Published

John Wilson

UK Managing Director at Avaloq

Avaloq’s survey among mass affluent and high-net worth individuals in ten countries, including the UK, China and Germany, has found that almost 30% of wealth man see more

- 08:00 am

- According to new report, titled Think Small First, policymakers and large companies must standardise and simplify carbon reporting and accounting for SMBs or risk millions of businesses being left behind

- The report highlights tangible steps that can be taken, through an integrated approach, to empower SMBs, remove existing administrative burdens and progress the global journey to Net Zero

- Findings presented at COP26 session at the International Chamber of Commerce (ICC) “Make Climate Action Everyone’s Business,” bringing together 10,000 SMBs, supply chain leaders and government officials to discuss next steps for real action

Small and medium businesses (SMBs) – the backbone of the global economy – risk being left behind in the race to Net Zero unless urgent action is taken to simplify carbon reporting and accounting. This is according to a new report from Sage, the market leader in cloud business management solutions, the International Chamber of Commerce (ICC) and the Association of Chartered Certified Accountants (ACCA).

The Think Small First report highlights how providing standardised SMB-friendly reporting frameworks could unlock significant progress on the journey to Net Zero, given the SMB sector represents over 90% of the global economy.

As more stringent emissions reporting requirements are being driven by government and investors, more companies will need their suppliers, many of which are SMBs, to be ready to report their own emissions. The report suggests that governments and policymakers must acknowledge the specific challenges and reporting burdens faced by SMBs to deliver accurate carbon reporting and accounting, such as lack of expertise and dedicated resources, and offer credible and immediate support in mitigating these issues. In turn, larger organisations must work more closely with SMBs in their supply chains to make the task of measuring, disclosing and reducing their greenhouse gas emissions as straightforward as possible.

Finally, the Think Small First report calls on the accountancy profession to galvanise and support SMBs, helping them to remove barriers and transparently navigate an increasingly complex landscape as part of global efforts to reduce greenhouse gas emissions.

It suggests four key integrated principles to help policymakers and large companies take on this mission:

- Standardise. Large companies should work together within sectors and industries to ensure SMBs are being asked for information on a standardised basis. Government has a role in underpinning this consistency, including coordinating the time when this information should be delivered.

- Simplify. Much of the guidance for climate and ESG disclosure is designed for large companies. Government should develop simpler guidance. In addition, large companies trying to gather data, such as their Scope 3 emissions, should work together on simplifying and aligning the process by focusing requests on the most material issues, for example with consistent questions that do not exceed two pages.

- Automate. Governments and business need to support the development of automated tools to make information gathering and reporting as straightforward as possible. Large companies can develop the technology and offer training in those tools to SMBs where appropriate. Governments should create an enabling policy framework and invest in digital infrastructure so that SMBs can innovate and share data more effectively.

- Enable. Government policy and action by large corporates must recognise the challenges for SMBs and enable them to overcome them. Investing in supply chain emissions reduction should be an ESG priority for companies, while government needs to provide an enabling policy framework by ‘Thinking Small First’ when drafting climate policy, providing the right incentives that are accessible and actionable for SMBs.

To view/download/access the Think Small First report please visit: www.sage.com/en-gb/company/sustainability-and-society/planet/

Steve Hare, CEO, Sage Group, commented, “Small and medium businesses have a powerful role to play as we collectively shift towards a low carbon economy, but the customers we speak to every day are deterred by the complexity they face when it comes to carbon reporting and accounting. Accountants are already playing their part in making sure SMBs can see how sustainability can be practical as well as purposeful and are armed and ready to navigate this challenging landscape. But we urgently need policymakers and large companies to provide a simplified framework and guidance. It’s in everyone’s interests to get this right for the benefit of the planet’s future.”

Helen Brand, Chief Executive of ACCA, added: “As well as representing about 90% of businesses globally, SMBs also offer more than 50% of employment worldwide. As such, they have a huge role to play alongside the professional accountants who advise them in tackling climate action. They need to know what to report, and for standards to be proportionate and focused on information that improves business management. As with big business, we need to avoid disclosure overload, so that users of reports can easily access the information they need.”

Maria Fernanda Garza, ICC First Vice Chair, said, “We’ve seen a proliferation of initiatives aimed at getting small businesses to Net Zero over the past few years, but where these initiatives fail is their inability to resonate with their audience. Coupling the principles outlined in the report with financial incentives and enabling regulatory reforms will ensure that small businesses view climate action as a business opportunity – rather than another burden during trying economic times.”

Sage’s innovative approach to tackling the climate crisis and support SMBs to do the same is outlined in its Sustainability and Society strategy ‘Knocking Down Barriers’.

Sage Intacct is used by SMBs to monitor and manage their energy consumption, while the Sage Sustainability Hub provides owners of small businesses with expertise and actionable advice on how to reduce the carbon impact of their operations and play a key part in creating a more sustainable future.

Sage has committed to becoming Net Zero by 2040 across scope 1, 2 and 3 emissions with an interim goal to cut emissions by 50% by 2030.

Related News

- 03:00 am

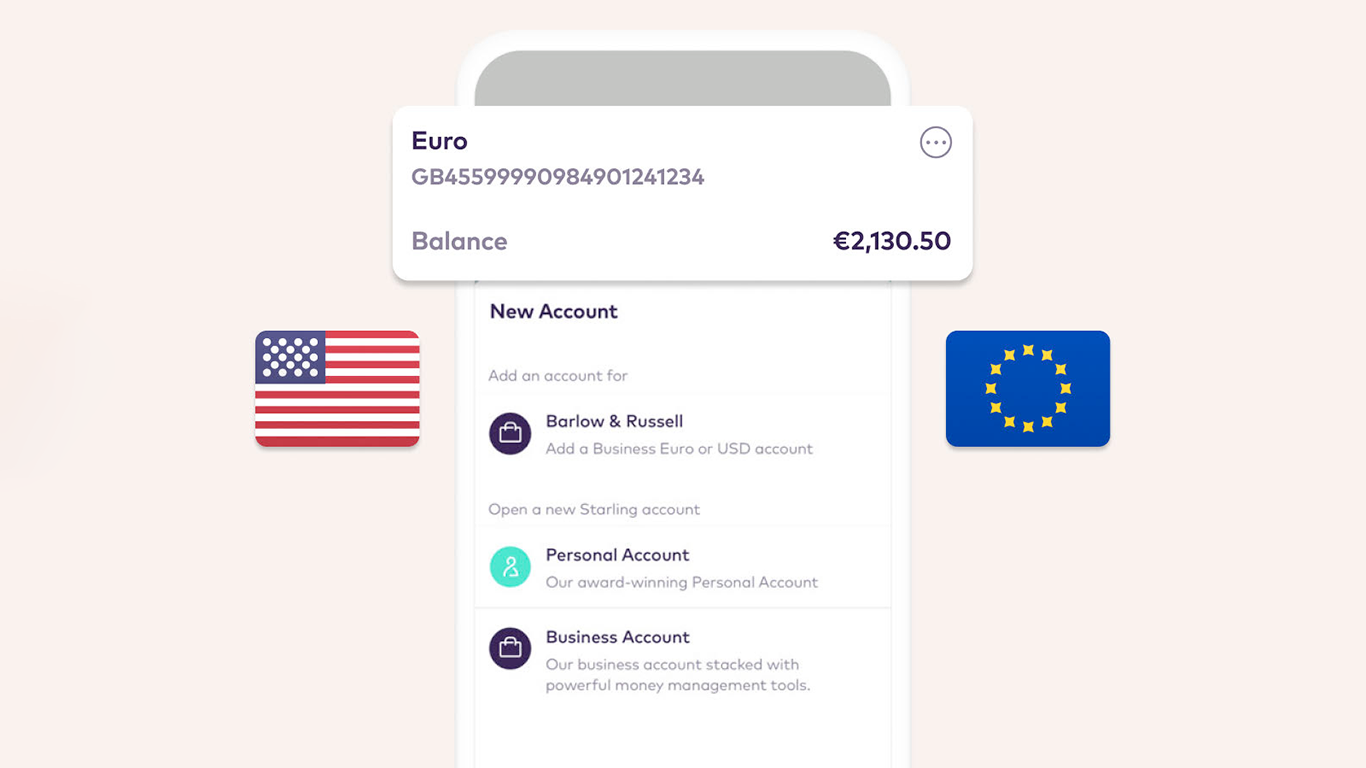

If you run a UK business and regularly need to send, receive or hold euros or dollars, Starling’s multi-currency accounts could save you time, money and stress.

Whether it’s paying suppliers in Italy or receiving payment from clients in the US, Starling’s multi-currency business bank accounts can make payments simpler, especially now that we’ve expanded our integration with Xero.

Online accounting software from Xero is one of the many options available in the Marketplace, the section of the app where you can connect to third-party products and services.

If you connect your Starling multi-currency account to Xero, transactions made from that account in euros or dollars will automatically feed through to Xero in real time.

What can you do with our euro and US dollar accounts?

- Hold, send and receive euros and dollars and use a single debit card to manage all your Starling business accounts

- Get your own local account details including IBAN for Europe and account/ACH routing number for the US

- Weekend transfers. Transfer money between your Starling accounts 24/7. You’ll always see the exchange rate before the conversion is made

- Benefit from some of the best exchange rates and fees on the market if you convert euros or dollars back into pounds

- No hidden fees. We use the actual market rate that we’re charged for buying and selling currencies and 0.4% conversion fee

You can also connect your US dollar and/or euro account with Xero, provided you have a Xero Premium subscription.

If you choose to connect to Xero and have a premium subscription, our new integration means that the income and outgoings from both your GBP and your multi-currency business accounts will be fed through to Xero in real time.

That way, everything can be kept organised and up to date, making life easier for both you and your accountant. We want to help you spend less time on banking admin and more time on running your business.

Three month promotion for multi-currency accounts in November 2021

This November, if you sign up to a Starling euro or US dollar account for business, we’re running a multi-currency account promotion.

You’ll receive your first three months subscription free, for either or both of our multi-currency accounts, provided you apply for your multi-currency account in November 2021.

Important things to note about our promotion:

- US dollar accounts are only available to limited company businesses

- Euro accounts are available to both limited businesses and sole traders

Also, make sure you have the latest version of the Starling app

When the promotion ends on 1 March 2022, you’ll pay £5 per month for a US dollar account and £2 per month for a euro account.

Applying for a multi-currency account

If you’re already a Starling business customer, you can apply for a euro or US dollar business account through the Starling app. Simply go to the main menu and tap ‘Open a new account’.

Before you can apply for a Starling euro account or US dollar account, you’ll need to have a Starling GBP business account. You can apply for a Starling business account by downloading the app.

Personal customers can also apply for a personal euro account - with no monthly fees. You’ll need to be up and running with your personal account, before you apply for a euro account.

Explore Starling multi-currency transactions and the integration with Xero on our dedicated pages.

Related News

- 06:00 am

Sber announced the opening of its first research and development (R&D) center in Europe at Web Summit, Europe’s biggest technology conference, currently being held in Lisbon. Executive Vice President of Sberbank, CTO of Sber, and head of Technology David Rafalovsky discussed the news in his address.

The center will be located in Berlin and will focus on attracting high-class IT developers, architects, and machine learning specialists. Professionals from all over the world will work on Sber’s breakthrough technological ideas, including SberDevices, SberCloud and SberAutoTech products and services. The R&D center will start operating in Q1 2022 after regulatory approval.

David Rafalovsky, executive vice president, Sberbank; CTO, Sber; head of Technology:

“The opening of our R&D center in Berlin underscores our commitment to creating the best technological products and services for our clients with the help of the best specialists in the world. We invite developers, architects, and data scientists to work on the most relevant and innovative projects that will change the customer experience for over 100 million Sber Group customers.”

Related News

- 04:00 am

HT.KZ, one of the leaders in the travel industry in Kazakhstan, uses Smart Engines on-premise solution to securely scan its clients' passports. AI software has been integrated into the tour booking system, making the booking process fast and convenient. Managers no longer need to enter passport data manually — the document is scanned automatically in less than a second, and the data from it is entered into the fields of the completed tour application.

Scientists from the Smart Engines company developed the software product implemented in the HT.KZ travel agency ecosystem. It is based on environmentally-friendly proprietary Smart Engines OCR technology GreenOCR® that serves as a passport scanner to identify passports issued in the Republic of Kazakhstan and other countries, necessary for passing border control. The HT.KZ tour booking system uses a server-side implementation of ID scanning, ensuring high accuracy and speed of data extraction from photos and documents.

The procedure for auto-filling passport data using Smart Engines technologies is safe since the recognition library works autonomously within the HT.KZ system and document images are not sent for processing to third-party services. The integration of the OCR library into the tour booking system was carried out independently by the tech team of HT.KZ.

"The booking system plays an important role in the work of a modern travel agency and the opportunities that it offers to the company's employees and customers. And, of course, the key issue is the application of innovative practices that can bring the service to a qualitatively new level. Smart Engines technologies provide OCR of high accuracy and open up new opportunities for optimizing our business processes," says Maxim Banin, founder of HT.KZ travel agency.

Today, more than 60 HT.KZ managers work in the tour booking system in Almaty, Nur-Sultan, Shymkent, and Petropavlovsk offices. At the next stage of cooperation, it is planned to use Smart Engines ID scanning technologies to sell air tickets and for self-booking of tours by clients in its mobile application.

Related News

- 08:00 am

- Rebrand follows years of significant investment in the platform

- Recent innovation has resulted in an 80% growth in the platform’s user base

Fintech provider finova, formally DPR Group, today announces the rebrand of eKeeper and Burrow to finova Broker Platform - offering brokers a range of digital solutions to enhance their efficiency as well as their customer experience.

finova’s SaaS cloud platform has undergone a period of considerable innovation, leading to 80% growth in new users over the last two years. Currently, the platform serves over 3,000 users across 680 broker firms of varying sizes.

The finova Broker Platform provides mortgage advisers with a range of modules that support the end-to-end customer journey from onboarding to retention:

- Customer Onboarding module: a tool designed to attract new customers and make their onboarding process as seamless and efficient as possible

- Digital Qualification services for credit checks and AML: streamline customer qualifications with instant credit checks and anti-money laundering checks.

- Case Management & CRM: manage and engage with customers all in one place with finova’s highly configurable CRM solution. With customisable products and workflows, full management information suite, communication tools to keep customers fully informed of case progress and cloud-based storage with all data and documents securely stored on a bank grade infrastructure – it has been designed to suit every broker’s needs.

- Client portal: an online module which enables brokers and customers to collaborate on their application, with all relevant documentation stored in one place and easily modifiable

- Customer Retention Module: Using marketing automation, the module engages with consumers during the initial term of their mortgage and prompts them to renew through a timely stream of personalised emails.

David Bennett, Commercial Director at finova comments:

“In the last two years we have strived to improve the quality of this product, from integrating several valuable features to making the platform as accessible as possible. We are pleased to see our efforts result in a large boost in new sales, as well as a strong retention, which we hope to continue as we move forwards as finova.

“Having already delivered new onboarding tools, client portals and retention solutions, work is already underway on single sign-on and verification services, all of which will be integrated to the existing solution. By innovating to create value, we aim to support businesses in the mortgage and savings market, regardless of their scope or size.”

Related News

Paul Frost

Chief Architect, Wholesale Banking Technology at HSBC

As COP26 gets into full swing, I’ve started reflecting on what we as technology leaders can do to support the sustainability and the net-zero agenda. see more

- 01:00 am

Fusion Risk Management, Inc. (“Fusion”), a leading provider of operational resilience, risk management, and business continuity software and services, today announced the launch of its Dynamic Response Console, an agile solution which will ultimately transform the way the industry views and executes traditional plan management.

Following the recent launch of Fusion’s Scenario Testing functionality, where clients can test and model ‘what if’ scenarios to measure the impact of different responses, the Dynamic Response Console utilizes the same technology to inform tailored data driven responses to these scenarios. The technology will be particularly useful for large scale events which affect organizations across multiple locations, enabling clients to make better informed decisions based on real-time data, rather than relying on static plans.

“Fusion’s Dynamic Response Console was created to give our clients a more efficient way to access the most up-to date, data-driven, agile response actions. We know that static plans can sometimes be stored across different locations, and large run books can take time to sift through – none of which is efficient during a crisis. Leveraging Fusion’s Dynamic Response Console will enable customers to quickly visualize the impacts of disruption, immediately understand what actions need to be taken to recover and in what order, allowing them to immediately protect the most business critical applications,” said David Halford, Vice President of Continuity Solutions, Fusion Risk Management.

Dynamic Response Console uses the foundational data gathered from a company’s static data plans and reorganizes the information in a way that most efficiently informs an up-to-date response. Users are able to review and edit the responses to improve the visualization and adjust the sequence of response to ensure the most critical applications are recovered first. In the event of a disruption, the system will facilitate action supported by scenario-based, dynamically built responses, bringing to life all the information previously gathered, and then leverage the responses through Fusion’s Incident Manager.

Halford continued, “Dynamic Response Console offers the power to create a tailored response based on a particular scenario and impacted asset. For example, if a customer loses a data center, then the system would pull all the specific actions required associated with that data center and impacted applications. If they lost a site due to a weather event such as a hurricane, the system would automatically aggregate the relevant plans, allowing the client to quickly and efficiently initiate their response.”

Fusion’s Dynamic Response Console will be rolled out via three phases, with the first phase launching in November this year. The first phase will enable clients to generate composite responses based on the scenario and impacted assets from plan and procedure data already stored in Fusion. Over the next 1-2 years, phase two and three of Fusion’s Dynamic Response Console will ultimately deliver real-time, automatically generated response strategies tailored to specific disruptive events, empowering organizations to think beyond static plan management and implement a data-driven approach.

Fusion is highlighting its new Dynamic Console capabilities during its headline sponsorship at BCI World Virtual, Nov. 3-4, 2021.

For more information, visit www.fusionrm.com.

Related News

- 09:00 am

Brings Simple-to-Deploy, Advanced AI and Digital Footprint Technology to World's Most Popular Ecommerce Shopping Platform

SEON, the fraud fighters, today announced that its fraud detection and prevention app is now available on Shopify. SEON’s new app delivers smarter, easier fraud checks to help reduce chargebacks, lost payments and goods, and smarter fraud checks powered by AI and machine learning to Shopify’s 1.75 million merchants globally.

E-commerce merchants of all sizes have the same privacy, fraud and banking concerns, but rarely can afford large teams of security experts or the custom enterprise-grade solutions available today. With no technical or fraud risk knowledge required, the advanced, flexible and transparent integration can be set up with one click to ensure a frictionless customer experience. SEON’s Shopify fraud prevention solution reduces losses and increases profits by enhancing Shopify’s fraud defenses and it amplifies protection using automated, real-time data checks and assigned risk scores, powered by SEON’s intelligent scoring engine.

With SEON’s industry-leading device fingerprinting and data enrichment technology, customers’ digital footprints - a trail of publicly available data belonging to the same online user including visited websites, email addresses, and data submitted to online services - are compiled and analysed. This includes checking 35+ social media and online signals as a fraudster cannot match this scale, depth and breadth of social and digital footprints in our highly connected world. The analysis will help vendors radically improve risk assessment accuracy, reduce false declines and ensure orders are legitimate before fulfilling them. Additionally, SEON is offering a free for life plan for Shopify users so even the smallest shops can access cutting-edge fraud protection for their businesses.

“Merchants of all sizes want to understand and simplify their fraud fighting efforts, but today’s enterprise solutions are too difficult and expensive for smaller online businesses to integrate. Most AI and blackbox machine learning fraud detection solutions also keep the actual fundamentals of how they fight fraud a secret and how risk assessments are made, making it hard for merchants to understand why a transaction is declined,” said Tamas Kadar, CEO of SEON. “We’re democratising fraud fighting with fully transparent, simple and powerful solutions that give any size business the opportunity to use enterprise-grade fraud prevention software to better protect their operations.”

To learn more about SEON’s Shopify app, visit our website or watch this app walkthrough video, or visit the Shopify app store.

Related News

- 01:00 am

· Currensea, which offers the UK’s first open banking-enabled direct debit travel card, launches its ‘powered-by’ programme, allowing charities and businesses to offer custom branded cards which allow people to allocate savings made on foreign exchange charges to a specific purpose.

· The Currensea card uses open banking to allow travellers to make overseas transactions directly from funds in their current account, whilst avoiding high bank fees and saving at least 85% on every transaction.

· Users can donate a portion, or all of the savings they made on foreign exchange fees to a selection of organisations, while accessing the best rates of 0-0.5% above the FX base rate, contrary to the average of 3.25% charged by banks per transaction abroad.

· The first charity signed up to offer the new service is the Cameron Bespolka Trust which will use donations to help young people to connect with nature and animals.

Fintech Currensea, which has created the UK’s first open banking powered direct debit travel card saving users at least 85% on foreign exchange (FX) charges, is launching a first-of-its-kind concept to allow cardholders to convert these savings into donations.

Currensea provides its users with access to the best FX rates at only 0% to 0.5% above the FX base rate. With banks charging 3-5% per transaction abroad, this results in savings of at least 85% on every transaction abroad. The Currensea card uses open banking to partner with someone’s existing bank account, allowing travellers to make overseas transactions directly from funds in their current account, while avoiding high bank fees.

With this new ‘powered-by’ service, Currensea helps charities and businesses to issue their own branded card to supporters, customers, or employees. The cards allow users to donate a portion, or all, of the savings they make using the card, while removing the fees. For example, a user spending $1500 while visiting the USA can choose to contribute 50% of their savings – over £20 – while still saving money on foreign exchange.

The first charity to sign up to this new service is the Cameron Bespolka Trust, a charity that encourages young people to connect with nature and animals. In partnership with the RSPB, the Trust is renovating Cameron’s Cottage, a unique residential educational facility for young people to immerse themselves in nature. This is one of the charity’s projects that the donations made by Currensea card users will contribute towards.

James Lynn, Co-Founder, Currensea, comments: “Our ‘powered-by’ cards provide people with more choice on where their hard-earned money goes. Rather than being hit by unexpected fees – an average of 3.25% per transaction – people have a choice; they can either benefit from the full savings of at least 85% or automatically allocate funds to a specific purpose or donate to the causes that mean the most to them. Rather than lining the pockets of banks, people can now save money on holiday as well as donate to their chosen charity. This latest partnership with the Cameron Bespolka Trust allows us to help travellers benefit from a new way to give back.”

Kevin Bespolka, Founder Trustee, Cameron Bespolka, comments: “We're delighted to be partnering with Currensea on its ‘powered -by’ product. We used our cards widely this summer in Europe and we hope our donors will do the same as they start travelling again. The card is an excellent way for our supporters to save fees and make donating as easy as possible.”