Published

- 06:00 am

Addressing all the complexities faced by small businesses associated with business payments, Mswipe will power all SME customers of Karnataka Bank with its newly launched android-based POS device, WisePOS Go to streamline their business management.

A first-of-its-kind POS machine in India, WisePOS Go is a compact, lightweight and easy-to-use device that will help small business owners improve mobility by integrating payments with business applications in one single device.

A leading end-to-end digital enabler for MSMEs, Mswipe introduced WisePOS Go at a time when most businesses are using separate devices for accepting payments. This low-cost, easy-to-use, with advanced NFC, and QR code device works across platforms and has connectivity options, making it suitable for small business owners. Karnataka Bank customers will be able to integrate apps on the same POS device from Mswipe’s MoneyStore (a curated app preloaded on Mswipe’s smart POS terminals) and reap the benefits from multiple payment solution apps and value-added services on the same device.

Mswipe’s Chief Executive Officer, Mr. Ketan Patel said, “We are happy to develop this product for Karnataka Bank’s MSME customers which will simplify their payment processes. The introduction of ‘WisePOSGo’ is yet another step in the direction of expanding the digital payment infrastructure in the country and promote a cashless economy.”

Mr. Mahabaleshwara M S, Managing Director & CEO of Karnataka Bank said, “This is yet another product in line with our vision of becoming the ‘Digital Bank of Future’. Mswipe’s compact, light-weight and user friendly device will be a game changer and transform the digital payment ecosystem associated with POS machines. By integrating payments with business applications in one single device, small business establishments will benefit by having an agile and conducive platform to source business. The ease of processing transactions through ‘WisePOSGo’ will help the Bank’s retail and MSME customers to augment their businesses by providing their consumers a convenient and flexible way of shopping”.

Related News

- 06:00 am

Safe Security, backed by British Telecom & John Chambers invests in international markets to drive next phase of growth

Safe Security, a pioneer in Cybersecurity & Digital Business Risk Quantification today announced its entry into the Europe, Middle East & Africa (EMEA) region, to build on its success in North America. Headquartered in Palo Alto, California, Safe Security helps organisations manage, measure and mitigate cyber risks with its breach likelihood prediction platform SAFE. Backed by marquee investors such as British Telecom Group, John Chambers and other prominent industry leaders, the company appointed Cherif Sleiman, a veteran industry leader to head the business for international markets.

Sleiman is a visionary technologist and ‘turnaround specialist’ who will focus on building Safe Security’s regional presence, go-to-market and channel strategy in the region. Over his illustrious career which spans over 26 years, he has held leadership positions at giants of the tech industry including Cisco, Nortel, Brocade and most recently Infoblox. As part of its business expansion strategy, Safe Security will significantly ramp up its investments in Europe, Middle East & Africa – regions that the company believes are key to its growth. It plans to hire more than 100 employees in the next 18 months in the region.

Reflecting on his appointment, Cherif said, “Cybersecurity is a global concern. For all of the time, money, and energy spent telling us how to protect ourselves including what to buy to do so, there’s little sense of actual progress when it comes to security. And that’s key, because safety is not about how much money we spend on products, analysts or investments, it is simply about Knowing. Safe Security is uniquely positioned to provide organisations with the knowledge necessary to better secure their organisations. The SAFE platform delivers 360 degree continuous, dynamic & intelligent quantitative cyber risk management and breach likelihood prediction by assessing People, IT Infrastructure, Cloud Presence, Saas Deployments and Third Party Partnerships. It streamlines the knowledge and language needed by all stakeholders from the boardroom to the frontline security professionals, so accurate decisions and actions can be taken in a timely fashion. I am excited to join Safe Security and honoured by the trust they have in me. I am confident that we will grow exponentially in the next 2-3 years across international markets.”

Over the course of the last year, cyber security incidents have seen a dramatic increase globally. With the growing sophistication of cyber attacks, cybersecurity through generic red-amber-green heat maps is not enough. Safe Security is at the epicentre of this paradigm shift; they provide an enterprise-wide, objective, unified and real-time cyber risk quantification platform called SAFE. It aggregates automated signals across people, process technology and even third party entities that an organisation works with, to dynamically predict the breach likelihood (SAFE Score) & the financial risk of the breach, to an organisation.

Saket Modi, Co-founder & CEO, Safe Security said, “With SAFE, we have created a brand new category of products within cybersecurity, and we are pioneering the shift from a project led, reactive risk management approach to one that is proactive, and enables the Board to truly understand cybersecurity in a de-jargonized manner. Our vision is to make the SAFE score the global de-facto standard for measuring and mitigating cyber risks and our expansion to international markets is central to this vision. International markets are extremely strategic for us and I am ecstatic to have Cherif join us to lead our business in the EMEA region. Cherif is a proven business leader and I am confident that he will replicate our global success and make Safe Security the preferred partner for addressing customer’s needs in the region.”

Related News

- 07:00 am

Cryptocurrency is a highly popular investment, particularly among younger people, but much of the terminology may confuse off-putting beginners. It might be difficult to get started with cryptocurrency if you don't know what gas is, what is HODL, who a whale is, or what the disparity between Bitcoin and blockchain is.

Cryptocurrency is more than simply a different investing choice; it reflects a whole other universe than traditional equities and bonds. Even for experienced traditional investors, understanding the basics takes time due to unfamiliar jargon, developing technology, and keeping up with memes and tweets.

Before investing in cryptocurrency, we advise building an emergency fund, paying off high-interest loans, and establishing a standard retirement savings plan. And, as previously said, you should only invest what you are ready to lose in cryptocurrency, with experts recommending that you allocate no more than 5% of your portfolio to these digital assets.

However, another item you should include on your checklist is at least a basic grasp of what you're getting into, such as how crypto differs from conventional investing methods and the many factors that can impact the market value.

Before you begin, like with any investment, it is critical to understand exactly what global asset you are investing in. This is especially true for a speculative — and continuously evolving — asset like cryptocurrency. It is much easier to do this if you are familiar with the words often used in this world. Whether you want to acquire cryptocurrencies now or later, knowing the terminology is a smart place to start. To make sure you don't be left out in the cold, here's a beginners guide to getting started with cryptocurrencies.

Crypto Terms:

Here are some terminology and jargon to assist newcomers in grasping the world of cryptocurrency investment.

Mining:

This phrase can be a little perplexing at times. It looks like exploding mountains create the coins. No, they are not. Mining is the process of creating and distributing new crypto coins. Solving complicated mathematical problems necessitates the use of powerful computers. Users who complete this task get coins as a consequence. They may then trade the coins directly with their peers or through internet exchanges.

Of course, most traders do not mine or create new coins. Instead, much like any other asset in your financial portfolio, you may purchase and sell tokens from other individuals.

Whale:

Whale accounts are those that possess a huge amount of a coin and have the ability to affect the market on their own. Most well-known and popular cryptocurrencies have a slew of whales that can truly throw their "weight" around.

Indeed, there are prominent websites that follow the activities of whales to increase transparency in the bitcoin market.

Many whale accounts are early investors or huge money, and following what they're doing is a good method to predict how the cryptocurrency market will move.

Blockchain:

The bitcoin transaction relies heavily on a peer-to-peer network. Blockchain is a digital database that records each bitcoin transaction. There is no risk of a hacker gaining access and corrupting the information kept on the blockchain because there is no central database, and everyone may view the blockchain facts from anywhere.

Gas:

It is the charge of completing a bitcoin transaction. The fee covers the expense of paying a "miner" (the person who solved the equation and earned a coin) to search for and receive cryptocurrency on your behalf. Its size is determined by how soon you want the transaction to be completed.

Address:

It is the precise location to which bitcoin is transferred. It functions similarly to a bank account but solely contains cryptocurrency. For maximum security, each address, which consists of a string of alphanumeric characters, is used only once to store crypto assets. This address also assists a receiver in proving ownership of the bitcoin that has been delivered to them.

Fiat:

This phrase is most commonly used to contrast cryptocurrencies with normal currency (fiat), which is backed and issued by the government. It provides central banks with greater influence over the economy. Currencies, such as the US dollar and the Indian rupee, are examples of fiat money.

Altcoin:

It is basically anything or any other coin that isn't Bitcoin. Altcoins can range from the second-most popular coin, Ethereum, to any of the hundreds of coins with extremely little market value. According to experts, you should primarily invest in the larger, more popular cryptocurrencies.

Block:

These are the data sets within a blockchain. Blocks on cryptocurrency blockchains are made up of transaction records created when users buy or sell currencies. Each block can only store a certain amount of data. When it hits that limit, it creates a new block to continue the chain.

Crypto Wallet:

A wallet is where you keep all of your bitcoin currencies. It is encrypted, and if you forget your password, you will lose access to your wallet. Because cryptocurrency is founded on the concept of decentralized distribution, the only way to do so is to hold individuals accountable for their passwords.

Wallets are classified into two types: cold and hot. While a hot wallet is stored online and facilitates online trading, a cold wallet is similar to an offline safe to keep your valuables secure.

Hot Wallet:

A bitcoin wallet that is software-based and connected to the Internet. While digital wallets are more convenient for immediately accessing your crypto, they are more vulnerable to hacking and cybersecurity threats than offline wallets, just as data stored on the cloud may be more readily accessed than those kept in a safe at home.

Cold Wallet:

This is a safe way to keep your Bitcoin offline. Many cold wallets (also known as hardware wallets) are physical devices that resemble USB drives. This type of wallet can help secure your cryptocurrency from hackers and theft, but it also has its hazards, such as losing it along with your cryptocurrency.

Decentralization:

The distribution of power away from a central location. Blockchains have typically been decentralized since they require the majority permission of all users to function and make changes rather than a centralized authority.

Decentralized Applications:

These are the developer-created applications installed on a blockchain to carry out operations without the use of mediators. Decentralized finance operations are frequently carried out with the help of decentralized applications. Ethereum is the primary network that supports decentralized finance activity.

Fork:

When its users change the rules of a blockchain, changes to a blockchain's protocol frequently result in two new paths: one that follows the existing regulations and another that branches off from the prior one. (For instance, a Bitcoin fork resulted in Bitcoin Cash.)

HODL:

Though the word began in 2013 as a user mistake on a Bitcoin forum, it now stands for "Hold On for Dear Life." It refers to a passive investing technique in which investors acquire and hold cryptocurrencies rather than trade them to expect their value to rise.

Market Capitalization:

In the context of cryptocurrencies, the market cap refers to the total value of all coins produced. The market cap of a cryptocurrency may be calculated by multiplying the current number of coins by the current value of the coins.

NFTs:

NFTs or Non-fungible tokens are value units used to represent ownership of one-of-a-kind digital objects such as art or collectables. NFTs are often stored on the Ethereum blockchain.

Public Key:

It is the address of your wallet, which is comparable to your bank account number. You may provide people or institutions with your public wallet key so they can send you money or withdraw money from your account when you approve it.

Private Key:

The encryption code allows you to access your cryptocurrency directly. Your private key, like your bank account password, should never be shared.

Smart Contract:

A computational software that automatically enacts the conditions of a contract based on its code. The capacity of the Ethereum network to execute smart contracts is one of its primary value propositions.

Token:

A value system on a blockchain generally has a value proposition other than merely a value transfer (like a coin).

Final Words

Those considering investing in cryptocurrencies should understand that acknowledging industry terms can be advantageous. Would-be traders can enhance their chances of reaching their investing objectives by conducting the appropriate study and understanding this knowledge.

Interesting in learning more about cryptocurrency? You can visit AskCrypto, a cryptocurrency forum where you can get more info about all the callouts, crypto trading, daily updates for the crypto market, and much more.

Related News

- 01:00 am

Speakers, Customers, and New Product Enhancements Demonstrate Importance of the Data-Driven Society

TIBCO has announced an impressive roster of speakers and customers to take the virtual centre stage at TIBCO NOW 2021, September 27-30, 2021. This year’s digital experience will include a free, two-day, core event; a jam packed agenda of keynote speakers; three premium one-day tracks; and a host of certification opportunities.

TIBCO customers continue to demonstrate the limitless power of insights when embracing data as the fuel for innovation. This year's theme, “Limitless,” showcases how advancements in data continue to accelerate, with original content targeted to business executives, data analysts, data scientists, business intelligence experts, and anyone in an organisation affected by or using data.

"Every modern organisation now runs on data, and our ability to deliver deep insights from real-time data is truly limitless,” said Dan Streetman, chief executive officer, TIBCO. “At TIBCO NOW, we are excited to share how leading organisations around the globe are connecting, structuring, and using data to fuel innovation and make faster, smarter decisions."

TIBCO NOW will host industry thought leaders from around the world, representing a range of industries, including:

Dr. Jennifer Doudna, a biochemist at the University of California, Berkeley, and Nobel Prize-Winning co-inventor of CRISPR Technology, who will speak about the role of data in medical science and how her CRISPR-Cas9 genome technology forever changed human and agricultural research;

Michael Lewis, a financial journalist, New York Times best-selling author, and leading social commentator, who will offer perspectives on the ever-changing value systems that drive economic markets, political landscapes, and cultural norms;

Dr. Jill Seubert, an interplanetary navigator and leading expert on astrodynamics, estimation theory, and deep space navigation, who will walk attendees through technology advancements that support the next generation of deep space exploration;

Associate Professor Ngiam Kee Yuan, group chief technology officer at National University Health System, who will share insights around artificial intelligence research and its implications for the future of healthcare.

The event will host 20 customer speaking sessions from respected companies such as New Balance, GM Financial, Autostrade per l'Italia, and Change Healthcare.

In addition, TIBCO executives will spearhead discussions on data’s role at the centre of the digital debate – how it’s driving customer experiences and reshaping the face of all industries. Speakers include Dan Streetman, chief executive officer; Rani Johnson, chief information officer; Matt Quinn, chief operating officer; Nelson Petracek, chief technology officer; and Fred Studer, chief marketing officer.

TIBCO NOW offers a free, two-day, core virtual event, with three product-focused premium tracks: Connect, Unify, and Predict. These tracks speak to the importance of integration and API management, events and messaging, master data management, visual analytics, and the future of the data-driven enterprise.

Related News

- 08:00 am

smartKYC, the world’s most advanced enterprise solution for KYC due diligence automation, has today announced the addition of the Hindi language and script to smartKYC’s multilingual Natural Language Processing technology. smartKYC’s technology now processes and analyses over 35 different languages in multiple writing systems including Latin, Chinese, Arabic and Devanagari.

Financial institutions facing unique KYC demands will often need to conduct enhanced background checks on clients, particularly those with associations with certain jurisdictions or sectors. This presents significant challenges due to names and various permutations that need to be searched with linguistic and cultural sensitivity. Multiple sources in multiple languages need to be searched to ensure no-risk relevant intelligence is missed.

The increased language coverage will allow clients of smartKYC to merge results within a language and across languages which will lead to streamlined results. Natural Multi-Language Processing technology identifies all textual elements in a piece of text regardless of source language or script. smartKYC reviews the findings in native language first to avoid any loss of meaning pre-translation and then produces an English version for review ensuring nothing is ‘lost in translation’.

“Banks with an international element to their client base, whether it is by way of a client’s birth, domicile or footprint, monitoring the English language content alone will expose the bank to the risk of missing important information. Extracting intelligence with precision from foreing language sources is essential,” commented Hugo Chamberlain, COO, smartKYC.

The additional language coverage is particularly pertinent for financial organizations dealing with ultra-high net worth clients as recent research from Knight Frank suggests that India will see a 63% increase in this group by 2025. This will outpace the global average of 24% and the Asia average of 38%. Currently, India publishes over 1,000 Hindi dailies with circulations of around 80 million, compared to 250 English dailies with circulations of 40 million. Any firm working with Indian partners, clients or subsidiaries must monitor Hindi media or risk missing important risk relevant intelligence.

smartKYC’s technology enables its clients to drive faster, better, and more cost-effective KYC at every stage of the relationship - liberating human effort to focus on decision-making rather than laborious research. smartKYC fuses artificial intelligence with linguistic and cultural sensitivity and deep domain knowledge to set new standards for KYC quality, whilst transforming productivity and hardwiring compliance performance.

Related News

- 07:00 am

Auriga, a global provider of technology solutions for the omnichannel banking and payments industries, today announced that it has won the first place in the Best ATM/Self-Service Experience category at this year’s Bank Customer Experience (BCX) Summit Awards.

The BCX Summit awards are run by Networld Media Group and ATM Marketplace and recognise the most unique, innovative, and pioneering financial institutions and technology providers whose branches and technologies are having the most impact on consumers.

Winners were officially announced during the Bank Customer Experience Summit, which took place in Chicago from Sept. 13 to 15.

Auriga won the award for its #NextGenBranch solution which enables a state-of-the-art, digital, remote, and customer-oriented branch. This leverages advanced assisted self-service and new technologies such as video banking, AI and automation to deliver 24/7 access to banking services and increase the efficiency of processes.

#NextGenBranch modules Bank4Me and WWS Fill4Me allow customers to access all the branch services in self-service assisted mode around the clock and interact with the bank's consultants via video banking for more complex transactions in a safe and personalised way.

This technology allows customer-facing employees to be able to focus on more complex activities that require the added value of human interaction. It also reduces branch management costs, while maintaining access to financial services and generate new revenue streams by customising modern ATMs with add-on services.

Commenting on the award, Vincenzo Fiore, founder and CEO, Auriga said: “We are delighted to have won this accolade for our cutting edge solution for today’s branch banking. #NextGenBranch is a real game changer for retail banks in how it creates a single source of truth on each bank customer and tracks the complete customer journey. When full adopted banks see a significant reduction in operating costs and an equally big increase in customer satisfaction from improved services”

Find out more at this link: https://www.atmmarketplace.com/articles/winners-announced-for-bank-customer-experience-awards/

Related News

- 05:00 am

The regulatory environment around funds has drastically increased in recent years and this trend is expected to continue. As a leading provider of the fund industry in Luxembourg, EFA is committed to providing its clients with the best service and the most up-to-date tools to respond to their existing and future regulatory requirements.

To this end, the EFA wanted to adopt a dedicated platform to industrialise the operations of its teams of experts.

At the end of a selection phase, EFA chose NeoXam’s Impress Regulatory Edition for its qualities of data integration and rationalization, its robust and complete calculation engine and its advanced visualization interface, allowing EFA to meet all of its expectations.

This decision reinforces and expands the long-standing relationship between EFA and NeoXam initiated with the adoption of the back-office investment accounting tool NeoXam GP.

Gary Janaway, COO at EFA, said: “The ability to provide our clients with a full range of regulatory reports with increasing demand for digital output led EFA to extent our partnership with NeoXam. Primary factors that influenced our selection were the ability to manage the integrity and quality of data from internal production systems and to import data from external sources. Impress Regulatory addition facilitates our clients’ need for high quality branded regulatory reports and provides EFA with a high capacity production capability.”

Florent Fabre, COO of NeoXam, added: “The future of reporting is undoubtedly industrial and digital. We develop high-performance and innovative solutions that meet the demanding expectations of the market to support our customers. We’ve worked closely with EFA for over a decade now and look forward to continuing to support them in their growth.”

Related News

- 07:00 am

Open Banking Expo, the largest global community of Open Banking and Open Finance executives driving the biggest digital transformation in the financial services sector, will this November bring back together European innovators, disruptors and visionaries.

On 4 November 2021, leaders and experts from across the breadth of financial services, including the UK’s largest banks, fintechs, credit card and payments providers, business lenders and regulators, will gather to share lessons learnt from the initial implementation journey and insights into the future of the industry, as well as what is required for continued adoption of Open Banking and Open Finance across the globe.

With Token as its headline partner, this year’s event, the first in-person gathering in over 18 months, comes at a time when the industry is anticipating change in Open Banking governance in the UK and follows the mandate from the Competition & Markets Authority (CMA) on variable recurring payments (VRP).

Todd Clyde, CEO of Token, said: “We’re delighted to support the Open Banking Expo UK as its headline sponsor. Since last year’s Confex, Open Banking has seen tremendous growth and is fundamentally changing the payments landscape. As Open Banking payments reach a tipping point, we are excited to reconvene together with industry innovators and visionaries to carry forward the mission that Token shares with Open Banking Expo: to drive the shift to an Open Banking-powered world.”

Adam Cox, co-founder of Open Banking Expo, said: “This year’s Confex comes at a time when we all anticipate change in the governance of Open Banking in the UK. It is therefore the perfect opportunity to bring together the Open Banking and Open Finance community in Europe to explore how far we have come on the implementation journey and what the next chapter will look like. Furthermore, the world of Open Banking payments has exploded in recent months and we’re delighted to welcome first adopters to share their insight as the market predicts continued growth.”

Headlining more than 80 speakers sharing topical and fresh content across five stages, the Confex is the perfect opportunity to reunite with industry friends and colleagues and to build new relationships. Speakers include:

High-street banks

- Daniel Globerson, Head of Open Banking, NatWest Group

- Harcus Copper, Global Channel Lead, Barclays

- Hetal Popat, Open Banking Director, HSBC

- Duncan Lathwell, Director, Cash & Trade Sales, Midlands & East, NatWest Group

- Jason Wilkinson-Brown, Head of Digital Propositions, Partnerships & Open Banking, TSB

- Marion King, Director of Payments, NatWest Group

- Phil Gossett, Head of Innovation, Nationwide

Investment bank

- Winston Pearson, UK Open Banking Lead, Goldman Sachs

Challenger & international banks / alternative & business lenders / SME finance

- Hayley Viner, Products Lead, UK payments, ClearBank

- Helen Bierton, Chief Banking Officer, Starling Bank

- Natalie Ledward, Head of Vulnerable Customers, Monzo

- Vicki Bracey, Open Banking Product Director, Mettle

- Nick Fahy, Chief Executive Officer, Cynergy Bank

- Noam Zeigerson, Chief Data & Technology Officer, Tandem Bank

- Richard Davies, Chief Executive Officer, Allica Bank

- Rob Hale, Chief Digital Officer, Regional Australia Bank

- Ylva Oertengren, Chief Operating Officer & Co-founder, Simply

- Simon Cureton, Chief Executive Officer, Funding Options

Credit cards & payments

- Charlotte Duerden, UK Managing Director, American Express

- Nilixa Devlukia, Regulatory Expert, Payments Solved

- Sendi Young, Managing Director, Ripple

- Todd Clyde, Chief Executive Officer, Token

- Chris Higham, Head of Cards & Payments, Secure Trust Bank

Fintech

- Sam Seaton, Chief Executive Officer, Moneyhub

- Will Billingsley, Co-founder, ApTap

- Dr Leda Gyptis, Chief Client Officer, 10x Future Technologies

- Dr Ruth Wandhöfer, Global Fintech 50 Influencer

- Rune Mai, Chief Executive Officer & Co-founder, Aiia

Policy, regulation and industry bodies

- Dr Bill Roberts, Head of Open Banking, Competition & Markets Authority

- Simon Lyons, Head of Ecosystem Engagement, Open Banking Implementation Entity

- Chris Hemsley, Managing Director, Payment Systems Regulator

- Becky Clements, Director of Payments, UK Finance

- James Shafe, Head of Consumer & Retail Policy Department, Financial Conduct Authority

- Liz Barclay, Small Businesses Commissioner

- Janine Hirt, Chief Executive Officer, Innovate Finance

- Phillip Mind, Principal, Financial Services, UK Finance

There are 500 tickets available to senior leaders and executives and the agenda is now live. Open Banking Expo was crowned ‘Best Conference Series’ at the 2020 Conference Awards for its conferences in the UK, Europe and Canada.

Related News

- 06:00 am

Binance is pleased to announce that Binance Labs, the venture capital and incubator of Binance, and Multicoin Capital co-led the $6M funding round for LayerZero, an omnichain interoperability protocol that unites decentralized applications across disparate blockchains.

Sino Global Capital, Defiance, Delphi Digital, Robot Ventures, Spartan, Hypersphere Ventures, Protocol Ventures, Gen Block Capital, Echelon Capital also participated in this round.

LayerZero is a new interoperability protocol that connects disparate blockchains. Interoperability hinges on passing messages between chains; current solutions achieve this with a middle-chain (hub-and-spoke model) such as Polkadot or running pairwise on-chain light nodes such as Cosmos IBC.

The former solution centralizes security around a single hub, allowing for cheap transactions at the cost of a single point of failure. The latter achieves high security with on-chain validation but is both capital and resource-intensive. LayerZero brings the best of both worlds together with a novel on-chain "Ultra Light Node," which achieves the security of a light node with the cost-effectiveness of middle chains.

“DeFi applications have spread out and deployed across multiple chains due to high fees and evolving investors preferences. This has led to severe fragmentation across the market. You can currently trade on Sushi using Ethereum, Moonbeam, Fantom, xDAI, and Binance Smart Chain, and more chains are coming. While all of these applications are Sushi, but none alone is Sushi. LayerZero solves this problem by uniting liquidity across chains and making it possible to transact in, out, and across disparate networks with ease,” said Bryan Pellegrino, co-founder, LayerZero.

LayerZero plans to support Ethereum, Binance Smart Chain, Polygon, Avalanche, Fantom, Arbitrum and Optimism at launch. It will add support for more EVM chains and non-EVM chains, such as Solana, Polkadot, and Algorand, in the months following launch.

“Binance Labs invests in disruptive innovations that have incredible potential to shape the crypto landscape. We view the future crypto space as a multi-chain universe, with a strong demand for lightweight and secure interoperability solutions. That is the future we see in LayerZero and why we fully support the team,” said Chase Guo, Investment Director at Binance Labs.

LayerZero achieves speed, security, and cost-efficiency by performing the same validation as an on-chain light node but instead of keeping all block headers sequentially, block headers are streamed on-demand by decentralized oracles. This is a fundamentally new interoperability model that improves security by coordinating validation between nodes and oracles. LayerZero currently leverages Chainlink and Band Protocol for oracles but was designed to be oracle agnostic.

LayerZero paves the way for the first omnichain applications, opening the door for lending, AMMs, governance and much more to become truly chain agnostic,” said Kyle Samani, Managing Partner, Multicoin Capital. “Dapp developers no longer have to write chain-specific code; instead, they can just use LayerZero to develop one interface that sends messages to all chains. Anything that wants to share or consolidate state across multiple chains—which is practically every application today—should be using LayerZero.”

LayerZero will use the new funds to further the development of LayerZero endpoints across the ecosystem and drive the adoption of the protocol. The project is currently under audit and is expected to launch in early Q4 2021

Related News

- 04:00 am

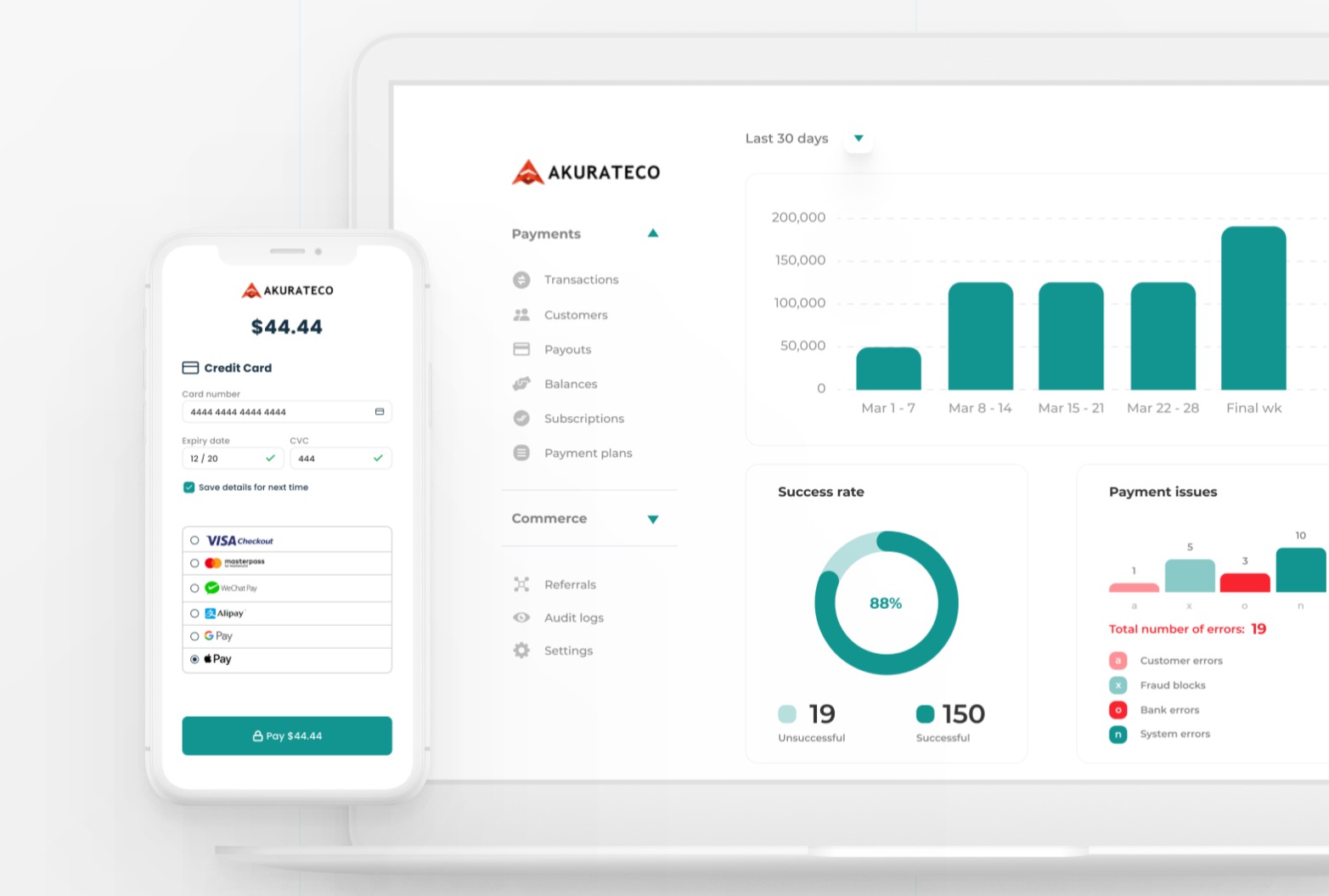

If it feels like somewhere in the middle of your payments department, there is a hidden black hole, invisible yet very real, and your budget seems to disappear there month after month, consider it a sign. A sign that it is time for you to switch your payment provider and instead opt for a white-label payments orchestration platform like the Netherlands-based Akurateco.

In fact, a lot of companies start with it right away. The thing is that this solution allows you to save money on the development, get immediate access to the cumulative experience and expertise of the provider’s payments team, and lay your hands on a multitude of payment connectors with a single integration.

In this guide, we’ll help you identify cues showing that it’s time for you to make that change and walk you through the change process step by step.

When should you start looking for a white-label solution?

- It got too expensive.

Disclaimer: At no point in your payment processing storyline will the service be cheap. In fact, if you decide to build the product on your own, you’ll have to pay between 105.000 and 420.000 USD for it. This includes a team of seasoned developers working on your payment gateway’s development for about 6 to 24 months depending on the functionality. We talked about it in detail in our recent research.

However, if you notice that over time the overall budget for maintaining both your gateway and your team goes through the roof, it’s a red flag meaning it’s time for you to look into your payment provider choice and maybe even consider a WL solution. - The tech team no longer meets your expectations.

As your business grows, so do your sales volumes. And a team that was managing your transaction flow at the beginning of your path seems to be dropping a ball with the growing payment intensity.

That’s when a white-label payment platform comes in handy. Besides offering a variety of connectors and an omnichannel payment experience, WL solution also serves as an outstaffed technical team for your company. As a result, you get access to an expert team of payment experts acting as a technical team for your company. They help you take care of integration and maintenance as well as keep you in the loop on the latest upgrades of the system. - You need a system upgrade.

You can’t afford outdated technology. To keep up with the current trends and meet your audience’s expectations, you have to go above and beyond providing the latest tech stack for your clients.

It’s not a secret that your TA is now more demanding than ever. One-click payments and a smooth checkout experience are no longer an option but rather a must-have for any payment provider. And if you don’t offer them, your customers will easily leave to find a provider with all these benefits.

Choosing a payments orchestration platform like the one offered by Akurateco is a wise move for those who want to get immediate access to state-of-the-art solutions without robbing the bank. - Tech team turnover.

Finding good payment candidates for your company is no walk in the park. It is demanding if not entirely impossible. And if one of your payment team members has recently left, and you can’t find a decent substitution right away, consider going for a white-label payment gateway solution.

This move will save you both time and money since WL provider’s teams are always fully staffed and ready to go. No training or time for onboarding. No grooming of any sort. With them, you resume work from day one.

Finally, it’s time for us to explain the steps you are to take when switching your payment provider.

Forget-me-nots of switching to a new payments orchestration platform

- Importing anti-fraud modules settings.

As you move to a new platform, consider transferring your anti-fraud module settings, too. Since it’s not a trivial task, you need to request your new payment software provider to help you with the move. Thus, for instance, Akurateco help their clients move existing whitelists and blacklists as well as offer Akurateco’s own pre-defined ones. On top of that, they have a session with a client where they sit down to discuss his/her previous experience, anti-fraud use cases and offer a way to set up a similar set of rules as well as consultation on their correct usage, advice on how to adjust them to newly emerged needs. - Importing historical data.

Switching to a different provider inevitably means transferring all your historical data collected over the years of payment processing to a new platform. Therefore, be ready to move all your payment data stats, subscriptions, chargebacks, and refunds, etc. Depending on how many years you’ve been in the industry, the volumes of this transfer might differ. However, first and foremost, make sure to get clear instructions on how to transfer this data to a new platform and what the protocol is. - Integrate necessary payment methods.

Make sure that the system you’re switching to offers all the necessary payment methods both your existing and potential customers expect. If the method you need isn’t on the list of those immediately available, it’s only smart to request its development and integration in advance because this process takes between two to four weeks depending on the provider you’re working with. - Ensure a smooth transfer experience for all your merchants.

Look for a white-label provider ready to personally participate in consulting your merchants during their move to a new platform. Ideally, this provider will not only answer their questions regarding technical setup on early stages of the move but also act as their tech department, solving the issues as they rise and nipping the errors in the bud. Actively involve the vendor in the communication and keep them updated along the way to ensure the best migration experience for all your clients. - Prepare for the MID migration.

At last, prepare for the MID migration. When we say MID, we mean a single point of sale for every merchant. Take your time both to migrate the data and test it. It’s vital to run tests early on to spot mistakes and solve them before they backfire with lost sales and claims from unsatisfied customers.

All in all, these are the steps to take and signs to look out for when making a final decision to give your business to a white-label payment gateway provider.

A final word of advice here: look for a vendor that has already helped its clients with a system migration. Their experience will save you long hours of troubleshooting and error fixing as you dive into the move. Thus, for instance, Akurateco has recently helped several of its new clients transfer to their platform. For it, the company has held training and special sessions where they discussed customers’ needs and expectations, suggested the most effective ways to transfer data securely and acted as an outsource technical department ready to solve any tech issues coming their way.

If you still have any questions, fire them away: our team at Akurateco would be more than happy to answer them all. Or even better, consider booking our free Demo to check out what a white-label system is all about and how it can meet your specific business needs.