Published

- 01:00 am

The aim of the solution is to provide researchers and companies with funding to create Blockchain solutions that contribute to trust in social media content.

In the context of TruBlo and led by Worldline, a consortium of six European partners with different profiles and capabilities has been formed. Among the members of the consortium are the Blockchain experts from Athens University of Technology; ATC, a company specialized in the development of technologies and a specialist in detecting and combating fake news; Deustche Welle, the German public international broadcasting company that provides services in 30 languages; F6S, the world's largest community of startups and SMEs; and ALASTRIA, a Spanish Blockchain infrastructure provider.

The registration period for the 2nd Open Call was opened on June 14th and will last until September 10 at 12:00 noon. We encourage the participation of all stakeholders interested in deepening their research into solutions that boost trust in social networks and develop their own MVP. (https://www.trublo.eu/apply/)

In the first call held between January 18 and March 11, 2021, 79 proposals were submitted from countries across Europe, from which the 10 best proposals were selected to enter the TruBlo programme. Among the selected teams are mainly SMEs and academic research teams, with proposals focused on the provision of mechanisms that promote the reliability and trustworthiness of content in various areas and with a possible practical application in the near future along with its launch in the current market.

A brief description of the projects selected in the 1st Open Call can be found on the project website. (https://www.trublo.eu/

Now begins an exciting 9-month journey in which each of the teams, supported by a mentor from the consortium, will start their research tasks using the technological infrastructure provided by TruBlo, as well as the technical support and market orientation services that will enable them to achieve a successful outcome after the end of the TruBlo funding period.

According to Toni Paradell, R&D Manager of Worldline Iberia & TruBlo Project Coordinator: "After the success of Open Call 1 in which we have selected 10 very innovative projects that will receive support and funding from the TruBlo programme over the coming months, we have just opened Open Call 2 for which we hope to receive very innovative proposals based on Blockchain technology that contribute to the trust and reliability of content on social networks and the Internet".

Related News

- 05:00 am

Leading fintech enablement partner, Ukheshe Technologies has announced a new partnership with global next-generation card solutions and digital security company, dzcard. The partnership will enhance dzcard’s customisable solutions for various digital ecosystems and locations.

The partnership will leverage Ukheshe’s Eclipse API platform and its market leading digital payments solutions, allowing both companies to deliver digital strategies within their respective markets.

Donovan Drew, President: Asia-Pacific of Ukheshe says the company’s digital payments enablement platform has expanded and evolved significantly as the financial services market seeks innovative solution providers that can address fundamental payment gaps. “The partnership will provide further channels for dzcard to expand upon within the existing customer base and remain current in the fast-evolving digital payments domain. With this Ukheshe will expand its footprint into Asia Pacific.”

He adds the partnership is a natural fit for both organisations through the combination of Ukheshe’s position as an award-winning digital payment platform provider and dzcard’s influence as leaders in secured smart card solutions and digital security.”

Sutat Suksawat, Managing Director of dzSolution at dzcard says “At dzcard, we aim to address the changing needs of our customers who are craving advanced services and seamless experiences. By fusing the physical and digital spaces, customers can enjoy secured cashless payments solutions. With this partnership, Ukheshe and dzcard bring a unique service offer in terms of accessibility, availability and usability to customers from fintech to financial institutions reinforced with reduced time-to-market, good cost-effectiveness, and a customer-first approach.”

Currently Ukheshe provides the platforms and technology that support nine issuers comprising four telcos, six banks and fintechs, 334 029 merchants and 2 271 880 apps.

Related News

- 03:00 am

We gathered perspectives from executives at incumbent banks and cutting-edge vendors who are helping to shape the key digital account opening (DAO) trends. Here are two of the major takeaways from our discussions:

Analog account opening may see a moderate bounce back post-pandemic—but for DAO, the crisis was a watershed event.

What executives think: Kevin Kielbasa, head of business development at Narmi, said it’s likely that there will be at least “some bounce back in [branch] activity,” led by consumers who like face-to-face interaction or want to be helped through a transaction.

The degree to which the pandemic has cemented digital banking behaviors into consumers’ lives is not to be underestimated, however.

Fintech company nCino’s director of customer engagement Tatjana Bobic and its chief product officer Trisha Price expect that for simple deposit account types, there will be no analog bounce back at all. Bobic predicts:

- Physical channels will see regular ongoing use only for banks’ more complicated financial products.

- But even that usage is likely to peter out as digital applications become available for those offerings as well.

Insider Intelligence believes: The most profound effect of the pandemic on DAO may be increased use of digital channels to apply for complex financial products.

Looking at two major US incumbents that break out digital engagement—Bank of America and U.S. Bank—digital loan sales have spiked.

- Bank of America went from making only one in three loans through digital channels in Q1 2020 to making nearly half (49%) of loans via digital channels in Q1 2021.

- U.S. Bank was even more impressive, making 61% of loans digitally in Q1 2021 (up from 39% a year prior). The rapid growth of digital loan sales suggests that the pandemic may be converting consumers to digitally applying for more advanced financial products.

The competition for digital account opening will extend to driving primary bank status.

What executives think: FIs have set their sights on determining how to put their DAO processes to work alongside the rest of their digital offerings to drive primary bank relationships.

Gregory Brown, head of digital product management for growth and marketing at BMO, emphasized this, saying that that challenge is “a big focus, and it’s not just [BMO], it’s a lot of banks that have gone through the same evolution of driving a ton of [account opening] volume through digital, and then figuring out how those customers can be primary.”

Insider Intelligence believes: This is a top priority for neobanks—in particular as they strive for profitability and proof of the viability of their business strategies.

A huge majority (83%) of neobank account holders have a primary banking relationship with one of the top 20 US banks, according to data from Javelin Strategy & Research published in February 2021.

The long-term sustainability of neobanks will depend on their ability to turn the tables on incumbents.

For a deeper dive into what the trajectory of digital account opening will look like over the next few years for incumbent banks and digital challengers, read “Account Opening in the Next Normal: Digital Account Opening Interest Is Exploding, but Many User Experience Gaps Exist”

Related News

- 03:00 am

Netherlands-based acquirer and payment gateway Adyen reported $246 billion (EUR216 billion) in processed volume in H1, up 67% year over year (YoY), per its shareholder letter. Adyen’s processed volume growth in H1 outpaced the same period last year, when it increased 23% YoY, indicating that the pandemic-driven shift to digital payments has endured.

More key data: Other metrics underscore strong performance:

- Point-of-sale (POS) volume doubled YoY, hitting $26 billion (EUR22.8 billion) in H1 2021 and comprising 11% of total processed volume. Recent growth reflects a strong acceleration from H1 2020, when POS volume growth remained flat—and was likely spurred by global consumers returning to stores post-vaccine.

- Company revenue jumped 46% YoY, reaching $507 million (EUR445 million), up from the same period last year, when revenue increased 27%. Adyen pointed out that existing partners and regional diversification mostly drove that increase.

How we got here: Adyen identified three factors that helped achieve growth in H1.

- Minimal client churn and the addition of new ones. Adyen added big-name brands to its partner network, including Dick’s Sporting Goods, Nando’s, and Hunter. Growth from existing enterprise partners like AirBnB and Shein also translated into increased POS and processing volume for Adyen.

- Global expansion to support more merchants. In May, Adyen brought its acquiring business to Japan, and the following month to the UAE—two countries where ecommerce is expanding. It also obtained a US branch license, allowing it to expand its capabilities in the country and diversify its US business.

- Evolving consumer shopping preferences. The company pointed out that longer-term shifts in consumer shopping preferences—with consumers increasingly turning away from cash and adopting digital payments—continued to support business growth.

What’s next? New partnerships and further global expansion should help Adyen carry growth into the second half of the year.

Adyen recently partnered with Just Eat Takeaway, one of Europe’s biggest food delivery companies, to issue corporate meal expense debit cards, which come preloaded with allotted funds and can help employees to consolidate meal expenses. The partnership benefits Adyen by expanding its burgeoning issuing business and boosting its revenues.

Global expansion offers further opportunities, particularly in regions like Asia and the Middle East, where ecommerce is continuing to grow and Adyen’s presence is limited. Extending its reach can increase revenue-generating opportunities as global consumers continue to embrace digital payments.

Related News

- 06:00 am

Taoping Inc, a provider of blockchain technology and smart cloud services, today announces that its wholly-owned subsidiary Taoping Digital AssetsLimited and a Kazakhstan company Aral Petroleum Capital LLP have signed a memorandum of understanding ("MOU") to establish a joint venture in Kazakhstan, of which TDAA and APC will own 51% and 49%, respectively. TDAA will control the board of directors of the joint venture.

APC is an oil and gas exploration and development company operating in Kazakhstan, a wholly-owned subsidiary of CaspianEnergy Inc. It holds an exclusive license which entitles it to explore and develop certain oil and gas properties known as the "North Block", an area of 1,916 square km, and a production contract for the area known as "East Zhagabulak". With a strong industry position and integration experience, APC is able to ensure high-quality utility-scale electricity supply at a low cost to the joint venture.

The joint venture plans to invest and build cryptocurrency mining sites with a total capacity of 100MW, the first stage construction of 30 MW is expected to complete within three to six months. TDAA will have the priority to deploy cryptocurrency mining machines owned by TDAA or its partners. The joint venture will carry out operation and maintenance of cryptocurrency mining machines in Kazakhstan. In addition, the joint venture plans to rent out excess operating capacity to third parties for additional income.

On April 15, 2021, the Company announced that it has signed a Bitcoin mining machine purchase agreement with Bitmain Technologies Limited for the purchase of Antminer S19j Pro Bitcoin mining machines with a total hash rate of 300,000 TH/s. TAOP plans to deliver these mining machines to Kazakhstan for deployment once the construction of the mining sites is completed.

"We continue to look for global opportunities that can bring business growth. With year-round cool temperatures, low real estate and labor costs, and relatively low energy prices, Kazakhstan is becoming a crypto mining hub that currently ranks 3rd in the world in terms of hash rate power," said Mr. Jianghuai Lin, Chairman and CEO of TAOP, "We are working actively to capture current unique opportunity of the rapidly changing cryptocurrency mining environment to create value for shareholders."

Related News

- 09:00 am

Commenting on the news the limit on contactless payment will rise to £100, Matt Phillips, VP, Head of Financial Services at Diebold Nixdorf UK&I, says:

“The increase to the contactless payment limit emboldens the industry’s commitment to giving consumers choice over how they pay - whether that be by cash, card, wallet or contactless. It ensures that digital progression reflects the needs of the market.

“It represents timely action from the industry after the pandemic heightened appetite for contactless, as customers desired safety and efficiency when shopping. This move will widen the consumer usage of contactless payments while keeping a limit that protects their account. Any move that improves the service for customers, while enabling the digital evolution of the UK banking industry is a positive step, and a trend that we hope to see continue across the sector.”

Related News

- 06:00 am

To date, AllianceBlock has launched a number of working products, and has sealed partnerships and collaborations with leading players including Chainlink, Hedera Hashgraph, Ava Labs, Avalanche and the London Stock Exchange Group Partner Platform

AllianceBlock, the chain-agnostic protocol building compliant and data-driven products that improve the DeFi industry and enable financial institutions to access opportunities in decentralized finance, has today unveiled a new technical roadmap. The highly anticipated roadmap outlines the upcoming milestones that will bring AllianceBlock’s vision of bridging the gap between decentralized finance (DeFi) and traditional finance (TradFi) closer by remedying issues that exist in both spheres and linking the two worlds of finance together.

AllianceBlock is building the next-generation of financial infrastructure through an interplay of products designed to accelerate and galvanise the DeFi industry, as well as improve the current state of the traditional financial industry. Under AllianceBlock’s new technical roadmap, the company will release a comprehensive product suite that will contribute to the company’s vision of creating the comprehensive, financial infrastructure of tomorrow. In the past twelve months, the team has released innovative solutions including decentralized interoperability, white label liquidity mining campaigns and trustless user identification. These products have already been extended to some of the world’s top protocols including Ethereum, Avalanche, Binance Smart Chain and Elrond in a series of partnerships as well as strategic collaborations.

Rachid Ajaja, CEO and Co-founder of AllianceBlock, said, “We pride ourselves on being the first users of our own solutions. As DeFi veterans, we’ve spotted real challenges in the industry and used our product development to actively address them. At the same time, in the past 12 months we have seen monumental changes in institutional attitudes towards the digital asset industry from all facets of the global financial system and beyond. While the winds have changed, what the industry is still lacking is a stable channel to enable banks to trade digital assets legally, safely, securely, and in a fully compliant manner. That’s where AllianceBlock steps in. The release of our technical roadmap marks a new phase in our journey to bridge decentralized and traditional finance. Our team deals in real-world solutions, not just theory and we look forward to reaching new milestones, launching new products and upgrades, and making our vision a reality over the coming months.”

The products and milestones laid out in AllianceBlock’s technical roadmap are designed specifically to address the challenges faced by projects operating at the new intersection of traditional and decentralised finance. To counteract these challenges, AllianceBlock has designed a unique product suite, consisting of three layers: the DeFi Layer, the Data Layer and the Regulatory and Compliance Layer.

In the DeFi Layer AllianceBlock offers cross-chain interoperability with AllianceBlock Bridge, white label liquidity campaigns with AllianceBlock LMaaS (Liquidity Mining as a Service) and aims to reduce impermanent loss for traders with AllianceBlock DEX. Additionally, AllianceBlock Fundrs gives users access to a peer-to-peer lending protocol with a comprehensive data analytics dashboard for use in DeFi strategizing through AllianceBlock Terminal, the “Bloomberg of DeFi”.

In the Data Layer, AllianceBlock helps DeFi projects and traditional finance players to monetise and leverage mass amounts of data they produce through the AllianceBlock Data Tunnel.

In the Regulatory and Compliance Layer, AllianceBlock enables DeFi projects, protocols and DEXes to introduce scalable compliance frameworks that help them grow with regulation and open doors to institutional players to participate into DeFi with AllianceBlock TIDV (Trustless Identity Verification) and the AllianceBlock Cross-Border Regulatory Compliance Rules Engine.

DeFi projects need access to new liquidity and investment opportunities which AllianceBlock will provide through its LMaaS, AllianceDEX, and Fundrs offerings. At the same time, the industry cannot compromise on KYC compliance. AllianceBlock addresses this through its Trustless IDentity Verification (TIDV) framework. Once DeFi operates in this way, it will invite vast investment from traditional financial institutions. DeFi projects of all sizes will be able to benefit from decentralised and scalable interoperability through AllianceBridge, which will also serve as the connector between AllianceBlock’s partners, clients and extensive product suite. Finally, the vast amounts of valuable data they produce will be leveraged via the AllianceBlock Data Tunnel.

A range of products from the three-layer product suite will be released over the next 12 months. The full roadmap can be viewed here.

Matthijs de Vries, CTO and Co-founder of AllianceBlock, said, “With years of first-hand experience, our team knows the barriers traditional financial institutions are facing when it comes to accessing DeFi. We have built a protocol and supporting products aimed at empowering legacy financial institutions by solving those problems and providing compliant access to innovative DeFi investment opportunities. We know that traditional finance has standards. Our goal is to build these DeFi products with those standards built in, so players can save time, money, and increase efficiency without the need to worry about compliance. Our plan is ambitious, but so are we. We look forward to reaching new milestones and bringing our roadmap to life.”

The AllianceBlock vision has always been clear: to create a new generation of infrastructure providing the best of both worlds via a compliant gateway between centralised and decentralised finance. Led by an unrivalled leadership team experienced in traditional finance, DeFi, technology and software development, the company has been making huge strides in cementing its position as a hallmark player in the DeFi industry over the past three years through partnerships and collaborations with leading players including Chainlink, Hedera Hashgraph, Ava Labs, Avalanche, Elrond, Ocean Protocol, Injective Protocol, Orion Protocol, Edgeware, and many more, as well as joining the London Stock Exchange Group Partner Platform. AllianceBlock’s technology is being developed and leveraged by Devraaj, a technology and professional services provider.

For more information, visit https://allianceblock.io/

Rachid Ajaja, CEO and Co-Founder of AllianceBlock, and Matthijs de Vries, CTO and Co-founder of AllianceBlock are available for interview.

Related News

- 09:00 am

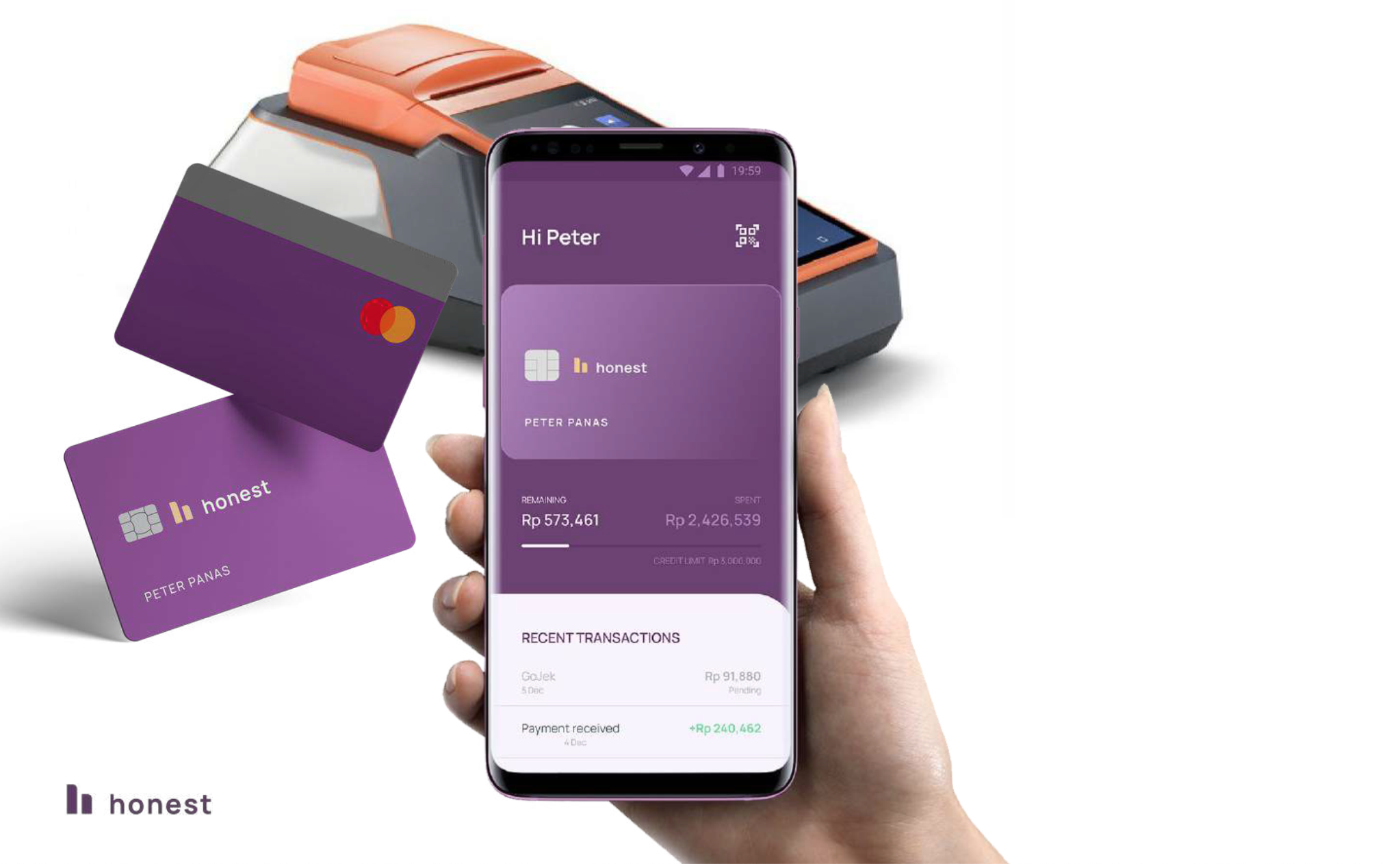

Honest Bank is building a credit product for the Indonesian market.

Digital Horizon Venture Fund invested in a Singapore fintech company Honest Bank during its series A round. The company raised a total of $19.7 million; the round was led by Insignia Ventures Partners and Digital Horizon VC. Digital Horizon invested $5.5 million.

Honest Bank aims to become a leader of the credit card market in South-East Asia. The project got off the ground in Indonesia where only 3% of the population have credit cards. Previously, the Honest Bank founders worked for investment banks, fintech-focused venture funds, and the Big Four firms. One of them, Peter Panas, led the Apple Card launch at Goldman Sachs. Another co-founder, Will Ongkowidjaja, founded Alpha JWC Ventures - a leading VC in Indonesia with a fintech focus.

The funding raised during the round will be used to receive a licence for credit card issuing. Honest Bank also plans to increase their headcount and open new offices in Bangkok and Jakarta.

“Although Honest Bank is a young company, we see that their team is able to achieve the declared goal - to build a new fintech giant in the Southeast Asian market. The share of online shopping is growing in this region, but there are still not enough modern technological credit products. Honest Bank may become an Asian Nubank,” says Alan Vaksman, the Founder and Managing Partner at Digital Horizon.

Related News

- 06:00 am

WNS, a global Business Process Management (BPM) company, today announced the formal launch of the Business Transformation After the Digital Tipping Point survey report in partnership with market research firm Corinium Global Intelligence. The survey respondents included more than 100 digital transformation leaders across organizations in North America, Europe, and Australia, gauging their priorities, challenges, and progress in their digital business transformation journey.

According to the respondents, the COVID-19 pandemic has both expanded and accelerated digital transformation initiatives. These include the optimizing and automation of both client-facing and back-office business processes, and the migration of data, applications and services to the cloud.

“90 percent of enterprises that didn’t accelerate their digital transformations in response to the pandemic have lost business as a result,” said Keshav R. Murugesh, Group CEO, WNS. “Clearly, advancing the digital agenda is ‘the’ priority in the new normal, with a focus on building AI and analytics-powered tools, capabilities and business models. WNS is a key strategic partner for organizations looking to drive true business transformation by deploying unique digitally led strategies, models, accelerators and critical skills.”

The study also highlights how the levels of digital adoption vary across industry verticals. While 28 percent of leaders stated that digital is now part of their company’s DNA, 30 percent are still in the process of scaling up successful digital transformation pilots.

In addition, enterprises are increasingly focusing on AI, data-driven approaches and analytics, and social media intelligence to fuel their digital transformations, specifically to optimize customer experience – a high-priority area. However, our survey also finds that many enterprises still lack the strong data governance and cybersecurity foundations required to take advantage of leading-edge digital technologies.

Related News

- 02:00 am

Tinkoff has been recognised for its innovative banking solutions as the Most Innovative Digital Bank in Central and Eastern Europe at Global Finance magazine’s 2021 World’s Best Digital Banks awards.

In 2020, Tinkoff unveiled its AI Banking strategy that aims to transform its customer offering through personalisation with the help of artificial intelligence across all products and services.

To that end, Tinkoff has expanded the use of AI across its financial and lifestyle services to provide tailored advice, interface personalisation, automation of repetitive financial tasks and interactive content that drives engagement and improves the customer experience.

Oliver Hughes, CEO of Tinkoff Group, commented:

“We are honoured to be recognised at the World’s Best Digital Banks awards for the seventh consecutive year. Tinkoff places tech innovation at the forefront of its efforts to revolutionise financial services. Winning this nomination is a testament to the innovation that makes the Russian tech industry a leader on the global stage, with Tinkoff being a significant contributor to this success.”

Winning banks were selected based on the following criteria: strength of strategy

for attracting and servicing digital customers, success in getting clients to use digital offerings, growth of digital customers, breadth of product offerings, evidence of tangible benefits gained from digital initiatives, and web/mobile site design and functionality.

The winners were chosen from entries evaluated by a world-class panel of judges at Infosys, a global leader in consulting, technology, and outsourcing. The editors of Global Finance were responsible for the final selection of all winners.

Joseph D. Giarraputo, publisher and editorial director of Global Finance, commented:

“With the global pandemic forcing people to conduct their personal and professional banking activities from their phones, tablets and computers, digital banking took on an importance and prevalence far beyond anything that had come before. Banks were forced to respond to this drastically altered landscape, and those that met the challenge most successfully are being honored as Global Finance’s World’s Best Digital Banks 2021.”