Appian Launches Connected Underwriting for Life Insurance in Partnership with Swiss Re

- 5 months 3 weeks ago

- Insurance

Appian today announced the availability of the Connected Underwriting Life Workbench to help insurers unify workflows and data in an automated, end-to-end process. The solution makes underwriters’ lives easier by giving them a single interface to evaluate and classify risk, handle exceptions, and make case decisions.

Ecommpay Announces US Local Acquiring with Insurance from Chargebacks, The Move Enhances US Access for its UK and EU Merchants

- 8 months 1 week ago

- Insurance

Ecommpay, a leading international payment service provider and UK and European direct bank card acquirer, now offers local acquiring in the US, enabling UK and EU merchants the ability to expand into North America. Additionally, Ecommpay will offer protection from fraud-related chargebacks to ensure merchants do not lose valuable time and money when those chargebacks occur.

The Future is Now: Digital and Intelligent Upgrade Drives Insurance New Growth

- 9 months 5 days ago

- Insurance

The COVID-19 pandemic has accelerated innovation and forced insurers to attract market share through digital solutions that drive efficient distribution and create an excellent customer experience. The future for insurers has to be to finally make the shift from push selling to engaging with their customers based on understanding their needs, creating customer learning and new experiences. And a big portion of these interactions along customer... more

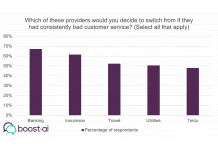

New Research: Insurance and Banking Most at Risk of Losing Customers to Bad Customer Service

Chatbots are the future of customer service

Reuters Events Exclusive Report: Insuring Tomorrow – CEO Insights on Future-Proofing Insurance

- 1 year 3 weeks ago

- Insurance

Insurance is evolving at record pace, and carriers are faced with the challenge of keeping up with changing times. As Mary Boyd, President & CEO of Plymouth Rock Assurance Corporation puts it, “Insurance risk doesn’t disappear, it simply changes form – and over the next decade, we all need to ready our businesses for material change”. The need for future-proofing insurance has become more critical than ever, and carriers must adapt their... more

Five Priorities for Optimum Insurance Product Strategy & Profitable Growth

- 1 year 2 months ago

- Insurance

Cheaper, quicker, better the demands of an increasingly price-sensitive customer base are growing every year. Insurance products must be affordable, easy to purchase and offer value beyond simple protection if they are to attract the modern customer, but how can carriers achieve this whilst maintaining profitability? To answer this question, Reuters Events put together a quick 10-minute read on what's hot in product design and the implications... more

The Ardonagh Group Selects AutoRek to Drive Efficiency

- 1 year 4 months ago

- Insurance

AutoRek, a leading software provider to global financial services firms, is excited to have The Ardonagh Group join as their latest client.

Risky Business: Insurers Neglect Payments at Their Peril

- 1 year 5 months ago

- Insurance

Rising customer expectation and pressure from insurtechs is driving a fresh wave of competition within the insurance sector, with incumbent firms rushing to revamp legacy products and processes.

Stubben Edge Group acquires Bonhill Group’s Business Solutions & Governance Division

- 1 year 7 months ago

- Insurance

Stubben Edge Group is pleased to announce the acquisition of Bonhill Groups Business Solutions & Governance (BSG) Division. The BSG Division holds several brands which will be key to Stubben Edge’s further growth and expanded capabilities for customers, brokers, and Independent Financial Advisers (IFAs).

iDenfy Announces its New Cyber Insurance by Landing a Massive Contract with Lloyds

- 1 year 8 months ago

- Insurance

iDenfy, the Lithuanian-based global identity verification and fraud prevention platform, announced a new collaboration with Lloyd’s, the leading insurance and reinsurance marketplace. iDenfy selected the Technology Errors and Omissions Coverage insurance as well as the Cyber protection package to meet the highest security standards.

“Fintech will Drive Customer Centricity for the Rest of 2022” – Reassured

- 1 year 10 months ago

- Insurance

As the cost of living crisis continues to bite over the second half of 2022, fuelled by an inflation rate expected to hit 10% this year according to the Bank of England, consumers need greater flexibility, efficiency and advice on where best to put their money.

The Islamic Corporation for the Insurance of Investment and Export Credit (ICIEC) and Tabarak Investment Capital Agree to the Insurance Cover for Shariah Goods

- 1 year 10 months ago

- Insurance

The Islamic Corporation for the Insurance of Investment and Export Credit (ICIEC) and UAE-headquartered Tabarak Investment Capital has signed an insurance policy that will provide greater insurance cover for the export and import of Shariah-compliant goods and services.

Reply Extends its Presence in Banks and Insurance in Germany with the Acquisition of FINCON

REPLY [EXM, STAR: REY] announces today that has signed an agreement to acquire 100% of FINCON Unternehmensberatung GmbH (www.fincon.eu) - a German consulting company leader in digital transformation projects for the banking and the insurance industry.

Ebury to Meet Insurance Industry at BIBA 2022

- 1 year 11 months ago

- Insurance

Ebury, the Santander-backed fintech and global provider of mass payment and FX risk management solutions, is delighted to announce that it is exhibiting at BIBA 2022. Those attending the event will be able to meet Ebury’s experts in international payments and cross-border risk management, as well as members of its award-winning Mass Payments team.

Bolero and HMM Join Forces to Accelerate eBL Growth in Asia

- 1 year 11 months ago

- Insurance

Bolero International, the leading provider of cloud-based trade finance digitisation solutions, and HMM Co., LTD (HMM), South Korea's national flagship carrier and one of the world's leading container shipping companies, announce their collaboration in the adoption of the electronic bill of lading. The two industry leaders will work together to improve the visibility, transparency, and efficiency of trade transactions by using Bolero's... more