UK LendTech Leader DivideBuy Reports Encouraging Sales at Black Friday 2022

- 2 years 11 months ago

- Lending

DivideBuy, the leading UK Point of Sale (POS) finance pioneer, has today revealed continued sales success for Black Friday 2022 following a strong 2021, with an increase in gross sales and a 12.8% increase in gross merchant value from previous years.

Freedom Finance Launches Improved Auto Finance Service Strengthening Embedded Lending and Consumer Marketplace

- 2 years 11 months ago

- Lending

Freedom Finance, the award winning embedded lending and digital lending marketplace, is delighted to announce that it has launched an improved auto finance service to provide greater choice for customers. Customers will enter a bespoke vehicle finance journey that allows Freedom Finance to better identify their needs and provide customers with more accurate auto finance options that suit their personal circumstances.

Biz2Credit Small Business Lending Index™ Reports Loan Approval Percentages Dropped at Banks and Credit Unions in November

- 2 years 11 months ago

- Lending

Small business loan approval percentages at

finova Payment and Mortgage Services Adds StrideUp to Lender Panel

- 2 years 11 months ago

- Lending

finova Payment and Mortgage Services today announces its partnership with home finance provider, StrideUp, extending the range of lending products available to finova’s directly authorised (DA) broker club.

Rapid Finance Announces Availability of API Service to Support State-Level Business Lending Disclosure Requirements

- 2 years 11 months ago

- Lending

Rapid Finance, a market leader in helping small businesses find sustainable and customized financing solutions through a fast and simple application process, announced the availability of its new standalone Software as a Service (SaaS) Regtech module, SMB Disclosure Service, to enable business lenders and financing companies to quickly and easily produce compliant disclosure statements at a state-by-state level.

Disclosure Direct for Salesforce Helps Lenders Comply with New Commercial Lending Regulations

- 2 years 12 months ago

- Lending

Northteq, Inc., a leading provider of Salesforce loan origination solutions, announced that its new commercial lending disclosure application, Disclosure Direct for Salesforce, is now available for commercial and equipment finance lenders.

Indirect Lending Expected to be a Top Trend for Community Banks to Watch in 2023

- 2 years 12 months ago

- Lending

Teslar Software, provider of lending process automation tools for community financial institutions, today shared commentary on what most significantly impacted the lending landscape in 2022 as well as the primary trends for community institutions to watch for in 2023. More community banks will embrace indirect lending to diversify portfolios and keep business local.

Jocata Announces Pan-India Launch of AI/ML based Score ‘SME DNA’ to Power Banks and NBFCs to Scale Priority Sector Lending

- 3 years 11 hours ago

- Lending

On the occasion of International Day of Banks, celebrated globally by the banking fraternity on December 4, B2B lending and compliance fintech Jocata announced pan-India rollout of SME DNA score, a proprietary AI/ML based risk and business intelligence score – after having successfully beta tested the model on the GSTN filings of over 20,000 MSMEs with two of the top Indian private lenders and one of the largest development banks in the country.

Ashman to Launch SME Loan Origination Offering on Mambu

- 3 years 5 days ago

- Lending

Ashman, the ambitious new entrant bank serving small and medium enterprises (SMEs) in the commercial real estate sector, has successfully gone live on Mambu. Ashman is currently leveraging Mambu’s cloud banking platform to manage its loan offering to build speedy, personalised service for conscientious property businesses and entrepreneurs in the UK.

Responsible Lender Creditspring Expands Senior Leadership Team with Major Operations Hires as Cost of Living Crisis Drives 2.6M to Seek Affordable Credit in Just One Month

- 3 years 6 days ago

- Lending

Creditspring, the responsible lender, has expanded its senior leadership team with a new Vice President of Operations, Head of Credit Operations and Head of Data as the UK becomes increasingly reliant on credit due to the cost of living crisis.

Black Friday Debt Warning with Almost 8M Brits Wrongly Thinking You Can’t Get into Debt Using BNPL Services

- 3 years 1 week ago

- Lending

Nearly 8m Brits wrongly believe you can’t get into debt using ‘Buy Now Pay Later’ (BNPL) services*, prompting fears that shoppers are at increased risk of financial difficulty this Black Friday and in the run-up to Christmas.

Yubi and axio Tie-up to Deepen Co-lending in India and Enhance Financial Inclusion for Underserved Sectors

- 3 years 1 week ago

- Lending

Yubi (formerly CredAvenue), the world’s first possibility platform that powers the discovery, execution and fulfilment of credit, and axio (formerly Capital Float), India's leading digital consumer finance company offering pay later, credit and personal finance management announced a strategic partnership, through which axio will leverage Yubi’s co-lending platform to continue expanding its retail credit business.

Lending Revolution Predicted as Industry Adopts Secure Yet Frictionless Experience

- 3 years 2 weeks ago

- Lending

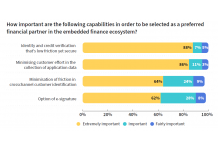

Embedded lending – the integration of lending into non-financial ecosystems – presents a major growth opportunity for lenders. As consumers embrace the uber-convenience of accessing the funding they need when and where they need it, 45% of loans could be taken out in a non-financial context within just five years.

1.7 Million Brits Forced to Borrow from High-cost Lenders to Pay Off Existing Loans Prompting Fears of UK Debt Crisis

- 3 years 2 weeks ago

- Lending

1.7 million people across the UK are borrowing from high-cost lenders in order to pay off existing debts*, according to research from a responsible lender, Creditspring. A quarter of people (24%) who borrowed from high-cost lenders sought credit so they could repay other debts – prompting fears that millions of people in the UK are at high risk of falling into a debt spiral as interest and debt repayments pile up.

Corporate Lending App, VeriLoan, Now Available on Finastra’s FusionFabric.cloud

- 3 years 2 weeks ago

- Lending

Finastra today announced the availability of VeriPark’s VeriLoan cloud-based solution on its FusionFabric.cloud open development platform. Pre-integration with Finastra’s Fusion Loan IQ lending software provides out‑of‑the-box integration between loan origination and servicing functions – joining up the corporate lending process for customers, from the moment they apply for funding, right through to servicing the loan.