Published

- 09:00 am

- Fraud awareness week begins on Sunday 14th November.

- Between the start of 2021 and mid-October, more than £146 million had been lost to cryptocurrency fraud.

- The average loss per victim was just over £20,500.

- Over half (52%) of crypto fraud victims were aged 18 – 45 years old.

Susannah Streeter, senior investment and markets analyst, Hargreaves Lansdown

‘’Crypto scammers are spinning a complex web of deceit and an increasing number of younger people are being lured in with promises of high returns. The fear of missing out on the huge gains we’ve seen in crypto assets over the pandemic, means more people are dropping their guard and being seduced with claims the latest coin or tokens is the next big thing.

Action Fraud fund has found that between the start of 2021 and mid-October, £146,222,332 had been lost to cryptocurrency fraud. It’s just one eye watering statistic under the spotlight as International fraud awareness week approaches.This headline number is particularly shocking given that it’s 30% more than was fraudulently taken in crypto scams during the whole of 2020, an indication that scammers are stepping up their malevolent work.

The sums involved aren’t small and are potentially life changing. Action Fraud has received 7,118 reports of cryptocurrency fraud, with an average loss per victim of just over £20,500. As crypto chat runs rife on social media, and speculation about coins and tokens replaces gossip about house prices around middle class dinner tables and at the school gates, younger people are becoming increasingly susceptible to scams. Over half (52%) of crypto fraud victims were aged 18 – 45 years old, with 18 to 35 year olds accounting for the highest percentage of reports (11%).

The squid game token was one of the highest profile scams in recent months, snaring speculators who had poured money in with the promise it could unlock an exciting new online game. Unlike the desperate characters in the hit show, the token purported to represent, investors didn’t risk their lives, but some are likely to have risked piles of savings, to spin the crypto wheel of fortune.

The writing was on the wall that the token had the hallmarks of a scam, given that buyers couldn’t sell once they’d bought in. Within hours of the token reaching heady heights, having soared thousands of per cent in less than a week, the rug was pulled, the website closed, and it lost all value.

These pump and dump schemes are far from unusual, with many crypto fans desperate to catch a ride upwards on a rapid growth trajectory, with the hope of raking in short term profits. A very common tactic of fraudsters is using online adverts, emails and websites featuring fake celebrity endorsements to attract vulnerable investors’ money. So far this year 558 investment frauds reported related to bogus celebrity endorsement, and 79% of them were crypto scams.

What is particularly worrying the Financial Conduct Authority, the financial watchdog, is that 14% of people who old crypto assets have got into debt to do so. It’s highly likely that some people who have been scammed, may have lost borrowed money, plunging them even deeper into debt. Most firms advertising and selling investments in the crypto wild west are not regulated which mean that if you invest in certain cryptoassets you will not have access to the Financial Services Compensation Scheme if things go wrong.

If you are tempted to dabble in crypto assets you should only do so with money you are prepared to lose. As well as suspicious celebrity endorsements, there are there are other warning signs to look out for to try and avoid fraudsters. Be aware of heavy marketing and promotional offers that could be designed to lure in people fast and make sure you are not rushed into making any investment. It pays to do your research and check out the team behind the coin or token. If there are unnamed or non-existent team members it could be a warning sign. Other suspicious ploys include offering unusual ways to invest in assets like weekly or monthly investments. It’s also very important to check out reviews of crypto trading platforms or brokers to try and spot any signs of past fraudulent behaviour.’’

Related News

- 09:00 am

Today, New Orleans Mayor LaToya Cantrell was joined by executives from Mastercard, Mobility Capital Finance, Inc. (MoCaFi), and Forward Together New Orleans to announce the Crescent City Card Program. The program involves of a series of initiatives and products to offer financial inclusion, access to emergency disbursements, incentives to drive economic growth, empower underbanked residents, and provide better access to City services such as NORD recreation centers, parks, libraries, and public transportation.

“This series of initiatives will address racial and wealth gaps that we know are prevalent right here in our city,” said Mayor LaToya Cantrell. “My administration continues to identify innovative ways to serve and empower our residents and will make sure that the unbanked are banked and have access to financial education and other resources so that they can attend to basic needs and continue to invest in themselves. We are strategically focused and being intentional in meeting our people where they are as we invest in their future.”

As part of this transformative partnership, Forward Together New Orleans Mayor’s Fund launched the Hurricane Ida Emergency Relief Program in September, working in tandem with the City of New Orleans to distribute $190,000 to residents to aid in recovery efforts. These funds are being distributed through an Immediate Response Card furnished by MoCaFi, which acts as a prepaid bank card for quick and easy use.

“Mastercard is proud to join Mayor Cantrell, the City of New Orleans, and MoCaFi to introduce this first-in-the-nation partnership connecting New Orleans residents and businesses to the digital economy,” said Linda Kirkpatrick, President of Mastercard North America. “With our product innovation and insights, Mastercard is helping cities like New Orleans accelerate recovery with equity and resiliency in mind so they are better equipped for the future. We are committed to investing in New Orleans and look forward to partnering on new solutions like the Crescent City Card that support citizens and small businesses who call this great city home.”

“MoCaFi is honored to join the City of New Orleans and Mastercard in offering a financial product that will effectively address the wealth gap in this incredible city,” added Wole Coaxum, Founder and CEO. “A city that represents resilience, diversity, and history deserves a card that reflects the richness of its heritage and cultural appeal. The Crescent City Card will open doors to access for everyone who calls New Orleans home.”

“We have been working with Mayors across the country to rethink how we recover and rebuild moving forward. This program and the Mayor’s leadership provides clear direction for other cities across the country. This is also a great example of how the private and public sectors come together to do good for everyone,” said George Burciaga of IGNITE CITIES.

Through a $500,000 grant from Mayors For A Guaranteed Income, 125 opportunity youth will participate in the New Orleans Guaranteed Income Program beginning in December, and will receive $350 a month for ten months via a MoCaFi immediate Response Card. Using innovative technology, this card will also provide access to NORD recreation centers via contactless technology as a part of the Crescent City Card program umbrella.

During the press conference, community partners from The First 72+, CEO Works and Collegiate Academies Next discussed how the Crescent City Card Program, through the Guaranteed Income initiative, will ensure the residents they serve gain access to resources that will help build generational wealth.

Today’s announcement builds on Mastercard’s commitment to the City of New Orleans and its residents and businesses. New Orleans is one of seven cities in Mastercard’s “In Solidarity” initiative, a $500 million commitment to closing the racial wealth and opportunity gap for Black Americans.

Along with this new partnership, Mastercard is hosting programming across New Orleans touching on empowering small businesses, increasing financial literacy, lifting up HBCUs and collaborating with City leaders to use data to drive inclusive economic growth. On Monday, City representatives will join Mastercard for “In Solidarity with New Orleans,” a virtual discussion hosted by Blavity addressing a financial system that has systemically disadvantaged and excluded Black communities and how the public and private sectors can collaborate to advance opportunity and equitable growth in New Orleans.

The card is expected to be launched in Spring/Summer 2022, interested participants can visit mocafi.com for more information.

Related News

- 02:00 am

Fintech Service Combines A.I. and Tax CPA Experts to Simplify, Handle and

Drive Down Cost of Complicated Tax Filings

FlyFin, a fintech provider, announced its exit from beta to launch its namesake offering officially. FlyFin is the first AI-based tax engine that combines the human expertise of real CPAs to eliminate 95% of work required for self-employed individuals. The mobile-first app is ideal for freelancers, gig workers, creator economy free agents, and self-employed individuals with a higher level of tax complexities.

FlyFin squarely addresses the pain points that self-employed and freelancers have around tax preparation, including accounting and tax filing uncertainties, time-consuming and complicated, knowing what deductions qualify, and meeting established deadlines to avoid tax penalties. According to a survey done earlier this year, 33% of Americans procrastinate doing their taxes and wait until the last minute. It also found that millennials are most likely to procrastinate on filing their taxes compared to different generations.

As part of its launch, FlyFin also introduced additional services bundled into its plans.

- Comprehensive Tax Report: An in-depth analysis and report produced by analyzing all the user's expenses to figure all the areas and specific deductions that they can take to maximize their tax savings. The custom tax report is generated with the help of A.I. and entirely reviewed by CPAs. The average value for a service like this is $499, but FlyFin will provide it free for subscribers opting for standard and premium plans.

- Full Audit Insurance: An important assurance, this insurance provides comprehensive management of any IRS or state tax notice or "audit" requesting to review a tax filing. FlyFin's CPA team will review, research, respond and represent a user with the IRS from start to finish. This guarantee is typically a $150 value that standard and premium subscribers receive for free.

To get started, users download the app and link their accounts to make tracking expenses effortless. FlyFin's A.I. engine automatically scans expense accounts daily to suggest which category to classify the expense based on profession. FlyFin's A.I. and CPAs find all possible tax deductions. Users also have access to the domain expertise of tax CPAs, who review each individual's tax information and provide expert help to maximize savings. Users have the option to file their taxes with FlyFin's CPAs, who ensure 100% accurate tax review and preparation, or can export their data in an IRS-ready format.

FlyFin aims to disrupt the $23 billion individual tax preparation market in the U.S. The pandemic has permanently altered businesses adapting to remote work, accelerating their plans to hire more freelancers. With 70 million freelancers, the U.S. market is projected to grow to 86.5 million self-employed over the next five years. By 2027, freelancing will comprise approximately 51% of the total U.S. workforce. The most common type of freelance work is in skilled services, with 45% of freelancers providing programming, marketing, and other consulting work, according to an Upwork 2019 report.

FlyFin is led by a strong team of experienced, successful entrepreneurs in A.I. and search and hail from industry-leading companies, including LinkedIn, Microsoft, and Facebook. Co-founder and CEO Jaideep Singh's proven track record has created more than $3 billion in value for companies. In 2007, he co-founded Spock, the market's first people search engine and early adopter of A.I., indexing over 1 billion people, representing more than 1.5 trillion data records. He has founded or funded numerous companies in Silicon Valley and India.

Pricing and Availability

Available immediately, FlyFin offers three plans (basic, standard, and premium) that vary in service and features provided, with pricing starting at $7, $16, and $29, respectively. For iPhone or iPad users, the app requires iOS 11.0 or later and can be downloaded here. A desktop version is also available for Macs with an Apple M1 chip. Android users can download FlyFin's app here.

Related News

- 05:00 am

Operating Profit of 77.5 Million Euro for 9M21 (+176% Over 9M20)

Net Profit of 46.2 Million Euro for 9M21 (+90% Over 9M20)

Net Profit of 18.8 Million Euro in the Third Quarter of 2021

(+26% Compared to 2Q21 and +98% Compared to 3Q20)

Solid and Well-Diversified Revenues, Costs Under Control

Also Including Investments in New Initiatives

Excellent Quality of Existing Business

ROE Climbs to 9% in the Nine Months 2021

Short and Medium-Long Term Targets Confirmed

Resolved to Convene the Shareholder’s Meeting to be Held on December 15, 2021 for Integration of the Board, Remuneration Policy and New Long-Term Incentive Plan

- Growth Credit Division: the driver behind the rise in the Group’s volumes in the quarter, with net customer loans up by 16% over the previous quarter (+70% y/y) to 1.17 billion euro and further revenue diversification, with a positive contribution coming from the initiatives launched at the beginning of the year (capital markets, Ecobonus1)

- Distressed Credit Division: confirms itself as the force behind the Group’s profitability, thanks also to the dynamic management of its existing portfolio, generating revenues in the first nine months of 2021 exceeding those earned in the whole of 2020. The Division’s Cost income ratio remained at excellent levels at 32%

- Direct Banking Division: direct retail customer funding rising to ca. 1.3 billion euro and significant advances on the new initiative front. HYPE released its new offer in September and asserted the market leadership with around 1.5 million customers. B-ILTY – the first fully digital direct bank designed for small corporates – confirmed the launch by the first quarter of 2022

- Liquidity of 1.1 billion euro and a robust capital base with a CET1 Ratio of 20.1% (20.6% pro-forma2) and a Total Capital Ratio of 26.5%

- The capital increase reserved to the ION Group completed in the third quarter and the licence agreement for illimity’s IT architecture gets under way.

MILAN, Italy, Nov. 11, 2021 (GLOBE NEWSWIRE) -- via InvestorWire -- Chaired by Rosalba Casiraghi, the Board of Directors of illimity Bank S.p.A. (“illimity” or “Bank”) yesterday approved the illimity Group’s results at 30 September 2021.

illimity again reports solid financial and operating performance in the third quarter of 2021: net profit of 18.8 million euro (14.9 million euro in the second quarter of 2021, +26% q/q, and 9.5 million euro in the third quarter of 2020, +98% y/y), taking the net result for the first nine months of the year to 46.2 million euro, up by 90% over the corresponding period in 2020. ROE3 closed at over 9% for the first nine months of 2021 on an annualised basis.

All the new strategic initiatives are running to schedule and the trajectory towards the short and medium-long term targets set in the 2021-25 Strategic Plan presented on 22 June is therefore confirmed.

Specifically:

- Revenues in the third quarter rose by 49% over the third quarter of 2020, driven by the Group’s recurring activities and the development of its new initiatives. The strong performance accompanied the gradual balancing of the revenue mix, with the component of income other than net interest income representing around 50% of the total in the first nine months of 2021.

- Standing out among revenues is the rise in fees and commissions, which in the third quarter rose by 18% q/q to reach 10.3 million euro – three times the corresponding figure for the previous year – driven by the robust generation of new business volumes in the Growth Credit segment, including Factoring, the solid results of neprix and the rising contribution of the new initiatives.

- Revenues for the period include the first income of 5 million euro arising from the licence agreement entered into with the ION Group for the use of the information systems developed by illimity (part of the 90 million euro planned to be received over five years).

- The Distressed Credit Division’s performance in managing purchased loans proved once again to be excellent in this quarter, with an extremely good progression in gross cash flows, generating ca. 5.3 million euro of profit from closed positions and other income of ca. 7.2 million euro; overall, the Division produced revenues of 146.1 million euro in the first nine months of 2021.

- Despite the fact that the Bank continued to invest in new initiatives which have yet to produce revenues, operating costs in the third quarter fell by around 9% over the previous quarter due to seasonal savings on certain staff cost items. This trend, together with the robust performance of revenues, led to a further improvement in the Cost income ratio, which reached 56% in the quarter and 60% in the first nine months of 2021, a clear-cut improvement over the same period of the previous year (76% in 9M20).

- As a result of the above dynamics, illimity’s operating profit rose to 77.5 million euro in the first nine months of 2021, nearly three times the figure of 28.0 million euro reported for the same period in 2020.

- The Bank’s risk profile strengthened further, remaining at the top levels of the system: the CET1 Ratio rose to 20.1% at the end of September 2021 (20.6% pro-forma with the inclusion of the special shares) due to the completion of the capital increase reserved to the ION Group and the profit of the quarter just ended; the ratio between gross doubtful organic loans and total gross organic loans fell to 2.5%; excluding the loan portfolio of the former Banca Interprovinciale, this ratio stands at around 0.5%. Liquidity continued to be abundant at over 1.1 billion euro at the end of September 2021, consistent with the expectation of an acceleration in opportunities in the distressed credit market in the final part of the year.

- Lastly, the Bank continued developing the new initiatives outlined in the Strategic Plan in line with the timetable. In September, HYPE launched new services and products on the market, enhancing its offer, with the aim of giving a further thrust to the already robust growth performance of the company, which can currently count on 1.5 million customers, confirming its leadership position among the fintechs that operate in Italy. The development of B-ILTY, the new highly digital direct bank designed for small corporates, ready for launching in the first quarter of 2022, is running to schedule. And in conclusion, the operating activities continued for enabling neprix Sales – the remarketing entity already a leader among platforms for the sale of real estate and capital goods arising from legal procedures – to enter the real estate free market by way of an innovative and digital offer model.

Corrado Passera, CEO and Founder of illimity, commented: “The world served by illimity, that of the small corporates, offers significant opportunities. A growing number of corporates present ambitious projects to enhance their potential and many are on solid paths towards a turnaround. The increase in distressed corporate credit will also accelerate once the banking moratorium ends, and the role of banks such as illimity specialising in this market segment will prove itself fundamental.

The decisions and technology investments we have made in these years will enable us to provide a service model that has shown itself to be competitive in terms of both expertise and efficiency. B-ILTY, the direct bank for small corporates, which will be launched on the market in the first part of the year 2022, will complete the construction of the illimity model and be completely unique, and not only at an Italian level.

The results of the first nine months of 2021 and in particular the third quarter confirm that the path that illimity has taken, has only just begun to bear its fruits for our customers and our shareholders.”

Related News

- 09:00 am

The Royal BNB team brings you Royal BET (RBET), the first part of the Royal Ecosystem. Royal BET will be a high quality play to earn utility, launching on Friday, 12 November 2021.

Royal Bet (RBET) is launching on the Binance Smart Chain with an animated horse racing game. Further play to earn games will be rolled out in the coming weeks and months, making RBET an attractive online place to use your cryptocurrency. The first RBET game is a horse racing animated game, this has never been seen before in the BSC space of cryptocurrency.

Part of every transaction made on RBET will buy coins in the mother coin, Royal BNB ($RB), driving up the price of the coin, as well as increasing the transaction volume of Royal BNB which gives 15% BNB rewards every 12 hours to Royal BNB holders - a great place to reinvest your RBET winnings!

The original coin, Royal BNB was launched on 31st July 2021, and sold out the presale in milliseconds! Since then the coin has been listed on Coin Gecko, CoinMarketCap, and currently has over 3500 holders. The rewards type of crypto project has great possibilities for long term financial investment as long as the transaction volume continues to grow.

The Royal BNB team are developing the Royal Ecosystem which has various connected projects to ensure growth in the original coin as well as fun utilities for the Royal BNB community to enjoy. Royal BET (RBET) is the first part of their long-term plans to see the Royal BNB Family achieve financial freedom.

When investing in cryptocurrency projects, it is important to look closely at the code, liquidity and team to see if the project is worth your time and money. Royal BET has had its code audited, and has been developed by King Edward, the Head Developer of Royal BNB. The liquidity has been locked protecting investors from being scammed. The team have been working together for about 6 months, developing a great community with Royal BNB, building loyalty and trust by following through on their promises.

Here in the Royal tokens, the team treat their investors like royalty, and consider the community to be like a Royal family. Many people made large financial returns from coins such as Shiba Inu, Doge and Safemoon, and to follow on that trend Royal Bet is the one to watch, it’s definitely going to give you an opportunity to make some serious gains!

Check out the details of this project and the royal ecosystem on https://www.royalbetbsc.com

Related News

- 08:00 am

- Data from ClearScore shows challengers and fintechs stealing share of lending market during Covid-19 pandemic

- ClearScore data suggests there are 9.3m credit customers ready to use open finance for their lending needs, 3.2m of whom are currently poorly served by the market

- Early adopters of open finance data-sharing are lower risk says ClearScore

During the pandemic, challenger banks and fintechs tripled their share of the credit card market and grew their personal loan books by 50% – according to new data from ClearScore, the UK’s leading free credit score and credit marketplace.

Andy Sleigh, ClearScore COO, commented: “The pandemic allowed newer entrants and more nimble, smaller operators to focus on growth at a time when the high street banks had to – understandably – protect and serve their current customer base. And we don’t see this trend abating. In fact our own analysis points to increased consumer adoption of open finance which in turn could help challengers to take further market share from the high street banks.”

ClearScore’s data reveals that there are some 9.3 million adults in the UK that would consider using open finance to get better access to credit, improved offers and interest rates. Of these, 3.2m are currently underserved by the market - that is, they lack credit options or are unsatisfied with the credit options available to them. 3.6 million currently have no credit products at all.

This combination of the underserved and those without any credit products shows that the lending market is set for considerable growth and that those using open finance will be able to reach a wider array of customers than ever before.

“The lending market has been changed forever by the pandemic” Sleigh said. “Fintechs and challengers have embraced open finance more readily than their larger competitors, as it allows them to expand their lending footprint, manage risk better and reduce their overheads. The fact is that open finance allows lenders to offer more competitive, personalised rates to consumers thanks to a far deeper understanding of their finances and risk profile.”

“Traditionally, customers would first turn to their existing financial partner – i.e. their bank – if they were in the market for a credit product. But with the influx of challengers and fintechs, who, thanks to open finance and more agile technology, are able to offer not only highly competitive rates, but also pre-approved products with a guaranteed rate and credit line. This all means that the traditional route to market is becoming less and less popular.”

ClearScore’s data also suggests that consumers who choose to share their data are typically lower risk than others within the same credit score bands. This means that lenders can afford to test the use of open finance data with little risk to their product economics.

Sleigh concluded: “The size of the open finance market is huge and presents lenders with the opportunity to create innovative products that benefit the customer. Those customers are engaged, aware of the benefits and ready to shop around. The lending market is still 30% down compared to pre-Covid, but we see open finance as the key to unlock it and offer consumers better options than before. When it does, we expect the floodgates to open and the race to support those customers is one we’re excited to see.”

Related News

- 09:00 am

Acquisition expected to accelerate Company's exposure to local lifestyle services

Yeahka Limited, a leading payment-based technology platform in China, announced today that it has agreed to invest RMB100 million in Dingding Cultural Tourism (Chengdu) Co., Ltd. (the parent company of Qianqianhui, "Qianqianhui") as registered capital and capital reserve of Qianqianhui. Following the acquisition, Yeahka will hold 60% of the enlarged share capital of Qianqianhui, and Qianqianhui will be integrated into Yeahka's in-store e-commerce services solutions segment.

Yeahka's strategic investment in Qianqianhui further strengthens the Company's capabilities in its technology-enabled business services segment by deepening the connection between merchants and consumers, and improving the sales performance of merchants. At the same time, consumers will be able to conveniently enjoy local lifestyle benefits such as discounts and promotions.

Liu Yingqi, Chairman and Chief Executive Officer of Yeahka, said, "Qianqianhui has been a highly competitive player in the local lifestyle services market in China, and our company delivers services to millions of merchants that have expressed a great deal of interest in more local lifestyle service solutions. We look forward to continuously creating value for merchants and consumers, and realizing synergies between our existing businesses."

Chen Jiading, Founder of Qianqianhui, said, "Qianqianhui has accumulated extensive experience and capabilities in local lifestyle services, e-commerce services and the distribution through of new media KOL. We are delighted to join the Yeahka family and look forward to writing the next chapter as we roll out our combined capabilities in the local lifestyle services market.

Qianqianhui is a highly competitive player in local lifestyle services, delivering a high of nearly RMB100 million in GMV in a single month

Established in May 2020, the Qianqianhui platform positions itself as a popular "high-end shopping platform," offering users access to tourist attractions, high-end resorts, buffets, catering, other local lifestyle services and products.

In just the half year following its establishment, Qianqianhui achieved breakthroughs in terms of both revenue and business scale. To-date, the platform has served more than 6 million merchants, and its peak monthly GMV has exceeded RMB93 million. Qianqianhui has branches in first-tier cities such as Beijing, Shanghai, Guangzhou and Shenzhen, as well as key provincial cities such as Chengdu, Hangzhou, Changsha and Suzhou.

As a highly competitive player in the local lifestyle services sector in the post-mobile Internet era, Qianqianhui has emerged as a strong player through its precise product positioning and the extensive experience of its management team.

In terms of merchandising, with its high-quality product supply chains and diversified channels, Qianqianhui helps merchants increase exposure and sales, reduce inventory pressure and lower customer acquisition costs while helping consumers obtain products and services with better value-for-money.

Qianqianhui's product supply chain business covers more than 200 cities nationwide, but still has strong expansion capabilities. At present, the platform targets selected quality merchants, including five to seven-star hotels, special catering brands and major national catering chains to guarantee a superior user experience.

Qianqianhui has also established comprehensive sales channels to improve its penetration and operational capabilities in the consumer space. Currently, Qianqianhui has built a comprehensive communications network covering WeChat official accounts, boasting over 8 million followers, and other mini programs. On the WeChat platform, Qianqianhui also has more than 3 million registered community experts specializing in social network distribution. It is a leader in terms of KOL recommendations and shop-visit operations on Douyin. From July to November 2021 alone, the GMV from short videos on Douyin and live-streaming sales exceeded RMB100 million.

Qianqianhui's founder, Chen Jiading, has accumulated years of experience in the local lifestyle services industry. He has managed and operated the LianLian Travel Around project for three years. Other core team members also have years of local lifestyle services experience and are veterans in merchandise product innovation and channel expansion.

Yeahka continues to strengthen its local lifestyle services, and evolve its technology-enabled business solutions

To bolster the Group's development in technology-enabled business solutions, Yeahka has presented its development roadmap for local lifestyle services in the recent years.

With a market potential of trillions of dollars, the local lifestyle services sector is not sufficiently connected. According to publicly available data, as at the first half of 2021, Yeahka served over 6.13 million merchants reaching 820 million consumers. Most merchants have expressed strong demand for services that support customer acquisition and sales, while consumers are constantly looking for more offline local lifestyle benefits, discounts and promotions.

Yeahka officially entered the local lifestyle services sector after launching its in-store e-commerce solutions business in the second half of 2020. Services such as the "Leshangquan Small Gold Card" and "Leshangquan In-store Services" grew rapidly after their debut. In the first half of 2021, the Company's in-store e-commerce business served nearly 10,000 merchants, and more than 1.42 million paid consumers. The platform's GMV exceeded RMB71 million, and overall revenue nearly reached RMB45 million.

For merchants, Yeahka's in-store e-commerce services include guidance from local merchandising experts, design of promotional packages, and support for launching on e-commerce platforms, payment and SaaS sales networks. The Company helps merchants precisely drive consumer traffic and improve direct sales through its omnichannel coverage.

For consumers, services such as the "Leshangquan Small Gold Card" and "Leshangquan In-store Services," and the Company's diversified marketing methods can offer customized and cost-effective in-store or to-home lifestyle services.

Following the integration of Qianqianhui, Yeahka will not only further consolidate its foundation in the local lifestyle services sector, but also create new growth opportunities for its technology-enabled business service solutions.

For Yeahka's in-store e-commerce business, Qianqianhui's strong supply chain, sales and channel operations will create strong synergies after connecting with the brands, traffic and technologies of existing businesses, thus further optimizing the portfolio of its in-store e-commerce business solutions. In addition to the in-store e-commerce sector, Qianqianhui can also generate strong synergies with businesses such as payment and SaaS digital solutions and boost development of their businesses.

Related News

- 04:00 am

A combination of quickly shifting consumer preferences, the disruptive impact of technology and relentless pressures facing financial institutions have made the strategic use of automation and digitization more critical than ever before. From regulatory demands and disaster planning to widespread staffing shortages, banks and credit unions are being challenged to accomplish more with less resources while still delivering excellent customer service. Experts from NCR today shared commentary on how these factors will shape trends to watch in 2022 and beyond.

Digital is being accelerated and physical is being transformed, resulting in merged channels. While digital adoption has been on the rise for several years, the pandemic’s irreversible impacts solidified it as the preferred touchpoint for a wide majority, which is why digital-first banking will continue to be a major theme next year. However, digital-first does not mean digital only, but rather digital everywhere.

In response, branch strategy is being reimagined, with many optimizing their footprints to smaller, more digitally forward branch and retail models. Branch employees are migrating away from their traditional role as everyday activity managers and are embracing relationship-centric advisor and sales roles. There is also a mass shift toward more advanced self-service technologies, such as ITMs.

As channels continue to integrate, institutions will make it a priority to implement more simplified, flexible architecture to power and unify what were once separate experiences, resulting in more connected customer journeys. By simplifying the technology that runs different customer touchpoints – from digital banking to ITMs and call centers – banks and credit unions can improve efficiencies, deliver new products and services more quickly and facilitate more consistent experiences across interactions of all types.

More modern infrastructure also enables institutions to better participate in the shift toward open banking, leveraging API connectivity to innovate faster and match (or even exceed) capabilities offered by emerging competitors, including neobanks, bigtechs and fintech providers. Expect to see more banks and credit unions embrace cloud banking to help future-proof their business models.

More banks and credit unions will solidify their cryptocurrency strategies in 2022. What was once a niche market is now receiving mainstream attention, and institutions must determine when and how digital currencies will fit into their service offerings moving forward.

Banks and credit unions want to and should be leaders when it comes to setting the vision of how digital currencies can work across all touchpoints. Use cases such as buy, sell, hold; cross-border remittance; and payments will continue to become more common next year. Those that solidify their strategies and expand consumer access to frictionless cryptocurrency capabilities will be poised to better compete with new threats, prevent customer attrition and grow wallet share and revenue.

Personalization will continue to mature, with financial wellness initiatives standing out as a significant use case. The need to better leverage data to personalize experiences has been a focus and imperative for many years, and in 2022 more institutions will see these efforts come to fruition. As personalization efforts advance, a strong use case will include tailored advice and narrowly targeted product recommendations designed to help customers strengthen their financial health. Such efforts will be especially important next year as many look to reestablish their financial wellness in the pandemic’s wake.

More financial institutions will embrace the as-a-service model. As institutions are challenged with competing resources, budgets and priorities, more will continue to turn to the true as-a-service model, especially for those areas that may not be as strategic to the institution. This doesn’t just mean managed IT services, but rather relying on a trusted partner to run areas such as security, compliance, business processes and asset ownership. Such a model significantly enhances efficiencies and helps ensure strong outcomes for banks and credit unions while freeing their time and resources for more customer-facing and growth-focused areas and initiatives.

“As banks and credit unions are under pressure to operate more efficiently and optimize margins while simultaneously continuing to innovate and deliver hyper-personalized experiences, they most often turn to technology for support,” said Frank Hauck, president and general manager, NCR Banking. “We remain committed to delivering the software platform and services necessary for institutions to power flexible, efficient and modern banking experiences across all customer touchpoints. The future of banking is self-directed, connected and digital first, and those that are embracing the right technology and strategies will be well positioned for success in 2022 and beyond.”

Related News

- 07:00 am

Platform will support lenders with digital customer onboarding

Facilitates complex affordability modelling for lenders

Fintech provider finova, which is backed by Norland Capital, has today announced the addition of the Apprivo2 platform to its suite of solutions. Apprivo2 is a configurable SaaS banking originations platform, designed for lenders operating a multi-sales channel model.

The platform is the only “cloud-first” SaaS banking originations product in the UK, and fully supports the entire application process. Open architecture is at the centre of Apprivo2’s technology, which enables rapid integration for lenders into a wide range of third-party applications and aggregates numerous sources for accurate decisioning.

Designed to meet the individuals needs of lenders, 80% of change can be self-serviced by clients using the highly configurable Apprivo2 system. It also has a built-in configurable decision capability, which lends the platform to complex affordability models and processes that can be built by business rules and product authors in clients’ own teams. It offers a highly visual user interface containing a Kanban-style case management visualisation and risk assessment hubs.

Apprivo2 leverages Microsoft’s Azure public cloud platform which means deployments are automated, scalable, fault-free and very rapid.

Paraag Davé, UK Managing Partner of Norland Capital, comments:

“We are delighted to have completed the acquisition of BEP systems and the market leading originations product, Apprivo2. Apprivo2 represents the very best of both modern SaaS based technology and the powerful configuration engines that are prevailing across the secured lending market. We are excited for this product to evolve into new areas and help us overcome many of the challenges our sector faces today. These are certainly exciting times for finova as we continue to cement ourselves as the market leader in the UK mortgage technology space”.

Related News

- 08:00 am

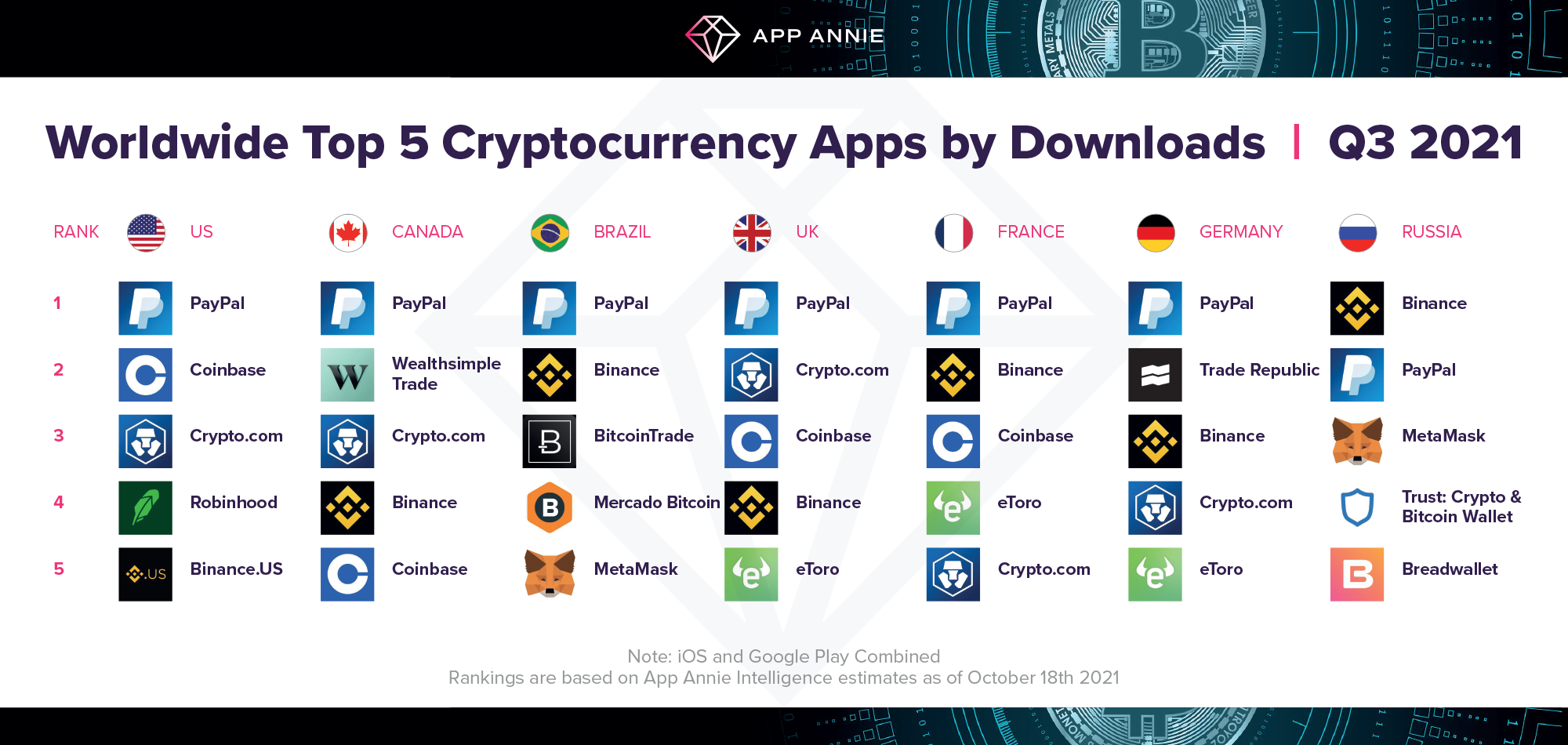

- Crypto is a significant driver of increased sessions in 2021 across the board. Among US Gen Z and Millennial users, the top three crypto-trading apps by time spent on Android Phone were Robinhood, Coinbase, and Wellbull Stocks (Sep 2021).

- Gen X and Baby Boomers also spent more “crypto-time” in these three apps than other crypto apps. While these apps also ranked in the top 15 by time spent for the Gen X/Boomer audience, this age group still favoured spending time in more ‘traditional’ apps like TD Ameritrade, Chase Mobile and IBKR.

- 2022 will be an unprecedented opportunity to engage Gen Z on mobile – as a mobile-first generation on the verge of financial independence, this is the time to cultivate customer loyalties on their preferred device: mobile.