Leading Fund Administrator, Alter Domus Goes Live on Temenos Multifonds Platform to Manage Growth in Alternative Funds

- 1 year 1 month ago

- Fund Management

Temenos today announced that Alter Domus, a leading provider of tech-enabled fund administration, private debt, and corporate services for the alternative investment industry, has gone live on Temenos’ automated fund management platform, implementing the solution in under six months.

Digital Asset Hedge Fund AltTab Capital Opens London Office To Expand International Footprint

- 2 years 3 weeks ago

- Fund Management

AltTab Capital, the cryptocurrency and digital assets hedge fund company, announces the launch of an office in London, UK, which will allow it to expand its network of international Professional Investors and other partners. AltTab Capital was founded as an investment company in North America in 2021 and the fund has timed this launch to take advantage of thawing conditions in the digital asset markets to establish a presence in Europe.

Choco Up and Know Your Customer Announce Partnership to Accelerate Access to Capital Financing

- 2 years 1 month ago

- Fund Management

Choco Up, a global technology and financial services provider offering revenue-based financing and growth solutions, and RegTech company Know Your Customer have announced a partnership to streamline client verification and accelerate access to capital financing for e-commerce businesses worldwide.

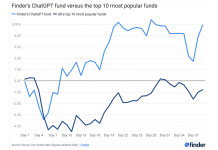

An Investment Fund Created by ChatGPT is Smashing the UK’s Top 10 Most Popular Funds

- 2 years 1 month ago

- Fund Management

A fund consisting of 38 stocks chosen by ChatGPT has risen 4.9% in the 8 weeks since it was created on 6th March 2023 by the personal finance comparison site, finder.com.

Northern Trust Enhances Digital Workflow Experience for Private Capital Fund Managers

- 2 years 2 months ago

- Fund Management

Northern Trust is enhancing the net asset value (NAV) workflow communications between private capital fund managers and Northern Trust through a collaboration with Appian, a leading provider of low-code process automation solutions. The solution is aimed at supporting private capital fund managers with a secure digital experience offering enhanced efficiency, oversight and data security across the NAV production lifecycle.

GoLogiq to Acquire Boutique Investment Manager, Bateau Asset Management, Providing Entry to Southeast Asian Fund Management Market

- 2 years 2 months ago

- Fund Management

GoLogiq, Inc., a U.S.-based global provider of fintech and consumer data analytics, has entered into a non-binding letter of intent to acquire a controlling interest in Australia-based Bateau Asset Management, a boutique global investment manager.

Jon Lukomnik – ‘Pioneer’ of Modern Corporate Governance – Joins Tumelo as Advisor

- 2 years 2 months ago

- Fund Management

Jon Lukomnik – one-time fiduciary for the five New York City pension funds and lauded by Forbes as one of the pioneers of modern corporate governance – is joining investor fintech Tumelo as an advisor. Jon will provide strategic guidance and support as Tumelo pursues its mission to democratise shareholder voting.

FINBOURNE and Tumelo Partner to Help Fund Managers Reflect Investors' Voting Interests

- 2 years 3 months ago

- Fund Management

FINBOURNE Technology today announces a new partnership with market-leading investor voting Fintech, Tumelo. Integrating Tumelo’s voting technology into FINBOURNE’s cloud-native investment management data management platform, LUSID, will help fund managers better understand and reflect investors’ voting interests.

FCA ‘Greenwashing’ Consultation: Tumelo Calls for Compulsory Disclosure of Fund Manager Voting Policies

- 2 years 4 months ago

- Fund Management

Investor voting fintech Tumelo is calling on investment funds to disclose to investors whether they permit them to vote the shares in their portfolios.

Hedge Fund Attitudes Shift on Front Office Tech Stack - Acuiti

- 2 years 4 months ago

- Fund Management

Systematic hedge funds are changing long-standing attitudes to how they source and develop their front-office technology stacks, a recent study by Acuiti shows. The study, Brining the case for buy-and-build to the front office, revealed a shift in attitudes among systematic hedge funds towards sourcing and developing their front-office technology stacks.

Apex Group Enhances Technology Offering with PFS-PAXUS Acquisition

- 2 years 5 months ago

- Fund Management

Apex Group Ltd. (“Apex” or “The Group”), a global financial services provider, announces today the acquisition of Pacific Fund Systems (“PFS”), a leading global fund administration software business, from co-founders and Pollen Street Capital. This acquisition follows Apex Group’s longstanding partnership with PFS through the use of PFS-PAXUS and will expand use of the technology platform to enhance the delivery of timely, accurate and... more

Virtual Cards and Updated Spending Insights Join Starling Bank’s Enhanced Suite of Money Management Tools

- 2 years 6 months ago

- Fund Management

Starling Bank is introducing virtual cards for Personal Current Account customers and updated its Spending Insights. These new features add to the bank’s money management tools, designed to help people track their spending and provide greater visibility of their budgets.

Tide Launches Business Account for Expense Management; Plans to On-board 5 Lakh SMEs by the End of 2024

- 2 years 6 months ago

- Fund Management

Tide, the UK’s leading SME-focused business financial platform announced today the launch of the Tide app in India. The business financial platform has introduced two business banking solutions – the Tide Business Account and its RuPay-powered Tide Expense Card. Tide aims to onboard half a million SMEs in India over the next 24 months.

TripActions’ All-in-One Platform Increases Valuation to $9.2B

- 2 years 8 months ago

- Fund Management

TripActions, the all-in-one travel, corporate card, and expense management company, today announced its Series G financing at a post-money valuation of $9.2 billion. The raise, a combination of $154 million in equity from new and existing financial investors as well as a $150 million structured capital transaction led by Coatue, marks the third financing round for the company in three years.

Capchase Announces New Integration with Xero to Provide Small Businesses fast Access to Capital

- 2 years 8 months ago

- Fund Management

Capchase, a leading provider of non-dilutive financing to SaaS companies, has today announced a new integration with Xero, the global small business platform.