Published

Neil Kadagathur

CEO at Creditspring

Typically, when we think of someone struggling to access affordable credit, we think of young people who haven’t borrowed in the past. see more

- 06:00 am

A Fast Track to Investment (FTI) service is in development, facilitating data-driven due diligence at record speeds while increasing confidence amongst investors and startups.

In line with its mission to bridge the gap between decentralized and traditional finance, AllianceBlock has announced a strategic partnership with Graypes GmbH, a Swiss-based company using algorithms and AI to rate startups and vett opportunities for investors.

AllianceBlock and Graypes are teaming up to provide the global investment community with a unique Fast Track to Investment (FTI) service. Through FTI, businesses can be evaluated and then micro/seed-funded at record speeds, helping to provide swift and reliable investment to businesses, drastically reducing time and cost spent on evaluation processes. This service will target retail and professional investors and will be based on top rated businesses with a focus on technology such as Fintech, PropTech and SaaS, as well as more conventional startup models.

This will be a mutually beneficial partnership; AllianceBlock will integrate Graypes’ leading business rating technology and company assessment mechanisms into its decentralized peer-to-peer funding protocol, AllianceBlock Fundrs. This enables smarter investment, lending, and borrowing in the decentralized finance space. In tandem, Graypes will gain access to the Fundrs platform enhancing their ability to support their existing network of entrepreneurs.

Commenting, Rachid Ajaja, CEO and Co-founder of AllianceBlock, said, “The finance industry is still lacking a verified vetting system to allow investors to identify and invest in promising startups. Recent interest amongst leading institutional players is a testament to the demand for integrated products like these, where costs and time are vastly reduced without compromising on proper due diligence. In addition, many startups face issues with accessing capital from reliable sources. Our new partnership with Graypes will create a unique, verifiable, and trustworthy funding ecosystem that increases capital flows between investors and startups through data-driven verification.”

Federico Carrasco, CEO and Founder of Graypes, said, “There is a real gap in the startup investment market for fast, reliable services that help global businesses to receive evaluation and access the funding they need to grow. Co-developed with AllianceBlock, the Fast Track to Investment (FTI) service will provide investment capital to businesses while reducing time spent on assessment and funding in a decentralized environment.”

Ajaja concluded, “Our partnership with Graypes represents another milestone in AllianceBlock’s growth, bringing us closer to making our vision of an integrated financial sector a reality. By integrating Graypes solutions with AllianceBlock Fundrs, we have created an invaluable opportunity for investors to optimize decision making across the board and make data driven decisions about projects. In addition, startups will benefit from increased capital flows from reputable industry investors. We believe that delivering on this commitment is essential to the future of the global financial system.”

For more information, visit: www.allianceblock.io

Rachid Ajaja, CEO and Co-Founder of AllianceBlock, and Federico Carrasco, Founder, and CEO of Graypes, are available for interview

Related News

- 04:00 am

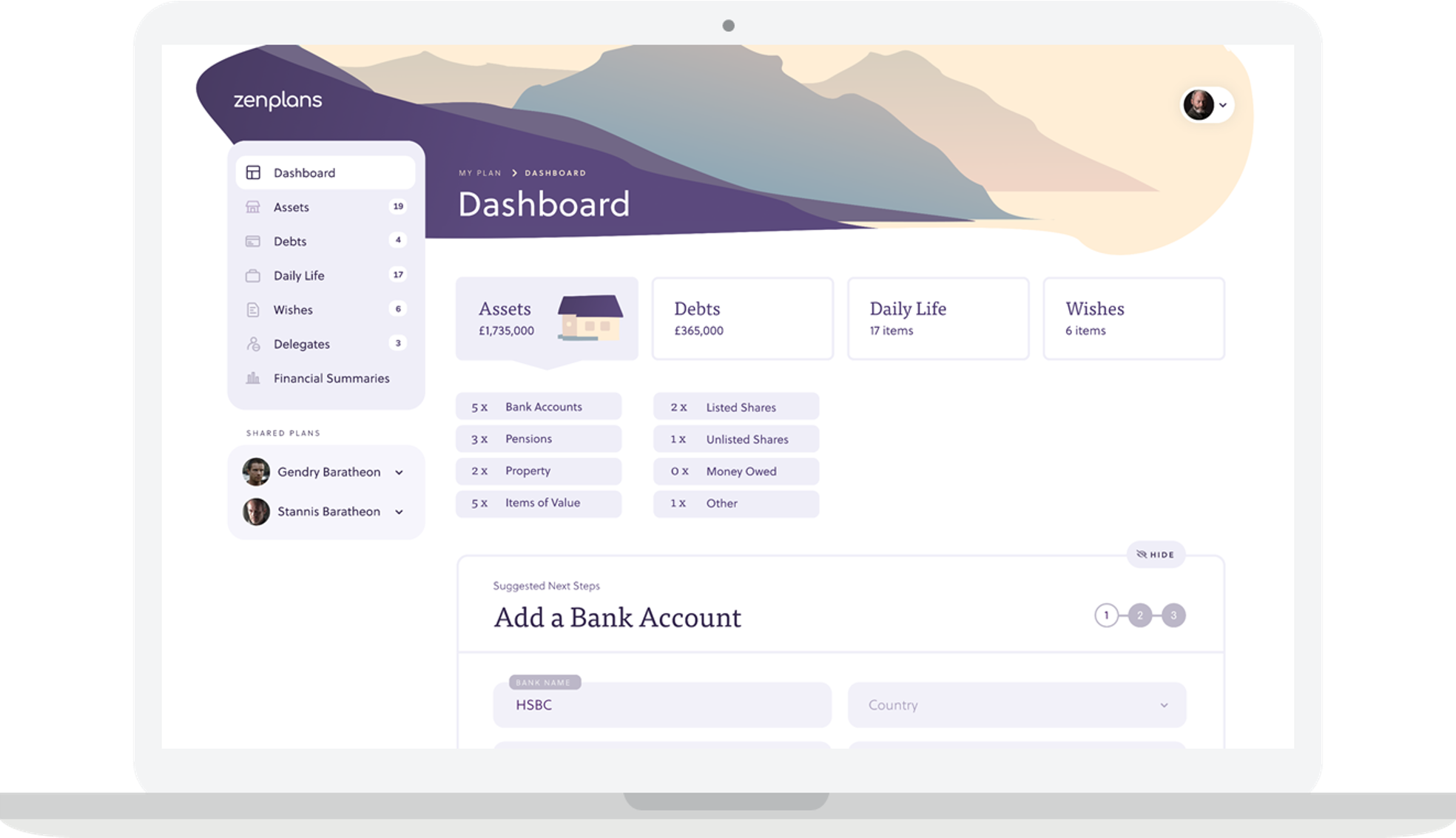

- Organise, maintain, securely store and selectively share important personal, legal and financial information

- All details stored in one place for efficient planning and improved customer experience

- Enables clients, professionals and their families to work together seamlessly

Zenplans a new digital estate planning service has been launched for advisers, solicitors and accountants to help their clients securely organise, maintain, store, and selectively share all their most important personal and financial information.

As we move away from traditional paper documents towards a more digital society, it is becoming increasingly difficult to keep track of all the various personal and financial information we have. Zenplans offers a solution; professionals can help their clients manage their assets, debts and other financial affairs as well as key information about their daily lives; from their utility provider to their social media accounts.

The system also securely stores a clients’ wishes - including details about their will and Lasting Power of Attorney (LPA) and how to organise their digital legacy - with the option to selectively share key details with named delegates. These delegates can be granted restricted or full access, either immediately or after a particular time - for example, after death, or if the client becomes incapacitated - ensuring that information is quickly and easily accessible by the right people as and when needed.

This means that if a client dies and they had a Zenplan in place, any professionals with access to it can then work together to find all the information they need to complete probate, saving time and stress, mitigating the risk of missing any key information and ensuring a much-improved experience for those left behind.

Zenplans was created by Stephen Moses, a former management consultant for EY, after he experienced first-hand how difficult it can be to identify and collate all the information needed to administer someone’s estate. He realised that, not only is there a huge amount of personal and financial information to deal with, but that finding it all and making sure the right people have access to it - both during their lifetime and when they die - can be a complete minefield.

He said: “We all have so much personal and financial information, that it is hard enough to keep on top of it all ourselves, making it almost impossible for our loved ones to sort out when we pass away.

“And now everything is online, it can be difficult to know exactly what assets the person had, let alone where they are, making trying to piece it altogether really stressful at what is already an incredibly emotional time for those left behind.

“I wanted to do something to make it much easier for people to keep on top of all their important information during their lifetime, but also create a way for people to share all that key information securely with those closest to them - both professionals and family members - to make estate administration easy.”

Zenplans also works as a key planning tool for professionals - the step-by-step guidance helps create touchpoints, and identifies any planning gaps, enabling them to turn a transactional relationship into a more advisory, lifetime connection, creating a closer bond with both the client and their family, as Stephen explains: “Zenplans helps identify any gaps in a clients’ planning, giving professionals the opportunity to operate at the forefront of estate planning and make a real difference to their clients’ lives.

Stephen concludes “Plus, by creating a Zenplan, clients are encouraged to think about sharing their wishes with loved ones, which then naturally helps engagement with family, offering an organic way for professionals to build and maintain new relationships with the next generation.”

Related News

- 01:00 am

Profile Software, an international financial solutions provider, announced today its participation, once again as a partner, in Sibos, the largest annual conference, exhibition and networking event for the financial industry, taking place ONLINE, on 11-14 September 2021.

With a growing presence across 45 countries, 30 years of experience and continuous investments in R&D, Profile is already delivering systems that incorporate advanced capabilities to Financial Institutions. The company is planning to present and discuss its newly launched platforms that support the digital transformation in action, true automation, use of numerous APIs, and more το the Sibos online delegates and elaborate on what drives the futures of banking.

The solutions to be presented include:

Finuevo: the mobile-first digital banking platform. The pioneering platform that offers a modern banking experience to both professionals and end-users across all channels.

FMS.next: all new and completely revamped banking platform with a powerful front for advanced operations

Acumen.plus: the evolution of the established Acumen-net, offering a complete open cloud-native platform for the whole spectrum of Treasury and Capital Markets operations in real-time.

Axia Custody: the upgraded new platform for Custody that offers unique automation features to streamline the process globally. It delivers digital, web-based capabilities as well as configurable workflows, customisable dashboards and reports.

RiskAvert: the complete and modern Risk, Capital Management and Regulatory Reporting platform for Credit, Market, Operational and Liquidity Risk according to the international frameworks.

Sibos, this year, will examine how digital acceleration, technological innovation, risk and change (including towards greater diversity and sustainability) intersect with some of the most pressing topics of our time.

For more of our product range visit our products. To register at the event, please visit the event website here.

Don’t miss the opportunity to meet with us online at Sibos 2021. Book your meeting online !

Related News

- 05:00 am

With broad industry consensus around the benefits of increased central clearing of U.S. Treasury transactions, firm outlines how to best implement a clearing mandate.

The Depository Trust & Clearing Corporation (DTCC), the premier post-trade market infrastructure for the global financial services industry, today issued a new white paper, “Making the U.S. Treasury Market Safer for All Participants: How FICC’s Open Access Model Promotes Central Clearing,” that explores how to advance central clearing around U.S. Treasury transactions.

The latest paper from DTCC’s subsidiary, Fixed Income Clearing Corporation (FICC), describes how FICC’s long-standing “open-access” approach provides the flexibility necessary to allow a wide variety of market participants to access central clearing, while also ensuring impartiality and fairness. It also compares and contrasts key differences between the cleared U.S Treasury market and the cleared swaps market, as well as important considerations for implementing a possible clearing mandate.

The paper suggests that it is important to consider the significant differences between markets when developing market regulation. For example, several market participants who do not engage in the swaps market are critical liquidity providers to the U.S. Treasury market. The systemic risk mitigation objectives of a clearing mandate will not be achieved if those market participants cannot effectively access clearing. FICC currently offers a variety of client clearing models for U.S. Treasury cash and repo transactions, including correspondent clearing, prime broker clearing and Sponsored clearing via FICC’s Sponsored Service, to allow market participants to select the model that best addresses their needs.

“DTCC applauds industry efforts to introduce greater levels of central clearing to the U.S. Treasury markets,” said Murray Pozmanter, Head of Clearing Agency Services and Global Business Operations at DTCC. “The benefits of such a move are significant, including a reduction in settlement and counterparty risk, lowering the risk of market disorder and fire sales and enhancing market access and liquidity. However, in order for such an effort to be implemented effectively and deliver upon risk management objectives, considerations must be given to current market practices and approaches as mandates are developed. We look forward to working with regulators and the industry on this important effort.”

To advance this critical initiative, DTCC will continue its work with the industry to ensure that all firms looking to access clearing, either on a voluntary or on a potentially mandatory basis, can do so in an impartial and fair way.

Industry participants are welcomed and encouraged to become active parts of this conversation as next steps are identified.

Related News

- 05:00 am

Payhawk introduces industry-first 3% cashback on all payments, integration to Microsoft Dynamics 365, and Single Sign On for enterprise clients, as the company looks to disrupt corporate payments and expense management market.

Payhawk, the all in one finance system helping businesses spend effortlessly, has today announced an industry-first 3% cashback on all payments, integration to Microsoft Dynamics 365, Single Sign On for enterprise clients, as the company looks to disrupt corporate payments and expense management market. In addition, the company’s integration with both Google Pay and Apple Pay now reaches over 30 countries.

Payhawk’s new suite of enterprise tools and features are targeted at fast-growing multinational companies that are expanding their international presence, and need a strong and efficient financial stack to control company spend without prohibitive administrative overhead.

Hristo Borisov, CEO and Co-Founder of Payhawk said, “Currently, finance teams often use multiple disconnected tools for payments, invoices and expense management. Often paying hundreds of thousands of euros for license fees to different vendors that add the overhead of additional integration costs to the company’s main ERP system. We bring all these enterprise tools under one solution together with an industry first corporate card with 3% cashback capped at our subscription. This way, we reinvest a portion of the interchanges we earn from Visa to subsidize the licenses of our customers that spend heavily through corporate cards. Our customers get enterprise grade financial software with the most efficient company card free of charge.”

Payhawk combines payments, invoices and expense management as it closes the gap between banks and ERP (Enterprise Resource Planning) systems. As a result, Payhawk empowers finance teams to reduce manual work, keep tight control of budgets in real-time, and fully automate spend across every payment method. Instead of using 5-6 tools across multiple markets, Payhawk delivers a single solution for finance teams that can serve businesses in over 30 countries.

The new pricing plans are available on www.payhawk.com and new customers can sign-up from today.

Payhawk also announces live reconciliation of expenses and payments to Microsoft Dynamics 365 Business Central streamlining all administrative work around managing company spend. Single sign-on with support for SAML and Active Directory is also making its debut for enterprise customers that want maximum security and easy access of employees to company cards, reimbursement claims and more.

Related News

- 04:00 am

- 30,000 people in over 40 countries now paid by businesses receiving Sonovate’s embedded finance

- Sonovate funds second billion pounds to British and overseas companies in just two years - four times faster than the time taken to fund its first billion pounds

- Established lender poised to benefit from growing international demand for “Lending as a Service” and adaptation by global business community to more flexible, contract working

- Company expects to hit £3 billion funding total within next ten months as growth accelerates further

Sonovate, a Fintech lender that provides embedded finance and technology services to businesses that engage contract and freelance workers, has surpassed £2 billion in total funding during September 2021.

Half of this total funding (£1 billion) was provided by Sonovate to businesses in the last two years (October 2019 to September 2021). This latest milestone has been achieved four times faster than the time taken to fund the first billion pounds.

Alongside this reaching this latest milestone, Sonovate has achieved its most successful month yet in September, achieving £67 million in funding, a full £10million ahead of its previous best month.

Over 30,000 freelancers, contractors and gig workers in more than 40 countries have now received payments from over 3,000 businesses funded by Sonovate. The average duration of new contract placements submitted for Sonovate funding increased by almost 50% in the first six months of 2021, further indicating the fast-growing and global shift in preference by businesses and individuals alike towards more flexible, contract-based working.

Sonovate, which began funding businesses to pay their temporary workers in 2013, is one of the fastest growing business finance lenders in the UK, providing embedded finance services to recruitment businesses, consultancies and labour marketplaces of all sizes. Since the start of 2020, the lender has onboarded more than 500 new clients, including a record number of enterprise businesses. In the same period, it onboarded a record number of small and medium sized businesses outside of the recruitment sector, while continuing to broaden its reach in the recruitment space - its primary vertical.

Richard Prime, co-founder and co-CEO at Sonovate, said: “Since the start of 2021, we’ve closed a new deal with a business customer almost every single working day - helping hundreds more companies across Europe, Asia and the US to pay their people on time, every time. During the pandemic, our team worked tirelessly to remove barriers to growth and solve cash flow and working capital issues for thousands of businesses. During the pandemic we were able to double our funding volume and onboard hundreds more new clients making this past September a record month for the business for funding performance.”

Entrenched at the intersection of business finance, technology and the future of work, Sonovate anticipated two transformational and permanent trends emerging in the global business community and has been well positioned to benefit from both.

1, The adoption of embedded finance

Tipped to generate global annual revenues of $230bn by 2025, the process of enabling organisations to create and manage their own unique financial services through integration with financial service providers’ APIs is a rapidly expanding industry. ‘Lending as a Service’, the frictionless provision of on-demand funding to companies is, in particular, gathering pace as a result of tighter lending controls imposed by traditional lenders during the Covid pandemic.

2, The rise of freelance or contract working

The Covid pandemic has accelerated trends that have already been in play for several years: the transition to more flexible, contract working arrangements, and the rise of the global contingent workforce. Businesses of all shapes and sizes are considering how to culturally, operationally and - crucially - financially accommodate a greater proportion of contract and freelance workers in their future workforce.

Richard Prime added: “Being completely focused on providing the best possible tech-driven funding to our customers at their point of need, we’re accelerating our market share of the emerging Lending as a Service space and cementing ourselves as an established, proven and fast-adopted challenger to banks and other traditional lenders.”

Sonovate predicts even greater demand for its tech-driven finance in the next year as the international business community gets back on its feet after the pandemic, continues to invest in its financial technology services and adapts to a more prevalent flexible working environment. Sonovate expects to hit £3 billion of total funding within ten months by summer 2022 driven by this shift in worker habits and product improvements.

Sonovate will launch a new platform later this month, strengthening its lending as a service and embedded finance offering for businesses of all sizes. This cloud-native SaaS platform will provide instant funding decisions and credit limits, variable advance and facility management, and automated reporting.

Related News

- 08:00 am

According to IDC research, 63% of CIOs in the Middle East have brought their digital roadmaps forward by at least one year as a result of the global COVID-19 pandemic. With digital acceleration in full swing, and many organizations now on their way to recovery, the IDC Middle East CIO Summit 2022 will explore the ongoing shift in priorities as it hosts some of the biggest names in ICT.

Taking place in a hybrid format, the 15th edition of this highly anticipated event will run under the theme 'Accelerating Your Journey to a Digital-First World', with a physical event taking place in Dubai on February 22 at the Ritz-Carlton, DIFC, to be followed by a two-day digital installment for the wider GCC region on February 23 and 24.

The IDC Middle East CIO Summit 2022 will feature a series of presentations, panel discussions, real-life use cases, and individual technology tracks. With Days 2 and 3 hosted on IDC's fully immersive virtual platform, delegates will be able to explore a broad range of themes central to their ongoing digital journeys and take an exclusive look at the very latest developments in technological innovation.

"As the uncertainty wrought by the pandemic continues, and many organizations strive to recover, they are taking a digital-first approach to building resilience into their operations," says Jyoti Lalchandani, IDC's group vice president and regional managing director for the Middle East, Turkey, and Africa. "This means that the journey to becoming a 'Future Enterprise' has accelerated, spurred by significant investments in new customer experiences, new digital ecosystem business models, digital supply chains, and 'Future of Work' models.

"This all needs to be supported by resilient, cloud-enabled digital infrastructure and applications, rapid app development, digital platforms, data-driven and AI-enabled intelligence, comprehensive security, and unwavering trust. Effective leadership, an appetite for innovation, a broad range of skills, and a sound strategy for addressing regulations will be key to driving the digital agenda. Technology suppliers must also adapt as they position their solutions and work with customers to help address these new priorities and buying requirements.

"With all this in mind, the annual IDC Middle East CIO Summit is the place to come for thought-provoking, in-depth discussions about cutting-edge tech solutions, emerging use cases, and proven strategies for driving success. For 15 straight years, it has served as the ICT world's premium source of learning about the industry's latest developments."

Senior business leaders, influential IT heads, and respected industry analysts will converge on the IDC Middle East CIO Summit 2022 to share their collective expertise on how best to meet the unique challenges of these unprecedented times. Following the immense success of last year's event, the 2022 edition will see the return of the CIO Masterclass Arena that attendees can access throughout the course of the event. This section of the virtual platform will showcase a series of exclusive CXO best-practice presentations, fireside chats, and panel discussions with more than 50 international and regional industry pioneers.

Related News

- 02:00 am

Banking Circle research reveals roadblocks stopping Banks and FinTechs futureproofing their organisations

The latest study from Banking Circle has revealed the new challenges faced by CIOs and CTOs working in Banks and FinTechs. The insight from the Payments bank for the new economy found that more than half have skills gaps in their organisations that could hold them back from capitalising on the latest technology, seriously undermining their post-COVID recovery.

Key data

- All FinTechs and 99% of Banks confirmed they have skills gaps in their organisation

- 63% of FinTechs (56% of banks) expect to see their Payments IT team/resource increase in the next 12 months

- 34% of all respondents are not confident that their recruitment plans are fit for purpose for the future

- 35% of Banks are not confident that existing systems maintenance and infrastructure is future-proofed; 31% of FinTechs feel the same about their API technology

- Across all respondents, ‘API technology’ will see the highest level of new funding compared to pre-Covid levels, with 44% planning more investment in the coming months

- ‘Build’ or ‘Buy’?: FinTechs (66%) are slightly more likely than Banks (64%) to collaborate with external partners to solve their tech challenges

In July 2021, Banking Circle spoke to 600 Chief Technology Officers (CTOs) and Chief Information Officers (CIOs) at Banks, FinTechs and PSPs across the UK, DACH (Germany, Austria and Switzerland) and Benelux (Belgium, The Netherlands and Luxembourg) regions. The research has been published in a white paper ‘Futureproofing payments tech: The challenges facing CIOs and CTOs’.

“It was encouraging to see that the Banks, PSPs and FinTechs we surveyed remain generally optimistic about the future,” commented Anders la Cour, Chief Executive Officer, Banking Circle Group. “The pandemic has forced IT departments to make big changes to digitalise and futureproof their organisations, but it seems they are concerned about the distance still left to travel.

“FinTech CTOs and CIOs are kept awake at night by thoughts of tech outages, staying up to date with market developments and staff skills. Bank CTOs and CIOs worry about digital transformation projects. However, on a more positive note, increased investment appears to be a solution for tackling these concerns with plans cited for further funding in all areas of tech we looked at – from data access, data security and existing infrastructure maintenance to new systems procurement, AI/ML and API technology.”

Banking Circle found that tech budgets are increasing, but not by enough for CIOs and CTOs to sanction a complete overhaul of their tech or payments infrastructure. As a result, collaboration will be an important tool in futureproofing both Banks and FinTechs.

Two thirds of all respondents are planning to ‘build’ payments tech in-house, and the same number plan to ‘buy’ off the shelf. Only slightly fewer (65%) intend to outsource or utilise partnerships. Banks are most likely to buy off-the-shelf (71%) and PSPs and FinTechs are most likely to build solutions in house (70%).

Both Banks and FinTechs are almost equally likely to collaborate with external partners, but FinTechs (66%) are slightly more likely than Banks (64%) to take this route.

Anders la Cour continued, “To bring about the required transformation, respondents plan to employ a combination of building payments tech in house, buying ‘off the shelf' solutions and collaborating with external providers. The study found that Banks and FinTechs have yet to move their operations into the cloud, with close to half saying they have less than half of their IT or Payments systems in the cloud.

“Utilising cloud-based systems via an external partner is a faster route to gaining the flexibility, speed-to-market and competitive edge that being cloud-based can bring.”

Download the full white paper at www.bankingcircle.com/whitepapers

Related News

- 02:00 am

UK brands will claim lion’s share of £619 billion European embedded financial services market in the next five years

UK-headquartered brands hold higher revenue expectations of embedded finance than their European counterparts, according to new data from OpenPayd, a leading global payments and banking-as-a-service platform. Over the next five years, UK brands expect to generate £230.48 billion from embedded financial services, 37% of the £619 billion (720 billion Euro) total for European brands.

As revealed in Embedded finance surge to net €720bn for European brands by 2026, 73% of European brands plan on launching embedded financial services within the next two years. UK firms are among the continent’s early adopters. 7% of them already offer embedded financial services, tied with Italian brands and only slightly behind Germany, where 10% of brands have launched embedded finance propositions. 14% of British brands are currently building an embedded finance product and more than a third (36%) expect to launch embedded financial services in the next year, followed by Italian (27%), German (26%), French (23%) and Spanish (21%) brands.

One of the early examples of embedded finance, Buy Now Pay Later (BNPL), has taken the e-commerce world by storm. Worldpay estimates that BNPL accounted for 2.1% of global e-commerce transactions in 2020 – roughly $97 billion. Juniper Research anticipates that BNPL will account for more than 50% of the market for embedded finance by 2026.

“BNPL has rapidly hit the mainstream. It’s now almost unthinkable for an e-commerce player to not offer BNPL. In the next two years the same will be true of more sophisticated embedded financial services that extend far beyond e-commerce,” said Iana Dimitrova, Chief Executive at OpenPayd.

“The UK is a world leader in financial services. Now it’s becoming a world leader in embedded financial services. However, it’s critical brands embrace the partnerships they need in order to ensure embedded payments, banking, lending and insurance achieve the success we’re witnessing with BNPL. Brands will need help accessing the fintech skills they need to put embedded finance propositions in place and support navigating increasingly complex regulations. We’ve only scratched the surface of the huge, unmet demand for embedded finance across Europe – the next two years are going to be transformative."