Published

- 09:00 am

- From the start of 2021, the UK has reported a total of 14,883 instances of cyber crime, with the total losses of £5.7m

- Despite 90% of offences being made against the public, UK businesses have reported £1.9M of losses - a third of the total figure

- Offences involving hacking, social media and email account for 6.3k of reported incidents

- Primary targets for cyber crime appear to be tech-savvy individuals under 40

British people and businesses have suffered financial losses of £5.7m from a reported 14,883 cyber crime incidents since the start of the year.

The new study from click fraud prevention experts PPC Shield indicates that malicious hacking, fraudulent use of social media accounts and email scams are the most common form of cyber crime so far this year – accounting for 43% of all reported incidents since 1st January. Also in the high-ranking categories are reports of malware/viruses, personal hacking and extortion.

Data compiled from the National Fraud Intelligence Bureau indicates that those under 40 reported the most incidents this year, at a total of 5,000. This suggests that scammers and hackers are predominantly targeting younger, more tech-savvy generations; Those used to juggling multiple social media accounts, email addresses and banking apps.

Though cyber crime against corporate bodies only accounts for 10% of the UK’s reported offenses, their financial losses of £1.9M accounts for a third of the total figure.

Concerning the effects on victims of cyber crime - ONS data from the Crime Survey for England and Wales (CSEW) indicates that 72% of those affected by cyber crime expressed that they had been emotionally affected by their experiences, with almost a third stating a moderate to severe impact as a result of the offense – predominantly annoyance and anger.

A further 1 in 10 individuals experienced emotions such as anxiety, depression, fear or difficulty sleeping.

Despite the personal nature of the crimes, 81% of offences were committed by an individual person (as opposed to a group) that was not known to the victim.

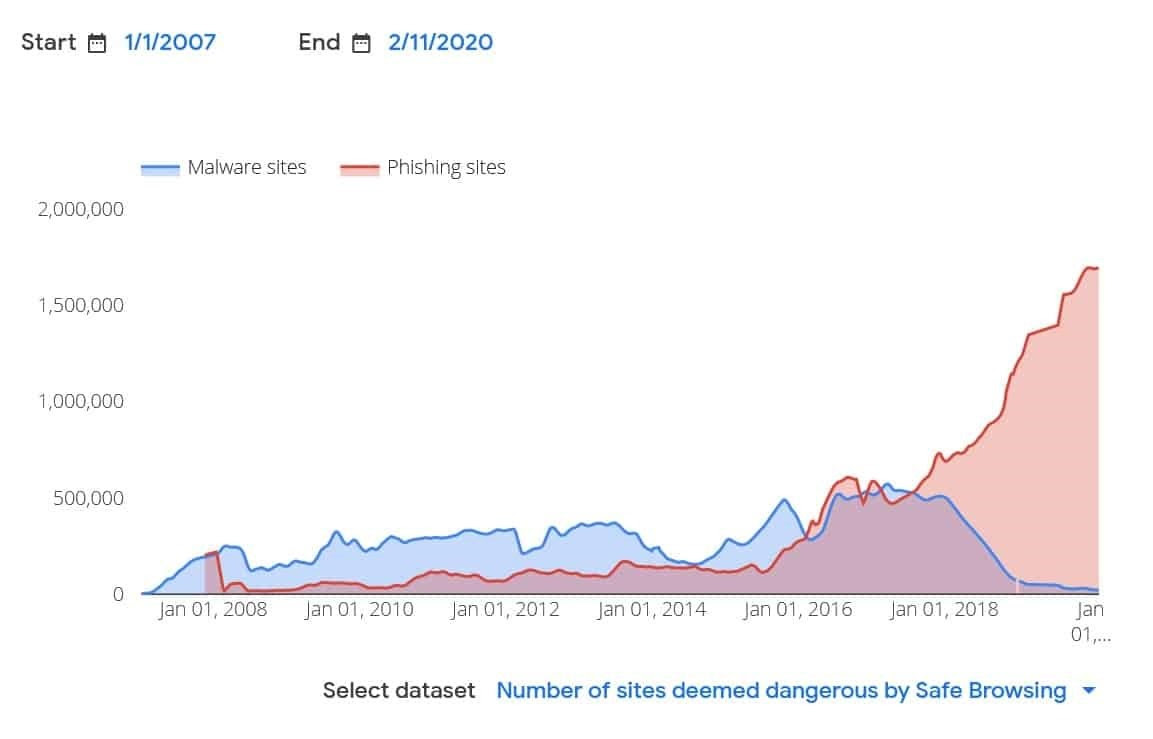

Concerning the tools used to commit cyber crime, malware (software designed to cause damage to a computer, server, client, or network) is at its lowest point since 2007, according to Google’s Transparency Report. In contrast, phishing websites - which seek to gain passwords, credit card numbers and other private information without the use of applications - have seen an increase of more than 750% since 2007.

In all cases of cyber crime that resulted in financial loss, one in three individuals discovered the offence through communications from their bank, building society or other financial institution.

Including non-cyber assisted fraud, the UK has logged 253,736 reports that equate to total financial losses of £1.2bn this year. Health minister Lord Bethell has previously commented on the rise of phishing scams conducted over the course of the COVID-19 pandemic, with an increase in fraudulent text and calls to mobile phones, with individuals posing as bank employees, HMRC and even the NHS charging for fake COVID tests and track & trace.

A spokesperson for PPC Shield comments: “With the internet such an essential part of our daily lives, taking care online and using robust security measures are of utmost importance. Always be aware of what you are clicking on, and be especially wary of phishing sites and emails sent from companies or individuals that you are not familiar with.”

Related News

- 04:00 am

- Over 10 years, Chargebacks911 has protected over 10 billion transactions and recovered over $1 billion in falsely disputed and/or stolen revenue to-date

- Grown from working with just 12 merchants to over 45,000

- Expanded its connection hub in both scale and scope, growing from 5 to over 500 data integrations

- Launched its new brand Fi911, to include end-to-end chargeback lifecycle management for financial institutions and payment facilitators

- Celebrated over 200 students graduate from its not-for-profit, Paid for Grades educational programme

- Donated over $1 million to charity

Founded in 2011 in Tampa Bay, Florida by Monica Eaton-Cardone and Gary Cardone, Chargebacks911 is now celebrating its 10-year anniversary. The company has since successfully protected more than 10 billion online transactions and has recovered over $1 billion in falsely disputed and/or stolen revenue.

The global leader in chargeback management, remediation and dispute resolution now has over 400 fintech professionals working across corporate offices in North America, Europe and Asia for some 45,000 active merchants in 87 countries across 27 verticals. It also recently launched a new dispute management brand for financial institutions, Fi911, to empower FIs with the most sophisticated dispute management technology in the world. Today, it serves some of the world’s largest financial institutions.

“We were the first chargeback company in North America and Europe – we can add APAC to that list this year as well,” said Co-Founder and COO, Monica Eaton-Cardone. “Originally when we first started, it was assumed that chargebacks were an unavoidable cost of doing business. Instead of trying to combat them, merchants would just accept them – there was a need for serious, transformative change.

“We’ve been working hard to alter this perception over the past decade. It’s now widely acknowledged how systemically unfair the chargeback process can be to sellers and many want to join our campaign for change.”

Gary Cardone, CEO of Chargebacks911, added, “Right now, we’re in a moment of history where the world is digitising at a staggering rate, causing an upwards trajectory of global ecommerce which is expected to grow 16.5% from 2020 to $2641.1 billion in 2021.

“Chargebacks911 will continue to innovate and expand our technology and solutions, to support the growing, multi-acquired, multi-currency and multi-lingual merchants and FIs who are raring to take advantage of the expanding global opportunities.”

Discussing her proudest moments, Eaton-Cardone explained, “Of all our accomplishments over the past 10 years, I’m most proud of how we’ve elevated awareness and helped inspire change. This was our first goal, and arguably our largest initial barrier to success. It is also something that’s impossible to achieve without genuine teamwork, dedication, and perseverance.”

As the company has grown, so too has its desire to give back and champion many causes – both in and out of the industry. It has helped over 200 students graduate the Paid for Grades programme by providing learning modules in key subjects, support through tutors and cash rewards upon graduation.

Eaton-Cardone is a long-time advocate of overhauling chargeback processes and making other substantial changes to legacy infrastructure and policies. In a bid to improve merchant rights and equip them with the knowledge to effectively manage chargebacks, she authored the book, Chargebacks for Dummies, and then offered it free to the public. To help educate the consumer sector, she partnered with Citibank, American Express and Bank of America, spear-heading the ConsumerAction initiative which provides free courses and guides to banks and their cardholders – teaching them when and how to correctly use the chargeback process, and protect themselves from unauthorised charges.

This was followed by Chargebacks911’s thousands of pages of free content, infographics, eBooks and advice on its website, and more recently the launch of its educational seminars series, Chargeback University, in London, Toronto, New York, Chicago, San Francisco and Los Angeles.

“Initially, raising awareness of the issue was an uphill battle, but over the past few years there’s been a seismic shift in public opinion,” said Eaton-Cardone. “Instead of automatically blaming the sellers, there is now an acceptance that fraud can go both ways in the merchant-consumer relationship.

“Equally, we’re becoming increasingly cognisant of the link between consumer fraud and price-inflation – when the cost of fraud rises for the merchant, eventually it’s going to result in higher prices for the consumer. That’s why chargeback fraud is like a multibillion-dollar hidden tax on online products.”

Eaton-Cardone predicts that the next 10 years will see a decade of ecommerce dominance, creating a further need for companies like Chargebacks911.

She concluded, “There is big change coming over the next decade – the drastic increase in digital payments and chargebacks we’ve seen from COVID-19 has just been a taste of that – we are dealing with a structural and permanent shift in merchant-led technology and consumer behaviour. In order to reduce the billions that will be lost to invalid payment disputes, we must continue our push for industry-wide effective chargeback management systems, updated dispute rules based on modern (and future) commerce, and adequate support for both merchants and financial institutions.”

For more information about Chargebacks911, visit chargebacks911.com

Related News

ince Graziani

CEO at IDEX Biometrics ASA

Central Bank Digital Currencies (CBDCs) are becoming increasingly popular with nation states around the world, and for a good reason. see more

- 09:00 am

Current proof-of-concept (PoC) processes can take on average 18-24 months. By centralising the PoC process QAssure/prooV's end-to-end PoC platform shortens the time from discovery, testing to deployment of the right solution by 75% so financial enterprises can adopt new technology while it is still new and the technology is relevant.

By combining smart integration technology, behavioural prediction analytics with bespoke development to support workflows, this solution will also leverage Delta Capita’s integration, testing and managed services expertise and its unique capability of certification and assurance. Upon the completion of the PoC, the digital assurance platform will further help in performing both ends to end functional and non-functional testing of the solution. It will reduce the testing timeframe from months or weeks to days and ensure that all solutions produced are of the highest standard.

The news follows the recent merger of QAssure and prooV™, a cloud-based testing platform owned by global technology group, Prytek.

Jerry Ngo, Vice Chairman, Delta Capita Asia says “The true potential of innovation is often held back by slow processes, and this needs to change. These challenges aren’t unique to one sector. There is a huge opportunity to help drive innovation across various industry verticals. We’re always looking for ways to do things better, and faster – with cost efficiencies front of mind. We have already been able to put this into action with a use case that was presented to us by a government entity that is at the forefront of catalyzing innovation by smaller start-ups - by allowing them the ability to quickly respond to problems being posed by their clients.”

Toby Olshanetsky, CEO and Co-founder of prooV™ says “We are very excited about this opportunity. Our joint offering will allow to meet the growing demands of a continuously changing landscape – particularly as financial institutions plan to increase onboarding of FinTech solutions. A crucial part of this effort is running proofs-of-concept - but then security, regulation, bureaucracy, legal red tape, and slow processes come into play. QAssure and Delta Capita is the hub where you can discover, test, analyse, compare and deploy new technology this will give our customers 360 PoC solution: before, during and after PoC is finished with no regulatory barriers, no security risks, just pure technology testing and evaluation.’

Delta Capita has been reinventing this space by putting together disparate capabilities into leading edge use case solutions for our customers for example within the KYC space putting together Karbon, Karbon8, Scannovate and Klarion into an end-to-end orchestration. With this innovation-as a-service offering, we investigate the challenge of innovation itself and of technology adoption for our clients.

Related News

- 09:00 am

RegTech company, Napier, provider of advanced anti-financial crime compliance solutions, has announced that cross-border payment specialist ONEPIP will be using its technology as part of ONEPIP’s upgraded anti-money laundering (AML) controls.

Napier’s AI-led Transaction Monitoring, Client Activity Review and Risk-Based Scorecard Review will give ONEPIP a systematic, intelligent review of all its transactions and customer profile data to help identify suspicious activity quickly and easily, creating a robust compliance solution.

Dagian Cheong, Head of Risk Management, said “With over 25,000 transactions worth over USD4.5bn in value since 2016, licensed operations in Hong Kong and Singapore, and planned expansion in the region, automated transaction monitoring has become imperative for the management of the risks in our business.

“As one of the fastest-growing FinTechs in the region, ONEPIP is on a continual quest to collaborate with best-in-class technology innovators, to integrate with our proprietary FX management platform, to meet the exacting standards of all our stakeholders, which include regulators and partner banks. We are particularly grateful to the Monetary Authority of Singapore for awarding us with the Digital Acceleration Grant which helped fund this project."

Named as Best AML/CTF Solution in the Regulation Asia Awards for Excellence last year, Napier works with financial organizations around the globe to provide an AI-led platform for intelligent AML and trade compliance. Its presence in APAC was further strengthened earlier this year with the opening of a new Kuala Lumpur base, adding to its offices in Singapore, London, North America, Australia and Dubai.

Robin Lee, Head of APAC at Napier, said: “Financial services organizations continue to face mounting pressures to ensure that their regulatory compliance measures are constantly up to date and robust enough to identify any potential criminal activity, or face huge fines. With Napier’s advanced and intelligent technology, this can move from being a mandatory duty to a competitive edge. ONEPIP’s new solution enhances its regulatory compliance regime to further strengthen its position as the trusted cross-border payment specialist in the region and beyond.”

Related News

- 02:00 am

Encompass Corporation, the provider of intelligently automated Know Your Customer (KYC) solutions, today announces the appointment of experienced financial crime compliance professional Michael Horsnell as Business Development Director.

With more than 20 years of experience in the financial services industry, Michael has focused on areas including operations, transformation and risk and control and governance. His expertise covers client onboarding, financial crime and Anti-Money Laundering (AML).

He has held senior roles at institutions including Citi, Royal Bank of Scotland and UBS Investment Bank, where he has headed up client Know Your Customer (KYC) services and client reference data. Prior to Encompass, Michael was Global Head of PEP, KYC & Financial Crime Exits at Barclays.

Michael, who brings vast experience of leading KYC and customer onboarding improvement initiatives at some of the world’s largest banks, joins at a time of high growth for Encompass, and following other crucial appointments across the business. Michael will be a key figure, overseeing existing relationships with customers in the global banking space.

Ed Lloyd, EVP, Global Head of Sales, Encompass Corporation, said: We are delighted to have someone with Mike’s expertise and level of experience across the industry join our team at such a crucial time for our business.

His experience, knowledge and industry understanding will be crucial as we scale globally and continue to develop in order to deliver the best for our growing list of customers. We are at an important juncture, and I am looking forward to growing our talented team further as we progress.

Michael Horsnell added: It is great to be part of an innovative team that has developed a product offering that is game changing in a very challenging space for financial services organisations.

I am looking forward to utilising my industry knowledge to help develop the product further, and strengthening partnerships with our existing and future customer base.

Related News

- 09:00 am

Growth hacking is a hugely popular buzzword right now. Founders are desperate to understand what it is and how to do it. It, therefore, comes as no surprise that there is an abundance of growth hacking books on the market. Unfortunately, while these guides are often packed with insightful tips and tricks, I've found that they also fail to put everything into context. Many times I'd finish reading a chapter and feel like I'd learned a bunch of interesting tactics but be left completely in the dark about which ones to use, when to use them, and why they work (or don't).

Determined to find a growth hacking book that could provide me with a holistic approach, an approach that showed me not just the what but also the why and how I searched for a resource to answer all my questions. Although I believe there are many great growth hacking books on the market, nothing fit the bill for me. This led me to put together this list of 13 Growth Hacking Lessons From The Experts so others wouldn't have to waste time wondering what to read.

This list includes 12 of my favourite growth hacks pulled from various books from startups, VCs, and business experts. Each lesson has been carefully selected to provide you with actionable advice on how you can use growth hacks to take your business from zero to hero. For example, if you're looking for tips on how to get customers without spending money or time on ads, then you'll love this resource.

"Always have a clear, measurable goal." – Gary Vaynerchuk

I agree with this statement. Before you do anything, you must know what it is you are trying to achieve. If you don't start out with a clear goal, you may go down many paths and won't get any results for your efforts.

Don't chase the shiny object.

A growth hacker's job is not to grow one thing, like email signups or Facebook likes. Instead, it's to see how many users you can get to onboard and use your product. If you work at a company where the goal is to get 1,000 people to share your content on Facebook, then you're likely working on the wrong thing.

You can't make everyone happy.

You may be trying to provide a great service, but that doesn't mean it will resonate with everyone. Narrow down your focus on the people who matter the most. Is your target market in a certain age group, gender, income level or profession? Take time to identify your ideal customer and then optimize your messaging so they know exactly why they need your product or service.

Growth hacking is a "game," so keep score.

Most people know that when they are starting a startup, they need to track their company's performance. In startup land, the main performance indicator is growth. This means tracking things like daily active users or monthly recurring revenue. The same thing goes for growth hacking—keep track of everything! Keep a log on your laptop or in a notebook of every experiment that you try and measure the results. Then move on to the next experiment because if you don't know what is working, how can you optimize your business for growth?

The only way you will be able to recognize patterns is by consistently tracking the numbers. So start now and keep up with your progress. You'll be glad you did when you look back at a year from now.

Figure out your product-market fit.

What is product-market fit? It's a term coined by entrepreneur Marc Andreessen in 2011. He said: "Product/market fit means being in a good market with a product that can satisfy that market." That's not just good advice for entrepreneurs; it's good advice for growth hackers, too.

Build A Community

It's so important to know who's following your blog or podcast because they're the ones who are most likely to support you or become customers. So make sure that you mention them by name and always keep them in mind when creating content.

How can you engage with your audience and make them feel special? Listener mail, interviews, feedback sessions are all great ways of showing appreciation for their attention. Engaging them in social media is another great way to gain their attention. Don't make engagement one-sided; respond to their comments and always ask for feedback. Offer a behind-the-scenes look at your operation.

File your taxes early.

While conducting your small business tax filing early may seem like a strange tip for a growth hacker, it's a brilliant practice that helps you to stay on top of your business finances. By doing this task as soon as possible in the year, you can better look at the financial numbers objectively and identify any problems or questions that might be looming further down the line.

"It can be eye-opening," says Gary Ruffin, founder of One Tree Growth's digital agency. "You can see which clients are underperforming or not converting from free trials into paying customers."

"Getting your taxes done early is about having an objective look at your business," he adds. "It forces you to think about what is working and what isn't. It allows you to adjust things before they become too big of a deal."

Tailor your customer needs

Here's a little nugget of wisdom from Aaron Ginn, co-founder and President ofSimple Target:

"Study your customer's behaviour and tailor your approach to match it. The best marketing campaigns use the same tactics that matter most to the people they are marketing to." Short, sweet, and to the point. This lesson is a great reminder that you need to be sure you are tailoring your approach to match your customers wants and needs. When you do this correctly, you'll be able to figure out which channels to spend the most money on and which channels aren't working for you at all. Of course, this strategy isn't an exact science. You can't just figure this out on a spreadsheet after crunching your numbers for a day or two. Your customers won't behave the same from one month to the next. They will act differently depending on what they just bought, how they feel about what they just bought, and how they feel about their general financial situation as well. You need to do more than just survey them, though. It would help if you watched them. Watch them purchase things. Read their reviews. Read their comments about price changes or product changes. Don't just listen in on your customers- watch them. That way, you can tailor your efforts to get more sales from them in the future by matching up with their behaviours.

Be Productively Disagreeable.

Steven Sinofsky opines, "People with strong views and the ability to state them assertively and passionately are apt to disturb the status quo and challenge existing assumptions. To be a productive contrarian, you have to be substantially right more than you are wrong. If you're right only 50 per cent of the time, you're not going to be heard. But if you're right, 70 per cent of the time, you will force people to take notice. That is what we called productive disagreement."

Make It A Habit To Look For Growth Opportunities - When you create an opportunity for growth every day, you will soon realize that it isn't as hard as it sounds. Learn to spot opportunities, and opportunities will learn to spot you.

Create A–Z Playbook For Growth - Go through many different cases, analyze what works and what doesn't to have a growth plan for everything from A to Z.

It's not about the tools.

You might be overwhelmed by all the tools available to you today. It's tempting to rely entirely on these tools and not think about your customers as people or what they want or need. That would be a mistake: Your customers are human beings with problems, desires, and goals. Tools don't know anything about this. You do. Figure out how to solve those problems and figure out what those people want, then find ways to connect those two things.

Confirm if your product is solving a problem

Confirming if your product solves a problem is crucial, and there are many ways to do that. Let's take a look at two techniques:

- Surveys: Send out surveys and collect responses to see if people want what you're planning to offer them. If they don't answer the survey, this could mean one of 2 things. In one case, they were too busy or didn't find the survey enticing enough; in the other case, they didn't feel like they wanted what you were offering or that they had the problem you're trying to solve.

- Asking your network: Another way to understand if there's a need for your product or service is to ask your network. If you don't have an established customer base or network, ask 5-10 people who are part of your target market directly if they would buy what you plan to offer them.

Related News

- 06:00 am

Collaboration will produce immersive online executive education programmes that deliver rewarding and transformative career development across frontier fields

Cambridge Judge Business School and Esme Learning, the AI-powered digital learning platform, have announced a collaboration to empower working professionals’ career development across frontier fields. The multi-year collaboration commences with two inaugural six-week online executive education programmes:

- Startup Funding: From Pre-Seed to Exit, which will help entrepreneurs overcome the trickiest funding challenges facing startups.

- RegTech: AI for Financial Regulation, Risk, and Compliance, which will prepare risk, compliance, innovation, and data sector business leaders to navigate the complexities of the industry, including technologies such as AI and machine learning that support automated regulation.

Successful programme participants will receive a certificate issued by the Cambridge Judge Business School. The first presentation of Startup Funding, run with the Entrepreneurship Centre, begins 13 October, 2021. The first presentation of RegTech, run with the Cambridge Centre for Alternative Finance (CCAF), begins 20 October, 2021. Registration for both programmes will close one week after they begin. Esme Learning will offer additional presentations for both programmes in 2022.

“We are delighted that the Cambridge Judge Business School has joined our growing family of university partners to deliver critical knowledge and skills to build the workforce of tomorrow,” said David Shrier, CEO and co-founder at Esme Learning. “Our suite of programmes with Cambridge Judge Business School integrate Esme Learning’s measurable, collaborative approach in online learning with the School’s internationally renowned tradition of research and action. The result is two programmes offering actionable insights for business leaders that advance the state of the art of digital learning.”

ABOUT THE REGTECH: AI FOR FINANCIAL REGULATION, RISK, AND COMPLIANCE PROGRAMME

The RegTech programme will provide critical insights and hands-on tools for working professionals in government and industry to address an increasingly complex regulatory environment.

In this programme, professionals will:

- Identify new applications and revenue opportunities for RegTech solutions – including technologies such as big data, cloud computing, and AI

- Understand model-driven, machine-readable and executable regulations to scale a business

- Learn from leaders who created the Regulatory Genome Project, a transformational initiative launched in part by the CCAF to sequence an open-source repository of machine-readable regulatory information

- Run RegSimple, a tool developed from the Regulatory Genome Project to simplify and accelerate the process of regulatory compliance for corporations and facilitating new regulation and policy for governments

Leading luminaries in regulation and risk from CCAF at the Cambridge Judge Business School will teach the programme, including:

- Programme Director, Robert (Bob) Wardrop: Management Practice Professor and Director of CCAF

- Faculty, Emmanuel (Manos) Schizas: Research Associate & Lead in Regulation and RegTech

- Faculty, Simone di Castri: Senior Lecturer at Centre for Finance, Technology and Entrepreneurship

ABOUT THE STARTUP FUNDING: FROM PRE-SEED TO EXIT PROGRAMME

Cambridge Judge Business School's course Startup Funding: From Pre-Seed to Exit goes beyond what first-time entrepreneurs to seasoned founders must understand when raising capital – especially at a venture’s earliest funding stages (seed to Series B). The programme will cover exactly how to launch a venture and navigate critical inflection points along a company's growth trajectory to achieve either a successful exit, or long-term operational viability.

University of Cambridge has been responsible for over 140 startups since 2011, and these companies have raised over £1.9b in equity investment across more than 400 rounds. Notable spin-outs include gene therapy company Quethera, voice-controlled AI platform VocalIQ, and AI cyber defense company Darktrace.

Designed to empower entrepreneurs, the Startup Funding programme provides the tools and insights to:

- Structure a new venture so it is more appealing to investors

- Effectively position companies and pitch potential investors, by communicating product value to drive investment

- Increase efficiency in the fundraising process

- Optimize the negotiated terms of the funding obtained

- Develop and harness a distinctive entrepreneurial mindset

In addition to leading the Cambridge RegTech programme, Robert Wardrop will also serve as Programme Director for the Cambridge Startup Funding programme. Participants will learn from other industry leaders, including:

- Faculty, Stylianos (Stelios) Kavadias: Margaret Thatcher Professor of Enterprise Studies in Innovation and Growth; Co-Director of Entrepreneurship Centre, CJBS; Academic Director, Advanced Leadership Programme.

- Guide, Ariane de Bonvoisin: startup leader and advisor for Union Square Ventures, Twitter, and Google.

PROGRAMMES POWERED BY ESME LEARNING

Both programmes, produced by Esme Learning in collaboration with Cambridge Judge Business School faculty and staff, will feature high-quality video instruction; interactive, timely media such as podcasts and articles; and correlating formative assessments that test knowledge retention.

Programmes on Esme Learning are thoughtfully crafted with learning design principles that emphasise measurement and feedback. Learners have numerous opportunities to immediately apply programme knowledge via live simulations and small group exercises that emulate work scenarios. Esme Learning’s AI coach leverages 15 years of cognitive science research to intelligently analyse small group peer interactions and suggest individual feedback per learner to ensure productive and rewarding group collaboration.

To register and learn more, visit the RegTech: AI for Financial Regulation, Risk, and Compliance and Startup Funding: From Pre-Seed to Exit programme sites, powered by Esme Learning.

Related News

- 07:00 am

Real estate lender’ new client portal demonstrates flexibility, adaptability and innovation of Backbase’s solutions

Backbase has supported real estate financing leader pbb Deutsche Pfandbriefbank (pbb) to introduce its new client portal which is powered by the digital banking technology provider’s Engagement Banking platform. With the help of the Backbase platform, pbb has been able to further digitize its processes, create new efficiencies and empower both its development and business teams with a new portal that will facilitate innovation and customer service.

Leveraging the digital sales capabilities of Backbase’s Engagement Banking platform, pbb’s portal digitizes the interface between the bank and its clients. The major benefits the portal offers are a digital workflow, higher transparency over the entire credit application process and improved document management. In addition, Backbase’s out-of-the-box accelerators are flexible and scalable, empowering pbb’s own developers to continually innovate the bank’s solutions and enhance the end-user experience. Pbb and Backbase are working together to deliver a best-in-class customer-centric approach.

Gert Krouwel, Head of the client portal project at pbb, comments: “We are delighted to have further digitized parts of our processes and solutions. The flexibility of Backbase’s platform, which we can easily build on internally, made them the obvious choice as we embarked on our digital transformation. And the culture fit with the team at Backbase made the collaboration a natural and seamless venture.”

Frank Uittenbogaard, Backbase’s Regional Vice President, Europe, adds: “We have been thoroughly impressed by pbb’s dedication to optimising both user and employee experience, and are thrilled to be partnering with them to enhance their offering. pbb’s implementation of our technology demonstrates its flexibility, adaptability and innovative spirit, and we are excited to see how they continue to scale its use within their organisation to bring further improvements to their operations.”

Related News

- 04:00 am

FRANKFURT AM MAIN – Despite the current pandemic, China retained solid growth in 2020. As the only major economy around the globe, the middle kingdom reports a positive economic growth of 2.3 percent in 2020. China’s pillars of growth roots in its innovation power and a growing middle class, making Chinese companies the profiteers of globalized markets. One of China’s vital technological prevalence is the production of renewable power from wind and solar photovoltaics, and according to statistics from the International Energy Agency (IEA), China is the world leader in both of these fields.[1] To enable Korean investors to benefit from the high demand for Chinese clean energy technology, Mirae Asset Global Investments continues reissuing its already successful ETFs in Hong Kong under its TIGER ETF Brand in Korea. The new Mirae Asset TIGER China Clean Energy Solactive ETF (396510 KS) starts trading on August 10th on Korea Exchange (KRX). The ETF tracks the Solactive China Clean Energy Index.

China plays a critical role in the global demand and supply of renewable technology. Not only is China the largest manufacturer of solar panels and wind turbines, but it is also the biggest supplier of raw materials such as silicon and rare earth materials that play a vital role in the production of renewables technology[2]. This initial situation builds a confident position on which Chinese companies draw on, making this business sector a promising opportunity for investors.

The Solactive China Clean Energy Index, which serves as the underlying for the Mirae Asset TIGER China Clean Energy Solactive ETF (396510 KS), tracks exactly those companies with significant exposure to affordable and clean energy and its related supply chain, headquartered in China or Hong Kong. Eligible companies should be listed on one of the following exchanges: Hong Kong (HKEX), Stock Connect: Shanghai and Shenzhen, and NYSE and NASDAQ. Furthermore, companies from nine industry and economic sectors, comprising, for example, alternative power generation, engineering & construction, industrial specialties, and semiconductors, are included in the index, resulting in 20 stocks making up the index composition.

“Before 2020, China’s global market share in renewable technology totaled up to 40%, reaching 50% in 2020 due to a rush to complete open projects before the Chinese government phased out special subsidies by the end of 2020, comments Timo Pfeiffer, Chief Markets Officer at Solactive. “It is assumed that China will remain one of the top players in terms of innovation in renewable technology, and Mirae Asset Global Investments’ new TIGER ETF enables Korean investors to benefit from this potential development.”

Nathan Namki Kim, Head of ETF Portfolio Management at Mirae Asset Global Investments, comments: “With China’s goal to reach carbon neutrality by 2060, the renewable energy sector in China will enjoy long term growth. Currently, China accounts for a third of globally installed renewables capacity and according to IRENA, renewable energy has the potential to meet over 90% of China’s electricity demands by 2050. We believe the Mirae Asset TIGER China Clean Energy Solactive ETF is well positioned to benefit from the country’s commitment to support the development of renewable energy.”