Published

- 02:00 am

1. Background

Financial inclusion is the next step in the evolution of financial systems and has played a key role in the development of China's finance. Before 1978, China's macro economy was primarily regulated through fiscal policies, first establishing a modern banking system in 1985 with the creation of the People's Bank of China — China's central bank — along with commercial banks. Later, in 1991, the Shanghai Stock Exchange marked the emergence of capital markets in China. And more recently, China has been progressing towards financial inclusion; in 2007, the country established its first micro-loan company pilots, and in 2009, the ChiNext stock market (for growth enterprises) in the A-shares market (RMB-denominated equity shares of China-based companies and trade on either the Shanghai Stock Exchange or Shenzhen Stock Exchange).

On December 31, 2015, the State Council issued the Plan for Promoting the Development of Financial Inclusion (2016–2020), signaling the strategic importance of financial inclusion for China. Within this context, digital financial inclusion — a recent trend and business model in financial inclusion — has also been flourishing in China. Bei Duoguang and Li Yan (2017) define digital financial inclusion as a model of financial inclusion enabled by digital technologies. In China, it has already gone through four development stages, namely start-up, slow development, explosive growth, and then transformation and regulation. Throughout its development, digital financial inclusion has adhered to the G20 High-Level Principles for Digital Financial Inclusion, which were adopted and published at the Summit in Hangzhou in 2016 and aim to optimize inclusive finance services and increase people's well-being.

2. Practices

There are four main drivers of digital financial inclusion in China: advanced FinTech, optimized infrastructure, stable and inclusive regulation, as well as innovation in business models and products.

Implied in its name is the dependence of digital financial inclusion on digital technologies, such as cloud storage, big data, cloud computing, artificial intelligence (AI), and blockchain. These reshape the traditional concept of financial inclusion services, dramatically enhancing digital capabilities and reducing costs. Specifically, the Internet facilitates data transmission, cloud storage and big data technologies expand data storage, while cloud computing and AI improve data processing and usage. Typically, financial inclusion is unsustainable as a business model, lacking a positive cost-benefit ratio. However, these technologies enable digital financial inclusion by reducing overall costs, transmitting data faster, collecting more types of data, and enriching the economics of micro-finance. This happens both online and offline, so financial institutions continue to see return on investment.

At the same time, the Chinese government is strategically focused on extensive planning for digital technology, which is speeding up updates and transformations in digital inclusive finance. For one, the industry's development depends on comprehensive infrastructure. To this end, China has established a nationwide payment system that incorporates a variety of stakeholders. This includes licensed financial institutions (such as banks, payment and market infrastructure operators, as well as non-bank payment institutions), outsourced service providers that assist in business expansion or provide technical support, manufacturers of payment instruments or hardware equipment, as well as innovative FinTech companies. Together, they drive financial inclusion.

One of the key digital technologies in this entire process is mobile payment. Today, anywhere you go — rural or urban — in China, you will be able to pay using quick response (QR) codes. A large proportion of this market is dominated by Ant Financial, a digital financial inclusion service provider based in Hangzhou, Zhejiang Province. Its services enable users to complete daily transactions, take out loans, and much more, using only a QR code. In 2020, China recorded 123.22 billion mobile payment transactions amounting to CNY432.16 trillion, a year-on-year growth of 21.48% and 24.50%, respectively. Through integrating databases and credit information at different levels and domains, China has basically built up another major infrastructure — the Individual and Corporate Credit System, which hosts the world's largest number of individual and institutional users, thus driving financial inclusion from the administrative and market perspectives.

In general, China has a steady regulatory climate, thus smoothly shifting from centralized regulation and services early on to the co-existence of the People's Bank of China, China Banking and Insurance Regulatory Commission (CBIRC), and China Securities Regulatory Commission (CSRC). Furthermore, China's regulatory authorities have long encouraged financial research and innovation conducive to inclusive finance. More importantly, the Central Government actively promotes inclusive finance in an effort to reduce financial exclusion. An example of this is the agricultural financial policies issued annually since 2004 in the No. 1 document. These aim to establish a diversified system of rural financial services with lower access thresholds, encourage rural financial institutions to provide more support to farmers, and ultimately reform the rural finance system.

In addition to reshaping financial inclusion, digital technologies also encourage numerous business model innovations, which in turn facilitate financial inclusion. One typical example of innovation is customization. In fact, the biggest difference between digital and traditional finance lies in the transformation of financial services from single static products to dynamic tailored solutions. Essentially, this means that providers design bespoke financial services and products based on customers' individual requirements.

Download the Huawei Inclusive Finance Journal to get the latest trends and insights: https://bit.ly/3CYAqDl

3. Outlook

"The only constant in life is change", said Heraclitus. Looking ahead, there are three clear trends in China's digital financial inclusion.

First, focusing on customer needs is key to digital financial inclusion. Ensuring that everyone has access to financial services requires tailoring services to a diverse group with complex requirements. A single service or product cannot suffice for everyone. To ensure that low-income customers have access, financial products and services need to address their unique needs and requirements.

Second, financial services need to be customizable. Digital financial inclusion emphasizes access to financial services for all and financial institutions are not required to provide full-scale services. Instead, it is more appropriate to determine the specific customer needs and offer tailored professional services. Therefore, the market needs to create space for customized digital financial services.

Third, digital financial inclusion will be closely integrated with other types of services. One example is bike-sharing, which has grown rapidly thanks to and in turn has encouraged the growth of mobile payments. Today, mobile payment has already become popular in transportation and shopping, and will likely penetrate other aspects of daily life very soon.

4. Implications

The discussed practices and trends signal four implications for other countries.

First, focus on developing and applying science and technology at the national strategic level; particularly, there should be a focus on FinTech and digital technologies. These will reduce the cost of digital financial services, enhance service efficiency, improve customer experience, and satisfy emerging customer needs.

Second, it is important to address long-term infrastructure in education, healthcare, transportation, utilities, energy, and communications. These will facilitate financial service outlets, payment services, and credit systems, driving digital inclusive finance.

Third, there needs to exist an inclusive and stable regulatory climate. China's financial regulators have long required financial institutions to promote financial services and support major economic activities. Although most financial services have targeted large economic activities after 1978, there are still many policy documents encouraging financial institutions to provide services to small and micro enterprises as well as individuals.

Fourth, it is key to continue encouraging business model innovation in financial inclusion. The integration of technology and finance has already given light to many new business models, which create feasible solutions for sustainable digital financial inclusion. Apart from being guided by the government, financial institutions should also pursue this type of innovation in terms of finance systems and governance.

5. Conclusion

Facing the continuous growth of technologies and innovation, we need to constantly consider the significance of financial inclusion. First of all, financial inclusion is the result of adjustments in the financial system, offering low-income groups access to financial services. Financial inclusion also signals macro economy re-balancing. Inclusive development urges financial institutions to serve the real economy and speed up technological innovation to achieve sustainable macroeconomic development. Last but not least, finance leads to a positive society. The call for financial inclusion is actually an aspiration for growth and development in the financial field amid social transformation. Beyond commercial values, financial inclusion also brings us long-term social benefits and human-centric development.

For more industry leaders’ and experts’ view, we highly recommend you to download Huawei Inclusive Finance Journal. The leading financial transformation solutions and practices are all here: https://bit.ly/3CYAqDl

[1]This article is based on a publication by the Chinese Academy of Financial Inclusion (CAFI). The content draws on said publication along with Professor Bei Duogaung's speech during his visit to Huawei, and CAFI's reports such as China's Experience in Digital Financial Inclusion, Development Report of Digital Financial Inclusion in China, and The Role of Financial Inclusion in the Belt and Road Initiative.

Related News

- 07:00 am

Bowdon RUFC, a popular grassroots rugby union club in Greater Manchester, is the first sports club in the world to introduce a new membership scheme based on members’ unique finger vein patterns. As the club looks to bounce back post-COVID and safely reopen for members, it has given the final whistle to traditional memberships cards, asking members to scan their fingers to pay and prove identity going forward.

The club has rolled out a biometric system called FinGo, a unique finger vein mapping technology that enables payment and ID checks through a single scan of the finger. To use, members register their vein pattern once, connecting it securely to personal details and a digital wallet. Bowdon members can then scan their finger at the till to pay for food and drink in the clubhouse; and take advantage of discounts when paying with their finger.

As well as payments, the technology makes life easier for members by providing secure access to buildings and authenticating age, therefore removing the need to carry physical ID and devices. FinGo was given the go ahead to be used for age verification by Manchester City Council in July 2020, making it the first city in the world to introduce the technology for this purpose.

Tom Fleming, Chairman, Bowdon RUFC, said: “The club is really excited to roll out an innovative new scheme like this, and offer our members something different to the usual plastic cards. FinGo has made lives a little easier for members and staff too, as they’re able to come straight off the pitch and grab a drink without having to go fetch their cards. Already, we are seeing a steady shift away from traditional card payments or cash as members switch to FinGo.”

“It’s also been an easy way for members to support us financially. Having been shut down for near enough a full year we’ve obviously felt the impact. We hoped that by giving people the option to pay with a Bowdon digital wallet and get a members’ discount, we can both support our cash flow and encourage the important social aspect to the club

FinGo partnered with Counter Solutions to introduce a pre-paid digital wallet for members to load in order to pay through their vein scan, through the Bowdon Rugby Way2Pay app.

Simon Binns, Chief Commercial Officer, FinGo, commented: “We’re thrilled to support Bowdon with this landmark launch. We heard about plans to introduce a plastic card-based scheme, and wanted to offer a better alternative. This also builds on the work we’ve been doing in Greater Manchester over the last two years.

“Vein mapping isn’t a far-off, futuristic technology. It’s here now, and can help make transactions of all kinds simpler and more secure. We also hope it can play a real part in the all-important COVID recovery, for clubs and businesses at any level and in every sector. FinGo has already been able to help bars roll-out test and trace collection systems, introduce COVID test verification in care homes, and now it’s supporting grass roots sports clubs to rebuild revenues, as is the case with Bowdon.”

Related News

Vince Graziani

CEO at IDEX Biometrics ASA

When see more

- 05:00 am

Despite Bitcoin recently experiencing volatility, the asset is attempting to mount another resurgence towards a new record price. Crypto hedge funds are therefore increasingly projecting the asset to hit a new level towards the end of the year.

Data presented by cryptocurrency trading simulator Crypto Parrot indicates that 65% of 55 crypto hedge funds who participated in a survey remain bullish, predicting that Bitcoin will trade between $50,000 and $100,000 by the end of 2021. Another 21% believe the asset will hit the $100,000 to $150,000 price mark by December 31, 2021.

About 9% of the hedge funds also project a positive outlook stating that Bitcoin will trade at between $150,000 and $200,000 while 4% put the price target at $200,000. However, only 1% of the hedge funds project Bitcoin to trade below $50,000.

Elsewhere, the hedge funds at 63% also predicted the cryptocurrency market capitalization would hit a value of between $2 trillion and $5 trillion. About 21% projected the market cap to range between $1 trillion and $2 trillion by the end of the year.

Another 11% put the market cap at between $5 trillion to $10 trillion, while 2% put the projections upwards of $10 trillion. However, 3% believe the market cap will be below $2 trillion by the end of the year.

Institutional investment to potentially drive Bitcoin’s price

With a majority of the hedge funds presenting a bullish outlook for Bitcoin, the report highlights some of the potential drivers. According to the research report:

"A possible influx of institutional capital will also propel Bitcoin's market capitalization to new levels. The asset's market cap has previously caught the financial world's attention by surpassing the valuation of traditional financial institutions like leading banks. Such developments have led Bitcoin to remain resilient mainly due to existing and potential investors becoming numb to negative news around the cryptocurrency."

However, the price projection might be hampered by the unclear regulatory outlook in most jurisdictions. Historically, negative regulatory news around the asset has resulted in the price dropping.

Read the full story with statistics here: https://cryptoparrot.com/article/65-of-crypto-hedge-funds-predict-btc-will-trade-between-50-100k-by-the-end-of-2021

Related News

- 02:00 am

Wholesale and retail lenders leverage 6 Solutions data within Total Expert to improve broker and loan officer recruitment and engagement strategies

Total Expert, the customer experience platform purpose-built for banks and lenders, today announced the integration of mortgage market data and analytics platform 6 Solutions, a housing and banking data startup transforming how banks and lenders make strategic growth decisions. The integration empowers lenders with the data and engagement tools needed to find, attract, and retain mortgage brokers and loan officers.

“Attracting top talent is critical for growth across lending channels,” said Josh Lehr, director of technology alliances at Total Expert. “By partnering with 6 Solutions, one of the most robust business intelligence platforms in the mortgage industry, we’re able to close the data knowledge gap and arm recruiters with powerful marketing automation technology to grow their workforce and overall loan volume.”

The Total Expert and 6 Solutions integration brings data into Total Expert by leveraging more than 60 different data sources within the 6 Solutions platform, delivering a single source of truth for lenders. Through the patent pending process that filters and sequences the data to ensure its accuracy, lenders can research and create targeted lists of broker and loan officer contacts, and seamlessly export those leads into Total Expert for a central data source for recruitment activities. As a result, lenders can focus their loan officer and broker recruitment efforts based on their specific type of originations (FHA, VA, jumbo, etc.) so they can fill the right gaps in their workforce. Lenders can automate outreach, nurture leads, and manage workflows across their teams at scale.

“This partnership is a game-changer for wholesale and retail recruiters looking to expand their pipeline and deliver a consistent and repeatable strategy from the time they source a candidate to onboarding,” said Jeff Walton, CEO at 6 Solutions. “We’re beyond excited to partner with Total Expert to enable the most powerful marketing intelligence platform in the mortgage industry.”

Additionally, for wholesale lenders, the integration provides visibility into their share of originations with each broker to determine if there is room for growth and better understand their broker relationships across the market.

The 6 Solutions integration is available today for all Total Expert customers, providing a key component in managing recruiting efforts within the leading CRM and customer engagement platform to create a better experience for lenders and loan officers. In particular, it elevates the functionality within Total Expert for Wholesale by enabling wholesalers to build better relationships with brokers.

Related News

- 05:00 am

Antelop, the Paris-based start-up which offers digital payment solutions to improve customer banking experiences by helping banks tackle the challenges of the digital-first world head on, will be part of the French Tech delegation at Money 20/20 Europe on stand D60 from 21st to 23rd of September.

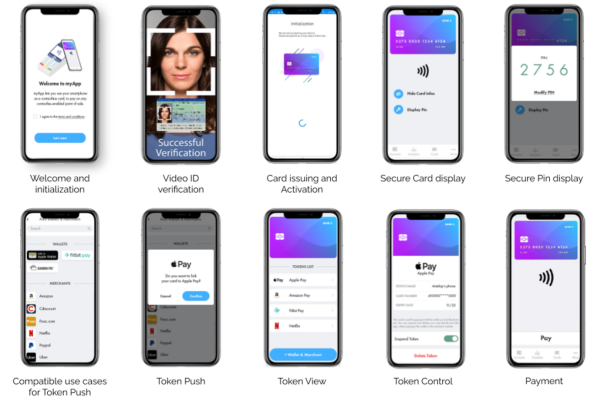

A unified solution for all digital card features

Antelop has reinvented digital cards and mobile issuance with a unified solution for banks and card issuing processors. Thanks to Antelop’s unique offer, it is now possible to use just one single software development kit (SDK) to add all the latest digital card features to a mobile banking app.

The complexity banks face with the multiple tokenization systems associated with digitalization of payment cards is no longer an issue thanks to Antelop’s unified solution. The importance of mobile banking apps for client experience is ever more crucial – to keep end users satisfied, banks must offer a directly integrated unified service via their mobile apps.

The Antelop One Digital Card

With little to no back-end development, the Antelop One Digital Card SDK lets banks replace complex integrations with one single unified and simplified digital card integration with a full range of features. This mobile-only integration works with Android & iOS with easy maintenance, protection, and security.

As a one size fits all solution, banks and card issuers can access the solution as an SDK, as a white label application or as white-label components. The only prerequisite for deploying the Antelop One Digital Card is compatibility with tokenization – and if it’s not already the case, then Antelop also has a solution for that via their iTSP hub for Visa VTS, Mastercard MDES & more.

An international hit

Serving more than 40 banks in 25 countries, Antelop is certified by EMVCO, Visa VTS, Mastercard MDES, Cartes Bancaires CB & PCI DSS.

In France and worldwide, Sodexo has partnered with Antelop for Sodexo Pay. Thanks to Antelop’s technology, Sodexo Pay is a Digital Card platform multi-processor, multi-scheme, and certified Mastercard MDES, Visa VTS, CB, PCI DSS which also works with Apple Pay.

“The Antelop platform is a real asset for Sodexo. It allows us to manage all card digitization processes (via iTSP) for the many countries we operate in, with different card systems and models (private label, Visa, Mastercard). It also gives us the opportunity to transform our application into a contactless payment application and Digital Card management app via the Antelop SDK”, emphasizes Gabriel Rotella, Global CIO BRS.

Elsewhere, Antelop has partnered with Oslo’s Opera to provide an Issuer TSP Hub to offer users a seamless digital-first experience.

Antelop is also working on several projects with Quipu, an IT solutions provider for banks and financial institutions, with operations across Europe and LATAM, including the implementation of NFC mobile payments using Antelop’s SDK. The Antelop Digital Card platform was selected by Quipu as it enables both Visa and Mastercard cards for mobile payments, and is now being implemented around the world, from Kosovo to North Macedonia, to Ecuador and beyond.

Related News

- 03:00 am

NCR Corporation, a global enterprise technology provider, today announced that $2.7-billion asset TruMark Financial Credit Union has selected NCR to provide a more seamless, consistent digital banking experience to its retail and business members.

The credit union recognized that a strong digital banking partner was a critical piece of its overall digital transformation strategy. With NCR Digital Banking, TruMark Financial will be able to offer an intuitive experience for consumers and businesses alike. Plus, the credit union will be delivering advanced financial wellness tools through the platform, a core focus for the institution.

“We initially partnered with NCR to enable member self-directed banking through our ATM channel. By also offering their modern digital banking platform, we’ll be able to tie members’ experiences together across all channels,” explained Richard F. Stipa, CEO of TruMark Financial Credit Union. “We were impressed with NCR’s high ratings in the App Store and their dedication to future innovation. Our number one priority is the member experience, so these factors were very important in our decision.”

TruMark Financial even involved their members in the decision-making process. Two member focus groups were given the opportunity to review demos of the vendor finalists’ digital banking platforms, with NCR’s experience and functionality receiving top feedback.

“TruMark Financial does an excellent job of prioritizing member service, which is evidenced by their unique and member-centric partner selection process,” said Douglas Brown, president, Digital Banking, NCR Corporation. “By investing in our software and services, the credit union will be able to simplify digital banking for both consumers and businesses. We look forward to supporting their digital transformation.”

Related News

- 02:00 am

Huber Brings Extensive Finance and Operations Experience, Including 15 Years as a Public Company CFO

FactSet (NYSE:FDS) (NASDAQ:FDS), a global provider of integrated financial information, analytical applications, and industry-leading service, today announced the appointment of Linda S. Huber as Chief Financial Officer (CFO). She will join FactSet in early October 2021.

Huber brings over 30 years of experience in the financial services industry, including 15 years as a public company CFO. As CFO, Huber will lead FactSet’s global finance organization and oversee all financial functions, including accounting, corporate development, financial planning and analysis (FP&A), treasury, tax, and investor and media relations. She will report to Phil Snow, FactSet’s Chief Executive Officer.

“We are delighted to welcome Linda to our leadership team,” said Snow. “Linda is a seasoned business leader with extensive financial and operations experience in our industry. She has a proven track record of delivering results and creating shareholder value. I am confident her leadership and expertise will be a tremendous asset to FactSet as we continue to execute on our growth strategy.”

“I am excited to join FactSet and to partner with its talented team to drive long-term growth,” said Huber. “FactSet’s strong financial performance and innovative solutions truly position it as an industry leader, and I look forward to applying my knowledge and experience to help the Company achieve even greater success in the future.”

Huber most recently served as CFO of MSCI Inc., where she had responsibility for the company’s global finance activities, including controllership, FP&A, tax, treasury, investor relations, and enterprise risk management. Prior to joining MSCI, she served as Executive Vice President and CFO of Moody’s Corporation from May 2005 to June 2018. Earlier in her career, Huber held a variety of increasingly senior roles in financial services, including Executive Vice President and CFO at U.S. Trust Company, a subsidiary of Charles Schwab & Company, Inc.; Managing Director at Freeman & Co.; Vice President of Corporate Strategy and Development and Assistant Treasurer at PepsiCo.; Vice President of the Energy Investment Banking Group at Bankers Trust Co.; and Associate in the Natural Resources Group at The First Boston Corp.

Huber also held the rank of Captain in the U.S. Army. She earned an MBA from the Stanford Graduate School of Business and a B.S. degree in business and economics from Lehigh University. Huber currently serves on the board of directors of the Bank of Montreal.

Huber will succeed Helen Shan, who, as previously announced, has assumed leadership of FactSet’s sales organization as Chief Revenue Officer. Shan will continue to serve as CFO until Huber joins FactSet in October 2021.

Related News

- 03:00 am

First-of-its-kind investment and borrowing app for consumers, in partnership with RBI approved NBFCs

· Offers up to 12% interest annually for consumer investments with no lock-in

· Consumers can borrow up to Rs 10 lacs at an interest rate of 12%

· Targets investment of US$ 100mn and loan book of US$ 50mn from the product in the first year

BharatPe, one of India’s fastest growing fintech companies, today announced its foray into the consumer space with the launch of its first-of-its-kind consumer product- 12% Club. Available on Google Play Store and Apple App Store, this product is set to redefine the rules of consumer lending and investments. With 12% Club, consumers will have an option to invest and earn upto 12% annual interest or borrow at a competitive interest rate of 12%. BharatPe has partnered with RBI approved NBFCs to offer this investment-cum-borrowing product for consumers. The company aims to achieve an investment AUM of US$ 100 mn and a lending AUM of US$ 50 mn from this product, by the end of the current fiscal.

The consumers on the 12% Club app can invest their savings anytime by choosing to lend money through BharatPe’s partner P2P NBFCs. Additionally, consumers can avail collateral-free loans of upto Rs. 10 lacs on the 12% Club app for a tenure of 3 months, as per their convenience. There are no processing charges or pre-payment charges on the consumer loans. The loan eligibility will be defined based on a number of factors including consumer’s credit score, the shopping history using PAYBACK loyalty system or the payments done via BharatPe QR.

The consumers investing via the 12% Club app can put in a request to withdraw their investment anytime, partially or completely, without any withdrawal charges. They can start their investment journey by investing as low as Rs. 1000 and enjoy daily credit of interest. The upper limit for investment by an individual is currently set at Rs. 10 lacs and would be increased to Rs 50 lac over the next few months.

Commenting on the launch, Suhail Sameer, Chief Executive Officer, BharatPe said, “As we begin our journey on the consumer side, our focus will be to launch products that are industry shaping, 100% digital and easy to use. This one-of-its-kind product for consumers has been designed to ensure industry-best benefits both for lenders, as well as borrowers. We believe that 12% Club will strike the right chord with a diverse set of new-age digitally savvy customers- from young salaried individuals, to professionals with disposable incomes, as well as the investors who park their funds in various financial instruments. The initial response has been phenomenal. In the pilot phase, we have seen great traction with US$ 5mn of monthly investment run rate and US$ 1mn of monthly borrowing run rate. We are confident that this product will be well received in the market and will play a key role in driving financial inclusion in the country. This is just the beginning and we will be adding new customer products during the rest of the financial year.”

Added Suhail, “BharatPe’s P2P lending product for merchants has been one of our industry defining products with Gross Investments of close to US$ 700mn done by over 6.3 lac merchants. Also, we are one of the largest B2B Fintech lenders in the country, having disbursed over US$ 300 mn in business loans to over 2 lac merchant partners”

In order to begin the journey of investments/ borrowing via the 12% Club, a customer needs to follow the steps below:

ü Download the 12% Club app by visiting the link

ü Complete the sign-up process

ü Create the 12% Club account and accept T&Cs

ü Start investments or borrowing journey with 12% Club

Today, BharatPe is a trusted fintech partner for millions of small merchants in India. Over the last 3 years, we have led the way and launched disruptive products to empower merchants- from India’s first interoperable UPI QR, to collateral free business loans and India’s first zero rental POS machines. These products have been well received and have been key contributors for driving financial inclusion for small merchants and kirana store owners.

Recently, BharatPe forayed into the unicorn club with Series E fund raise of US$ 350 mn at a valuation of US$ 2.85 bn. The round, led by Tiger Global, also saw new participation from Dragoneer Investment Group and Steadfast Capital. Five out of the seven existing institutional investors participated in the round - namely Coatue Management, Insight Partners, Sequoia Growth, Ribbit Capital and Amplo. BharatPe is now amongst the Top 5 most valued Fintech startups in India, and has one of the strongest cap tables for any start-up in India.

Related News

- 05:00 am

UTP, a provider of market leading credit and debit card payment solutions, is launching a new eBook for SMEs, offering advice in how to future-proof their businesses.

The eBook, entitled ‘Never Going Back: How SMEs can future-proof for post-pandemic success’ explains how a secure, fast, and smart payments infrastructure can help SMEs become more resilient and adaptable to events such as natural disasters and trade restrictions.

Speaking of the last 18 months, Michael Ault, CEO at UTP, said: “We may not live in a cashless society just yet, but it’s clear that cash is diminishing in usage, and the sooner any business can start taking digital payments, the better prepared for the future they’ll be.

“And with digital payment acceptance in place, small businesses can drill into a goldmine of data analytics that can tell them who their customers are, how they pay and how best to reach them with targeted offers generated by their preferences. That’s yet another way businesses can ensure they get future-proofed with ease.”

It is fundamental changes to how we shop that inspired UTP to create their eBook. In it, the business shares how SMEs can use available payments and commerce options to protect their revenues in any eventuality – even those that cannot be predicted.

Advice is imparted on how to mitigate against fraud and costly interchange and processing fees, as well as how businesses should choose the best POS terminal for their requirements.

Jaime Lowe, Sales Director at UTP, added: “We know that small businesses - from cash-based sole traders to hospitality and events businesses - suffered a huge loss of footfall during the pandemic.

“Pre-Covid, it was unthinkable that an event could occur that would see the UK locked down and consumer footfall vanish overnight. But what small businesses lack in scale, they make up for in sheer tenacity, and pivoting to new business models at short notice.

“However, lockdowns changed purchasing behaviours in a way that is likely to be permanent. Indeed, as the use of cash declines and both consumers and businesses have become more digitally capable, it’s predicted that by 2024, 95% of all UK retail sales will be conducted through an e-commerce platform.”

Worldwide eCommerce sales increased by 57% in 2020, and though the easing of restrictions has attracted more people back to the high street, online shopping is only going to become more normalised.

Should the future bring more disruptive events such as further lockdowns or extreme weather small businesses now have the technology and the tools to keep serving customers, and stay flexible, multi-channel, and available.

A key theme throughout the document is the need for businesses to choose their POS terminals carefully to maximise the potential they can deliver.

Michael Ault said: “Modern terminals are highly innovative and confer all kinds of benefits to the businesses that use them. However, they are not a one-size-fits all technology. Factors such as how a business operates, their volume of sales, what they sell, and who they sell to will all influence what type of terminal is best for their needs.

“The eBook covers the various types of businesses that are either using – or should be using - POS terminals and provides advice on the best devices to help them achieve their goals. It’s free to download and we encourage all SMEs to access it. For some, it could be one of the most important documents they read this year.”