Tonik Furthers its Credit Inclusion Leadership in the Philippines by Unveiling New Revolutionary All-digital Loans

- 2 years 7 months ago

- Lending

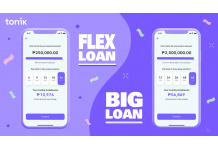

Tonik, the Philippines’ first neobank, continues to accelerate financial and credit inclusion with the launch of its two new lending products, Flex Loan and Big Loan. Building on the success of its all-digital savings portfolio and the successful launch of its first lending product, Quick Loan, the new products are set to position Tonik as among the pioneering digital lenders in the country with loans catering to every need.

SME Lending Startup ftcash Gets NBFC Licence from RBI; Aims to Disburse INR 100 Crore in FY23

- 2 years 7 months ago

- Lending

SME lending startup, ftcash has received a licence from the Reserve Bank of India to set up a non-banking financial company. With this, the company aims to disburse loans worth INR 100 crore in FY23.

DTOne’s Lending Arm, Ezra, Announces Erwan Gelebart as CEO

- 2 years 7 months ago

- Lending

Ezra, the fintech company that partners with financial service providers to offer credit solutions to financially underserved consumers and SMEs, has appointed Erwan Gelebart as its new CEO to drive its agenda for growth. Built upon 12 years of success, Ezra was born from TransferTo Group along with leading Fintech companies including DTOne and Thunes. Gelebart now leads a 100-strong team which operates across three offices in Dubai, Nairobi and... more

Yabx Enters Nigeria to Democratise Credit Across the Country

- 2 years 7 months ago

- Lending

Yabx, a FinTech venture headquartered in the Netherlands, today announced its foray into Nigerian markets with a mission to democratize credit across the country with its digital lending offerings.

Leading UK LendTech DivideBuy Partners with Salesforce to Offer Instant Onboarding for Merchants

- 2 years 7 months ago

- Lending

DivideBuy, the leading UK Point of Sale (POS) finance pioneer, has today announced a partnership with

New Zealand Based Ranqx Shortlisted Finalist in MyVentureTech Showcase

- 2 years 7 months ago

- Lending

Ranqx, the leading provider of fully digital lending solutions for small-to-medium-sized businesses (SMB), has become the first non-North American candidate to be shortlisted in the final of the prestigious MyVentureTech Fintech Showcase. A proud New Zealand-based company, Ranqx is making a significant impression on the SMB lending market in the US since its launch there in August 2022.

Freedom Finance Partners with Experian to Add New Brands to the UK’s Widest Panel of Unsecured Lenders

- 2 years 7 months ago

- Lending

Freedom Finance, one of the UK’s leading digital marketplaces for consumer credit, is delighted to announce that it has integrated its platform with Experian’s Marketplace lender panel. The partnership gives customers immediate access to seven new brands, complementing its existing direct connections to lenders and paves the way for even further expansion for loans and credit cards.

Swedbank to Offer Sustainable Loans to Farmers in New Partnership with eAgronom

- 2 years 7 months ago

- Lending

As the financiers of two-thirds of the European economy, banks bear an important responsibility to propose real solutions to mitigate climate change.

iwoca SME Expert Index: Cash Flow Becomes Top Priority for Small Businesses as Economic Storm Brews

- 2 years 7 months ago

- Lending

With inflation hovering at a 40-year high, managing day-to-day cash flow has become the primary reason for small business applications for finance, according to iwoca’s latest SME Expert Index.

Oklahoma-Based Community Bank Partners with Fintech to Streamline Lending Processes

- 2 years 7 months ago

- Lending

First Pryority Bank, a member FDIC bank, and Teslar Software today announced their partnership to expedite and streamline processes across the bank’s loan department.

Sambla Group Partners with Tink to Strengthen Lending Verification Process

- 2 years 7 months ago

- Lending

Tink, Europe’s leading open banking platform, has partnered with Sambla Group - a leading loan broker in the Nordics - to offer the lenders in its network access to more accurate affordability assessments.

Australian FinTech Spenda Offers Cash Flow Relief to Businesses as Banks Tighten the Grip on Lending

- 2 years 7 months ago

- Lending

Banks remain the biggest business lenders, issuing over 90 per cent of Small to Medium Enterprise (‘SME’) loans in the past year, however, recent banking decisions have forced businesses to look for funding options away from traditional bank lenders. Many are now exploring the FinTech sector to improve their cash flow and fund business growth.

Kapitus Selects Mambu to Deliver Modern Lending Solutions for SMBs

- 2 years 7 months ago

- Lending

Today at the Money20/20 conference, Kapitus, a leading provider of financing to small and medium-sized businesses (SMBs), announced it has selected

Listed DeFi Company AQRU Launches Crypto Lending Service BlockLender

- 2 years 7 months ago

- Lending

AQRU plc, an incubator specialising in opportunities in decentralised finance (“DeFi”), is pleased to announce that it is launching a start-up offering cryptocurrency-collateralised lending services under the brand “BlockLender”. BlockLender will offer digital asset-holders the opportunity to use their cryptocurrency as collateral to access instant loans, with a minimum starting value of USD$100.

AAZZUR and Channel Capital Join Forces for Embedded Lending Partnership

- 2 years 7 months ago

- Lending

Embedded finance integrator AAZZUR and alternative asset manager Channel Capital (Channel) have formed an embedded lending partnership.