US Inflation Wild Cat

- Clifford Bennett, Chief Economist at ACY Securities

- 12.08.2021 12:15 pm trading

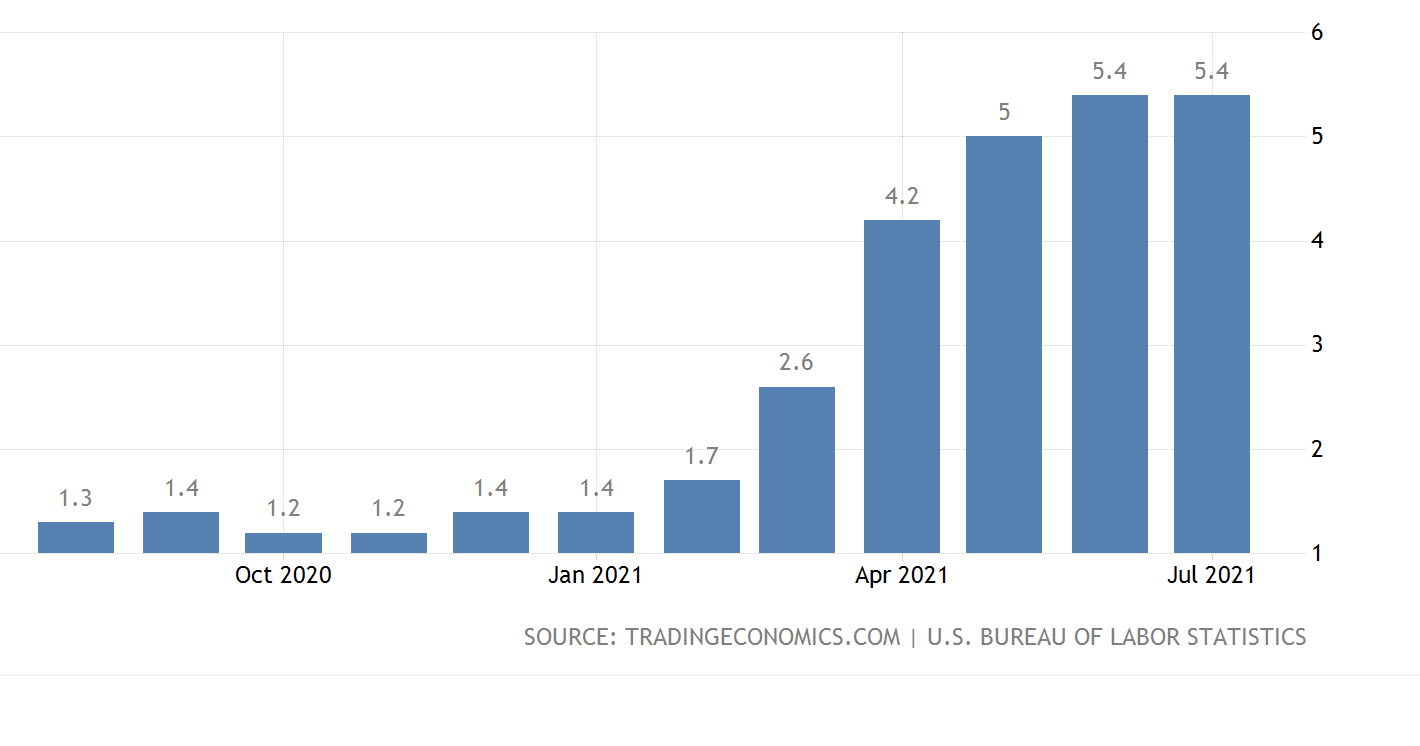

US INFLATION 5.4%

and going to stay high!

Good morning,

The idea that continuing firm upward pressure in the data represents a peak in US inflation is rather optimistic.

There is much discussion, as I am sure many of you are aware, of the coming long term impact of higher rents. While, I am bearish Oil, and this will reduce inflation to some extent, I do not see a corresponding decline in transportation costs at all. They may even continue to rise. The transport industry will make the most of their freedom of pricing for as long as they can. Just like every other industry.

Some are calling for a peak, simply because they do not understand my principle of renewed freedom of pricing pressure.

In 2009, I wrote that there would be no inflation despite quantitative easing. Every major investment bank and economist disagreed. I got it right, because I stepped back, 'looked out the window', and appreciated how the world had entered a true competitive price pressure environment.

The pandemic economic dislocation forces have not only interrupted supply chains, but have released the price-self-interest settings of businesses everywhere. Which is exactly correct for our economic system of capitalism. Except, the anomaly of a void of competitive price pressures for the next year or two is already generating sky high extremely long term damaging inflation.

Inflation, from wildcat to kitchen kitten, and now back to wildcat is what we are experiencing. The Federal Reserve and RBA are asleep at the wheel. The journey ahead will therefore be a little bumpy for both economies. More strident and longer lasting rate hike cycles, are the inescapable outcomes of central banks being behind the curve.

In Australia it is a creeping vine rally!

No need to look it up, I just created it. Was not sure whether to call it creeping vine or creepy vine, but anyway, there it is.

Getting the economics right. Getting the market wrong.

I think that is a fair assessment. Where to from here?

That inflation number in the USA was absolutely terrible. Yet, the bullish sentiment minded managed to spin in it in to 'its a peak'? Whether they are right or wrong, is not really the question. The real point is that this is extremely high inflation, and the great majority of it or more in fact, is going to continue.

The US economy is still down 6 million jobs from pre-covid employment levels. There are real problems with the US economy. Nevertheless, at around previous GDP levels and sky rocketing inflation, it is difficult to make the argument that the Fed should maintain record historic stimulus. On top of the government stimulus measures. I expect the US economy to continue to slow, and I strongly put forth that tapering should already be occurring and rates should be started on a path, upward, toward normality in the first half of 2022.

That's the economics. What of the markets?

Well at least I have highlighted why the market goes up, as it does regardless of economic fundamentals and valuations. The world is hedging Delta by buying US equities. I still see a gradual shift to gold, to achieve the same fear driven outcome with time. When does that fear buying stop? At any moment would be my best guess. My tune is not changing on the market. We simply cannot ignore the stretching from reality to these sentiment highs.

Where I could be badly wrong on the fundamentals for stocks, is that perhaps we have had a once only historic valuations range break to the upside, and valuation stretch is actually the new norm?

This requires further mulling, but respecting the price action, myself included, has never been more vital relative to the fundamentals. I say that, then, all I want to do, is sell because this market is just plain crazy!

Three charts above, daily,

DOW JONES continues gains on infrastructure,

SP500 positive, but muted further gains,

NASDAQ really could still be making a major top with further heavy action on the day.

One wonders, what further booster shots the Australian market might receive, after the left field way too much paid Afterpay purchase, and the CBA reaping of stimulus driven borrowing?

On the day, would watch 14945 in the Nasdaq and 7563 directly, for signs of trouble. While those immediate supports hold, the bulls have a winning price argument.

All the best for your day,