Markets Dance With The Stars As Delta Rises

- Clifford Bennett, Chief Economist at ACY Securities

- 25.08.2021 04:15 am trading

Dancing with the stars.

Equity markets stalled in the USA, and that loss of momentum could prove telling in coming days. As the market looks to Jackson Hole for a warm blanket around the fire, stock prices dance with the stars. Nasdaq SP500 record highs.

The Australian market pushed higher on the back of excitement over vaccination rates. Australia is not yet half way to the first 70% level, and the Israeli studies show efficacy drops to around 16% after 6 months.

The Australian stock market is in yet another unrealistic Nirvana type sentiment bubble.

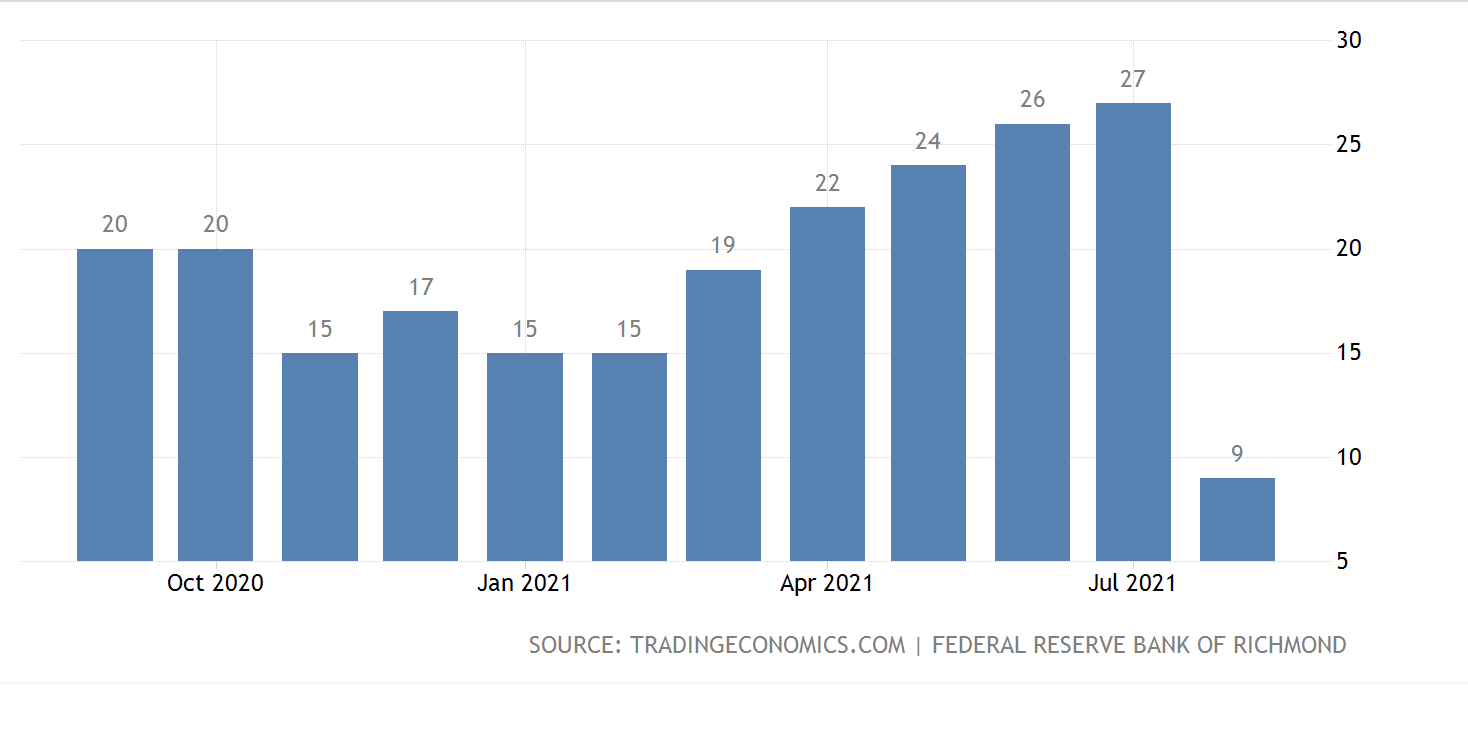

If you thought the rise of Delta was not having an economic impact?

The Richmond Fed Manufacturing Index just collapsed.

I often speak of the ivory tower detachment of Wall Street from what is really going on, on the ground in Main Street, USA.

This past month has seen a momentary market caution regarding the Delta surge, but then a strong recovery. That recovery in index pricing was largely driven by a handful of companies, though well they should be, as I have long been an advocate of respecting the power of the new monoliths. Interesting side note... the richest individuals in the USA today, have only a fraction of the comparative wealth to the rail, steel and banking tycoons of the past.

Back to present day. Stocks should be bought for their market dominance and freedom of pricing windows now in existence, but how can consumers continue to buy even streaming services as much as they have if the economy again goes into a free fall?

Not possible, many will say. Well, it is already happening.

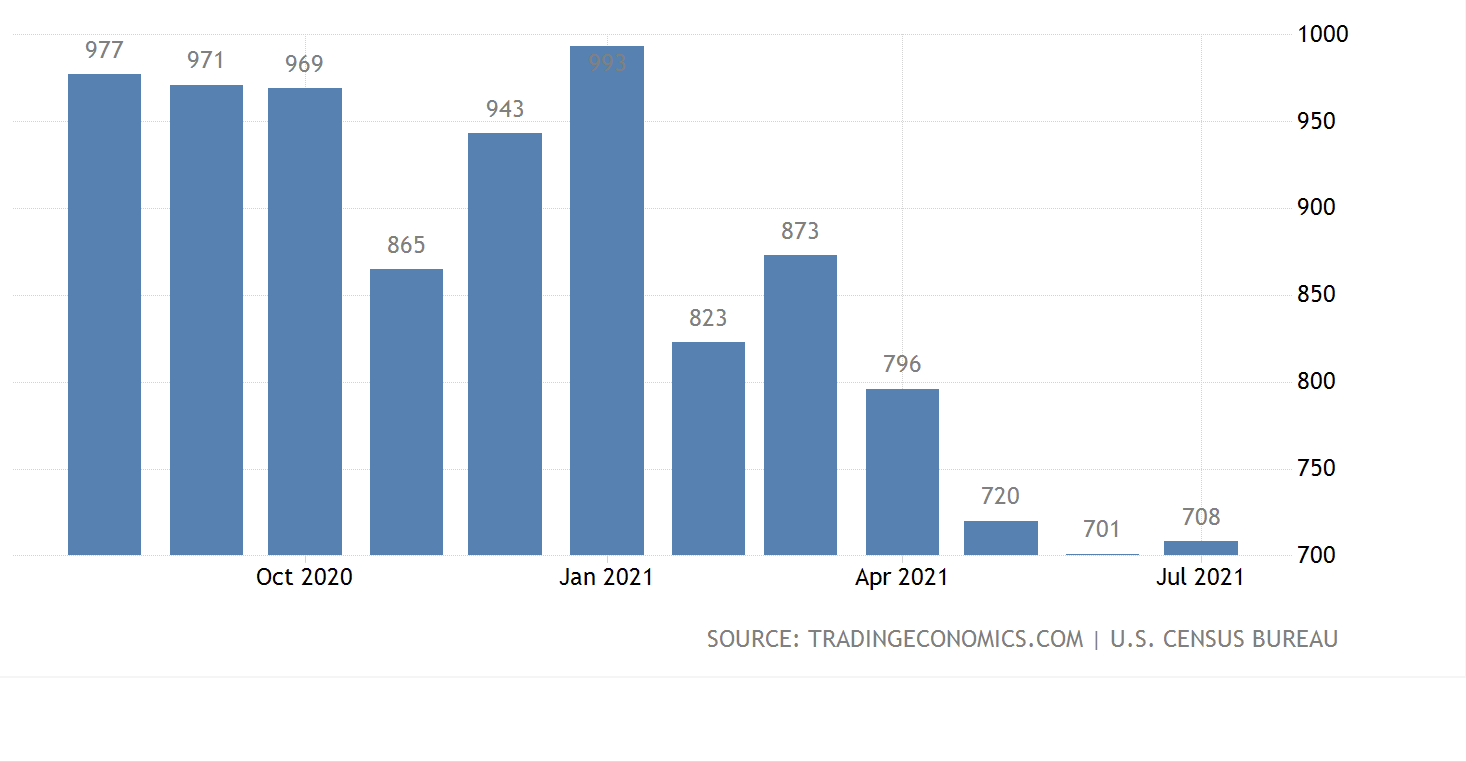

US New Home Sales

The collapse from the highs remains in place with little to no recovery. My assertion remains, the second housing bubble this century, that no one wanted to talk about, is already bursting.

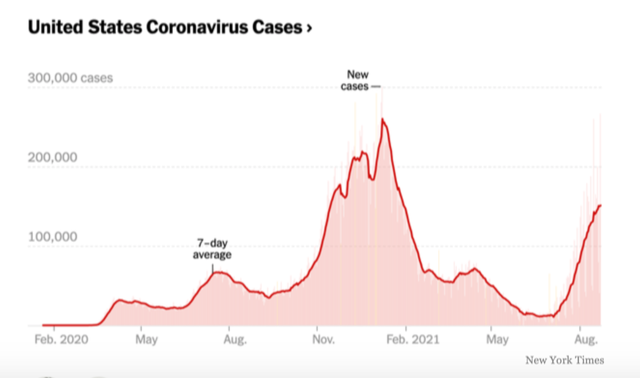

US Cases

While largely among the un-vaccinated, this surge of Delta is not exclusive to them. Nor, can the absolute numbers and strain on hospitals be ignored for very much longer.

In Israel, though numbers are lower due to 88% vaccination, there is nevertheless a renewed strain on the health system. 59% of those being hospitalised are fully vaccinated with two doses of Pfizer.

Vaccinations help, but it is a mistake to see them as a sole solution. Which is exactly what Australia is doing right now, ignoring all of the substantial evidence to the contrary. Even, Oxford University, co creators of AstraZeneca, stated recently that vaccination herd immunity 'is a myth'.

People seem determined to believe what they want to believe.

A false sense of security appears the objective of the moment. This could set communities up for a bigger fall in health further down the track.

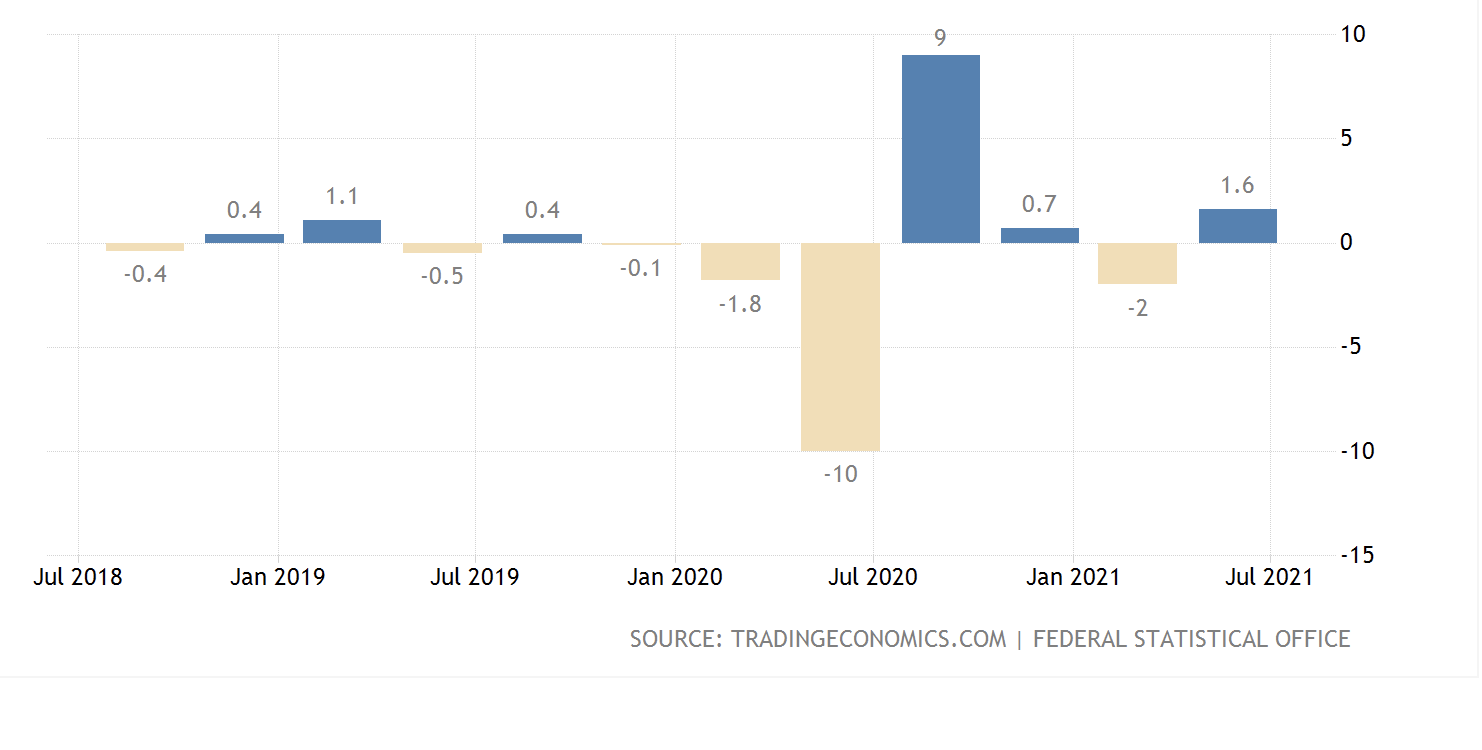

German GDP

The economy of Germany has certainly had a good recovery, but like everywhere else, that growth path is quickly plateauing out. Even the Bundesbank is now warning that Delta is a real risk to the economy going forward.

We cannot consider the future economic path outside of the surge of the Delta strain. Especially, in Australia, where policy settings are now centred around the Doherty report. A report, which did not fully take account of Delta's 5-8 times more contagious rating, or its greater transmission and impact on the young.

The markets are willfully looking the other way, because no one wants to talk about what I am saying here. It is simply too painful to do so. These realities are not what any of us want to hear. If we take note however, and maintain our caution, despite being vaccinated, we will all fare far better than the denial scenario will bring forth.

Markets are being impacted by two distinct forces. As we forecast well ahead of time, a twin tsunami of inflation and Delta. How will Fed Chair Powell navigate such a conundrum? Does it really matter, if the US and the world are going to experience yet another slowing phase, even if more moderate, when all stimulus measures have already been implemented.

Not happy reading. Yet, a probable scenario, that markets are not at all pricing, and therein lies our strength. A readiness in planning for a possible outcome, none are currently incorporating.

Such is a market advantage.