Published

- 03:00 am

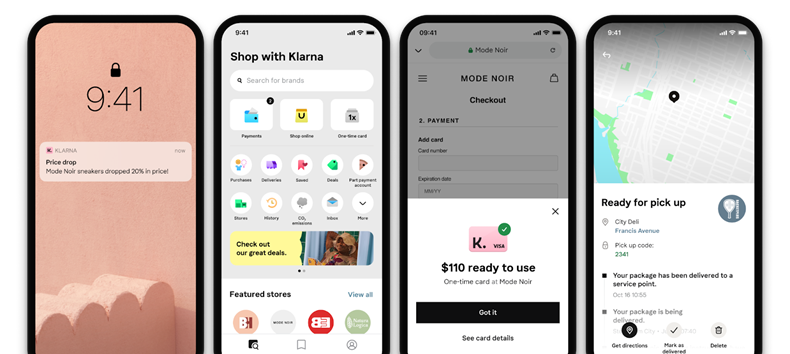

- Klarna’s new all-in-one shopping app is being launched to all markets globally.

- App provides Klarna customers with a single destination to carry out all of their online shopping: shop at all stores online, unlock deals and price drop alerts, manage payments and view delivery tracking. A space to collect loyalty cards, additional money saving tools, live shopping events, and integrations powered by third parties will be added soon.

- App continues to be a growth engine for partner merchants, with more than 18 million consumers shopping through the app every month.

Klarna, the leading global payments provider and shopping platform has today revealed its new all in one shopping app across Klarna markets.

As the app economy grows, today consumers face an increasingly cluttered and confusing landscape of e-commerce apps - this is frustrating and time-wasting for the consumer. Klarna solves this by launching the only app consumers need. Today consumers can shop at all online stores through the app, explore exclusive deals and personalised shopping collections, save items and unlock price drop notifications, view items' delivery tracking, manage payments and returns, and more. With Klarna’s interest-free shopping feature consumers can now use Klarna's payment methods at all online shops, regardless of whether they are directly partnered with Klarna or not. The new Klarna app will fundamentally change the end to end shopping experience, placing consumers firmly in control with an app that meets their real needs.

The app has been tested in a few markets for some time, including the UK, but is now being launched in ten new markets. With the updates, Klarna's app, with its more than 18 million monthly users globally, continues to be a growth engine for Klarna - affiliated merchants.

Mobile commerce continues to grow at a tremendous rate, with retail app downloads in the UK increasing by 36% in the last two years and in-app purchases by 54%*. While the rise of e-commerce has made shopping more accessible than ever before, it has also created friction throughout the shopping journey. Today people want streamlined, integrated experiences that respond to their specific needs while also saving them time and money.

Additional features will soon become available that will further bridge the gap between shopping and payments. This includes a collective loyalty card space, additional money-saving tools, social features such as live shopping events and product data that will make price history, reviews, and store availability visible; and much more. Klarna will also enable third-party integrations going forward to provide even more solutions and services that will make Klarna the ultimate shopping browser of the future.

A recent global survey conducted by Klarna revealed that 70% of consumers would choose a single shopping app that allows them to perform multiple actions in place of having to switch between apps. Over 68% of respondents rated simplicity in the shopper journey and time saving as the two most significant benefits. The new Klarna shopping app answers this call, giving consumers everything they need right at their fingertips - eliminating the need to switch between several apps.

Sebastian Siemiatkowski, CEO of Klarna: “Today people seek simplicity that solves for their specific needs in one place and enables a range of activities across their shopping journey. Switching between apps is something we as consumers find more and more frustrating. Today we are announcing a major milestone on our journey to helping people save time and money and giving them more control over their finances. With the introduction of our new app, Klarna becomes an end to end shopping service that caters to many needs - from inspiration and discovery to seamless post-purchase experiences. Meanwhile, we’ve made transparent and flexible payments a possibility everywhere because we believe no one should ever have to pay credit card fees or high-interest rates.”

The new Klarna app provides a shopping browser with a broad range of solutions and features that makes shopping easier and more enjoyable:

- Shop at all online stores through the in-app shopping browser

- Klarna’s new shopping feature empowers users with interest-free flexible payments at all online retailers, regardless of whether they’re partnered with Klarna or not. Powered by virtual one time cards, these are free to use and can be used at any online store

- Curated content based on consumers’ interests and their favorite stores

- Unlock exclusive deals and price drop notifications

- Delivery tracking on all Klarna and non-Klarna bought items

- Spending overviews and monthly budgeting

- One-click payments, report issues, and returns

The new Klarna app is available to download for iOS and Android mobile devices. The new Klarna app is available in the US, UK, Australia, New Zealand, Germany, Austria, Spain, Netherlands, Belgium, Sweden, Finland, Norway, Denmark, Poland and France.

Related News

- 01:00 am

- Fundraise: Fin VC and Barclays Bank invest £5.1m into fintech insurance startup Nimbla

- Growth: Nimbla expands to offer a fully flexible model from single invoice to whole book and scales operations to support more businesses while targeting the £2.6tn embedded fintech opportunity

- Embedded Insurance: Launch of Nimbla API into banks and lenders provides opportunity to offer invoice insurance at the point of issue

- Opportunity: Nimbla in front seat to help as UK company debt levels hit £6.6tn in 2021 with half of UK businesses carrying ‘toxic debt’ that may never be repaid

Fintech business insurance startup Nimbla has today announced a £5.1m funding round led by Silicon Valley venture fund Fin VC with participation from Barclays Bank. The funding comes as Nimbla seeks to scale its operations with increased demand from embedded credit risk solutions through its API with banks and alternative lending platforms.

Founded in 2016, the Nimbla platform has given businesses the confidence to trade with a peace of mind using invoice insurance with quotes provided within seconds. Their proprietary digital automated credit risk platform is able to process requests immediately and provide real time quotes. Nimbla has processed over 67m invoices worth £2.5b. During the pandemic, volumes of invoices tripled as economic uncertainty and supply chain concerns increased and Nimbla continued writing new business.

Flemming Bengtsen, CEO at Nimbla commented: “We have been growing steadily over the past few years, ramping up our technology and team to better understand businesses, the nature of B2B debt and to make faster decisions to serve our growing customer base. 2020 was a seminal year for Nimbla, at a time of global crisis, we were there for businesses enabling them to trade with a peace of mind and giving them confidence to carry on. This funding round will enable us to expand our platform, grow the team as we enable a confident and trusted trading environment for businesses across the UK and beyond”.

Nimbla has worked directly with businesses and brokers to provide invoice insurance cover and more recently has launched a new API for Banks, fintech lenders and B2B platforms to enable more business to access the service. Nimbla partnered with Barclays Bank in 2020 to give their one million small business customers the ability to take out insurance against individual invoices, rather than the whole book.

“We have built a powerful and robust credit risk model, automated large parts of the process and have now launched a new API to enable others to embed seamless credit risk solutions into their platforms” added Flemming Bengtsen.

On investing in funding round Henry Cashin, Head of EMEA at Fin VC, commented: “Nimbla is giving businesses the confidence to trade again. They have a proven credit risk model and its tech is being adopted by top tier banks and a host of lending platforms. We believe this will scale their reach and help more businesses benefit long term”.

Looking ahead, Flemming Bengtsen commented: “UK companies have added £1.9tn debt in 2020 to their balance sheets, taking the total amount outstanding to over £6.6tn. This number was inflated by the various government loan schemes. Over half of them are carrying ‘toxic debts’ which carries enormous risk for their trade creditors, there is a huge opportunity and responsibility for Nimbla to give companies a peace of mind and insure their invoices against insolvencies”.

Related News

- 01:00 am

Raisin DS turns Raisin Bank into one of the first German cloud banks. Mambu’s flexible technology strengthens Raisin Bank’s position as a BaaS provider for fintechs.

Raisin Bank, the company-owned servicing bank of fintech Raisin DS, has publicly launched its Banking-as-a-Service (BaaS) offering using Mambu's SaaS cloud banking platform. All of Raisin Bank’s existing customers have been migrated to the Mambu platform and can now leverage state-of-the-art digital solutions for business models that require a banking licence.

This move makes Raisin Bank, which was founded in 1973, one of the first German cloud banks. Since its acquisition by Raisin DS in 2019, the bank has focused on offering the most advanced digital solutions in account management, payments and lending for financial vendors and start-ups. In the last two years Raisin Bank has established itself as a leading European BaaS provider, with a German banking license passported in every country in the European Union.

Andreas Wolf, Chief Commercial Officer at Raisin Bank, explains, "Migrating all of our services to Mambu’s platform enables us to add real value to our many partners and clients as well as to Raisin DS. For our continued growth as a Banking-as-a-Service provider, we now have one of the most modern and agile IT platforms among European banks. With Mambu, we have multiplied the speed with which we can scale processes and develop new applications. This step positions us to meet the rapidly increasing demand for digital banking solutions."

Mambu’s SaaS banking platform offers maximum flexibility and speed, enabling financial institutions to rapidly configure and deploy new products, giving them a unique competitive edge.

By building with Mambu, Raisin Bank has the flexibility to swap out components as required, avoiding vendor lock-in and wholesale re-platforming. The bank has additionally created its own architecture on top of Mambu, developing interfaces for embedded banking solutions and automating previously complex processes for more efficient customer onboarding, credit decisions, repayments and real-time notifications.

Raisin Bank offers BaaS products for platforms and ecosystems, and utilizes these within Raisin DS itself for all banking operations. This means that customers profit directly from the improvements of the Raisin DS integration. With Mambu, the bank has future-proofed its IT stack. As an API-first and cloud-native platform, Mambu aligns with Raisin Bank's customer-first philosophy, empowering the bank to create transparent, real-time customer experiences for their partners' business models. All of Mambu’s core banking processes and interfaces are cloud-based, allowing Raisin Bank’s customers to innovate and integrate services faster in a low-maintenance set-up.

Eelco-Jan Boonstra, Managing Director EMEA at Mambu, added, “The future of modern servicing banks lies entirely in the cloud. Building a licensed BaaS offering and migrating all customers is a fantastic achievement and we are proud to have supported Raisin Bank in becoming one of the first cloud banks in Germany. Their customers and partners now benefit from innovation, security, and resilience of the platform, all at scale. We know this is just the beginning for the Raisin Bank team and are looking forward to being part of their story as they keep revolutionising banking services across Europe.”

Related News

- 09:00 am

NatWest revealed that its digital engagement from customers has surged 41% year over year (YoY) for the first nine months of 2021.

The UK banking giant attributes the pop to a massive increase in personalized messages delivered to customers YoY, increasing from 72 million in the first nine months of 2020 to 318 million during the same period in 2021. The skyrocketing number of messages represents an increase of over 340%.

More on this: The engagement boost is coupled with favorable digital-usage metrics for NatWest in Q3 2021 that it also disclosed:

- Customer needs that were met digitally reached 89% in the quarter, up from 77% YoY. The shift came despite modest growth in the bank’s overall digital customer base, which rose YoY from 6.7 million to 7 million, or nearly 4.50%.

- Mobile payments rose 13% YoY, from 81 million in Q3 2020 to 91.4 million in Q3 2021.

The bigger picture: The bank’s success with engagement follows a series of measures that the bank announced this year to make customer personalization a high priority:

- In March, it said that it would offer video meetings with retail bankers, which is part of a hybrid-channel approach.

- In August, NatWest launched Housemate, an app enabling roommates to split shared bills that could gain disproportionate traction with young adults.

- The bank announced in October that it acquired PFM app RoosterMoney, which caters to children ages 4 to 17.

The big takeaway: NatWest’s personalization-driven rise in engagement suggests that its plays for individualized attention and demographic targeting give it the building blocks of a strategy that will make it a formidable digital player—and play on incumbents’ advantage over neobanks with people’s trust.

Making personalized plays to customers gives the incumbent a way to stay competitive against UK neobanks—like Revolut, Starling, and Monzo—because it’s going beyond simply making digital products available; instead, it’s centering them around customers' needs. Higher engagement due to messaging suggests that other targeted plays could lead to NatWest’s customers turning to it more often than to challengers.

NatWest can also use its approach to build on the public’s perception of incumbent banks being more trustworthy than challengers: A June 2021 survey from Klarna and Nepa shows that 61% of UK adults trust established banks while only 17% trusted neobanks.

Related News

- 09:00 am

Finastra is teaming up with WTax, a world leader in withholding tax recovery services, to support asset management firms in recovering withholding tax on behalf of their clients. By introducing Fusion Invest customers to WTax, Finastra will help portfolio and investment managers around the world to deliver net savings for end clients, recovering tax that has been levied on income from securities investments in territories where they are non-resident.

“Finastra’s work with WTax benefits all parties and is a great addition to our Fusion Invest value proposition,” said Younes Guemouri, Senior Vice President and Managing Director Fusion Invest, Finastra. “By outsourcing the withholding tax recovery process, asset managers are freed up from the onerous and complex administrative process involved in reclaiming tax across multiple jurisdictions for clients. Since WTax operates on a ‘no win, no fee’ model, it only charges on the basis of successful reclaims, delivering value to asset managers and end customers alike.”

The scale of withholding tax that’s unclaimed is significant. In 2017, the European Commission reported an estimated cost of unclaimed withholding tax recovery of EUR 8.4 billion per year in the EU alone. Often the beneficiaries of the dividends and interest being taxed are institutional investors. The withholding tax can reduce their return on investment and can add up to as much as 35% of the gross income amount. The process of recovering the tax is complex – involving knowledge of double taxation agreements, domestic legislative provisions and precedents.

Available globally, WTax’s ISO 27001 compliant technology makes claims more efficient to process and more transparent for clients. Automating the claims process is faster and more effective and eliminates human error.

"WTax is thrilled to collaborate with Finastra and join the Fusion Invest ecosystem,” said Daniel Ginsburg, CEO of WTax. "Fusion Invest users can be assured that WTax will streamline the process for recovering withholding tax globally since we assign specialist teams who understand the unique complexity of each jurisdiction to ensure maximum recovery in the shortest possible time.”

Related News

- 09:00 am

Report Provides Additional Insight into Previously Observed Trends

The Consumer Financial Protection Bureau (CFPB) today released research finding that consumers in majority Black and Hispanic neighborhoods, as well as younger consumers and those with low credit scores, are far more likely to have disputes appear on their credit reports. The new research is a part of a series of reports focusing on trends in the consumer financial marketplace, and uses data on auto loan, student loan, and credit card accounts opened between 2012 and 2019.

“Families living in majority Black and Hispanic neighborhoods are far more likely to have disputes of inaccurate information appear on their credit reports,” said CFPB Director Rohit Chopra. “Error-ridden credit reports are far too prevalent and may be undermining an equitable recovery.”

The report shows that majority Black and Hispanic neighborhoods continue to face significant challenges with credit records. In nearly every credit category reviewed (auto loans, student loans, credit cards, and retail cards), consumers residing in majority Black areas were more than twice as likely to have disputes appear on their credit reports compared to consumers residing in majority white areas. For auto loans, consumers in majority Black areas were more than three times as likely to have disputes appear on their credit reports (0.8% of accounts with disputes in majority white census tracts compared to 2.8% of accounts in majority Black census tracts).

Under the Fair Credit Reporting Act, people have a right to file a dispute with credit reporting companies to correct inaccuracies on their reports. The Fair Credit Reporting Act requires consumer reporting companies to process and investigate the disputes in a timely manner, and correct any inaccuracies uncovered by the investigation. According to today’s report, these kinds of disputes are common.

When credit reporting is sloppy or rife with errors, this can limit fair and equitable access to individuals and families nationwide. The CFPB is committed to further researching the root causes of credit information disputes, as well as investigating the reasons for the demographic disparities found in the report. In October, the CFPB, along with the Federal Trade Commission and the North Carolina Department of Justice, filed an amicus brief in a case regarding a technology company seeking to use Section 230 of the Communications Decency Act to gain immunity from inaccurate, misleading, and false consumer reporting.

Read the report, “Disputes on Consumer Credit Reports.”

Related News

- 07:00 am

Digital bank Zopa has appointed Graham Robinson as its new Chief Risk Officer.

Graham joins Zopa as it completes its successful first year as a digital bank and sets its sights on further growth.

With over 20 years’ experience of leadership across credit risk, operations, and digital, Graham brings a wealth of knowledge from both established and challenger banking institutions. During over 18 years at Capital One, Graham held various positions including VP: Digital, VP: Customer Management, Collections & Recoveries, and Head of Credit in Italy.

Most recently, Graham was the Director of Credit at Monzo where he built the credit risk management capability to support the scaling bank.

Graham Robinson, Chief Risk Officer at Zopa said: “Zopa is unique as it has the energy and innovation of a new bank, but 16 years’ experience and expertise in the lending market. No other provider has this combination across digital banking. Zopa’s growth so far has been exciting, and I believe that its approach to risk management can continue to give it a competitive advantage in the future. I’m delighted to be joining Zopa at this pivotal point in its journey and to be part of a team delivering products and services that truly help people manage their money better.”

Jaidev Janardana, Zopa’s CEO added: “At Zopa we have an ambitious vision. We will only achieve it by attracting the best talent across all functions, including in our senior leadership team. We’re delighted to welcome Graham to the team. He brings a wealth of experience in risk management which will enable Zopa to build a strong and well controlled platform for continued growth.”

Over the last 16 years, Zopa has approved over £6 billion in personal loans. Since the launch of the bank in June 2020, Zopa has attracted £700m in deposits, issued 165,000 of its British Bank Award-winning credit cards becoming a top 10 credit card issuer, and more than doubled revenue per customer.

Related News

- 06:00 am

Xantos Labs, the investment adviser for everyday folks, has announced its plans for international expansion following its partnership with Currencycloud, the experts simplifying business in a multi-currency world.

For several years Xantos Labs has been offering its transparent and pragmatic investment advice to everyday folks in the US who want to invest in US securities but have found offering its services to an international audience difficult. Each territory had specific solutions for their regions, but no one provider could offer the global coverage of Currencycloud.

Chuk Orakwue, Managing Partner at Xantos Labs, commented: “We looked at our competitors and realized that we could exercise a first market mover advantage if we were willing to jump into international markets. As we were evaluating different partners that could help us make this happen, Currencycloud stuck out as a particularly capable platform. We knew we could work together on delivering extremely high-quality investment advisory services to the world.”

David Heitzmann, Vice President Sales & General Manager, North America at Currencycloud, commented: “When we were talking with the team at Xantos Labs about their ambitions for global expansion, it soon became apparent that we could provide a solution that would support them in all their target territories. We look forward to working with them as a result of this partnership.”

Everyday investors around the world can now take advantage of Xantos Labs’ advice and investment platform with immediate effect.

Related News

- 04:00 am

GIFT City & International Financial Services Centres Authority (IFSCA) jointly launched I-Sprint’21 as the global FinTech Hackathon Series on the 7 October 2021. A series of Hackathons cutting across various financial services sectors have been planned under the banner of I-Sprint’21. Sprint01: BankTech, the first of the series focused on the "Banking" sector has been launched. It is being conducted virtually and is open to eligible FinTechs from across the Globe.

The Partners to the Hackathon are ICICI Bank, HSBC Bank, iCreate, Zone Start-ups and Invest-India. The aim of the Hackathon is to invite innovative and cutting-edge solutions for the given Problem Statements. These Problem Statements have been framed to solve the Business Problems related to Banking Units at GIFT IFSC and to promote retail business for the Banking Units at GIFT IFSC. The best solution may eventually be implemented by the Banking Partners.

IFSCA had introduced a framework for “Regulatory Sandbox” in October 2020 which allows the FinTech entities to have facilities and flexibilities to experiment with innovative FinTech solutions in a live environment with a limited set of real customers for a limited time frame. The FinTech Hackathon finalists will be allowed direct entry into IFSCA Regulatory/Innovation Sandbox.

Speaking about this Hackathon, Mr. Tapan Ray, MD and Group CEO of GIFT City said, “GIFT City receiving such large number of applications for its maiden edition of Global FinTech Hackathon is testimony to the immense interest and enthusiasm this project has in the fintech community. The fintech industry is an important accelerator to the progress of GIFT IFSC and their new age technology solutions will bring innovation to GIFT City We expect GIFT City to evolve as a laboratory and hub for fintech research in future.”

The selected FinTechs will be provided Direct-Entry into IFSCA Regulatory/Innovation Sandbox. They will also get a chance to directly interact with the Partner Banks on the problem statement who will provide the APIs, mentoring and guidance. The selected Applicants will also get an opportunity to show-case their solution or product during the Flagship FinTech Forum of IFSCA scheduled during Dec’2021.

Chairman of IFSC Authority said “This is a great opportunity for FinTechs to get into the IFSCA’s Regulatory Sandbox. We will shortly launch hackathons focussing on Insurance and Capital Market segments as well.”

The last date of application is 4th Nov 2021. For further details regarding the application process, eligibility and problem statements, please visit www.isprint.in or http://www.giftgujarat.in/

Related News

- 06:00 am

The CISI membership has elected Amyr Rocha Lima CFPTM Chartered FCSI and Peter Moores, Chartered FCSI to its Board of Directors.

The CISI Board of Directors, comprising non-executive directors who are typically employed in senior positions in financial services sector firms, meets five times a year.

The directors are also CISI Trustees and elected either for a term of three years by membership ballot at the AGM or appointed by the Board.

Amyr Rocha Lima CFPTM Chartered FCSI

Amyr holds both the CERTIFIED FINANCIAL PLANNER™ and Chartered Financial Planner designations. He specialises in helping successful business owners and senior professionals with their retirement planning.

He is a partner at Holland Hahn & Wills LLP, a financial planning and wealth management firm based in Kingston upon Thames. Amyr is a frequent commentator on financial planning and wealth management matters for both national and specialist media.

Amyr is also chair of the CISI Financial Planning Forum, working with over 7,800 members to champion the financial planning profession in the UK. Originally from Brazil, Amyr has lived around the globe, spending his childhood in Australia and completing his education in the USA and the UK, where he graduated from Bayes Business School (City, University of London). His summers were spent on his family’s farm in Brazil, where he helped with raising cattle and horses, and setting up an apiary. Amyr and his wife, Patricia, have two young children. Outside of the office, Amyr enjoys spending time with his family and friends. He is a keen traveller, has a passion for world cinema and can often be found in one of London’s eclectic array of restaurants.

Peter Moores, Chartered FCSI

Peter (right) is chief executive officer at Raymond James, responsible for overseeing all its businesses in the UK, including wealth management, capital markets and corporate finance. Peter started his career with Chase Manhattan Bank in New York where he completed both the Associate Development Programme and the Financial Analyst Programme. He spent ten years working at Chase Manhattan in New York, Frankfurt and London initially as a relationship manager for Chase International Institutional and then in Chase Asset Management & Mutual Funds as vice president, regional sales director, for Europe.

Peter then joined DAB bank, in Munich, Germany as head of group development and was seconded to DAB’s UK subsidiary, SELFtrade UK, as managing director and senior country officer. He then joined Raymond James Investment Services in December 2004 as managing director and became CEO in February 2005.

Peter was appointed as Raymond James country manager for the UK in July 2013, at which point he assumed responsibility for its capital markets businesses in addition to wealth management, and subsequently the Corporate Finance business when it opened in the UK in September 2017. Peter chairs the Raymond James TCF Committee. In addition, he is a Chartered Fellow of the Chartered Institute for Securities & Investment, Chair of its Membership Committee.

Peter is a member of the Institute of Directors and a mentor to start-up businesses in London Business School’s Summer Entrepreneurship Programme. He read Business Studies at Trinity College, Dublin – the city where he was born – and was conferred with both a B.B.S (Hons) and an M.A. degree. Peter has also completed executive education programmes at Northwestern University’s Kellogg School of Management, Stanford University’s Graduate School of Business and the London Business School. For five years in a row, 2017 to 2021, Peter has been named one of the PAM 50 Most Influential. He is also an ambassador for Co-operation Ireland’s Youth Leadership Programme, which seeks to help encourage young people from challenging backgrounds into leadership positions in their community, through leadership development training.

Michael Cole Fontayn MCSI, CISI Chairman said: “We are delighted to welcome Amyr and Peter to the CISI Board and we look forward to their support and guidance as we continue to grow our global membership and professional qualifications.”