Published

- 09:00 am

Ketch, the next generation data control platform for privacy, governance and security, named a Gartner® Cool Vendor in Privacy[1]. Ketch provides granular control over protected consumer data, including data discovery and classification. Ketch also offers end-to-end privacy automation including data subject rights (DSR) fulfillment --ensuring people’s privacy preferences are fully honored across data ecosystems.

In evaluating vendors, Gartner notes that: “Digital transformations and continued adoption of cloud services mean that personal data is processed in more locations than ever. It is imperative that organizations automate data discovery and governance functionalities in order to better protect personal data throughout the data life cycle.”

To help with this challenge, Ketch automates the discovery of personal data across a company’s data systems, and uses machine learning to classify and label data (e.g. personal, sensitive, and social security number, address, etc.). Through a central policy center, Ketch customers can articulate and enforce policies for access, security and privacy on data wherever it lies.

“Companies need an automated, scalable way to discover, classify, and inventory data for their privacy and data governance programs,” explained Tom Chavez, Founder and CEO of Ketch. “We believe that Gartner nailed the challenge succinctly: it’s not feasible for any company to comply with globally expanding regulations with a manual approach. We built Ketch to provide a programmatic approach to privacy, to help companies respect and honor people’s privacy rights, while responsibly using data to grow.”

To book a virtual demo with a Ketch expert today, visit: https://www.ketch.com/request-a-demo.

Related News

- 05:00 am

CurrencyWorks Inc., an award-winning, full service blockchain platform provider, is pleased to announce that the Wave 2 “Rare” NFT packs released through its Motoclub platform as part of the Barrett-Jackson 2021 Las Vegas Collector Series have sold in 30 minutes in yesterday’s drop.

The final packs went on sale November 9, 2021, priced at $25 each, selling out to NFT collectors within 30 minutes. The complete run of “Rare” tier packs in the 2021 Las Vegas Series are now all sold, and no further packs of this will be minted to ensure scarcity and exclusivity to those that own them.

On November 16, 2021, Motoclub will release the last 20 packs from the Las Vegas Collector Series “Epic” tier. This Wave 2 drop represents the last of the packs from this campaign, and draws to a-close the 2021 Las Vegas Collector Series. Priced at $50 per pack, sales will go live on Motoclub.io at 12pm PST.

“The Las Vegas Collector Series has been incredibly well received within the space,” said Cameron Chell, Executive Chairman of CurrencyWorks. “The confidence these sell out drops have given us, provide a strong framework for real long-term success with Motoclub as we scale up with new products, new partners and a growing customer base.”

For more information on the Barrett-Jackson 2021 Las Vegas Series please click here.

Related News

- 01:00 am

New partners work with Mastercard to maximize scale, inclusion and consumer protection across more payment choices

Mastercard today announces further expansion of Mastercard Installments, its unique Buy Now Pay Later (BNPL) program that delivers greater choice of flexible, digital-first payment options at checkout, both in-store and online.

In the U.S., American Airlines, CSI, Fiserv and TSYS, a global payments company, will work with Mastercard and the already diverse and dynamic array of participants in the program. In Australia, BNPL players hummgroup and Limepay are embracing the benefits of adopting Mastercard's innovative open loop model.

Mastercard Installments makes BNPL available to millions of consumers and merchants worldwide. It enables banks, lenders, fintechs and wallets to offer a variety of flexible installment options to consumers - including a zero percent interest, pay-in-four model – without onerous merchant integration. This allows participating partners to quickly offer secure and competitive BNPL experiences at scale through Mastercard’s trusted global acceptance network.

“Our diverse set of new partners demonstrate the versatility, flexibility and agility of our BNPL program,” said Craig Vosburg, Chief Product Officer, Mastercard. “Mastercard Installments offers a digitally focused way to pay today and tomorrow, delivered through consumers’ most trusted relationships with their banks and other lenders, at merchants of their choice. The program’s unique, open loop model provides lenders, merchants and consumers alike the ability to enjoy the benefits of BNPL purchasing, with the security and consumer protections they’ve come to expect from Mastercard.”

Delivering scale, inclusion and consumer protection

Consumers access BNPL offers, either through their lender’s mobile banking app or through instant approval during checkout. Pre-approved installments can be used directly on a merchant’s website or can be stored in digital wallets like Click-to-Pay to be used wherever Mastercard is accepted.

Mastercard Installments will also provide access to and support from a new suite of APIs at each step of the BNPL journey, from installment calculation to multiple repayment options. Learn more on Mastercard Developers.

Rebecca James, CEO of hummgroup said, “Mastercard is a key strategic partner for hummgroup as we roll out our BNPL products across our markets. We launched the first open loop BNPL in the world with bundll, using Mastercard’s rails, so truly believe in the benefits of this model for consumers and will work very closely with Mastercard to continue making BNPL even simpler for merchants to use. Partnerships are core to hummgroup’s growth strategy, and we’re delighted to continue working with Mastercard on their new open loop BNPL initiative to help us further scale our products.”

hummgroup has been offering BNPL to its customers for more than a decade, operating in the U.K., Australia and New Zealand.

Willie Pang, CEO of Limepay said, “Mastercard’s new Installments program brings clever thinking and innovation to the evolving payments and BNPL ecosystem. As a brand-first, white-label payments solutions enabler that brings brands closer to their customers, however they pay, Limepay is looking forward to unlocking Mastercard’s scale and open loop network to enhance and build on its core offering to merchants. We’re excited to bring new innovations to our existing and growing portfolio of merchants by combining Mastercard Installments’ capabilities with Limepay’s white-label payments platform. We see our participation in Mastercard's program as a smart way to accelerate adoption of our platform, which is all about empowering brands to own their customer experience, loyalty and customer data."

Related News

- 03:00 am

Leading fintech bank breaking both traditional model and challenger approaches to drive next wave of integrated UK banking

FinecoBank, one of Europe’s leading fintech banks has continued to set the pace of revenue growth in Q3 2021 – following strong results reported in H1, exceeding last year’s record-breaking growth.

In the first nine months of the year, Fineco opened more current accounts in the UK than in the whole 2020, while improving the penetration of active clients on brokerage, representing more than 70% on new current accounts.

Highlights:

- Overall Fineco recorded robust net profit of € 257.2 million in 9M21 (+4,4% y/y)

- Revenues at 596.9 million in 9M21 (+4,1% y/y)

- FinecoBank has a strong and safe capital position: CET1 (Tier 1 Capital) Ratio is 18.37%

- Further European expansion with plans to launch in Germany by next year

Paolo Di Grazia, vice general manager of FinecoBank commented:

“Financial needs are changing. The first nine months of this year have confirmed that a one-stop approach to connect banking, investing and trading all in one platform is the future for UK customers. New current accounts in the last quarter have been almost 70% higher compared to the whole of 2020. As we approach the end of the year, we expect this momentum to continue. We continue to grow at speed in the UK with the launch of Fineco ISA this year, and now over 20 asset managers available through our investing platform. We are also excited to announce that plans are underway to launch in Germany – a one stop digital solution across banking, investing, and brokerage will be the default model of the future in Europe.”

Fineco continues to drive its UK customer offering and has further expanded its investing platform with the introduction of more than 20 asset managers and the launch of the Fineco ISA in April. Fineco now has plans to improve its ISA with the introduction of multicurrency options, focusing on value and a personalised approach for customers by ensuring they can select the best investment solutions to align with their goals.

Related News

- 05:00 am

ACI augments Omni-Commerce solution with payment insights that drive conversions, boost engagement and accelerate decision-making for merchants

ACI Worldwide, a leading global provider of real-time digital payment software, today announced the launch of Omni-Commerce Payment Analytics. Part of ACI Omni-Commerce, this new feature offers merchants the ability to surface payments data gathered through multiple channels within a merchant’s payment ecosystem.

“Merchants are tasked with offering personalized and seamless shopping experiences while also keeping up with the increasing demands for alternative payment methods and channels such as mobile apps, social media, BNPL and QR codes,” said Debbie Guerra, head of merchant segment, ACI Worldwide. “Tracking data across multiple channels and translating it into meaningful and actionable insights is challenging. ACI’s Omni-Commerce Payment Analytics makes it easier for merchants to quickly and easily fine tune their payment strategies based on facts, which is especially useful during peak season.”

ACI’s Omni-Commerce Payment Analytics enables merchants to access and analyze large sets of transaction data in real time. The feature provides extensive visibility into payment trends, helping to deliver rich insights that unlock new opportunities and drive business growth. ACI Omni-Commerce with integrated payment analytics allows merchants to draw insights from a single source, guiding smarter and more confident decision-making. Merchants can surface payments data gathered through multiple channels to:

- Gain the clearest view of shopper preferences

- Accelerate and improve business decision making

- Enable greater data sharing and collaboration

- Hone strategies to help maximize conversions

- Reduce costs by streamlining data gathering

ACI Omni-Commerce brings simplicity to complex payment challenges and provides merchants with greater control over their payment processes and costs. The integrated, multi-layered fraud management capabilities include machine learning models, predictive and behavioral analytics, customer profiling techniques, unlimited rules and powerful consortium data. ACI Omni-Commerce was recently recognized by Juniper Research, winning Gold Awards in two categories—"Best Checkout Experience Solution” and “In-Vehicle Payments Innovation.”

Related News

- 05:00 am

Tickeron, the quant-sourced marketplace for AI stock trading tools, presents a new version of its portfolio marketplace with a wide range of investment strategies and asset allocation models capable of meeting the needs of a wide range of investors.

We introduce two types of easy-to-use portfolios to our clients:

AI Active portfolios offer active investment strategies with portfolio rebalancing once a week, month, or quarter. Stocks for purchase are selected by algorithms based on technical and fundamental analysis methods and optimized by neural networks, which have been proven to be effective by back and forward tests. This type of portfolio is most suitable for risk-tolerant investors who want to receive higher returns than passive investing.

AI Model portfolios offer asset allocation models with infrequent position rebalancing. We are constantly looking for the best dividend stocks, growth, or undervalued stocks and compose diversified portfolios from them. To assess the quality of diversification, we use Diversification Score (TM) known as DivScore(TM), our unique quantitative algorithm that analyzes the risk metrics of all industries and stocks included to find the most resistant models to changes in the market situation. This type of portfolio is suitable for long-term investors and can be used for retirement accounts and taxable accounts like IRA.

“Our goal is to give a wide range of investors access to algorithmic methods by which hedge funds achieve their high profits. In our marketplace, everyone can choose a portfolio that best suits their investment goals using a wide range of filters and settings. In addition, the user can subscribe to one portfolio or all at once and receive an impressive discount. We are constantly looking for new investment ideas and algorithms to help our users invest smarter and better.” said Sergey Savastiouk, CEO and Founder of Tickeron.

About Tickeron: The company is an algorithmic AI trading marketplace for traders, investors, and proprietary neural network developers. To learn more about Tickeron, please visit tickeron.com. In addition, follow Tickeron on the following channels: Twitter, YouTube, Stocktwits, and Google News.

The detailed charts provided by Tickeron are subject to certain limitations disclosed on tickeron.com that investors should review before investing. Tickeron's investment advice relies on historical information. Past performance is not indicative of future results. Investing in securities involves significant risks, including the risk of loss of the entire investment.

Related News

- 04:00 am

Following initial success with CellPoint Digital’s Payment Orchestration Platform, Velocity,

the airline bolsters its payment methods, features that enable split payments, and currency conversion

CellPoint Digital, a fintech leader in payment orchestration, today announces the next leg of its partnership with Cebu Pacific, the largest airline in the Philippines.

Cebu Pacific is one of the most successful low-cost airlines in the world, having flown over 22 million passengers to over 60 destinations in 2019, with 70% of these bookings being made directly via the carrier’s digital channels.

Following the successful implementation of CellPoint Digital’s cutting-edge Payment Orchestration Platform, Velocity, across all of Cebu Pacific’s digital channels last year, the airline has now implemented new alternative payment methods to provide more flexible options to their customer’s payment experience. Thanks to the PSP/acquirer agnostic Velocity platform, Cebu Pacific customers will now have access to the following popular payment methods: GCash, GrabPay and PayMaya.

The new alternative payment methods boast wide-ranging end-user benefits, including enabling split payments between travel fund vouchers and cash, and converting local currencies in real-time. For the airline itself, providing more payment methods should increase revenues, and by optimising card payment processing across multiple acquirers, they will be able to do real-time transaction monitoring – by market, and by payment method – all delivered conveniently in one place.

The intelligent routing module already dynamically optimises the routing of each transaction made via a bespoke network of acquiring banks, thereby maximising acceptance rates and lowering transaction costs.

Candice Iyog, Vice-president for Marketing and Customer Experience at Cebu Pacific added: “Our partnership with CellPoint Digital continues to go from strength to strength. As the world begins to open back up and consumers are more used to using flexible digital payment methods than ever before, we’re proud to be able to offer our customers a frictionless customer experience at checkout by giving them the payment methods they most want to use.”

Commenting on the announcement Kristian Gjerding, CEO of CellPoint Digital commented: “We’re delighted to announce this evolution in our partnership with Cebu Pacific. Airlines have, by necessity, some of the most complex payment ecosystems of modern merchants, and an equally diverse customer base to match. By utilising our comprehensive payment orchestration platform and having access to a large payments ecosystem, we have simplified the payment process for Cebu while bolstering its offering with popular alternative payment methods for its customers.”

The news comes as the APAC airline sector gears up to take off again following the disruption caused by the COVID-19 pandemic, with 77% of APAC airline customers ready to travel as soon as restrictions fully ease. Via its access to CellPoint Digital’s growing ecosystem, Cebu Pacific is ready to maximise the payments journey for APAC travellers with payment methods covering over 40 local and global cards, and over 350 alternative payment methods.

The future is promising for the partnership as the two companies work towards introducing more new features such as stored cards and other popular APMs, while also empowering Cebu’s B2B offering with more payment capabilities.

Related News

- 08:00 am

Aquaponics AI releases the NextGen Farming Marketplace collaborating with the industry’s leading talent in fish, crops, designers, and laboratories.

Aquaponics AI is a social-impact aquaponic technology company powering next-gen smart farmers who actively use technology to streamline their hydroponic, aquaponic and aquaculture farm operations.

Their recently released, NextGen Farming Marketplace, aims to connect the aquaponic community with essential resources from industry trusted experts. Producers can now import best practices and libraries for aquaponics, hydroponics and aquaculture directly into their existing project.

“Who has time to read hundreds of pages to understand how to do one thing when you're trying to change the world?!” said Jonathan Reyes, co-founder and CEO. “We've been working hard to gather the industry's experts, consolidate all their life's research, and provide it in a fast, tangible, and applicable way on your projects.”

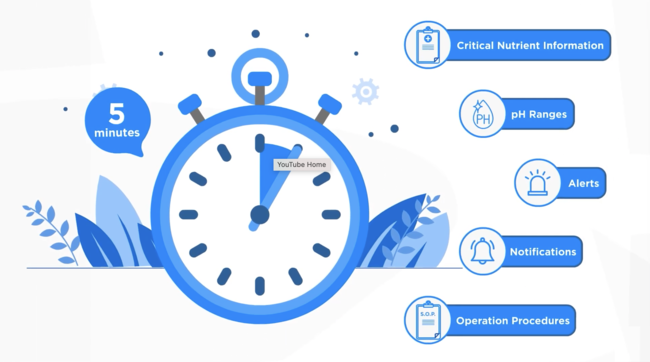

Within the new Marketplace producers can now:

- Get a jump start on their farm by downloading a SOP from a trusted source like the Food and Agriculture Organization of the United Nations

- Install a fish profile from a leading fish nutritionist that tells a farmer exactly how they should be cultivating that fish within their real-time water parameters

- Get alerts, insights and practical advice from experts on how to run a farm, at the click of a button

- Order plant sap analysis and water nutrient tests from collaborating laboratories directly from their dashboard and have the data automatically recorded.

To learn more about the NextGen Farming Marketplace and how producers can now have instant access to mission critical nutrient information, recommended pH ranges, alerts, notifications, and operation procedures directly in their Aquaponic AI projects, visit https://aquaponics.ai/marketplace.

Related News

- 05:00 am

Frank Ready has joined Wolters Kluwer’s Governance, Risk & Compliance division this week as Senior Specialist, Corporate Communications, for its Legal Services businesses. He is based just outside of Philadelphia and will help to proactively drive strategic PR, Thought Leadership and Analyst Relations for both Wolters Kluwer CT Corporation and Wolters Kluwer ELM Solutions globally.

Ready joins Wolters Kluwer from Law.com where, for the past three years, he has worked as a Reporter for the industry-leading Legaltech News publication. Law.com is the global media platform that includes 18 online U.S. national and regional legal publications that deliver breaking news, features and rankings. It is part of ALM, the international business-to-business information and intelligence media company. In his new position Ready reports to Paul Lyon, Global Corporate Communications Director: Global Marketing, Communications & Planning, at Wolters Kluwer GRC.

Prior to writing news and features concerning legal technology developments Ready was an award-winning journalist for a variety of local papers. He holds a Masters in Journalism from Syracuse University’s Newhouse School of Public Communications, as well a BA in Television, Radio and Film from the university.

Wolters Kluwer ELM Solutions is the market-leading global provider of enterprise legal spend and matter management, contract lifecycle management and legal analytics solutions. ELM Solutions provides a comprehensive suite of tools that address the growing needs of corporate legal operations departments to increase operational efficiency and reduce costs. Corporate legal and insurance claims departments trust its innovative technology and end-to-end customer experience to drive world-class business outcomes.

For nearly 130 years, Wolters Kluwer CT Corporation has been the leading provider of registered agent services, incorporation services, and legal entity compliance. The company has a global reach into over 150 countries. More than 75 percent of Fortune 500 companies, 95 percent of AmLaw 100 law firms, and 350,000 small businesses trust CT Corporation to handle their compliance needs.

The banking and regulatory compliance business lines of Wolters Kluwer GRC are Wolters Kluwer Compliance Solutions and Wolters Kluwer Finance, Risk & Regulatory Reporting.

Related News

- 06:00 am

The acquisition aims to strengthen and drive rapid growth and bolster the platform’s payments checkout process

Flutterwave, Africa’s leading payments technology company, has acquired Disha, a platform that enables digital creators to curate, sell digital content, portfolios and receive payments from their audience worldwide. Flutterwave’s acquisition aims to improve the process of digital content creation for Disha users, enabling them to earn value for their creativity using the platform’s new payouts and collections solution. Disha has acquired over 20,000 users organically over 12 months.

By enabling creators to receive payments from anyone, anywhere in the world, this acquisition is expected to further grow the estimated over $100bn global creator economy. Creators on Disha who already monitor performance with the platform’s analytics feature, embed social media pages, add call-to-action buttons, and more are expected to find it easier to access global markets.

Young people all over the world are seeking better ways to earn more value from their creativity. In a report by NDTV, Non-Fungible Tokens (NFTs), a new way of owning and selling digital arts, surged past $10bn in Q3 of 2021. This shows the large appetite of young people to create, own, sell or share various digital arts, creatives, and assets to a global audience— an industry Disha is well positioned to support in the near future.

Flutterwave’s acquisition of Disha will help grow its base by providing users with the ability to make, receive and withdraw money from their Disha accounts in over 150 currencies and 34 countries across the world.

Commenting on the news, Olugbenga GB Agboola, Founder and Chief Executive Officer of Flutterwave said: “At Flutterwave, we care about the creators on Disha who over the years have found a home for their craft. That is why we’re making this huge investment to continue to support their growth. Beyond Disha users, this is an exciting effort to equip the global creator community of about 50m individuals, with innovative tools to grow their craft. We are thrilled to be supporting Disha to provide new opportunities for freelancers and creators to showcase and receive value for their creativity, across the world.”

Commenting on the News, Rufus Oyemade, Software and Architectural Lead, Disha said: “Flutterwave’s acquisition will accelerate our path to being an important toolset for creators to showcase and get paid for their work from all over the world. The new payment feature will support creators who will in turn become key players in the global creator economy. Disha earlier used a US-based payment partner for collections, but now that we’re part of Flutterwave, it’s amazing how we can provide excellent global services from Africa. We’re excited to continue to provide creators and freelancers with tools that add value to their craft. We’ll be focusing on features and integrations that help creators easily schedule meetings and exhibitions, build sustainable income through subscriptions and leverage emerging technologies in the creator space.”

“I believe this acquisition will bring about only positive changes. With increased resources, expertise and customer service, Flutterwave will certainly make Disha stronger and more competitive in the market.” Evans Akanno, Co-founder and Former CEO of Disha said.

Disha was Co-founded by Evans Akanno (ex CEO), Rufus Oyemade (ex CTO) and Blessing Abeng (ex CMO). Disha will continue to maintain its distinct and unique brand identity and operations, despite the acquisition by Flutterwave. Disha had earlier in February 2021, announced it was closing services.