US Jobs Collapse Australia heads toward Recession

- Clifford Bennett, Chief Economist at ACY Securities

- 06.09.2021 05:00 am trading

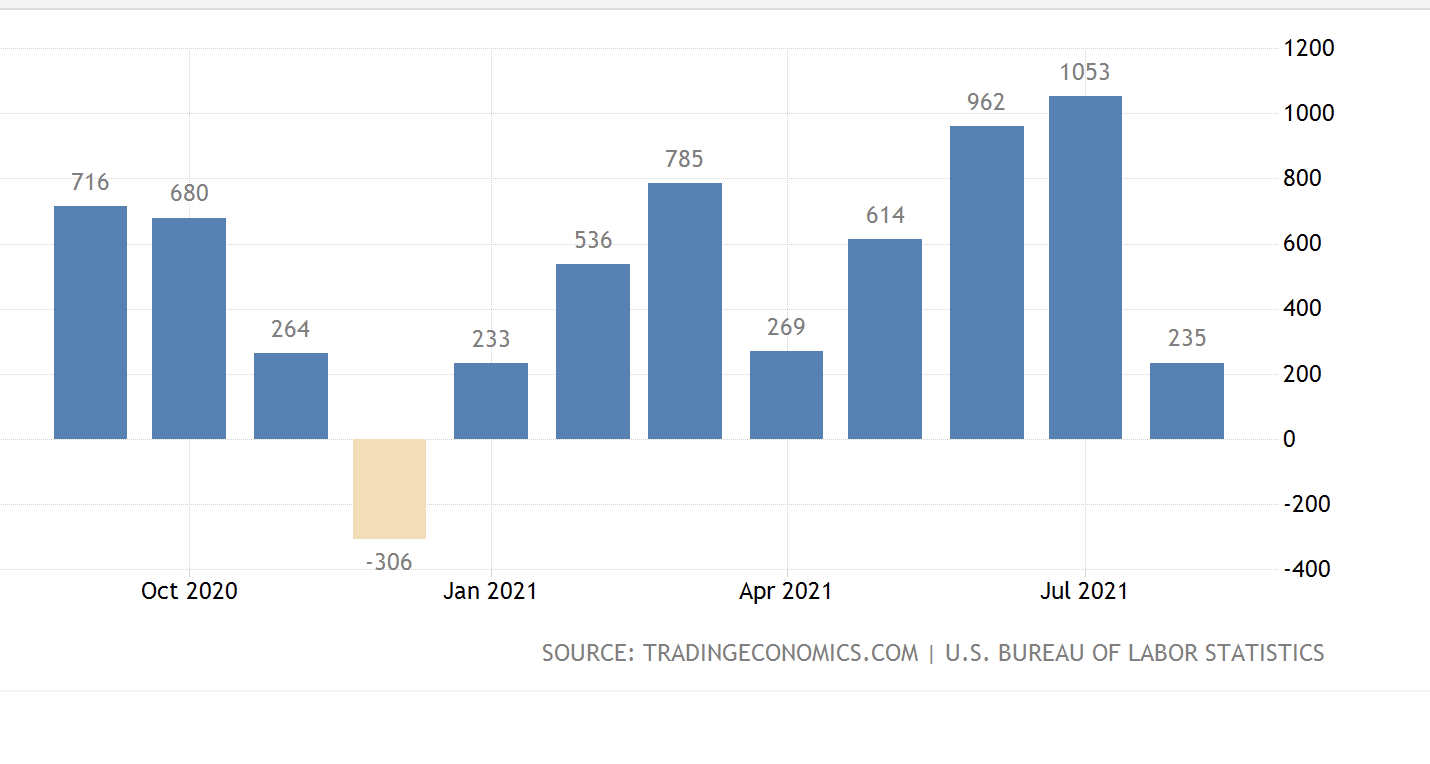

Our forecast decline of the US economy continues to materialise.

Jobs collapse.

US equities stand still, as economic pressures build.

Australia remains excited about vaccinations, while hospitalisations continue to rise across all age groups.

Our forecast of Q3 Q4 RECESSION is looking more and more likely.

Over the weekend, in Sydney, there were three children on ventilators. A baby, and two children under 14 years of age. Medical authorities said all had underlying conditions, but emphasised they were only on ventilators because of Covid.

This is important, as it highlights how high risk Delta remains.

Australia risks becoming frustrated, if vaccinations do not stop the relentless march of Delta. It is now well proven, that vaccinations have maximum effect in the first few months, and so we should see some kind of inhibition to the spread of the virus, most certainly during that period.

Whether it is a solution to the degree that would resolve the risk to the health system of becoming over-whelmed, remains to be seen. Hopefully, it works.

In the meantime, restrictions across NSW and Victoria, are likely to remain far more significant than the government suggestions of relative freedom seem to convey. The economy will remain severely pressured, and extension of lockdowns is not entirely out of the question either. The view here, remains that the euphoria over vaccinations as a way out, may well be found to have been overly optimistic. It is vital we understand the reality of the way forward, rather than simplistically believe in what of course we all want to be the case.

The Australian economy will remain under pressure and stocks are over priced. Corporate earnings are likely to moderate from their recent strong run. The Australian dollar upside was added excitement by the record trade surplus, but this was driven more by lower imports, reduced domestic activity, than by external demand exports.

The RBA will leave rates on hold this week.

Falling further behind the mammoth inflation surge continuing to come our way. A response pinned down by Delta for the foreseeable future.

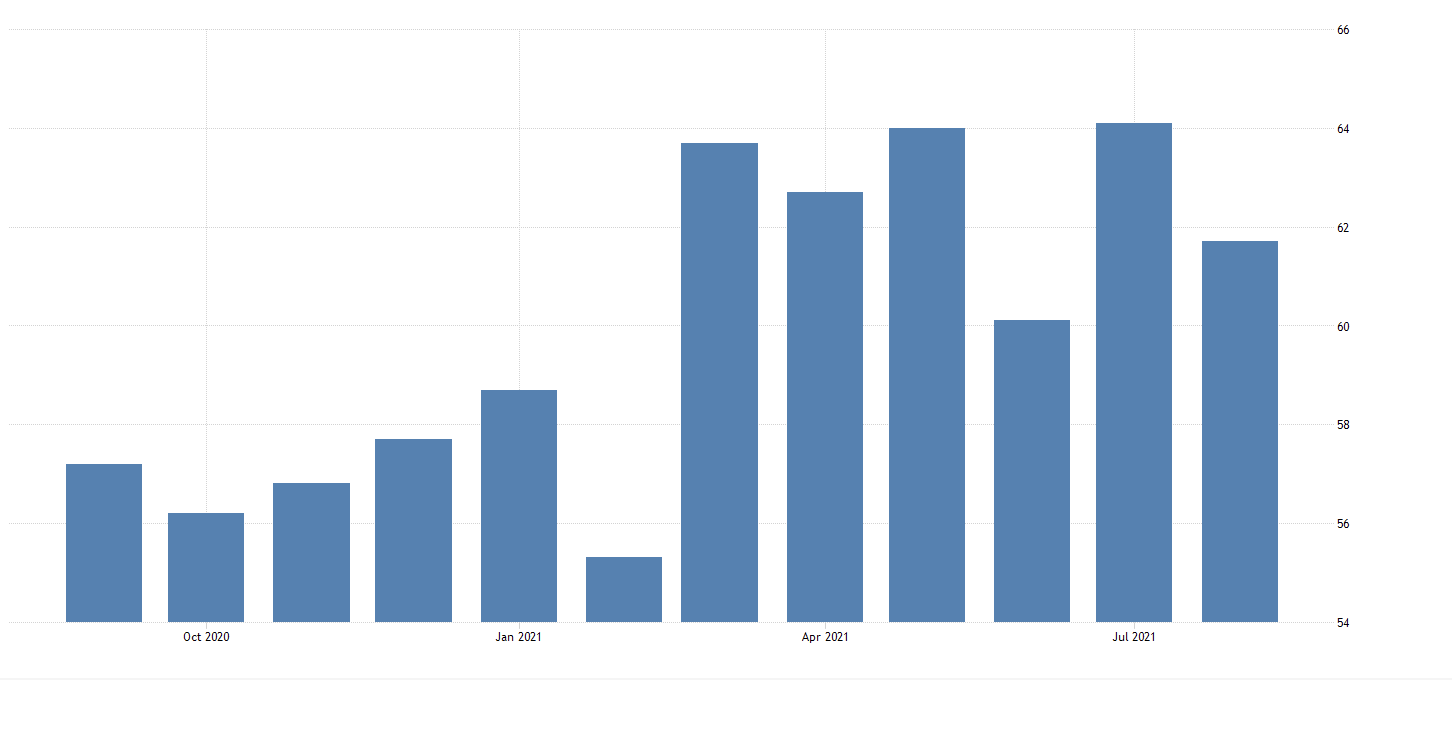

US ISM Services PMI

Three months ago, we forecast the US and the world would be struck anew by the twin tsunami of Inflation and Delta. This is exactly what is happening. US jobs data collapsed in the past month, as layoffs remain 50% higher than was the pre-covid norm. The services sector PMI has also fallen, and is clearly rolling over to the downside. The news on Delta and economic impact for the US is likely to intensify in coming months.

Still with an upward bias, though it is a struggling, marginal, if any, new high environment over the past week. The Dow Jones looks far less enthusiastic just now, while the Nasdaq more so. The SP500 needs to immediately hold above support at 4520, in order to maintain hope of further upside.

All the time, the fundamental case against prices being at these high levels continues to intensify.

The languishing Australian market looks very sick indeed.

When will the peak for Sydney cases be?

Over the weekend, Paramedics are reporting the situation at hospitals is the worst they have ever seen it. The tunnel is far longer than any of us would like to be the case, before the light.

Wise hedging of investment portfolios is, of course, advisable in such an environment.

With ever higher hospitalisations, there is certainly risk of there actually being NSW lockdown extensions in coming weeks. Additionally, still of high concern is Victoria, with potentially fresh outbreaks in Queensland and South Australia as well this week.

The tendency for the Australian stock market will remain under-performance against global markets, and even a significant fall in absolute value.