Published

- 03:00 am

Nearly 70% of people claim to be doing more to protect themselves from online fraud and identity theft than a year ago

According to research released today by Trulioo, the leading global identity verification company, 68% of consumers claim to be doing more to protect themselves from online fraud and identity theft than a year ago.

The research found more than three-quarters (76%) of people feel that they’re at greater risk from online fraud than they were 12 months ago, and 75% are now worried about becoming a victim of fraud.

The research is presented in a new whitepaper, ‘New Fraud Threats in the Digital-First World’, which examines how online brands can find the right balance between online security and customer experience in a digital-first world.

The steps people are taking range from creating stronger passwords and changing them more frequently, through to installing VPNs and anti-virus software. Alongside this, many people are reading up on security issues to become more informed and be more selective about the businesses they buy products and services from online.

However, while people are trying to protect themselves from online fraud and identity theft, 80% admit that they could be doing more and 70% are worried that they’re not keeping up with the latest fraud threats. In fact the biggest barrier stopping people taking more action to protect themselves online is quite simply that they don’t know what to do and don’t feel knowledgeable enough around the risks they face.

“The last 18 months have seen the use of digital services skyrocket as consumers have needed flexibility and convenience during a period of lockdowns and social distancing,” said Zach Cohen, COO, Trulioo. “But in this day and age, greater use of digital brings an unwanted shadow of identity theft and fraudulent activity. As we move from response to recovery, businesses need to reassure customers that they are taking all necessary steps to protect them in an efficient and convenient way.”

Some consumers feel that their online footprint is now so broad and dispersed from using so many websites that they can no longer take any meaningful action to protect themselves across the board. On average, consumers have started transacting with six new brands during the last year, engaging with these businesses for the first time. This is particularly true in China, where more than half (52%) of consumers report that they transact with too many websites to do more to protect themselves, versus 25% in the U.S. and 24% in the UK.

Cohen concluded, “The message from the research is loud and clear. Businesses need to reset their security strategies to meet the needs of consumers that will continue to heavily rely on digital services for many aspects of their lives. This will involve educating customers around how to protect themselves, demonstrating that websites and apps have the right security measures in place at all times, and providing a choice of highly secure but convenient identity authentication methods. Doing this will not only help keep the fraudsters at bay, but it will be the basis for trusted customer relationships in the future.”

The whitepaper, ‘New Fraud Threats in the Digital-First World’, is available for download now.

Related News

- 03:00 am

- Chase will introduce a fee-free current account that combines money management features with cashback rewards on everyday debit card spending

- Chase customers can access their bank through an intuitive mobile app and reach customer support 24/7, with no reliance on chat bots

- New customers can join Chase by signing up at chase.co.uk

JPMorgan Chase today launched its new digital bank in the U.K. under the Chase brand. Chase is the largest consumer bank in the United States and provides a broad range of financial services to more than 60 million American households.

New customers can sign up at chase.co.uk, after which they will be invited to download the Chase app. Customers can open a current account in minutes via the simple and intuitive app. The account offers a range of features to help people budget, manage money, spend and save. A U.K.-led customer support team will be a key part of the Chase banking experience. With just a few taps in the Chase app, customers will be connected to a specialist – 24 hours a day, 7 days a week.

Sanoke Viswanathan, CEO of the bank, said: “We’re offering people in the U.K. the opportunity to experience Chase for the first time with a current account that’s based on simplicity, a fuss free rewards programme and exceptional customer service.”

The Chase current account will launch with a rewards programme offering 1% cashback on all eligible debit card spend for 12 months*. This has been developed in line with U.K. consumer debit card spending habits in order to ensure all customers can benefit from rewards on many of the things they already buy every day, including but not limited to groceries, travel, meals, entertainment, fashion, homewares, electronics, as well as flights and holidays.

There will be no fees to open the Chase current account and start earning cashback rewards. Customers will receive the cashback rewards without needing to switch their banking provider, commit to a minimum account balance or set up direct debits. The 1% cashback is payable when customers use their Chase debit card in person or online, and will be offered at retailers at home and abroad.

In addition to a simple and straightforward rewards programme, Chase also features:

- Customisable additional current accounts to simplify money management: configurable through the Chase app in seconds and designed to help people budget, set aside, save and spend in the way that works best for them. Each Chase account comes with its own unique account number, and the Chase debit card can be linked to it instantly, so customers can spend at any time from the account of their choice.

- Small change round-ups on which they will earn 5% interest for 12 months: customers can save as they spend by rounding up their debit card purchases to the nearest £1, and depositing the small change into a separate account where it will earn interest at 5%** for 12 months. Round-ups will be rolled out to all customers over the coming weeks.

- Fee-free debit card use abroad: customers won’t be charged any fees by Chase when using their card while travelling, including for cash withdrawals at ATMs abroad.

- A numberless debit card: card details are stored behind a secure login on the Chase app, so customers don’t put their account details at risk if they lose their physical card. They can still continue to use their Chase card via their digital wallet. The debit card has been made from recycled plastic (rPVC) and all card packaging is made from recycled materials and everything is fully recyclable.

“Having spoken extensively to consumers across the U.K., we know that people want good value combined with an excellent experience, from a trusted bank. With cashback on everyday debit card spend and an interest boost on round-ups, we can help customers save while they spend on items they already buy every day,” said Viswanathan.

Chase intends to introduce a broad range of banking products in the future, including new current account features, savings and investment accounts, and lending products.

Related News

- 03:00 am

A safer, more secure and private way to pay with iPhone and Apple Watch

Payhawk, the growing platform that combines expense, payment and invoice management in one solution, today brings its customers Apple Pay, a safer, more secure and private way to pay that helps customers avoid handing their payment card to someone else, touching physical buttons or exchanging cash — and uses the power of iPhone to protect every transaction.

Customers simply hold their iPhone or Apple Watch near a payment terminal to make a contactless payment. Every Apple Pay purchase is secure because it is authenticated with Face ID, Touch ID, or device passcode, as well as a one-time unique dynamic security code. Apple Pay is accepted in grocery stores, pharmacies, taxis, restaurants, coffee shops, retail stores, and many more places.

Customers can also use Apple Pay on iPhone, iPad, and Mac to make faster and more convenient purchases in apps or on the web in Safari without having to create accounts or repeatedly type in shipping and billing information. Apple Pay makes it easier to pay for food and grocery deliveries, online shopping, transportation, and parking, among other things. Apple Pay can also be used to make payments in apps on Apple Watch.

Security and privacy are at the core of Apple Pay. When customers use a credit or debit card with Apple Pay, the actual card numbers are not stored on the device, nor on Apple servers. Instead, a unique Device Account Number is assigned, encrypted, and securely stored in the Secure Element, an industry-standard, certified chip designed to store the payment information safely on the device.

Apple Pay is easy to set up. On iPhone, simply open the Wallet app, tap +, and follow the steps to add Payhawk’s credit or debit cards. Once a customer adds a card to iPhone, Apple Watch, iPad, and Mac, they can start using Apple Pay on that device right away. Customers will continue to receive all of the rewards and benefits offered by Payhawk’s cards.

For more information on Apple Pay, visit: https://www.apple.com/uk/apple-pay/. For more information on Payhawk, please visit: https://payhawk.com/.

Related News

- 06:00 am

Latest raise led by Tiger Global Management LLC with participation from global payments technology firm Stripe. Brings the total raised to date to c$270m.

TrueLayer processes billions in payments, with 400% growth in payment volume and 800% growth in monthly payment value as the company expands across Europe and doubles its customer base.

Funding to accelerate the global rollout of TrueLayer’s payments network, with a focus on instant and recurring payments.

TrueLayer, the global open banking pioneer, today announced that it has closed a $130 million fundraising round, led by new investor Tiger Global Management LLC, the New York-based technology investor, with participation from global payments technology provider Stripe. The latest investment gives the business a post-money valuation of more than $1 billion.

The raise reflects TrueLayer’s position as the market leader in open banking payments, and the scale of its ambition to introduce a new global payment network, making instant and recurring payments available everywhere, in a few lines of code. In 2021, TrueLayer has processed billions in payments, experiencing 400% growth in monthly payment volume and 800% growth in monthly payment value as the company expanded across Europe and doubled its customer base.

Millions of consumers and businesses use TrueLayer to pay for goods and services. Whether investing through Freetrade, banking with Revolut, buying or selling a car on Cazoo, or saving money with one of the UK’s largest loyalty card schemes, TrueLayer powers some of Europe's most innovative brands. With the new funding it takes greater aim at opportunities in ecommerce, to supercharge the mainstream adoption of open banking payments. On average, 1 in 3 people already choose to pay via technology powered by TrueLayer, and some merchant partners are seeing more than 70% of their customers choosing to pay securely with their bank account over cards or digital wallets.

Francesco Simoneschi, CEO and co-founder of TrueLayer, commented: “There is only so long that global business can rely on systems that are outdated, expensive and not fit for the digital age. TrueLayer is carving a new world of payments altogether, which can deliver a fundamentally faster, safer and more user friendly experience that also improves conversion and delivers higher revenues for merchants. We are leading this innovation through instant deposits and withdrawals, and merging Variable Recurring Payments and Direct Debit to build ‘account on file’ services on top of our open banking network. There is an opportunity to rewire the financial system from the ground up and we are leading that evolution through open banking payments.”

TrueLayer’s network provides 95%+ coverage across the UK and major European markets, and accounts for more than half of all open banking traffic in the UK, Ireland and Spain. Its API-first approach helps customers to seamlessly pay, onboard, and share financial information in seconds, garnering a reputation as the technology provider behind many of the most valuable fintechs and cutting-edge businesses.

“Our investors have seen the impact TrueLayer is having by empowering important sectors, from ecommerce platforms and marketplaces, banks, through to trading and investment firms. I’m delighted to welcome an investor of the calibre of Tiger Global, who have an incredible track record backing firms like Flipkart, Nubank and Square that are creating the platforms, distribution networks and services of tomorrow,” Simoneschi added. “I’m also incredibly proud to have a new partner like Stripe, a company we have long admired for its developer experience and focus on solving real world problems that deliver significant value to its customers. I’m looking forward to collaborating closely with both firms to deliver on our vision.”

The new funding will be used to further scale TrueLayer’s business, offering the benefits of instant bank payments to more markets and sectors, and delivering continued product development and innovation, such as the PayDirect solution. It will also be used to continue the firm’s geographic expansion and deepening its engineering, product and commercial teams globally.

“When Francesco and I founded TrueLayer it was with a belief that open banking would act as a catalyst for fundamental change in financial services. I’m incredibly proud of how we’ve built the firm, with a focus on quality engineering and user experience aligned to product development that delivers the best possible services,” commented Luca Martinetti, co-founder and CTO at TrueLayer. “That is reflected in the thousands of developers using our services, the talent we are retaining and the calibre of leaders we’re attracting from world-class technology and fintech companies. Our people buy into the vision for what we’re building and the journey ahead. It’s also reflected in the quality of our investors who believe in our ambition and are as excited as us about what comes next.”

Alex Cook, Partner, Tiger Global, said: "The shift to alternative payment methods is accelerating with the global growth of online commerce, and we believe TrueLayer will play a central role in making these payment methods more accessible. We're excited to partner with Francesco, Luca and the TrueLayer team as they help customers increase conversion and continue to grow the network.”

The funding round is the latest milestone for TrueLayer in 2021. It follows the launch of its PayDirect solution, Verification API, and Payouts solution, receiving its full EU authorisation from the Central Bank of Ireland and establishing its European HQ in Dublin.

Related News

- 04:00 am

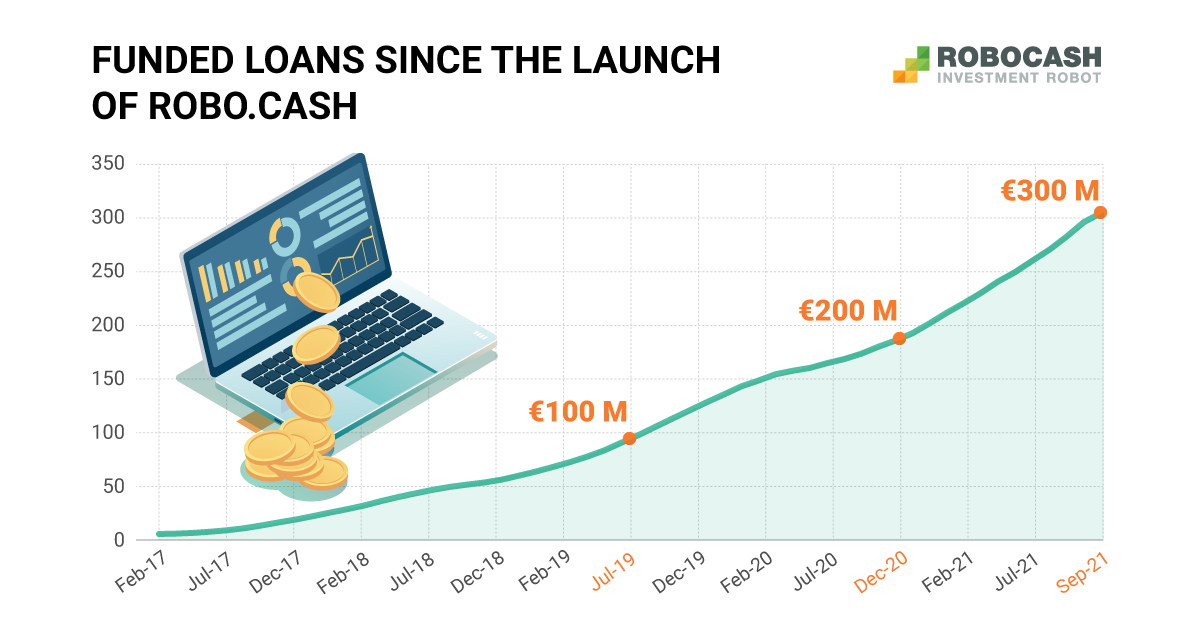

In September, European investment platform Robo.cash reached 300 M euro in total funded loans. The month was also recorded by another achievement - the number of investors crossed the mark of 19 thousand.

2021 sets a dynamic pace for the platform development, supporting the trend of the previous year. Thus, August brings in 13.4 M euro of funded loans, which is 105% more than in August 2020. With a slight decline in April and June, the volumes grow steadily, averaging 7%.

The platform currently has 19 thousand investors. For the entire period of Robo.cash operation, the customers have already earned more than 66 M euro.

In May, the platform introduced two new types of loans to invest in - “Buy Now, Pay Later” and salary-linked loans. They are placed by the service UnaPay launched by Robocash Group in the Philippines. The product is already successfully developing, increasing the volume of loans financed through the platform by 46% MoM since its integration. Investors of the platform have already funded almost 1.8 M euro of such loans.

“The platform received its first 100 M euros of funded loans two years after launch. After a year and a half, we have passed the 200 M mark. Now we are pleased to announce that we have reached a new milestone in less than 9 months. These results show that we are moving in the right direction. Thus, we follow market trends, integrate new products and bring even better transparency to our investors who are largely involved in these achievements”, comments Sergey Sedov, CEO of Robocash Group.

Related News

- 07:00 am

The increasing mobile data and cloud computing traffic and the rapid development of technologies such as artificial intelligence and the Internet of Things significantly increased the volume and complexity of data sets, driving the growth of the big data and business analytics market.

According to data presented by StockApps.com, the global big data and business analytics (BDA) market was valued at $215.7bn in 2021. This figure is projected to grow by 27% to over $274bn by the end of the next year.

Global BDA Spending to Surge by $60B in a Year

Over the years, digitalization has completely changed the economy, society, and people, and the COVID-19 has only speeded up the entire process. The data generated by billions of devices is in the center of this revolution. According to Statista, there are more than 21 billion interconnected devices globally, and their number is set to explode in the following years as internet consumption rises and new gadgets and machinery hit the market.

Big data is the set of technologies created to store, analyze and manage this bulk data, and identify patterns to design smart solutions. However, digitalization and increased cloud adoption have also been significant boosters for the growth of the business analytics market. Advanced analytics tools, like predictive analytics and data mining, help extract value from the data and generate business insights.

According to IDC's Worldwide Semiannual Big Data and Analytics Spending Guide, the global big data and business analytics (BDA) market had seen impressive growth even before the pandemic, with revenues rising from $122bn in 2015 to nearly $169bn in 2018.

By the end of 2019, total spending on these technologies and solutions jumped to over $189bn. As the COVID-19 continues driving the global shift to digital solutions, total BTA spending is expected to jump above $215bn in 2021. More than half of BDA spending will go towards services. IT services are projected to make up around $85bn, and business services will cover the remainder.

By the end of 2022, global BDA spending is projected to jump by almost $60bn, showing the most significant annual increase so far.

United States Account for Half the Total BDA Spending

The IDC survey also showed the United States is the leading big data and business analytics market, with a 51% market share in 2021. The adoption of big data and AI in the country has been increasing for the last two years, and as of 2021, around 49% of industry-leading firms in the US are driving innovation with data.

Far behind the United States, Japan ranked as the second-largest BDA market with a 5.7% share this year. China, the United Kingdom and Germany follow, with 5.5%, 5.1%, and 4.4% market share, respectively.

Related News

- 06:00 am

Councils that embed social value strategies into their procurement processes can add a minimum of +20% value says Eastbourne-based security print company Zunoma.

The Local Government National Procurement Strategy shows that councils embedding social value add a minimum of +20% value at no additional cost by providing genuine additional benefits for local communities.

In a recent review conducted by the Local Government Association, only 23% of 343 councils had published a social value strategy, with 44% having no mention of social value online.

Social value is setting the path for public and private sector procurement processes. It is the outcome of efforts by organisations to ensure that successful tenders demonstrate a positive contribution to the long-term wellbeing of individuals, communities, and the wider society.

As one of the key themes of the Local Government National Procurement Strategy, some councils have successfully implemented social value into their commissioning and procurement processes and are obtaining genuine benefits in areas such as employment, training and healthier communities.

Zunoma is urging councils to deliver strong social value initiatives by helping to align its services with local authorities to achieve community benefits.

Dinah Ouzman, Director of Strategy & Product Development at Zunoma, said: “Having a clear and committed social value statement will help communicate to your key stakeholders how seriously you view social value.

“From the recent review, we can see that there are many councils that are missing out on delivering real additional value to their communities, and this revolutionary shift creates a necessity for businesses to be transparent with their social value contributions as part of the tender process.”

Zunoma is dedicated to demonstrating social value contributions and is committed to supporting the local community and local schools. Its HR Manager, Lorraine Willis is working with The Turing School in Eastbourne as one of two Enterprise Advisers.

The role of an Enterprise Adviser is to volunteer time to help bridge the gap between the world of work and education, working with the career leaders and wider senior leaders of the school or college to create opportunities for young people. This government-funded voluntary role helps teachers to plan the school’s careers education and promote different workforces.

Lorraine said: “My role is to give the school strategic advice to help them reach the Gatsby Benchmarks standards which is the national measures for careers excellence”.

“As an HR professional, I am also able to utilise my skills to help students with job applications and employability skills. With Zunoma keen to recruit local talent, working with East Sussex schools makes it hopeful that we will attract the best talent.”

This year, the company will begin to promote upcoming apprenticeships and Kickstarter opportunities to local schools.

Related News

- 06:00 am

- Pensionhelp will deploy Comentis’ vulnerability assessment technology

- The leading provider of DB transfer advice will be utilising Comentis’ Cognitive Assessment Engine to detect vulnerability and direct customers to appropriate support

Pensionhelp, one of the leading providers of defined benefit (DB) transfer advice has selected Comentis’ technology to facilitate the process of identifying and supporting vulnerable customers.

Pensionhelp prides itself on offering bespoke and expert transfer advice to customers with DB pension schemes and works on referrals from Independent Financial Advisers (IFAs).

The Comentis software will help the firm to detect and support vulnerable customers early in the transfer process by asking all their new clients to complete the short online questionnaire. If the signs of vulnerability are detected, it’ll be flagged to the adviser who will then be supported through the next steps of managing that individual safely and professionally through the app.

Users will also have a clear audit trail to help with the recording and reporting of vulnerability, critical in the DB transfer market which is regularly subject to review from the regulator.

Pensionhelp is one of the first specialist providers of DB transfer advice that is proactively deploying this type of technology to support vulnerable customers. This is more important than ever following guidance from the regulator that it is against most people’s best interests to transfer their pension from a DB to a defined contribution (DC) scheme. As such, ensuring that a customer who wishes to do so is not vulnerable is vital.

Jonathan Barrett, Co-Founder & CEO of Comentis, comments:

“It’s vital that all providers of financial advice are using integrated tech when it comes to identifying and supporting vulnerable customers. The level of subjectivity that results from using manual processes alone can lead to a number of problems, particularly in the DB transfer market, which is subject to close scrutiny from the regulator. It’s therefore vital that advisers have a consistent and failsafe method for identifying signs of vulnerability and can direct these customers towards appropriate support.

“Pensionhelp is the first DB advice provider in the market to take the bull by the horns and address this head on. Our partnership will be crucial in helping them do so, providing them with a highly targeted solution to improve how they ask customers tricky questions so that no one falls through the cracks. It will also help when it comes to recording and reporting the identification of these customers to the FCA, making compliance with regulations much easier.”

Mark Wilson, Managing Director at Pensionhelp, comments:

“We opted for Comentis as its software allows us to consistently identify and support vulnerable customers, critical in the defined benefit sector as it’s so closely regulated. Some potential advantages of transferring from a DB scheme to a DC one can be outweighed by other factors, so it’s essential that customers wishing to do so not only seek independent expert advice, but also are properly assessed for any signs of vulnerability. Tech is the most efficient and consistent way of achieving this goal, especially as we are already seeing the impact of the last couple years with the FCA now estimating that there are nearly 28 million financially vulnerable adults in the UK. We’re excited about how Comentis’ tech will help our valued advisers and clients.”

Related News

- 03:00 am

Monneo, regulated by the Financial Conduct Authority (FCA), a virtual IBAN and corporate account provider, has enlisted cryptocurrency exchange Coinbase, in a move that will enable payment of invoices in a range of cryptocurrencies. The new service will be available for B2B invoice settlement and is supported by two of Monneo’s partner banks.

Coinbase, a secure online exchange platform for buying, selling, transferring, and storing digital currencies is a leader in the cryptocurrency industry.

Lili Metodieva, Managing Director of Monneo, comments: “We are excited to offer corporates an additional method of payment. Monneo will closely monitor the launch and implementation of this new service so that it is secure and reliable for both payers and payees.

“Increasingly companies in the IT and software sectors issue invoices with the option to settle via cryptocurrency, as well as traditional currency. Through its relationship with Coinbase, Monneo is responding to customer demand and remains at the forefront promoting flexibility in how payments are executed.

“In its platform, Monneo offers payments in 130+ fiat currencies to which leading cryptocurrencies are now added. Essentially payments in a cryptocurrency are no different from FX payments via fiat currencies. The mechanisms are the same”.

Lili added: “Whatever one’s perspective on cryptocurrency, it is here to stay. Many people see both the value of it and enjoy using it. We believe that by working with Coinbase, Monneo is offering its customers the highest standards in the cryptocurrency market.

Online merchants and B2B companies can set up multiple IBANs in their company’s name across multiple banks from Monneo's network.

With its high service standard and “private banking” approach towards business customers, combined with its expertise and knowledge in all aspects of merchant payments, Monneo’s customers can receive and send payments in more than 130 currencies internationally.

Related News

- 04:00 am

- Record number of participants in Bybit's World Series of Trading (WSOT) 2021 drove up total prize pool to a historic $4.09 million, up from last year's $1.27 million

- 매억남 secured No.1 title as captain of top troop 유튜브매억남 with a staggering 2,044.90% P&L, followed by 금융인 강은호 (1,774.84% P&L) and PepeCup Army (1,417.15% P&L)

- A star-studded cast from the esports world: gaming legends from four elite esports clubs dabbled in competitive crypto trading

The 2021 edition of the World Series of Trading (WSOT) ended on a high note on Friday. The world's best crypto traders can now kick back and relax after 20 intensive days of trading, having divided up a record prize pool at $4.09 million.

South Korean outfit demonstrated the value of team effort — 840,000 USDT to be exact, taking home the prize money on top of their stunning 2,044.90% P&L earnings. This year's trading super stars also include winners by individual P&Ls: HeresJonny (P&L: 7,265.94%), chinesebirdman (P&L: 4,599.74%) and CHANS (P&L: 4,249.09%).

Powered by Bybit, the world's largest cryptocurrency trading event attracted more than 34,738 sign-ups this year, up 280.86% from last year. Team players from 136 eligible regions formed or joined 196 troops in the main event, with 19,592 independent traders opting to play solo in the individual competition.

WSOT 2021 has captivated crypto lovers worldwide this year with the sheer size of its prize pool of USDT and NFTs. The event has also extended its reach to another community with a group of special guests: A-list esports athletes.

12 gaming professionals from four prominent organizations — NAVI, Astralis, Alliance and Virtus.pro — put on their crypto trader hat and assumed the role of troop captains with 198 troopers slash fans from around the world, who followed their exhilarating performances live on the event website.

"We are in awe once again of the outpour of support from the global crypto community, and we are excited to have met all 34,738 participants this year. Whether you've just discovered WSOT or crypto, whether you are a seasoned trader or a budding crypto lover, you have found an incredibly creative and supportive community," said Ben Zhou, co-founder and CEO of Bybit.

"We have returned bigger and better this year as promised. WSOT runs on the principles of fair competition, full transparency, access to opportunities and everything crypto is about. We hope everyone who took part in WSOT 2021 will continue to find joy in trading and explore the potential digital assets have to offer in the next 12 months as we build the next big thing," Zhou added.

City of dragons, secret codes, surprise dropping of NFTs, WSOT 2021 was not for the faint of heart. Keeping up with its imaginative gamification tradition, this year's tournament kept participants entertained and challenged with live tasks, mini games, and most importantly traders had to compete to deliver the most impressive final P&Ls and performances for the grand prizes and bonus prizes. Together, traders from around the world successfully unlocked the largest prize pool the crypto trading world has ever seen.

It takes imagination and dedication to win in a trading competition, which is why Bybit is committed to furthering its partnership with UNICEF to empower girls' education in East Asia and the Pacific with another BTC donation equivalent to $400,000 in WSOT 2021, or 5% of the prize pool plus contributions from Bybit. The donation is dedicated to UN's Sustainable Development Goal No. 4 towards "inclusive and equitable quality education" via UNICEF efforts. It helps fund, among other initiatives, digital education for girls in the region by making science and technology education within reach for marginalized groups with innovative education solutions.