US Dollar, Bond Yields Advance; Oil, Gold Slide; Fed - Taper is Near

- Michael Moran , Senior Currency Strategist at ACY Securities

- 10.08.2021 07:45 am trading

Delta Variant Cases Growing; CAD, CHF, Asians Underperform

Summary: US Treasury yields and the Dollar advanced after several Fed officials said that the start of a bond-purchase taper is close. Atlanta Fed President Ralph Bostic said that he was looking at the fourth quarter to start a bond-purchase taper. Bostic and Richard Barkin, Richmond Fed President, both said that inflation had already achieved the US central bank’s 2% threshold. The US releases its July CPI report on Wednesday (11 August). The benchmark US 10-year bond yield rebounded to 1.32% (1.30%). Global bond yields were mixed. Germany’s 10-year Bund rate was flat at -0.46%.

Meantime worries continued to grow about rising Delta variant cases in the US which are averaging 100,000 a day. Gold prices tumbled over 4% in Asia yesterday before recovering to finish down 1.6% at USD 1,729.40 (USD 1,762). Brent Crude Oil prices slid to settle at USD 69.30 (USD 70.50 yesterday). Against the Canadian Loonie, the US Dollar rose 0.35% to 1.2580 (1.2550). The Euro edged lower to 1.1735 from 1.1763 while Sterling settled at 1.3850 from 1.3873. A favoured measure of the Greenback’s value against basket of 6 major currencies, the Dollar Index (USD/DXY), advanced 0.18% to 92.97 from 92.77 yesterday. USD/JPY edged up 0.19% to 110.32 from 110.22 yesterday. The Australian Dollar extended its fall, settling at 0.7332 (0.7355). New Zealand’s Dollar, the Kiwi eased 0.16% to 0.6992 (0.7010). The US Dollar extended its rally against most of the Asian and Emerging Market currencies. Against China’s Offshore Yuan, the Greenback (USD/CNH) was up 0.15% to 6.4860 from 6.4785. USD/SGD gained 0.20% to 1.3575 (1.3547).

Data released yesterday saw China’s Annual CPI up at 1.0%, higher than estimates of 0.8%. Chinese Annual PPI rose to 9.0% from a previous 8.8%, beating estimates of 8.6%. Switzerland’s July Unemployment Rate was unchanged at 3%. Germany’s July Trade Surplus rose to +EUR 13.6 billion from +EUR 12.8 billion in June, but lower than forecasts at +EUR 13.9 billion. Eurozone Sentix Investor Confidence Index slipped to 22.2 from 29.8, lower than forecasts at 29.2. US July JOLTS Job Openings climbed to 10.07 million from an upwardly revised 9.48 million, beating forecasts at 9.27 million.

- EUR/USD – The Euro dipped to 1.1735 from its 1.1763 open yesterday on the overall stronger US Dollar. Overnight low traded was 1.1732 while the recorded high was at 1.1769. Germany and the Eurozone release their ZEW Economic Sentiment Index’s later today.

- USD/CAD – soared to an overnight high at 1.2588 from 1.2548 opening yesterday, settling in late New York at 1.2580. Lower Oil and commodity prices weighed on the Canadian Loonie. Canada’s Employment report released last Friday was also a letdown for the currency.

- AUD/USD – The Aussie Battler extended its fall against the Greenback to 0.7332 from 0.7355 yesterday, down 0.25%. Lower resources and broad-based USD strength weighed on the Battler. Overnight the State of Victoria recorded 20 locally acquired Covid-19 infections. Fifteen were reportedly outside the community while infectious.

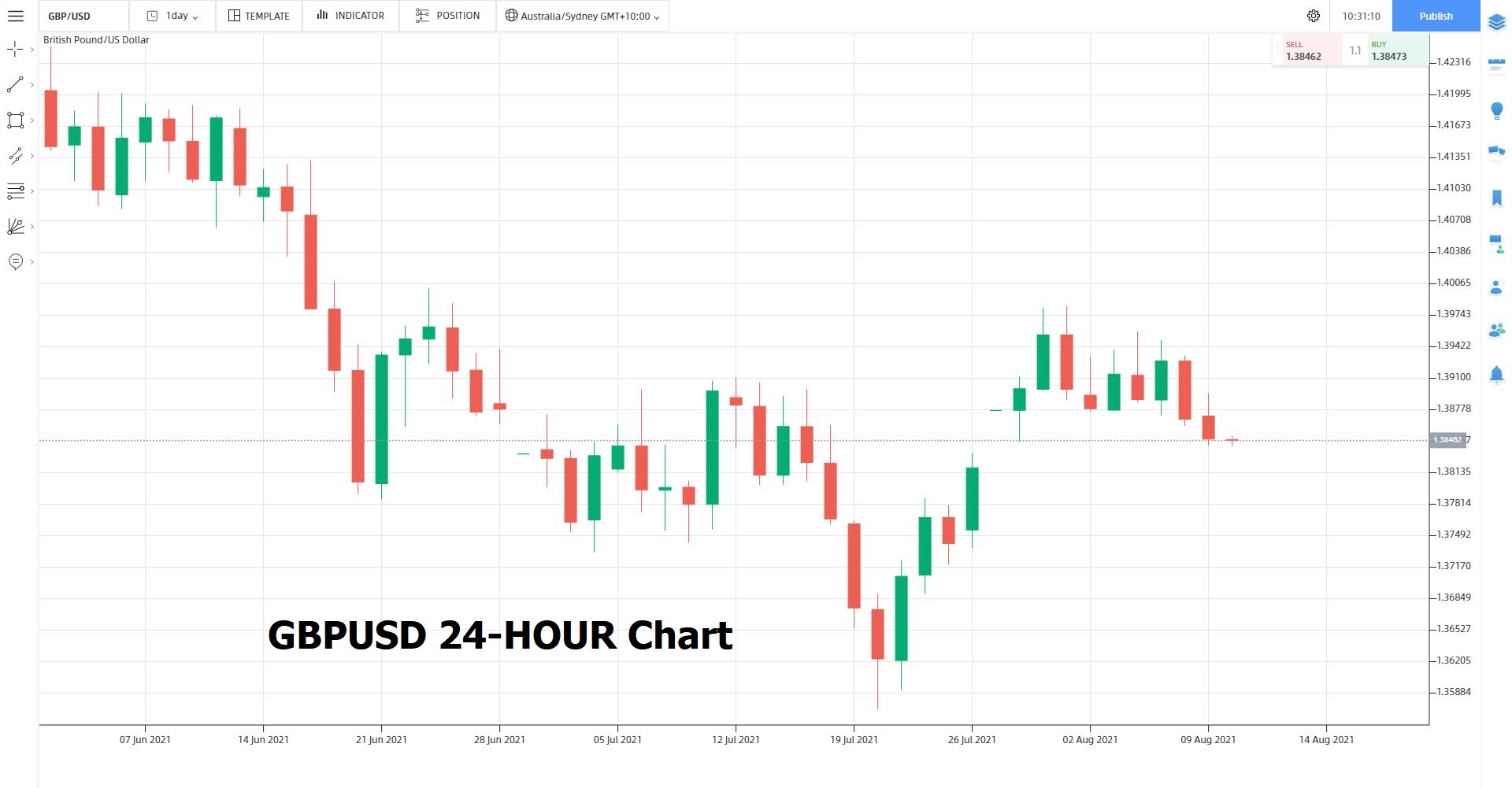

- GBP/USD – The British Pound eased further against the US Dollar to 1.3850 from 1.3873 yesterday. Overnight low traded was at 1.3841 while the high recorded trade for GBP/USD was at 1.3895. On Thursday (12 August) the UK releases a data dump starting with Q2 GDP and Industrial Production.

On the Lookout: Today is a light data day which will see markets consolidate after some choppy moves following the release of US Payrolls on Friday. The UK kicks off today’s data releases with its BRC Retail Sales Monitor report (y/y f/c 4.9% from previous 6.7%). Japan follows with its Bank Lending (y/y f/c 1.6% from 1.4%); Japanese Current Account (f/c +JPY 779.8 billion from +JPY 1,979 billion – ACY Finlogix). Australia follows with it HIA New Home Sales for July (m/m no forecasts, previous was 14.8%). Australia’s National Australia Bank’s Business Confidence Index for July follows (no forecasts, previous was 11). Japan releases its July Economy Watchers Sentiment Index (f/c 43.5 from 47.6). Europe kicks off with Eurozone ZEW Economic Sentiment Index for August (f/c 55.3 from 61.2); Germany releases its ZEW Economic Sentiment Index (f/c 56.7 from 63.3 – ACY Finlogix). The US releases its NFIB Small Business Index (f/c 101.9 from 102.5). Finally, US Q2 Preliminary Non-Farm Productivity (f/c 3.5% from 5.4%) and US Preliminary Unit Labour Costs (f/c 1.1% from 1.7% - ACY Finlogix) round up today’s data releases.

Trading Perspective: Higher US bond yields and worries due to a growing rise in the Delta variant of Covid-19 will continue to support the Greenback. Rising inflation in the US has some Federal Reserve officials talking taper sooner rather than later. This week sees the release of German and Eurozone ZEW survey (later today), US Headline and Core CPI (Wednesday) and UK GDP, Industrial and Manufacturing Production and US PPI (Thursday). Results of these data releases will determine the course of the US Dollar and its Rivals. FX traders would do well to monitor the bond markets.

- EUR/USD – The Euro eased further against the broad-based stronger US Dollar to 1.1738. Immediate support lies at 1.1730 (overnight low 1.1735), followed by 1.1700. Immediate resistance can be found at 1.1770 (overnight high 1.1769). The next resistance level lies at 1.1810. Look for consolidation, likely between 1.1720-1.1790 first up. The ZEW numbers released later will be watched closely.

- AUD/USD – Slip-sliding away, the Battler closed near its overnight lows. AUD/USD hit a low at 0.7328 before settling to finish at 0.7332. Immediate resistance lies at 0.7320 followed by 0.7290. Immediate resistance can be found at 0.7360 (overnight high 0.7364). The next resistance level can be found at 0.7390. Look for the Aussie to trade in a likely 0.7310-0.7380 level today. Feels heavy, but not convinced we break much lower.

- USD/JPY – The US Dollar advanced 0.19% against the Yen to finish at 110.32 from 110.22 yesterday. A rise in the US 10-year bond yield to 1.32 % (1.30%) supported this currency pair. Risk sentiment is starting to look a bit shaky which will see the Yen advance, against the US Dollar and other currencies. Likely range today 109.85-110.45.

- GBP/USD – Sterling dipped to 1.3850 from 1.3873 yesterday. The British currency’s fate lies in the hands of the US Dollar from here. With a couple of Fed officials saying that a bond taper is near, Sterling could wilt under the pressure of a strengthening Greenback. UK GDP data is released on Thursday. Second quarter GDP is forecast to have grown 1.8% against Q1’s contraction of -1.6%. GBP/USD has immediate support at 1.3840 followed by 1.3810. Immediate resistance lies at 1.3890 (overnight high 1.3895) followed by 1.3920. Look for Sterling to trade in a likely 1.3820-1.3890 range today. Prefer to sell into strength.

(Source: Finlogix.com)

Happy trading and top Tuesday to all.