Published

- 09:00 am

- PwC Switzerland, PwC UK and CUBE launch a new offering to transform managing regulatory compliance

- KYR or “Know Your Regulations” is a rapid, technology-enabled assessment service that works twice as fast as current practices

Compliance in financial services is set to be transformed by technology-based assessments drawing on regulatory data from 180 jurisdictions as part of a collaboration between PwC and RegTech company CUBE.

PwC Switzerland, PwC UK and London-based CUBE have revealed a collaboration which will see the organisations work together to transform the world of financial compliance by combining PwC’s expertise in regulatory compliance with a leading RegTech platform.

The first move of this new collaboration is the launch of KYR, a service designed to shake up the compliance space. KYR, or ‘Know Your Regulations’, transforms how companies demonstrate compliance.

This rapid, technology-based assessment, which draws on regulatory data from across 180 jurisdictions in 60 languages, accelerates the process of understanding applicable regulations and identifying how the organisations is complying with them.

This provides huge time-savings compared to current manual practices. It allows financial institutions to understand their regulatory obligations, and deliver compliance effectively and efficiently. KYR is the first and only service of its kind in the market and has produced accurate and efficient results in the six months of beta testing.

Due to the complexity of regulatory compliance, financial institutions often struggle to clearly identify the regulations that apply to them, especially if they operate in multiple jurisdictions and offer a broad range of products and services. Banks with a global presence need to understand a multitude of changing regulations that impact different business areas, which is currently a laborious and time-consuming process.

This complexity and lack of regulatory traceability has led financial institutions to implementing overly complex and costly operating environments that often don’t demonstrate compliance. KYR is designed to transform this.

KYR provides:

- a rapid scoping of applicable regulations using CUBE’s proprietary technology

- a detailed view of what obligations the institution needs to comply with

- a gap analysis of where institutions are currently falling short

The KYR service addresses the issue of regulatory traceability and provides an opportunity for financial institutions to identify quickly and effectively the exact regulations that affect them, then map it out to processes, controls and policy areas in order to demonstrate watertight compliance.

“Our collaboration is accelerating how we support clients to define their regulatory obligations and demonstrate compliance,” said George Stylianides, Global FS Risk lead, PwC UK. “Having a continuously updated golden source of regulations, with exceptional language translation capability, and the ability to align regulations to client specific or pre-defined operational taxonomies is a game-changer.”

“We are delighted to be partnering with PwC, an industry-leader in the financial services and regulatory sector,” said Ben Richmond, Founder and CEO of CUBE. “This collaboration will enable us to deliver further value to our customers combining CUBE's leading regulatory intelligence RegPlatform and PwC's domain expertise. We look forward to working together to deliver transformative regulatory compliance solutions to the world's leading financial institutions.”

“We are impressed with CUBE’s capability to curate and segment regulatory documents down to the individual obligation,” said Matthias Leybold, Data & Analytics Leader at PWC Switzerland. “Thanks to this, regulatory themes can easily be viewed across different regulations and it is now possible to link individual obligations to specific client controls.”

Related News

- 08:00 am

The British Business Bank today announces a further £62.4m of financing to Shire Leasing under its ENABLE Funding programme, which aims to improve the supply of finance solutions to smaller UK businesses for business–critical assets.

The transaction follows on from a first round of funding of £37.4m in 2017 - bringing the overall amount of money under the ENABLE Funding programme awarded to £99.8m.

The financing will aid Shire Leasing in delivering in excess of £150m to help smaller businesses with cash flow, recovery, growth, and investment plans.

Launched in 2014, the ENABLE Funding programme supports the Bank’s objective to diversify finance markets for smaller UK businesses. Providers of finance to SMEs often lack the scale required to access capital markets – a key source of funding for lending institutions – in a cost-efficient manner. The ENABLE Funding programme warehouses newly-originated finance receivables from different originators, bringing them together into a new structure. Once the structure has sufficient scale, it will refinance a portion of its funding on the capital markets, helping small finance providers to tap into institutional investors’ funds.

Helen Lumb, Chief Financial Officer of Shire Leasing, said: “Our partnership with British Business Bank allows us to grow and diversify our funding base. Our journey to achieve this increased facility shows, even during times of calamity, that Shire are continuously working with our strategic partners to make alternative lines of finance more readily available for businesses.

“This latest credit line under the ENABLE Funding programme comes at a vital time for our economy, enhancing our ability to support UK SMEs across all business sectors in accessing the finance required to recover, thrive, and grow affordably.”

By utilising the ENABLE Funding, Shire has been able to expand into new markets and deliver finance solutions through non-conventional methods. In 2020, Shire Leasing was appointed as a funder on the UK’s first Clean Air Zone (CAZ) Financial Assistance Scheme, providing businesses impacted by the Bath and North East Somerset Council CAZ with direct financial support in the form of grants and/or interest-free financing to accelerate investment in low/no emission vehicles. Since funding the first vehicle on the scheme in January 2021, Shire continues to place CAZ agreements on its own book, with the majority of these secured by the ENABLE Funding programme.

Reinald de Monchy, Managing Director, Guarantee and Wholesale Solutions of the British Business Bank, said: “Smaller businesses in the UK are affected by a funding gap as many traditional providers provide cost efficient financing to only a relatively small percentage of firms. By partnering with alternative and non-bank lenders, like Shire Leasing, we can give smaller UK businesses access to the asset and lease finance they need. The Bank remains committed to its objective to create a more diverse finance market, and we look forward to continuing to work with Shire Leasing and other non-banks to help provide even more funding options to smaller businesses across the UK.”

Related News

- 01:00 am

Report from FintechOS explores the SME banking landscape and challenges of becoming digital-first

FintechOS, the global technology provider for banks, insurers and other financial services companies, has launched a report, in association with Efma, a non-profit organisation created by leading banks and insurance companies. The report reveals that 40% of SME bankers say the average time spent on approving an SME loan takes more than one week. The finding is part of FintechOS’s latest report, Digital-first SME Banking, which explores the SME banking landscape and the challenges of becoming digital first.

To understand the current SME banking landscape, FintechOS commissioned an independent survey of 40 SME banking executives from around the globe to gain a better understanding of the challenges they are facing and what is working best. The study features contributions from leading banks including Nordea, ABN AMRO, OTP Bank and HSBC.

Key findings include:

Payments pose the greatest competition in the SME market

According to 60% of SME bankers, payments is the area in which they see the most competition from fintechs. Other areas of competition from fintechs include loan products and overdrafts (13%).

Loans hold the biggest opportunity for growth for SME banks

Despite competition from fintechs, there is still opportunity for growth with 63% of respondents stating loans as the biggest growth area for SME banks. Deposits and cash management products (17%) was another area identified.

Lack of appropriate IT tools are a huge barrier

Whilst loans represent a major growth opportunity, 41% of SME bankers reported they lack the relevant IT tools, such as credit scoring models, to service customers in a personalised way. 75% said the reason behind this lack of tools is down to the high cost of technology implementation. Bank’s hierarchical organisational structure (18%) was reportedly the next biggest obstacle.

The standardisation of SME products

Due to these barriers most SMEs are offered standardised products with 51% of SME bankers stating this is the case. Therefore, it comes as no surprise that the two biggest areas in which bankers said they could use support from technology companies was in providing end-to-end digital customer journeys (25%) and facilitating access to third party data from the SME ecosystem (21%).

“Specialists are targeting specific segments like the SME market and financial services are becoming increasingly embedded into other products through partnerships and APIs. This results in banks becoming one step further removed from their customer base,” says Teodor Blidarus, CEO and Co-Founder, at FintechOS.

“To compete on the same level as fintechs, they need to leverage a partner that can support them to deliver personalised products, fully digital customer journeys and platforms that can support their ideas around innovation. Only then can SME banks confidently walk a clear and controlled path to a digital future, where they can bring new products and services to market that are more customer-centric, data-driven and faster to deploy.”

Related News

- 01:00 am

Related News

- 06:00 am

Partnership will deliver opportunities to end-investors seamlessly and in fractional sizes; first product sees minimum investment reduced by 25x due to efficiency of digital securities

Investcorp, a leading global provider and manager of alternative investment products, and private capital exchange ADDX – formerly known as iSTOX – announced today a long-term partnership to expand the use of digital securities in the alternative investment or private market space. The collaboration promises a more seamless, coordinated delivery of opportunities to end-investors and will benefit accredited corporate and individual investors, offering them easier access to opportunities that traditionally require high minimum ticket sizes.

The first product that was offered under the partnership was a diversified portfolio of US residential properties. The Sunbelt Multifamily Portfolio raised US$150 million from global investors to be invested in five multifamily[1] apartment complexes at near-full occupancy[2]. The properties are in Texas, Arizona and Georgia, markets experiencing healthy economic and population growth. Following the close of primary subscription[3], the fund was listed on the ADDX Exchange for secondary trading in July.

Since 1996, Investcorp has acquired more than 900 properties for a total value of more than US$20 billion. According to Real Capital Analytics, Investcorp is the 3rd largest cross-border buyer of US real estate and 4th largest cross-border seller, over the full years of 2019 and 2020. The Sunbelt Multifamily Portfolio is the 20th such US fund which has been launched by Investcorp since 2012.

The Investcorp-ADDX partnership could cover a variety of alternative investment opportunities. The two companies will explore possible joint projects in areas such as private equity, real estate, credit management, absolute returns investments, strategic capital, and infrastructure. Investcorp is expanding its Asia footprint, having invested about $500 million in the continent over the past 18 months, in sectors such as technology, healthcare and consumer consumption. Investcorp could potentially make more opportunities available on ADDX’s regulated digital securities platform, which

currently serves accredited investors[1] from 27 countries, spanning Asia Pacific, Europe, and the Americas.

Digital securities, also known as security tokens, make use of blockchain and smart contract technology to automate processes in the life cycle of securities such as equity, bonds, and funds. The innovation reduces the time and cost needed to issue, custodise, and service securities, because actions such as capitalisation table management, dividend and coupon payment and secondary trades can become digital and self-executing. This efficiency makes it possible to offer private market investments in fractional sizes, which allows investors to take part in opportunities previously out of reach due to high minimums. This in turn enables more diversified portfolios. The ADDX Exchange also gives investors the option of cashing out ahead of maturity. Issuers benefit too – from lower issuance cost, faster speed to issuance, and access to a larger pool of capital.

Oi Yee Choo, Chief Commercial Officer of ADDX, said: “The beauty of this new partnership lies in the fact that Investcorp and ADDX are both experts in the private markets – and yet we do have different geographical and commercial focus areas. When we combine our strengths, there is a fresh dynamism – an exciting, invigorating prospect. Individuals and companies that work with us will have an assurance that their capital is put to work in a smart way and in high-quality products. In the case of the Sunbelt Multifamily Portfolio, the efficiency gains from digital securities meant investors on ADDX could take part in the fund with a minimum amount of US$20,000 – significantly lower than the US$500,000 typically required for private real estate funds.”

Ms Choo added: “When we look at the way sovereign wealth funds and large pension funds invest, alternative assets make up a significant and growing share of their holdings because the blend of private and public investments helps to maximise long-term returns. With digital securities enabling fractional sizes, accredited individual investors can now, for the first time, take a similar approach. There is fairer access to economic growth.”

Founded in 2017, ADDX is fully regulated by the Monetary Authority of Singapore (MAS). The financial technology company is backed by Singapore Exchange, Temasek subsidiary Heliconia Capital and Japan government-backed investors JIC Venture Growth Investments (JIC-VGI) and the Development Bank of Japan (DBJ)[2].

[1] The Singapore regulatory regime that ADDX operates under defines an accredited individual investor as an individual whose net personal assets exceed in value S$2 million (or its equivalent in another currency), or whose financial assets (net of any related liabilities) exceed in value S$1 million (or its equivalent in another currency), or whose income in the preceding 12 months is at least S$300,000 (or its equivalent in another currency).

[2] Other ADDX shareholders include Korea’s Hanwha Asset Management, Japan’s Tokai Tokyo Financial Holdings and Thailand’s Kiatnakin Phatra Financial Group.

[1] Multifamily real estate refers to buildings or complexes that serve multiple households in separate units. Examples include an apartment block or a condominium.

[2] The average occupancy rate across the five residential complexes is currently 95%. The complexes consist of more than 2,200 units altogether.

[3] This issuance of digital tokens on ADDX was carried out through a special purpose vehicle company (Prometheus-4 Pte. Ltd.) incorporated for this issuance.

Related News

- 04:00 am

Enthusiastic staff more than double their gift towards the life-changing surgeries and training the charity provides in Africa

inCruises International announced this week that what began as a $100K fundraising goal to benefit their corporate charity of choice has now exceeded $250K raised to help the life-changing work of Mercy Ships.

Announced last February, the company's goal was to allow its members, supporters, and employees to be inspired to give and engage in a matching fund opportunity that would double their impact on the charity's healthcare services to those without other access in sub-Saharan Africa. The inCruises community surpassed the initial $100,000 goal a few weeks into the campaign and raised a total of $261K by August 12, 2021.

Inspired by inCruises partner Javier Cardona, inCruises and Mercy Ships galvanized their connection in 2021. “As a parent of a child born with a congenital malformation, my family's dream was to get involved with an organization that could help special children in need like ours. Many families do not have the resources for the treatment and surgeries their children need; some of these conditions are even life-threatening. For these reasons, I became a believer in the mission of Mercy Ships, and I hope our inCruises family will do the same.”

Mercy Ships is a non-profit organization and works with nations in sub-Saharan Africa to strengthen local healthcare systems and provide national medical professionals training opportunities. The Africa Mercy®, a former Danish rail ferry, is currently preparing to return to West Africa in 2022. The organization is also outfitting their newest purpose-built vessel, the Global Mercy™, in Belgium until the new year. Built with the benefit of more than 30 years of offering surgical care, the new vessel will be the world's largest non-governmental hospital ship.

"The excellent work Mercy Ships does serves as a role model of possibility and positivity for some of the world's most needy. Their healing work has empowered our team to give back and support areas of the world that need medical resources the most. We are incredibly grateful to support the life-changing medical solutions Mercy Ships provides," states inCruises CEO Michael Hutchison.

"To provide access to critical surgical expertise in localities where this is simply unavailable to the general population, Mercy Ships relies on the partnership of volunteers and supporters around the world," said Robert Corley, Chief Operating Officer of Mercy Ships. "The incredible commitment from generous corporate partners and donors like inCruises makes it possible to provide these services at no cost to the recipients."

Related News

- 05:00 am

DTI Product Advisory Committee, (PAC) kicks off with first meeting amid regulatory focus on crypto-markets

The Digital Token Identifier Foundation (DTIF) announces the first meeting of Digital Token Identifier (DTI) Product Advisory Committee, (PAC), which took place on Thursday 12th August, 2021. The DTIF is responsible for the DTI Registry and providing stewardship on DTI implementation, and is a new non-profit division of Etrading Software (ETS), the Registration Authority for the ISO Digital DTI standard, ISO 24165. The PAC has been established to discuss the new vendor-neutral, open, freely available, global DTI standard.

The PAC will meet monthly and one of the first areas of focus for this industry forum is stable-coins, a priority for the DTI Service upon launch in September. The PAC will also discuss such topics as how future regulatory changes will impact the crypto-market landscape.

The PAC comprises more than 20 members, representing a cross-section of crypto-market participants, global institutional investors, standards bodies, academics, asset managers and market infrastructure providers, from multiple global regions. The complete list of PAC members is available on the DTIF website (details below).

Sassan Danesh, Managing Partner of Etrading Software, said, “We are delighted to announce the first meeting of the PAC this week, and pleased that such a comprehensive cross section of industry both geographically and by sector is involved. This broadest collaboration, expertise and knowledge represented in both the DTIF and PAC will ensure for a DTI which will bring efficiencies and transparencies to the market.”

The crypto-asset class the DTI will cover includes crypto-currencies such as Bitcoin, as well as multiple other product types, such as stable-coins, security-tokens and utility-tokens. With thousands of crypto-assets in the market, and the list rapidly growing, there has so far been no standard way to identify one digital token from another. Currently, the same digital token can have multiple different identifiers. The DTI standard will work for industry to identify crypto asset trades to improve transparency and efficiency. It is expected standardization could help investors that operate at scale and consequently manage large operations groups to process crypto-asset transactions without having to significantly rework their existing systems and processes.

Related News

- 03:00 am

Fujitsu Limited (TSE 6702) and NEC Corporation (TSE 6701) have begun developing technologies for interoperability testing(1) between 5G base station equipment conforming to O-RAN specifications at Fujitsu's U.S. laboratories and NEC's U.K. laboratories. This initiative will be implemented as part of the 'Post 5G Infrastructure Enhancement R&D Project' under the New Energy and Industrial Technology Development Organization (NEDO) of Japan. Both companies are scheduled to build a verification environment using these technologies in their respective laboratories from August of this year, then will begin interoperability testing. Leveraging this verification environment offers the potential to significantly streamline interoperability verification between base station equipment from different vendors.

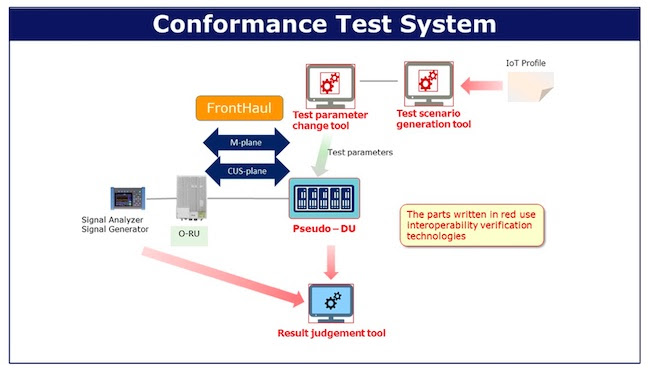

Figure 1. Conformance Test System incorporating interoperability verification technologies.

Through this initiative, Fujitsu, NEC, and NEDO will accelerate the global reach of base station equipment that conforms to O-RAN specifications, and contribute to stimulating growth and innovation in the open 5G market.

1. Summary

With the start of 5G commercial services in various countries, post 5G(2) with enhanced functions such as ultra-low latency and multiple simultaneous connections is expected to be used in a variety of industries, such as automobile factories. It is expected that the technologies that realize these functions will serve as the core of Japan's competitiveness.

In recent years, base station equipment has become more open due to O-RAN fronthaul interface specifications(3) formulated by the O-RAN Alliance(4), and it is becoming possible to connect to RUs (radio units) and CUs / DUs (central units / distributed units) from a variety of vendors. However, in order to quickly verify interoperability between different vendors' equipment, it is necessary to establish a verification process, develop tools that can be used in common, and to develop a verification environment.

Under these circumstances, NEDO commissioned Fujitsu and NEC to conduct R&D on assessment and verification technologies for interoperability between base station equipment in the "Post 5G Infrastructure Enhancement R&D Project," which is scheduled to run from FY2020 to FY2023. In response, Fujitsu and NEC are building an environment and developing technologies to assess and verify the interoperability of different vendors' equipment and the impact of such connections on the entire network.

Fujitsu and NEC have begun developing technologies to verify base station equipment interoperability at their respective facilities in the U.S. and the U.K.. Fujitsu is conducting trials at its Open RAN laboratory hosted at Fujitsu Network Communications, Inc., a Fujitsu group company in the United States, while NEC is doing so at its laboratory in NEC Europe Ltd., London, U.K..

2. Characteristics of technology for interoperability verification and establishment of a verification environment

1) Significantly improve the efficiency of interoperability verification

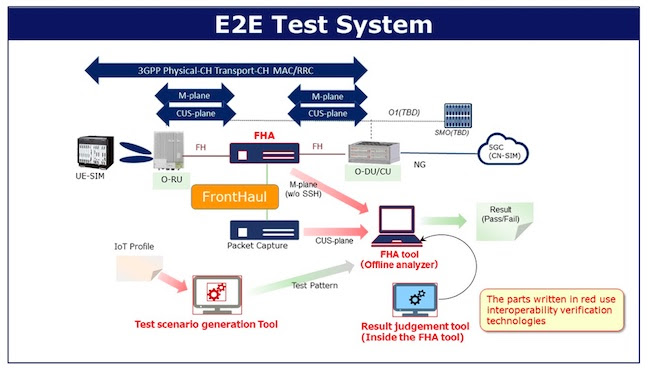

Fujitsu and NEC will combine their many years of experience and know-how in developing base station equipment compliant with O-RAN fronthaul interface specifications. The two companies will develop technologies to verify the interoperability of various vendors' equipment for O-RAN fronthaul. The technologies include FHA(5), P-DU(6), test scenario extraction tools(7), test parameter change tools(8), and validation result determination tools(9). Introducing these technologies into the verification environments of both companies' laboratories, will make it possible to significantly improve the efficiency of interoperability verification for different vendors' equipment.

2) Verification under conditions close to commercial environments

In this project, Fujitsu's lab in the U.S. and NEC's lab in the U.K. will make it possible to implement a Conformance Test System that can perform standard tests in accordance with O-RAN specifications and to implement an End-to-End (E2E) Test System that can verify the connection from the core network to the terminal. In addition, by incorporating the newly developed technologies into the interoperability test systems, it will be possible to efficiently conduct system-wide normality verification and performance verification under conditions that are close to the commercial environments of each country and business.

3. Future plans

Fujitsu and NEC will establish a verification environment using new technologies in their respective laboratories from August of this year, and will begin interoperability testing. The two companies will collaborate with carriers, equipment vendors, and governments in various countries and regions, aiming to significantly reduce the time required to conduct interoperability testing for base station equipment. The companies will also work with NEDO to support the global adoption and development of equipment that conforms to O-RAN specifications through this project, thereby contributing to the stimulation and growth of the open 5G market.

(1) Interoperability Testing: Evaluates and verifies the connectivity between base station equipment, whether maximum throughput can be achieved, and whether required throughput can be achieved even when multiple user devices are connected.

(2) Post 5G: 5G with enhanced functions such as ultra-low latency and multiple simultaneous connections.

(3) O-RAN Fronthaul interface: An open interface that connects CU/DU and RU formulated by O-RAN Alliance.

(4) O-RAN Alliance (Open Radio Access Network Alliance): An industry-wide organization that promotes standardization with the aim of realizing an open and scalable next-generation wireless access network, incl 5G.

(5) FHA (FrontHaul Analyzer): The technology for verifying the normality of fronthaul protocols (M-Plane, CUS-Plane) in accordance with O-RAN specifications.

(6) P-DU (Pseudo-DU): The technology verifying the normality of the RU itself.

(7) Test scenario extraction tool: A tool that automatically extracts the best test scenario for each 5G network.

(8) Test parameter change tool: A tool that automatically extracts and changes test parameters for more efficient verification.

(9) Verification result determination tool: A tool that automatically checks pass or fail status of verification results.

Related News

- 05:00 am

Teraco Data Environments Proprietary Limited, Africa’s largest vendor-neutral data centre and interconnection services provider, has completed the JB3 data centre facility, located within the Isando Campus in Ekurhuleni, east of Johannesburg, South Africa.

This multi-billion-rand facility represents a strategic addition to Platform Teraco, offering enterprises a scalable platform for IT infrastructure deployment while sustaining performance, reliability, security, and the widest network choice. JB3 comprises 45000sqm of building structure, 12000sqm of data hall space, and 29MW of critical power load. When combined with the existing Isando Campus facilities, the critical power load totals 40MW across the campus data centre footprint with room for further growth.

Jan Hnizdo, CEO, Teraco, says that the latest Isando Campus expansion meets the growing demand by both cloud providers and enterprises for data centre capacity and enables Teraco to offer highly resilient and secure colocation facilities while working towards ensuring its long-term vision of enabling digital transformation across the African continent: “This investment also aligns with the support we pledged to the South African Government’s investment drive and our commitment to investing billions of Rands into South Africa’s digital infrastructure. As the leading interconnection hub across the continent, Teraco has over 600 clients, including key networks, cloud providers, global content, managed IT service providers, and direct access to Africa’s largest Internet exchange, NAPAfrica; within its multitude of data centres.”

With over 200 telcos within Platform Teraco providing connectivity to Africa, Hnizdo says that enterprises are now accelerating their digital transformation strategies and placing a greater focus on cloud adoption strategies: “Teraco is making significant investments in providing access to digital infrastructure that is both resilient and highly flexible. This offers enterprises the ability to scale as network strategies evolve in a world where fast and secure interconnection with strategic business partners and cloud on-ramps are a source of competitive advantage.”

Platform Teraco provides the lowest latency interconnection points to both cloud and content. With a direct private connection to all leading cloud providers, enterprises can deploy in the most latency efficient, secure and resilient manner possible. Enterprises can also deploy their public, private and hybrid cloud strategies from the Teraco platform and significantly reduce the time and cost to access these cloud platforms.

Hnizdo says Teraco has continued to see growth in cloud adoption strategies making its role significant for those who need access to robust digital infrastructure: “Our clients use the data centre to scale their IT infrastructure, adopt hybrid and multi-cloud architectures and interconnect with strategic business partners within the Teraco ecosystem. Over the last year, we have seen a 48% increase in direct interconnects to public cloud on-ramps, reflecting the increasing trend of cloud adoption by enterprises.”

Related News

- 09:00 am

KGiSL, a global IT products, services and solutions provider, has announced a landmark contract win from the Stock Exchange of Thailand (SET), one of the largest stock exchanges in ASEAN, to provide a Broker Back Office platform for Thailand's brokers. KGiSL's offering, which will be hosted by SET and made available to all capital market brokers, will be based on its flagship Dolphin platform, an end-to-end back-office system that eases business operations with seamless and controlled automation. The implementation is expected to be completed within 16 months.

Dolphin, the leading back office platform in India, caters to 60% of its institutional brokers, supporting back office clearing and settlement operations. Dolphin is set to become the one-stop solution for brokers in Thailand, with its ability to handle multiple asset classes including equities, bonds and offshore trading for both retail and institutional brokers. The next-generation technology platform has been tested for handling 5 million trades/day and has the potential capability to scale vertically and horizontally, supporting increases in business volumes. Dolphin was chosen over other leading systems because it was a better fit for requirements and for the robustness, scalability and automation capabilities it offers.

Dr Pakorn Peetathawatchai, President, The Stock Exchange of Thailand said, "This is one of our most ambitious and challenging projects to establish a common, streamlined infrastructure that will open up new possibilities for Thai brokers to revolutionize back office business models. We strongly believe that continued support from participating brokers in providing valuable insights along with KGiSL's delivery capabilities will be key ingredients in contributing to the project's success."

On the association with SET, Prassadh Shanmugam, Director & Chief Executive Officer KGiSL said, "This is a huge win for KGiSL. Dolphin has been the undisputed market leader in India so far, but we have had limited successes in other markets. This order opens up the entire ASEAN & APAC market to create similar success stories like how we have done in India. KGiSL is poised to invest more in Dolphin's capabilities by adding Artificial Intelligence (AI), Machine Learning (ML), Business Intelligence (BI) and Analytics. I would also like to thank Dr Pakorn Peetathawatchai, President of The Stock Exchange of Thailand and the entire management of SET for placing their trust in KGiSL and Dolphin."