Published

- 05:00 am

Award-Winning Company Blazes New Trail to Introduce a More Rewarding Way to Invest Backed by Technology and Data Science

Cult Wines, a global fine wine collection management and investment company transforming the fine wine industry, today unveiled a new platform that redefines how consumers invest in wine. Responding to significant market growth over the last 18 months which has seen Cult Wines’ assets under management increase to £200m, the company has created greater accessibility to the asset class, introduced elevated experiences and significantly invested in sophisticated data science and proprietary technology to provide an offering unlike anything on the market today.

Changing the face of wine investment forever, the Cult Wine Investment platform turns the traditional investment playbook on its head by emphasising enjoyment and discovery of wine while making investing in wine even simpler and more accessible than ever before. With just four simple steps, anyone from experienced investors to wine lovers to novice investors can build a customised collection of investment grade wine and start enjoying enriched benefits immediately. Significantly lowering the investment threshold, clients can now build a rewarding wine portfolio with as little starting from £10k.

“Historically, the wine investment category has been perceived as only for the wealthy, or those with considerable wine knowledge. We know that is not the case and are enabling more people to invest effectively while maintaining the client service, impeccable standards, and returns for which we are known,” said Tom Gearing, CEO & Co-Founder of Cult Wines. “Equally important is the investment we have made in developing technology that gives our team of experts unrivalled tools to complement their market expertise.”

Leveraging over ten years of consistent performance and returns for clients in 80 countries, the company has built a superior platform that provides better functionality, an intuitive user experience and impactful investment data and insights. Seamlessly paired with a team led by Chartered Financial Analysts® and WSET Level 3 holders, the company delivers best in class management that sets a new industry standard.

“We looked at what we had done previously and explored optimising user experience and how we build, balance and allocate portfolios using proprietary tools and modelling to seek the highest yields possible for our clients, stated Corey Parkinson, Global Head of Product. “Every aspect of the platform, from digital onboarding, automated portfolio generation and our client portal have been re-imagined using a best practice tech stack and data science approach. These tools enable our team to maximise their insights and experience to deliver an unparalleled customer experience.”

New tools include Vintel, a proprietary tool for automatically evaluating, analysing, allocating wines, generating and actively managing portfolios. Clients will benefit from digital onboarding and a web app where they can track their portfolio, see curated offers specific to them, receive buy and sell recommendations from the Cult Wines Investment Committee, liaise with their relationship manager, deposit funds, set up regularly monthly deposits and explore a programme of events and experiences around wine. Clients can also enjoy the profits of their investment whenever they choose by simply requesting shipment of any of the wines in their portfolio through the Client Portal.

As a key component of the new platform, the Customer Experience programme for Cult Wine Investment has been dialled up to bring passion and wine exploration to the forefront.

“Many producers are reviewing their business models in light of new technologies, global reach and a customer first approach,” noted Patrick Thornton-Smith, Chief Experience Officer. “Cult Wines is mirroring these practices in our approach to contribute to the continued evolution of the fine wine industry as well as broaden the audience around the world. We aim to actively increase the opportunity to experience the world’s finest leading wine brands in a tangible way. Wine is inherently enjoyable, investing in it should be too.”

Leveraging the network of relationships and community established over the years, clients will benefit from access to private vintage releases, experiences with renowned chefs to explore food and wine pairings and bespoke trips to prestigious estates among other money-can't-buy benefits. A core component of the CX programme will be introducing clients to producer’s unique histories, terroirs, values and of course, wines to drink, collect and enjoy.

“At Cult Wines, we passionately believe that an investment in wine benefits you more richly than traditional – or even other alternative – investments. We know our customers love wine, so it was a natural extension to take our community on a journey of wine discovery, connecting them with like-minded wine enthusiasts and providing a plenitude of exclusive experiences,” continued Thornton-Smith.

As part of the new platform, the company has introduced four account types – Cru Classe, Premier Cru, Grand Cru and Cult Cru – that provide clients with the benefits of bespoke services, exclusive offers and a world of wine discovery, with industry low fees for fully managed accounts. Opening the door to more investors, the Cru Classe account begins with a £10k investment and unique to Cult Wines, features the world’s first automated and customised account with live allocation. The portfolio is built in real time according to risk appetite and investment horizon, with clients able to view the wines in their portfolio before confirming, after which the wines are immediately allocated.

“We believe the key to the success of our new platform will be the unique blend of wine knowledge, the expert guidance of our relationship managers, the powerful technology underpinning the portfolio, and the human expertise from our investment committee and portfolio managers,” noted Gearing. “Together with our superior Customer Experience programme that leverages our relationships and draws on our shared values between wine estates and producers, we have a truly unmatched and game changing proposition.”

Related News

- 02:00 am

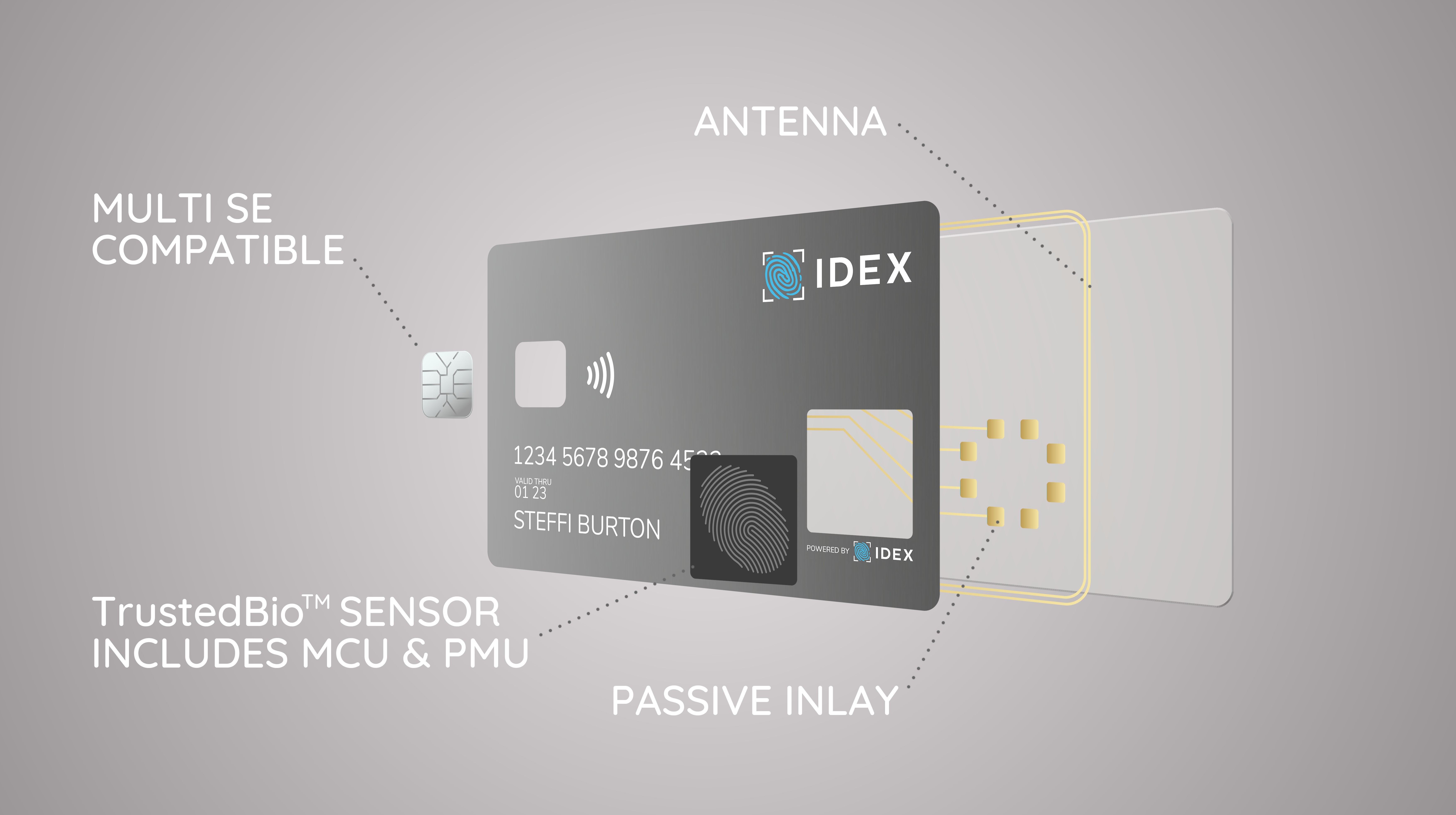

- VISA and Mastercard have certified smart card with IDEX Biometrics fingerprint sensor

- IDEX is now set to deliver a mass production order of its TrustedBio® fingerprint sensors

- IDEX sensor certified with the top three global payment networks following Letter of Approval from China UnionPay in 2020

Fingerprint biometric payment cards move one step closer to our wallets this month following full certification from Mastercard and VISA for IDEX Biometrics’ TrustedBio® fingerprint authentication solution as part of IDEMIA’s F.CODE biometric payment card platform.

The certification means the TrustedBio® sensor is now certified by the three largest global payment networks, with IDEX Biometrics having already received a Letter of Approval from China UnionPay in 2020. The Letters of Approval indicate that the TrustedBio® sensor is fully compliant with EMV® interoperability and the security and performance standards of all three networks.

According to Nielsen, Mastercard and VISA collectively have more than six billion payment cards in circulation, while 150 million UnionPay cards have been issued across 67 countries. Certification of the IDEX sensor presents an important achievement in the development of fingerprint biometric authentication payment cards for those payment networks, with associated card producers now able to begin high-volume deployment to meet increasing market demand for fingerprint authenticated payment cards.

With card-present fraud still on the rise, the pressure is on for payment providers to deliver more secure payment methods to consumers. Despite the use of chip and PIN authentication, the European Central Bank estimates that card fraud committed at POS terminals has increased by 2.2% in recent years. Overall 3.6 cents in every €100 spent in Europe using credit and debit cards is being lost to fraud. Fingerprint biometric authentication is one of the major technology developments to address this concern.

Momentum around fingerprint biometric smart cards is growing and the technology is set to play a critical role in the future of a better, more secure payment experience. The sector is set to generate more than $5 billion in global revenue and account for 15% of the market by 2026.

Vince Graziani, Chief Executive Officer of IDEX Biometrics, commented, “This certification is a response to the proven demand for increased security in payments, delivered by our proprietary solution to card-based fingerprint authentication. We now have certified biometric solutions with the top three global payment networks, allowing for deployment of biometric cards, together with our integration and issuer partners, at a rapid pace to over 15 billion consumers. We are happy that our TrustedBio® solution is contributing to the ground-breaking performance and cost profile of our partner’s biometric payment card platform.”

Following the certification, IDEX Biometrics has also received a mass production order for its TrustedBio® fingerprint sensor from IDEMIA Group. This is the largest production order for TrustedBio® to date and indicates the scale of demand for biometric payment cards has reached an inflection point.

“We are proud to announce this significant additional order from our partner IDEMIA. Our joint development has resulted in a highly integrated, biometrically-enabled smart card with industry leading performance. This order reflects the rapid increase in demand we are seeing for smart cards secured by fingerprint authentication,” continued Vince Graziani, CEO, IDEX Biometrics.

Deliveries of TrustedBio® are scheduled to begin shipping to IDEMIA in early 2022.

Related News

- 09:00 am

He says:

“If the UK is to become the first ever net zero aligned financial centre, consumer carbon consumption must change. Open banking can be the catalyst for this.

A recent survey we conducted revealed that 28.6% of 1,987 UK consumers said they would choose to use a new payment method if it has a positive environmental impact. This highlights how consumers today are actively becoming more aware of their carbon footprint and as such, are seeking to use, buy and consume goods through conscious channels.

Built on smaller infrastructures, open banking is, arguably, a more sustainable solution compared to larger, traditional card infrastructures. It would be foolish for financial institutions and listed companies not to listen to consumer demands - implementing open banking into their net-zero strategies is undoubtedly the way forward.”

Related News

- 09:00 am

When the pandemic first hit the UK in March 2020, the sudden obligation to spend 24 hours a day together pushed thousands of couples towards the brink. By mid-May of that year, inquiries to divorce lawyers had jumped by 42 per cent, compared with the same period in 2019.

That may seem shocking enough, but the uplift in unhappy couples during lockdown was nothing to the figures just over a year later. In June 2021, divorce enquiries were 136 per cent higher than at the beginning of the year – itself traditionally a peak time for separations.

“Even the strongest of marriages have been severely tested by the overall stresses of the pandemic – financial, emotional and physical,” says Sarah Havers, senior associate in the divorce department at Stewarts law firm. “Having been forced to take a long, hard look at their partners, the much-heralded promise of ‘freedom day’ has taken on a whole new meaning.”

For many separating couples – and 42 per cent of marriages end in divorce – the process is among the most painful of their lives. It can also be one of the most expensive. A recent report calculates the average cost of a UK divorce is more than £14,500, taking in legal fees and lifestyle payments. For those who need to sell property, or contest a settlement through the courts, the costs can easily mount to tens of thousands of pounds – an average couple will spend £30,000 on solicitors’ and court fees, £35,000 on rent and £144,000 on a new property.

At the top end, where properties are valued in the millions of pounds, the difference between selling in a bull or a bear market can run into hundreds of thousands of pounds.

Equally, when selling a business, market cycles, interest rates and banks’ lending appetites have a huge impact on valuations. In 2012, the Top Shop and Top Man fashion brands were valued at $3.2 billion. In 2021 they were acquired for around $300 million.

For high net worth couples, pensions and investments can add up to sizeable assets, once again involving complex calculations of value and future worth. Financial experts and lawyers may be required to reach a fair resolution – both of them expensive to hire.

As a backdrop to these divorce costs, the pandemic has added new and often severe financial pressures. Whether from reduced income due to furlough, stagnating prospects due to lack of demand, for example in the travel or hospitality industry, or reduced working options due to childcare or illness such as Covid-19 itself, many thousands of UK couples have suffered financially, just as they conclude that they no longer wish to be married.

To cap it all, if a couple decide to separate but cannot agree on a division of assets, there are lengthy queues in the courts, as a backlog of cases inches its way through, potentially meaning higher costs for both parties.

All of these simultaneous factors mean that, while divorce rates appear to be rising during the pandemic, the options for many couples are limited: a sluggish housing market, a stalled economy and rising prices have narrowed the divorce window. Should couples who wish to separate bury their differences for now, and wait for sunnier economic weather before acting? While this may seem to be sober and commonsense advice, the psychological reality of a fractious marriage can make it impossible to follow.

“When a couple decide to divorce, they often need to find large amounts of money at short notice,” says Stephen Clark at bridging finance company Finbri. “This could be to buy a new property, or to buy out their partner’s interest in the family home or business. Bridging loans can provide a solution.”

Selling a property at short notice is seldom ideal: it may disrupt children’s schooling, or mean accepting a below-market valuation. The same issues apply to a business. A fire sale is unlikely to yield an optimum price.

“By using bridging finance - often secured on the value of a property - a couple can divide their assets without the disadvantages of a forced sale,” adds Clark. “A bridging loan can be very useful in smoothing the path towards an amicable separation and allowing people to get on with their lives.”

Box out – four ways to minimise the cost of divorce

Where there are significant assets to divide, there are likely to be unavoidable costs in any divorce. To keep other expenses to a minimum, here are four suggestions:

1. Have an ‘uncontested’ divorce.

Beyond the basic legal costs of divorce – around £1,000 for the ‘petitioner’ (the person who initiates the divorce) and around £300 for the ‘respondent’ (the other spouse) - there are no other inevitable costs. If you and your partner can resolve all your financial and logistical issues, it leaves you free to retain the full value of your assets. The UK government’s online MoneyHelper website offers free advice.

2. Choose mediation over court

Instead of expensive lawyers, who sometimes appear to prolong cases in order to increase their fees, using a mediation service costing between £50 and £120 per session can save you a great deal of money and aggravation. The best-known UK organisation offering mediation services is Relate.

3. Failing mediation, choose arbitration over court

In this situation, a qualified arbitrator listens to evidence from both sides and comes to a decision. You can find an arbitrator on the website of the Institute of Family Law Arbitrators, with costs averaging around £3,000 shared between a couple.

4. Do your research

Whether you resolve your issues between you, through mediation, arbitration or the courts, do your research ahead of time. For example, the government’s child maintenance calculator will give you a monthly figure, based on your income and expenses.

Related News

Brad Hyett

CEO at phos

As multiple national lockdowns forced physical stores to close last year, and customers demanded easy, cash-free payment options, merchants had to adapt quickly . The result? see more

- 09:00 am

Nutanix has appointed Dominick Delfino as Chief Revenue Officer, effective December 6, 2021. Delfino will be responsible for leading the Company’s worldwide sales organisation including sales engineering, sales operations, inside sales, OEM sales, and channel sales.

“Dom is a talented leader with a proven track record of scaling businesses, has a strong history of delivering on go-to-market strategies and sales growth, and is an ideal fit for our company culture,” said Rajiv Ramaswami, President and CEO of Nutanix. “Dom’s global sales and industry leadership experience, combined with his innate understanding of what customers want and need, will be invaluable to our continued growth and success as we help our customers navigate to a hybrid multicloud future. I have known Dom for almost twenty years and I look forward to working closely with him as we expand our go-to-market presence, deliver on our long-term financial goals, and drive value for our stakeholders.”

“I have long admired Nutanix for its industry-defining technology, strong customer-centric culture, and large market opportunity,” said Delfino. “I’m excited to join this talented team to deliver exceptional customer satisfaction and drive revenue growth. Given the simplicity, flexibility, and resilience of Nutanix’s powerful Cloud Platform, I see tremendous opportunity to build on Nutanix’s strong foundation and continue expanding its loyal partner and customer base.”

Delfino brings more than 20 years of global sales experience, having led software sales and system engineering teams at multiple technology and software companies. Most recently, Delfino was Chief Revenue Officer at Pure Storage, where he was responsible for leading and growing the sales organisation while developing differentiated go-to-market strategies. Prior to that, Delfino spent six years at VMware, most recently as Senior Vice President and General Manager for all VMware sales in the Americas. While at VMware, Dominick had extensive experience selling VMware’s Cloud Foundation and VSAN solutions. Prior to that role, he led VMware’s worldwide sales specialist teams for networking, storage, cloud management, and cloud foundation. Previously, Delfino spent 14 years at Cisco leading its data centre and virtualisation technology strategy and pre-sales systems engineering globally. Delfino has a bachelor’s degree in engineering science from the State University of New York Morrisville.

Related News

- 09:00 am

Paya Holdings Inc., a leading provider of integrated payment and commerce solutions, today reported financial results for its third quarter ended September 30, 2021.

“Paya performed well in the quarter, with payment volume growing 28%, revenue growing 22% and gross profit growing 26%. We signed some great new partners across our verticals and saw a certain B2B partner scale faster than expected, which is promising as we focus on our medium-term growth ambitions,” said Jeff Hack, Paya CEO. “Additionally, we hired some key talent, which will serve to accelerate our sales and go to market efforts, while further enhancing our existing product offerings and technological capabilities. While there were modest headwinds in the quarter that prevented us from growing even faster, we remain focused on the continued execution of our medium-term strategy and our competitive positioning remains strong in high-growth end markets,” Hack concluded.

Third Quarter 2021 Financial Highlights

- Payment volume was $11.1 billion, an increase of 27.7% from $8.7 billion for the third quarter of 2020.

- Total revenue was $63.1 million, an increase of 21.8% from $51.8 million for the third quarter of 2020.

- Integrated Solutions segment revenue was $39.7 million, an increase of 30.6% from $30.4 million for the third quarter of 2020.

- Payment Services segment revenue was $23.4 million, an increase of 9.1% from $21.4 million for the third quarter of 2020.

- Gross profit was $32.6 million, resulting in a gross profit margin of 51.7%, as compared to $25.9 million with a gross profit margin of 50.0% for the third quarter of 2020.

- Net income (loss) was $(3.0) million, compared to $1.6 million for the third quarter of 2020.

- Adjusted EBITDA(1) was $16.3 million, an increase of 20.7% from $13.5 million for the third quarter of 2020.

- Adjusted Net Income(1) was $5.5 million.

- Earnings per share was $(0.02).

- Adjusted earnings per share(1) was $0.04.

- Ended September 30, 2021 with $133.1 million of cash and $250 million of total debt.

These financial highlights include non-GAAP measures. See below for definitions and reconciliation.

2021 Outlook

Paya provides the following updated revenue, gross margin, and Adjusted EBITDA guidance for the full year 2021, which replaces previously issued guidance. This outlook assumes no further unanticipated impacts from the COVID-19 pandemic or other factors outside of Paya’s control.

| 2021 | ||

| Total Revenue | $244M - $248M | |

| Gross Margin | 52.0% - 53.0% | |

| Adjusted EBITDA(1) | $64M - $66M | |

Conference Call

The Company has scheduled a conference call for November 5, 2021 at 8:00 a.m. Eastern Time to discuss the third quarter 2021 results.

The conference call will be available by live webcast through Paya’s Investor Relations website at https://investors.paya.com or by dialing in as follows:

| Domestic: | 1-833-665-0668 |

| International: | 1-914-987-7320 |

| Conference ID: | 3872346 |

Please register for the webcast or dial into the conference call approximately 15 minutes prior to the scheduled start time.

A replay of the conference call will be available for approximately 14 days and can be accessed through the Investors section of Paya’s website or by dialing 1-833-665-0668 (for Domestic callers), or 1-914-987-7320 (for International callers), with passcode 3872346.

Related News

- 01:00 am

- Funds will be deployed alongside Green Angel Syndicate’s Climate Change Fund (EIS) and angel syndicate.

- Green Angel Syndicate will be the first Regional Angels Programme delivery partner specialising in the fight against climate change.

British Business Investments, a commercial subsidiary of the British Business Bank, today announces a new £5m commitment to green economy investor, Green Angel Syndicate, to support early-stage UK businesses operating in the green technology sector.

The commitment is being made through the Regional Angels Programme, which seeks to reduce regional imbalances in access to early-stage equity finance. It will match funds raised via Green Angel Syndicate’s network of investors and their EIS Climate Change Fund. The fund supports a portfolio of UK wide, early-stage climate tech companies, primarily in the agritech and water, built environment, energy, transport and waste and recycling sectors.

Green Angel Syndicate’s specialisation is in the fight against climate change and it only invests in companies whose technology and process innovations have the potential to reduce carbon or greenhouse gas emissions or to remove carbon from the atmosphere.

Judith Hartley, CEO, British Business Investments, said: “Our Regional Angels Programme is designed to address imbalances in access to early-stage finance in the UK and to increase the overall amount of capital available to smaller businesses through early-stage investors such as Green Angel Syndicate. This £5m commitment from British Business Investments means increased support for green technology sector early-stage businesses across the UK.”

Nick Lyth, CEO, Green Angel Syndicate, said: “This welcome commitment will expand our bandwidth substantially, and hence the impact of our investments in the fight against climate change. The recognition from British Business Investments of the importance of investing in UK start-ups fighting climate change is an encouraging sign for the future.”

Some of the companies that have benefited from Green Angel Syndicate’s EIS funding during the last 12 months include: Surrey-based DNA biomonitoring service provider NatureMetrics, Bristol-based greenhouse gas detection technology company QLM Technology, and sustainable seaweed product developer Oceanium, which is based in Scotland.

Related News

- 06:00 am

Ventrata launches Ventrata Payments, and integrated payment solution powered by Adyen for Platforms

Adyen , the global payments platform of choice for many of the world’s leading companies, has partnered with Ventrata, a leading provider of ticketing solutions for tours and attractions operators, to launch Ventrata Payments, a single payments solution for its global merchants.

By leveraging Adyen for Platforms, Ventrata will make it easier for its merchants to accept payments, however their customers choose to pay. It also gives Ventrata’s multi-destination businesses a single view of payments to help manage ticketing across global sites, both online and via POS channels.

This unified commerce approach will simplify payments acceptance for Ventrata’s merchants, support those which don’t have an established payment provider, and end the struggle of managing payments from separate POS and online providers.

Importantly, Adyen for Platforms helps Ventratra make the process of onboarding and paying its merchants quick and simple. With many different operators involved across the tours and attractions sector, Adyen for Platforms removes the complexity of paying merchants across the globe, while ensuring compliance with relevant financial regulations.

Ventrata’s newly launched offering will transform payments for global businesses with sites in Canada, Europe, America, UK, and Asia. This follows a sustained period of growth for Ventrata, which is at the forefront of innovation in the tours and attractions industry; a sector looking to bounce back from disruption caused by the pandemic.

“Customer experience is absolutely vital in the tourism industry, so we put it at the heart of what we do. We want customers to have a smooth experience regardless if they’re booking in advance, on web or mobile, or at the point of sale,” said Oliver Morgan, CEO and Founder of Ventrata. “Adyen enables us to keep payments simple for our customers. With Adyen for Platforms we can offer over most local payment methods, provide a unified commerce solution for ticketing businesses online and via POS, and ensure they are paid quickly and with ease.”

“We’re passionate about removing complexity from payments and helping our platforms to innovate and enhance customer experience,” said Colin Neil, Managing Director Adyen UK. “After the disruption to the tourism sector in the past 18 months, we’re particularly excited to be working with Ventrata to push the envelope when it comes to customer experience and help them turbocharge the recovery in tourism.”

Related News

Josh Gunnell,

head of fraud & ID pre-sales at TransUnion

Josh Gunnell, head of fraud & ID pre-sales at TransUnion in the UK, comments on the recent ONS fraud statistics: see more