Published

- 06:00 am

Rent payments platform Till introduced four new features that enrolled landlords can offer their tenants.

- Budget and Save lets renters make short-term installment payments leading up to their rent due date. This can help with expense management so tenants can ensure rent is paid in full and on time.

- Rent Protection covers rent for residents who are short on rent to make sure they don’t miss a payment. Residents can repay Till while using the Budget and Save tool for the following month.

- Free Credit Builder, which is free for both renters and landlords, helps residents build their credit and incentivizes them to make payments on time.

- Rewards for Rent gives eligible residents rent payment rewards—like having Till cover their rent—when they make on-time payments.

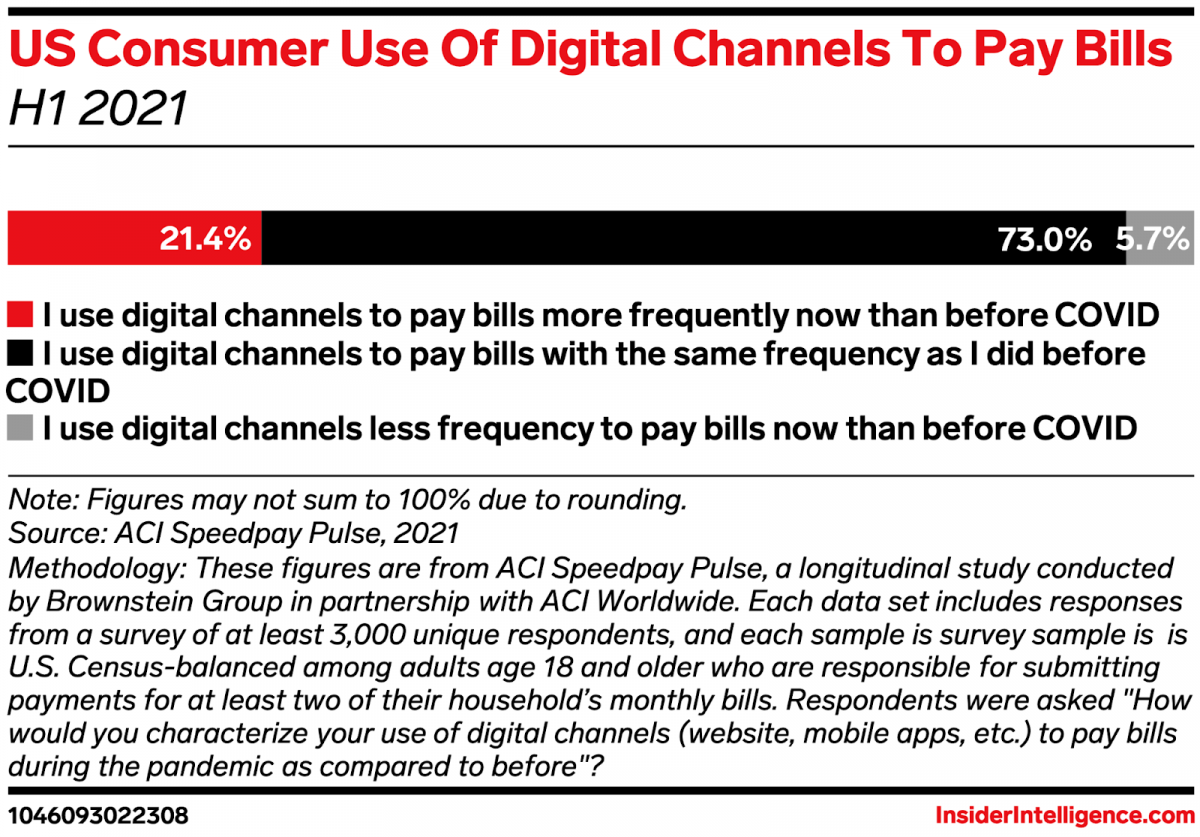

Why it’s worth watching: The US rental market is huge—and it’s prime for disruption as consumer appetite for digital bill payments rises.

- In 2019, renters made up 36%—approximately 44.2 million—of US households, according to Pew Research. That same year, they paid a whopping $512.4 billion in rent, per Zillow.

- More recently, the rental market has seen higher demand for digital payment options, likely triggered by a need for faster payments and the rise in contactless transactions during the pandemic. The percentage of digital rent payments almost doubled from 17% in Q4 2019 to 33% in Q4 2020, per data from Zego.

- There’s also been more innovation in the space: For instance, Mastercard recently introduced the Bilt Mastercard credit card, which offers perks like 2x points for rent payments.

The opportunities: Till’s new features can help it further penetrate the rental market and could make it a leader in the space as the market undergoes digital transformation.

- Till’s Credit Builder feature incentivizes on-time payments by helping renters build their credit. Alternative credit-building tools like those offered by Credit Sesame and card issuers are bringing more consumers into the credit system, increasing their access to key financial services. Credit Builder can further that initiative and help Till pull in more customers.

- And the Budget and Save tool’s installment payments offer customers more payment flexibility. The feature is similar to many of the buy now, pay later solutions that have grown popular amid the past year’s pandemic-induced financial uncertainty. Letting customers pay their rent in short-term installments can help Till build good customer relationships, which could lead to more platform engagement.

- The solutions can help landlords get paid faster and reduce missed payments, making it an appealing partner. Till’s new features could draw more landlords to its network if it demonstrates that it can reduce escalating unpaid rents: The share of unpaid rent balances more than doubled from 1.9% in 2019 to 4.5% in 2020, per Zego—adding cash-flow pressure on landlords.

Related News

- 03:00 am

First Ever Communications Network Brings Banks and Law Enforcement Together to Fight Back Against Fraudsters

FiVerity, a leading provider of cyber fraud defense, today announced the launch of the Cyber Fraud Network™, the industry’s first collaborative system built to combat the convergence of cyber tactics with fraudulent theft. FiVerity’s Cyber Fraud Network improves the collective cyber fraud knowledge of financial institutions, regulators, and law enforcement by facilitating the secure exchange of intelligence on suspected fraudsters without disclosing personally identifiable information (PII).

This revolutionary information-sharing network gives financial institutions the industry’s first secure method of sharing the critical details that make it easier to effectively combat synthetic identity fraud (SIF). In this growing financial crime, criminals combine information taken from social media and compromised identities available on the dark web to create entirely new, fraudulent identities. These identities are then used to infiltrate consumer lending institutions and steal billions of dollars. SIF is one of the fastest-growing financial crimes and is responsible for a growing number of credit losses. In 2020 alone, FiVerity estimates SIF cost U.S. financial institutions $20 billion.

Using AI and machine learning solutions, the network detects sophisticated forms of cyber fraud and delivers actionable, proactive threat intelligence to banks and law enforcement agencies. For years, fraudsters using a single synthetic identity have been able to create accounts at multiple institutions, with little fear of being caught. Now, the network can help prevent this through information sharing, while keeping PII safe.

As noted by The Federal Reserve in its July 2020 Payment Fraud Insight paper, “No single organization can stop synthetic identity fraud on its own. Fraudster tactics continually evolve to stay a step ahead of detection – and the most sophisticated fraudsters can operate at scale in organized crime rings, generating significant losses for the payments industry. It is imperative that payments industry stakeholders work together, share information and keep up with the threat.”

The Cyber Fraud Network, which can be accessed through simple and secure API integration, strengthens each user’s defense by alerting them to fraudulent activity detected throughout the network. This multiplies each user’s ability to identify - and learn from - new fraud patterns. In addition to providing ongoing defense, FiVerity offers a fast and lightweight portfolio analysis to identify SIF accounts within existing portfolios.

“Financial institutions - from the smallest community bank to the largest global lender - all understand the severity of the cyber fraud problem,” said Greg Woolf, CEO of FiVerity. “Until now, they’ve been uncertain about what information they can share without violating privacy regulations or other security rules. Many also worry about giving up a competitive advantage when sharing customer data. FiVerity’s Cyber Fraud Network was created to solve these problems and give financial institutions the tools they need to share information without violating their customers’ privacy.”

The network’s “double-blind” approach splits the encryption key across members, so that no single institution holds the complete key to decrypt PII data. This allows financial institutions to maintain complete confidence in the security of their customer data, as the only companies that can validate a shared profile are the ones that already possess the corresponding PII.

For more information about FiVerity’s Cyber Fraud Network, please visit fiverity.com/cyber-fraud-network.

Related News

- 04:00 am

SavvyMoney, the leading provider of a fully integrated credit score solution that provides credit scores, reports, and actionable insights directly from a financial institution’s online and mobile banking platform, today announced the launch of its 500th financial institution partner. By partnering with both digital banking platforms and financial institutions, this fast-growing fintech is leveraging its strengths in the credit score and technology sectors to bring financial education to consumers via their trusted financial institution across the United States.

More than 35 digital banking platforms have selected SavvyMoney to seamlessly integrate into digital banking, adding additional value and functionality to end-users. Financial institutions are then able to deliver SavvyMoney’s solution to their end-users via their digital banking platform. The industry-wide adoption of SavvyMoney’s engaging platform highlights the power of the solution. SavvyMoney’s partners share a common goal of elevating their personalized digital banking experience. Each financial institution partner is committed to providing next-level, personal financial wellness.

“We are excited that so many financial institutions have trusted SavvyMoney to be their credit score, personalized loan offer, and analytics marketing solution,” said JB Orecchia, CEO and President of SavvyMoney. “Knowing these partners depend on SavvyMoney to push the needle from a technology, credit, and financial wellness perspective fuels us to keep innovating.”

“The strong adoption of SavvyMoney’s agile platform highlights the confidence financial institutions have in their solution,” said Jonathan Price, EVP Emerging Businesses, Corporate & Business Development at Q2. “Leveraging Q2’s Innovation Studio, the implementation between our platform and SavvyMoney was quick and easy. We’re proud to offer SavvyMoney to our financial institutions and are excited for their continued growth.”

Founders Federal Credit Union, the 500th financial institution partner to go live with the SavvyMoney solution, is a Q2 customer that implemented SavvyMoney via the integration.

“Founders Federal Credit Union is honored to be the 500th partner,” says Nicki Nash, Chief Marketing Officer at Founders. “We take pride in offering this cutting-edge technology and look forward to discovering new insights as we examine the data. We plan to launch a digital loan recapture campaign in the coming months and really leverage SavvyMoney analytics for maximum return on our investment.”

Further enhancements and exponential growth are expected as SavvyMoney continues to partner with financial institutions to drive deeper relationships and engagement in digital banking through financial wellness.

Related News

- 06:00 am

MSA and 88mph co-lead on seed round as pawaPay expands payments infrastructure across Sub-Saharan Africa

African payments company pawaPay, has secured a $9m Seed raise. The round was co-led by MSA and UK-based investment fund 88mph, with participation from Vunani Capital, Kepple Ventures and Zagadat Capital. The capital will be deployed to scale pawaPay’s operational presence, find more talent to join the team, and expand into new markets on the continent.

Founded in 2020, pawaPay is focused on the mobile money infrastructure provided by telecommunications companies (telco) in Africa. Each telco in each country provides its own unique mobile money product, which makes the mobile money infrastructure as a whole - across borders and telcos - highly fragmented and opaque. For merchants, this fragmentation means that it is unnecessarily expensive to use and frustratingly unstable. Through pawaPay’s simple API, merchants can access more than 300 million customers in more than ten markets and enjoy seamless, transparent and highly reliable payments.

pawaPay’s customers are large Pan-Africa/global merchants and companies needing to make payments to African consumers’ accounts. Payments in Africa have long been made difficult by large unbanked populations, declined credit card transactions, charge-backs, fraud, dropped and lost payments, and slow cross-border settlements. The alternative financial infrastructure created by the telco-led mobile money wallets now has more than half a billion registered accounts in Africa, making it both one of the largest financial infrastructures in the world and one of the most under-developed. pawaPay has positioned itself as an industry leader in high volume mobile money payments and focuses on delivering reliability and transparency for merchants wishing to connect to the customers on the continent. With a single API, pawaPay’s customers can access all telco mobile money systems and thus receive and send payments to hundreds of millions of people. pawaPay handles local operations, compliance, regulatory cover and bank accounts, making it as simple as clicking a button to start receiving payments in a new market. pawaPay is already successfully handling millions of transactions on its rails per week and has operations in 10 countries.

Commenting on the company’s raise and growth prospects, Nikolai Barnwell, CEO of pawaPay said, “Africa’s alternative financial infrastructure is in an exciting phase with double digits CAGR everywhere. And mobile money has come out as the de facto money infrastructure for hundreds of millions of people on the continent. A quarter of the adult population is an active mobile money user. A third of all wallet holders have their salaries paid into them. We’re making a bet that this infrastructure will continue to grow and offer a superior experience than traditional financial infrastructures such as card and banking. With more than 500 million registered users on the continent - 200 million of which are active frequent users, this isn’t a fringe fad or a stepping stone to cards and swift payments. This is an example for the rest of the world of how payments could - and should look. Most of our competitors are largely focused on bank and card payments; but over the past many years we have been laser focused on addressing the unique set of challenges that accompanies specializing in mobile money. I think this gives us a good position to explore the opportunities that are coming up as this alternative financial infrastructure continues to grow.

“We are excited to have world-class investors supporting our vision to connect every mobile money wallet in Africa to each other, and the rest of the world, as we continue to make it simpler to do payments”.

Kresten Buch, Founder of 88mph, added “When we first invested in Africa in 2010, one of the key drivers was that mobile money was a superior payment method to credit and debit cards when used for online payment. So, we are excited to be an investor in pawaPay’s journey and continue to witness the development of digital infrastructure in Africa''.

Mr. Eazi, singer, songwriter, entrepreneur and Founder of Zagadat Capital, added: “Being investors hugely focused on Africa and very familiar with the landscape, we believe that mobile money focused fintech is not just one of the most exciting places to invest but also one of the most important bridges to ensuring financial inclusion of the billions of people across the continent, the kicker for us was that we believe in the clear mission, vision and strategy & we are confident that the pawaPay team is the best team to achieve it”.

Related News

- 08:00 am

iQSTEL, Inc. (OTCQB: IQST) today announced achieving $5.23 Million in revenue for the month of July based on preliminary accounting. The July 2021 revenue exceeds the July 2020 revenue by 21%. The company has exceeded $5 million in revenue now for four consecutive months.

iQSTEL Inc. (OTCQB: IQST) (www.iQSTEL.com) is a US-based publicly-listed company with an Independent Board of Directors offering leading-edge Telecommunication, Technology and Fintech Services for Global Markets, with presence in 15 countries. The company provides services to the Telecommunications, Electric Vehicle (EV), Financial Services, Chemical and Liquid Fuel Distribution Industries. iQSTEL has 5 Business Divisions: Telecom, Electric Vehicle (EV), Fintech, Technology and Blockchain, with worldwide B2B and B2C customer relations operating through its subsidiaries: Etelix, SwissLink, QGlobal SMS, SMSDirectos, Global Money One, IoT Labs and itsBchain. The Company has an extensive portfolio of products and services for its clients: SMS, VoIP, international fiber-optic connectivity for 5G, Cloud-PBX, OmniChannel Marketing, EV Batteries, EV Chargers, EV Battery Management System, EV IoT Connectivity, Mobile App For EV Connectivity, EV Dashboard Display, Visa/Mastercard Debit Card, Cryptocurrency Exchange Services, Money Remittance, Mobile Top Up, IoT Smart Gas Platform, IoT Smart Tank Platform, Mobile Number Portability Application MNPA (Blockchain Platform) and Settlement & Payments Marketplace SPM (Blockchain Platform).

Safe Harbor Statement: Statements in this news release may be "forward-looking statements". Forward-looking statements include, but are not limited to, statements that express our intentions, beliefs, expectations, strategies, predictions or any other statements relating to our future activities or other future events or conditions. These statements are based on current expectations, estimates and projections about our business based, in part, on assumptions made by management. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. Therefore, actual outcomes and results may, and are likely to, differ materially from what is expressed or forecasted in forward-looking statements due to numerous factors. Any forward-looking statements speak only as of the date of this news release and iQSTEL Inc. undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date of this news release.

Related News

- 03:00 am

TIBCO Receives Highest Possible Scores in Natural Language Query, Cloud Connectivity and Hybrid Environments, and Four Other Criteria

TIBCO Software Inc., a global leader in enterprise data, empowers its customers to connect, unify, and confidently predict business outcomes, solving the world's most complex data-driven challenges. Today, TIBCO announced it was named a Leader in The Forrester Wave™: Augmented BI Platforms, Q3 2021 report. The study analyses vendors’ strengths in augmented business intelligence (BI), evaluating companies through rigorous research across 25 criteria.

“The worlds of BI, analytics, data science, and data management are colliding and converging, as we innovate and adapt to rapidly changing business ecosystems,” said Michael O’Connell, chief analytics officer, TIBCO. “This position as a leader in augmented BI adds to TIBCO’s recognition by top analyst firms as a leader in analytics. We see this as confirmation of TIBCO’s hyperconverged analytics vision, where the combination of visual analytics and data science with real-time data results in smarter decisions and high-value business outcomes.”

The Forrester Wave™: Augmented BI Platforms, Q3 2021 gave TIBCO the highest possible scores in the criteria of machine learning for citizen data scientists, machine learning functionality for data scientists, natural language query, cloud connectivity and hybrid environments, and translytical low-code app development.

According to the Forrester report, “TIBCO Spotfire fuses all advanced analytics — data science, geolocation, streaming. TIBCO Spotfire packs a formidable set of advanced capabilities in a single platform – an impressive number of complex, highly interactive data visualisations (a differentiator that reference customers point out); advanced geospatial, graph, and network analytics; and about a dozen pre-packaged ML models. The product also includes Spotfire Data Streams, a highly differentiated streaming analytics capability that can be set up simply by connecting to a streaming data source, while most competing platforms require additional integration efforts to achieve the same capability.”

TIBCO Spotfire 11 delivers embedded data science workflows, opening up its use by non-developers, while Spotfire Mods assists in enabling low-code development for tailored, visual analytics applications, speeding customer innovation. More than just a BI dashboarding solution, Spotfire scales across any size enterprise, meeting simple or advanced use cases and serving the full spectrum of forward-thinking, data-driven users, including analysts, citizen data scientists, and data scientists. TIBCO continues to add innovative enhancements, including a generational set of immersive, smart, and real-time analytics capabilities. This increases business value by compressing the time from business events to analytics, insights, and action.

Related News

- 02:00 am

|

|

|

|

|

|

|

Related News

- 09:00 am

Beats Expectations, Gradually Expands from Payment to Digital Technology-Enabled Business Services

Yeahka Limited ("Yeahka" or the "Company") (Stock Code: 9923), a leading payment-based technology platform in China, is pleased to announce the interim results for the six months ended 30 June 2021 (the "Reporting Period" or the "first half").

Financial Highlights

-- During the Reporting Period, the Company's total revenue reached RMB1,402 million, representing a YoY increase of 30.2%. Revenue from technology-enabled business services increased rapidly by 86.6% to RMB358 million.

-- The Company recorded net profit of RMB291 million, growing 30.7% YoY; adjusted net profit grew 142.2% YoY to RMB318 million. Earnings per share was RMB 0.71.

-- Revenue of the Company's SaaS digital solutions was nearly RMB27.34 million, an increase of 134.3% YoY.

-- Revenue from fintech services amounted to RMB42.72 million, representing a YoY increase of 18.7%. The total amount of loans that the Company facilitated was approximately RMB537.3 million, with a weighted average tenure of 10.2 months.

-- Precision marketing services revenue was RMB240 million, an increase of nearly 68.5% YoY.

-- The newly launched in-store e-commerce service recorded revenue of RMB44.95 million.

Operational Highlights

-- The total gross payment volume ("GPV") of the payment services has recorded significant growth and exceeded RMB990.4 billion, up 56.1% YoY. Of which, app-based payment services GPV increased by 72.9% YoY, accounting for 61.8% of total GPV, up from 55.8% in the same period of last year. The peak daily count of QR code payment transactions was nearly 42 million.

-- The scale of merchants and consumers traffic within the Company's ecosystem has continuously fueled the rapid growth of technology-enabled business services. The number of technology-enabled business service customers reached 1.69 million representing a YoY increase of 188.9% in the first half of 2021.

-- For the newly established in-store e-commerce platform, the number of paid consumers was more than 1.42 million and the gross merchandise value ("GMV") from the platform exceeded RMB71 million.

Mr. Luke Liu, Chairman of the Board, Chief Executive Officer and Executive Director of the Company, said, "The recovery of China's real economy in the first half of 2021 has provided Yeahka a perfect opportunity to expand its business from payments to digital technology-enabled services. With that we continued to innovate and meet the diverse needs of merchants and consumers. Regarding the merchant ecosystem, the number of active payment service merchants increased 30.6% year-on-year ("YoY") to approximately 6.13 million. For the consumer ecosystem, by focusing on small and high-frequency purchases for offline payment services case scenarios, the number of consumers reached via our merchant ecosystem grew by 67.2% YoY to 822.4 million. Through the continuous innovation of our mobile payment and technology-enabled business services, we cater to the needs of merchants and consumers alike. On commercial digitalization, we focus on improving the operating efficiency for our merchants. To achieve this, we continued to optimize and upgrade our self-developed SaaS digital solutions through deployment of a series of upgrade modules which help enhance the stores' economics. Moreover, on top of helping merchants improve their brand awareness through our marketing services, we are also dedicated to improving merchants' sales directly. In achieving this, we launched the in-store e-commerce service, where merchants can now easily create various forms of promotions to connect millions of consumers through our online and offline sales network.

Mr. Liu continued, "Technology-enabled services continued to grow rapidly, the number of technology-enabled business service customers surged 189% YoY, and its gross profit contribution also increased significantly to 43.5%, from 34.9% in the same period last year. The Company's growth of payment traffic has significantly accelerated in the first half of the year through building a diversified channel system and attractive fee rate policies, which support business enablement, consumer insights and outreach. With our full confidence in the Company's growth strategy and focus to incentivize our core talent, the Company recently announced a share purchase program of up to a total of US$100 million. The repurchased shares will be used for the issuance of restricted shares to outstanding employees.

Outlook

We are committed to establishing a commercial digitalized ecosystem with strong self-reinforcing network effect. Based on its favorable initiatives for different brands, merchants, consumers, marketing personnel, advertisers and other participants, the Company conducts cross-selling for participants across its entire ecosystem to maximize monetization and facilitate the growth and success of the digital economy.

In the future, the Company will continue to explore the value of traffic and data derived from payments, led by its experienced production and research team in order to extend the boundaries of its business and promote technology innovation and digital solutions among merchants and consumers. The Company will also strive to become an integrated internet service provider and create sustainable long-term value for shareholders, employees and society.

Related News

- 07:00 am

ThycoticCentrify, a leading provider of cloud identity security solutions formed by the merger of privileged access management (PAM) leaders Thycotic and Centrify, today announced enhancements to its PAM solution for DevOps, Thycotic DevOps Secrets Vault. The latest version offers certificate-based authentication and the ability to configure Time-to-Live (TTL) for secrets, leading to even tighter DevOps security and easier management.

“With the latest enhancements to Thycotic DevOps Secrets Vault, we’re continuing our commitment to deliver usable security solutions,” said Richard Wang, Director of Product Management at ThycoticCentrify. “Today’s organizations require a DevOps solution that’s as agile as their development while satisfying the needs of IT and security teams.”

Certificate-based authentication designed for privileged machines

Thycotic’s DevOps Secrets Vault addresses all scenarios in a DevOps flow where secrets are exchanged between machines, including databases and applications for software and infrastructure deployment, testing, orchestration, configuration, and Robotic Process Automation (RPA). In sync with the high-speed workflow, DevOps Secrets Vault creates digital authentication credentials that grant privileged access to systems and data.

With the latest release, organizations can use certificate-based authentication for enhanced security and easier management. Unlike authentication solutions designed for people (such as biometrics and one-time passwords), certificate-based authentication can be used for machines – non-human privileged users such as systems, devices, and the growing Internet of Things (IoT) – to identify a machine before granting access to a resource, network, or application. Certificates are stored locally and securely, which alleviates the headache of managing passwords and distributing, replacing, and revoking tokens.

Time-to-Live eliminates standing secrets for all cloud platforms

In a DevOps workflow, resources are created quickly and must expire automatically to meet compliance requirements and avoid the risk of standing privilege. When cloud platform administrators, developers, applications, or databases need to access a target, DevOps Secrets Vault generates just-in-time, dynamic secrets.

DevOps Secrets Vault has long supported automatically expiring secrets for AWS and Azure, and now extends this capability to Google Cloud Platform. Now, no matter which environment organizations choose, they can set a predetermined time for secrets to expire automatically.

“Security and identity teams are working in lockstep with DevOps to meet the requirements of these high-speed processes,” said Wang. “They require a powerful solution that delivers immediate value while serving the needs of agile innovation.”

Combined with Thycotic Secret Server, the industry-leading vault for digital credentials, DevOps Secrets Vault provides security and IT teams full visibility and control over secrets management throughout an organization. Specifically, DevOps Secrets Vault replaces the need for hardcoded credentials used in the DevOps process and CI/CD toolchains.

Related News

- 09:00 am

Anderton, an investment company whose shareholder is Gamma Capital Markets - renowned, independent Italian asset managers - announces the launch of the Challenger Impact High Income Fund to raise a minimum of 15 million EUR in its first initial offering period from investors seeking opportunities in early stage companies, focused on innovation and environmental impact. Gamma Capital Markets manages over EUR 1.2 billion of European clients and is present in 5 countries.

- We intend to put investors’ money to work in the world of neutral interest rates. Challenger Impact High Income Fund is one of the first funds that give investors access to private market investment opportunities through subscription to an open-end fund, with potential return on investment significantly beating other asset classes

- says Pawel Osowski, director at Anderton SICAV plc.

-Our investment objective is to achieve mid-term capital growth, with a minimum of 3x cash on cash return on investment, 44% of IRR- with a 3-4 years horizon. Historically PE/ VC industries yield an average of 25~30%, depending on the vintage years – says Pawel Osowski. The Challenger Impact High Income Fund allows investors to achieve absolute returns in the venture capital field, based on short and mid-term investments. The Fund opens doors to opportunistic off-market deals - VC, pre-IPO, minority growth capital - and provides a safe harbor by operating in a licensed and heavily regulated scheme available for subscription through select brokerage houses throughout Europe

- The fund will invest in early-stage global businesses and SMEs within sectors proving above average growth potential. We provide financing to chosen, impactful companies in exchange for an equity share, combined with Revenue Based Investments - working capital in return for a fixed percentage of on-going gross revenues. The fund's investments focus on areas related to biotechnology, medical technologies (including diagnostics), technological innovations in sport, information security, supply chain and the transportation and communications market – says Jasper de Trafford, director at Anderton SICAV plc.

The fund’s impact investment strategy is aimed at investors who seek a capital investment that will make a positive environmental and social impact in addition to its economic objective of midterm high-yield returns – says Jasper de Trafford, director at Anderton SICAV plc. Venture capital is an attractive asset class due to the ability to get early access to potential market leaders of tomorrow, as well as generating strong returns for investors at a comparatively lower risk.

The fund’s impact investment strategy is aimed at investors who seek a capital investment that will make a positive environmental and social impact in addition to its economic objective of midterm high-yield returns – says Jasper de Trafford, director at Anderton SICAV plc. Venture capital is an attractive asset class due to the ability to get early access to potential market leaders of tomorrow, as well as generating strong returns for investors at a comparatively lower risk.

- Venture capital is also not as cyclical as most investors think, providing consistent strong returns through market cycles. Although individual venture capital investments are higher risk than public equity markets, venture capital portfolios are not.In fact, over the past 10 years, venture capital has been less volatile than public markets - says Joanna Stec-Gamracy, former country head for BlackRock and investment committee member at Anderton SICAV plc.

- Alternatives such as PE and VC is the fastest-growing asset class forecasted at 15.6% growth in AUM through 2025, with CEE markets taking the lead. We know these markets very well as we have spent several years advising, investing and starting companies within them– says Richard Piotrowski, director at Anderton SICAV plc. Anderton came up with an innovative idea for tapping an increasing retail demand for private equity and venture capital investments. - We believe the “Challenger Impact High Income Fund” is a creative way to provide eligible investors access to private equity investment opportunities, hopefully giving us a competitive advantage – says Joanna Stec-Gamracy.

The number of similar funds globally is estimated to be around 200. To put this into context just how innovative of a structure this is in VC, there are over 10,000 investors globally classified as “Venture Capital” funds. Despite investing in disruptive and innovative industries, the landscape of VC fund structures has largely remained unchanged. The fund is an open-end investment structure with only 3 years of capital freeze, whereas regular VC investments usually require 8 years of capital lock down. Investors may subscribe for, convert or redeem shares in a sub-fund, based on redemption regulations, directors notice and/or fund performance. Open-end structures make it easier for investors to invest due to the cleaner and more transparent subscription and monitoring process.

Anderton SICAV plc is headquartered in Malta with significant operations in Warsaw (with a special focus on CEE countries), strategic partnerships in Monaco and Italy, and an outpost in Canada. This gives the company significant leverage, yet flexibility of an agile organization.

Venture capital is also not as cyclical as most investors think, providing consistent strong returns through market cycles. Although individual venture capital investments are higher risk than public equity markets, venture capital portfolios are not.In fact, over the past 10 years,venture capital has been less volatile than public markets - says Joanna Stec-Gamracy, former country head for BlackRock and investment committee member at Anderton SICAV plc.

- Diversifying our assets from a geographical perspective means that our investment portfolio is spread across many different locations around the world in order to reduce risk and improve returns. We view risk primarily as the prospect of losing our clients’ capital, rather than any shortterm volatility or tracking error. Our target investments selection process is core to the management of risk – says Doreen Micallef director at Anderton SICAV plc

The fund’s Investment Manager and shareholder - Gamma Capital Markets Ltd - has approximately 1,2 bn EUR in assets under management. The group is independent of banks and other financial intermediaries, without any conflicts of interest. Gamma's business is 70% institutional and 30% retail and exposure of the firm's client portfolios accounts for 70% towards alternatives. Anderton, alongside Gamma Capital Markets, employs a proactive, research-based approach to investing.

Anderton is a company formed and advised by a group of skilled professionals with a broad range of expertise in the area of financial markets, having worked for BlackRock, HSBC Private Bank, GE Capital, JPMorgan, Merck, IBM & Alpha Value. The fund supports portfolio companies in a variety of ways - providing strategic counsel and arranging senior-level development or M&A introductions.

We are very much interested in opportunities in Central and Eastern European Countries. The highly- educated, young, technologically savvy, affordable talent-pool in the CEE means there is yet ample opportunity for investors to get on the next big thing. The emergence of a developing ecosystem has been underscored by investors to date – says Eros Lombardo, CEO of Gamma Capital Markets, Anderton SICAV plc shareholder.