Published

- 04:00 am

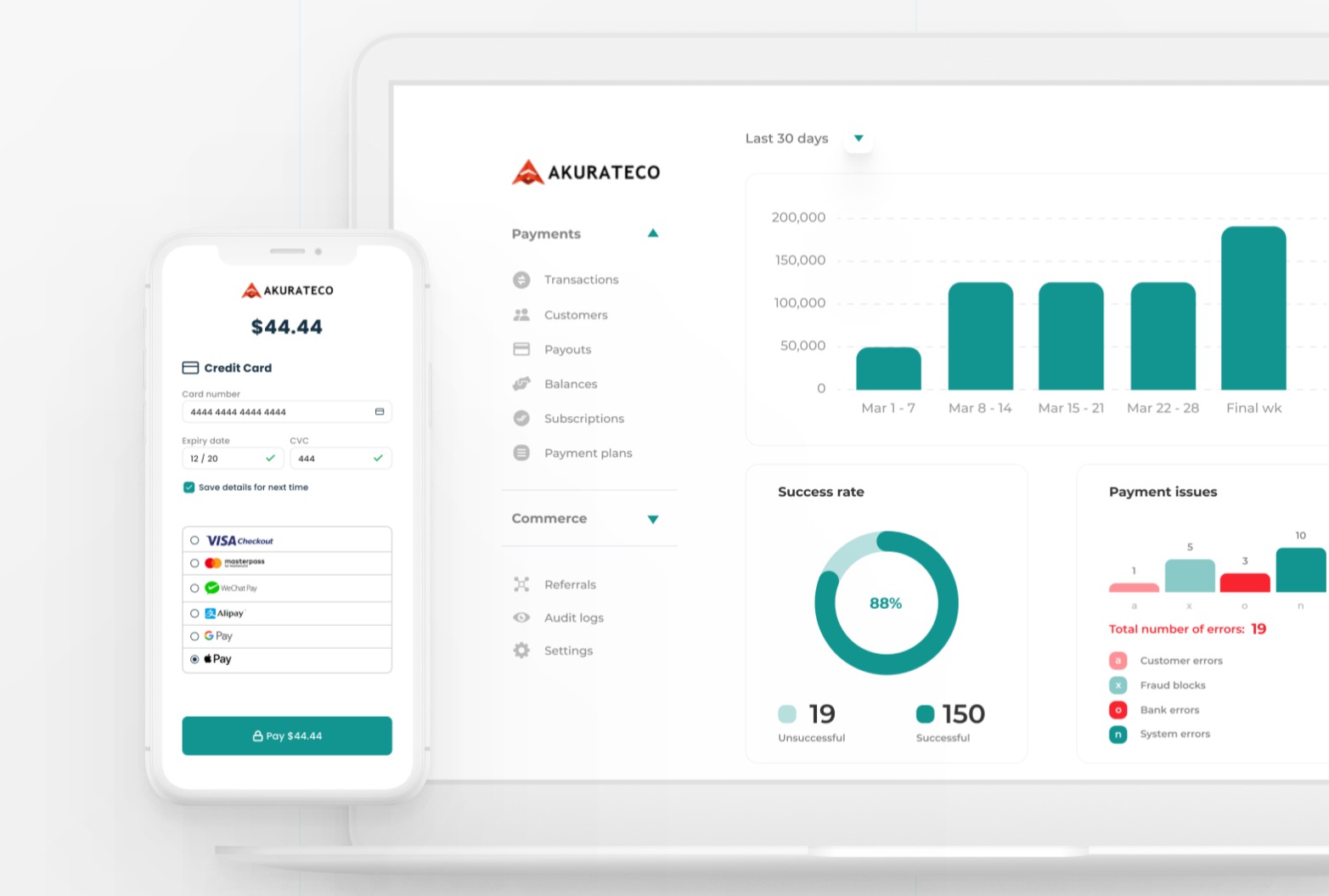

If it feels like somewhere in the middle of your payments department, there is a hidden black hole, invisible yet very real, and your budget seems to disappear there month after month, consider it a sign. A sign that it is time for you to switch your payment provider and instead opt for a white-label payments orchestration platform like the Netherlands-based Akurateco.

In fact, a lot of companies start with it right away. The thing is that this solution allows you to save money on the development, get immediate access to the cumulative experience and expertise of the provider’s payments team, and lay your hands on a multitude of payment connectors with a single integration.

In this guide, we’ll help you identify cues showing that it’s time for you to make that change and walk you through the change process step by step.

When should you start looking for a white-label solution?

- It got too expensive.

Disclaimer: At no point in your payment processing storyline will the service be cheap. In fact, if you decide to build the product on your own, you’ll have to pay between 105.000 and 420.000 USD for it. This includes a team of seasoned developers working on your payment gateway’s development for about 6 to 24 months depending on the functionality. We talked about it in detail in our recent research.

However, if you notice that over time the overall budget for maintaining both your gateway and your team goes through the roof, it’s a red flag meaning it’s time for you to look into your payment provider choice and maybe even consider a WL solution. - The tech team no longer meets your expectations.

As your business grows, so do your sales volumes. And a team that was managing your transaction flow at the beginning of your path seems to be dropping a ball with the growing payment intensity.

That’s when a white-label payment platform comes in handy. Besides offering a variety of connectors and an omnichannel payment experience, WL solution also serves as an outstaffed technical team for your company. As a result, you get access to an expert team of payment experts acting as a technical team for your company. They help you take care of integration and maintenance as well as keep you in the loop on the latest upgrades of the system. - You need a system upgrade.

You can’t afford outdated technology. To keep up with the current trends and meet your audience’s expectations, you have to go above and beyond providing the latest tech stack for your clients.

It’s not a secret that your TA is now more demanding than ever. One-click payments and a smooth checkout experience are no longer an option but rather a must-have for any payment provider. And if you don’t offer them, your customers will easily leave to find a provider with all these benefits.

Choosing a payments orchestration platform like the one offered by Akurateco is a wise move for those who want to get immediate access to state-of-the-art solutions without robbing the bank. - Tech team turnover.

Finding good payment candidates for your company is no walk in the park. It is demanding if not entirely impossible. And if one of your payment team members has recently left, and you can’t find a decent substitution right away, consider going for a white-label payment gateway solution.

This move will save you both time and money since WL provider’s teams are always fully staffed and ready to go. No training or time for onboarding. No grooming of any sort. With them, you resume work from day one.

Finally, it’s time for us to explain the steps you are to take when switching your payment provider.

Forget-me-nots of switching to a new payments orchestration platform

- Importing anti-fraud modules settings.

As you move to a new platform, consider transferring your anti-fraud module settings, too. Since it’s not a trivial task, you need to request your new payment software provider to help you with the move. Thus, for instance, Akurateco help their clients move existing whitelists and blacklists as well as offer Akurateco’s own pre-defined ones. On top of that, they have a session with a client where they sit down to discuss his/her previous experience, anti-fraud use cases and offer a way to set up a similar set of rules as well as consultation on their correct usage, advice on how to adjust them to newly emerged needs. - Importing historical data.

Switching to a different provider inevitably means transferring all your historical data collected over the years of payment processing to a new platform. Therefore, be ready to move all your payment data stats, subscriptions, chargebacks, and refunds, etc. Depending on how many years you’ve been in the industry, the volumes of this transfer might differ. However, first and foremost, make sure to get clear instructions on how to transfer this data to a new platform and what the protocol is. - Integrate necessary payment methods.

Make sure that the system you’re switching to offers all the necessary payment methods both your existing and potential customers expect. If the method you need isn’t on the list of those immediately available, it’s only smart to request its development and integration in advance because this process takes between two to four weeks depending on the provider you’re working with. - Ensure a smooth transfer experience for all your merchants.

Look for a white-label provider ready to personally participate in consulting your merchants during their move to a new platform. Ideally, this provider will not only answer their questions regarding technical setup on early stages of the move but also act as their tech department, solving the issues as they rise and nipping the errors in the bud. Actively involve the vendor in the communication and keep them updated along the way to ensure the best migration experience for all your clients. - Prepare for the MID migration.

At last, prepare for the MID migration. When we say MID, we mean a single point of sale for every merchant. Take your time both to migrate the data and test it. It’s vital to run tests early on to spot mistakes and solve them before they backfire with lost sales and claims from unsatisfied customers.

All in all, these are the steps to take and signs to look out for when making a final decision to give your business to a white-label payment gateway provider.

A final word of advice here: look for a vendor that has already helped its clients with a system migration. Their experience will save you long hours of troubleshooting and error fixing as you dive into the move. Thus, for instance, Akurateco has recently helped several of its new clients transfer to their platform. For it, the company has held training and special sessions where they discussed customers’ needs and expectations, suggested the most effective ways to transfer data securely and acted as an outsource technical department ready to solve any tech issues coming their way.

If you still have any questions, fire them away: our team at Akurateco would be more than happy to answer them all. Or even better, consider booking our free Demo to check out what a white-label system is all about and how it can meet your specific business needs.

Related News

- 04:00 am

Increased signs of financial pressure as government support reduces and spending opportunities increase, even though percentage of payments to balance maintains upward trend

Highlights

- The percentage of accounts missing payments in July increased 3 percent year on year

- Cash usage on cards – often a sign of financial stress - continues to slowly increase, up 4.2 percent

- Card spend falls £3 compared to June 2021 but is second month that is higher than pre-pandemic levels

- Percentage of payments to balance continues to grow – 5.7 percent – reaching over a two-year high

Global analytics software provider FICO today released its analysis of UK card trends for July 2021, which reveals that there was an uplift in missed payment rates, whilst spend on cards marginally fell. There was also growth in cash usage.

It was the first full month of all retail and hospitality sectors being open; the school summer holidays started and the government furlough contribution reduced from 80 percent to 70 percent. All of these factors are likely to have contributed to consumer spending and repayment behaviours.

Missed payment rates see month of growth

The percentage of accounts missing payments in July increased by 3.2 percent. Their associated balance as a percentage of total balance also increased by 3 percent, perhaps a reflection of the reduction in furlough support and business loans repayment starting. Unsustainable post-lockdown spend could also be contributing.

The increase in the percentage of accounts and their balance missing one payment in May has resulted in an uplift in accounts missing three consecutive payments in July — up 19 percent. July also saw:

- A 7 percent increase in the percentage of card holders missing one payment

- Increase in average balances on accounts missing one or two payments also increased in July.

- Balances for card holders missing two payments are £215 or 9.5 percent higher than July 2019.

However, there is also a trend amongst those consumers who are able to make payments, to increase the percentage of payment to total balance. In July it increased 5.7 percent compared to the previous month, to yet another over two-year high and it is 22 percent above pre-pandemic levels in July 2019. This suggests that the extra lockdown savings continue to influence payment trends, along with the final three months of furlough support and lower average card balances.

The percentage of accounts paying the full balance remains stable, at an over two-year high, and is 16 percent above July 2019’s result. Consumers shifted from paying the minimum amount in July to less than and more than the minimum; the majority moving to the former, which is reflected in the higher missed payment rates. And the percentage of consumers being charged interest increased in July, a common link with rising missed payment accounts, although it is 14 percent below pre-pandemic levels and the average amount charged is 22 percent lower.

The coming months will show if there is a trend emerging and more consumers who were able to maintain minimum payments are facing further financial struggles. Lenders will need to continue to monitor these payment trend changes, focussing on reducing payment percentages to balance, especially if balances are being maintained or, more worryingly, increasing.

Cash usage continues to slowly grow

The percentage of consumers using cash on their credit cards also continues to grow – in July by 4.2 per cent. Consumers moving to using cash, with little or no previous cash usage, could be showing signs of financial issues. But it is still well below pre-pandemic levels and with the contactless limit increasing mid-October from £45 to £100, cash usage may not return to the higher levels seen pre-COVID19.

Looking Ahead

Lenders will need to be vigilant and analyse their data and results rapidly, in the changing economic conditions during the remainder of 2021 and into 2022. The full scale of the debt issues should become clear over this period too, so focus will be on the impact on collections as well as preparation for strategic approaches post COVID as issuers decide what their ‘new normal’ is.

These card performance figures are part of the data shared with subscribers of the FICO® Benchmark Reporting Service. The data sample comes from client reports generated by the FICO® TRIAD® Customer Manager solution in use by some 80 percent of UK card issuers. Issuers wishing to subscribe to this service can contact staceywest@fico.com.

Related News

- 09:00 am

Compass Plus’ innovative universal mobile payments service, MobiCash, has been shortlisted for Best Mobile Payments Solution at the Payments Awards. The award recognises the most innovative mobile payments solutions across the globe and their contribution to the payments industry.

MobiCash is an integral component of Compass Plus’ wider digital solution offering, which come together to form a seamless mobile-first digital payments ecosystem. As a mobile payments service, MobiCash is designed to make payments easy without compromising security. It is simple to use and offers a cheaper and more inclusive way of accepting payments at a wide range of businesses, including charities, service providers (utilities, councils), sports clubs, schools and nurseries, local tradesmen, subscription services and many more.

The Payments Awards have been running for the past nine years and aim to celebrate excellence and innovation in the payments industry worldwide. The winners will be revealed at a ceremony on 11 November at the Marriott Hotel in Grosvenor Square, London. More information about the award categories and the final shortlist can be found here.

Related News

- 09:00 am

Unbanked, a global fintech provider that connects traditional enterprise and banking systems with blockchain, today announced that it has been certified as a Visa Ready partner for Program Management within the Visa Fast Track Program. Unbanked was approved in 2020 as a Fast Track Enablement Partner, and with this VISA Ready certification, will expand its capabilities to its suite of partners.

Unbanked currently provides infrastructure for many popular cryptocurrency-powered cards available today, making it faster and easier for fintechs to leverage Visa's global payments network and introduce new crypto-friendly payment experiences. Partners of Unbanked are given a seamless way for their customers to interact with cryptocurrencies, using linked debit cards and bank accounts which can act as an easy gateway from dollars to cryptocurrencies.

Unbanked offers a full suite of crypto-enabled solutions that solve common issues in the digital payments ecosystem, including debit cards and FDIC-insured bank accounts that are available in over 200 countries. Not only does Unbanked equip customers with a more convenient, flexible way to buy, send and spend their cryptocurrency, the company's debit card program also features one of the highest rewards rates in the industry, offering users up to 6.38% back on purchases.

"We could not be more excited that Visa has certified us as a Program Manager in its Fast Track Program," said Unbanked Co-Founder, Ian Kane. "We pride ourselves on offering a full-suite issuance, compliance, and ongoing management service for Visa cards linked to digital assets.

Related News

- 09:00 am

- New white paper identifies the best-positioned markets for the payments industry

UK “will remain an attractive market for payments issuers”

Nordics will be the first in the world to “realise digital transformation in payments”

Germany and Spain will see dramatic growth in corporate credit products

A new white paper released today unveils the markets which will be at the forefront of powering the payments industry in the coming years.

Released by Transact Payments Ltd (TPL), the experts in payment and card solutions, it reveals that the UK, Germany, Spain, and the Nordic countries will be the most well-positioned markets as digital transformation in the industry continues to gather pace.

TPL’s white paper comes at a time of significant change in the payments sector, presenting significant opportunities for all kinds of organisations issuing new payments products across the UK and European Economic Area (EEA).

In the last five years alone, important developments have included the advent of Open Banking legislation, the European Union’s (EU) Second Payment Services Directive (PSD2) and the impacts of Brexit and COVID-19. During this period there’s also been an unstoppable rise in digital and mobile payments, contactless cards, biometric security and wearable payment technologies.

TPL’s white paper findings

1. The UK

TPL believes Britain will retain its leadership position in payments technologies and remain an attractive market for payments issuers.

Highly developed market: The country is home to a growing (and sophisticated) market of 67 million digital-savvy consumers, backed by a forward-thinking regulator. It is also quick to adopt fast-developing payment trends, such as “soft point of sale” (POS) and mobile POS systems to enable wider acceptance for electronic payments, especially in the growing micro-merchant segment, as well as the use of QR code payments due to COVID-19.

Beyond Europe: Meanwhile, despite concerns relating to Brexit, a recent annual planning paper from the Payment Systems Regulator (PSR) suggests the UK may be about to pursue a strategy of “smart divergence” from EU legislation. This would give the UK flexibility to follow EU rules where it’s in their interests to do so, but also to diverge for commercial benefit. This could lead to opportunities for British payments firms outside Europe, including in Australia and Canada, which share similar legal systems and are exhibiting many of the same market characteristics.

2. Germany

TPL expects to see dramatic growth in corporate credit products as new specialist lenders using Open Banking, take hold in the market.

Championing PSD2: Germany has fully embraced PSD2 and created a common standard for open Application Programming Interfaces (APIs) through the Berlin Group. The country is also second only to the UK in terms of the number of permissioned intermediaries able to deliver payments services under PSD2.

SMEs: Yet historically, small and medium enterprises (SMEs) have struggled to gain access to credit and flexible banking services. However, new specialist lenders are taking hold in the market by using Open Banking to prove the creditworthiness of smaller companies.

FinTech to the fore: Thus, Germany’s relatively advanced status in PSD2 readiness is creating opportunities for partnership between banks and FinTechs via service delivery through shared APIs. Banks are now working with FinTechs such as Moss, a platform that integrates all corporate spending on one card, and Pliant, a business-to-business payments platform, to enable new payment services.

3. Spain

Similarly to Germany, TPL anticipates that credit products for SMEs are going to be huge in the Spanish market, but also for individuals.

Simplified infrastructure: Previously, Spain presented fewer opportunities for payments players given its relatively bureaucratic systems and standard debit-led card portfolios. Yet, in February 2018, Spain’s three major payment systems merged into a single infrastructure provider, SistemaPay.

Modernisation: As well as rationalising the previously complex infrastructure, Spain’s regulators have been actively engaging with the possibilities presented by PSD2 and its Open Banking mandate, including licensing Account Information Service Providers (AISPs) and Payment Information Service Providers (PISPs).

Development of credit market: With such changes taking place, much like Germany, it is realistic to expect the credit market to flourish via the digital channel, something that’s good news for both payments companies and the Spanish economy.

4. The Nordics

TPL predicts that the Nordics will be the first markets in the world to fully realise digital transformation in payments.

Digital transformation (nearly) complete? The Nordic markets of Sweden, Denmark and Norway have the highest penetration of electronic transactions anywhere in the world. The Nordics’ leadership position becomes clear - as coupled with this level of electric transactions - is a functioning, consumer-permissioned digital ID system known as BankID that makes Know Your Customer (KYC) compliance for e-commerce much easier.

National wallet schemes and “super-apps”: Since 2015, the Nordic markets have also wholeheartedly embraced digital wallet solutions. Therefore, as digital wallets rise and cards continue to be used for a very wide range of purchases, these markets will continue to seek opportunities to reduce cash use for everyday, low-value purchases such as parking, street vendors and others. This is going to create room for mPOS and soft POS systems providers, as well as multi-function card products.

How payments players can succeed

As TPL’s white paper findings highlight, success means identifying opportunities across markets, and creating products that respond to those opportunities. Yet with the payments business changing so fast, doing everything in-house is no longer an option. Those issuing payments products need to select the right partners to help them unpick the unique complexities in each of Europe’s 34 markets, from regulation to programme management.

Furthermore, flexibility – for issuers and their partners – is going to be equally important. This means offering a wide range of products to customers, products that respect the differences between markets and the specific needs of each market. “One-size-fits-all” approaches are not effective, and the signs are that such approaches will be even less effective in the future.

“We believe great opportunities lie ahead for organisations issuing payments products

throughout Europe and the UK,” said Kriya Patel, Chief Executive Officer CEO, TPL. “As highlighted in our white paper, Britain, Germany, Spain and the Nordics are all in excellent positions to navigate the new landscape in the European payments sector. However, most critically of all, the evidence shows that an effective partnership is going to be the winning strategy in the years ahead.”

TPL is a licensed UK and European e-money institution, regulated by the Gibraltar Financial Services Commission, Malta Financial Services Authority and Principal Members of both Mastercard and Visa. It provides innovative and flexible UK and European BIN sponsorship, modular payment, debit, credit and prepaid services

TPL’s white paper is available for download here.

Related News

- 01:00 am

Qumulo is the central data platform to enhance safety and security for 49ers fans

The San Francisco 49ers today announced a multi-year partnership with Qumulo to serve as the team’s new data storage provider. Qumulo is the breakthrough leader in radically simplifying enterprise file data management across hybrid cloud environments and will support the 49ers operations at Levi’s® Stadium and its SAP Performance Facility.

“The safety and security of our guests and employees is a top priority for us and Qumulo’s technology has certainly helped us enhance those efforts,” said Jim Mercurio, Executive Vice President & General Manager of Levi’s Stadium. “Though this sort of deployment may not be something people see, it allows us the capacity and capability to be more effective and efficient in our workflow. I’m looking forward to Qumulo being a part of our team and process moving forward.”

A primary use of Qumulo’s storage platform will be extending the storage capacity of security camera feeds captured in and around the 49ers’ home venue and training facility. What previously required 54 individual storage arrays will now be compacted into a single namespace. Paired with the data management company’s remote monitoring service, the benefits of the new partnership have significantly reduced management overhead. The technology has also allowed the 49ers to consolidate their data center capacity, freeing up a total of five racks of gear for future projects.

“By unleashing the power of data to enhance security and safety, the 49ers continue to stay at the forefront of stadium innovation,” said Bill Richter, CEO of Qumulo. “We’re proud to serve the 49ers as a trusted partner in delivering reliable, effective data solutions that will bring a safer fan experience to life in future seasons to come.”

Business strategy and analytics work is also simplified. Qumulo aids issue management by providing robust and easy-to-read analytics reports, making outliers and roadblocks much easier to find. Other technical feats accomplished by the franchise include writing over 44TB of data per day and completing cluster upgrades in under five minutes.

“We have a large employee base, a high number of data output, and a 68,500-seat stadium to manage, so our technology and systems in place need to be top of the line,” said 49ers Director of IT Jim Bartholomew. “Qumulo will be a great addition to our overall organizational management and I’m thrilled to welcome them to the 49ers family.”

Qumulo’s advanced file data management technology and systems add to the reputation Levi’s Stadium has built as one of the most technologically advanced sports and entertainment venues in the world. The site won Sports Business Journal’s prestigious “Sports Facility of the Year” award in 2015, along with The StadiumSportsBusiness Awards Venue of the Year. The venue was also recognized for Venue Technology of the Year from Leaders in Sport in 2019 and StadiumSportsBusiness in 2020 for the deployment of its Executive Huddle venue analytics hub.

To learn more about Qumulo and their offerings, please visit Qumulo.com.

Related News

- 06:00 am

Only one in six investors sufficiently understand the value and potential of cryptocurrency, reveals a survey conducted by Cardify. In addition, a third of buyers have either zero knowledge about the space or would call their level of understanding “emerging”. Coreto tackles the problem of knowledge and trust in the cryptocurrency industry by introducing a reputation-based social platform that bridges the gap between blockchain retail investors, traders, influencers, newcomers and project teams looking to achieve funding goals. This enables users to monetise their knowledge and build a reliable reputation online.

The platform is a tokenised, secure environment for crypto communities, offering verified crowdsourced information thanks to its comprehensive trust and performance system. Coreto employs various technologies, including Machine Learning and Artificial Intelligence, to save users valuable time in the due diligence processes when making trading decisions. These algorithms help recognise various market trends and investor interests to generate relevant metrics that are useful to the community.

One of the platform’s main differentiators is the gamification system, which brings components of video games into a social network. This means recurring tasks, rankings, achievements, leaderboards and much more.

The first feature that has the gamification component is its unique Staking of Opinion Pool (SOOP) mechanism. This is an innovative tool that encourages accountability, pledges and challenges, validates the legitimacy of shared information and records opinions through its native Community Reward Token (COR token), awarded by users who enter their stake into the pool. It’s designed to reward people who make significant contributions to the community, providing them with the opportunity to get closer to the level of “influencer” and generate additional income through subscriptions.

The staking pool and automated payments for subscriptions and rewards for increased participation and efficient utilisation of the COR token ecosystem is facilitated by an integrated decentralised finance (DeFi) solution.

Iustina Faraon, CEO and co-founder, says, “Coreto acts as a digital stage on which experts covering all the crypto fields showcase their knowledge and share new insights. It rewards content creators, allows them to communicate directly with their audience and helps them earn a reputation based on the number of posts and the endorsements they receive.”

The Cardify survey results also suggest that more than a third of respondents researched digital currencies for less than a month before buying.

Vlad Faraon, CBO and co-founder, adds, “Coreto will change the way people do their own research (DYOR), which is currently very time consuming. Sources such as social media, news outlets, Telegram or Discord groups, blogs and more need to be dug into for new possible investments, followed by research for market sentiment, community opinion and recent and future events. The decentralized aspect of the technology makes it attractive but at the same time confusing as each participant has limited knowledge and there is no reliable platform where they can learn more from others while sharing what they know with the community.

“There was an obvious need to protect people from the hype and so-called experts who were shilling projects to then delete traces of their online activity once their predictions were proven wrong. Through Coreto we aim for a healthier crypto ecosystem. With the help of aggregated news, tools and community knowledge, newcomers to the crypto space will better understand what projects are all about, who to follow and who deserves their trust, not solely based on the number of followers, but on a proven track record of their past calls.”

Registrations are still open so the early adopter community is invited to request access to the platform via https://reserve.coreto.io/ to reserve their username and test the Alpha version of Coreto.io while it transitions to the Beta launch. This way, they’ll gain a firsthand experience of what Coreto has to offer. They will be onboarded in multiple batches, enabling them to access all the latest features of the constantly evolving platform.

Coreto recently implemented Coreto Design Language (CDL), a design language system optimised for efficiency, cost, stability and usability of the platform. In the long run, Coreto aims to strengthen its position in the market as the main information platform for the cryptocurrency field. The team intends to develop the platform on several levels, including options through which Trust and Performance algorithms can be implemented on other platforms where there are peer-to-peer interactions. The final step will be the grand opening, which will focus on UX and scalability and will be ready to onboard thousands of people.

Related News

- 04:00 am

Avaloq today announced that the investment advisor of its fintech investment fund is being spun off from the group by means of a management buyout. This change of ownership will not impact the fund’s strategic focus and Avaloq will maintain its long-term interests and involvement in Avaloq Ventures.

Launched in 2020, the Avaloq Ventures fund provides investors with early-stage access to next-generation players in the financial industry through Avaloq’s unique ecosystem, consisting of established banks and wealth managers as well as up-and-coming fintech companies.

Following a successful go-live with seven promising investments in fast growing fintech companies, Avaloq and Avaloq Ventures have agreed to spin off the fund’s investment advisor, Avaloq Ventures AG, as a separate entity, independent of Avaloq Group. This will give the management team more agility in advising the fund while Avaloq will focus on growing its ecosystem, also by increasing its commitment to the fund.

The management buyout is led by Francisco Fernandez (founder/board member of Avaloq Group and Chairman of Avaloq Ventures), Alexander Christen (CEO of Avaloq Ventures) and FiveT Capital Holding AG, all of whom have already been a shareholder of the investment advisor. Following the spin-off from Avaloq Group, Avaloq Ventures is being renamed FiveT Fintech.

Francisco Fernandez said: “As FiveT Fintech enters the next stage of its growth story, we firmly believe that the fund will benefit from this new structure, allowing the management team more freedom to implement its innovative strategy. I’m personally very excited about the investment opportunities in the extremely dynamic fintech space and look forward to supporting start-ups to reach their full potential and giving investors the opportunity to participate in their success.”

Alexander Christen said: “Going independent is a major step for FiveT Fintech and we are very happy to further contribute to Avaloq’s ecosystem strategy. As the capital flows into the global fintech sector are reaching new highs, our fund is uniquely positioned to identify the most promising start-ups and accelerate the digitalization of the financial industry.”

Martin Greweldinger, co-CEO of Avaloq Group, said: “Constant innovation is part of Avaloq’s long-standing software DNA and being an active player in the start-up scene is key to keeping abreast of the latest technology trends in the financial industry. We are therefore delighted to continue our collaboration with FiveT Fintech as our preferred financing partner for growth companies as we not only remain a major investor in the fund but are also increasing our commitment in the upcoming fourth closing. At Avaloq, we firmly believe in focusing on core strengths, hence we are confident that the fund and its investors will benefit from this new setup.”

Related News

- 07:00 am

New resources enable use of EMV Payment Token data for EMV 3DS authentication to support improved consumer experience.

Global technical body EMVCo has published new resources to help card issuers and merchants to optimise the EMV® 3-D Secure (EMV 3DS) authentication experience for online shoppers when EMV Payment Tokens are in use, enhancing the fraud-prevention benefits that EMV 3DS provides.

EMV Payment Tokens are used across the payments ecosystem to increase the security of card-based transactions by replacing the primary account number (PAN) with a unique alternative value. Industry feedback identified an opportunity to improve the EMV 3DS authentication process by making Payment Tokens and related data available as part of the 3DS Authentication Request to improve issuer decision making and the consumer experience.

The EMV 3DS Payment Token Message Extension and supplemental white paper provide guidance on how payment token related data elements can be used to support the authenticity of EMV 3DS transactions. Using the extension, issuers can leverage additional payment token data to better identify the transaction and consumer. This reduces the need for additional consumer authentication in the form of a challenge, such as a one-time passcode or biometric.

“The use of EMV Payment Token data in the EMV 3DS authentication process further enables card issuers to make better risk-based decisions. As a result, merchants will benefit from improved transaction approval rates and a faster, more secure authentication process for their customers,” said Robin Trickel, EMVCo Executive Committee Chair.

The EMV 3DS Secure Payment Token Message Extension supports EMV 3DS v2.1 and v2.2. It is optional and does not impact interoperability. Based on the industry’s request for payment token data to be supported, the extension capabilities will be included in EMV 3DS v2.3 as part of the core specification.

To learn more, view the EMV Insights post: EMV 3-D Secure Transactions and Leveraging EMV Payment Token Data.

Related News

- 05:00 am

- Centtrip, the global fintech providing expense management and card payment technology, has launched its platform, app, and card in the United States.

- The fintech has partnered with Adyen to provide its U.S. offering.

- Designed for the demands of highly mobile businesses, the Centtrip card offers some of the highest spend limits on the market.

Centtrip, the global fintech providing expense management and card payment technology, has announced its launch in the United States.

The Centtrip platform gives businesses real-time visibility and control over their expenses and card payments, helping them empower their people, streamline expense payment processes, reduce the cost and risk of carrying cash, and make the accounting process significantly easier.

As one of the most flexible cards on the market, the Centtrip Mastercard offers high balance and transaction limits and is accepted across the United States and worldwide. Organizations can have as many cards as required (several hundred cards for a single project is not uncommon) – a feature not offered by traditional payment providers.

Centtrip is designed specifically for the needs of highly mobile organizations, notably those operating in marine, film and TV production, music, the wider arts and entertainment industries, and aviation. The fintech, headquartered in London, has over 20,000 clients and users around the world, including the world’s largest superyachts, music’s top touring acts and world-renowned arts companies. Founded in 2015, by experts in payments, foreign exchange and technology, Centtrip now processes over $1.3 billion in transactions each year and is experiencing rapid growth across all core markets as they emerge from the pandemic.

Jane Turner, Chief Executive Officer, said: “We already have clients in the United States who use Centtrip globally and who wish to use it domestically. By expanding into the US with Adyen, we are giving highly mobile businesses in the most demanding sectors greater control, flexibility and visibility over their money and their expenses.

We chose Adyen because we wanted a digital-first payments processor with a track-record for innovation. With its high-growth ambitions, offices around the world and a product-set that spans the payment ecosystem, Adyen are the perfect partner for our own growth plans in the US and beyond.”

Cardholders and authorized administrators can control the card directly from the award-winning Centtrip app, setting spend limits, freezing or unfreezing cards, and enjoying full, real-time visibility of transactions. Clients have the choice to either preload individual cards with funds (for example a cardholder’s available budget) or to have all cards on an account draw from the same, central account balance (in the same way that bank debit cards operate). In either case, Centtrip provides businesses with full control over their funds and maximum security.

As part of the expansion Centtrip has opened an office in Miami Beach, Florida, and plans to expand its US based team in the coming months.