Leading Fund Administrator, Alter Domus Goes Live on...

- 18.04.2024 09:45 am

Digital Asset Hedge Fund AltTab Capital Opens London...

- 19.05.2023 10:50 am

Choco Up and Know Your Customer Announce Partnership...

- 10.05.2023 08:20 am

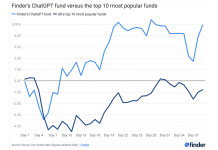

An Investment Fund Created by ChatGPT is Smashing the...

- 02.05.2023 10:10 am

Northern Trust Enhances Digital Workflow Experience...

- 30.03.2023 10:20 am

GoLogiq to Acquire Boutique Investment Manager, Bateau...

- 29.03.2023 06:15 am

Jon Lukomnik – ‘Pioneer’ of Modern Corporate...

- 20.03.2023 11:05 am

FINBOURNE and Tumelo Partner to Help Fund Managers...

- 20.02.2023 10:45 am

FCA ‘Greenwashing’ Consultation: Tumelo Calls for...

- 26.01.2023 12:20 pm

Hedge Fund Attitudes Shift on Front Office Tech Stack...

- 24.01.2023 08:20 am

Apex Group Enhances Technology Offering with PFS-PAXUS...

- 11.01.2023 09:55 am

Virtual Cards and Updated Spending Insights Join...

- 08.12.2022 08:50 am