iwoca SME Expert Index: Small Businesses Invest in Growth as Demand for Larger Loans Rises

- 3 years 3 months ago

- Lending

Growth continues to be the top reason for SMEs accessing finance, with even more brokers (43%) citing this as the most common SME loan purpose. Q4 sees a shift in the amount of money wanted by SMEs, with loans over £100,000 becoming most popular, compared to loans under £25,000 which took the top spot in Q3. Demand for the Recovery Loan Scheme remains stable following the extension of the programme’s application deadline.

The Association of National Numbering Agencies Celebrates 30 Year Landmark Anniversary

- 3 years 3 months ago

- Lending, Data, Infrastructure

Celebrating 30 Years working with National Numbering Agencies to provide a global, common language of financial instruments processing

Making AI Attainable For All Michigan Credit Unions

- 3 years 3 months ago

- Artificial Intelligence, Lending

Michigan Credit Union League and Scienaptic collaborate in new AI venture for Michigan credit unions Leading global AI-powered credit decision platform provider, Scienaptic AI announced an AI collaboration with the Michigan Credit Union League (MCUL). This alliance will enable the company to offer its AI-powered credit underwriting technology to credit unions throughout Michigan.

BlackLine Acquires FourQ, Redefining Intercompany Financial Management

- 3 years 3 months ago

- Lending, Management

Acquisition strengthens BlackLine's intercompany accounting solutions, adding advanced tax and statutory reporting compliance capabilities to its financial operations management platform

Changing the Landscape of African Small Business Lending with Uplinq

Transformational small business credit assessment platform and data provider, Uplinq Financial Technologies (Uplinq), has announced a new partnership with African technology and business solutions company, Nosmay, as part of its plans to help credit-lenders better serve the continent’s significant unbanked population.

Texas Bay Credit Union Collaborates With Scienaptic To Leverage Its AI-Powered Platform For Enhanced Credit Decisioning

- 3 years 3 months ago

- Artificial Intelligence, Lending, Credit Cards

Leading global AI-powered credit decision platform provider, Scienaptic AI announced today that Texas Bay Credit Union has chosen its credit decisioning platform. The collaboration will help the credit union to make stronger loan decisions and enhance member experience.

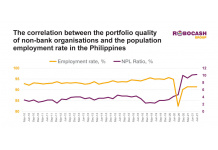

Increase in Wellbeing of Filipinos Has a Positive Effect on Alternative Lending

- 3 years 3 months ago

- Lending, Alternative Finance

The research by Robocash Group reveals that improvements in the employment rate and the final household consumption volume of the Filipino population will positively affect alternative lending in 2022.

Babel Finance Announces New Partnership With Chainalysis Leading to Innovations in Crypto Lending and Financing

- 3 years 4 months ago

- Lending, Cryptocurrencies

Babel Finance's financial services announced in December 2021 its partnership with Chainalysis. This will offer our institutional investors and high-net-worth individuals worldwide top in class risk controls and management to its crypto financial services, including crypto lending and crypto financing.

Altura Credit Union Taps Scienaptic's AI-Powered Credit Decisioning Platform

- 3 years 4 months ago

- Lending, Open Banking, Banking

Leading global AI-powered credit decision platform provider, Scienaptic AI announced today that Altura Credit Union has collaborated with its platform for enhanced credit decisioning.

5 Lending Predictions for 2022

From Doug Craddock Senior Principal Consultant in FICO Advisors Lifecycle practice “In an environment where everything is changing — the way we work, travel, meet and shop — the world of credit is adapting quickly. The pandemic isn’t the sole cause of this, as fintechs have been upending traditional banking models for years. Here’s what we at FICO see for next year. The Focus Will Change from Digital Transformation to Digital Engagement

SmartFi Becomes the Official Cryptocurrency Platform of Monster Energy AMA Supercross

- 3 years 4 months ago

- Lending, Cryptocurrencies

Millions of Supercross Fans world-wide will benefit from SmartFi’s, sponsorship deal leveraging similarities in demographics between cryptocurrency and Supercross. SmartFi, the open lending cryptocurrency platform, which launched in July 2021 and successfully completed a token launch of the SmartFi token (SMTF), has become the first ever official cryptocurrency platform of Monster Energy AMA Supercross.

Fintech Partnership Between FNWB and Splash Financial

- 3 years 4 months ago

- Lending

First Northwest Bancorp (FNWB) announced a new fintech partnership with Splash Financial, a leading digital lending platform that helps borrowers easily shop and compare financial products. Through its subsidiary, First Fed Bank, FNWB will work collaboratively with Splash to develop and deploy consumer loan products and solutions throughout the country.

Class Act Federal Credit Union To Deploy Scienaptic's AI-Powered Credit Decisioning Platform

- 3 years 4 months ago

- Artificial Intelligence, Lending

Leading global AI-powered credit decision platform provider, Scienaptic AI announced that Class Act Federal Credit Union has selected its AI-powered platform. The implementation will equip the credit union with enhanced underwriting capabilities to make stronger, faster credit decisions and strengthen financial options for its members.

Biz2Credit Small Business Lending Index™ for December Finds Loan Approval Rates Continue to Rise, But at Slow Pace

- 3 years 4 months ago

- Lending, Credit Cards

Approval Percentages at Big Banks, Small Banks, Institutional Lenders, Alternative Lenders and Credit Union Still Are Roughly Half of What They Were in December 2019