Serious Week. Stocks Down. Australia Wobbles.

- Clifford Bennett, Chief Economist at ACY Securities

- 13.09.2021 07:30 am trading

US500 is in free-fall.

This could be a serious week.

We called the impact of Delta early, and it is showing up in economic outcomes from the UK, to Canada, to the USA and Australia. This is a serious global slow-down again, and the impact on equities could be of a significant quantum level.

There is also an Australian specific story, and it is not good.

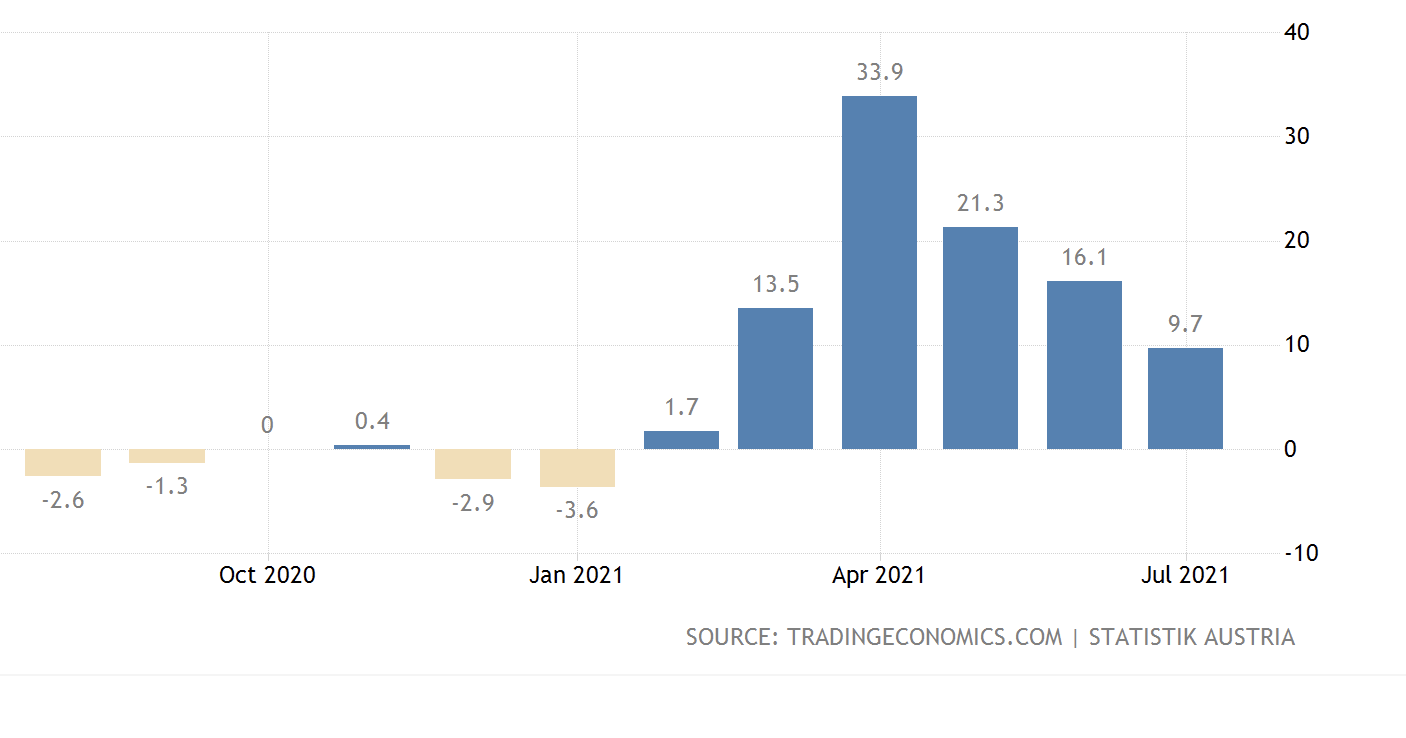

Australia Industrial Production. Expect more downside.

While every other economist in the land is forecasting a sharp rebound like before, we are at least aware that this will not be happening. there will be a momentary spike in some economic data series, that will quickly subside, with an on-the-ground real economy remaining in a parlous state.

The party is over, and the hangover will be of far greater duration than anyone would like.

Oh, and Inflation and Delta are still here?

Paradoxically; while stocks bizarrely rallied on every previous announcement of new lockdown measures, this time round, we may well see stocks in decline as the economy gradually re-opens. Despite rising case numbers. Such is the nature of the world. Always finding new ways to unfold itself.

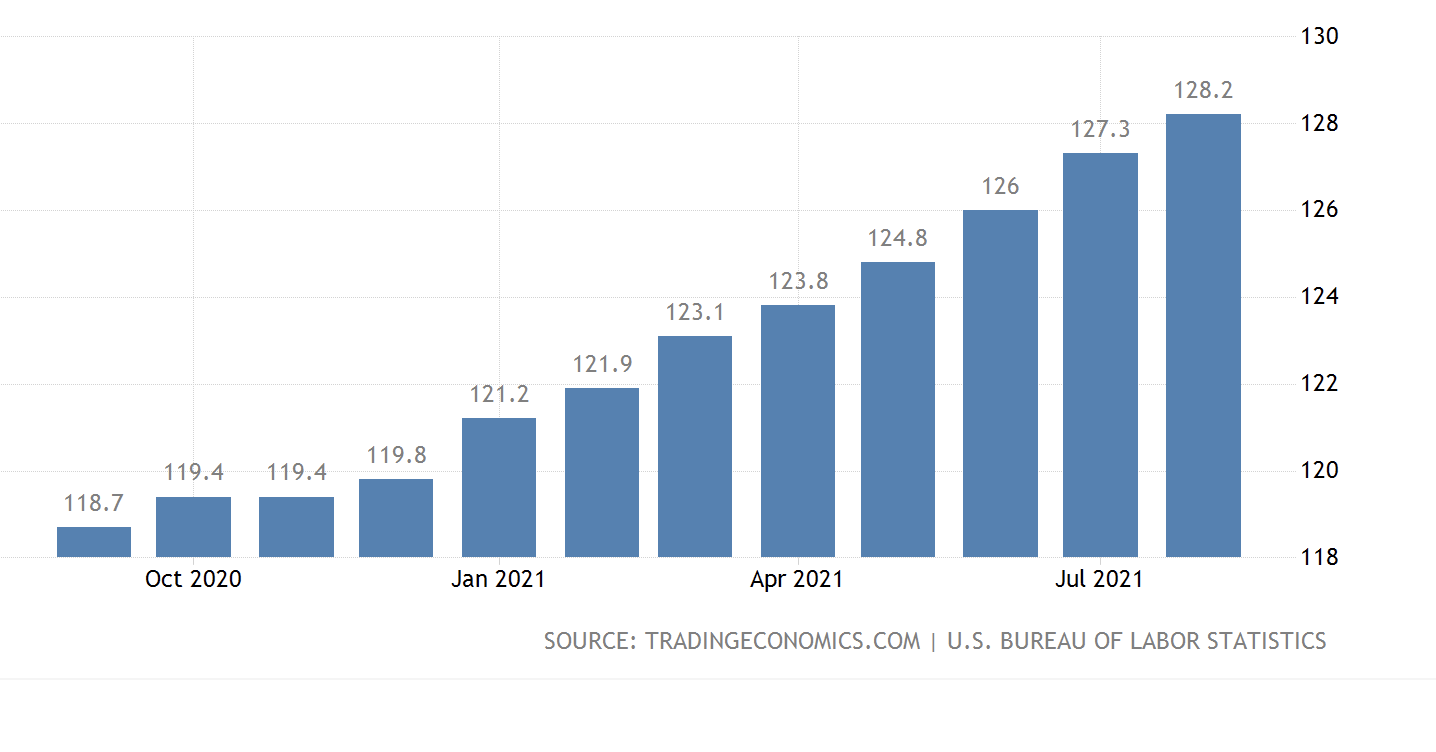

US Producer Prices continue their relentless march.

Rising 0.7% in August. Slightly above expectations. More inflation to come.

As headlined, this could be a very serious week.

While US stocks can sometimes pull a rabbit out of the hat on Monday's, and miraculously recover the ground lost in a Friday sell-off as just seen, this bounce, if any, is likely to be muted. The more likely scenario this week is continued and increasing downward pressure. The US economy is in serious trouble, and it is not just due to Inflation and Delta.

Long term structural and Covid dislocation problems will continue to wreak havoc over the next 1-3 years.

US Inventories

Moderating toward more normal levels. At least calming down. Nevertheless, it is also in line with other slowing data series.

Australian dollar, sitting on the edge of a fundamental cliff.

The Australian equity market remains in the fast decline phase we have been forecasting for quite some time. A move to 7000, 6900, is not out of the question.

Victoria 473 today.

Continues to look a lot like NSW a few weeks back.

Restrictions in Victoria and NSW will continue to be eased. A welcome relief. Hospitalisations, however, will continue to rise muting further easing of restrictions in the weeks and months ahead.

Our very early call, that NSW may remain locked out of the rest of Australia for a long time, continues to mature. As does our first to call recession, with risk of this stretching into Q1, 2022.

It looks like restrictions will only be easing for two thirds of the population, and spacing and social distancing restrictions will keep hospitality and retail down-trodden to a significant degree.

All the best for the week ahead, because in each of our own worlds, it is up to us to make the most of every day.