Alpian, Switzerland’s First Private Digital Bank, Selects Napier Continuum for Financial Crime Compliance

- 2 years 1 month ago

- Compliance

Alpian, Switzerland’s first digital private bank, and Napier, global provider of advanced financial crime compliance solutions, announce their partnership to implement a robust, end-to-end risk management platform for the bank.

Clausematch Announces Partnering with Arbuthnot Latham to Digitise the Policy and Compliance Framework

- 2 years 1 month ago

- Compliance

Clausematch, a technology company developing solutions for regulatory compliance is pleased to announce it has partnered with Arbuthnot Latham, the private and commercial bank, to enable the digital transformation of compliance. As part of the partnership, the firm is adopting Clausematch's policy management platform to automate and streamline compliance processes.

Hodge Bank Selects LexisNexis Risk Solutions for End-to-end Customer Onboarding and Ongoing Monitoring

- 2 years 2 months ago

- AML and KYC

Data and analytics firm, LexisNexis® Risk Solutions, has been selected to provide Hodge with a full end-to-end solution for customer onboarding and ongoing monitoring, incorporating AML screening, transaction monitoring and case management, all within a single platform.

°neo by Five Degrees and Fourthline Announce Collaboration to Fight Financial Crime in Digital Banking

- 2 years 2 months ago

- AML and KYC

Amsterdam-based Fourthline is one of the fastest-growing digital KYC providers and offers KYC-related services that complement the °neo lending and accounts engines. Integration will enable clients to do a quick and automated watchlist screening on existing customers against PEP and sanction lists. This will detect fraud and de-risk clients’ existing customer portfolio.

Napier Breaks Into Japanese Market Through New Partnership with Governance, Risk, and Compliance Firm, GRCS

- 2 years 2 months ago

- Compliance

Napier, the financial crime compliance specialist, has announced that its end-to-end financial crime risk management platform, Napier Continuum, is available to the Japanese market through a newly-minted partnership with Japanese firm GRCS.

European Banks are Failing to Plan for Future KYC and AML Risks, Says New Report by Ondato

- 2 years 2 months ago

- AML and KYC

European banks are spending most of their AML (Anti-Money Laundering) and KYC (Know Your Customer) budgets on manual processes that cannot scale to meet the costs and risks of increased compliance demands, according to a new report from Ondato, a technology company that streamlines AML and KYC processes.

iDenfy Partnered with SupplierPlus to Battle Fraud with AML Screening and Monitoring Services

- 2 years 2 months ago

- AML and KYC

The AI-based ID verification and fraud prevention startup, iDenfy, announced uniting with SupplierPlus, the fintech that helps simplify invoice financing between buyers, suppliers and banks. iDenfy’s AML Screening and Monitoring solution kit will automate compliance and ensure a smooth customer onboarding process for SupplierPlus.

SmartSearch Appoints New VP of Professional Services Sales

- 2 years 2 months ago

- AML and KYC

SmartSearch, the provider of the UK’s leading digital compliance solution for anti-money laundering (AML) has promoted Tom Dockerty to the position of vice president of professional services sales.

IboxPay Joins Forces with iDenfy to Ensure AML Compliance

- 2 years 2 months ago

- Compliance

iDenfy, full-stack ID verification, fraud prevention and compliance startup, partnered with IboxPay, a Poland-based fintech and cash-in payment solution provider that recently moved from Ukraine. The company integrated iDenfy’s AML solution pack to ensure compliance and prevent fraud.

Markor Technology Teams Up with Sumsub to Streamline Verification for iGaming Customers

- 2 years 2 months ago

- AML and KYC

Markor Technology has partnered with Sumsub to provide enhanced verification and fraud protection while ensuring full compliance.

The Clock is Ticking: ITRS Group Warns Firms Not to Delay in Complying with DORA, the EU’s Operational Resilience Requirements

- 2 years 2 months ago

- Compliance

The European Commission has voted to adopt the Digital Operational Resilience Act (DORA), in response to a spate of widespread system outages and cyber threats in the financial services sector, the regulation will bring all EU states into line when it comes to operational resilience.

Arion Bank and Lucinity Join Forces in the Fight Against Money Laundering

- 2 years 2 months ago

- AML and KYC

Arion Bank has announced it will implement Lucinity's technology to help strengthen its defences against money laundering and contribute to a safer financial system. Lucinity's software solution uses the latest artificial intelligence technology to detect money laundering and make it easier for financial companies to spot and resolve such issues more efficiently.

Sumsub Receives SOC 2 Type II Attestation

- 2 years 2 months ago

- AML and KYC

Sumsub, a global tech company offering customizable KYC, KYB, KYT, and AML solutions, today announced the successful completion of the System and Organisation Controls (SOC) 2 Type II audit.

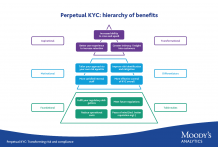

Moody’s Analytics: Forward-thinking Compliance Teams View Perpetual KYC as the Future of Compliance

- 2 years 2 months ago

- Compliance

Compliance teams see perpetual KYC (pKYC) as the future of KYC according to a report by Moody’s Analytics, “Perpetual KYC: Transforming Risk and Compliance,” released today. The report sought to uncover the key challenges faced by implementers of KYC today and understand how organizations are transforming their approach to risk and compliance.

Transferra Partners with Sumsub to Provide Straightforward Customer Onboarding

- 2 years 2 months ago

- AML and KYC

Transferra has partnered with Sumsub to create an easy, safe and secure onboarding experience for their clients.