Published

- 01:00 am

Commenting on the UK CPI slowing to 2%, Ian Warwick, Managing Partner at Deepbridge Capital, said “While inflation may have slowed slightly to fall within the Bank of England’s target of 2% this does not mean that rates won’t pick up over the coming months. Many early-stage businesses will be thriving in the recently reopened economy, but they will continue to watch the debate around the decision on a subsequent rise in interest rates very closely as this will directly impact how much they are able to borrow at a crucial time. With inflationary pressure continuing it raises the question of exactly how long the Bank can hold interest rates at current levels before it is forced to step in, subsequently causing a problem for growing, early-stage companies who require access to funding as we focus on economic recovery. It therefore remains critically important that scale-up businesses, particularly in high-growth sectors such as digital technologies and life sciences are supported as they will be at the very heart of economic growth as we create an economy fit for the twenty-first century.

“Government initiatives such as the Enterprise Investment Scheme (EIS) have never been more important for helping entrepreneurs and innovators source the funding they require, whilst also offering private investors with tax incentives to develop UK-supporting private equity portfolios. With our EIS funds reaching record levels of funding in 2020/21 it is evident that there is considerable demand from investors and financial advisers alike to invest in early-stage UK companies which we believe will be at the forefront of our economic recovery.”

Related News

- 08:00 am

Commenting on UK CPI inflation coming in at 2%, Olivier Konzeoue, FX Sales Trader at Saxo Markets, said: “CPI rose by 2% in the 12 months to July 2021, down from 2.5% in June and below the 2.3% expected. This is the first time UK inflation has fallen back to 2% since April and the first time in a while that UK CPI doesn’t match economists’ consensus.

This drop can be partly explained by the sharp rise in prices observed in July 2020 as lockdown restrictions were eased more broadly.

This slowdown in inflation is broadly regarded as a blip. The Clothing and Footwear sector as well as Recreational and Culture were attributed the largest downward contributions whilst price for transport represented the largest upward contribution to change. At last, manufacturers felt a stronger than expected inflation. Their input prices were up 9.9% in July (from 9.7% the previous month) whilst output costs also rose 4.9% which was more than expected (4.4%)

All in all, inflation in the UK is expected to pick up again in the coming months although base effects could create some further noise in future data. Investors may have just had a glimpse of how sharply inflation could fall once distortions implied by the pandemic have faded. Markets seemed unmoved by the print, FTSE trades flat to mildly negative, GBP is on the backfoot as are most G10 currencies versus USD due to new COVID outbreaks globally causing a flight to traditional safe havens.”

Related News

- 01:00 am

Commenting on UK CPI inflation coming in at 2%,Douglas Grant, Director of Conister, part of AIM listed Manx Financial Group, said: “The UK isn’t currently experiencing runaway inflation like in the US. This is not the say that rates won’t pick up over the coming months as more of the pandemic cost burden is passed onto consumers but as per UK GDP data last week, we are seeing more encouragement for the future of the UK economy. One area of concern however is current business default levels caused by the ongoing impact of the pandemic and we must acknowledge that the UK’s business debt burden has ballooned to unprecedented levels and unfortunately this has already created a relentless flow of weak zombie-like companies falling off a loan default cliff. It is imperative that we support sectors and businesses that are strong and nimble enough to adapt to the new economy and therefore continue contributing to its growth.

"We also believe that the introduction of the Recovery Loan Scheme will act as second support system for those businesses currently struggling but with long term growth potential . Indeed, we have been pleased to see the Government look beyond the obviously more resilient business sectors and introduce the RLS which can support those businesses that have been mostly negatively impacted by Covid-19, such as the hospitality and leisure sectors. Conister will continue to do all it can, working alongside the Government and traditional lenders, to support businesses.

"At Conister we have delivered upon all of our initial objectives. We have lent our full CBILS and BBLS allocation and have applications which we hope can be accredited under the RLS. We will focus on lending this to robust businesses in all sectors that we believe will thrive in the future. Conister will continue to do all it can, working alongside the Government and traditional lenders, to support British businesses."

Related News

- 06:00 am

Gilded, a new-age wealth-tech app offering fractional digital gold investment, allows users to send Swiss-refined physical gold digitally as gifts on the auspicious occasion of Raksha Bandhan and during the upcoming festive season.

Raksha Bandhan is a memorable day when siblings and families come together under one roof to celebrate the festivities. This year, however, might be different for many as social distancing is still being prioritised and travelling is being discouraged. Siblings living apart will be limited to sending rakhis and gifts via post.

Gilded will enable brothers to gift something as precious as Swiss-refined gold digitally to their sisters living anywhere in India, from the convenience of their homes via a mobile app available on Android and iOS. It is safe and secure as the process will be done virtually through the app. Gilded’s gifting feature is perfect for those brothers who forgot to buy a gift too. Digital gold is accessible 24*7 on the mobile app and can be sent to sisters (or other family members) on the day itself. Gilded offers fractional gold, making it more affordable and allowing it to be a gifting option for a larger population. There are also a variety of virtual gift wraps available for a personal touch.

Ashraf Rizvi, Founder & CEO, Gilded, said, “Gold is culturally important in India and holds immense value when bought or gifted on festive occasions. Digital gold has been making its way into Indian portfolios and now it should also be considered as a great gifting option. The receiver will not only own Swiss gold but will also possess a safe asset that will give long-term returns and build wealth. While digital gold rose in popularity during the pandemic, I believe it will continue to gain preference over physical gold as an investment.”

Digital gold is simply physical gold bought online through the Gilded mobile app. Gilded provides assured quality, safety, insurance and security. The physical Swiss gold is stored in fully insured non-bank Brink’s vaults in Zurich, Switzerland.

Related News

Anthony Perridge

VP International at ThreatQuotient

Cyber threat intelligence is now being used by organisations of all sizes across industries and geographies. see more

- 09:00 am

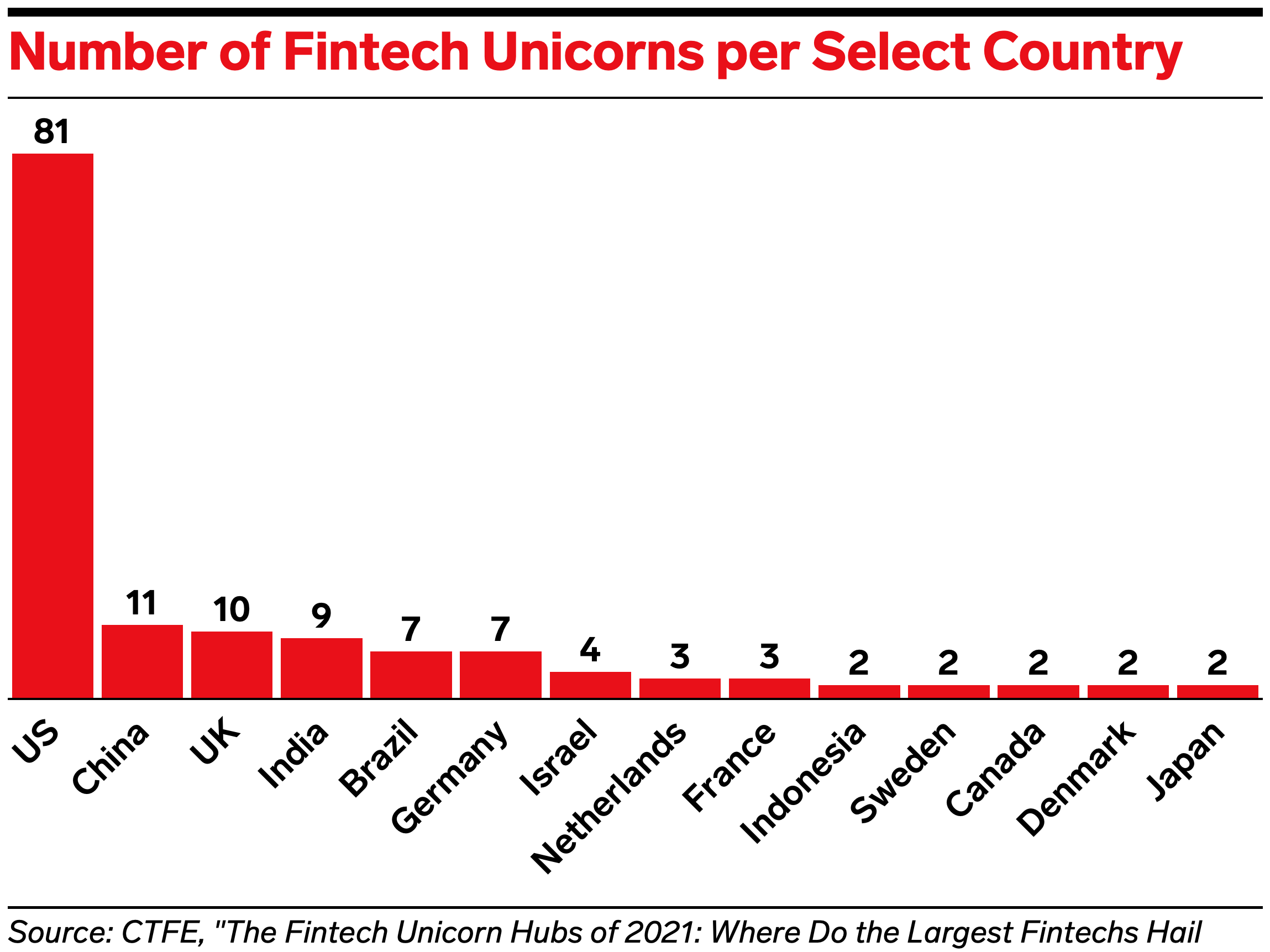

The UK-based Centre for Finance, Technology and Entrepreneurship (CFTE) compiled a list of the 157 fintech unicorns to date (those valued over $1 billion), per its blog post.

By the numbers: Unsurprisingly, the 81 unicorns in the US are more than in all of the other countries combined.

- The next fintech hubs are China (11), UK (10), India (9), Brazil (7), and Germany (7).

Looking ahead: The US undoubtedly will maintain its vast lead for the foreseeable future, but recent developments point to a reshuffling among the next four biggest unicorn hubs:

1. China. Tech giants Alibaba and Tencent secured the No. 2 spot for China.

- These super apps combine social, commercial, and financial solutions that cater to hundreds of millions of Chinese consumers and ease their access to other fintech startups.

- As a result, Chinese fintech unicorns' average market cap is $43 billion, compared with $11 billion in the US.

- However, the government regulatory crackdown against these tech giants—and more recently cryptos and insurtechs—will hinder their growth and create a less nurturing environment for new startups.

2. UK. Despite concerns over the country’s lead raised by Brexit at the start of the year, the UK has maintained a thriving ecosystem.

- The $5.7 billion of fintech funding during H1 already exceeds all of 2020.

- Fintechs now constitute the largest share of the UK’s 100 tech unicorns at 34%, surpassing other subsectors, like health and food tech.

- The government has recently adopted a series of proposals that should support more fintechs with potential to join the unicorn club. These include bolstering the country’s regulatory sandbox environment and making public listing reforms.

3. India. While China’s crackdown has inhibited fintech growth, in India they’re thriving.

- Sixty-seven percent of fintech startups launched in the last five years alone, and they already account for 40% of all the country’s unicorns, per CFTE.

- And fintech firms from abroad such as UK neobanks Revolut and Tide are eager to expand in India to capitalize on demand for fintech solutions.

4. Brazil. In generating decacorns (firms valued above $10 billion), Brazil surges up the rankings to tie for third place with the UK, highlighting the growing maturity of its fintech sector.

- In the short term, the country is poised to churn out more unicorns: Brazil took home 70% of LATAM’s record-breaking fintech funding in Q2.

- Local consumers have become incredibly receptive to digital solutions during the pandemic, with Nubank acquiring 41,000 new customers a day in September, while trading volume through the crypto exchange Mercado Bitcoin was higher in H1 than all previous years combined.

Related News

- 03:00 am

- UK Public Finance data released this morning shows a sharp improvement compared to where the Government’s finances were a year ago.

- Public Sector Net Borrowing in July almost halved, to £10.4bn, although this is still the second worst July for borrowing levels since records began. Both sides of the equation improved; spending fell by £2.9bn to £79.8bn, whilst government tax receipts of £70.0bn were up by £9.5bn on the prior year run-rate.

- Much of the improvement came from higher Self-Assessed Income Tax receipts, which improved by £3.7bn, or 76%, which likely reflects the catching up of receipts after 2020’s introduction of tax payment deferrals.

- With borrowing below expectations, total Public Sector Net Debt of £2.22 trillion stayed just below 100% of GDP, but at 98.8%, the level is at its highest since March 1962.

Commenting on the numbers, Steve Clayton, HL Select Fund Manager said:

“You can almost hear the sigh of relief coming from 11 Downing Street this morning. Chancellor Rishi Sunak must feel as if someone has poured cream on his cornflakes. These numbers could have been so much worse, but with the UK economy turning up, government finances are fast improving. This bodes well for the Chancellor’s flexibility going into the next Spending Review and makes it easier to keep the promise of no return to austerity.

But after the initial relief subsides, the stark truth remains; the pandemic played havoc with public finances and borrowing is way above anything that economists expected in late 2019. Whilst interest rates are rock bottom, this higher level of debt can easily be supported. But the Treasury will be keen to see debts brought down before the day interest rates eventually rise and servicing those trillions of debt becomes increasingly challenging.”

Related News

- 05:00 am

Combined effort further supports financial institutions with best-in-breed digital banking products and services

Marstone, Inc., a leading digital wealth technology firm, today announced it is partnering with banking technology solutions provider Nymbus. The collaboration brings together Marstone’s relentless focus of promoting financial health and literacy with Nymbus’ mission of accelerating growth for banks and credit unions through new routes to market.

“As we move forward in a post-pandemic environment, banking has shifted significantly with an arising need for greater financial planning tools as a core component to end-clients’ life and stability,” said Allison Netzer, Chief Marketing & Strategy Officer at Nymbus. “At Nymbus, we know that there are best-in-breed solutions already in the market to help our clients achieve their goals quickly and easily. Marstone’s digital wealth management platform will play a critical role as we continue to remove the hurdles historically associated with digital banking innovation.”

In addition to a complete suite of banking technology applications offered for core, onboarding, lending and CRM services, Nymbus formed a Labs unit to amplify the capabilities of traditional institutions and extend their reach to new niche customer segments. It brings together Nymbus’ world-class development, marketing, and user-experience teams—and key partners such as Marstone—integrating everything needed to build out and operate a full-scale digital bank positioned for success on day one.

Marstone offers a comprehensive, industry-leading digital wealth management platform and financial health and wellness toolkit that can be implemented in a fraction of the time it would take to build in-house, helping organizations create a seamless digital experience that creates backend efficiencies and cost-savings, all while meeting evolving end-user demands.

“COVID accelerated the already growing number of consumers shifting their wealth and banking to digital offerings,” said Margaret J. Hartigan, Co-Founder and CEO, Marstone. “To remain successful, financial institutions need to recognize that digital financial management and education are essential. We’re thrilled to be partnering with Nymbus as they incorporate our turnkey digital wealth management platform into their rapidly growing solution set for niche banking players.”

Today’s partnership comes on the heels of Marstone’s recent $5 million Series A financing announcement as well as the company’s partnership with Amerant Bank to accelerate customer-centric digital wealth management solutions.

To learn more about Marstone’s offerings, please visit https://www.marstone.com or contact us at info@marstone.com.

Related News

- 04:00 am

A new Home Mortgage Disclosure Act (HMDA) data report on residential mortgage lending trends released today by the Consumer Financial Protection Bureau finds that the total number of closed-end originations, as well as applications, increased substantially between 2019 and 2020. Closed-end originations (excluding reverse mortgages) increased in 2020 by 65.2 percent, from 8.3 million in 2019 to 13.6 million in 2020. Most of the increase was driven by the refinance boom observed in 2020. The data point also notes that, while the number of financial institutions reporting 2020 HMDA data declined compared to 2019, the number of closed-end records in 2020 increased compared to the previous year. While mortgage activity generally increased, year over year, significant differences between demographic groups persisted, including higher interest rates and denials among Black and Hispanic consumers in the mortgage market.

“Initial observations about the nation’s mortgage market in 2020 are welcome news, with improvements in the overall volume of home-purchase and refinance loans compared to 2019,” said CFPB Acting Director Dave Uejio. “Unfortunately, Black and Hispanic borrowers continued to have fewer loans, be more likely to be denied than non-Hispanic White and Asian borrowers, and pay higher median interest rates and total loan costs. It is clear from that data that our economic recovery from the COVID-19 pandemic won’t be robust if it remains uneven for mortgage borrowers of color.”

The 2020 HMDA data mark the third year of data that incorporates amendments made to HMDA by the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010. Changes included new data points, revisions to certain existing data points, and authorizing the CFPB to require new data points. The CFPB issued a final rule implementing significant changes in October 2015 (2015 HMDA rule), reflecting the changing needs of homeowners and evolution in the mortgage market. Because these changes began with the 2018 HMDA data, today's report only covers HMDA data from 2018 to 2020 and focuses on trends in mortgage applications and originations during these three years. Among other recent trends in mortgage applications and originations found in the 2020 HMDA data point are:

- 4,472 financial institutions reported at least one closed-end record in 2020, down from 5,505 financial institutions who reported in 2019;

- The number of home-purchase loans secured by site-built, one-to-four-family properties increased by about 387,000, whereas the number of refinance loans increased by 149.1 percent from 3.4 million in 2019 to 8.4 million in 2020;

- The number of open-end line-of-credit originations (excluding reverse mortgages) in 2020 decreased by 16.6 percent, from 1.04 million in 2019 to 869,000 in 2020;

- The share of loans secured by closed-end home-purchase loans for site-built, one-to-four-family, first lien, principal-residence properties for Black borrowers increased in 2020 and the share of refinance loans for Asian borrowers increased in 2020; and

- The refinance boom observed in 2020 largely continued the trends since the second quarter of 2019.

Enacted by Congress in 1975, HMDA requires many financial institutions to maintain, report, and publicly disclose loan-level information about mortgages. Each year, millions of people apply for mortgages. HMDA data allow policymakers, industry, and the public to learn what happened to a great majority of those applications and compare the data to previous years. These data help show whether lenders are serving the housing needs of their communities, provide information that can help create more fair and equitable mortgage markets and policies, and shed light on lending patterns that could be discriminatory. The public data are modified to protect applicant and borrower privacy.

Related News

- 03:00 am

More than half of the LendTech’s newly onboarded retailers in 2021 are home improvement brands

Following a strong year for the DIY and home improvement market during 2020, leading UK LendTech company, DivideBuy, has revealed that 54% of retailers onboarded in 2021 are based in this sector.

The increasing number of home improvement brands turning to interest free credit (IFC) solutions has stemmed directly from the sheer amount of property upgrades occurring during the nationwide COVID-19 lockdowns.

By introducing IFC options to their checkout, home improvement retailers have been able to increase their basket values and drive the sales of bigger ticket items. In particular, desirable items such as expensive furnishings or home electronics are prime candidates to experience a sales uplift.

Due to the benefits IFC brings to both retailers and consumers, in 2020 alone, it racked up £9.6 billion in UK sales. That figure is expected to rise to £26.4 billion by 2024, with DivideBuy predicting a further use of IFC in the DIY, building and consumer technology sectors – where average ticket values tend to be larger.

James Bradley, Director of Sales and Business Development for DivideBuy, commented: “Consumers are increasingly favouring the flexibility of interest free credit to spread the cost of purchases. It’s now one the world’s fastest-growing payment methods – a trend that we’ve seen home improvement brands leverage in order to increase sales and better service their customers at a time when they’re spending more time at home and looking to make changes.

“More than this, through IFC, retailers give consumers more responsible and supportive finance options that enable access to the products they need without high or unknown costs. And being powered by an innovative LendTech like DivideBuy gives both retailers and consumers an added security over each sale.”

IFC can be integrated at both online and in-store checkouts. Unique to DivideBuy, retailers can register, approve and onboard customers in a matter of seconds through soft credit checks that don’t leave a mark on their credit score. Also individual to this LendTech is that it provides both the technology and the credit lending facility, cutting out expensive middlemen and enabling retailers to use transaction data to improve marketing strategies and customer service.

As a result of its distinctive offering, DivideBuy has grown rapidly over recent years, with it recently being named the UK’s fastest growing technology company by multinational professional services firm, Deloitte.

James Bradley continued: “While there’s a particular spotlight on the home improvement space, we’re seeing a marked increase in retailers providing flexible IFC checkout options across almost every sector. This is since more than a third of consumers value the convenience, transparency and spending control that it provides.

“Interest free credit has proven pivotal in helping businesses stand out from the competition to capture consumer attention or recoup funds lost during pandemic lockdowns. Seeing more and more retailers onboard with us each month demonstrates how truly important IFC facilities are to the market right now.”