Published

- 01:00 am

- Significant development in Net interest margin with March 2021 run rate at 114bps (March 2020: 10bps). This momentum has continued post year end with NIM of 130bps in June 2021

- Credit risk performance remained strong despite the impact of Covid

- Losses narrowed to an underlying operating loss of £36m with strong momentum to monthly break even during 2022, with a first month of operating profit recorded in June 2021

- A focus on supporting SMEs through the Covid pandemic saw business lending increase from £240m to £662m. Atom is on track to have provided £1bn in lending to SMEs by September 2021

Atom bank, the North East fintech, has reported strong progress in its latest annual report, narrowing its losses and generating a monthly net interest margin (NIM) of 114bps by March 2021 (up from 10bps in March of 2020). NIM continues to increase, reaching 130bps in June 2021. This progress strengthens Atom’s confidence that it will be generating sustainable month-on-month operating profit later this year.

Losses continued to shrink for the full year to 31st March 2021, to an underlying operating loss of £36m (2020: £46m) and statutory loss before other charges of £49m (2020: £57m). As seen in Atom’s Q1 trading update (to 30th June 2021), strong cost control and an improving credit outlook together with a one-off gain from its liquid asset portfolio allowed Atom to record a monthly operating profit in June, further adding to this positive momentum.

The momentum since March 2020 has been underpinned by a number of initiatives, with Atom diversifying its savings range by introducing its Instant Access Saver, completing its largest mortgage securitisation transaction to date (£0.8bn), and placing a strong focus on business lending which saw balances grow from £240m to £662m. Atom was also accredited as a CBILS lender in 2020, ensuring that it continued its support for UK businesses when it was needed most. The bank is on track to have provided £1bn in total lending to SMEs by September 2021.

Continuing the focus on delivering an excellent customer experience, the bank has successfully commissioned its new banking technology stack. Atom partnered with Thought Machine to deliver Vault, a cloud native and smart contract based banking core, which was used to launch Atom’s Instant Access Saver, now with over £1bn of customer savings balances. All savings accounts and balances were successfully migrated to the new platform, and Atom has made important improvements to its banking apps, enhancing both their speed and usability.

Atom continues to be one of the highest ranked UK banks by providing fast, transparent and good value customer experiences, with a Trustpilot rating of 4.6, and a Net Promoter Score of +76.

Mark Mullen, Chief Executive Officer at Atom, said:

“Throughout 2020 we served our customers with simple, transparent and competitively priced products and a first class customer experience.

“We continue to believe that the established banking model is well past its sell-by date. Too often it frustrates customers, antagonises regulators, disappoints investors and disengages employees. Why accept adequate when excellence is available?

“Atom has momentum, in recent years we have invested significantly in the business and now we’re seeing the results. Our losses are shrinking and we achieved our first monthly operating profit in June of 2021. We’re confident that we will deliver sustainable profitability in the weeks and months ahead as we continue our journey to IPO”.

Related News

- 01:00 am

AI Week takes place from October-5 to October-8, featuring industry leaders showcasing best practices in AI implementation and a series of hands-on workshops and success cases

Squirro, the Augmented Intelligence solutions provider, has announced the launch of its inaugural AI Week 2021, a virtual event designed to showcase AI best practices and provide interactive masterclasses that enable Financial Services (FS) leaders to get more from AI and Machine Learning (ML).

AI Week 2021 takes place between 5-October and 8-October and is split into two parts. On the 5th and 6th of October, speakers from international organisations, including Standard Chartered Bank, Bank of England and Armacell, will share their own AI implementation experiences and provide guidance on how to accelerate AI programs. Specific sessions include AI-Driven Banking Customer Service, Turn Your Data Investments into Revenue, and Visionary Women in AI.

Then, from 6-October to 8-October, a series of exclusive executive masterclasses will take place, all designed to enable business and IT executives in FS to get the most from AI and machine learning. A selected group of participants will benefit from hands-on workshops, led by Squirro AI experts, and live case studies from world-leading FS organisations to learn and understand how to maximise outputs with AI in their organisation.

“AI is fueling lightspeed transformation across financial services; revolutionising business strategy, development, and growth,” said Dorian Selz, CEO, Squirro. “AI Week 2021 brings together c-suite speakers of the highest calibre to share best practice expertise gained from their own AI journeys and provides attendees with the chance to understand how best to use AI themselves. Executive masterclass participants will gain the skills necessary to identify opportunities for data science in their business and learn about the tools to prioritise and successfully execute on those opportunities.”

The executive masterclasses at AI Week 2021 will provide business and IT leaders within FS with a range of skills to improve decision-making, extract greater customer insight, and apply AI to challenges within the business. Presented by business and IT leaders, together with Squirro experts vastly experienced in AI rollouts and techniques, the sessions are available across three regions - APAC, Europe, and North America – and will be tailored to specific information provided by the approved applicants beforehand.

"AI and ML provide opportunities across industries and departments, and can make a vast and tangible impact on any FS organisation,” continued Dorian Selz, Squirro. “Our masterclasses will provide leaders with insights about best-in-class strategies and guidelines about how to successfully implement AI and ML for the business.”

Registrations for AI Week 2021 are open here, while those interested in participating in the executive masterclasses can apply here.

Related News

- 07:00 am

The international Forex broker OctaFX turns ten years old. This past decade culminates in 6.6 million Forex trading accounts opened, 200,000 Trade &Win gifts delivered, over 102,000 followers on social media, 44 Forex industry awards received, providing services in more than 100 countries, and 500 million trades executed on the platform since inception—to just name a few company achievements to date.

To pay homage to this special anniversary, the fintech company recalls the ten most prevalent Forex occurrences of the past decade for all the history enthusiasts out there.

Trend-defining events rarely occur as isolated affairs, touching upon Forex alone—they naturally encompass and impact the vast financial world as a whole.

The following list shows an engaging view of the last decade from OctaFX's very own perspective.

The 'Flash Crash of 2010'

Around a year before OctaFX's inception, an event took place which came to be known as the 'Flash crash of 2010'. On 6 May, in a matter of mere moments, the stock market suffered a steep downfall leading to a loss that ranged around 1 trillion USD, before recovering again in the days that followed. The stock market's fall and swift recovery, in turn, tremendously impacted Forex market confidence in the world reserve currency.

2012's initial public offering of Facebook

No initial public offering (IPO) of any company has captured the industry's attention and the public's imagination quite as much as Facebook's IPO has in 2012. On 18 May of that year, the social network's IPO shares were valued at 38 USD, boosting a volume exceeding 16 billion USD and making it the heftiest tech IPO in history up to that point. As of July 2021, a Facebook share hovers at a value of 341 USD.

BREXIT 2016 (including the 2016 flash crash of the GBPUSD pair)

Now common knowledge, but when in June 2016, the results of the Brexit vote first came in, it caused utter panic in the European Union, the Western world, and in Great Britain itself. Most observers assumed that the British people would decide to remain in the European Union. The British pound sterling moved in an upswing trend right before the results of the vote were announced, but the currency pair GBPUSD ended up closing down 8% on that day.

Oil prices collapse in 2016

Crude oil prices traded between 75 USD and 115 USD per barrel for most of the first half of the 2010s. This extensive era of high prices led to a booming shale oil production and an outright revolution of U.S. fracking technology. The U.S. almost doubled its oil production in 2014 (compared to 2008), prompting a severe supply flood. West Texas Intermediate (WTI) prices in crude oil fell almost as low as 26 USD per barrel in 2016. This turned into a persistent trend, as oil stocks continued to have a rough time in the second half of the last decade.

The Trump phenomenon

Donald J. Trump won the 2016 U.S. election against Democrat candidate and former U.S. secretary of state, Hillary R. Clinton. This in itself was a great shock for the worldwide political landscape and engraved itself on the financial sector as well. Among the Trump administration's most impactful moves would have to be legislation that in 2017 has led to 1.5 trillion USD in tax cuts which stimulated domestic corporate profits by over 16% a year later.

The Twitter presidency, or how everybody learned to love Trump tweets

OctaFX felt that president Donald Trump's sometimes erratic Twitter account deserved a separate mention. The former president often decided to publish his take on the most pressing issues like the Iran nuclear deal, relations with North Korea, Syria, and the Middle East as a whole—usually, catching most by surprise. Doing politics via the American microblogging network added to Trump's unpredictable political persona, influencing the sentiments of the financial markets considerably.

Plummeting USDJPY and AUDUSD pairs in 2019 (flash crash)

In January of that year, an official statement by Apple is believed to have brought about the flash crash. The tech giant emphasised a struggling Chinese economy that consequently drew traders to sell out of more volatile currencies, among them, the Australian dollar. Many jumped on the Japanese yen, as well, which often happens when confidence in the Chinese economy fluctuates, and with it, its most significant trading partner, the Australian government.

Whoever had the right analytical outlook and strategic assessment in the professional trading community could bank on the consequences of this 'flash crash'.

Joe Biden's ascendency to the U.S. presidency

Amidst the biggest virus pandemic, Donald Trump as the sitting president, eager for reelection, lost to his Democratic challenger. After much controversy and political drama, which saw fervent uncertainty in society and the markets, Joe Biden won the election with a new record of becoming the first presidential candidate to gather more than 80 million votes.

Crypto's March 2020 'Black Swan Event'

As the mother of all cryptocurrencies, Bitcoin falls to almost 3,500 USD per coin, losing around 80% of its value from its previous all-time high of close to 20,000 USD (December 2017). Ethereum likewise dips to 86 USD after having reached an all-time high of almost 1,500 USD, taking down with it the entirety of the altcoin market. Only a few could have suspected that the beginning of the most extensive bull run in crypto history yet was just a few more months off. Experts unanimously consider the coronavirus crisis to be the leading cause of this crash.

The Coronavirus crisis, 2020–present day

Last but surely not least, and probably most important of them all—the worldwide pandemic that changed and keeps changing the world. Much has been written about how the COVID-19 pandemic and the political and economic measures that followed have impacted legacy finances, especially the fluctuating confidence in the U.S. dollar as the world reserve currency.

OctaFX hopes you liked its picks. By no means does it represent a complete list of trends, so if the fintech company missed any significant events or trends, it sure will include them in a future publication.

Related News

- 01:00 am

Leading LendTech provider DivideBuy has announced its new strategic partnership with premium hair styling tools retailer CLOUD NINE. The collaboration, which will see DivideBuy offer its interest free credit solutions to CLOUD NINE customers, aims to increase the accessibility of CLOUD NINE’s product range for its growing clientele base.

Founded in 2009, CLOUD NINE is an award-winning retailer and Official Hair Care Partner of this year’s Love Island series, and has opted to work with DivideBuy, who topped the Deloitte Fast 50 list in 2020, to make its premium products available to more customers as it grows its market share. The partnership will offer a financially responsible payment option that will help to make purchases more affordable and drive increased revenue opportunities.

High-quality styling tools are often seen as vital products, with many owners using them daily. For many people, the premium range of these award-winning products are extremely desirable, with CLOUD NINE’s range offering a huge variety of features for owners. By working with DivideBuy, CLOUD NINE will be able to offer four times longer payment terms when compared to many credit providers, giving consumers up to a year to spread their payments and making purchases from CLOUD NINE’s range even more convenient and affordable.

At the same time, retailers like CLOUD NINE can offer their premium products to a wider range of customers without any extra credit risk, with DivideBuy providing both the lending platform and the credit to the customer. This means retailers such as CLOUD NINE can expand their payment choice at the POS, and benefit from faster customer approval and onboarding, as well as data insights that can be used to influence targeted offers and loyalty bonuses. Interest free credit is proving to be a big hit with millennial consumers, with 54% of UK consumers in this age bracket using it as an easy and convenient payment option, in comparison to credit cards that charge interest and higher fees.

James Bradley, Business Development Director for DivideBuy, commented: “CLOUD NINE has already experienced strong success in the hair and beauty sector and, following the recent product placement deal with Love Island, has ambitious plans to capitalise on its brand awareness over the next 12 months. Interest free credit is enjoying rapid uptake among retailers and consumers alike, attracted by its flexibility that spreads out payments in an affordable way. Just in 2020, over 10 million UK consumers used interest free credit to make purchases. DivideBuy’s flexible payments solution is perfectly placed to offer a seamless payment option for CLOUD NINE’s customers, who had more disposable income to invest in themselves during lockdown.”

Nicki Milner of CLOUD NINE added “We want to make our products accessible to as many customers as possible and our strategic partnership with DivideBuy allows us to provide a higher level of payment flexibility, something that is of critical importance for consumers in the current economic climate. These benefits, along with the speed and simplicity of the process is what attracted us to DivideBuy, and we’re thrilled to have them on board to support our future growth.”

CLOUD NINE will join a list of diverse retailers working with DivideBuy to provide customers with payment instalment options. 2021 is set to be DivideBuy’s most successful year to date, having onboarded nearly 30 new retail partners already in just the first seven months of the year, including the leading premium homeware brand Simba Mattresses.

James Bradley concluded; “Over the past 18 months we’ve witnessed a seismic shift in the retail landscape. Bolstered by the changes in payment behaviour resulting from the pandemic, consumers are increasingly looking for more convenience and control in the way they browse, order and pay for their goods. Whether it’s used to buy high-end large-value items like styling appliances, home furnishings or tech gadgets, interest free credit is creating a real service differentiation for retailers that is attracting more customers. It’s a win-win situation for consumers and businesses alike.”

Related News

- 04:00 am

Dreams is a provider of behavioural and engagement banking solutions, which is powered by cognitive science, and helps some of the world’s largest financial institutions engage critical new target audiences and increase loyalty, by boosting their customers’ financial health and empowering them to save and feel better about their money. Dreams initially launched as a consumer app, which is live in the Nordics, and currently the top-rated app of its category across all app stores in its native Sweden, where it has helped over 460,000 users save over 440 million EUR to date.

Through the integration within a bank’s own digital tools of the Dreams Platform, customers can set and achieve money-saving goals through clever, automated saving features, in addition to nudges and saving hacks and the option to invest through mutual funds. Users can also utilise the platform’s ability to consolidate loans for more efficient payment towards credit card debts, in addition to bespoke insurance offers, providing customers with the necessary asset and debt management skills to live more sustainably. In turn, banks can leverage Dreams’ B2B2C offering, its methodology and behavioural science concepts to engage and cater to the needs of new, underserved target audiences, and ensure their solutions stay relevant in the era of digitisation and challenger banks.

Initially launched as a money-saving app in Sweden in 2016, and then in Norway in 2018, Dreams has achieved a 16% market share of all 20-39 year olds in both countries, in just under 4 years. In 2020, Dreams announced two strategic partnerships with banking software provider Silverlake Symmetri, and Ukrainian commercial bank UKRSIBBANK, marking an expansion of the company’s business model into the B2B space, as it evolves its services as a provider of digital banking solutions for financial institutions. To support this strategic shift, Dreams also recently unveiled a new department in Stockholm dedicated to the development of its B2B partnerships.

How the Dreams platform works:

Dreams leverages an effective and universal method, based on behavioural science, to offer users a personalised and engaging savings experience. Through the Dreams platform, users, rather than the bank, are in control of how they handle their money and what they save for.

Once customers open their new ‘Dreams’ savings account, they can then set a ‘dream’ or saving goals, and choose to activate multiple saving hacks.

The saving hacks are powered by different algorithms which leverage certain behavioural science principles and gamification to challenge users to improve their financial lives and change their spending habits for the better. Through these innovative hacks, users can benefit from automatic and seamless transfers of money from their current account to their ‘Dreams’ savings accounts. Altogether, there are 16 localised saving hacks to choose from. The two most popular hacks include:

‘The Thief’ - the in-app thief ‘steals’ varying, small amounts each week from the user’s salary account and adds it to their ‘Dreams’ savings account.

‘Autopilot’ - automatically calculates and withdraws from the user’s bank account the amounts necessary for them to reach their dream on time, taking into consideration other saving hacks activated and manual savings made by the user. If no other hacks are activated, automatic withdrawals are made on a weekly basis.

The rest of the saving hacks are rooted in behavioural change, inciting users to save money by changing their lifestyle and implementing more sustainable consumption and spending habits. These include “Quit Smoking”, “Skip Takeout Food” and “Exercise Outside”, to name a few.

Beyond in-app savings, Dreams also offers asset and debt management products to enable users to allocate the money they have saved through the app towards debt repayments or fund investments.

Research Partnerships and Dreams Institute

Dreams utilises collaborations with academia to design its products and methodology. This work is conducted in close partnership with the Dreams Institute, a separate entity founded to initiate relevant studies with some of the world’s top universities on matters relating to money, behavioural science, and personal finance management. Current research partners include academics from UCLA, University of Toronto, Stockholm School of Economics, University of Linköping, the Max Planck Institute, Stockholm Royal School of Technology, and Stockholm University.

Dreams Institute is headed by its CEO, Elin Helander, a celebrated neuroscientist formerly working for the Karolinska Institute in Stockholm.

Related News

- 02:00 am

Wealthtech provider’s digital-first offering makes SIPPs more accessible and affordable for fintechs and their customers

New API functionality will allow firms to offer digital SIPPs flexibly and affordably

Flexible model caters to both digital and paper-based transfer needs

Penny, the pension-tech company that consolidates savers’ pensions into one place, is one of the first customers to integrate the new offering

WealthKernel, a wealthtech provider for digital investment services, today announces the launch of its new digital SIPP (self-invested pension plan) offering. The new functionality will enable WealthKernel’s clients to offer digital SIPPs to their customers, using WealthKernel’s new API product wrapper.

The new digital SIPP offering, which is integrated over API, will enable WealthKernel’s clients to future-proof their business with a regulated, digital-first proposition that meets the needs of modern customers, whilst still offering the option of paper-based pension transfers where required.

WealthKernel’s digital offering arrives at a time when younger, digitally native consumers are engaging more actively with their finances and demanding increased accessibility to financial products. With most SIPPs on the market still relying on paper-based transactions, WealthKernel’s digital SIPP now provides an innovative, digital-first alternative to those wanting to be more proactive with their pension savings.

Penny, a pension-tech firm that uses automation technology to help users find and transfer all their pensions savings into one place, is one of the first businesses to integrate WealthKernel’s digital SIPP. Penny will use the product to offer its users additional retirement saving capabilities alongside their traditional pension pots.

Karan Shanmugarajah, CEO of WealthKernel, says:

“SIPPs are an incredibly valuable savings vehicle that allow people to have more say over how their pensions are invested, and we’re thrilled to be helping bring them to a wider audience. Thanks to seamless integration with our APIs, fintechs large and small will be able to support their customers with greater flexibility for their retirement savings. We look forward to working with the likes of Penny and many other forward-thinking businesses to help improve access to wealth management services.”

Josh Stott, CEO of Penny, says:

“This partnership with WealthKernel is an exciting step towards serving our customers even better by giving them more control over their pensions. When we founded Penny, we set out to make finding, viewing and managing pensions easier and we’re thrilled that WealthKernel is powering us further along that journey with its simple, affordable technology. We hope this unlocks a new mindset for our customers, who will now be able to view all of their old workplace pensions in one SIPP product, empowering them to make pension investment decisions that work for them and their ideals.”

Related News

- 05:00 am

Recognized by Gartner as a Leading Vendor in the innovative Cyber-Physical Systems (CPS) risk management category, Radiflow’s ROI-driven OT risk assessment and management platform offers multi-site prioritization based on attack simulations, keeping teams better protected and within budget.

Radiflow, a trusted provider of Cyber-Security Solutions for critical business operations, announces a revolutionary new enterprise-level risk management system for OT facilities that allows CISOs to view all their sites on one dashboard. This latest release also offers a first-of-its-kind, non-intrusive breach attack simulator that takes into account the business importance of each site so the CISO can find the most vulnerable points on their industrial automation networks across all their sires, allowing them to practice the most effective mitigation tools.

OT facilities and production sites don’t have the capability to temporarily shut down operations for CISOs to run simulated attacks since it may take days to stop and then restart operations entirely. The latest release of CIARA (Cyber Industrial Automated Risk Analysis Platform) allows for a digital twin of multiple facilities to be created on the same UI in order for security and risk teams to execute OT-BAS (Breach & Attack Simulations) in a global enterprise view. This takes the guesswork out of OT by letting teams anticipate the impact of potential threats via simulations of known attacks from a continuously updated global database. They can then simulate WHAT-IF scenarios of mitigations to decide which course of action would be most suitable in light of the changes in the threat landscape.

While this has been a common practice to prepare for attacks in the IT world through twin-network simulations, it is the first time that an OT environment can benefit from this proven strategy. “CIARA is now a central environment where CISOs can evaluate proven security techniques against the latest threats without tampering with their existing network”, said Ilan Barda, Founder & CEO of Radiflow. “Utilizing the revolutionary all-in-one dashboard to keep an eye on all global operations is a critical step to preventing any cyber attack on vital OT facilities.”

Radiflow’s newest CIARA software release was recognized as a vendor in the Cyber-Physical Systems (CPS) risk management category, which is in the Innovation Trigger of the Gartner® report titled, “Hype Cycle™ for Cyber and IT Risk Management”, 2021. Since its release, CIARA has earned acclaim for its capabilities in providing a data-driven approach to OT Security, especially following multiple major OT attacks, such as on the Colonial Pipeline and JBS.

The ability to configure business importance for each site and benchmark top sites in a central dashboard while allowing site managers to view their individual risk posture and optimize their security roadmap, is a major step in securing potential vulnerabilities across multiple facilities. Allowing CISOs to continuously monitor and simulate vulnerabilities, based on recent attacks that have been attempted in their industry or location, has a significant impact on the quality of OT monitoring, without slowing down or stopping critical infrastructure.

Related News

- 04:00 am

PayPal launched its crypto services in the UK—its first international crypto expansion, according to a press release.

How it works: UK users can buy, hold, and sell four cryptocurrencies––Bitcoin, Ethereum, Litecoin, and Bitcoin Cash––directly from the PayPal app. PayPal has not said whether it will bring other crypto features like Checkout with Crypto to the country.

The challenge: The UK has cracked down on firms that offer crypto services and threatened to shut down companies that don’t comply with anti-money laundering regulations by March 2022.

Likely to preempt close consumer protection scrutiny, PayPal urged UK consumers to research the risks involved with crypto before investing. It also implemented unique transaction limits for UK users, whereas it just scrapped its annual crypto purchase limit in the US.

The opportunity: In an interview with the Financial Times, PayPal CEO Dan Schulman outlined his company’s commitment to digital currencies and his belief that cryptos will shift from mainly acting as an investment vehicle to soon having wider payments utility.

Schulman said central bank digital currencies (CBDCs) are “inevitable” in the wake of China’s advanced pilot and wants PayPal to be ready to support them.

- PayPal’s push can help the company grow its user base by attracting consumers interested in crypto: 18% of the US adult population—46 million consumers—said they will likely use cryptocurrencies to make a purchase this year, according to a recent study from PYMNTS and crypto payment service provider BitPay.

- And PayPal customers who hold cryptos tend to log in twice as often as they did before owning crypto, according to Schulman, increasing engagement and tying them closer to the app overall.

Long-term outlook: Expanding its crypto services into new markets brings PayPal closer to its goal of morphing into a “super app” that consumers use every day.

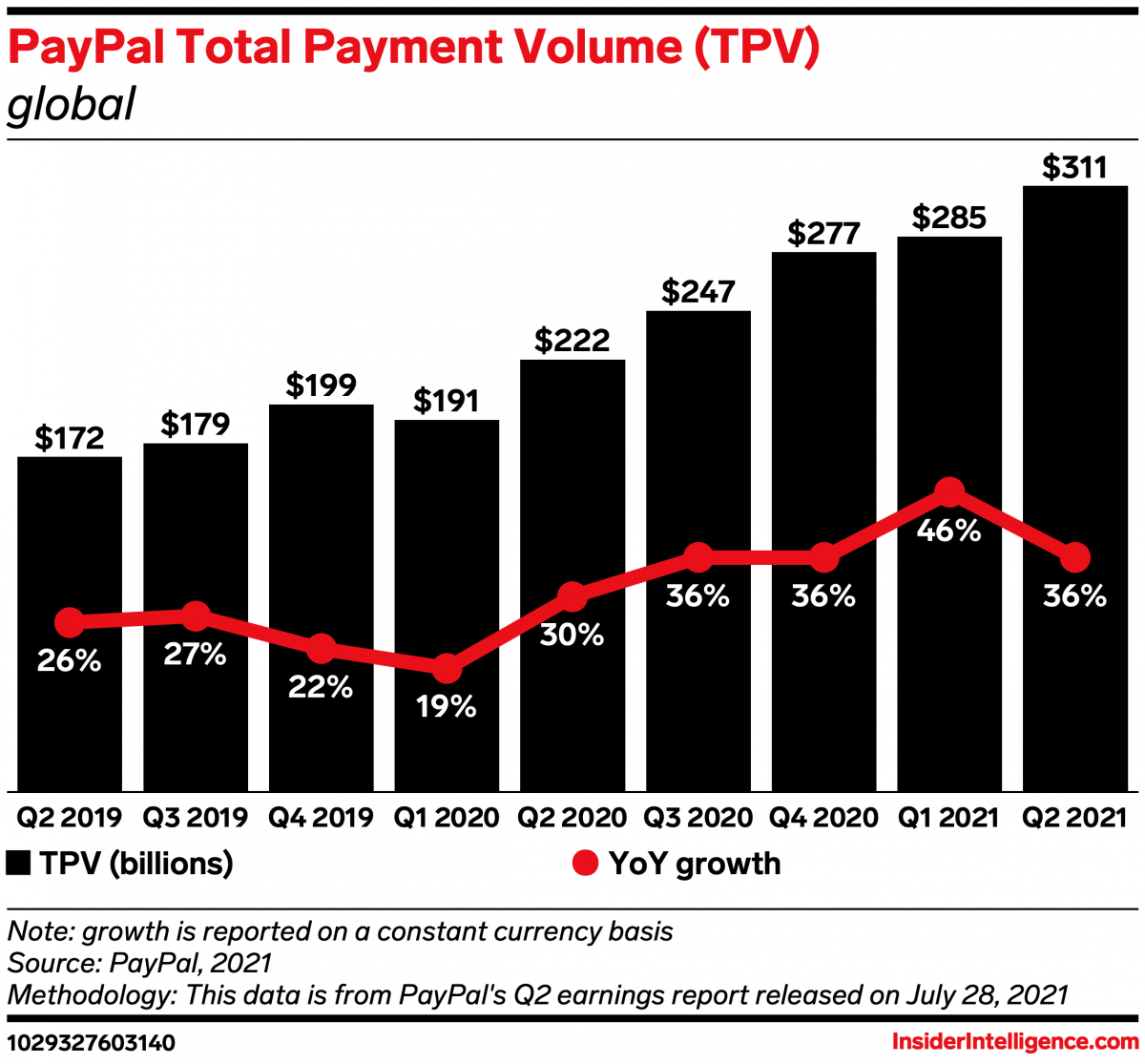

This super app will be ready to launch later this year, according to PayPal’s Q2 earnings call, and will include messaging, a savings account, bill payments, money transfers, and shopping features. Expanding beyond traditional payments can help PayPal continue its recent success and strong growth: In Q2, PayPal’s total payment volume (TPV) jumped 36% year over year (YoY), hitting $311 billion—up from the same period last year, when the metric grew 30% YoY.

Related News

- 01:00 am

New collaboration delivers impressive scalability, unmatched file density and increased cost savings in radically simple file system

Qumulo, the breakthrough leader in radically simplifying enterprise file data management across hybrid cloud environments, today announced its collaboration with Hewlett Packard Enterprise (HPE) to debut the highest file density node on the market for hyperactive data workloads, a compact 1U form

factor HPE ProLiant DL325 Gen10 Plus 291TB All-NVMe Node purpose-built for

Qumulo. Whether aggregating autonomous vehicle data, video surveillance and security data or capturing images while performing cutting-edge research, enterprises can now store the highest amount of data in the industry’s smallest all-flash data center footprint, while dramatically increasing scalability and cost savings simultaneously.

Combining Qumulo’s award-winning software with HPE innovation, using the latest AMD and NVMe technologies, the new 291TB offering delivers 23% higher density than competitive solutions. This new configuration greatly reduces management overhead with more data stored in a smaller, compact hardware footprint, scaling from 675TB to over 22PBs in a single file system with radical simplicity. As a result, enterprises such as hospitals with high-density images like 3D X-rays that produce petabytes of file data, and put increased demands on their organization’s file storage system, can now easily manage that data at a lower TCO.

“As the world’s most important organizations create and store more data than ever before, Qumulo is focused on providing customers radically simple solutions to store and manage that growing set of data. Together with HPE, we can do exactly that,” said Ben Gitenstein, Vice President of Product at Qumulo. “Having the ability to store more data than ever before in a space that is smaller than ever before gives customers the ability to consolidate complex storage systems, choose radical simplicity over legacy complexity, all while lowering TCO.”

The new 291TB offering makes it easier to combat operational costs and data center sprawl. Healthcare enterprises, for instance, can easily store and manage the equivalent of 25 billion genetic sequencing images or roughly 450 billion medical picture archiving and communication system (PACS) images in a single rack, to deliver patient care faster and more cost-efficiently than ever before.

“Storage is critical to our business, which is basically a massive fire hose of data. We could not do our work without a high-performance, high density, scalable storage solution of some kind,” said Nathan Conwell, Senior Platform Engineer at Vexcel Imaging, the world leader in developing and manufacturing high-end cameras for large-format digital aerial photography.

“Qumulo on the 291TB All-NVMe Node from HPE is playing a crucial role in simplifying the data management for demanding petabyte scale workloads – such as video surveillance, autonomous vehicle data, or post-production visual effects for Hollywood’s biggest film studios – in the data center by reducing the physical storage equipment and resource consumption. Data center space costs are rising, and oftentimes, more space isn’t available at any reasonable price. The 291TB offering solves this problem,” said Patrick Osborne, Vice President and General Manager, Collaborative Products and Big

Data, HPE StorageVice.

To learn more about this collaboration, please visit this link.

Related News

Jatan Pathak

Head of Product Management, Corporate Actions Data and Managed Service at IHS Markit

The complex bankruptcies, reorganization, and a very high volume of debt restructuring seen during the COVID-19 pandemic illustrated the growing complexity of corporate actions. see more