good result if the UK economy manages to grow to pre-pandemic size by the end of the year.”

Related News

Michael Moran

Senior Currency Strategist at ACY Securities

Pound Rallies, Euro Flat, AUD, NZD, EMS, Stocks Climb see more

- 07:00 am

Commenting on UK GDP data for April, Rupert Thompson, Chief Investment Officer at Kingswood, said: “UK GDP posted a large gain in April for the second month running, growing 2.3% m/m in line with expectations. This left GDP up a massive 27.6% up from its low point last April but still down 3.7% on its pre-pandemic level in February 2020. Today’s data confirm a rapid recovery in the UK is well underway and will fuel hopes that the economy will in a few months’ time have recovered all of its pandemic-related losses.”

Related News

- 02:00 am

Commenting on UK GDP and sterling’s potential to reach levels not seen since early 2018, Jesús Cabra Guisasola, Associate at Validus Risk Management, said: “The UK economy grew 2.3% in April (Vs 2.4% estimated), which confirms the British economy is firmly recovering after contracting the most since 1709 last year. There are no doubts that the UK has been one of the countries coming out in a better position from the pandemic after the success of its vaccination program.

“However, there are reasons to be cautious as coronavirus cases continue rising, with the delta variant spreading rapidly. Prime Minister Boris Johnson and his government are now facing the dilemma of moving the country to the final stage of the reopening on the 21st of June. Moreover, the BoE will need to decide when the best moment is to start tightening its monetary policy as some members like Andy Haldane already voted to scale back the stimulus program during the last meeting.

“Nevertheless, there is optimism surrounding sterling in the coming months and any delay on the reopening would have a minimal impact on the recovery. Hence, we could see GBPUSD closer to the 1.45-mark, a level not seen since early 2018.”

Related News

- 09:00 am

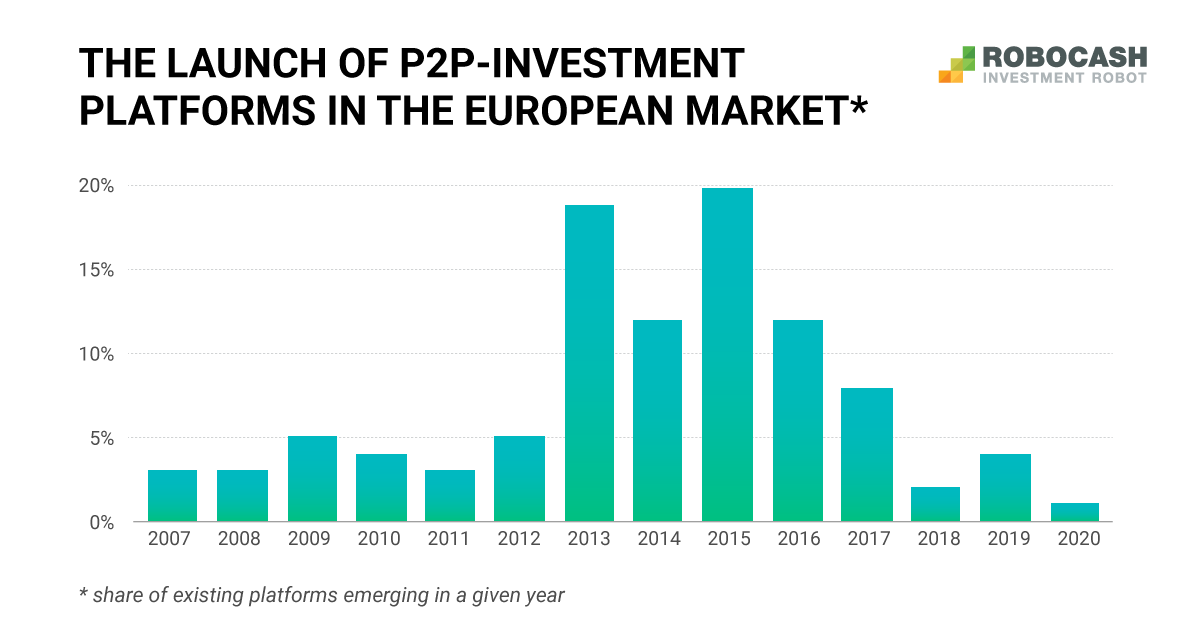

Analysts of the European investment platform Robo.cash predict that in the next year or two a small number of new lending platforms will enter the P2P-market. Moreover, most of them will probably be part of financial groups and will offer more favorable conditions in order to compete with older players.

Robo.cash researchers have analyzed data from P2PMarketData.com and found that about 80% of the entire European consumer and business lending market belong to 10 P2P-platforms, which indicates a high market concentration. Such a situation is characterized by the fact that “large players” maintain their positions, and significant structural changes in the market are not possible. Notably, the platforms that occupy the main positions are mostly mixed, that is, they work both with business and with consumers. Thus, they create a competitive advantage by diversifying their supply.

However, the P2P-market is undergoing changes in the ratio of market shares from large players to smaller ones. The sphere of P2P investments is becoming more demanding on the quality of the offered products and therefore, more promising for the development of platforms with smaller shares. Interestingly, the number of platforms working within financial groups has increased. In the face of growing uncertainty, launching a platform as a part of the group might reduce the risks when entering a new market.

If we assess the situation from a far-off perspective, we can see that the concentration of freshly launched platforms reached its peak in 2013-2016. During these years, about 60% of all currently existing platforms entered the European market. From 2017 to the present, the emergence of new platforms has slowed down.

“Future development of the European P2P-lending market will be primarily driven by existing platforms rather than new players. Market concentration will continue to weaken gradually as the corona crisis made many P2P-platforms with small market shares competitive enough to be able to change their positions in the market” - comment the analysts at Robo.cash.

Related News

- 06:00 am

Commenting on UK GDP rising 2.3% in April, Douglas Grant, Director of Conister, part of AIM listed Manx Financial Group, said: “The monthly rise in UK GDP follows the recent positive trend of economic data, falling in line with what we’d expect as restrictions are lifted and the economy nears fully reopening. As the lifeblood of the UK economy, agile and resilient SMEs have no doubt contributed to this growth in output as they adapt to the post-pandemic economy. However, we must remember that the UK’s SME debt burden is ballooning, and we are in serious danger of seeing a relentless flow of weak zombie-like companies falling off a loan default cliff. It is imperative that we avoid compounding this cycle by focussing solely on supporting sectors and businesses that are strong and nimble enough to adapt to the new economy and therefore continue contributing to its growth.

"We believe the introduction of the recovery loan scheme (RLS) will certainly help. We are pleased to see the Government look beyond the initial triage phase and instead identify, prioritise and protect our most resilient business sectors that can meaningfully contribute to the new economy.

"At Conister we have delivered upon all of our initial objectives. We have lent our full CBILS and BBLS allocation and have applications which we hope can be accredited under the RLS. We will focus on lending this to robust business sectors that we believe will thrive in the future. Conister will continue to do all it can, working alongside the Government and traditional lenders, to support British businesses."

Related News

N/A

N/A at TIBCO

Businesses that put data into action, tied it to innovation, and drove its use across the entire organisation were the real winners in 2020 and are blazing ahead into 2021. see more

- 02:00 am

FinecoBank today announces that UK customers will have access to a new suite of funds by Wellington Management via its investing platform.

Wellington Management is one of the largest global asset managers offering investment solutions spanning across the global equity, fixed income, multi-asset and alternatives.

The latest addition to Fineco’s investment platform follows a string of recent fund announcements made this year including AXA IM, Candriam and Ninety One.

Paolo Di Grazia, Deputy General Manager, Fineco: “Following the recent news that more than 70% of Fineco clients hold active current accounts on brokerage, we are determined to continue expanding our investment offerings. We are very pleased to have partnered with Wellington Management and to offer our UK customers access to their selection of quality funds through our competitively priced investment platform.”

Matthew Knight, Head of UK distribution, Wellington Management: “At Wellington Management, we strive to combine the resources of a large, global asset manager with the boutique feel of an independent, privately held partnership. We look forward to working with Fineco to offer their UK clients our innovative investment solutions.”

About FinecoBank

Launched in 2017 in UK, FinecoBank, the multi-currency bank and one of the most important FinTech banks in Europe, has built an integrated business model proposing customers its One-Stop-Solution: it offers from a single account banking, trading and investment services through innovative transactional platforms developed with proprietary technologies. Fineco represents a new way of banking, a smart way to invest money.

Fineco’s mission is to simplify customers’ lives when dealing with financial services and has developed a very powerful yet user-friendly platform. Learn more about us on finecobank.co.uk.