Published

- 07:00 am

Patrick Vu joins from Western Union Business Solutions

Identitii Limited is pleased to announce the appointment of Patrick Vu as its Head of Product. Patrick has been designing and developing payments and foreign exchange (FX) products for financial services businesses around the world for over 20 years.

Patrick spent the past 13 years with Western Union Business Solutions (WUBS), where he held a number of senior positions focused on international payments and FX. During his time as WUBS’s Global Director Product Management, Patrick was responsible for defining, developing and executing the company’s global product strategy that enabled banks, credit unions and MSBs to adopt WUBS’ FX and payments solutions around the world.

Prior to WUBS, Patrick spent eight years at Sun Microsystems as a Business Analyst and IT Consultant, leading the design and implementation of systems and process solutions to meet the regulatory requirements of various legal entities globally.

Patrick’s appointment provides Identitii with additional resources as it strives to meet increasing demand for products based on its market leading platform that helps regulated entities put the power of payments data at their fingertips, making it easier to facilitate cross-border payments and automate financial crime compliance.

Patrick’s role at Identitii will see him take responsibility for global product development. He will be charged with designing solutions that enable financial services businesses to harness payments data from multiple systems and in any format and automate key manual processes that currently hold up payment processing and regulatory compliance. Patrick’s broad-based experience with remitters, money-service businesses (MSBs) and credit unions will give Identitii a competitive edge as the Company expands its platform to support regulated entities of all sizes, many of which come with their own unique payment information requirements.

Commenting on Patrick’s appointment, Joe Higginson, Chief Commercial Officer, Identitii, said: “The payments industry is rapidly evolving: There is a huge opportunity for financial services business, with global cross-border payments expected to reach US$156 trillion in 2022, as well as a number of challenges, including the global adoption of ISO 20022 and increasing compliance requirements.

Patrick’s appointment comes as Identitii ramps up product development capabilities to address these needs and support increasing demand for our financial crime compliance platform. His payments industry knowledge and experience working with a wide range of payment participants will help us deliver on our growth and expansion ambitions to support regulated entities with a range of different payment information requirements.”

Commenting on his appointment as Identitii’s new Head of Product, Patrick Vu, said: “I’m really excited to join Identitii at this point in its growth journey. The Company’s platform is already contributing to the digitisation of the global payments industry, which has been hamstrung by clunky and error-prone manual processes for years. I recognised in Identitii a unique way to help our customers address these problems and look forward to helping develop product offerings that meet the unique payment information requirements of regulated entities of all sizes.”

Related News

- 04:00 am

Qualia honored for achievements in real estate technology for second year in row

CB Insights today named Qualia, the leading digital real estate closing platform, to the fourth annual Fintech 250, a prestigious list of emerging private companies working on groundbreaking financial technology. This year’s list was unveiled on stage at CB Insights’ Future of Fintech conference in New York City. This is the second year in a row that Qualia is featured on the distinguished Fintech 250 list.

“This is the fourth class of the Fintech 250, and it’s also the most international, representing 26 countries. These 250 fintech startups are attacking an incredibly diverse array of financial services opportunities across 19 sectors, including digital banking, insurance, payroll, retail investing, and more,” said CB Insights CEO Anand Sanwal. “After being named to the CB Insights Fintech 250 last year, the 2020 class saw 17 companies go public and 25 get acquired. They also went on to raise over $25B in additional financing and forged more than 380 new partnerships after being recognized. The Fintech 250 has a history of spotlighting the very best fintech companies, and this year is no different. We're excited to see how these fintech startups disrupt and transform financial services in the years ahead."

Qualia has become the leading digital closing platform used by over 500,000 lenders, title & escrow companies, real estate agents, and proptech companies seeking to deliver an end-to-end home purchase or refinance experience. On each closing, Qualia brings together these parties onto one system of record to orchestrate a seamless and secure real estate transaction, transforming what was once a paper-intensive and arduous process riddled with inefficiencies into a digitized, fully connected experience for all.

“We are honored to be named to CB Insights’ Fintech 250 list for the second year in a row along with such a distinguished list of fellow fintech companies,” said Nate Baker, co-founder and CEO of Qualia. “We look forward to the road ahead as we stay focused on helping deliver the end-to-end homebuying experiences consumers now expect.”

Through an evidence-based approach, the CB Insights Intelligence Unit selected the Fintech 250 from a pool of over 17,000 companies, including applicants and nominees.They were chosen based on several factors, including data submitted by the companies, company business models and momentum in the market, and Mosaic scores, CB Insights’ proprietary algorithm that measures the overall health and growth potential of private companies.

Fintech 250 2021: Investment Highlights

- Unicorns: 118 of the 250 companies (47%) are valued at or above $1B as of their latest funding round

- Funding trends: In 2021 year-to-date (YTD), these 250 private companies have raised $40.3B in equity funding across 275 deals (as of 9/14/21)

- Mega-rounds: Since 2020, there have been 178 mega-round ($100M+) equity investments to this year’s Fintech 250, with 138 of them in 2021 YTD

- Global representation: 36% of the 2021 Fintech 250 are based outside the US. After the US, the UK is home to the most Fintech 250 companies (25), followed by India (12). This year’s winners are based in 26 countries, including France, Brazil, Germany, Indonesia, and Nigeria.

- Top VC investor: Ribbit Capital is the most active investor in this year’s Fintech 250 companies, having invested in 62 deals since 2016. Since 2019, Ribbit has participated in 41 deals with this cohort of companies, including to Nubank, Uala, Brex, Vouch, Razorpay, and BharatPe. Tiger Global Management and Accel were close behind with 57 and 55 deals, respectively.

Related News

- 09:00 am

Michelle Beetar wins in the Team Leader – Non-Creditor category, Cecilia Fernandez de Cordoba takes Silver in Transformation of the Year

Two leaders at global analytics leader FICO have been honored for outstanding efforts in the Women in Credit Awards 2021, sponsored by Credit Strategy. The winners were announced in a black-tie ceremony on 30 September in London.

Michelle Beetar, Vice President and Managing Director for Africa at FICO, won Team Leader of the Year – Non-Creditor, Small

Cecilia Fernandez de Cordoba, Senior Director DevOps at FICO in Germany, won the silver award for Transformation of the Year

More information: https://www.creditstrategy.co.uk/women-in-credit-awards/women-in-credit-winners-2021

Michelle Beetar transitioned her sales team in the depths of a pandemic from a group of individual contributors to a strong team dynamic. Despite the challenges posed working in lockdown, her leadership has seen the regularly measured team engagement gain steady traction to leading levels. Her team’s efforts and customer-centric approach led the South Africa organisation to its most successful year since FICO entered the region in a direct capacity.

“There are many inspirational women at FICO and it is an honour to represent them in receiving this award,” said Beetar. “My sincere thanks go to my team, whose support and dedication during trying times is the reason I was nominated, and to the leaders I have been fortunate to work with during my career, whose strong moral character and ability to harness the very best energy, ideas and skills in a team inspire me every day.”

Cecilia Fernandez de Cordoba led the charge for FICO’s software engineering excellence, driving The FICO Developer Experience (DevEx) initiative that increases the speed of software development whilst improving the quality control. This initiative is critical to merging FICO’s development and operations organizations and accelerating time to market of software innovations.

“I feel honored to receive this award,” said de Cordoba. “This year brought many challenges and joys — among other things, I welcomed my third baby and got sick with Coronavirus. I am thankful for the proof that good things happen to the people who keep on trying!”

The Women in Credit Awards, now in its fourth year, is the only programme within the UK credit market that champions the role of women across the entire credit and financial services sector, celebrating and encouraging diversity to have a wider impact on the industry.

FICO has many programs that support and promote women in its workforce, including the Women @FICO Employee Resource Group, designed to enable structured information/experience sharing, education, and professional networking. Last year, Women @FICO produced an award-winning video on the importance of diversity in analytics.

Related News

- 06:00 am

- Enhanced digital savings and mortgage serviceability, streamlined account opening and enhanced anti-fraud protection will be delivered as part of ongoing digital overhaul by Darlington Building Society.

- The ieDigital Interact platform was selected to power the transformation.

- Darlington Building Society recently reported a profit before tax of £1.8m during the first half of 2021 - more than double the profit for the whole of 2020.

Darlington Building Society has announced a major investment in digital banking services. The upgrade will give members the option to open accounts online in a more streamlined way, provide self-service mortgage options and offer even more enhanced security with two-factor authentication, all powered by ieDigital’s Interact platform.

The award-winning society, recently named “Building Society of the Year” at the Money Age Mortgage Awards 2021, is in the process of an exciting transformation, incorporating all customer-facing channels.

Chief Operating Officer Chris Hunter, who is overseeing the transformation, said: “Investing in a new platform to digitally serve our customers is further evidence of our ‘members first’ strategy, which is contributing to solid growth in 2021. Enhancing our digital banking facilities for savings and mortgage customers, in conjunction with ieDigital, positions the Society for scalable growth. At the same time, it provides those of our members who want a digital service with the option to transact their way.

“The pandemic showed the importance of resilience and flexibility in how we serve members. We’re proud that we chose to keep branches open, expand our customer care team throughout the crisis, and maintain the high level of service our members are accustomed to.”

Commenting on the partnership, Jerry Young, CEO of ieDigital, said: “We’re delighted to partner with Darlington Building Society to help the Society extend its reach to savers and mortgage customers across the UK. Investing in Darlington Building Society’s online services is a recipe for scalable growth, while at the same time supporting the customer service excellence and member-focused ethos that the Society is renowned for.”

Discussing the selection, Darlington Building Society’s Chief Operating Officer Chris Hunter said, “ieDigital came top when we weighed all our criteria. They understand our market, the platform’s configurability and customer experience capabilities matched our vision, and the time to value made this the most compelling business case.”

Benefits that Darlington Building Society will achieve from the implementation of ieDigital’s Interact platform will include:

- Streamlined online account opening for existing members.

- The ability to onboard new members online with enhanced anti-fraud protection.

- Mortgage and savings account self-service options with 24x7 straight through processing.

- Digital banking services that work seamlessly across desktop, tablet and mobile devices.

- Enhanced security with two-factor authentication.

- Rapid configuration and extensibility that will provide long-term agility for the Society. For example, Darlington is integrating a third-party KYC service to enhance its fraud risk management posture for online account originations.

Related News

- 08:00 am

Tata Consultancy Services and Glasgow University Launch Problem-Solving Event to Empower UK University Students in Tackling Global Climate and Sustainability Issues

Tata Consultancy Services, a leading global IT services, consulting and business solutions organisation, has launched Sustainathon UK 2021, a problem-solving competition that empowers and inspires UK university students to address urgent environmental challenges using new digital technologies.

TCS has been organising Sustainathon events across the world, jointly with customers and partners, to get young people engaged in sustainability. Participants are challenged to devise innovative solutions to real-life sustainability issues facing businesses and organisations. Areas of focus include reducing emissions, incentivising behaviour change and creating sustainable products and services.

Sustainathon UK is now open for registration and will run until October 22, with participants being offered a unique opportunity to work alongside TCS’ clients across a variety of sectors, including energy, public sector, and finance. TCS clients, including Aviva, one of the UK’s leading insurance specialists, and Improvement Service, the national improvement organisation for Local Government in Scotland, are among the participating organisations.

“In keeping with our core beliefs, TCS is fully committed to building a sustainable future through innovation and collective knowledge. Sustainathon is our way of nurturing the ingenuity of young people to help solve critical real-world environment challenges,” said Yogesh Chauhan, Director, Corporate Sustainability, TCS.

TCS has partnered with Glasgow University to ensure students get the highest standard of support during the ‘sprint engagement’ period, in which students join a series of interactive online masterclasses, webinars, virtual mentoring and drop-in sessions that provide the knowledge, tools and guidance to help turn their vision into a reality. Students are invited to form teams of up to six and will be given a two-week window to propose ideas using innovative digital solutions.

The winning students will be rewarded with sustainable prizes and an opportunity to showcase their ideas at the grand finale event taking place during the week of COP26 and at TCS’ Innovation Forum on November 16, 2021, which attracts business leaders from some of the UK’s leading companies.

For full details and to enter this year’s Sustainathon UK 2021, please visit: https://www.sustainathon.tcsapps.com/events/ongoing/UK2021

Related News

- 09:00 am

UK brands will claim lion’s share of £619 billion European embedded financial services market in the next five years

UK-headquartered brands hold higher revenue expectations of embedded finance than their European counterparts, according to new data from OpenPayd, a leading global payments and banking-as-a-service platform. Over the next five years, UK brands expect to generate £230.48 billion from embedded financial services, 37% of the £619 billion (720 billion Euro) total for European brands.

As revealed in Embedded finance surge to net €720bn for European brands by 2026, 73% of European brands plan on launching embedded financial services within the next two years. UK firms are among the continent’s early adopters. 7% of them already offer embedded financial services, tied with Italian brands and only slightly behind Germany, where 10% of brands have launched embedded finance propositions. 14% of British brands are currently building an embedded finance product and more than a third (36%) expect to launch embedded financial services in the next year, followed by Italian (27%), German (26%), French (23%) and Spanish (21%) brands.

One of the early examples of embedded finance, Buy Now Pay Later (BNPL), has taken the e-commerce world by storm. Worldpay estimates that BNPL accounted for 2.1% of global e-commerce transactions in 2020 – roughly $97 billion. Juniper Research anticipates that BNPL will account for more than 50% of the market for embedded finance by 2026.

“BNPL has rapidly hit the mainstream. It’s now almost unthinkable for an e-commerce player to not offer BNPL. In the next two years the same will be true of more sophisticated embedded financial services that extend far beyond e-commerce,” said Iana Dimitrova, Chief Executive at OpenPayd.

“The UK is a world leader in financial services. Now it’s becoming a world leader in embedded financial services. However, it’s critical brands embrace the partnerships they need in order to ensure embedded payments, banking, lending and insurance achieve the success we’re witnessing with BNPL. Brands will need help accessing the fintech skills they need to put embedded finance propositions in place and support navigating increasingly complex regulations. We’ve only scratched the surface of the huge, unmet demand for embedded finance across Europe – the next two years are going to be transformative."

The full report Embedded finance surge to net €720bn for European brands by 2026 can be downloaded here.

Related News

- 02:00 am

NYMBUS®, a leading provider of banking technology solutions, today announced it will open a new corporate headquarters office located in Jacksonville, Florida.

Nymbus has established a local staff presence in the Florida city owing to its collaboration with Jacksonville-based VyStar Credit Union. The landmark partnership began earlier this year with VyStar’s $20 million investment in the newly formed Nymbus CUSO, and was recently extended with VyStar choosing Nymbus as its new online and mobile banking solution provider. Located in one of the fastest growing areas of Jacksonville, the new physical office brings together a unique local workforce of Nymbus talent and partners.

“The relocation of our headquarters from South Florida to Jacksonville represents a new partnership model that takes an excitingly progressive approach to vendor collaboration and accountability,” said Anne Miela, Chief Operations Officer at Nymbus. “Our teams are now afforded the opportunity to truly innovate alongside one another in a region that is experiencing substantial growth as a financial services and fintech hub.”

Approved by the Jacksonville City Council in August as Project End Game, the Nymbus headquarters shift adds over six hundred jobs to the area in the coming years.

“Jacksonville continues to grow as a hub for the financial technology industry,” said Jacksonville Mayor Lenny Curry. “The relocation of this new corporate headquarters will bring hundreds more jobs to downtown Jacksonville, contributing to the growing momentum in our urban core. I am grateful to Nymbus and their partners at VyStar Credit Union for the confidence and investment in the Jacksonville community.”

“Nymbus has proven to be an effective, valuable partner in our efforts to improve the member experience at VyStar and strengthen the credit union industry as a whole,” said Joe Colca, Senior Vice President of Digital Experience at VyStar. “We are thrilled to welcome them to Jacksonville and look forward to further collaboration that benefits our employees, members, and the communities we serve.”

“Nymbus choosing Jacksonville for its new corporate headquarters is incredible news for our city and further cements Jacksonville as a destination for fintech growth,” JAXUSA Partnership President Aundra Wallace said. “We appreciate Nymbus investing in Jacksonville and VyStar for helping attract another important corporate partner to our region.”

Related News

- 02:00 am

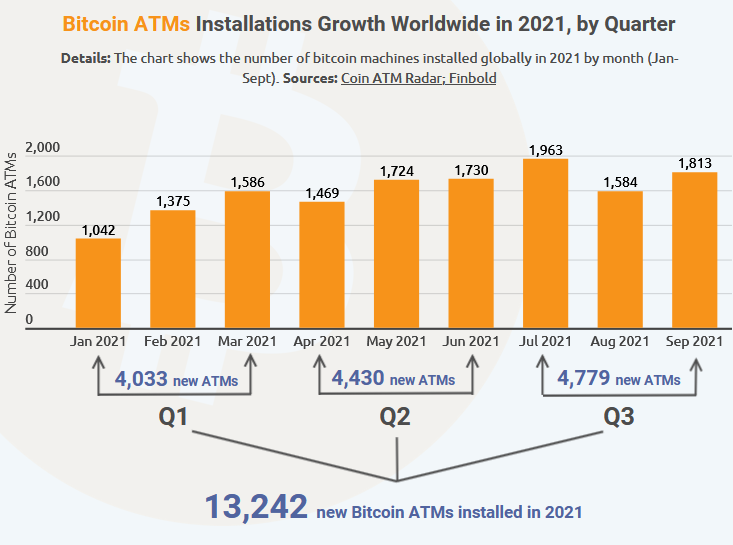

Bitcoin ATMs have emerged as a key element in the growth of cryptocurrencies as more investors aim to profit from the sector. In this line, the number of Bitcoin ATMs is on an upward trajectory.

According to data acquired by Finbold, in the first three-quarters of 2021, a total of 13,242 Bitcoin ATMs had been installed globally. A significant number of the machines were installed in 2021 Q3 at 4,779, a growth of 7.8% from Q2's 4,430 ATMs. The first quarter of 2021 recorded an installation of 4,033 new machines.

July had the highest installations at 1,963 machines, while January had the least figure at 1,042.

Elsewhere, North America dwarfs the rest of the world with 26,489 machines installed, representing a share of 93.5%. Europe ranks second with 1,268 ATMs or a share of 4.5%. South America is third, accounting for 1% of the global share of ATMs or 290 machines, followed by 234 ATMs or 0.8% share.

The Oceania region has recorded installation of 20 mins or 0.1% while Africa has 20 machines.

Crypto popularity driving Bitcoin ATM growth

The report takes note of the drivers behind Bitcoin ATM growth in 2021. According to the research report:

"The accelerated Bitcoin ATM installations for 2021 highlights the role of the machines amid the growing popularity and adoption of cryptocurrencies globally. Interestingly, the installation surged in the third quarter despite the general correction of Bitcoin. This is a possible indicator that providers and investors are bullish on the long-term prospects of the sector."

Although Bitcoin ATM installation is projected to continue growing, the sector might face the impact of the unclear regulatory landscape globally.

Read the full story with statistics here: https://finbold.com/over-10000-bitcoin-atms-installed-globally-in-2021-as-demand-for-crypto-surges/

Related News

- 01:00 am

ControlUp’s New Remote DX and Scoutbees Solutions to be Available from VMware for Horizon VDI and DaaS Customers

ControlUp, the industry leader in Digital Employee Experience management, is excited to announce VMware will resell ControlUp’s new digital employee experience management solutions, making them available to VMware Horizon customers. ControlUp Remote DX and Scoutbees solutions provide Horizon customers with a unique window into remote workers’ local area networks, and perform synthetic testing to spot potential problem areas before they result in employee frustration and hamper productivity.

Delivering a great digital employee experience is critical as the global workforce is distributed between home, office, and satellite locations. Most organizations have mandated or encouraged their employees to work from home for the foreseeable future. Having visibility into Wi-Fi network performance and SaaS applications is an essential component of enabling employee productivity. These capabilities for VMware Horizon customers make both IT department and employees more productive.

“VMware and ControlUp have partnered to bring Horizon customers even greater employee experiences while helping IT simplify operations and reduce cost,” said Asaf Ganot, CEO and Co-Founder at ControlUp. “These expanded offerings speak to the partnership ControlUp and VMware have had to date and will give VMware Horizon customers the added flexibility they need to relieve pressure on IT teams and keep employees happy and productive.”

VMware Horizon customers have been able to license ControlUp solutions, including ControlUp Solve and ControlUp Real-Time DX, and can now add the following ControlUp solutions to manage their Horizon environment:

- ControlUp Remote DX—Delivers end-to-end visibility into the digital employee experience, regardless of their location, by monitoring local network performance, including Wi-Fi strength and speed, as well as user device ISP connectivity measurements.

- ControlUp Scoutbees—Delivers a SaaS-based solution that uses proactive synthetic testing to alert IT operations teams about availability issues for applications, desktops, and network resources. By periodically emulating end-user actions to test availability and performance, system administrators can troubleshoot and resolve issues before employees become frustrated and their productivity is negatively impacted.

“ControlUp’s Remote DX and Scoutbees solutions can enable Horizon customers to provide better, more consistent experiences to employees as they work from any device and anywhere,” said Bharath Rangarajan, Vice President of Product Management, End-User Computing, VMware. “VMware and ControlUp will continue to collaborate to enable customers to better support their anywhere workforce.”

ControlUp, a VMworld Gold sponsor, will be at VMworld—the premier global online, multi-cloud event taking place from October 5-7, 2021—presenting Session EUS3057S The Top 5 End-User Challenges and How ControlUp Can Help You Solve Them.

For more information, or to set up a meeting with ControlUp, contact our sales team at sales@controlup.com.

VMware, Horizon, and VMworld are registered trademarks or trademarks of VMware, Inc. or its subsidiaries in the United States and other jurisdictions.

Related News

- 03:00 am

RAYL Innovations Inc., is pleased to announce that pursuant to the news release dated June 23, 2021 the Company has appointed David Tafel as an additional independent Director of the Company fulfilling another key listing requirement of the TSX Venture Exchange (the “TSX-V”):

| David Tafel - Independent Director Mr. Tafel holds a B.A. in Economics from the University of Western Ontario and contributes over 30 years of corporate structuring, strategic planning, financing, and management experience. He has been an officer and director of several private and publicly listed resource companies. He has been instrumental in raising well over $100 million for resource, life sciences, and technology companies. Mr. Tafel managed private investment funds at the most prominent independent Canadian securities firm. |

Nicholas Jeffery, the Company’s President & CEO commented: "The board's quality is critically essential to helping the business with both strategy and governance. I'm thrilled to see the incredible quality of our team growing in lock-step with the roll-out of our RAYL portfolio. Month-by-month, we’re attracting additional core team members into the Company to drive the individual business lines and support corporate infrastructure. The expanded team will form a solid foundation for our near-term plans to have our Company's securities traded on a highly esteemed Canadian stock exchange. This is an exciting moment for RAYL; everything we envisioned with our 3-cornered strategy is commercially available or on track to launch as planned. Additionally, we remain on track with the IPO, targeting Q4-2021 (subject to several items including securities commission and exchange approvals)."