Published

- 08:00 am

Baton Systems, the market solution transforming asset movements and settlements, today became a signatory to the updated FX Global Code, underscoring its commitment and support to firms keen to eliminate settlement risk by enabling real time, payment-versus-payment (PvP) settlement for all market participants.

Principle 35 of the updated FX Global Code strengthens previous guidance, advising “Market Participants should reduce their Settlement Risk as much as practicable, including by settling FX transactions through services that provide PVP settlement where available.”

Baton allows all market participants to reduce settlement risk, by providing on demand PvP settlement for real assets, in real accounts held at commercial banks. Since the solution was initially deployed, Baton has facilitated the PvP settlement of trillions of dollars.

Baton’s transformative PvP solution utilises secure distributed ledger technology (DLT), deployed through the cloud using a single tenant architecture, without the need for tokenisation. Backed by a robust rulebook, Baton currently facilitates PvP settlement in 18 currencies across a spectrum of G10 and EM currencies. In addition, Baton provides participants with the flexibility to settle when it best suits their funding profile, with access to real time netting and payment strategies. Delivering transparency, auditability and configurable automated workflows, Baton is opening up the benefits of PvP settlement protection to all.

Arjun Jayaram, CEO and Founder of Baton Systems commented “The world of clearing and settlement is on the threshold of revolutionary change. We see the updated FX Global Code as validation that today’s status quo for settlement risk and liquidity management must evolve. There is a clear need for safer and more robust settlement protocols for all currencies and all market participants.”

Related News

- 01:00 am

4 percent rise in credit card spend and 10 percent increase in payments to balance reflects continued use of pandemic savings, plus pragmatic financial management with end of government support on the horizon

Highlights

Third consecutive monthly increase in credit card spend – but growth rate slowing at 4 percent

Percentage of payments to balance increased for the second time since December, by 10 percent

Average balances on accounts with three missed payments 8 percent higher year on year

Cash usage continues to slowly grow – by 6 percent

Global analytics software provider FICO today released its analysis of UK card trends for May 2021, which suggests that some consumers are practicing pragmatic financial management, as well as continuing to make use of savings accrued during the pandemic. There are, however, warning signs of the financial pressure growing for those already in debt.

Whilst the effects of a full month of retail and hospitality re-openings were reflected in a further rise in card spend, the increase was just 4 percent compared to the 12 percent increase seen in April. This suggests that consumers foresee future pressure on income with the prospect of furlough support and payment holidays ending.

The percentage of payments to balance continued to increase - by 10 percent month on month. However, an 8 percent year-on-year increase in the average balance for accounts with three missed payments and a growth in the use of cash on cards – 6 percent – will ring warning bells for lenders.

June data will highlight the impact of a full month of the last stage of lockdown prior to the end of the final retail and entertainment restrictions. The ability of issuers to react swiftly and appropriately to sudden changes in their customers’ financial conditions will be tested over the coming months. Those who can detect and act upon the early warning signs accurately with a wide and flexible range of treatments and a robust collections strategy will provide the most benefit to their customers.

Spend on UK cards continued to increase, along with the percentage of payments

The average spend on UK credit cards increased for the third consecutive month, by £26 to £651 in May 2021. However, the monthly increase may not be as high as some might have been expecting for the first full month of the easing of lockdown restrictions, especially compared to the growth seen in April.

Some consumers receiving furlough payments may be showing caution relating to their spending levels, ahead of the planned scaling down of the government contribution as of 1st July. This caution could also be the reason that the percentage of payments to balance continued to increase — by 10 percent month on month to 36 percent, the highest ratio over the last two years.

Average balances on accounts missing three or four payments continue to grow

The percentage of accounts which have missed only one payment increased in May. June’s results will show if there is a segment of consumers where spend in April was unaffordable and so will miss their second payment.

Accounts missing one payment are £25 lower than a year ago. For accounts missing two payments, the average balances are £39 or 2 percent lower year on year, however, this was the peak month during the early stages of the pandemic, so this is not surprising. Average balances on accounts with three missed payments are £221 higher (8 percent) and four missed payments plus are £228 higher (8 percent).

One way to ensure payments aren’t missed is to set up a direct debit, but the percentage of accounts with a direct debit is 2 percent lower than a year ago.

Cash usage continues to slowly grow

May 2021 also saw the percentage of consumers using cash on their credit cards increase for the second time since September 2020, albeit again marginally. This is being driven by the increased spending opportunities, however, it remains 35 percent lower year on year.

Issuers could look at consumer cash spending patterns. If cash is being used when this was not the case prior to the pandemic, this could be another warning sign of financial stress.

These card performance figures are part of the data shared with subscribers of the FICO® Benchmark Reporting Service. The data sample comes from client reports generated by the FICO® TRIAD® Customer Manager solution in use by some 80 percent of UK card issuers. Issuers wishing to subscribe to this service can contact staceywest@fico.com.

Related News

- 02:00 am

- Two leading specialist financial services change management consultancies partner to offer an enhanced service

- Bishopsgate Financial’s expertise in transformation, change management, compliance and financial crime will combine with CubeMatch’s capabilities in strategic change, risk management and technology

Today, Bishopsgate Financial, the financial services change management consultancy, announces it has been acquired by CubeMatch Ltd. This move will create one of the UK’s largest independent financial services change management consultancies, with major global financial institutions as its client base.

CubeMatch and Bishopsgate Financial share the same vision, and are committed to ensuring financial services organisations facing large change programmes can complete them in an effective and timely manner.

Mike Hampson, CEO, Bishopsgate Financial

Both firms offer consultancy, resource augmentation and managed services enabling change programmes to be embedded in their clients’ businesses. Bishopsgate Financial’s core specialisms are in business change, compliance and financial crime which combines powerfully with CubeMatch’s expertise in strategic change, business and digital transformation, risk and compliance, data and technology, quality assurance and managed services.

The existing Bishopsgate Financial management team will remain in place, and assignments with existing clients will continue uninterrupted. The two management teams will come together to enable the wider capability to be made available to the firms’ joint client base.

Andrew Seymour, MD of CubeMatch UK, said “Our focus is helping financial services firms develop the skills, attitude and technology toolsets to cope with tomorrow’s challenges today. The CubeMatch approach is about blending deep domain expertise with a highly rigorous approach to project deployment to ensure our clients are future fit. Bishopsgate Financial has the same ethos as us, along with a significant proven track record in ensuring banks embed robust financial crime and compliance protocols. When this experience is combined with our expertise around strategic change, risk and technology, we offer a highly powerful proposition to our clients.”

Mike Hampson, CEO Bishopsgate Financial adds, “The pace and scale of change in financial services shows no sign of abating. Our clients know the challenges they need to prepare for are complex and they need partners with the combination of sophisticated specialist knowledge held across multiple fields. This transaction will provide an enhanced service offering to our clients as well as enabling us to service them in a wider number of geographies, I am excited to be becoming part of the CubeMatch team.”

Related News

- 02:00 am

· Lloyds Bank Commercial Banking will be utilising Mastercard’s Open Banking Merchant Payment Solution to launch PayFrom Bank.

· The solution enables individuals to make online payments directly from their bank accounts, giving consumers more choice over how they pay and providing merchants with instant settlement of funds

· United Response, a charity supporting vulnerable people, is the first merchant to sign up.

Mastercard and Lloyds Bank Commercial Banking have partnered to deliver a new Open Banking payment solution to Lloyds Bank’s business clients.

Lloyds Bank’s PayFrom Bank, enabled by Mastercard’s Open Banking Merchant Payment Solution, lets consumers make payments on an organisation’s website directly from their bank account, without having to enter any payment details.

The solution – which is compatible with most retail bank accounts – gives consumers greater choice over how they pay and enhances their user experience by providing a quick, secure and seamless payment option without the need to remember passwords or input data.

Meanwhile, merchants benefit from a cost-effective payment method that supports their working capital by settling funds immediately.

Mastercard and Lloyds Bank’s partnership will help to move open banking account-to-account (A2A) payments into the mainstream. PayFrom Bank combines Mastercard’s Payment Gateway capabilities and its Open Banking Connect platform – a universal connection to financial institutions’ Open Banking functionality – to deliver a merchant A2A payment solution that covers around 95% of UK bank accounts leveraging Open Banking APIs.

Initial interest in PayFrom Bank is coming from charities for online donations and wallet funding use cases such as investment accounts, although it can be used for any payment scenario. United Response, a charity that provides support to people with learning difficulties, autism, and mental health needs, is the first merchant to go live with the proposition.

Kelly Devine, Divisional President of Mastercard UK and Ireland, said: “Our Open Banking Merchant Payment Solution offers merchants and consumers an alternative to card based payments and even greater choice over how they checkout. Merchants can now provide their customers with a wider range of payment methods without needing to store payer account details. It also removes friction for consumers as all payer details are automatically populated, meaning there’s no risk of entering the wrong account details. We’re excited to be partnering with Lloyds who has a strong pipeline of merchants waiting to sign up to PayFrom Bank.”

Mastercard’s Open Banking Merchant Payment Solution is available as a white-label solution. Financial institutions – such as Lloyds Banking Group – are able to easily integrate with it and instantly access the majority of UK bank accounts through Open Banking Connect.

To find out more visit https://openbanking.mastercard.com/register-interest/

Related News

- 01:00 am

Axyon AI partners with DeFi FX exchange DeFinity to develop Deep Learning AI market anomaly detection

Axyon AI, the leading AI solutions provider for asset management and trading, today announces its partnership with DeFinity, a DeFi marketplace for fiat foreign exchange, tokenised currencies and central bank digital currencies (CBDC) to deliver the first ever use of Deep Learning-powered AI to detect market anomalies in the digital asset space.

Axyon’s AI-powered market anomaly detection is a leading-edge technology that generates automated alerts on irregular patterns in asset prices. These may be the result of undisclosed new information, ripple effects from correlated assets, or structural breaks in an asset’s behaviour versus the broader market. Axyon AI’s technology can promptly discover these hidden market data aberrations, which would be otherwise undetectable, and provide an early warning on potential volatility events.

This technology comes at a time when detecting the sign of an upcoming unpredictable event is more important than ever. Detecting market anomalies can help the digital asset space to anticipate and prepare for future events that could impact the industry, just like COVID-19.

Axyon AI is a leading European FinTech company with expertise in Deep Learning/AI for asset management and trading firms. Axyon AI has successful products in several financial use-cases, from security selection and asset allocation to anomaly detection in option pricing.

Daniele Grassi, Chief Executive Officer of Axyon AI, says “Digital assets will inevitably reconfigure the financial sector, and DeFinity is at the forefront of this evolution. We believe that our AI-powered solutions, which are already used by leading players in the traditional asset management sector, will provide DeFinity’s community a valuable help in identifying market anomaly and related risks in the digital assets space. It is a fruitful combination of two terrific technologies, AI and blockchain in the digital asset space.”

DeFinity is a layer-2 protocol and decentralised exchange solution that utilises existing blockchain frameworks, including WeOwn, Ethereum, Binance Smart Chain, Polkadot and Cardano. With a focus on interoperability, the ambition is to create a more inclusive decentralised ecosystem that helps to bridge traditional assets with digital assets.

Manu Choudhary, Chief Executive Officer of DeFinity, says: "Artificial Intelligence is the apex technology of the information age and we are incredibly fortunate to have partnered with Axyon AI, a true innovator in the field.”

Related News

- 01:00 am

New partnership aims to improve financial wellbeing through a gamified app experience

Maslife, the payment and wellbeing platform that rewards people for keeping healthy, has collaborated with regulated e-money services provider Paynetics to power its new financial wellbeing app.

The new Maslife platform enables users to make informed decisions about their lifestyle, wellbeing, and finances. It offers customers a full suite of financial tools to support them in better managing their finances and improving their state of mind.

Health is intrinsically linked with finances, however, the two are traditionally dealt with separately. There are many financial, health, and mindfulness apps on the market, but none that bring together these priority areas of life in an integrated way.

Maslife changes the way we deal with health and finance. The new app helps its users to implement positive habits and mindsets with actionable steps. These include mindful spending and budgeting with accounts in GBP, EUR, and USD, free currency exchanges, virtual and metal debit cards, along with other payment services.

Physical and mental health is supported within the app with health activity monitoring, guided meditation, informative podcasts, and much more.

Kash Amini, CEO of Maslife, said: “Maslife has been designed from the ground up to support and encourage our users from both a financial and a wellbeing perspective. These important aspects of a person’s life are closely linked and affect each other deeply. With this in mind, we have been working tirelessly on our AI-powered app to support and encourage our users in a way that works for them individually, with targeting and gamification to make it enjoyable. For this reason, our platform and ambitious roadmap of features demand advanced, forward-thinking partners. We are delighted to be working with Paynetics, Mastercard, GPS, and Thames Card Technology to support our exponential growth, enabling our users to be the best they can be.”

Maslife wants everyone to be able to benefit from its smart AI-powered app, which is customised to the user’s lifestyle. As such, they are offering free virtual accounts and cards where users can try all the wellbeing features for two weeks, including guided meditation, physical activities using AI, and more. Members can also add a physical card if they wish to benefit from additional rewards and make in-store purchases.

The Maslife partnership with Paynetics furthers the commitment of both companies to ‘fintech for good’, in collaboration with Mastercard, Global Processing Services (GPS) and Thames Card Technology.

Paynetics has integrated i's all-in-one banking-as-a-service (BaaS) solution with Maslife’s unique financial wellbeing offering to give consumers a rich and supportive financial experience.

Amanda Harrison VP, Head of Business Development at Paynetics said: “We have streamlined our integration services, enabling any established brand or fintech to migrate to Paynetics easily. We are delighted to onboard Maslife to help revolutionise the way consumers manage their finances. Over the last year, the financial challenges and stresses faced by many individuals have illustrated the need for a payment platform that also prioritises mental and physical health. Our innovative financial infrastructure, and collaboration with Mastercard, GPS, and Thames Card Technology has enabled this innovative wellbeing and payments application that will improve people’s lives.”

The app offers a dynamic, gamified experience that engages users and helps them achieve their lifestyle and financial goals. Users can set regular financial and wellness targets through the app, monitor their progress, and be rewarded if they hit them. With each goal reached, users gain more points, and the resulting healthier user gets to unlock new levels.

Maslife is improving its rewards programme with redemptions available on in-store purchases. New digital currencies will be integrated into the platform allowing members to make purchases and payments in a wide range of currencies anywhere in the world.

Neil Harris, Group Chief Commercial Officer at GPS said: “For years, we’ve known about the impact that debt and financial hardship can have on an individual's mental health. This is why GPS is really proud to work alongside Paynetics, Mastercard, Thames Card Technology, and the team at Maslife to deliver a new service that can help transform the wellbeing and finances of users.

“Our trusted and proven processing engine of the GPS Apex platform provides the transactional ledger with the highest levels of transaction management, security, and compliance. All whilst giving Maslife users the opportunity to customise their experiences and personalise the rewards and services they choose.”

By bringing together easy-to-use tools and incentives to solve daily challenges, Maslife is supporting the prioritisation of health and finances to foster a better future for its users.

Related News

- 03:00 am

· A highly experienced, energetic, and results-driven business leader

· Driving accelerated cloud adoption and technology modernisation programmes for clients

· Spearheading regional expansion plans for the UK

· Forging greater collaboration with GFT's global teams to deliver increased value to shared international clients

GFT, the global IT services and software engineering firm, announces Carlton Hopper as UK Managing Director. His appointment follows a year of sustained growth for GFT within the UK financial services marketplace and the forging of highly strategic business partnerships across new industry sectors. These include manufacturing, retail, and the automotive industries, where the company provides innovative cloud solutions, technology modernisation projects, data-powered AI programmes and more.

Carlton joins GFT from IBM Global Business Services, where he was the Partner for Banking, running strategic programmes encompassing IT strategy, digital delivery and IT resilience, to name a few. Prior to this, he was IBM's market development head for the UK financial services team and the European & UK blockchain lead. Carlton brings over 30 years of banking, technology and consulting experience, having worked at Accenture, Barclays and Ernst & Young. Alongside his love of guitar playing, Carlton has an established reputation for energy, enthusiasm, and an outstanding commitment to building high performing teams and delivering innovation and positive change to a client's business.

Carlton Hopper, UK Managing Director, commented: "GFT is an exceptional, high growth business with an impressive cross-industry client list. The firm is home to some of the industry's most talented people, underpinned by an award-winning service delivery capability, providing a rare combination of engineering skills core to all digital transformation programmes, and subject matter expertise. As client demand for our services grows apace and inspired by the successful transition to remote working during the pandemic, one of my first projects is to launch a regional network of GFT capability. Watch this space; there is more to share."

Christopher Ortiz, Group Chief Executive, Global Markets and Region Manager APAC & UK concluded: "We are delighted to welcome Carlton into the GFT family. I believe his knowledge and extensive experience of clients' needs are invaluable assets, not only for the UK business but also for the wider GFT group. I am looking forward to working closely with him and his team to deliver modern, business-critical solutions which support the evolving needs of our new and existing clients, across multiple industry sectors both now and into the future."

Related News

- 02:00 am

New functionality enables quick development wins for best possible trading experience for financial firms of all sizes; paves path to hyper-personalization of trading environments.

Glue42, the company that delivers integrated desktop experiences to financial institutions globally, has released new functionality to help firms bring an optimal trading experience and efficient operation in days versus weeks. The new release, Glue42 Enterprise 3.12, focuses less on individual applications and extends the workspace concept with an enterprise store that allows users to search for business solutions with best outcomes.

With desktop integration going mainstream and firms of all sizes buying into the concept, financial institutions are looking at how they can fast-track the delivery of the best possible user experience, leveraging existing resources and technology. At the same time, they need to consider that traders rarely perform their tasks within a single application and instead are the human glue between different data silos and systems.

To address this reality, Glue42 has added a set of features to make traders’ workspaces easier to use and reduce the burden on the desktop machine.

“It’s all about making traders and IT departments that support them more efficient,” said James Wooster, COO, Glue42. “Quite often our clients need to build back-end infrastructure services to handle personalization, permissions and security. This takes time and can delay go-live.”

He continued, “The new functionality is a natural evolution of the Glue42 Enterprise platform. It follows client demand to move away from app-centric desktops into hyper-personalized experiences based upon micro-applications, workspaces and user-aware enterprise stores”

With trading efficiency in mind, the new set of features enables the curation of an individual user experience accessible through a new launch pad. An upgraded global search engine capable of locating multi-app workflows, multi-screen layouts, business functions and business data, provides traders with answers in form that can be actioned immediately. More so, new server-side support enables firms’ development teams to configure trader specific profiles that provide levels of customization not previously possible.

For more information, join Glue42 for a 30-minute webinar on Tuesday, July 27 at 10:00 a.m. EST / 3:00 p.m. BST.

Related News

- 04:00 am

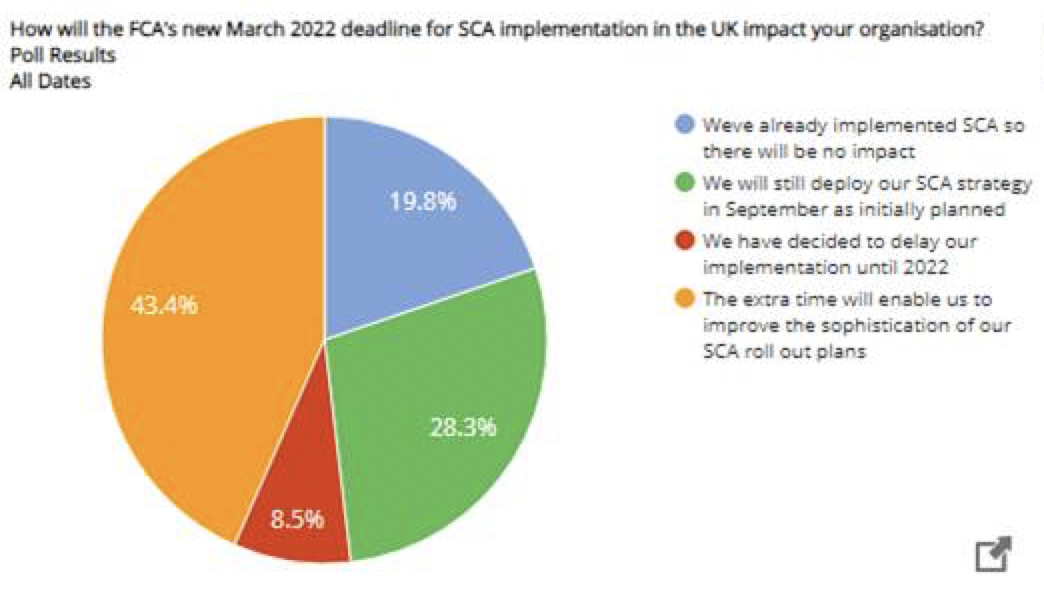

42% plan to use the extension to improve rollout plans, but poll reveals uncertainty still surrounds SCA regulation

UK banks have welcomed the six-month extension to implement Strong Customer Authentication (SCA) for e-commerce transactions, with 42% planning to use the extra time to improve and enhance the sophistication of their SCA roll out plans, according to a poll conducted by LexisNexis® Risk Solutions, the global data and analytics company.

The poll, conducted during a UK Finance webinar entitled ‘Addressing CNP Fraud in 2021: A Deep Dive into the Anatomy of a Payment Journey’ and attended by nearly 500 UK financial services professionals, reveals that UK financial services plan to utilise the SCA deadline extension to March 2022 to enhance their PSD2 strategy.

“The results from the poll were very interesting,” commented Dan Holmes, Solutions Director at LexisNexis Risk Solutions. “They suggested that some issuers are pressing on with SCA compliance, while others remain cautious – leveraging the extra time given by the deadline extension suggests that issuers may have been preparing to do the minimum to meet requirements, and then build-out post-September. They will now however take advantage of the extension to improve delivery sophistication

“Behavioural Biometric Authentication is a good example of what can be done with this extra time, as it buys more time for things like profile baselining, an essential component of biometric authentication. On behavioural biometrics specifically however, what the poll results really show us is the uncertainty around SCA compliance and a potential gap in who defines what a ‘compliant’ authentication strategy is - As well as what parameters this should be set within.”

The poll also asked respondents how their organisation shared fraud risk intelligence across the online customer journey. Only a minority (12%) indicated that they did share intelligence across all areas of their customer journey, suggesting that some financial services organisations may be wasting an opportunity when it comes to leveraging intelligence in remote payment channels.

Dan Holmes continues: “Financial Services organisations must leverage the defences or intelligence available from other parts of their business for their remote purchase channels. If you are already looking at device intelligence or utilising digital identity in one area of your business, then use those capabilities to assess fraud in your remote purchase channels.

“As well as ensuring the effective sharing of risk intelligence across the entire customer journey, financial services organisations must assess how innovative solutions,which tap into specific data like behavioural biometrics, can help them to improve their ability to authenticate customers effectively without causing additional friction or checkout abandonment.”

Related News

- 05:00 am

Aims to create a thriving ecosystem for its retail partners by helping them utilize PayNearby’s platform extensively to earn more

In continuation with its brand ethos ‘Zidd Aage Badhne Ki’, PayNearby, India’s leading branchless banking and digital payments network, has launched “PayNearby University” under its trade app to educate and handhold its retail partners towards a better livelihood and a sustainable life for themselves and their families. Available in 10 regional languages for an engaging learning experience, PayNearby University is designed to empower retailers by utilizing the full potential of the platform and help create a thriving ecosystem for the retail community.

PayNearby was built to educate, engage and push a wide range of assisted financial and digital services including basic banking services like cash withdrawal, domestic remittance, goal-based savings and insurance to the last mile. Today, more than 15+ lakh retailers use the PayNearby platform to service close to 15 crore Indians on a wide range of products and services. The success of the model lies not only in the 10+ lakh transactions that it clocks daily or the monthly GTV of ~5500 crores plus, but in the social reach of the platform across 17,500+ PIN codes in the country, helping uplift both the retail community and consumers in those areas, thereby helping access to the Government’s DBT disbursements in an easy manner. The company’s constant commitment has been to empower local retailers who are building the nation ground-up while driving financial inclusion at the last mile, thus creating a digitally forward and financially inclusive India.

Reiterating this commitment is PayNearby University, where retailers can acquire knowledge about the financial product and services the company offers, learn how to use these services, and how to efficiently utilize the platform to earn more. PayNearby University ensures that retailers can upskill themselves and are able to deliver financial products seamlessly to the customers at the last mile. It also trains retailers on the best practices in investments and how to manage their finances better in order to take care of themselves and their families’ future. PayNearby University enables bite-sized learning videos which are easy to consume along with financial and insurance consultation and career guidance, in turn, creating more aware, engaged and empowered retailers.

To enhance the learning experience, PayNearby University is available in 10 regional languages to all retailers who have downloaded the app across the country. With over 250+ videos made available, the initial response has been excellent with over 3,50,000 users visiting the module with 310,000+ daily impressions. To make the learning journey more profound, completion certificates are available which can be downloaded on successful completion of assessments.

Commenting on the development, Anand Kumar Bajaj, Founder, MD & CEO, PayNearby said, “Retailers are the very core of a business ecosystem and it is important for them to have all the necessary knowledge and skills to make their work easy and enhance customer engagement. As an organization, PayNearby recognizes the mutual relationship that it has with the retailer community and we want to take all possible steps to ensure the sustainable livelihood of the retailers. An important milestone in this direction is PayNearby University. PayNearby University was created with the vision to empower and upskill our retailers not just in trade skills but life skills as well and help them become financially independent and aware Digital Pradhans.

For India to thrive and grow, it is important that the retail community is given the essential support and tools to stay relevant in the fast-evolving economy. We are confident that this free-of-cost module which retailers can consume at their convenience in their own language will be a game-changer and in the long run, will help retailers across the country bridge the digital divide that exists in India. We are extremely delighted that PayNearby University is in sync with our Zidd Aage Badhne Ki.”