CFPB Takes Action Against American Advisors Group for Deceptively Marketing Reverse Mortgages to Consumers

- 3 years 7 months ago

- Lending, Data Protection

Proposed order would require nation’s largest reverse-mortgage lender to pay $1.1 million penalty for deceptive acts aimed at older homeowners

PPS Powers Sprive, The World’s First Mortgage Overpayment Platform

PPS, an Edenred company, today announces its partnership with UK-based Sprive, the first of its kind mortgage overpayment app designed to help homeowners become mortgage free faster and save interest.

People of Sri Lanka will get Better Financial Access Provided by Robocash.lk

6.5 million customers in Sri Lanka lack full access to finance due to the impact of the pandemic and increased consumption. International fintech holding Robocash Group has entered the consumer lending market in Sri Lanka with its new online lending service Robocash.lk, providing instant financial access.

TransUnion Invests in Monevo To Serve the Personal Credit Market

- 3 years 7 months ago

- APIs, Lending, Investment

TransUnion, a global insights and information company, today announced its investment in UK-based fintech Monevo – a personal credit platform and API empowering lenders to deliver highly personalised credit offers to consumers via comparison websites and other third parties.

Raiffeisen Digital Bank, brand of Raiffeisen Centrobank AG, launches a new app in six months with Mambu

- 3 years 7 months ago

- Lending, Personal Finance, Banking

Raiffeisen Digital Bank, a brand of Raiffeisen Centrobank AG, has announced that their new personal lending mobile app has gone live on Mambu.

Two FICO Leaders Win at Women in Credit Awards 2021

- 3 years 7 months ago

- Lending, Data, People Moves

Michelle Beetar wins in the Team Leader – Non-Creditor category, Cecilia Fernandez de Cordoba takes Silver in Transformation of the Year Two leaders at global analytics leader FICO have been honored for outstanding efforts in the Women in Credit Awards 2021, sponsored by Credit Strategy. The winners were announced in a black-tie ceremony on 30 September in London.

Saudi Arabia Tourism Development Fund Launches Digital Lending Service with Temenos in Just 60 Days

New digital service streamlines access to financing solutions from TDF to advance tourism projects in Saudi Arabia Temenos cloud banking platform enabled rapid development and time-to-market Powered by Temenos and implemented by NdcTech, the service offers digital customer onboarding and loan origination, providing a fast, frictionless customer experience

Bitfrost acquires Leading EU Crypto OTC Service OKONTO

- 3 years 8 months ago

- Lending, Derivatives and OTC Derivatives, Cryptocurrencies

The move aims to strengthen Bitfrost’s position as a gateway bridge between the worlds of fiat and digital money for financial institutions

Sovcombank Among the Top 3 Banks in Terms of the Number of Individuals Consenting to Apply for Bank Loans Through Public Services Portal

- 3 years 8 months ago

- Lending, Banking, Tax Authorities

Since the beginning of the year, more than 170 thousand individuals have submitted applications through the Digital Profile service on the Public Services Portal for consumer loans and for Halva instalment cards through Sovcombank. Today, the Bank receives nearly a quarter of its online loan applications through the Digital Profile service on the Public Services Portal, and that number is constantly growing.

UK Property Finance Completes £2.25m Bridging Loan

- 3 years 8 months ago

- Lending, Tax Authorities

One of the UK’s leading property finance specialists has announced the successful completion of an ambitious £2.25 million bridging loan. The team at UK Property Finance worked with Hope Capital to arrange the bridging loan which needed to be arranged as quickly as possible to meet pressing deadlines.

Saracens Foundation and Shawbrook Bank to Inspire the Next Generation of Female Leaders Through Sport

Partners launch Empower Her project for young women playing grassroots and professional sport.

MarketFinance in Pole Position as it Raises £280M and is Approved for Recovery Loan Scheme Lending

- 3 years 8 months ago

- Fundraising News, Lending

Fundraise: £280 million debt and equity raise at MarketFinance signals positive endorsement by investors for businesses as UK growth forecasts are revised up COVID support: MarketFinance accredited by British Business Bank as a lender under Recovery Loan Scheme (RLS) New product: MarketFinance launches Flex Loans, an unsecured flexible facility to help SMEs solve their day to day cash flow problems

Yabx Expands its Operations and Service Offerings as Digital Lending Gains Momentum in Africa Region

- 3 years 8 months ago

- Lending

Appoints Telecom Industry Expert Eunice R. Gatama as Director for Africa Business - Aims for continued growth as digital lending services are projected to grow rapidly in Africa

Finastra Introduces Total Lending Home to Deliver Access to Its lending Solutions Via a Single Entry Point

- 3 years 8 months ago

- Lending, Transaction Banking, Cloud

New interface eases the transition from on-prem to cloud-based applications by serving as a single access point for the Total Lending product suite

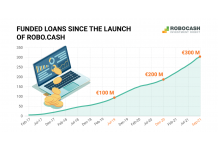

Robo.cash Exceeded 300 M Euro of Funded Loans

- 3 years 8 months ago

- Lending, P2P Lending

In September, European investment platform Robo.cash reached 300 M euro in total funded loans. The month was also recorded by another achievement - the number of investors crossed the mark of 19 thousand.