Risk-On Boosts AUD, NZD, Asian, EMFX; Dollar Eases

- Michael Moran , Senior Currency Strategist at ACY Securities

- 26.08.2021 04:00 am trading

US Bond Yields Climb Ahead of Powell Address

Summary: Risk appetite remained robust ahead of a key address from US Fed President Jerome Powell at the Jackson Hole Symposium which begins tomorrow. Resource and Asian currencies rallied with the Australian and New Zealand Dollars performing best. The Australian Dollar extended its gains over the Greenback, up 0.4% to 0.7277 (0.7255). New Zealand’s Kiwi (NZD/USD) powered higher to 0.6978 (0.6948 yesterday). The Dollar Index (USD/DXY), a popular gauge of the US currency’s value against a basket of foreign currencies, eased 0.07% to 92.82 from 92.90 yesterday. Sterling (GBP/USD) added 0.27%, finishing at 1.3760 from 1.3730 while the EUR/USD pair edged higher to 1.1770 (1.1758). The combination of higher US bond yields amidst risk-on saw the Dollar fare better against the Japanese Yen. USD/JPY settled 0.25% higher at 110.01 from 109.68. The US Dollar lost ground against most Asian and Emerging Market currencies. Against the Thai Baht, the US Dollar slid 0.30% to 32.79 from 32.91. The Greenback finished 0.15% lower against the Singapore Dollar to 1.3525 (1.3543 yesterday). USD/CNH settled at 6.4705 (6.4695).

Ahead of a key speech from Federal Reserve Chair Jerome Powell at the Jackson Hole economic summit US Treasury yields rose to near 2-week highs. The benchmark US 10-year bond rate climbed 6 basis points to 1.35% from 1.29% yesterday. US two-year treasury yields rose to 0.24% from 0.22%. Rival bond yields were also higher. Germany’s 10-year Bund yield was up 6 basis points to -0.42%. UK Ten-year Gilt yields settled at 0.60% from 0.54% yesterday. Japan’s 10-year JGB yield finished flat at 0.01%. Wall Street stocks edged higher. The DOW rose 0.13% to 35,436 (35,380) while the S&P 500 added 0.2% to 4,496 (4,486).

Data released yesterday saw Australia’s Q2 Construction Work Done ease to 0.8%, underwhelming forecasts at 2.5% and a previous 2.4%. Switzerland’s Economic Sentiment Index slumped to -7.8 from a previous 42.8. Germany’s IFO Business Climate in August slipped to 99.4 from a previous 100.8, missing estimates at 100.4. US July Headline Durable Goods Orders eased to -0.1%, beating forecasts at -0.3%. US Core Durable Goods Orders in July rose 0.7% from an upward revised 0.5% in June (from 0.3%), beating expectations at 0.5%.

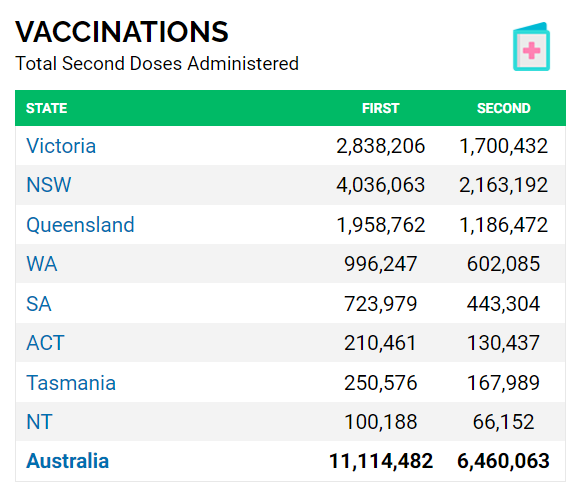

- AUD/USD – extended its gains to finish at 0.7278 from 0.7257 yesterday boosted by risk-on and an overall weaker US Dollar. The Aussie hit an overnight peak at 0.7280. New South Wales, Australia’s largest State saw first dose vaccinations against the coronavirus rise to over 60.0%.

- NZD/USD – The Kiwi kept its wings thanks to the weaker Greenback and stronger Aussie. The Kiwi settled 0.6% higher to 0.6978 from 0.6948 yesterday. Two days ago, the NZD/USD pair was 68.95. Overnight peak for the Kiwi was at 0.6983.

- EUR/USD – against the Greenback, the shared currency grinded higher. The Euro was last at 1.1770 from 1.1758 yesterday. The Euro shrugged off a fall in Germany’s IFO Business climate for August. Overnight high traded for the shared currency was at 1.1774.

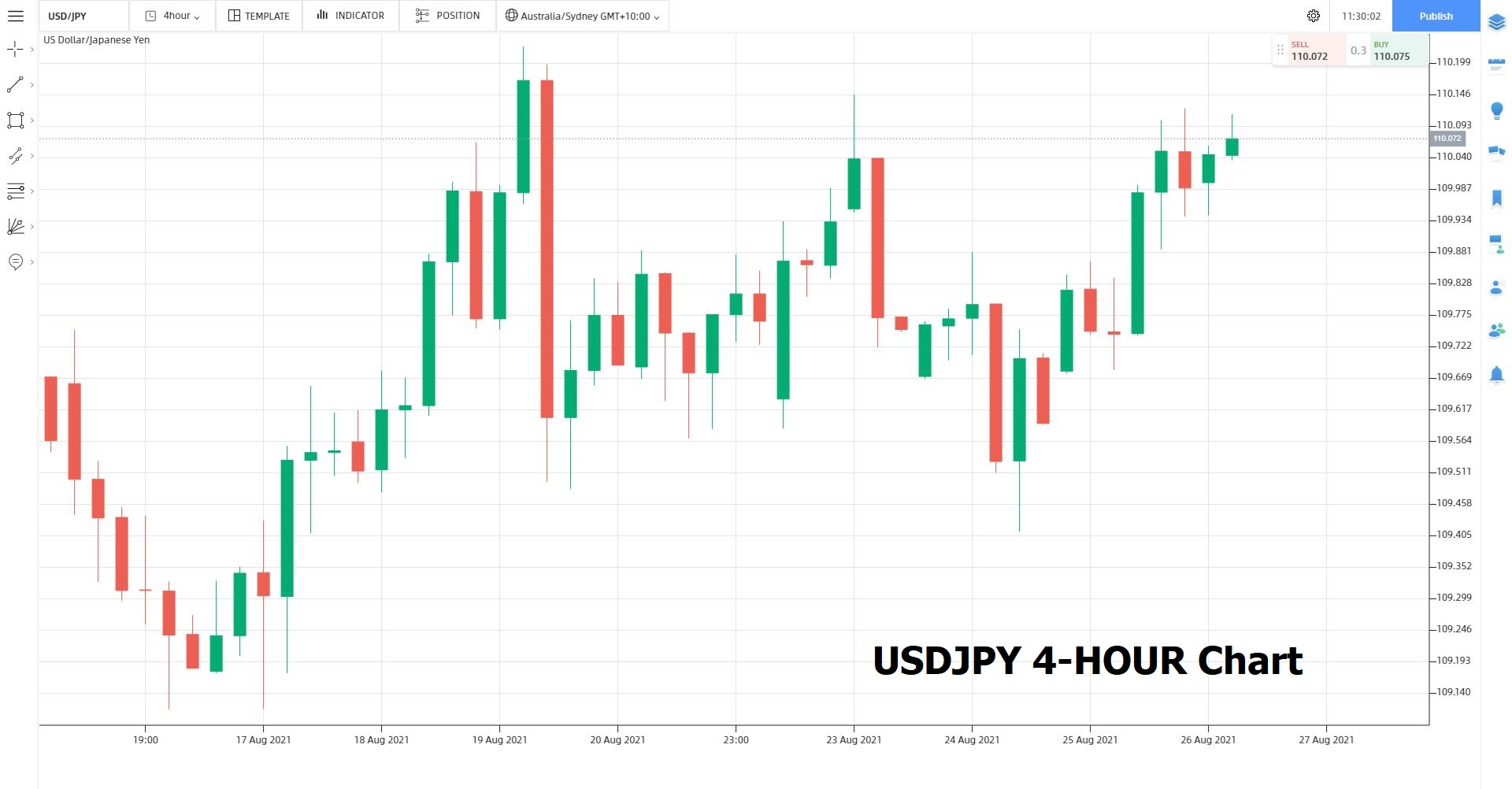

- USD/JPY – The Dollar gained 0.25% versus the Japanese Yen boosted by the 6-basis point rebound in the US 10-year bond yield. The USD/JPY pair finished at 110.01 from its 109.68 opening yesterday. Japanese 10-year JGB rates finished flat at 0.01%.

On the Lookout –Today’s economic calendar is light. Data kicks off with Japan’s Annual SPPI (Services Producer Price Index) (f/c 1.3% from 1.4%). Australia follows with its Q2 Private Capital Expenditure report (f/c to fall to 2.5% from 6.3% - ACY Finlogix). European data kicks off with the Eurozone GFK Consumer Confidence for September (f/c -0.7% from -0.3% - Finlogix). Eurozone Private Loans to Companies follows (f/c 4.1% from 4.0%). French Business Confidence for August is released next (f/c 109 from 110). The ECB Monetary Policy Meeting Accounts follows next (detailed record of the ECB Governing Board’s most recent meeting). Finally, the US releases its Q2 Preliminary GDP Growth Rate (f/c 6.7% from 6.3% - ACY Finlogix) and its Weekly Unemployment Claims (f/c 350,000 from 348,000).

Trading Perspective: Markets will keep their eyes open for press releases heading into the virtual Jackson Hole Wyoming symposium. Traders are looking to a key speech by Federal Reserve Head Jerome Powell. Powell may provide insight into when and how Fed officials will start tapering its bond purchases. Which will set the timetable for a Fed rate increase. Overnight the US 10-year bond yield jumped 6 basis points to 1.35%. Other global bond yields were also higher, mostly matching the rise in US treasury yields. If the Fed starts to pull back on its bond buying support, it will be the first of the global central banks. This will put the advantage back to the Greenback.

- AUD/USD – The Aussie had a good run higher on the market’s risk-on stance amidst a generally weaker US Dollar. Australia’s battle against Covid-19 moved ahead with more States recording increased vaccination rates. AUD/USD settled at 0.7278 from its opening at 0.7257 yesterday. Traders ignored a bigger than forecast fall in Construction Work done in Q2. Immediate resistance for the Aussie lies at 0.7280 (overnight high) followed by 0.7300. Immediate support can be found at 0.7240 followed by 0.7200. Look for a likely trading range today of 0.7230-0.7280. Prefer to sell rallies at current levels.

- EUR/USD – The Euro grinded higher as risk-on sentiment continued to drive asset markets. The shared currency closed at 1.1770 from 1.1758 yesterday. Overnight high traded was at 1.1774. Immediate resistance on the day lies at 1.1780. The next resistance level is at 1.1810. Immediate support can be found at 1.1730 (overnight low 1.1726) followed by 1.1700 and 1.1670. Looking to sell rallies in a likely range today between 1.1730-80.

- GBP/USD – Sterling rallied to 1.3760 in late New York after opening at 1.3730 in Asia yesterday. The British Pound traded to an overnight high at 1.3767 before settling a touch lower. Overnight, GBP/USD traded to 1.3697 lows. Immediate resistance for Sterling is found at 1.3770 followed by 1.3800. Immediate support lies at 1.3720 followed by 1.3690. Look to sell into Sterling strength with a likely range today between 1.3695-1.3775.

- USD/JPY – the Greenback settled higher against the Japanese Yen supported by the combination of higher US bond yields and elevated risk sentiment. USD/JPY closed at 110.01 from its 109.68 open yesterday. Overnight peak recorded was at 110.12. Immediate resistance for today lies at 110.20 followed by 110.50. Immediate support can be found at 109.70 followed by 109.40. Look to trade a likely range today between 109.70-110.20. A move higher in the US 10-year treasury yield and further taper talk could drive this currency north toward 111.00 area.

(Source: Finlogix.com)

Top Thursday and happy trading ahead all.