Published

- 08:00 am

Objectway, Global Top 100 fintech leader in the Digital Wealth and Asset Management software, announced today the acquisition of Die Software Peter Fitzon GmbH (DSW), a primary German provider of Core Banking solutions.

Founded in 1990, Objectway provides leading financial institutions with state-of-the-art technology to support their digital transformation programs, supplying front-to-back, intelligent and cloud-ready solutions that power up customer engagement, front-office productivity and back-office operational efficiency. Die Software is a leading provider of Core Banking solutions in German-speaking Europe, with more than 35 years of market presence. Its complete, open and modular platform fulfils the needs of prominent private banks, retail banks and central banks in the DACH area and in Luxembourg.

With this acquisition, Objectway complements and strengthens its Wealth and Asset Management offerings with a solid and comprehensive Core Banking platform. This creates an open, modular, end-to-end banking suite geared to support the digital transformation of private banks, retail banks, wealth and asset managers, further driving the future expansion in EMEA and globally.

As an EMEA leader in digital banking solutions, Objectway will now serve more than 200 clients in the region, boosting revenues in excess of €100 million.

“Die Software-team has done a fantastic job in developing a world-class banking platform with a loyal client base. Objectway places great importance on continuing to develop and evolve core banking platforms of its customers and to build long-term commercial relationships" said Luigi Marciano, Founder and CEO of the Objectway Group. "We aim at creating a unique and complete banking suite that combines Die Software solutions with Objectway's cutting-edge technologies in digital client management, investment advisory and portfolio management, to be deployed through Business Process as a Service (BPaaS) and Software as a Service (SaaS) models. We will also promote the global expansion of Die Software solutions by taking advantage of our presence in UK, Italy, Benelux and beyond”.

“We are delighted to be joining the Objectway Group, a solid and highly trusted company with a long-lasting track record in the industry. This will further help to enhance our client coverage and geographical footprint across EMEA" said Peter Fitzon, Die Software Founder. “With Objectway, we found a perfect new home to continue our growth path, providing our staff and clients peace of mind that our heritage will be in good hands in this ever changing environment".

“Our companies have a common DNA rooted in inherent culture of professionalism and drive for dependable perfection. We also believe in strong customer focus, delivering value and service quality in partnership with our clients. This makes our combined business highly promising for both firms, but also for our current and future customers, giving our talented and ambitious teams exciting goals and achievements to aspire for,” said Klaus Friese, Die Software Co-Owner and Managing Director. “The whole Die Software team is committed to driving forward our new group strategy and with such an established international player we will be able to support our development in the long-term guaranteeing continuity, stability and an exciting future of accelerated growth in new markets”.

Core banking solutions were built historically on reliability rather than open architectures. Digital banking, APIs and Cloud have created a significant shift in the way banking products are constructed. Financial institutions now need to address the imperatives underpinning next-generation core banking applications (in terms of scale, functionality, integration and the public cloud) to be able to process transactions in real time, release new features frequently and scale up their IT infrastructures. The combined Objectway and Die Software value proposition will respond to these new requirements, with the aim to become the fintech partner of choice for financial institutions.]

Objectway was advised by BNP Paribas, Giovannelli e Associati studio legale, Loeschner Rechtsanwaltsgesellschaft, Accuracy, Hilex – Avvocati associati, P+P Pöllath + Partners Rechtsanwälte und Steuerberater, Flick Gocke Schaumburg, and Tax Partner AG.

Die Software Peter Fitzon was advised by IPontix Corporate Finance and Witzel Erb Backu & Partner Rechtsanwälte.

BNL is acting as sole lead manager and bookrunner on the associated financing.

Related News

- 02:00 am

- Capital will be deployed alongside Praetura’s Enterprise Investment Scheme (EIS) funds and angel investors to back early-stage businesses across multiple sectors.

- Praetura Ventures will be the Regional Angels Programme’s first delivery partner with Manchester-based headquarters.

Manchester venture capital investor Praetura Ventures has today unveiled a £15m commitment from British Business Investments, to further support early-stage businesses and the ‘levelling up’ of funding in the regions.

Praetura Ventures will use the funding from British Business Investments, alongside its EIS funds and angels, to back even more companies in the future and provide company founders with everything they need to develop products, services and future-focused businesses.

British Business Investments, a commercial subsidiary of the British Business Bank, is making the commitment through its Regional Angels Programme, which seeks to address geographical imbalances around early-stage equity finance.

For Praetura, which backs companies in the North and UK-wide with a ‘more than money’ approach, the commitment is also a chance to connect investors to more diverse funds through investments in SaaS, AI, life sciences, medtech, gaming and more.

The news follows continued success in the EIS space for Praetura, with 19 business investments since 2019, and the recent appointment of heavyweight operational partners from Apple, The Co-op, Social Chain, OTSC and AO. As part of the offering, each partner provides regular one-on-one mentoring with relevant portfolio founders to help them on their journey. Access to those who have previously succeeded in scaling a company has helped Praetura’s portfolio better handle media relations, recruitment, marketing strategy and other challenges.

David Foreman, Managing Director of Praetura Ventures, which has raised circa £36 million for EIS businesses over the last two years, said: “From our headquarters in Manchester, we’ve seen regions across the North and the UK grow, thrive and continue to generate global recognition. We’ve been proud to play an active role in this great story, and it’s a privilege to be able to help even more founders scale exceptional companies. The response we’ve received confirms how important these investments are to the North as well as other thriving UK-wide regions and the UK economy.”

Judith Hartley, CEO of British Business Investments, said: “Our Regional Angels Programme is designed to address regional imbalances in the availability of angel finance, and to increase the amount of capital available to smaller businesses with high growth potential through angel networks. With this £15m commitment from British Business Investments, Praetura Ventures will be able to increase their support for early-stage businesses in the North and UK-wide.”

Companies that have already benefited from British Business Investments funding through Praetura include Deeside-based Reacta Biotech, which is developing oral tests to help those with suspected food allergies obtain a more accurate diagnosis.

Other businesses within Praetura’s portfolio include Patchwork, Dr Fertility, Pixelmax and Maxwellia – a pioneer in women’s health, who have recently achieved MHRA approval for their contraceptive pill Lovima, which will be the first of its kind available over the counter.

Related News

- 08:00 am

Legislate Technologies, a legal technology company pioneering the use of knowledge graphs for the creation and management of contracts, is pleased to announce the grant of United States Patent No. 11,087,219. The patent protects Legislate’s approach to using knowledge graphs, for generating, negotiating and managing documents. Knowledge graphs can be visualised like a mindmap which uses domain expertise to make links between data points.

Legislate’s patented knowledge graph can configure terms consistently together into robust contracts which are legally compliant. The same approach allows documents on Legislate to know what terms they contain and how they interconnect, creating the opportunity for fast, automatic insights into contract data. Unlike traditional PDFs, Legislate’s contracts flag key terms to signatories before they can sign. Legislate’s knowledge graph can also extract key terms across a database of contracts to aggregate statistics in real-time.

Charles Brecque, CEO “The grant of our patent is a significant milestone for Legislate as it confirms we are at the forefront of the application of knowledge graphs to documents. Thanks to our knowledge graph approach, we are making smart documents accessible to the unlawyered and have only scraped the surface of what we can unlock with this technology.”.

With its new patent, Legislate aims to set itself apart from its competitors by providing a safer, more transparent contracting experience combined with quick and accurate contract insights with a technology that has endless possibilities. Legislate currently works with landlords, letting agents and small businesses across the UK but has the ambition to scale internationally. By combining legal know-how and patented-knowledge graph technology, Legislate is transforming contracting for the unlawyered.

Related News

- 04:00 am

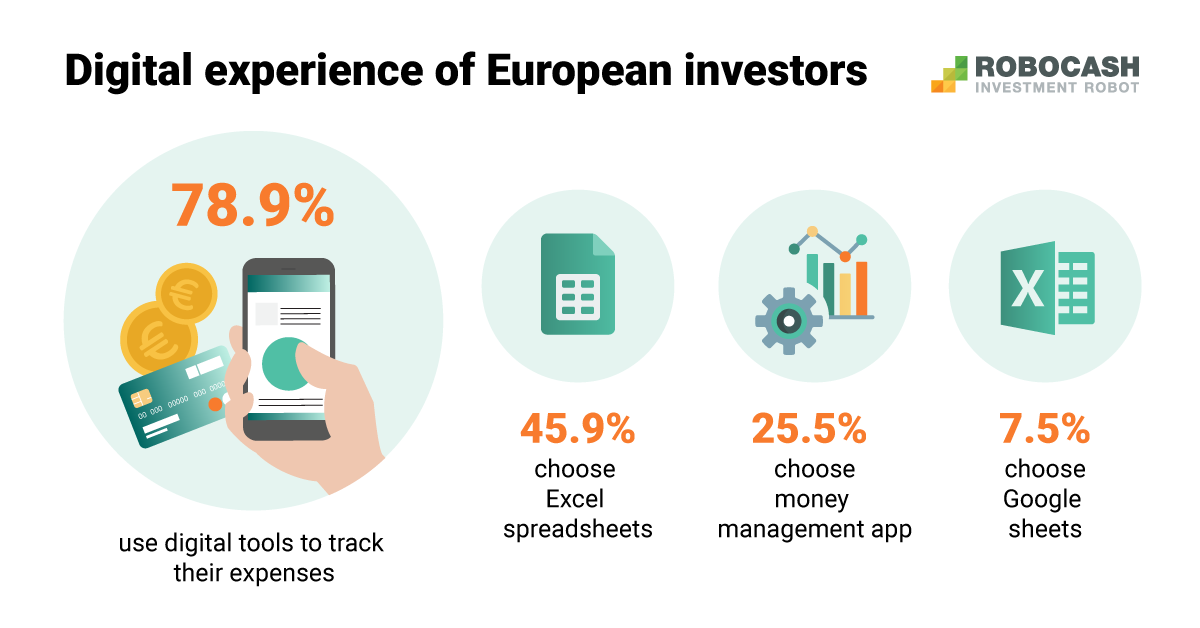

78.9% of investors monitor their spending using an app or software. These are the results of the latest survey conducted by the investment platform Robo.cash. Remarkably, only 7% trust Google Sheets and almost half of respondents prefer Excel spreadsheets. This largely confirms the notion that investors value data security highly when it comes to financial statements.

According to the survey, the vast majority of investors stay on track with their expenses and regularly update the budget data. The most important points for them when choosing a budget management tool are access to all information in one place (25%) and data safety (22%).

“Storing any data on the web entails certain risks, so it’s not surprising that investors rate the importance of information security highly”, comment analysts of the platform. “Whether it is a system malfunction or users’ databases being breached, it is important to be sure that your personal - and especially, financial - information is guarded carefully”.

45% of investors monitor their spending by using Excel spreadsheets. Interestingly, every third investor does not abandon the traditional form of financial reporting and prefers to keep data in a notebook.

When asked about the purpose of using the money management tool, 40% of respondents answered that this is how they budget, and 29% track the due payments.

On average, more than half of the respondents spend a few minutes everyday updating budget data, and 40% do it at least once a week. Every fifth investor notes the importance of being able to get automatic updates on cash flow.“Managing the budget consists mostly of repetitive and therefore time-consuming tasks, while users can put their resources to much better use”, the analysts add. “The implementation of digital solutions helps to secure customers’ comfort and productivity. This is what we strive for in our service too”.

Related News

- 07:00 am

Mphasis, an IT solutions provider specializing in cloud and cognitive services, today unveiled its brand transformation campaign – “Engineering is in our DNA” – a fresh approach that help organizations unlock the new digital future.

Mphasis’ drive is to engineer digital solutions to address specific business pain points, in a way that is replicable, scalable, and measurably impactful. At the core of the launch is Mphasis’ hyper-realistic computer-generated imagery, intricately designed to showcase how customers can benefit from a richer, more tailored experience that will help them meet their business transformation goals. The new brand campaign, with innovative 3D imagery for solutions and 4D brand video, will power Mphasis’ progression into a leading customer-centric solutions provider.

“At its core, our “Engineering is in our DNA” mantra is aligned with our key priority of approaching complex problems that our clients face in today’s world with design thinking and harnessing digital technology as an enabler of impactful business outcomes. It showcases how we at Mphasis lead with design and architecture to deliver a portfolio of next-generation offerings and services that blend deep domain expertise with cutting-edge technology, said Nitin Rakesh, CEO and Executive Director, Mphasis

Mphasis’ brand evolution and cutting-edge design can be viewed here

The graphic elements provide a vivid, visual representation of the process of architecting each of Mphasis’ digital solutions- much like engineering a real-life mechanism, and how the interplay between the different components leads to specific measurable outcomes. The 3D design allows to represent the different dimensions of each Mphasis’ solution in a way that customers can visualize what transformation will look like for them.

The branding complements Mphasis’ domain contextualized offerings, which are embedded with deep tech and powered by the ‘Tribes and Squads’ model – cross-functional teams focused on driving the development of next-generation offerings. Guided by its unique Front2BackTM approach, Mphasis’ focus is to create hyper-personalized experiences and enable customer-centric transformation through cloud and cognitive technologies.

“We employed a highly innovative design element, to showcase our brand vision for the future and to reflect how Mphasis brings the 'T' back into IT, where ‘T’ stands not just for technology but also for transformation. The branding brings to life the elements of advanced digital technology in a way that is accessible and interactive. It that may seem complex to explain but, through applying next-generation design, can capture in one image the huge benefits of the engineering mind-set. Our engineering mindset allows us to continuously innovate and #stayahead”, said Veda Iyer, Global Chief Marketing Officer, Head Sales APAC.

Related News

- 05:00 am

Even with a high banked population and a multitude of electronic payment options available, the average South African still use cash for daily purchases and payments with an estimated 78-80% of transactions being in cash.

Anton van der Merwe, the recently-appointed COO of Ukheshe Technologies, a fintech enablement partner that works with financial institutions to grow in the rapidly-expanding digital space, says that for these reasons alone, the opportunities for digital payments are set to boom.

Van der Merwe, who has a strong background in traditional financial environments says that his appointment at Ukheshe represents the significant shift in the traditional and fintech spaces: “New technologies are expected to change the local landscape as emerging trends accelerate and traditional financial services providers recognise the value in partnering with fintechs to deliver solutions quickly and efficiently.”

Electronic payments were first introduced in SA around 40 years ago, yet today, there are still many ecosystems such as the taxi environment, rural areas and townships that are cash heavy. That means the potential in the digital space is immense – reducing the use of cash by just 8 percent, for example, and growing digital transactions by that same number, means a shift of 10-15 billion transactions annually.

“Looking at the underpenetrated target markets we can already see how technology can make further significant differences. For example, if South Africa’s 16 million daily transport commuters were able to pay by scanning a QR code instead of counting out cash – with the transaction reflected in their accounts in real time. Not only would this simplify the process, but it would also represent billions in value for the institutions enabling transactions,” says van der Merwe.

As part of its National Payment System Framework and Strategy – Vision 2025, the South African Reserve Bank has outlined their vision for growth in financial inclusion and greater electronic payments and within the broader financial industry these efforts are gaining momentum through new industry initiatives. Surveys show that over 70% of South Africans would want to transact on their phone, while there are an estimated 1 million of township merchants that could be included into the digital payments ecosystem.

Van der Merwe says that the country already has a very high level of banked individuals, all that’s lacking is the infrastructure to accept digital payments on a large scale: “That’s where fintech enablement partners like Ukheshe come in. New solutions such as real-time QR code payments and recently-launched Whatsapp payments, in partnership with banks and retailers, demonstrates how large, traditional financial institutions or any company looking for a payment solution, can keep up with the rapidly changing needs of consumers.”

He says that such partnerships combine the agility of smaller fintech firms with the reach and trust of traditional financial institutions, bringing customer-centric solutions to market with greater speed and ease. Conversely, our digital payments solution, Eclipse, can also work entirely independently too. Through Eclipse, Ukheshe’s locally developed universal fintech API, the company has enabled card issuing, made up of three telcos, six banks and fintechs, 334 029 merchants and 2 271 880 apps.

Payments that eliminate the inefficiencies and hidden safety costs associated with cash payments are already here, with their implementation just around the corner – and a more inclusive society along with it.

Related News

- 02:00 am

FlexTrade Systems (@FlexTrade), a global leader in multi-asset execution and order management systems, and First Sentier Investors, a global asset management group focused on providing high quality, long-term investment capabilities to clients, today announced that the Flowlinx liquidity is available via FlexTRADER EMS.

Flowlinx simplifies block liquidity search in Emerging and Frontier market equities. The Flowlinx integration with FlexTrade will allow clients such as First Sentier Investors to access local block liquidity data and make it easier to navigate the challenging liquidity landscape across Emerging and Frontier geographies seamlessly and efficiently.

Todd Prado, Global Head of Dealing at First Sentier Investors said “Our partnership with FlexTrade is like an extension to our development team. This integration with Flowlinx allows our team to better source liquidity in the harder to reach markets. This helps us automate workflow and communication with counterparts from within the multi-asset FlexTRADER EMS.”

Yan Gloukhovski, Founder of Flowlinx said: “We are proud to work with First Sentier Investors, a highly regarded specialists in emerging markets equities and are delighted to be part of the FlexTRADER EMS. It’s been a pleasure working with the FlexTrade team, who are so open to innovative third-party solutions benefiting their clients.

Our data connectivity network aggregates and streamlines pre-trade information from local brokerages across more than 30 Emerging and Frontier markets. All contributions are automated, eliminating manual input and bringing reliable, actionable information to the surface. Information is delivered via a unique relationship-based protocol leading to meaningful and actionable conversations.”

James Hammond, Vice President Business Development – APAC at FlexTrade Systems stated: “This project demonstrates the engineering-driven culture at FlexTrade and the collaborative relationship we have with our clients. We are delighted to support First Sentier Investors by integrating directly with Flowlinx. This workflow provides easy access for traders to participate and consume data via the FlexTRADER EMS. When technology is built with openness in mind it helps to remove the friction that often comes with third party integration.”

Related News

- 05:00 am

· UK fintech Kroo has raised £17.7m from lead investor Rudy Karsan and others in a Series A funding round

· Kroo is building a truly social bank that helps users reduce anxiety around finances and champion social causes and was named Best Newcomer in the 2021 British Bank Awards

· Kroo will use the funding to support its mobilisation phase, grow its team and secure a full banking license.

Kroo Ltd has raised £17.7 million in a Series A funding round led by tech entrepreneur and founder of Karlani Capital, Rudy Karsan. The capital raised will be used to mobilise the bank ahead of its launch in early 2022.

Kroo’s goal as a social bank is to remove friction from financial interactions with friends and family. Currently it does so by offering customers a prepaid debit card and innovative ways to track their personal and social finances – enabling them to easily create groups with friends, track spending, and split and pay bills quickly and securely. It aims to reduce the anxiety that can surround social finances, and make it easier to share experiences without money getting in the way; gone are the days of feeling awkward and anxious, or wasting time managing finances.

Kroo goes beyond offering slick banking functionality. Fostering social good is at the heart of its vision. Kroo's board-level social conscience committee will ensure that it actively advances social good and the company has pledged to donate a percentage of profits to social causes. A tree-planting referral scheme has already been launched, so that every time a customer successfully refers a friend, Kroo plants 20 trees with the aim of creating a forest of 1 million trees.

Kroo is currently in the process of securing a full banking license, so that it can provide a comprehensive platform from which customers can navigate their financial lives. As a regulated bank, Kroo will be able to offer customers a safe, secure and intuitively designed current account, FSCS deposit protection and loans at fair and competitive rates. It aims to launch in early 2022.

Kroo has been built on a state-of-the-art agile technology platform that is microservices-based and cloud-native. This enables Kroo to deliver a trusted banking environment, with a fabulous end-to-end experience that is continuously improving. Rather than embedding its front end on an aging tech stack, Kroo’s scalable, resilient and performant core banking platform means market-leading features and products can be launched rapidly.

CEO Andrea de Gottardo has been key to the development of Kroo’s business model and the delivery of Kroo’s banking license. Andrea was already an experienced bank executive when he joined Kroo as Chief Risk Officer in 2018.

Andrea de Gottardo says: “We want to build the world’s greatest social bank: a bank dedicated to its customers and to the world we live in. We’re going to do more than just work with Kroo customers to improve their relationship with money and provide them with access to fair loans. We’re going to offer them ways to actively take part in making our world a better place, like carbon-offsetting and a tree-planting referral programme.”

Kroo will use its Series A funding to drive its mobilisation phase – scaling up operations, growing its team across engineering, marketing, product, compliance and customer service, and further developing its product offering and app ahead of launch in 2022.

Lead investor Rudy Karsan says: “The reason I’m excited about Kroo is that it has a concrete opportunity to dramatically change the way people feel about their bank, for good. Kroo has an exceptionally talented management team and a nimble tech stack that will enable the continuous delivery of banking features customers really care about. I’m confident Kroo is building a sustainable bank and am excited to support them on the next stage of their growth journey.”

Related News

- 02:00 am

Scotch Whisky Cask Auctions achieve record prices!

There are many fortunate souls among us who have purchased or inherited casks of whisky, had them stored in dusty warehouses for years, and then find ourselves with the quandary of what to do with them. Often, we haven’t paid huge amounts for the cask in the first place, buying them before the whisky boom of the last decade, but are aware that whisky has in many circumstances become more valuable than gold.

We’ve all read the many articles waxing lyrical about the value of whisky and its investment potential but even when we find ourselves in possession of a cask full of the amber nectar, we often find ourselves unable to reap the rewards we know should be accessible.

Until recently, we often found ourselves having to sell back to the distilleries or to brokers for substantially sub-market values as the cost of bottling was simply out of our reach.

Thankfully, that has all changed. Over the last three years, Mulberry Bank Auctions have made it their mission to give cask owners another option, one that will allow them to tap into the very lucrative cask market and sell their casks for their true values. By offering these first of their kind regular whisky cask auctions, charging 0% commission to the seller, they have achieved record prices for many casks of whisky:

Bowmore 1995 - £80,000

Springbank 1993 - £86,000

Ben Nevis 1996 - £63,000

Highland Park 1988 - £62,000

With these sorts of prices, they hope that cask owners will no longer feel that their options are limited and that they can finally reap the true rewards from selling their casks.

Notes to Editors

The next Whisky cask auction at Mulberry Bank Auctions will take place in October and they are currently offering free valuations of any casks people may be looking to sell.

Related News

- 08:00 am

Broadridge Financial Solutions, Inc, a global fintech leader, today announced that UBS has joined its transformative distributed ledger repo (DLR) platform. Early participants of the blockchain-enabled platform are accelerating their digital journey and realizing the significant and immediate benefits of reduced risk and operational costs as well as enhanced liquidity. The addition of UBS builds on the early platform success and accelerates the expansion of the DLR network, leveraging Broadridge’s fixed income platform that processes over $6T in average daily volume and includes 20 of the 24 primary dealers.

“We look forward to the enhanced liquidity and reduction of risk that Broadridge’s distributed ledger repo platform provides,” said Paul Chiappetta, Americas Chief Operating Officer of Group Treasury at UBS AG. “This partnership reinforces our overall digital strategy, leveraging new technologies aimed at reducing risk and improving efficiencies in the financial markets.”

DLR provides a single platform where market participants can agree, execute and settle repo transactions. Under a digital repo approach, collateral can be detached from the trade agreement, while the cash remains off-chain. Furthermore, DLR allows for the immobilization of the underlying securities in the repo transactions, while transferring ownership via smart contracts executed on the platform. The platform’s functionality significantly reduces the operating cost and risk of all repo activity, including intraday, overnight and term repos, both on a bilateral and intracompany basis and reduces counterparty risk while increasing auditability.

“In the first weeks since launch, DLR has executed $35B in average daily volume – a testament to the success of the platform, which we expect to continue to grow as additional clients join the platform,” said Vijay Mayadas, President of Capital Markets at Broadridge. “We are excited to welcome UBS onto the platform and to continue to bring significant benefits in the form of enhanced liquidity, reduction of risk and operational efficiencies to our clients and the industry.”