Mastercard Selects Aion Bank, Powered By The Vodeno Cloud Platform, as Strategic Partner for its Fintech Express Programme

- 4 years 1 month ago

- Transaction Banking, Payments, Banking

Mastercard and Aion Bank, supported by technology partner, Vodeno, have signed a strategic partnership, whereby the digital bank has become a welcomed, certified member of Mastercard’s Fintech Express programme. Through the partnership, fintechs will be able to leverage Aion Bank’s Vodeno Cloud Platform (VCP) technology, one of the most comprehensive banking platforms operating entirely in the cloud.

Curve Chooses Credit Kudos as Open Banking Partner for Curve Credit

- 4 years 1 month ago

- Open Banking, Payments, Credit Cards

Credit Kudos, the challenger credit reference agency and Open Banking provider, today announced they have been selected as the Open Banking provider for Curve, the fintech that brings your cards into one smart card and app, for its forthcoming Curve Credit product.

ekko Launches with Mastercard Making it Effortless For Consumers to Take Action on Climate Change

- 4 years 1 month ago

- Payments, Credit Cards

ekko, an innovative new app, debit card and ecosystem that turns the tide on climate change, has today launched in the UK with a strategic partnership with Mastercard. The launch comes as new research from Mastercard shows two in five Brits (43%) see reducing their carbon footprint more important now than pre-pandemic.

Mollie Appoints New Chair and Board Member

- 4 years 1 month ago

- Payments, People Moves

Mollie, one of the fastest-growing payment service providers in Europe, has appointed Eli Leenaars, Vice-Chairman of Global Wealth Management at UBS as its new chairman and Muz Ashraf, Principal at TCV as a new member of its supervisory board. Leenaars will step down from his UBS role on 31 May 2021.

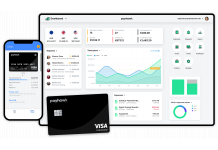

Payhawk Raises $20M From Klarna Backers QED Investors

- 4 years 1 month ago

- Management, Payments

Payhawk, the platform for payments and expense management, has raised $20 million. The Series A round is led by the US-based fund QED Investors, which has a strong track record of investing in 18 fintech unicorns, including Klarna and Nubank. Existing investor Earlybird Digital East, who led the $3.6 million seed round in March 2020, is also contributing fresh capital. Yusuf Ozdalga will join the Payhawk board alongside existing investors Mehmet... more

Nets and Gifted Partner Up to Develop New Digital Instant Prepaid Gift Card Solution in Europe

- 4 years 1 month ago

- Payments, Credit Cards

Nets, a leading European payment services provider and market leading digital gift card provider, Gifted, have entered into a new agreement to offer merchants an innovative digital solution across the Nordics and wider Europe, including DACH, Benelux and France.

MVIS and CryptoCompare Launch the MVIS CryptoCompare DeFi 20 Index

- 4 years 1 month ago

- Cryptocurrencies, Data

MV Index Solutions GmbH (MVIS®) in partnership with CryptoCompare, global leader in digital asset data, today announced the launch of the

High-growth Markets Report Unprecedented Surge in Online Consumer Shopping, According to New PayU Global E-commerce Report

- 4 years 1 month ago

- Payments

PayU, the fintech and e-payments business of Prosus, today launches a report titled “The Next Frontier: the most promising markets for emerging e-commerce leaders in 2021 and beyond”, highlighting unprecedented consumer spending growth in e-commerce in high-growth markets that have often been overlooked before 2020 in favour of more traditional, Western markets.

West Africa Launches New Payments Digitization Agenda

- 4 years 1 month ago

- Payments, e-Payments

In Senegal, 8 out of 10 workers are paid in cash. Most are temporary workers and excluded from health insurance. A survey revealed that 77% of temporary workers would be willing to receive their wages digitally if this gave them access to health insurance.

Bank of Abyssinia Taps Into Path Solutions to Achieve Sharia Compliance and Operational Efficiency

- 4 years 1 month ago

- Payments, Banking, Compliance

Path Solutions, a global provider of AAOIFI-certified software solutions and services for Islamic banks and financial institutions, today announced the signing of a new partnership agreement with Bank of Abyssinia (“BoA”), one of the leading banks in Ethiopia serving more than 4.6 Million custom

CoinDCX - Comment on Bitcoin Price Movement

- 4 years 1 month ago

- Bitcoins

Sumit Gupta, Co-founder & CEO, CoinDCX

Mastercard and Hi Partner to Launch Salary Access Card to Give Employees Real-time Access to Earned Pay

- 4 years 1 month ago

- Payments

Hi55 Ventures, a disruptive new fintech company in pay, has partnered with Mastercard to launch, a market-first salary access card, enabling people to access their pay as soon as they’ve earned it.

Fintech Startup Payer Selected by Returpack to Digitise Payouts in National Recycling Scheme

- 4 years 1 month ago

- Payments, e-Payments, FinTech StartUps

Returpack is the company that facilitates over 2 Billion deposits of recyclable PET bottles and cans in Sweden through a network of reverse vending machines. The fintech startup Payer was chosen to develop a new and innovative IoT technology with the ambition to create an easy digital payout experience for consumers. The digital solution, based on Payer’s API payments platform, is now being rolled out across Sweden.

Safenetpay and Banking Circle Take The Complexity out of Cross Border Payments

One stop business payment solution provider, Safenetpay, has joined forces with ground-breaking payments specialist, Banking Circle, to further enhance its cross border payment offering. Utilising Banking Circle’s multi-currency accounts, SEPA and SWIFT transactions solutions and foreign exchange (FX) capabilities, Safenetpay’s business customers can now access additional currencies, competitive FX rates and quick, reliable transactions within... more

Razorpay Raises $160 Mn led by Sequoia Capital and GIC; Triples its Valuation to $3 Bn in 6 Months

After being crowned a Unicorn a few months ago in October 2020, Razorpay, India’s leading Payments and Business Banking platform, today announced its Series E fundraise of $160 Million. This financing round has tripled the company’s valuation to $3 Billion in less than six months, signalling one of the fastest increases in valuation for an Indian Unicorn.