Stocks Set for Collapse the Powell and Fundamental Twists

- Clifford Bennett, Chief Economist at ACY Securities

- 27.08.2021 10:15 am trading

The over-hyped P-day.

Will it be a pay-day?

Yes, finally Fed Chair Powell will be speaking at Jackson Hole today. It really could be a dud in terms of entertainment value and market moving power.

Sure, there will be some knee-jerk reaction in both directions on various aspects of his virtual address. There is the slightest of chances he says something earth shattering. The only scenario for that, would probably be if he says the Fed will be tapering, regardless of the current Delta surge.

That would actually be spot on good policy. Keeping interest rates near zero is appropriate for the current state of the long term recovery and the immediate Delta situation.

The bond buying program however, is just a make the rich richer asset bubble generator of gigantic proportions.

It is a path to tears. Make no doubt.

Now we know the correct policy approach, let's get back to what the Fed will do. Which is most certainly remain behind the curve. They already are, and will not be catching up any time soon. Nevertheless, the Delta surge is real, and this will likely delay tapering slightly, but not stop it.

The market may be surprised at this point, given the intensifying Delta crisis everywhere, even in well vaccinated states, that the Fed Chair may well highlight a willingness to begin tapering as soon as circumstances allow.

Even such a modest shift, could be enough to spook markets at this point. Record highs on easy money with no regard to the real economy. How long can it go on? the market is set up to be hurt by any catalyst to the downside.

If the market gets what it wants, rather than the economy what it needs, the market want being reassurance of a slow central bank and easy money, then we will get new highs. Yes, yet again. You probably already know my reality bias, so I would give such a rally, only today, and Monday before fading.

We have already highlighted the loss of momentum immediately after the start of week surge. The market is vulnerable to the downside.

It is an interesting cocktail of positioning and reality economics, set to go off at any time.

We have seen warning signs on several occasions.

In summary, we could get new highs again, but only momentarily, and the dominant risk is very much to the downside.

This is the very last of the good news possibilities for quite some time.

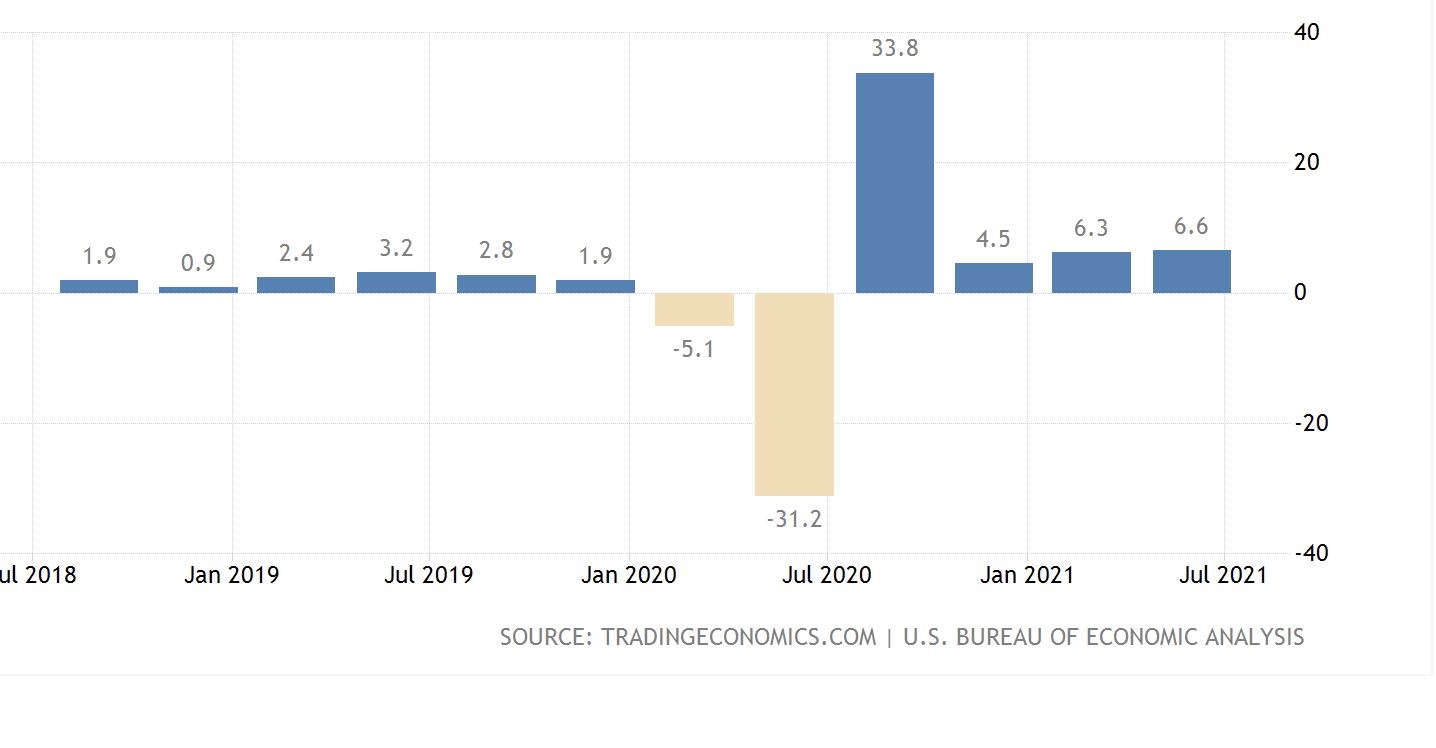

US Growth Stall.

US Q2 GDP, revised ever so slightly higher from the original 6.5% to 6.6%. Remember this number was expected to be around 8.5% by the World Bank, the IMF and all the other Nirvana economists. This rate of growth will slow substantially through the second half of the year and well into next.

The US economy is in serious trouble very few are seeing.

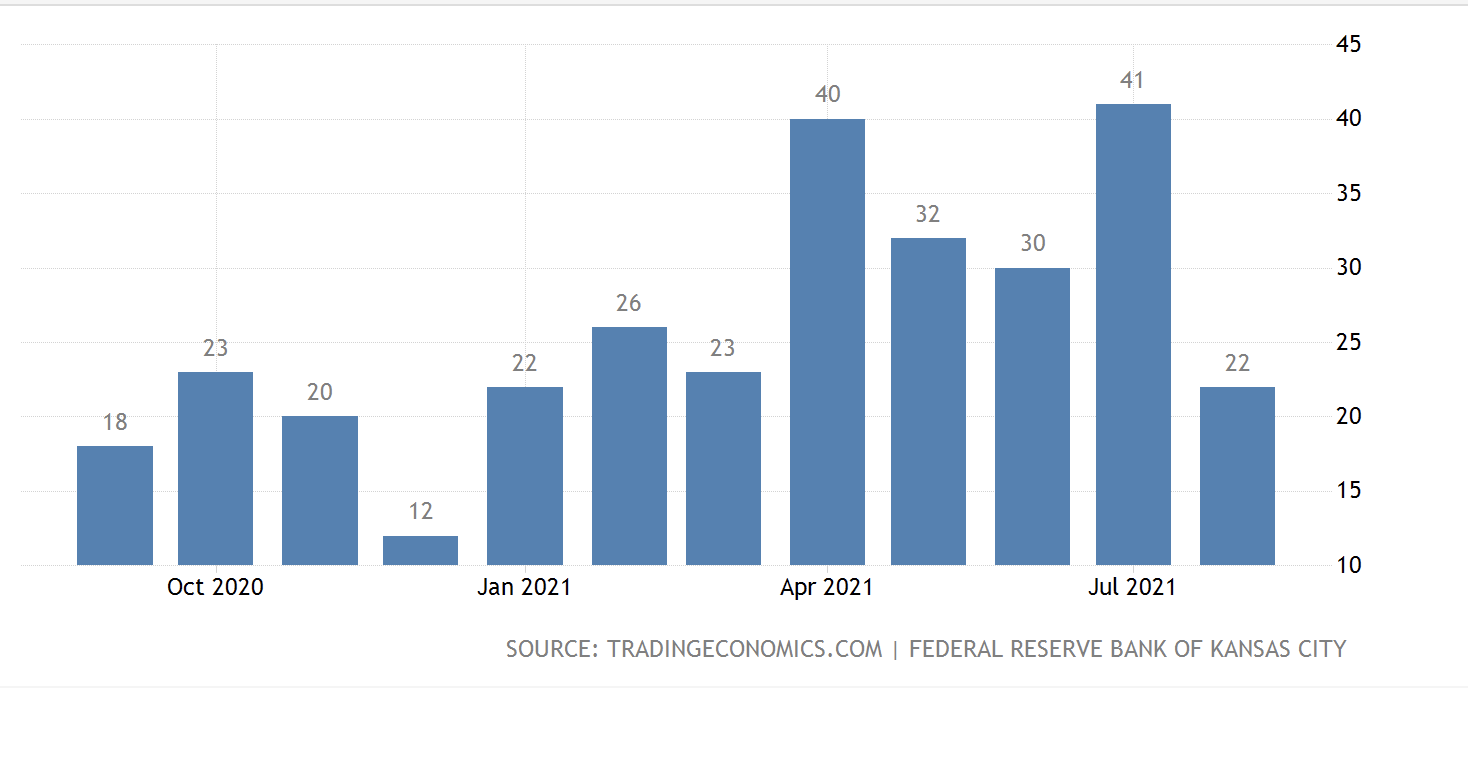

Kansas City Fed Manufacturing Production Index

Collapses. As, I said, serious trouble.

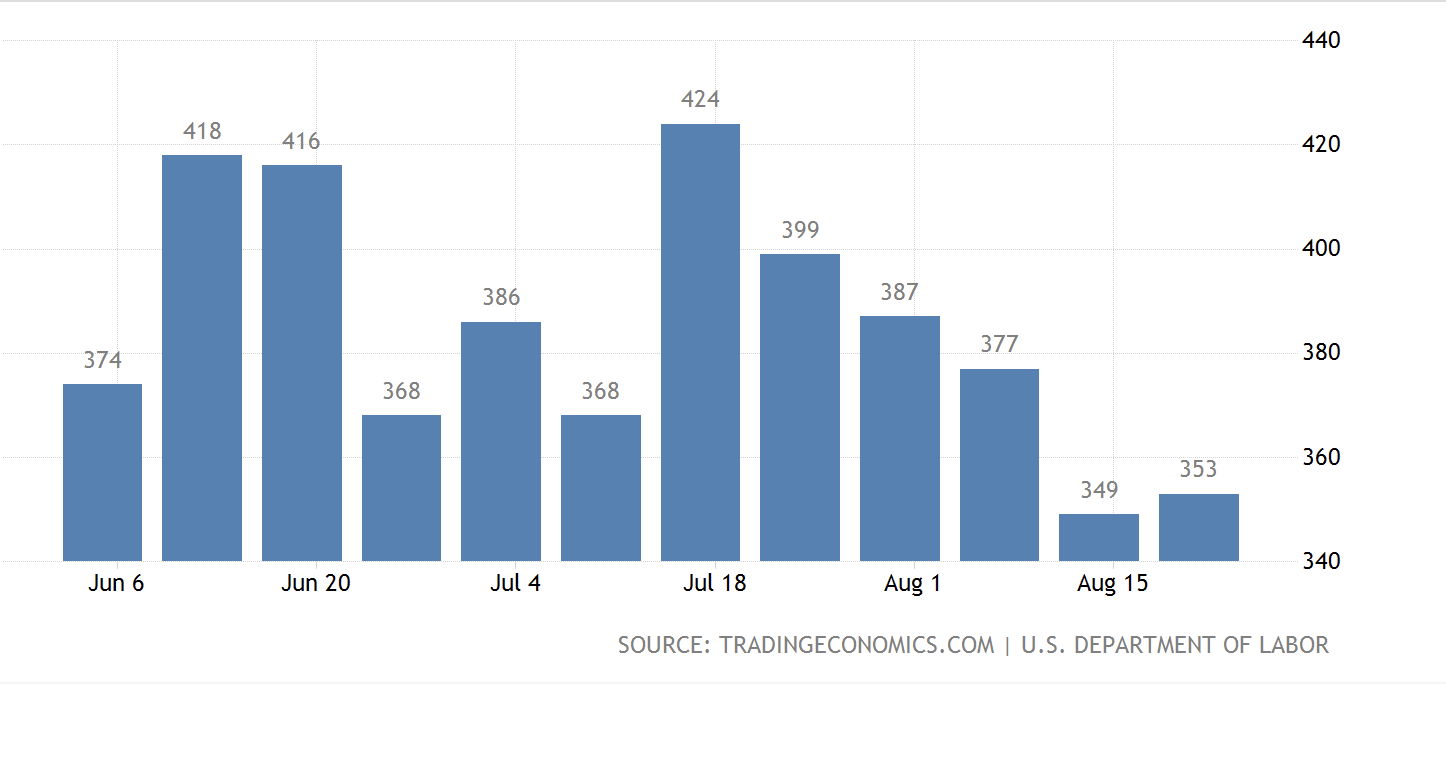

US New Jobless Claims

US businesses are still laying off workers at an extremely elevated level. Some 50-75% higher than pre-Covid.

US Corporate Profits

Continue to scream higher. Is any one else seeing the divergence here?

I feel like writing 'lol', but that would be un-professional at this level. The 'lol' is valid regarding how many other brokers, banks, funds have their heads in the sand over all of this.

It is quite obvious really.

The economy is in fast decline, the global economy is also stuttering, and still profits climb.

It is obvious. We mapped out how these profits are not so much based in a strong economy, as they are in the freedom of pricing currently afforded corporations and businesses around the world.

The problem for this profit curve, is it can only stretch so far before consumers baulk and re-think. At that point, earnings and profits will fall with a thud.

It will be the stratospheric profits, based on pricing power, that will come back to earth. Rather than the economy finding some miracle booster rocket to catch up and justify either corporate profits or 'dancing with the stars' stock prices.

All the best for an interesting global trading day. My fear for markets is, that a dovish Powell is already fully priced.

As for the Australian market, just keep selling.

We are seeing the roll-over in currencies I was expecting. The AUD move lower can turn into a free for all again at any moment.

Gold is still highly favoured as hedge against both Delta and Inflation. Still the ultimate safe-haven.

The forecast twin tsunami of Delta and Inflation ahead of everyone else, is turning out to be no exaggeration at all. The world's largest chip maker is raising prices by 20%. Everything will get more expensive again.

The penny will drop and stocks will fall.

Maybe not today, or maybe.