Published

- 03:00 am

Assets offers current account flexibility, with the potential for investment returns

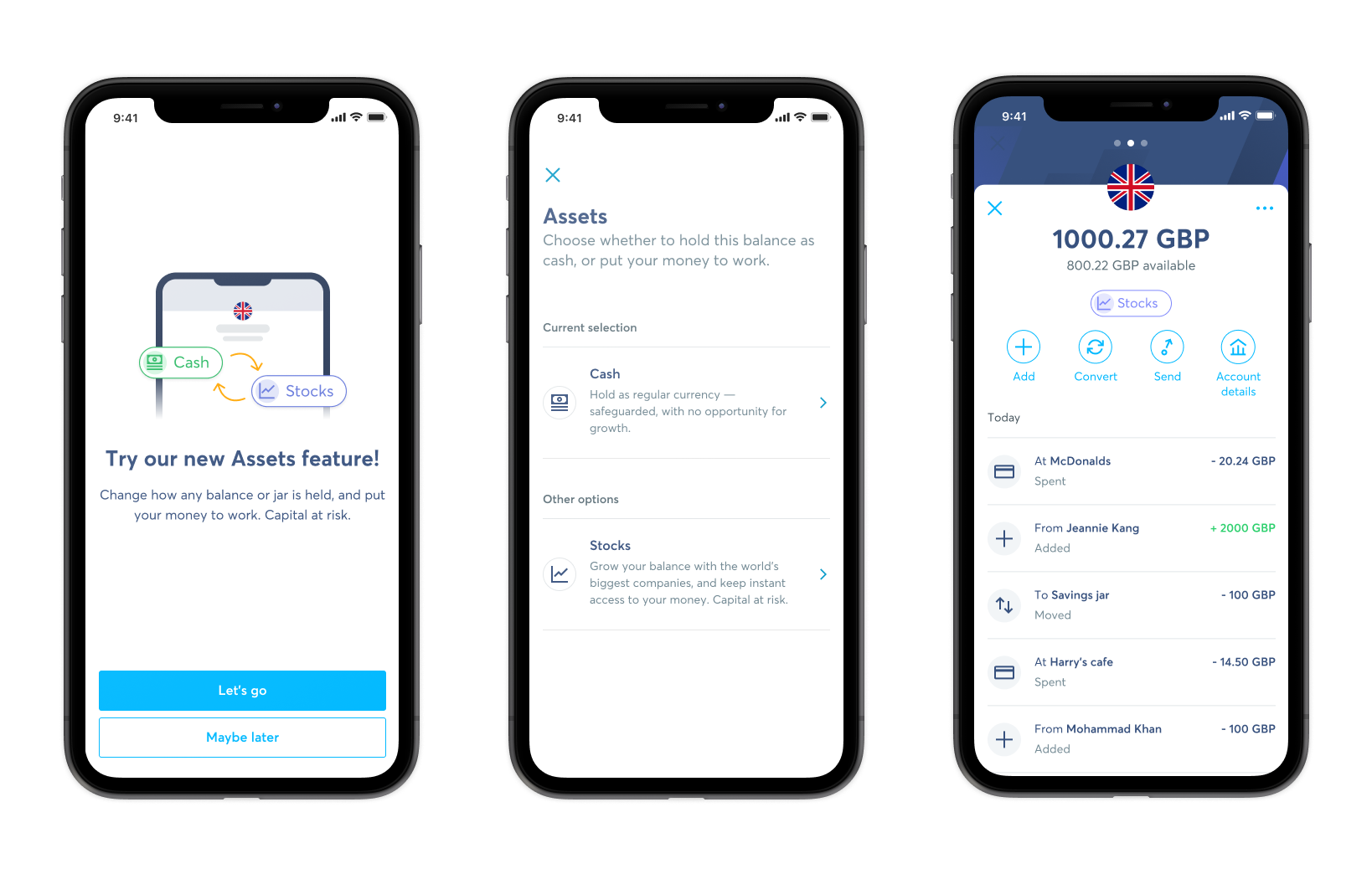

Wise, the global technology company building the best way to move money around the world, has today introduced its multi-currency investment feature Assets, to UK customers. Assets will give people and businesses in the UK the opportunity to choose how their money is held, and potentially earn a return on their money, across 54 currencies.

Wise Account holders in the UK will be able to access Assets today. Wise Business customers can start using Assets on the web, with access on Wise mobile apps coming in a few weeks.

Wise has selected the first asset to be Stocks, a broad portfolio of 1,557 of the world’s largest public companies included in the MSCI World Equity index, such as Apple, Amazon, and Google, and is collectively worth more than £40trn. Wise has selected BlackRock to provide the tracking fund for this index.

Unlike money held in traditional investment accounts, customers will have instant access to the majority of their money meaning they can hold their balance in Assets, and still spend and send the money in real time, as and when they need it.

By unlocking access to their money, and offering investment through multiple currencies, Wise seeks to create a more convenient experience for people who send, hold and receive money in multiple currencies.

With £4.3 billion being held globally in Wise Account balances, Wise will focus on a European rollout of Assets as a next step.

How it works

UK customers can tap ‘Cash’ on any of their balances or jars, then select ‘Stocks’, which will invest the money held into the chosen index fund

The BlackRock iShares World Equity Index Fund invests in hundreds of the world’s biggest companies

Earnings are represented in the customer’s balance currency and are updated daily

Up to 97% of customer money is available to use instantly

Customers can switch the money they hold in stocks back to cash at any time

Costs:

The overall cost of the product will include a 0.55% service fee to Wise, and a 0.15% fund fee (OCF) to BlackRock

Investments held in Assets may be entitled to compensation from the Financial Services Compensation Scheme (FSCS) for up to £85,000. However, the value of investments and the income from them can fall as well as rise, and are not guaranteed. Capital is at risk, and investors may not get back the amount originally invested.

Kristo Käärmann, CEO and co-founder of Wise said:

“People all over the world are holding billions in their Wise and Wise Business accounts for the long-term. But holding money in various currencies can be hard to manage efficiently. Assets is seeking to solve that problem, by providing an opportunity for customers to earn a return on their money with us, in a host of different currencies, all in one place.

“It’s not a standard current account, or a savings account, or a stock picking investment platform. It’s something new we’ve built to give our customers a balance between the convenience, reliability, and potential returns of all three.

“We’re solving financial problems for people who are living more international lives. This new product will take us one step further in replacing old-school international banking, by making Wise work harder for our customers.”

Joe Parkin, Head of Banks and Digital Channels in the UK at BlackRock added: “People are increasingly turning to a single app to manage their financial lives and improve their wellbeing. Offerings, such as Assets from Wise, are bringing financial services into the digital age and in-line with consumers’ expectations. Providing people with investments alongside other financial products is critical to helping them achieve their long term goals.”

Related News

- 01:00 am

Diasoft, a global provider of financial technologies, moves up on the annual IDC FinTech Rankings. The 18th vendor ranking highlights top 100 global providers of financial technology and represents the leading hardware, software and service providers to the financial services industry from around the world. Vendors are ranked based on 2020 calendar year revenues attributed to financial institutions. This is the 10th consecutive year Diasoft has appeared on the prestigious list. To view the list in its entirety, please visit HERE.

The ranking categorizes and evaluates the top global providers of financial technology based on calendar year revenues and the percentage of revenues exclusively attributed to financial institutions, including banks, capital markets firms, and insurers. These providers supply the technological backbone of the financial services industry, an industry in which IDC Financial Insights forecasts worldwide spending on IT across the globe to be $590 billion (USD) by 2025.

“Being named in the IDC FinTech Rankings is a significant accomplishment, demonstrating a provider’s commitment to the success of its financial institution clients,” states Marc DeCastro, Research Director at IDC Financial Insights. “The IDC Fintech Rankings, now in its 18th year, is the global standard list of fintech providers to the industry, and we congratulate the 2021 winners.”

To thrive in a digital economy, financial services organizations must embrace innovative and integrate cutting edge technology effectively to enhance the customer experience and achieve operational excellence. Diasoft is committed to helping financial institutions successfully execute their digital transformation initiatives for the betterment of their customers around the world. This helps Diasoft to constantly improve its position in this annual ranking, proving the company’s ongoing business growth and successful business strategy.

Related News

- 07:00 am

Innovative industry-first approach to machine learning considerably enhances fraud protection for merchants and financial institutions

ACI Worldwide, a leading global provider of real-time payments and digital payment software solutions, today announced at Money 2020 Amsterdam that the patent for its incremental learning technology – an innovative industry-first approach to machine learning – has received full approval.

Incremental learning technology is an integral part of ACI Fraud Management and considerably enhances fraud protection for merchants and financial institutions. While traditional machine learning models need to be ‘re-trained’ as fraud patterns change, models using incremental learning make small adjustments on an ongoing basis, allowing the model to adapt itself in production when new behaviors are observed.

“Fraud attempts on financial institutions and merchants continue to rise globally, while fraud patterns are evolving more rapidly than ever,” said Debbie Guerra, head of merchant segment, ACI Worldwide. “Incremental learning is a key development in the fight against fraud – a technology that is highly adaptable and responsive to emerging threats. Its full patent approval is a recognition of the innovative approach of our dedicated data science team.”

“As the first solution provider globally to roll out this incremental learning technology, ACI has set itself apart in a competitive and rapidly advancing fraud prevention market,” commented Jimmy Hennessy, head of data science, ACI Worldwide. “Incremental learning is a realization of our multi-year investment and will strengthen our sophisticated fraud monitoring and prevention solutions, helping customers to dramatically reduce payments fraud.”

ACI Worldwide has more than 20 years’ experience in designing and implementing machine learning models, which have long been a fundamental element within ACI Fraud Management. Machine learning models, combined with incremental learning technology, are capable of analyzing large amounts of complex data to identify fraudulent behaviors and alert future suspicious transactions, enabling merchants and financial institutions to minimize fraud loses while keeping revenue high.

Related News

- 06:00 am

The Ecosystem combines r10’s insurance industry knowledge and implementation expertise with its partners’ leading technology solutions and services. Clients will have access to a one-stop-shop of products and services that bring together best practice expertise gained from current experience of the insurance sector, providing a flexible approach to change.

Amechi Peirce-Howe, founder and managing director of r10, said, “Through our work across the London insurance market, we have seen that our clients are crying out for an effective way to break down silos and achieve genuine collaboration – not just talk about it. The r10 Partner Ecosystem is a way of addressing that need, understanding that effective tactical and strategic solutions simply should not and must not cost the earth or drag on for years.

“Each member of our Ecosystem can of course stand on their own to offer best-in-class solutions to any individual business problem, but by working together, we can all deliver more than we ever could on our own. In a well-balanced ecosystem, the whole is greater than the sum of the parts."

Seven partners are involved in this new venture: Amarillo, EDII, Eigen, Insureflow, Netcall, Vitale, and Vitesse who were chosen after a rigorous selection process. They provide diverse services such as document AI, connection tools for delegated underwriting authority parties, corporate creativity coaching, digital distribution systems, smart ways to make global payments, low-code messaging solutions and other digital solutions. Each service offers efficiency gains for the market, enhanced by r10 at the heart of the Ecosystem offering delivery and implementation support.

In practice, the Ecosystem will cover seven areas:

● Digital growth solutions

● Digital product distribution

● Talent incubation

● Low-code process transformation

● Artificial intelligence

● Revolutionising data

● Claims settlement and liquidity management

To find out more regarding the r10 Partner Ecosystem, please click: https://vimeo.com/604937495

Related News

- 01:00 am

Fresh data from OpenPayd reveals brand appetite for embedded financial services across UK, France, Italy, Germany and Spain

OpenPayd, a leading global payments and banking-as-a-service (BaaS) platform, today revealed insights from the largest ever independent study of brand attitudes towards embedded finance. The data informs the report, Embedded finance surge to net €720bn for European brands by 2026, which suggests 73% of brands plan on launching embedded financial services within the next two years. Across the countries surveyed, brands expect embedded finance to add an additional €720.78 billion in revenue over the next five years. This is despite 95% admitting to not fully understanding what embedded finance means, and many encountering challenges associated with hiring fintech talent.

Preparednss does not match appetite:

- On average, across the four main sub-sectors of embedded finance – banking, payments, insurance and lending - respondents expected to increase their current revenues by ~7% over the next two years, ~11% over the next five years and ~15% over the next ten years.

- 91% only have a partial understanding of embedded finance, even though 73% say they plan to launch embedded finance offerings in the next two years, 18% in the next 12 months. 92% of brands plan to release offerings in the next five years. Only 5% already have an embedded finance offering.

- More than 7 in 10 (71%) plan to build new internal fintech teams to work alongside BaaS partners and implement embedded banking offers, for example. However, demand for fintech talent already significantly outstrips supply and this looks set to intensify.

- Partnerships will be extremely important, but most respondents, who were senior executives from brands generating a minimum of €60m in annual revenue, are unable to name appropriate embedded finance/BaaS partners.

Embedded finance offerings fuelled by desire to improve customer experience:

- The top three most appealing aspects of embedded finance were named by respondents as - retaining front-end customer experience (85%), increasing the number of customer touch points with their brand (84%) and offering mobile wallet or current account options to customers (79%).

- Financial benefits ranked lower – increased cross-selling opportunities were appealing to 68% of brands.

Enthusiasm differs across types of embedded finance

- Embedded banking: 6% already offer embedded banking to customers and nearly all (92%) plan to offer it in the next five years.

- Embedded payments: 4% of respondents said they already offer embedded payments to customers and 83% plan to offer in the next five years.

- Embedded insurance: No respondents reported that they already offer embedded insurance to customers and only 28% plan on doing so in the next five years.

- Embedded lending: No respondents reported that they already offer embedded lending to customers and less than a quarter (23%) plan to offer it in the next five years.

“It’s promising to see more and more customer-centricity from brands, who are anticipating mass shifts in consumer need and making ambitious plans to launch embedded financial services,” said Iana Dimitrova, Chief Executive at OpenPayd. “We’re on the cusp of an embedded finance revolution across B2C and B2B sectors, which will peak in the next two years. However, navigating the complex maze of infrastructure providers with limited in-house experience slows down value creation of the otherwise significant €720 billion opportunity in Europe alone. No matter what, retailers, service-driven companies and all those in between are planning, partners will be essential – helping to navigate the complexities and to innovate ahead of demand.”

Embedded finance surge to net €720bn for European brands by 2026 can be downloaded here.

Conducted by Coleman Parkes, respondents included 150 senior executives from B2C and B2B marketplaces, horizontal and vertical SaaS brands and gig economy platforms across the UK, France, Germany, Italy and Spain. Brands covered markets from eCommerce and manufacturing to technology services and mobility and generate a minimum of €60m in annual revenue. The survey was completed in July 2021 in accordance with the Market Research Society’s Code of Conduct. Respondents were responsible for the identification and implementation of new product and service offers to customers.

Related News

Karen Holden

CEO at A City Law Firm

It seems that the pandemic has done nothing to dampen investment into technology businesses both in the UK and globally. see more

- 07:00 am

Central European energy group to implement OneStream’s Intelligent Finance platform

Energetický a průmyslový holding (EPH), a leading Central European energy group, has selected corporate performance management (CPM) vendor OneStream Software to unify the company’s finance operations. EPH will utilize the OneStream platform to streamline their financial close, consolidation, planning and reporting processes for over 400 users across the enterprise.

EPH owns and operates assets in the Czech Republic, the Slovak Republic, Germany, Italy, Ireland, the UK, France and Switzerland. The company manages over €18 billion in assets, with €8.5 billion in revenue in 2020. The company needed a flexible platform that could accommodate the complexity of EPH’s assets, as well as manage the company’s continued growth and ever-changing business environment. After a detailed evaluation process, OneStream was selected for the platform’s modern approach to CPM.

“OneStream brings a new and fresh concept based on predefined process and best practices in financial management,” said Martina Matouskova, Business Performance Director at EPH. “The platform is flexible to support our complex business environment as well as rapid changes in our Group structure. Partnering with OneStream will help with future automatization of our finance processes and will play a key role in improving our user experience.”

“Just as EPH seeks to achieve excellence in all aspects of its operations, our mission at OneStream is to drive 100% customer success,” said Craig Colby, President at OneStream. “We are thrilled to partner with EPH to evolve their financial processes and to support their growth by providing key insights into business performance, flexibility for users and a unified approach to the office of finance, from financial close and consolidation to reporting, planning and analytics.”

Related News

- 08:00 am

Roseland Born Logistics to utilize the new funds to purchase a new box truck for the company

Nav, the simple and intelligent financing platform for small businesses, today announced Roseland Born Logistics as the most recent $10,000 grand prize winner of its quarterly Small Business Grant. Roseland Born Logistics is a black-owned, logistics company that provides inbound and outbound dry freight services. Owned and operated by Mark Davis and Chris Banks, the logistics company plans to use the grant money to purchase a box truck for the business.

Nav’s quarterly Small Business Grant comes at a time when many small businesses are looking for financing, but are unable to access new funds because of changes in bank financing offerings and solutions. Nav is stepping in and providing solutions for small business owners in a post-PPP world through the Small Business Grant and working to make sure that small businesses are continuously supported.

“It’s an honor for Nav to work with the smallest of small businesses at every age and stage of their business, especially businesses like Roseland Born Logistics who are newer to the small business world,” said Greg Ott, Nav CEO. “We are inspired by Chris Banks and Mark Davis’ tenacity and drive to go out on their own and build a small business, and we look forward to seeing the great work that Roseland Born Logistics will do for the Minneapolis-area.”

Prior to opening Roseland Born Logistics, Banks and Davis were working at other companies. When they realized that they weren’t being paid their worth, the two decided they wanted to take ownership of their careers and build their own company. From there, Roseland Born Logistics was launched.

“With my co-owner, Chris Banks, we started this business back in April 2021. What we didn't realize before starting our business is how difficult it actually is to get funding as a new small business -- many banks only want to work with businesses that have been up and running for at least one year,” said Mark Davis, co-owner of Roseland Born Logistics.“As one of the only black-owned transportation companies in Minnesota, we wanted to make a lasting impact in our community. And thanks to Nav’s grant, we’re continuing to meet our goals and grow within our first year of business.”

Nav also awarded a runner-up prize of $5,000 to Artland Studios, an art education studio located in Paden, Oklahoma. Owner of Artland Studios, Leslie Anne Martin, founded her business in October 2018 as a sole proprietorship, and recently upgraded to an LLC in March 2021. Martin created the studio to provide art opportunities to children and adults living in rural, central Oklahoma.

“I grew up in Paden, Oklahoma so I knew there wasn’t nearly enough funding for arts programs in the local schools or arts opportunities for adults,” said Leslie Anne Martin, Owner of Artland Studios. “My long term goal for Artland Studios is to be able to host artist residencies, where an artist can come for a period of time, use the facilities and the equipment, make incredible art, and then conclude their residency with an art exhibition in the local vicinity.” Martin plans to use the funds from Nav to help build a classroom space within her studio so adults and children have a place to learn about the arts.

Nav created the Nav Small Business Grant in 2018 to raise awareness about the obstacles small business owners and entrepreneurs experience when building and maintaining their businesses. As of September 2021, Nav has awarded $170,500 to small businesses across the country. In the last round of grant winners, Nav provided a $10,000 grand prize to JW Equine Services, a full-service equine training facility.

The next round of Nav’s Small Business Grants are open now and will close on October 26, 2021. Learn more about the grant and how to apply here.

Related News

- 03:00 am

UK-based personal finance management platform Fineo partnered with European open banking company Nordigen to leverage open banking technology. Fineo facilitates the integration of customer bank accounts using Nordigen's account information API to offer a clever way to manage finances. Fineo understands that managing personal finances isn’t always easy, so they developed a solution that allows users to do so in a simple, but powerful way. The company aims to give users the best tools to make personal financial management easy and effective.

“Every day we make decisions on where to eat, what transportation to use, or what our plans are for the upcoming weekend. All these choices have a financial basis and have an impact on personal finances. Our tools help users develop a vision of the financial life they want to achieve both in the short and long term. Nordigen’s account information API enables us to help them create a foolproof budget by taking into account future expenses, so that they don’t have any surprises.” says Fineo Representative Mohammed Amine Atmani.

Using Nordigen’s free API, Fineo customers are able to connect their personal bank accounts through Fineo’s personal finance platform. The platform provides the tools for users to plan a budget, have a centralised view of all their accounts, manage transactions and analyse finances. The end result is a fast and easy technological solution for creating and maintaining a personal budget. Nordigen’s API is fully PSD2 compliant, so Fineo users gain the additional benefit of a secure connection to their open banking account data.

“Fineo is perfectly positioned to leverage secure, consented connections to account information to provide users with the best personal finance management experience. PSD2 was created to democratise access to open banking data and we’re pleased that our solution can help Fineo offer a seamless and effective personal finance management solution to users all over Europe.” says Rolands Mesters, co-founder and CEO of Nordigen.

Related News

- 05:00 am

Bitcoin's growth in recent years has resulted in investors reaping significant returns with the asset's rising value. The growth in Bitcoin's return on investment has seen the asset outperform stocks by major banks.

According to data acquired and calculated by Finbold, Bitcoin's return on investment over the past five years has outperformed leading banks' stocks by 4,214% on average. The cryptocurrency has outperformed Wells Fargo (WFC) by a whopping 7,151.86%.

Compared to Citigroup (C), Bitcoin ROI is higher by 4,951.47%, while Goldman Sachs (GS) ranks third at 3,101.94%. JP Morgan (JPM) is fourth at 3,067.51%, while Bank of America (BAC) is fifth at 2,800.59%.

Among the highlighted asset classes, Bitcoin also controls a higher market capitalization of $813.56 billion as of September 21. JP Morgan (JPM) ranks second with a market cap of $471.17 billion. Among the banks, Bank of America (BAC) has the second-highest market at $340.80 billion.

Wells Fargo (WFC), Citigroup (C), and Goldman Sachs (GS) have a market cap of $190.82 billion, $141.49 billion, and $131.96 billion, respectively.

Bitcoin banks on monetary debasement to grow in value

The report highlights some of the drivers being Bitcoin's significant return on investments. According to the research report:

"Additionally, the gains might be a reflection that the asset is emerging as a formidable hedge against inflation and a store of value. Amid the coronavirus pandemic, stocks plunged, and while most economies went into recession and central governments embarked on wide-scale printing of money, Bitcoin was viewed as a hedge against monetary debasement."

It is worth noting that Bitcoin has sustained the returns despite facing barriers on the regulatory front alongside concerns on high volatility.

Read the full story with statistics here: https://finbold.com/bitcoins-5-year-roi-outperforms-major-banks-stocks-by-over-4000-on-average/