Look out for the Drop AUS Warning Alert and US could follow

- Clifford Bennett, Chief Economist at ACY Securities

- 01.09.2021 06:00 am trading

Is the US market starting to look down more than up?

In my comments of last week, I highlighted the loss of momentum we were seeing, and still the risk of a knee-jerk bullish reaction to Jackson Hole. With a Monday momentum follow through to the upside also being likely.

Well, again, I do need to apologise, I was too early on the peak. However, we are now again staring into an abyss as the bulls begin to fade rather quickly.

Still an immediately bullish technical construct while 4510 holds. Just do not like how the economy is headed south at an accelerating speed, while stocks are reaching for the stars? Have to say the price action of the past 24 hours does encourage my bearish bias again.

AUS200 has no legs Collapse Warning

Struggling to maintain the highs, can begin to collapse sharply at any time. An un-expected get out of gaol scenario would be a break of resistance at 7508.

More likely, is immediate collapse!

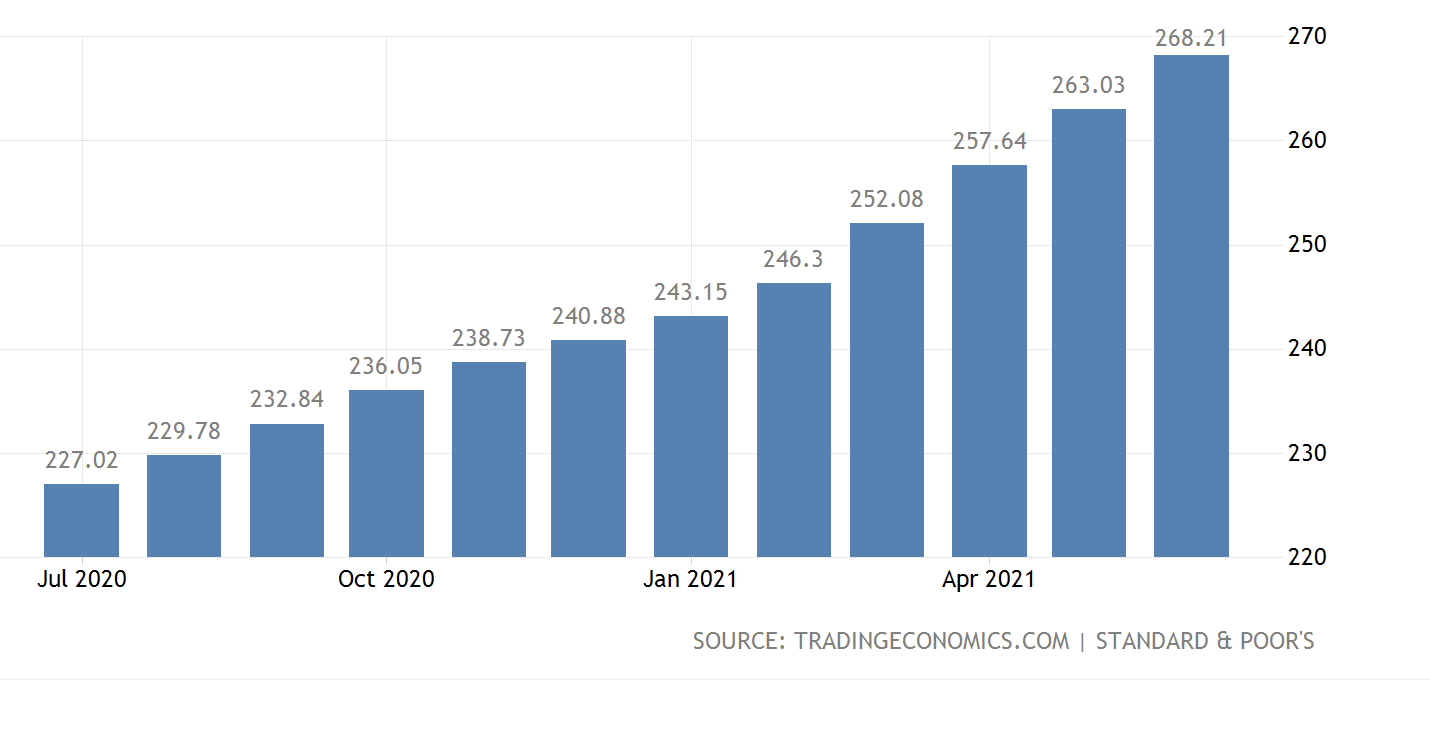

US House Price Index

The Schiller housing price index is up a whopping 19.1%.

This is, as we were expecting. I have consistently pointed out that all other housing data is going in the exact opposite direction to that of prices. At first, all the data takes were booming together. Now, all have rolled-over badly, even into negative territory. While prices continue to climb. It just doesn't get any clearer, that the US is in the throes of the last legs of its second great housing bubble this century.

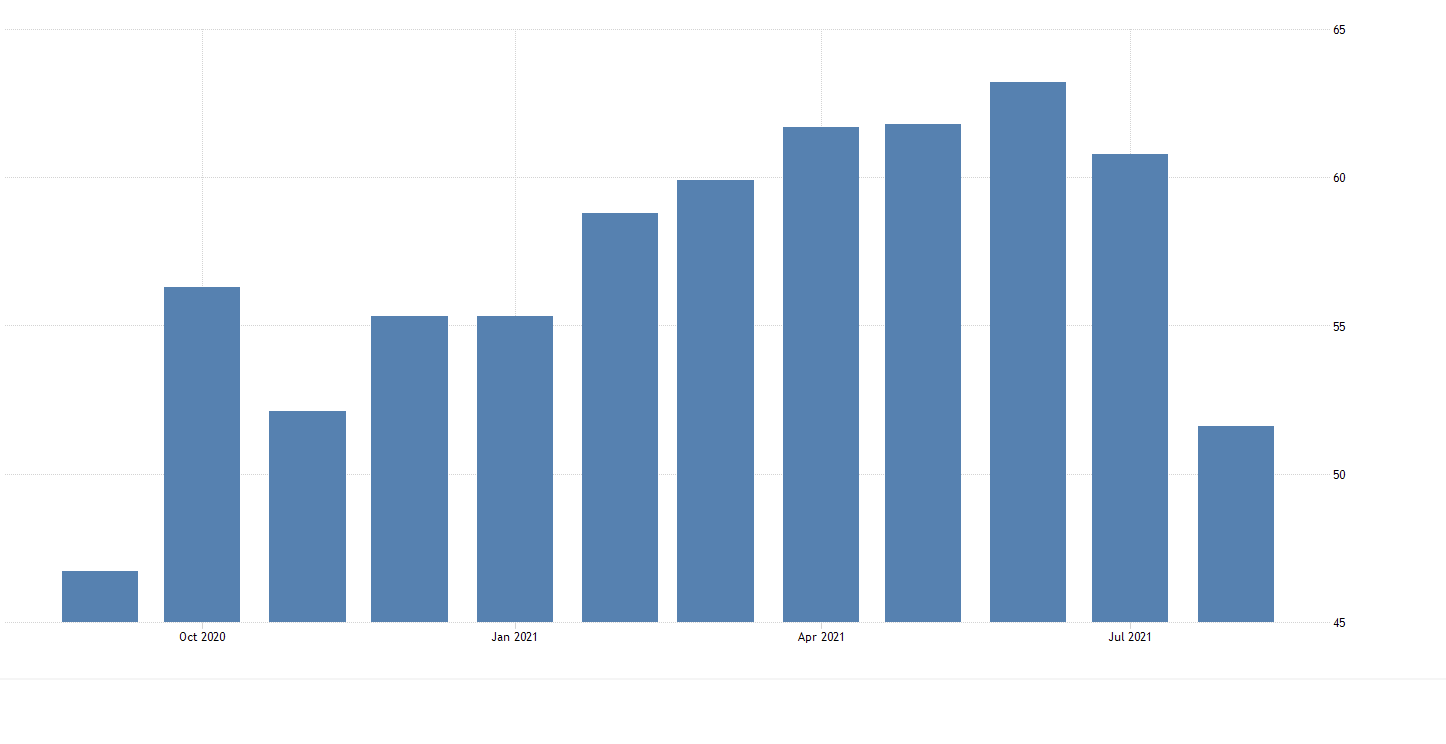

Australian Ai Group PMI Manufacturing Index

Collapsing as expected. To be honest, it is slightly pointless to be looking at any Australian data at the moment, as the immediate' look out the window' reality is worsening at a rapid rate. Still, it simply confirms what I have been saying all along, that we are already in Recession.

Sterling/AUD

It If we break that immediate support at 1.8755, it may be the case that the general investment thinking toward the UK is changing to 'it is still not over regarding Covid'. For the moment, prefer a buy the dip approach. Which represents a good risk/reward opportunity. Especially, given Australia's recession.

These are challenging times, and so the easy ride of the stock market must falter at some time. There are already plenty of alarm bells chiming for the Australian market, and the US market may well follow suit.

Please note, for the Australian dollar the news yesterday was 'as good as it gets'.