AXA Forms Strategic Partnership with Ant Bank and...

- 09.04.2025 09:55 am

Appian Launches Connected Underwriting for Life...

- 26.10.2023 10:30 am

Ecommpay Announces US Local Acquiring with Insurance...

- 15.08.2023 09:00 am

The Future is Now: Digital and Intelligent Upgrade...

- 18.07.2023 09:35 am

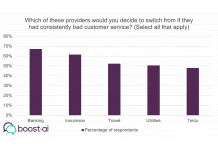

New Research: Insurance and Banking Most at Risk of...

- 04.05.2023 10:20 am

Reuters Events Exclusive Report: Insuring Tomorrow –...

- 29.03.2023 09:20 am

Five Priorities for Optimum Insurance Product Strategy...

- 30.01.2023 09:30 am

The Ardonagh Group Selects AutoRek to Drive Efficiency

- 08.12.2022 11:30 am

Risky Business: Insurers Neglect Payments at Their...

- 26.10.2022 10:35 am

Stubben Edge Group acquires Bonhill Group’s Business...

- 26.08.2022 10:30 am

iDenfy Announces its New Cyber Insurance by Landing a...

- 26.07.2022 11:55 am

“Fintech will Drive Customer Centricity for the Rest...

- 09.06.2022 11:30 am