Published

- 07:00 am

Yapily, the leading open banking infrastructure provider, today announces it has appointed Maria Palmieri as its Head of Public Policy.

Maria brings extensive experience in policy communications, with a proven track record of success in the UK’s digital tech sector, developing and leading a number of cross-organisational projects including the Tech Nation Visa scheme and the Fintech Delivery Panel.

Prior to joining Yapily, Maria was Head of Government Relations at Tech Nation. She was the main point of contact for government and policymakers on a range of tech policy issues, including regulation, Brexit and access to finance. During her time at Tech Nation, Maria also provided Government relations and communications support to fast-scaling tech businesses.

Maria has a genuine enthusiasm for the banking and Government sectors and joins the team with specialist experience in running tech and policy campaigns. The appointment follows Yapily’s Series B funding raise of $51m, led by Sapphire Ventures, to expand across Europe and beyond as open finance regulation is implemented globally. Maria will play a significant role in fulfilling Yapily’s commitment to advance the open banking and open finance cause, to help deliver better and fairer financial products and services for all.

Speaking about her appointment Maria says, “I'm excited to join Yapily to further educate the market on the benefits of open banking and help shape the future policy agenda at such a pivotal time. The UK is winning when it comes to open banking adoption, and Yapily’s forward-thinking proposition acknowledges there is much more potential, and fintech is driving forward the open finance revolution.

“Open banking is such a critical enabler of more efficient, fairer financial products and I’m looking forward to working with regulators across Europe to increase awareness and adoption, as well as build the narrative towards open finance.”

Stefano Vaccino, Chief Executive Officer at Yapily says, “We are delighted to welcome Maria to Yapily. We have ambitious European expansion plans over the next 12 months and, with Maria’s expert knowledge and excellent connections to regulators and leading Government bodies, we can work with industry partners to create an ecosystem where innovation can thrive. We’re excited to continue and grow our discussions across Europe as we enter the new year and a new chapter for open banking and open finance.”

Related News

- 05:00 am

Just in time for festive shopping, flexible in-store spending becomes available to customers nationwide

Clearpay, a leader in “Buy Now, Pay Later” payments and known as Afterpay (ASX:APT) in the US, Australia and New Zealand, has today announced that its in-store solution is now available to UK customers at some of the best retail stores nationwide.

Shoppers can use Clearpay to buy items in select retail stores using the Clearpay card, a virtual, contactless card stored in the Wallet app on iPhone or Apple Watch. Just like using Clearpay online, customers can pay for their in-store purchases in four installment payments, without the need to take out a traditional loan or pay upfront fees or interest. With the launch of the in-store solution, shoppers can now use the Clearpay they know and love, with the added benefit of taking home their purchase that very same day.

Clearpay first introduced its in-store solution in 2016 in Australia and New Zealand (ANZ), where from July 2020 to June 2021, 23% of underlying sales came from in-store. The service was launched in the U.S. in 2020, and became one of the only online payment companies to successfully offer its service in physical stores. And as autumn turns into winter, and crisp walks and festive functions are back on the agenda, shoppers can now use Clearpay at some of their favourite stores, including Pandora and The Fragrance Shop. Consumers can find the full list of in store locations at the Shop Directory on the Clearpay website and in the Clearpay app.

“We are delighted to roll out our in-store capabilities to our UK customers just in time for the festive season, giving them the option to pay over time for their holiday shopping. By partnering with the nation’s favourite brands, we are making paying in-store more convenient, secure and contactless,” said Rich Bayer, Clearpay’s UK Country Manager. “Our in-store solution provides much needed positivity to the high street with new customers and more sales providing a boost in the run up to Christmas.”

Clearpay has found that its customers who shop both online and in-store spend twice as much per annum than online-only shoppers, and shop 61% more frequently.2

Customers can initiate a purchase in stores by simply tapping the card icon in the Clearpay app, which activates the Clearpay card in the Wallet app and can be used to make purchases with Apple Pay. Shoppers can then take their purchase home right away but pay over time,

1 Late fees may apply. Full terms and conditions available at clearpay.com

2 Based on Afterpay Australia gathered merchant data, April 2020 - May 2021

interest-free. More information about Clearpay’s in-store solution can be found here.

The Wallet app lives right on your iPhone. It’s where you securely keep your credit and debit cards, transit cards, boarding passes, tickets, car keys, and more — all in one place. And it all works with iPhone or Apple Watch, so you can take less with you but always bring more.

Related News

- 05:00 am

The U.S.-based startup revolutionising e-commerce is launching one-click checkout in the UK with Revolution Beauty

Fast, the world's fastest online checkout experience, today announced a major expansion into the UK in response to extraordinary demand for the company’s unique one-click checkout product.

Revolution Beauty, a publicly traded global mass beauty and personal care business, is one of the first British merchants to partner with Fast, bringing one-click checkout technology to their UK online customers.

By launching in the UK, Fast is offering merchants a checkout button that completes online orders in just a few seconds. After entering their contact information and payment details as they normally would for their first purchase on a merchant’s site, buyers are automatically signed up and can use one-click checkout at any online store with Fast Checkout.

Accelerated by the Covid-19 pandemic, retailers globally saw a dramatic increase in demand for frictionless online purchasing. Fast’s one-click checkout button enables UK customers to purchase online products seamlessly, just in time for the holiday season which is forecasted to be the busiest in e-commerce history.

“The UK has been at the very forefront of e-commerce for years. Merchants here truly understand how crucial a frictionless internet shopping experience is, and sophisticated shoppers demand speed and convenience,” said Domm Holland, co-founder and CEO of Fast. “Revolution Beauty has built a global business that has mastered this new era of online shopping. They are the perfect partner for Fast to bring the world’s quickest checkout experience to the UK”

Through the partnership with Fast, Revolution Beauty’s UK customers can now complete online orders using the company’s signature one-click checkout technology that has proven to increase conversion and reduce cart abandonment rates, two of the major pain points for online retailers globally.

“Revolution Beauty has seen exponential growth due to our unique digital experience and stress free, informative online environment,” said Sally Minto, digital director of Revolution Beauty. “We are excited to become the first beauty brand in the UK to partner with Fast and offer best in class one-click functionality, bringing frictionless & consistent purchasing to our valued and loyal customers. We foresee high user satisfaction post-Covid-19 pandemic, moving through peak period and beyond”

Fast already has several employees based in the UK and plans to open an office in London in 2022. The rapidly growing start-up is aggressively hiring in the UK thanks to the country’s highly educated and e-commerce-savvy talent pool.

Related News

- 02:00 am

Exabel, a data and analytics platform for investment teams, is partnering with ExtractAlpha to deliver a powerful new insights platform for ExtractAlpha’s investment clients. The ExtractAlpha Intelligence Engine will give portfolio managers and hedge funds additional insights based on ExtractAlpha’s diverse alpha signals. The platform delivers user-friendly dashboards, visualizations and KPI monitoring capabilities, with a focus on TrueBeats - ExtractAlpha’s advanced earnings and sales surprise forecasting model. This assists investors in idea generation and fundamental analysis by spotting trend shifts in ExtractAlpha’s data. Partnering with Exabel gives alternative data vendors a compelling extra presentation and monitoring layer that investors value, utilising Exabel's unique Al analytics, financial modelling and data science platform.

The ExtractAlpha Intelligence Engine forms part of Exabel’s growing partnership program. The platform empowers data vendors to discover new value-added insights in their datasets, demonstrate extra value to potential customers in easy-to-create report cards, and deliver a new, proven Insights product that appeals to a wide group of professional investors. Through the partnership with Exabel, ExtractAlpha’s clients can now much more easily and quickly identify alpha generating investment opportunities from its TruBeats revenue and EPS predictions.

ExtractAlpha is an independent research firm dedicated to providing unique, actionable alpha signals and datasets to institutional investors. ExtractAlpha’s rigorously researched quantitative products are designed for institutional investors to gain a measurable edge over their competitors and profit from these unique new sources of information.

Neil Chapman, CEO of Exabel commented: “We are delighted to be partnering with ExtractAlpha on this new insights platform. ExtractAlpha are well established in the alternative data world and their team’s magpie-like eye for value in a dataset has led to them accumulating an impressive portfolio of signals. We are proud to be able to help present these signals to ExtractAlpha’s clients in their best possible light.

“Today most investors want to use alternative data, but many find the cost and complexity of modeling data in-house a prohibitive burden. Exabel allows active managers to benefit from alternative data immediately to supplement fundamental strategies.

“We are looking forward to working with ExtractAlpha to create actionable insights on its data. Dashboards, intelligent screening of KPI predictions and company drill down tools are among the many features our easy to use SaaS platform can deliver.”

Vinesh Jha, CEO of ExtractAlpha commented:

“Today’s institutional investors are inundated with interesting-sounding datasets, but the vast majority of these datasets do not have true predictive power and the data delivery is often not designed with the end user in mind. We are excited to work with Exabel on addressing this issue by delivering our consistently profitable, predictive analytics via Exabel’s intuitive, user-focused, and feature-rich platform. This collaboration will allow discretionary managers access to the same powerful insights which our quant clients have been leveraging for years - including the most accurate earnings prediction model available on the market - in a way which is designed for their individual workflow.”

Related News

- 01:00 am

Thanks to Banca Sella’s new "Banking As A Service" offer, the Spanish group will allow its customers to make local payments in Italy.

As part of a broader international collaboration, Fabrick’s Open finance platform will serve some corporate customers of BBVA

The Spanish multinational banking group BBVA and the Sella group have entered into a strategic partnership for Open finance. The above will allow BBVA to offer its foreign customers willing to operate in Italy and those of the newly launched digital bank a series of local payment services such as F24, postal bills, CBILL and pagoPA.

The agreement provides that Banca Sella makes available to the Spanish financial group its products through the APIs (Application Programming Interface) managed through the platform of Fabrick, a company operating internationally to foster Open finance.

For the Sella group, therefore, this is one of the first initiatives in the "Banking As A Service" strategic area, which aims to enable and expand, in an innovative way, the range of services offered to corporate, fintech and international financial institutions. The agreement, moreover, is also part of a broader cooperation context that sees the Fabrick platform contributing to the International Open finance projects of BBVA.

The project, sharing the know-how of the three players to meet the new needs of the global market, has allowed BBVA to optimize technological investments, implementation times, organizational impacts and accelerate time-to-market.

“The strategic alliance with Banca Sella and Fabrick, a Sella group company recognized for its experience and credibility in the Italian market, was a powerful element in launching our tax payment proposal for Italian users. This alliance makes our pioneering vision, in which we combine our strengths and experience to provide our customers with the best possible experience tangible", commented Javier Lipúzcoa, Head of BBVA Digital Banking in Italy

“Banca Sella was among the first companies to seize the opportunities of open banking and to offer innovative tools in As A Service mode thanks to the advantage of being part of and encouraging an open financial ecosystem. The partnership with BBVA, one of the most established financial institutions globally, is a vital part of our strategy that aims to enable third parties with an open finance perspective“, said Andrea Tessèra, Head of Banking As A Service at Banca Sella.

“Banking As A Service is a fundamental part of Fabrick’s offer: the platform model allows for easy integration of new financial services and enables banks and other players, whether Italian or foreign, to do so. What accomplished for BBVA is a unique offer on the market and only represents the tip of the iceberg of the infinite opportunities that Open finance allows and that Fabrick can achieve”, added Paolo Zaccardi, CEO of Fabrick.

Details of the partnership and the opportunities of the Banking As A Service will be the subject of the “Banking As A Service, a strategic choice” workshop, which will take place at the Salone dei Pagamenti on November 4, at 11.30.

Related News

- 03:00 am

EDM Council, a cross-industry trade association for data management and analytics, has released its first research report providing first-hand insights and recommendations for implementing best practices related to environmental, social and governance (ESG) data management for corporate reporting entities.

The report takes a close look at:

Data management challenges firms face with reporting and disclosure of ESG data

Who’s responsible and accountable for ESG reporting

Data management plans and strategies to support ESG reporting

ESG data quality related to direct and indirect data sources

Data management capabilities related to internal and external audit and assurance

ESG reporting is still in the early stages as standards and regulations develop and evolve. ESG reporting provides important information about a company’s performance, risks, and overall strategy, and the resulting data is used by multiple stakeholders across the ESG Ecosystem, including investors, asset owners, regulators, customers, suppliers, and employees. The focus on ESG, including carbon emissions, biodiversity, water consumption, employee health and safety, gender diversity, wage equality, child labor, and culture and ethics, creates a unique set of challenges due to the complexities associated with the underlying data, and the management of this data.

This paper was developed by the EDM Council’s ESG Workgroup, which was formed in 2020 to investigate current data challenges across the ESG Ecosystem. The Workgroup approached the exercise by looking at the problem through the lens of a data professional in each constituent group –Corporate Reporting Entity, Data Aggregator/Research/Rating firm, Investment/Product Creation firm, and Asset Owner.

“Everyone is trying to understand how to incorporate ESG principles into their organizations’ strategies and use ESG data throughout the ESG Ecosystem. Data is the glue that connects everything. As a result, ESG data and data management are critical to all constituents and it’s still in the early stages of development,” said Eric Bigelsen, EDM Council Head of Industry Engagement and Head of the ESG Workgroup. “This paper examines considerations such as data reporting preparations, where data responsibility lies, and specific advice from our ESG Workgroup on key steps to enhance ESG best practices within any organization.”

This EDM Council ESG Corporate Reporting Entities paper is the first part in a series of papers that will contain the results of a nine-month study detailing ESG data challenges and recommendations. The report incorporates input from data professionals across multiple industries, corporate sustainability reporting professionals, ESG subject matter experts, and other business leaders in an effort that spans over 80 participating organizations and over 150 professionals.

For more information and to download the full EDM Council ESG Corporate Reporting Entities report, please visit: https://app.smartsheet.com/b/form/45e8fb7e57844ff5bb39098733818e70

Related News

- 08:00 am

PCI Pal the global provider of cloud-based secure payment solutions, has today announced that the leading European Contact Centre as a Service (CCaaS) provider, Puzzel, has extended its reseller partnership agreement to include PCI Pal’s Digital and IVR payment security solutions to its portfolio.

Having originally joined PCI Pal’s partnership program in 2018, Puzzel incorporated the flagship PCI Pal Agent Assist solution into its overall contact centre portfolio to offer a PCI compliance telephone-based payment security solution to customers. Since then, Puzzel has successfully implemented Agent Assist into multiple customer infrastructures, including Business Growth and Lifeplus.

Following this success, Puzzel has now added PCI Pal’s full complement of products to its portfolio. The team is now able to help customers handle payments across multiple engagement channels, including telephone, email, SMS, social media, webchat, or via automated IVR solutions, supporting customers’ omnichannel strategies.

Darren Gill, Chief Revenue Officer for PCI Pal said, “We are delighted that Puzzel has extended its partnership agreement to now offer organisations secure payment solutions that support a true omnichannel approach. In addition to our Agent Assist solution for telephone-based payment security, Puzzel has now incorporated our IVR and Digital solutions to its extensive portfolio to secure payments, no matter what communications channel is used.”

Acknowledging the extension of the partnership agreement, Rob Wiles, Director of Channel Partnerships, Puzzel said, “The PCI Pal suite has been extremely well received by our customers who need a seamless, cloud-based solution that can be integrated with existing payment service providers, gateways and CRM solutions. The PCI Pal solution never fails to deliver, and the service we receive from the team is excellent; extending our partnership to add IVR and Digital means we have a fully comprehensive portfolio that complements our customers’ increasing omnichannel payment security needs.”

For more information regarding the PCI Pal Partner Program, visit www.pcipal.com/why-us/partners-integrations/.

Related News

- 02:00 am

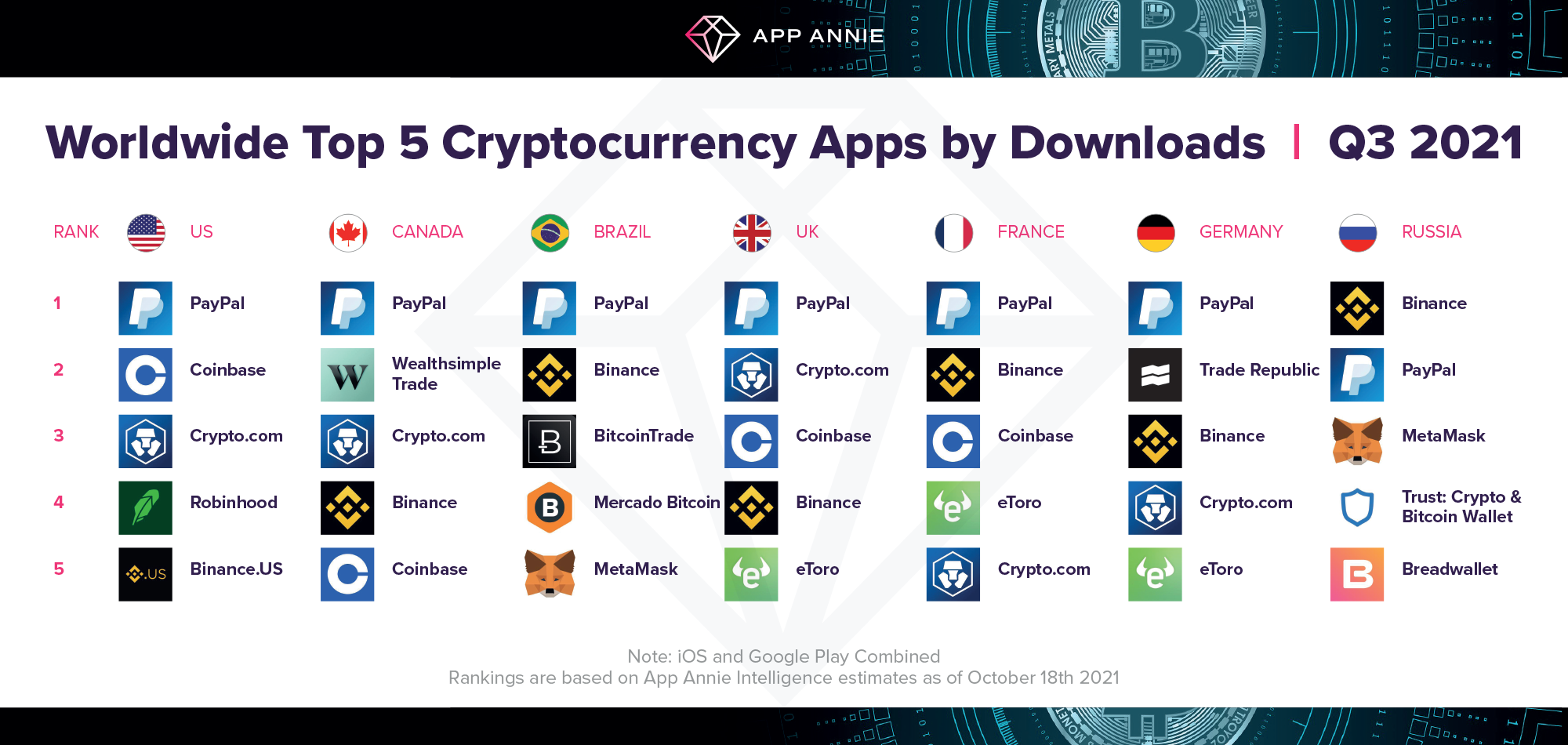

- In Q3 2021, worldwide downloads of the top 5 cryptocurrency apps reached a total of 46M downloads on iOS and Google Play (an increase of 75% year-over-year), highlighting growing consumer interest.

- PayPal held the #1 spot in worldwide downloads in the United Kingdom.

- In fact, based on an analysis of fourteen global regions, PayPal held the #1 spot in worldwide downloads in all regions except for India, Russia, and South Korea.

- Although PayPal offers traditional payment features, what makes it attractive is its ability to allow users to explore curated deals and buy, sell, and even check out with cryptocurrency such as Bitcoin (which recently reached record highs) without leaving the app.

- As digital currencies increase in value, we’ve also seen greater interest in buying and selling accentuated by the growth of digital exchanges highlighted by increasing time spent in-app.

- Binance, the world’s number one cryptocurrency exchange by trading volume, saw a 25% growth in average total time spent per user year-over-year in Q3 2021, while DMM Bitcoin, an APAC cryptocurrency exchange, saw a 280% growth over the same time period.

- As crypto currency becomes more mainstream, we’ll likely see more fintech apps tap into crypto capabilities to compete on mobile.

Related News

- 03:00 am

Consortium will aim to establish new methods of economic and statistical analyses, moving beyond GDP and addressing wider societal challenges

A new research consortium, or Chair, exploring ‘Economic Measurement beyond GDP’, has been created at the Paris School of Economics (PSE). The Chair aims to enhance the methods used for economic statistics—particularly by promoting the use of new data sources and the development of real-time forecasting tools, also known as nowcasting.

The research consortium brings together five organisations—the Paris School of Economics, AI and big data specialist QuantCube Technology, Société Générale, the French National institute of Statistics and Economic Studies (INSEE) and asset management firm CANDIRAM. It aims to continue the initiative led by the Stiglitz Commission to enhance the statistical measurement of economic performance and society’s well-being, beyond GDP.

To achieve the Chair’s aims, partner organisations will share knowledge and resources to:

- Promote new data sources for the development of short-term economic forecasting (nowcasting) tools, moving beyond GDP.

- Understand how statistics can be used to deliver insights beyond economic projections, such as assisting in meeting national sustainability targets and other societal challenges.

- Bring together researchers and experts from across the globe, encouraging the exchange of ideas through seminars, training sessions and major conferences, as well as fund doctoral and postdoctoral grants in relevant fields of study.

Speaking of its involvement with the Chair, QuantCube Technolgies’ CEO and co-founder, Thanh-Long Huynh said: “QuantCube is honoured to participate in the ‘Economic measurement beyond GDP’ research programme in partnership with the Paris School of Economics, INSEE, Candriam and Société Générale. For some time now, eminent economists across the globe have argued that we need to measure economic value and well-being beyond the production of goods and services, to incorporate social factors such as public services, people’s living standards and long-term sustainability. Until now such information has only been available sporadically and there is no agreed standard for what should be measured.”

In close collaboration with its consortium partners, QuantCube Technologies will use its cutting-edge AI and big data analytics tools and expertise to uncover new methods of economic analyses.

“QuantCube is using AI and big data analytics to collect and process huge volumes of relevant data, creating timely nowcasting indicators that can be evaluated by the research team. Long term we aim to collectively agree and standardise on an approach for measuring economic value beyond GDP,” Huynh, said.

Jean-Oliver Hairault, Director, Paris School of Economics, said: “With this Chair, the Paris School of Economics reaffirms its commitment to a quantified approach to economics, and its desire to be involved in the major challenges facing society. The conception of economic and social statistics must evolve in order to have real time data, particularly useful in times of crisis, and richer data to open up new fields of analysis, first and foremost that of the environmental transition. PSE is delighted to be able to gather around this project partners whose expertise and support will greatly contribute to the advancement of knowledge in concert with our researchers.”

Related News

- 05:00 am

Mojo Mortgages has announced it will be relocating its head office to Manchester city center as the business enters its next phase of growth.

The online mortgage broker, based in Macclesfield prior to the pandemic, has been operating as a remote-first business over the past 18 months with new members of staff joining the team from across the UK. The new office will provide a hub for staff to collaborate and provide a space for those who wish to work from an office when desired.

Based out of Manchester’s WeWork at Dalton Place, the permanent office will play a critical role in the company’s growth plans in the North West following the announcement it is to be acquired by RVU, owners of Uswitch, Confused.com, and money.co.uk.

Richard Hayes, CEO, and co-founder of Mojo Mortgages, said:

“We are delighted to be opening a permanent office in our new home in the heart of Manchester. The city is a real hub of talent - particularly in the fintech and software space - which will be crucial to the continued growth of Mojo over the next few years.

“This move reaffirms our commitment to the North West which has served us so well since the business launched in 2017 and we’re excited to welcome our staff - old and new - back to the office to collaborate and catch up in person whenever they would like.

“Our marketplace for mortgages has changed significantly as a result of the pandemic with more people than ever before seeking mortgage advice online and as part of our growth plans, we will be looking to add more over the next few years.”