Don’t Think Just Buy and Australian Trade Record

- Clifford Bennett , Chief Economist at ACY Securities

- 06.08.2021 05:15 am trading

Don't think, just buy.

The relentless march higher in the AUS200 above appears unstoppable. Even while most of the eastern seaboard of Australia is now in lockdown.

It is, to some degree, a following of the US market, but it also defies all pre-covid economic principles. It is one thing to be living in a new paradigm, but does it have to be mindless as well. OK, so what we are seeing is the 'Awash with money' side of the Einstein equation (see yesterday's report) win out.

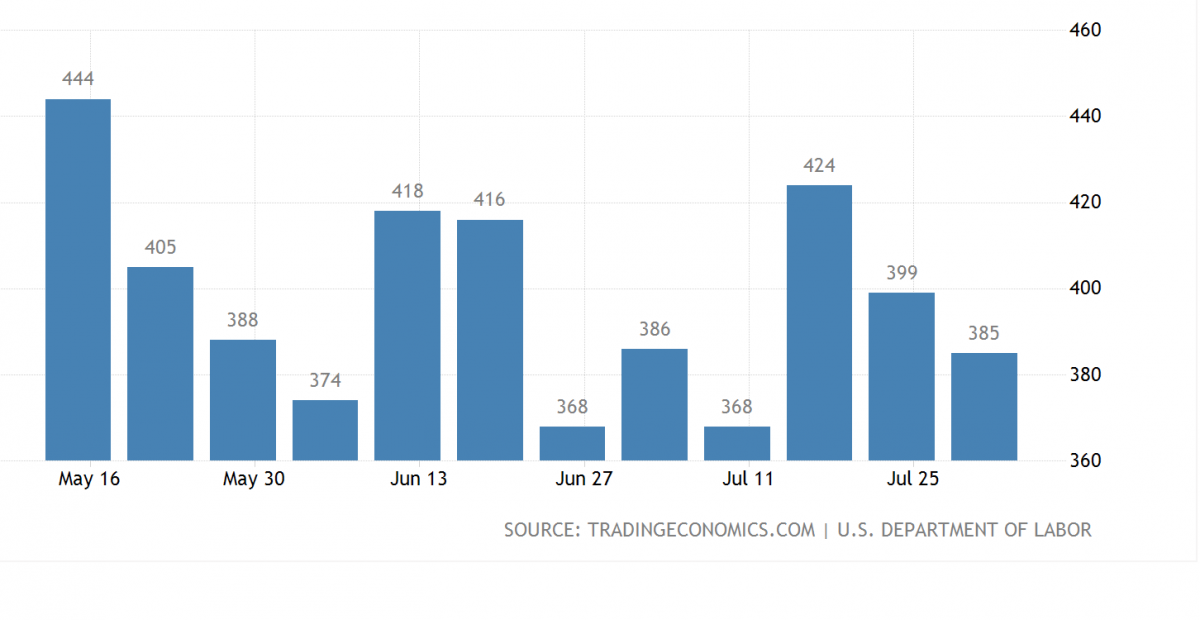

US New Jobless Claims

The chart above has a base line that is above pre-covid levels. We are still seeing people lose jobs at an elevated level.

The market did not rally because of this data. It is just a band-aid reason placed on what was a strong day. The real reason is the steady inflow of capital fleeing cover ravaged parts of the world. Which continue to overwhelm any of the domestic fund managers selling. The later, recognising valuations are way over-heated for where the real economy is. The foreign inflow blissfully unaware of this reality continues to see good returns.

This is the nature of all self-fulfilling bull markets moving away from reality. They always end in collapse. But when. How long is a piece of string. I have been calling cautious awareness to the market far too early, and it may well be time I stop standing in front of this freight train.

We have been getting currencies and commodities right.

From here though, there may be a period of drifting sideways consolidation for these markets. Just for the short term and I still expect the US dollar to straighten overall.

Gold, to separate from other commodities as the delta/lambda surge continues. Gaining ground.

Oil is very heavy at these levels and has more than priced in any global recovery in activity we are likely to see over the next few days. Despite daily fluctuations, still seeing a major top as already being in place.

Nasdaq (hourly)

Firm gains, but not running away gains. At the same time, we are clearly hitting the top of the screen here? So that's not possible to go higher. Is it?

The market only remains immediately bid on the day, while 15145 holds. On a short to near term basis, the key level is 15,000.

I seem to be the last person standing to be finally giving up on selling for a significant correction. This, of itself, could also be an indicator that the actual peak is near.

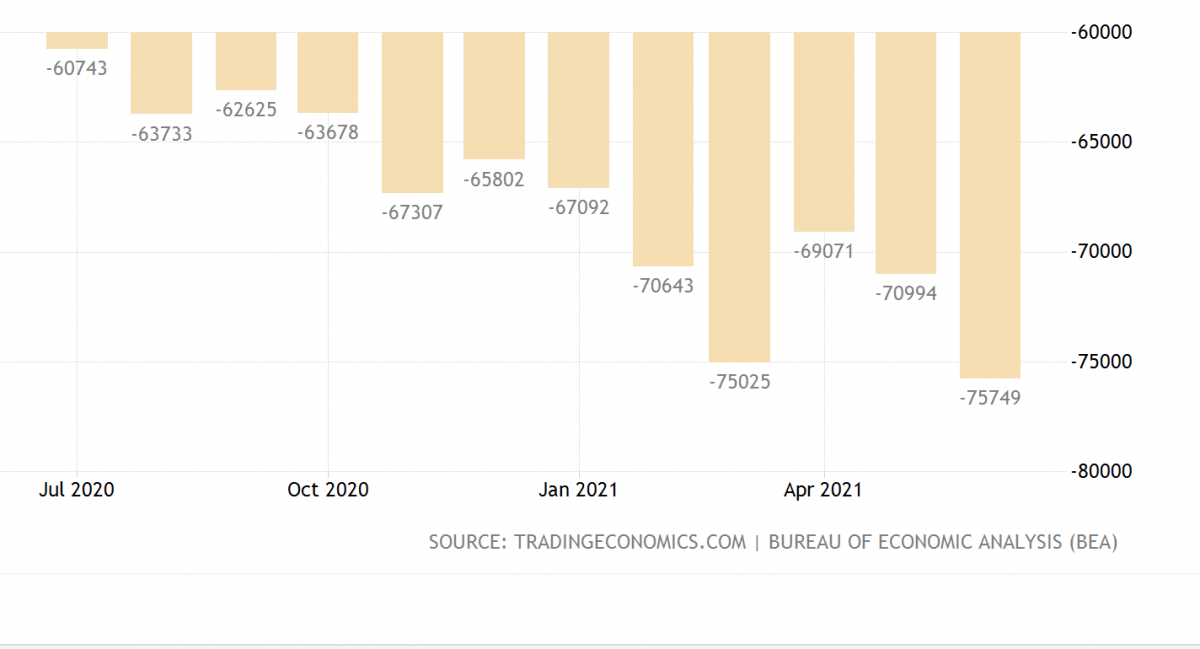

US Trade Deficit Worst in History

On the bright side, both imports and exports gained. Indeed suggesting a firming domestic economy as schools have opened up. That stocks and currency continue to climb regardless, which just shows how immense the capital flow fleeing other parts of the world is.

Australian Trade Balance Impact and other market points video late yesterday: https://youtu.be/ZkC0uTk_InU

Despite the heading today, the acceptance the surge of Delta is a central driver for higher prices, which is certainly problematic for markets in the long term. Israel, the world's most vaccinated country, is now having people work from home again and starting third booster shots.

There is the possibility that these safe-haven investment funds will also remain relatively permanently in the US. These are not short term positions that will be reversed any time soon. This aspect will also support prices.

I do feel like throwing the towel in a bit, and just being set long as well. However, it is hard to get past the fact that stocks are going up in Australia because they are following gains based in a fresh crisis around the world. Completely ignoring a now entrenched shutdown in Australia that will bring the economy to its knees.

A recession is more than on the horizon for Australia.